4 Best Target Date Retirement Funds in 2024

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

Target date retirement funds make investing in a 401(k) or IRA easy. Simply pick a fund that corresponds with when you plan to retire, and the fund does the rest. In this article we’ll look at several of the best target date retirement funds available today.

Target date retirement funds can be great tools for long-term investors. There are, however, factors that differentiate great target date funds from others I would not recommend. I’ve researched dozens of funds to identify the best options, as well as an example of a target date fund you should avoid.

4 Best Target Date Retirement Funds

For each of the target date funds below, we’ll explore the 2050 version. A 2050 fund is designed for those retiring around the year 2050. Each of these fund families offer funds in five-year increments (e.g., 2020, 2025, 2030).

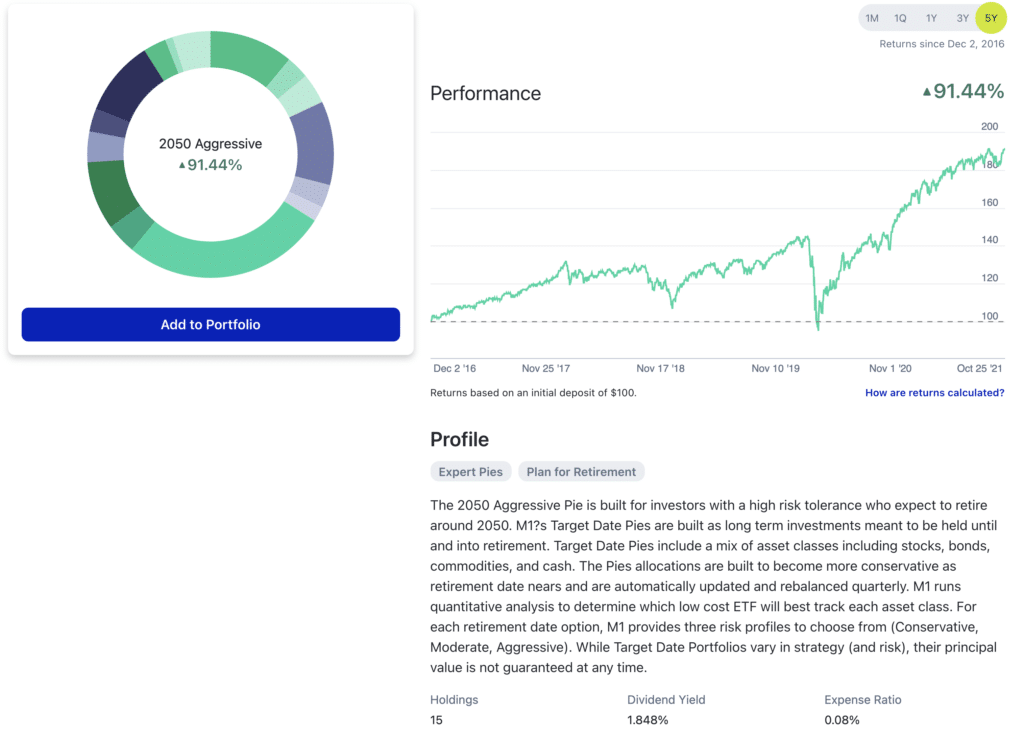

M1 Finance Target Date Retirement Funds

M1 Finance retirement funds make the top of my list for several reasons. First, for each retirement year (e.g., 2020, 2025, 2030), M1 Finance offers three different funds. All of the other options below only offer one. Specifically, M1 Finance offers investors Aggressive, Moderate and Conservative options for each retirement year.

For example, the M1 Finance 2050 Aggressive Target Date Retirement Fund allocates just 3% to bonds, while its 2050 Conservative fund allocates 19% to bonds.

