How Investment Fees Affect Wealth

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

It costs money to invest. We pay all types of fees, some obvious, some not so obvious. In this article I’m going to walk through the most common investing fees you are likely to encounter. Then we’ll examine just how destructive a seemingly small amount of fees can be to your wealth and retirement.

Table of contents

Do Fees Really Matter?

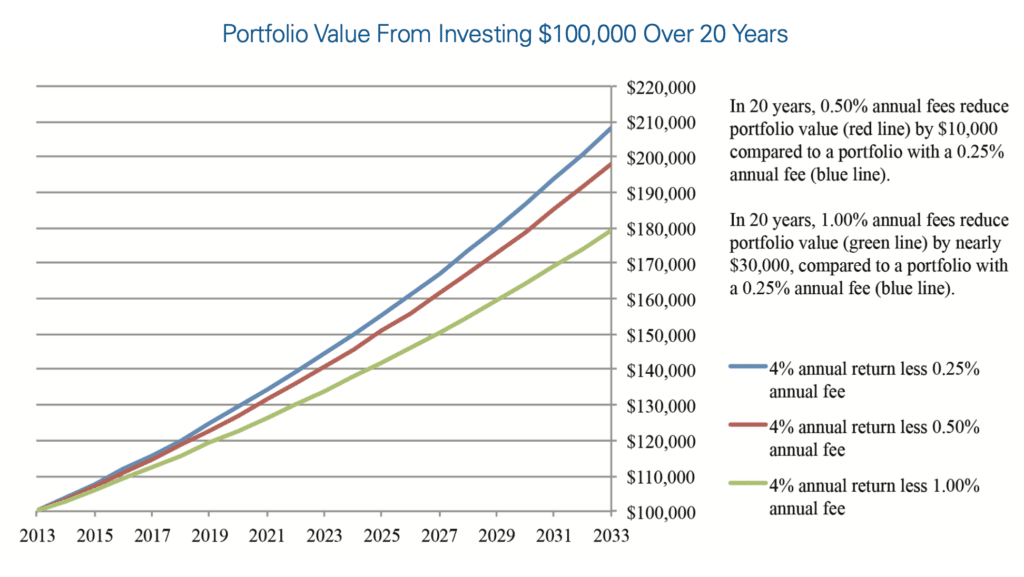

Before looking at specific types of investment fees, let’s first ask whether fees really matter. To answer that question, the first thing we must recognize is that seemingly small fees, over time, can seriously reduce the value of an investment portfolio.

The Securities and Exchange Commission (SEC) published a paper on this very topic in 2014. It noted that “fees may seem small, but over time they can have a major impact on your investment portfolio.”

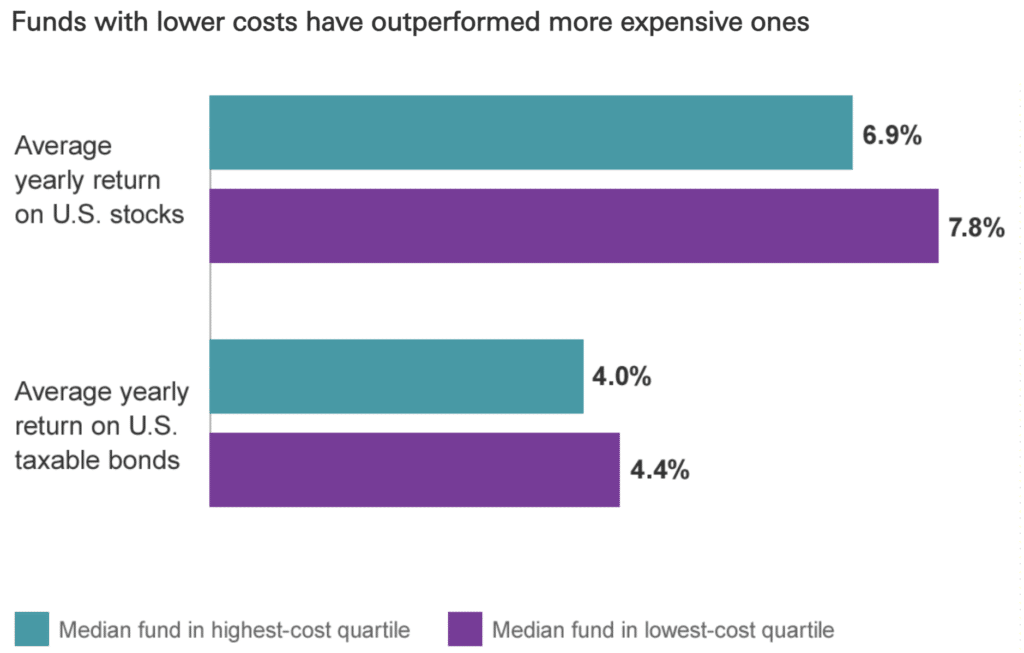

Some have argued that fees don’t matter. Instead, what matters are returns after factoring in the fees. In other words, paying high fees is not only fine, but ideal, if the investment returns enough to justify the fees. Conceptually this makes sense. In practice, however, it falls apart.

