Morningstar User’s Guide

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

Welcome to the Morningstar User’s Guide. We’re going to cover everything you need to know about using and getting the most advantage out of Morningstar. In this first article and video, we’ll cover an overview of Morningstar. We will also look at some resources you’ll need as we work through this guide.

It’s my hope that this will help you become a better, more confident investor.

Morningstar User’s Guide Video

Morningstar Overview

Morningstar was founded in 1984. Before the internet as we know it, by Joe Mansueto. The story is that he started it in his apartment in Chicago with about $80,000. I don’t know if that’s true, but regardless, he started Morningstar in 1984. Today, it’s a publicly traded company trading under the ticker MORN. It went public in 2005.

Last year, Morningstar generated about $1.2 billion in revenue. By my calculations, individual investors who pay for the premium version of Morningstar accounted for only about $22 million. Most of the revenue comes from tools designed for professional money managers and investment advisors. Some of these tools can cost tens of thousands of dollars a year.

The good news is that Morningstar made a lot of its data available for free to individual investors. And its premium version, which offers additional tools, is only $199. So that’s the good news.

Issues with Morningstar’s New Website

Now, there is some bad news. Last year Morningstar made some substantial changes to its website. They launched the new website in July 2019. The look of the new site is an improvement, sort of.

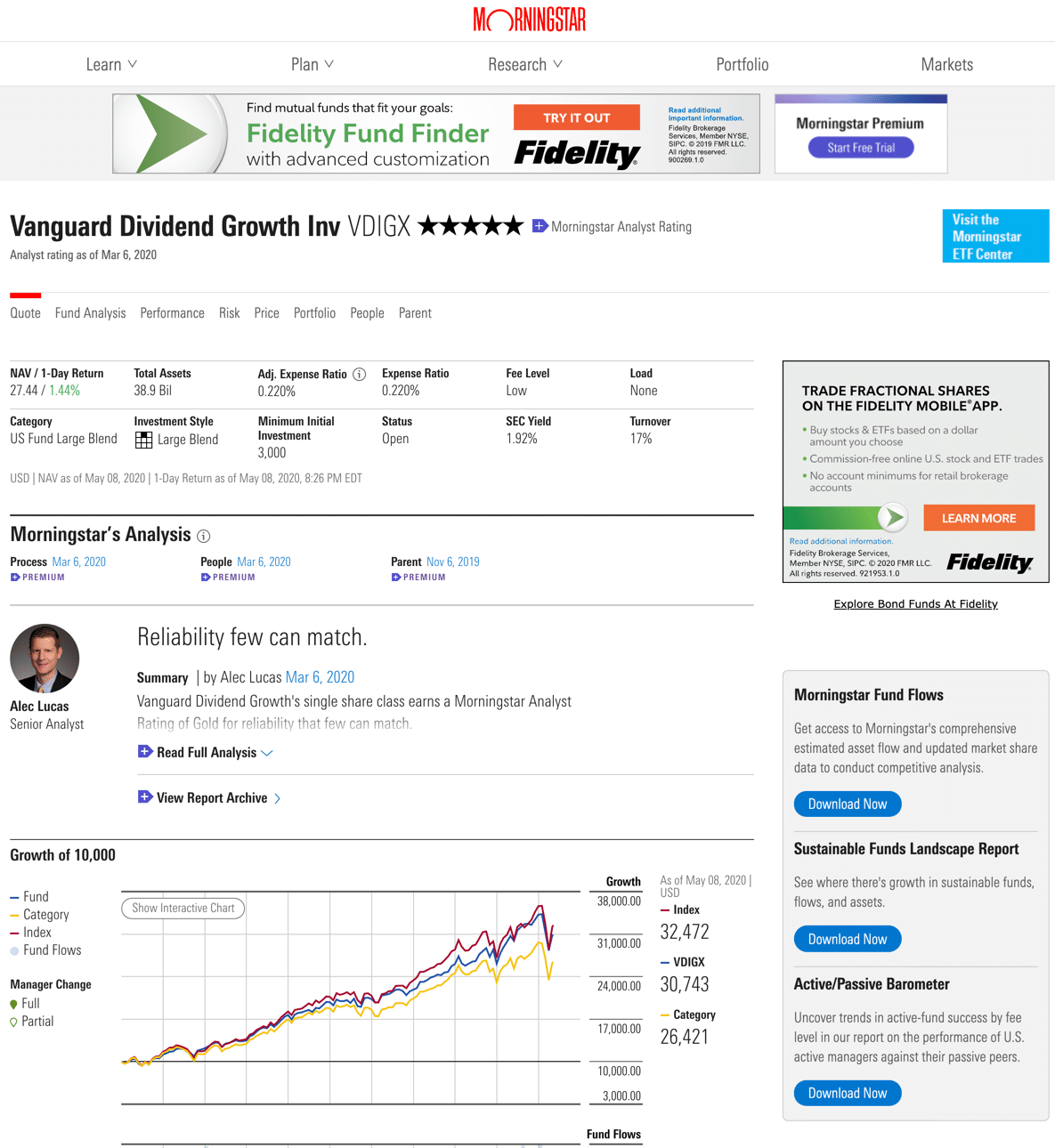

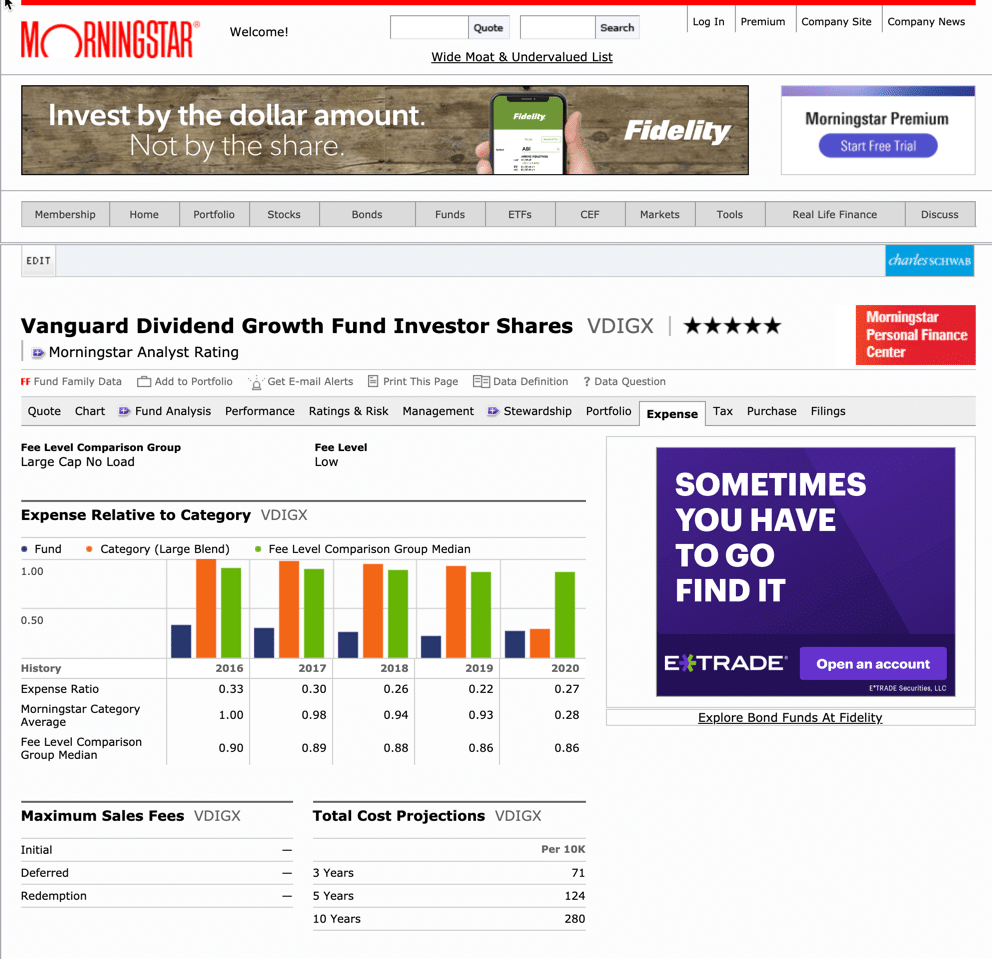

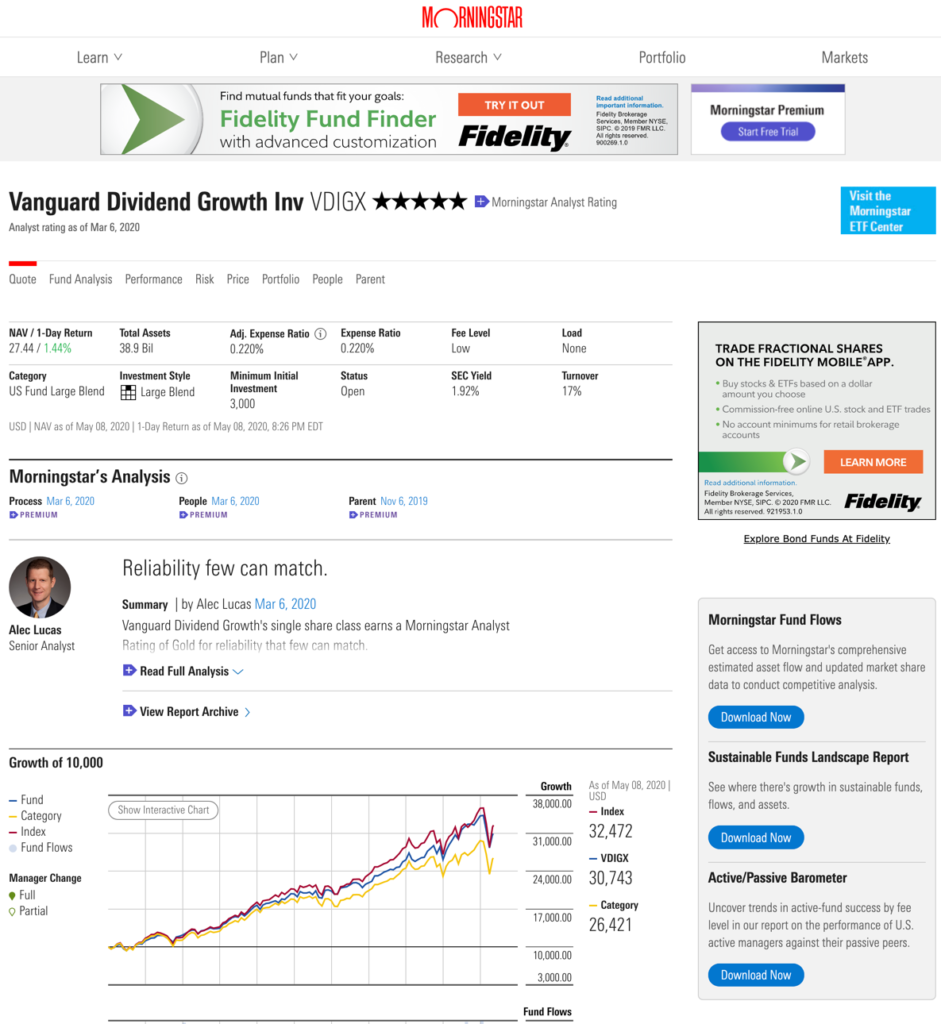

Here’s what the old site looked like:

And here’s the current website design:

The problem is that the functionality took a big hit for several reasons.

First of all, they took away a lot of the tools and data that were available in the old version of the site. For example, the removed the after-tax returns of mutual funds, which I thought was a very helpful data point. There are ways to get at that information, and we will cover that when we get to it in the series. That’s the good news, we can still get back to this old version, for now.

Second, they haven’t bothered to update the user guide. The Premium User Guide for paid members still reflects the old website design and functionality. I reached out to Morningstar support, thinking I just couldn’t find the new guide. Nope. They haven’t updated it. I guess that makes this User’s Guide all the more important!

Finally, many of the tools that still exist are really hard to find. In the old version they had a menu item called “Tools.” Seems simple enough. That page now no longer exists. So there’s no one page to go to to see all of the tools Morningstar offers investors.

This Morningstar User’s Guide

This guide will be divided into four parts.

Part 1: The Data

The first part is going to be simply understanding the data. It’ll be creating a number of videos that walk through all of the data about mutual funds, ETFs an stocks that Morningstar offers.

Part 2: Using The Data

Now that we have all this data from Part 1, how do we actually use it to make important investment decisions? That’s what we will cover in Part 2. First, we’ll figure out of all of the data you get from Morningstar, what pieces of it are really important. And then once we know that, we’ll cover how to use the data.

How do we use it to pick a mutual fund in our 401k? How do we compare two mutual funds? So we’ll be looking at that in part two.

Part 3: Portfolio Manager

In Part 3, we’re going to be looking at the portfolio manager in Morningstar.

