How A 1% Investment Fee Can Cost You $1,000,000 (Or More)

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

Investment fees can wreck havoc on your wealth. Think bull in a china shop destruction. What's worse is that it can happen without you even knowing. The fees seem small and insignificant while they drain your portfolio of its earning potential. In this article, we'll look at just how costly investment fees can be and what you can do about it.

In this article, we are going to examine four aspects of investment fees. First, we’ll look at the numbers to see just how big an impact seemingly small fees can have on your wealth. Then we’ll consider whether high investment fees translate into better returns. Third, we’ll look at how to determine the investment fees you currently pay. And finally, we’ll look at a free tool that I use every day that includes an investment fee analyzer.

Investment Fees Matter . . . A Lot

Even a 1% fee, over a lifetime of investing, can significantly reduce the value of a portfolio. Using Vanguard data, we know that from 1926 through 2019 an 80% stock and 20% bond portfolio returned 9.7% a year. Let’s imagine we invest $1,000 a month over a 40-year career. Using this savings calculator, we know that the portfolio would grow to about $5.8 million.

Yes, compounding is a beautiful thing.

Let's now assume we pay an advisor 1% of our investments for their services. That's a standard fee in the industry, although you can find less expensive and more expensive advisors. The result is that on an after fee basis, our returns drop from 9.7% to 8.7%. The result is a portfolio of just $4.3 million. The one percent fee cost us about $1.5 million, or 25% of our wealth.

Fees matter.

High Fees Do Not Generate Better Returns

In defense of fees, some argue that higher fees generate better returns. Studies do not support this conclusion. A study by S&P Global published in 2020 found that actively managed funds underperformed their respective index over a 10-year period:

Large-cap funds made it a clean sweep for the decade—for the 10th consecutive one-year period, the majority (71%) underperformed the S&P 500. Their consistency in failing to outperform when the Fed was on hold (2010-2015) or raising (2015-2018) or cutting (2019) rates deserves special note. Of the large-cap funds, 89% underperformed the S&P 500 over the past decade.

The results for mid-cap and small-cap funds weren’t much better–”84% of mid-cap funds and 89% of small-cap funds underperformed over the longer 10-year period.”

Studies by Morningstar have similar results.

How to Find a Mutual Fund’s Expense Ratio

Determining a mutual fund’s expense ratio is easy. As a starting point, a prospectus will include this information. Most 401k and other workplace retirement accounts should also provide this information. If you know the ticker symbol of the fund, you can also find the expense ratio on Morningstar. I have a video series that walks you through how to use Morningstar’s free tools.

Keep in mind that the expense ratio is not the only fee a mutual fund will charge. They also charge transaction fees that aren’t reflected in the expense ratio.

As for advisors, make sure you understand the fees they are charging you. If you don’t know what they are, ask.

Free Fee Analyzer Tool

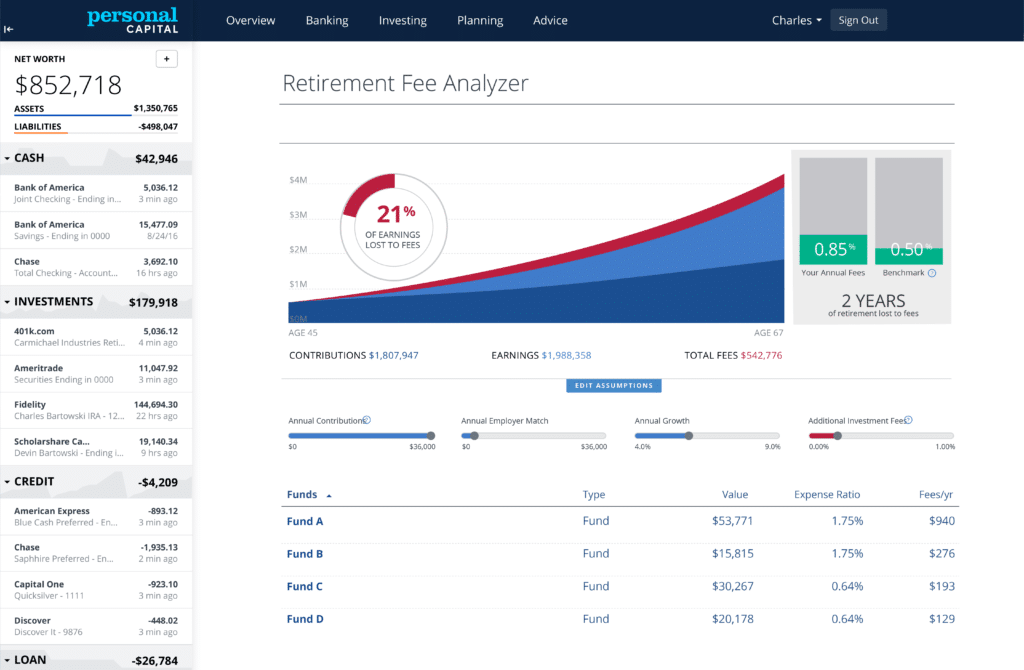

Finally, there is a free tool you can use to evaluate your investment costs. It’s called Personal Capital. One feature of the tool is called the Retirement Fee Analyzer. Once you connect all of your investment accounts, the tool first determines the expense ratios of all of your investments. It shows you this information for each fund and it calculates the weighted average expense ratio for your entire portfolio.

Beyond the data, Personal Capital also provides two tools to evaluate your investment fees. First, it compares your fees to a benchmark. Personal Capital uses 0.50% as its benchmark. More importantly, it shows how the fees will impact your wealth over time. Here’s what it looks like.

Keep in mind that the Fee Analyzer does not factor in any advisor fees you may be paying. It just looks at the expense ratios of the funds that are in your portfolio.

It’s easy to forget about investment fees. Yet they are one of the most important aspects of investing. They are also a great indicator of returns. The lower the fees, the higher your returns. That’s why index funds are such an important part of long-term investing.

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.