Study after study after study shows that expensive investments underperform inexpensive investments. For example, Vanguard looked at the annualized returns for a 10 year period ending December 31, 2014 for two groups of mutual funds: 25% of the funds with the lowest expense ratio and 25% with the highest. The low-cost funds won.

The primary way we keep fees down, as we’ll discuss more below, is to use low-cost index ETFs and mutual funds. It’s an approach Warren Buffett, the CEO of Berkshire Hathaway and arguable the best investor alive today, supports:

Nevertheless, both individuals and institutions will constantly be urged to be active by those who profit from giving advice or effecting transactions. The resulting frictional costs can be huge and, for investors in aggregate, devoid of benefit. So ignore the chatter, keep your costs minimal, and invest in stocks as you would in a farm.

My money, I should add, is where my mouth is: What I advise here is essentially identical to certain instructions I’ve laid out in my will. One bequest provides that cash will be delivered to a trustee for my wife’s benefit. . . . My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.

Types of Investment Fees

There are countless fees investors may encounter. I’m going to list them in the order you are more likely to encounter them. Some fees are virtually unavoidable, but can be kept to a minimum. Other fees should be avoided at virtually all costs. Frankly, the only fee that is truly unavoidable is the first one on our list–expense ratio.

Expense Ratio

Mutual funds and ETFs charge investors a fee. The fee covers the cost of the fund, including payroll, as well as profit for the fund company. Expense ratios are expressed as a percentage. For example, a fund that charges a one percent (1%) expense ratio would cost an investor 1% of the amount invested in the fund (e.g., $100,000 investment would cost $1,000 per year with a 1% expense ratio).

The expense ratio is practically unavoidable. Fidelity does offer a few funds with no expense ratio, but that’s the exception. Even low-cost fund provider Vanguard charges expense ratios on its ETFs and mutual funds.

Transaction Costs

There can be costs to buy and sell stocks, mutual funds and ETFs. By and large these costs are easy to avoid. Most mutual fund companies and brokers have gone to $0 trades if made online. There is, however, one important exception.

Many brokers charge a commission when you purchase a mutual fund (not an ETF). For example, I have an account at Merrill Edge, and the broker charges $19.95 when I purchase certain mutual funds. They do have a list of fee-free funds, but many of the funds I use from Vanguard would require payment of the commission.

For this reason, it’s important to understand the types of investments you want to make before choosing a broker. If you know, for example, that you’ll invest entirely in Vanguard funds, it makes sense to open an account at Vanguard or a broker that offers at a minimum free Vanguard ETFs. M1 Finance is a good example and a broker I also use.

Investment Advisor Fees

Advisor fees come in two forms: (1) a percentage of assets under management (AUM), or (2) a fixed or hourly fee. The vast majority of advisors charge a percentage of AUM, with 1% the industry standard (although fees do vary based on account size and services provided).

Some lower cost AUM advisors have entered the market over the past 10 years or so. Vanguard offers advisory services for just 30 basis points. A number of so called robo-advisors offer their services for about 25 basis points (e.g., Betterment and Wealthfront).

A growing list of advisors have turned to hourly or fixed fees. These arrangements almost always favor the client, as the total cost is generally far less than the AUM model. One such advisor is Mark Zoril of PlanVision.

As you’ll see in a minute, Advisor fees based on a percentage of AUM destroy more wealth than any other fee (although high expense ratios are a close second).