We will walk through the Portfolio Manager, showing you how to set up your own portfolio, how to add new holdings, and then the different ways you can use the tool to evaluate your investments.

Part 4: Morningstar Tools

In Part 4 we will look at Morningstar Tools. These include fund and stock screeners, calculators, and the X-Ray tool.

Morningstar Resources You Need Handy for this User’s Guide

To finish out this brief overview, I want to talk about some things that that you want to keep in mind that are important as we move through the series.

Membership

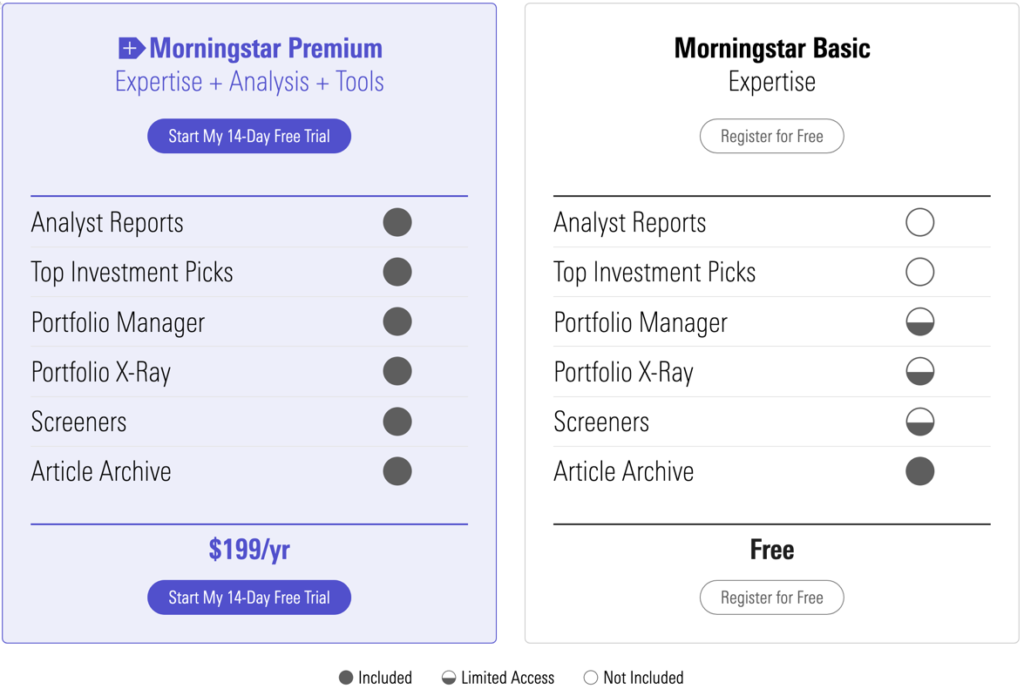

The first is the Morningstar membership options. For individual investors like you and me, there’s are two options. At a minimum, you’ll want the Morningstar basic membership. It’s free, and you will need it to create and monitor your portfolio. If you want the premium version, it costs $199 per year.

Here’s what the two options cover:

While I’m a Premium member, it’s not necessary for most people.

Snapshot and Glossary

Two more things briefly, that I think you should focus on, or at least have handy. The first is Morningstar Snapshot definitions.This gives you the definitions of key terms and concepts that we will encounter throughout this series.

For example, Morningstar categorizes mutual funds as a stock, bond or balanced fund. One might think that a bond mutual fund invests in bonds. Well, it does, but Morningstar categorizes a fund as a bond fund if at least 80% of its assets are on bonds. As a result, a “bond” mutual fund could also have a not insignificant amount invested in equities.

As another example, consider Morningstar’s definition of an international stock fund. According to Snapshot, it’s a stock fund that has invested 40% or more of its equity holdings in foreign stocks. So don’t assume you know Morningstar’s definition of these terms.

A similar tool is the Morningstar Glossary. It offers a wider range of investing terms.

Morningstar Search Tool

The last thing I want to show you in this overview is the search box on Morningstar. This really is the door through which you’ll find a lot of the things that you need on Morningstar. For example, you can you the search box in several ways to find key information on Morningstar:

- Ticker: Search an investment by its ticker symbol

- Name: Search a mutual fund or stock by name

- Screener: Search the term “Screener” to find Morningstar’s stock and fund screeners

- Tool: Search the term “Tool” to find Morningstar’s calculators and other investment tools

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.