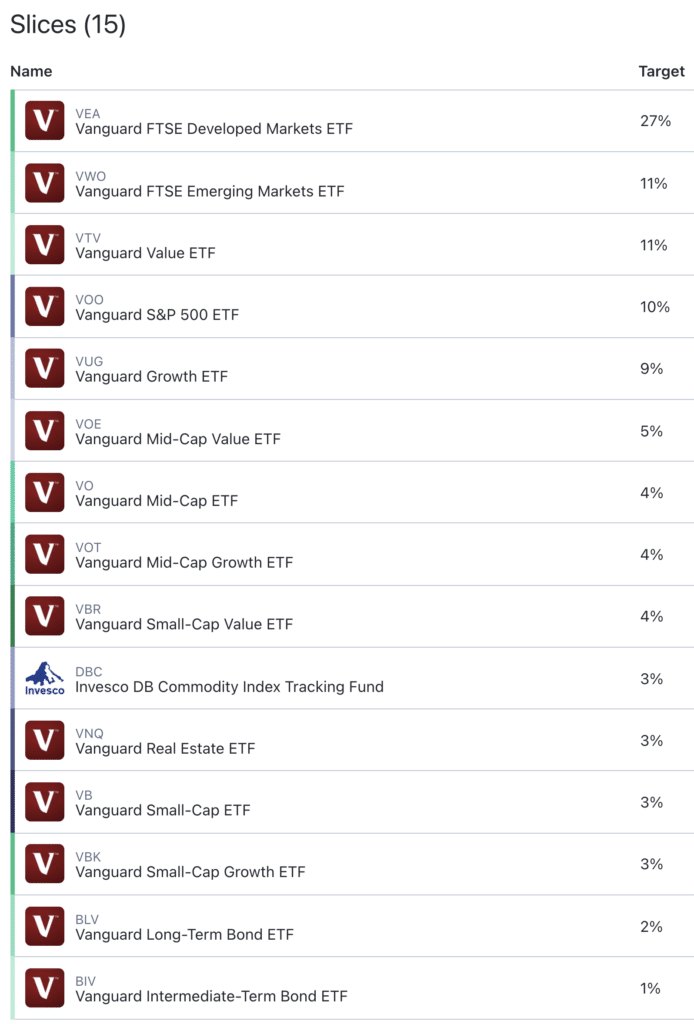

Second, each of M1 Finance’s funds (they call them Pies) include broad stock and bond exposure across more than a dozen low cost ETFs. Here, for example, are the ETFs used in the 2050 Aggressive fund:

Third, unlike the other funds in my list, there is no elevated expense ratio to pay. M1 Finance doesn’t charge a fee. The only fees are those associated with the low cost ETFs M1 uses in each portfolio, and these are lower than the fees a target date fund charges.

Finally, the fund for those now in retirement (the 2020 fund) is in my view the best option available. The Aggressive 2020 fund is approximately 60/40 stock to bond allocation a reasonable approach for retirees following the 4% rule. Without exception other retirement funds become far too conservative at this stage.

M1 Finance target date funds are automatically updated and rebalanced quarterly. There is no minimum initial investment required.

Summary

- Expense Ratio: 0.08%

- Dividend Yield: 1.831%

- Minimum Investment: None

- Website: M1 Finance

Vanguard Target-Date Retirement Funds

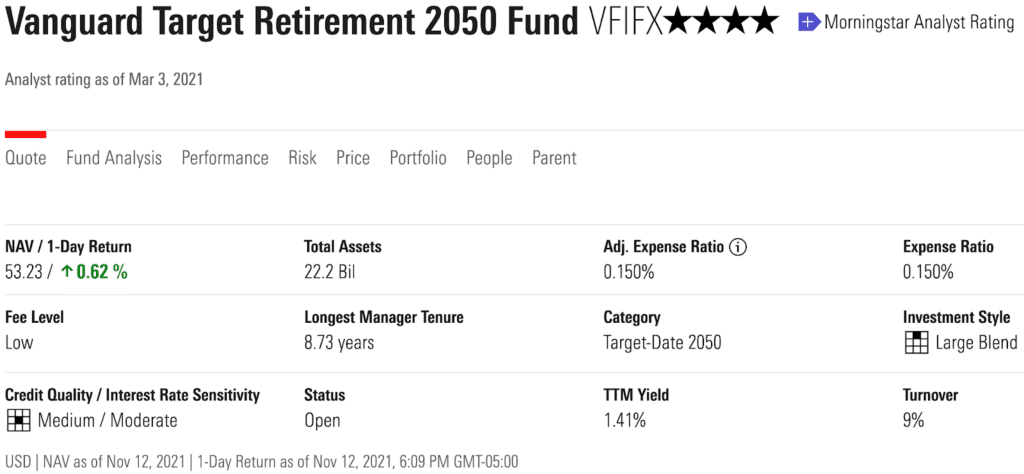

Vanguard’s 2050 offering, ticker VFIFX, is another solid option.

