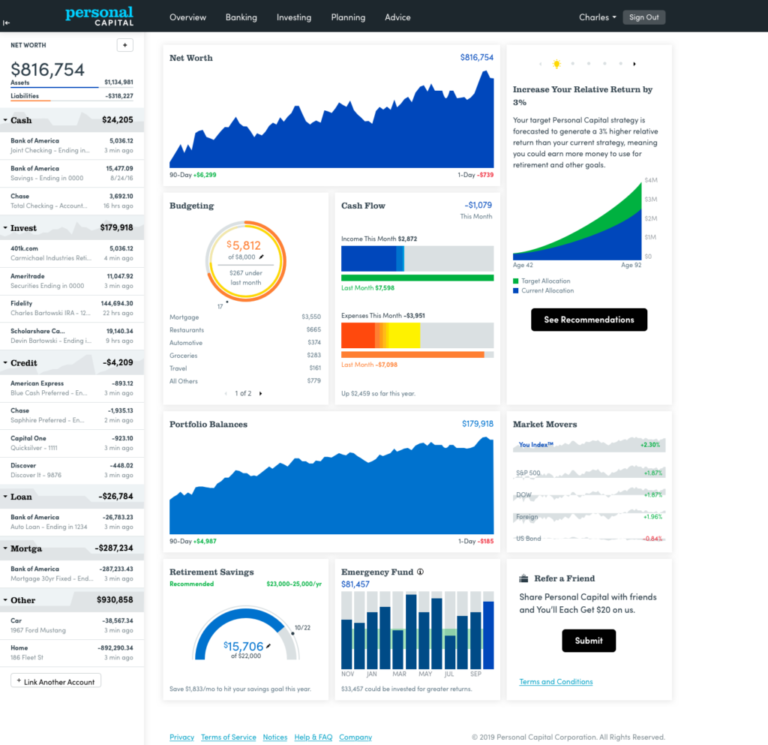

8 Best Net Worth Calculators in 2026 (#1 is Free)

There are plenty of free net worth trackers on the internet. For most of them, you enter the value of your assets and liabilities, and the calculator does the simple math to show you how much you’re worth. The best net worth calculators, however, do far more than simple math. They enable you to connect…