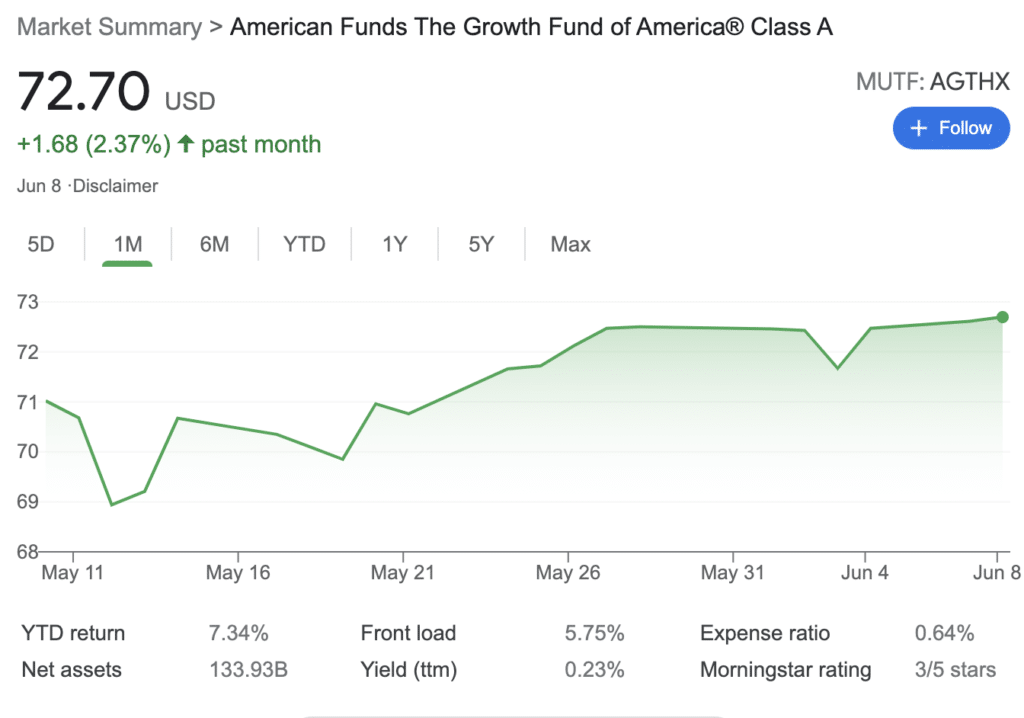

Load Fees

Some mutual funds charge what are called load fees. Front-end load fees are paid when you invest in a mutual fund with this type of fee; Back-end load fees when you sell.

Front-end load fees typically cost 5.75%. For every $100 invested, fees take $5.75, leaving $94.25 in your account. There’s absolutely no reason to invest in mutual funds that charge load fees. Ever!

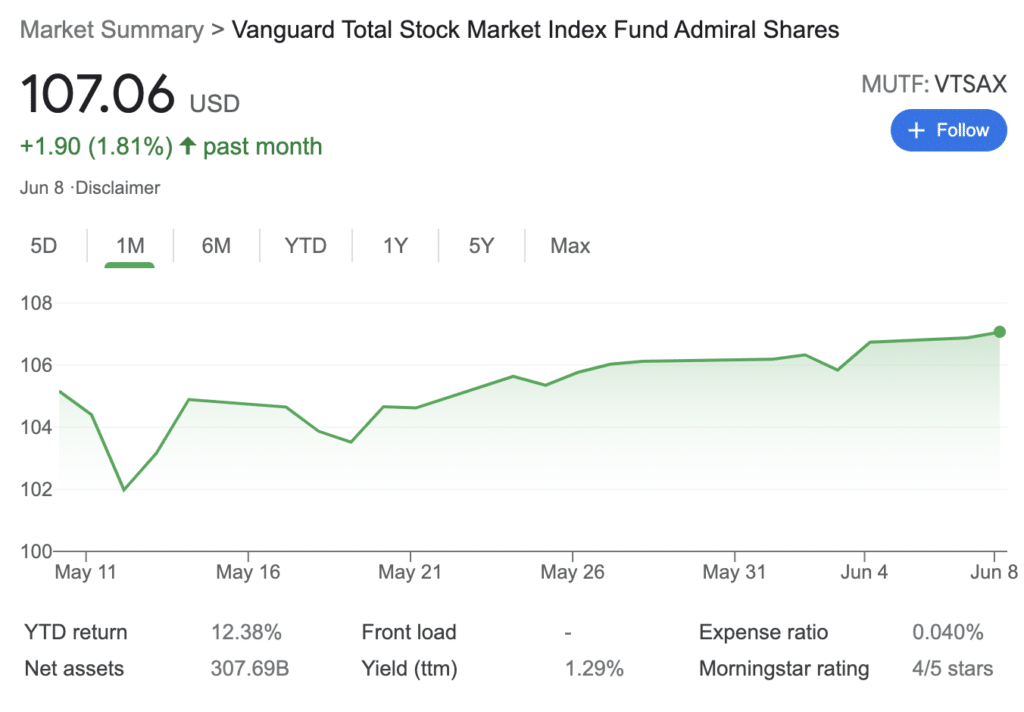

Where to Find the Expense Ratio of a Mutual Fund

There are several easy ways to find the expense ratio of any mutual fund or ETF. For starts, you can Google the ticker symbol of the fund. VSTAX, for example, is Vanguards total stock market fund. Searching “VSTAX” returns the following result, including the fund’s expense ratio:

You can also see if a fund charges a load fee AGTHX, an American Funds growth fund:

Another free tool that tracks both the expense ratio as well as any load fees is Morningstar. You can also check the prospectus of the funed.

As for investment advisor fees, you should ask. It’s as simple as that. It should also be reflected on your statements. You can also find fee disclosures in the advisor’s Form ADV. But asking is much easier.