The expense ratio for the fund is extremely reasonable at only 15 basis points (0.15%). Important to note given low fees often predict the later success of a fund. VFIFX checks that box.

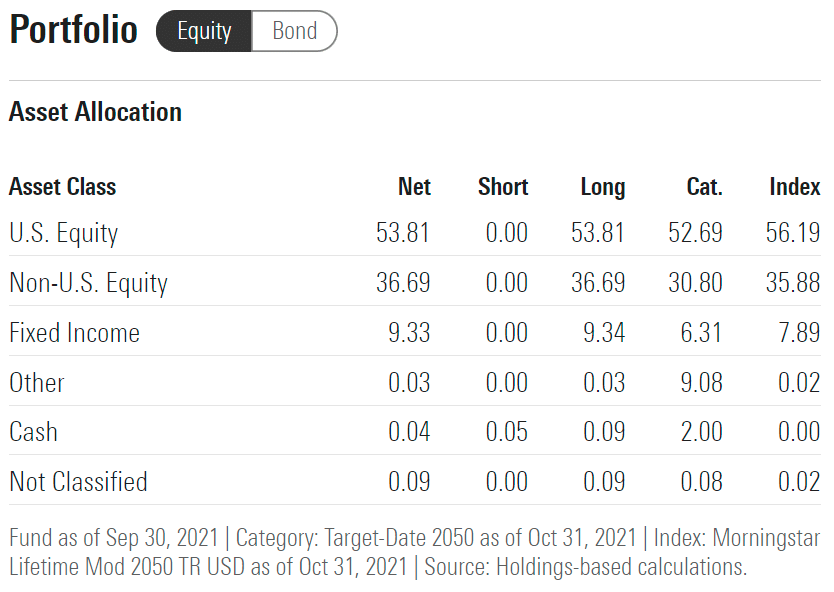

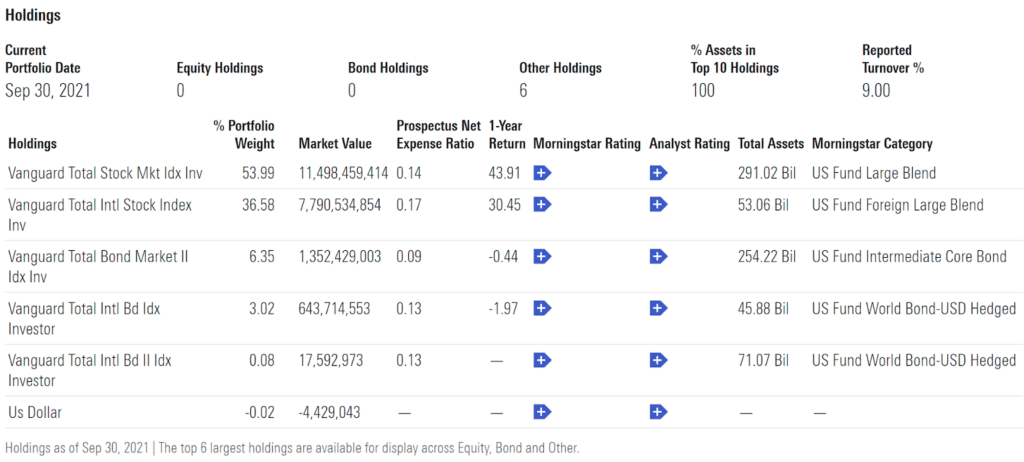

Turning to the Portfolio tab on Morningstar gives us a better look into the asset allocation of the fund.

Vanguard’s 2050 fund is 54% invested in US stocks and about 37% invested in international stocks. The remaining 9% of the fund is allocated to bonds. This aggressive investment mix makes sense given that it’s tailored for an investor with 30 years left to build their Portfolio. Keep in mind that this allocation will become more weighted toward fixed income as we get closer to 2050.

Vanguard implements this asset allocation plan using five Vanguard funds:

Five holdings doesn’t seem diversified. Here it’s important to understand that the number of funds in a portfolio tells us nothing about its overall diversification. We need to know what each of the funds owns. In this case, the holdings include thousands of stocks and more than 10,000 bonds. It’s well diversified.

Vanguard requires a $1,000 minimum initial investment.

Summary

- Expense Ratio: 0.15%

- Dividend Yield: 1.41%

- Minimum Investment: $1,000

- Website: Vanguard

State Street Target Date Retirement Funds

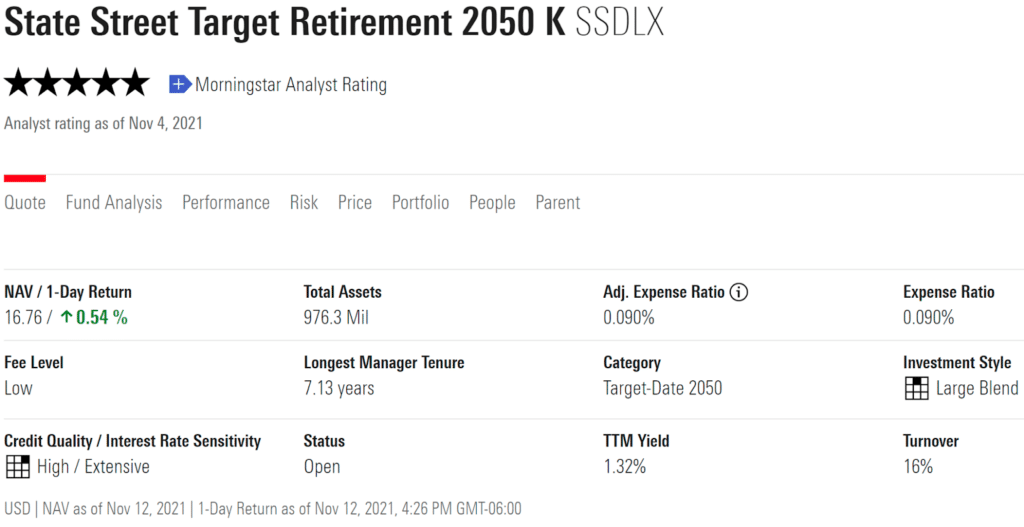

State Street’s 2050 target date retirement fund, ticker SSDLX, makes a strong impression with only a 9 basis point (.09%) expense ratio. It’s one of the least expensive options available today.

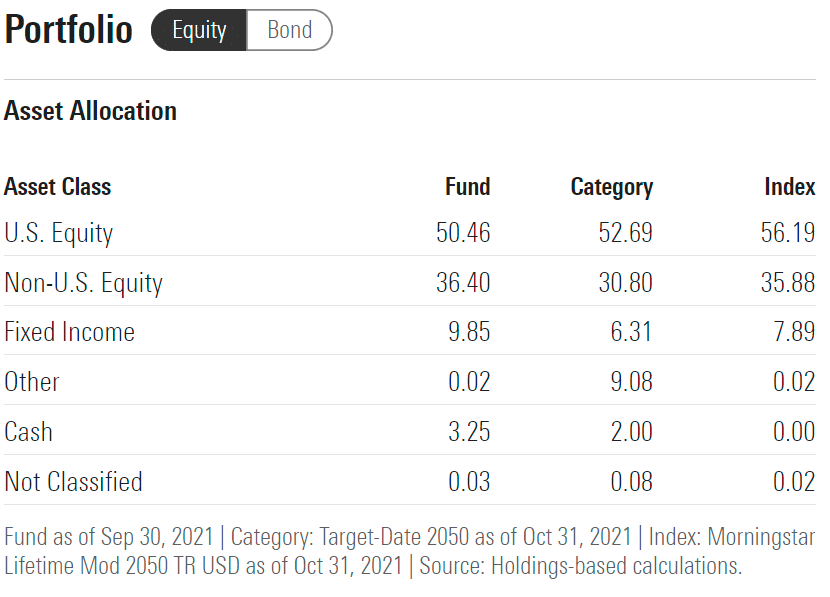

Its asset allocation is similar to Vanguard’s.