How to Determine the Expense Ratio of Your Investment Portfolio

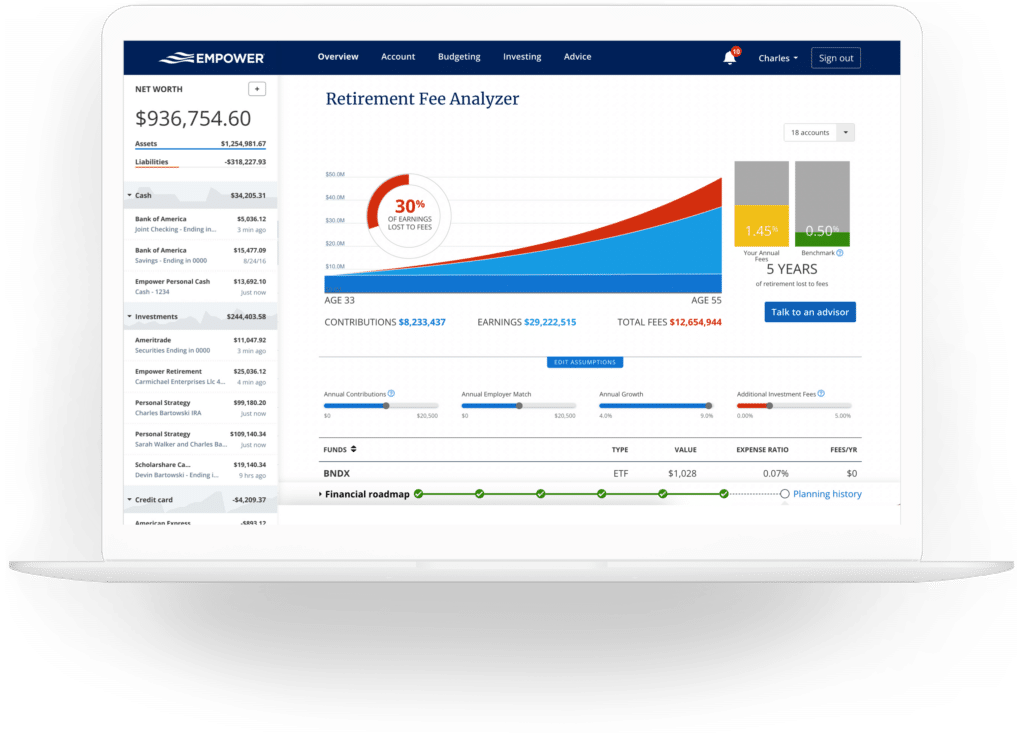

While it’s important to know the expense ratio of each investment, what really matters is the overall expense ratio of your portfolio. You could calculate this by hand. Just take the weighted average of your expense ratios across all of your investments. If that sounds as inviting as a root canal, there is an easier way. Use Empower.

Empower is a free financial dashboard. Link all your financial accounts (checking, savings, credit cards, retirement accounts, HSAs, loans, taxable investments) and Empower provides a wealth of tools. You can do everything from budgeting to loan payoff to retirement planning. And for our purposes, it will automatically calculate the expense ratio of your investment portfolio.

Here’s the results from a demo portfolio I entered into Empower:

Note the 0.10% annual fee to the right. That’s the expense ratio of a portfolio that included dozens of investments. You can read my review of Empower or go directly to its free signup page (truly free-no credit card needed–ever).

How Fees Affect Your Wealth

Let’s imagine that we make the maximum contribution to an IRA ($6,000) during our working years from age 20 to 65. If we earn an average of a 9% return on our investments, we’ll retire with about $3.1 million (gotta love compounding).

Now let’s assume we pay an investment advisor a “small” 1% fee. Our retirement fund drops to $2.3 million. Add in a 1% expense ratio on the mutual funds, and our nest egg falls further to $1.7 million. Yeah, fees matter.

How to Avoid Most Investment Fees

There are several important steps to take to keep you fees low.

Low cost index funds: First, stick to low cost index funds (ETFs or mutual funds). They outperform the vast majority of actively managed funds over time. There are plenty of sound “lazy portfolios” that make for great long-term investment strategies. Here are a few of them:

Avoid Expensive Advisors: There’s simply no good reason to pay more than about 0.30% of AUM, at the most. Vanguard offers its services at this price. Why pay more? And there are plenty of advisors who charged by the hour, which is even better.

Consider Automated Investment Services: For those that want a little help, you can consider a robo advisor. They come in all shapes and sizes. I like Betterment and Wealthfront for those who want a set-it-and-forget-it arrangement. Cost is about 25 basis points. For those who want more control, M1 Finance is the way to go. It lets you create your own mutual fund (they call them Pies). It’s easy to use, easy to rebalance, and free.

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.