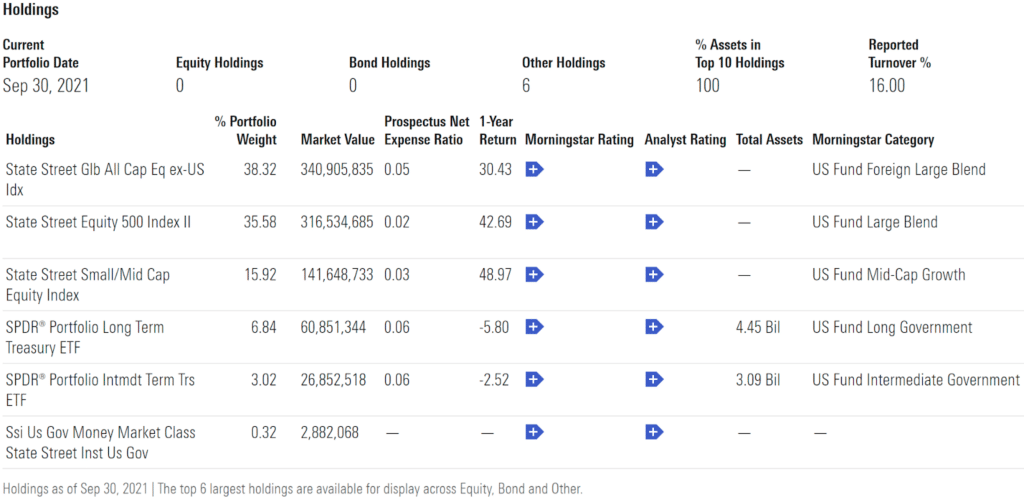

The Portfolio tab shows us the fund is invested 51% in U.S. stocks, 35% in international stocks, and about 10% in bonds. The holdings of the fund reveal more similarities to its Vanguard counterpart. It invests the fund in six index funds.

Three stock funds and two bond funds substitute for the inverse with Vanguard’s offering. The U.S. stock portion of the fund is split into an S&P 500 large blend fund and a mid-cap growth fund. Still, State Street’s fund should perform in line with Vanguard’s, with the added benefit of the lower expense ratio we saw earlier.

Summary

- Expense Ratio: 0.09%

- Dividend Yield: 1.32%

- Minimum Investment: None

- Website: State Street

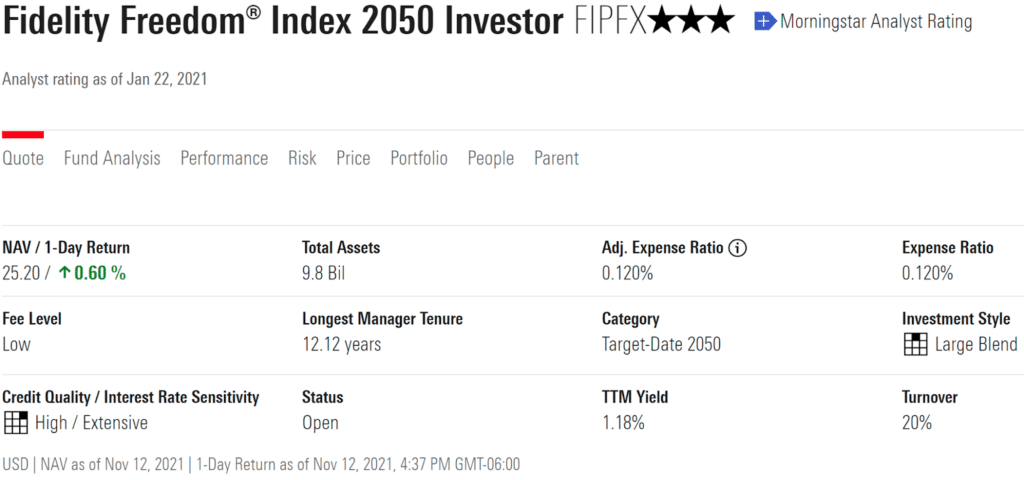

Fidelity Freedom Index Funds

The final fund is Fidelity’s Freedom Index 2050 Investor, ticker FIPFX. The exact naming of this fund is important to note. FIPFX has the word index in the fund name. Fidelity offers another Freedom 2050 target-date fund, but the underlying holdings consist of actively managed mutual funds.

As a result, that fund charges 75 basis points (.75%) in fees. In contrast, the Freedom Index fund only charges 12 basis points (.12%). That expense ratio puts the Fidelity fund in between State Street’s and Vanguard’s options.

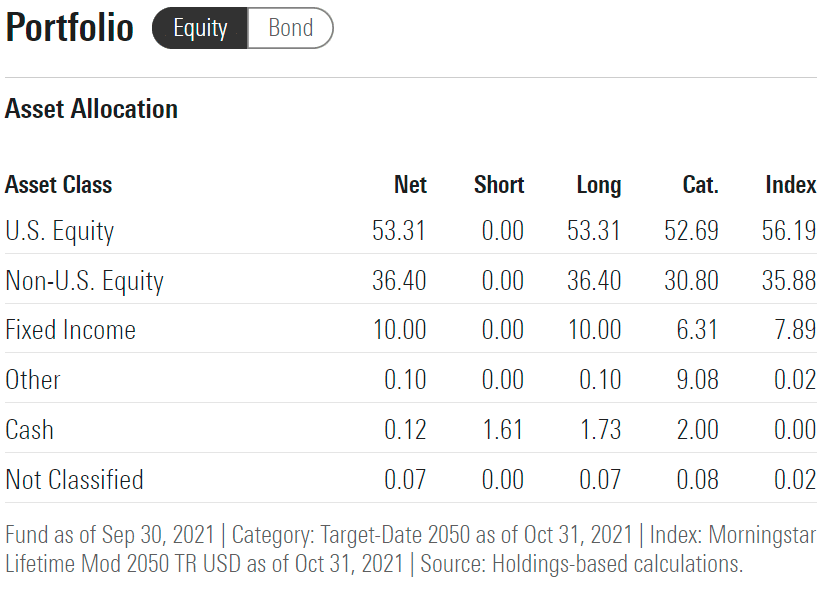

The asset allocation of this fund is nearly identical to the Vanguard, State Street and M1 Finance Moderate funds.

Nothing surprising jumps out–53% of the fund is allocated to U.S. stocks and 37% to international stocks. Bonds fill out the remaining 10%.

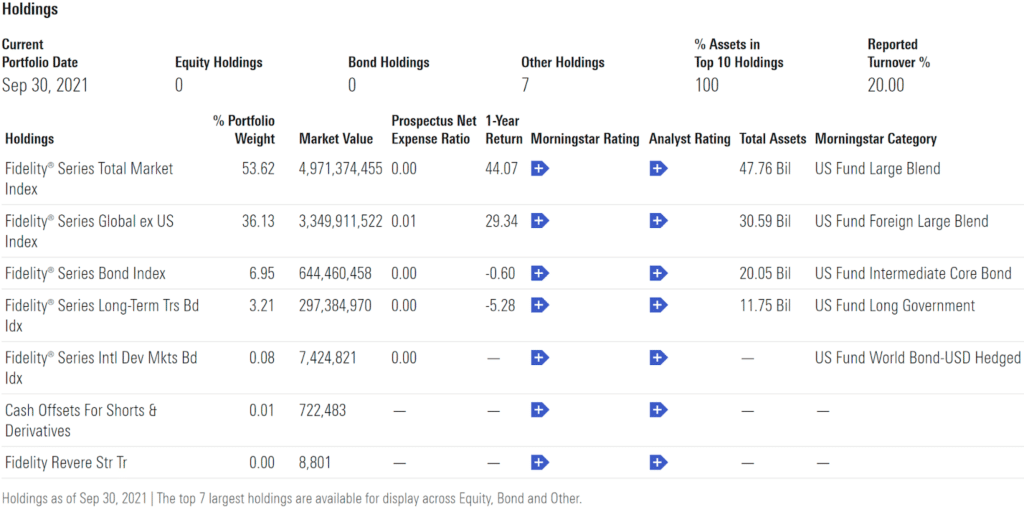

The holdings of the fund shouldn’t shock anyone either. Fidelity uses Fidelity index funds to implement its asset allocation.

Overall, another sensibly arranged portfolio–Diversified, low-cost, and convenient.

Summary

- Expense Ratio: 0.12%

- Dividend Yield: 1.18%

- Minimum Investment: None

- Website: Fidelity

Target Date Retirement Funds in 401(k) Accounts

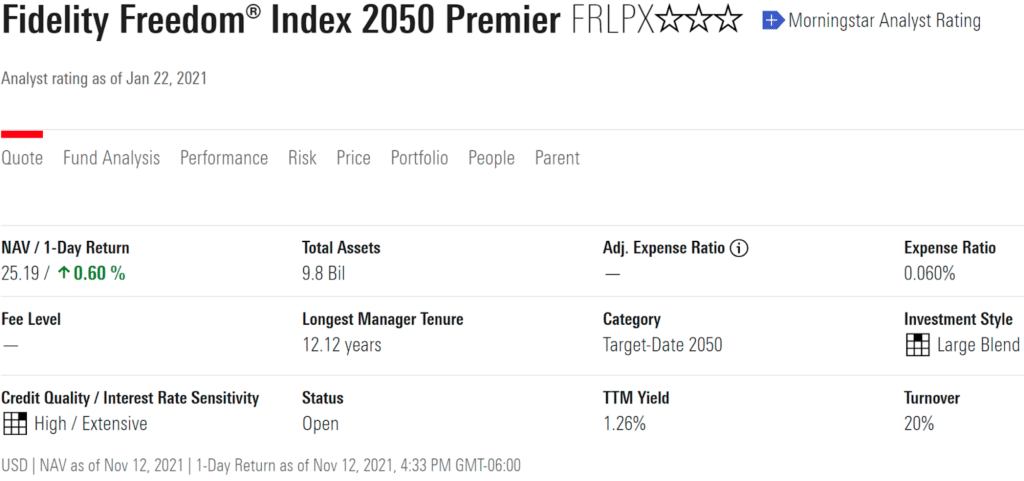

If target-date retirement funds are starting to seem like attractive options, it might be worth considering holding a target date fund in a 401k if one is available to you. Since company 401(k) plans often invest hundreds of millions at a time, mutual fund providers may offer companies an expense ratio discount to attract their business.

For example, ticker FRLPX is the Fidelity Freedom Index 2050 option offered in my 401(k) at Forbes. This version of the fund has the same asset allocation, holdings, and glide path but charges half the fees of the non-401(k) investor class fund.

I mention this industry convention not only to highlight the fee difference but also to prevent any confusion when picking funds in a 401(k). If there’s any doubt as to whether one fund mirrors another, it’s best to check the Portfolio tab on the Morningstar listing for both funds and make sure the only difference is the expense ratio.

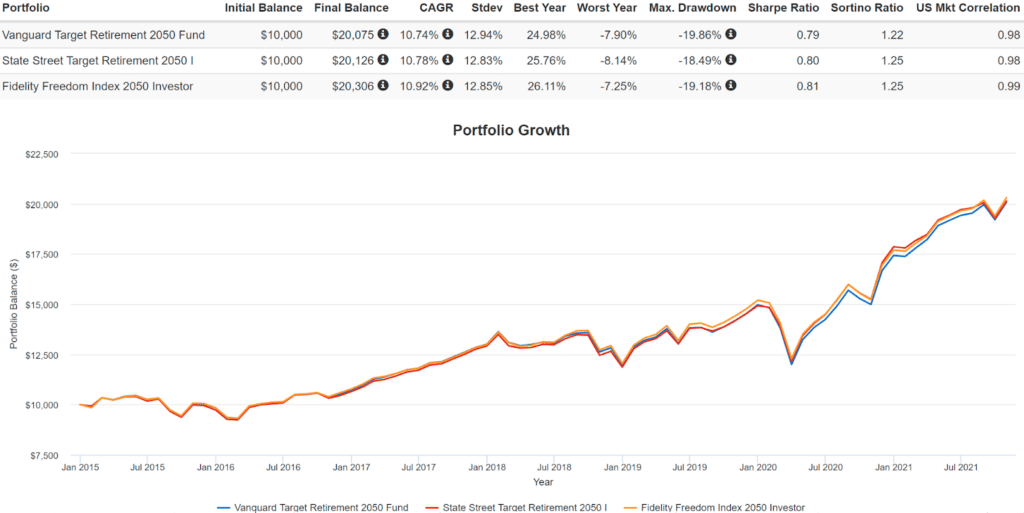

Backtesting Target Date Funds

For a performance comparison of the funds, we’ll be using Portfolio Visualizer. This site is great for backtesting portfolio options and provides a number of useful metrics for weighing funds. The data set will be limited by the age of the newest target-date retirement fund, but we have a reasonable length of time to compare the funds.

The 3 funds compete very closely with one another. The Fidelity fund ultimately wins out by only a couple hundred dollars. The standard deviation of the funds, a measure of portfolio volatility, is fairly uniform from fund to fund. The same goes for the maximum drawdown period of the funds. Safe to say, any of the three funds are reasonable and comparable options.

The M1 Finance fund has had similar return and risk characteristics.

Not All Target Date Funds are Good Investments

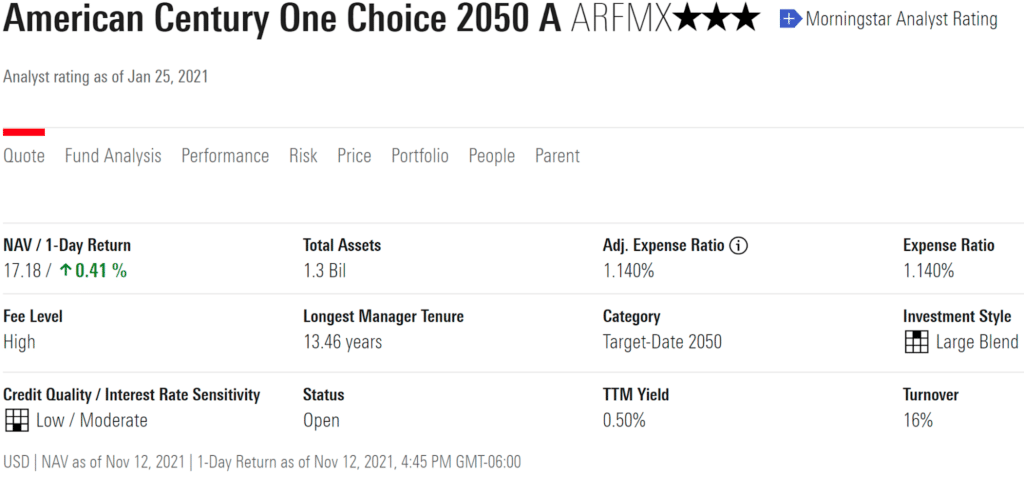

I’ve chosen one fund that exemplifies some suboptimal aspects that should signal investors to steer clear. I do this not to belittle the mutual fund company or fund in particular, but to illustrate what potential negative qualities of target date funds can cost investor’s future returns.

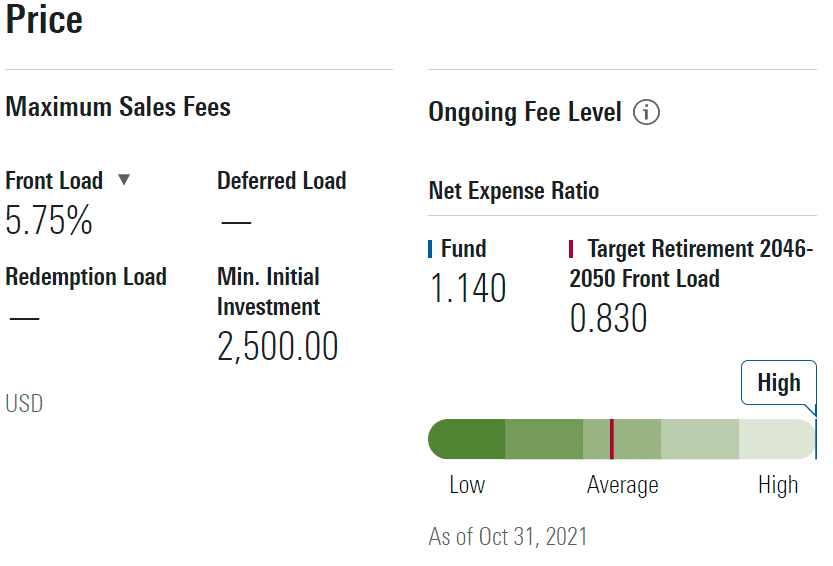

The fund is called the American Century One Choice 2050, ticker ARFMX. I would avoid the fund for two main reasons.

First off, the fund’s expense ratio is simply too high. American Century charges over 1%, making it more than 10 times as expensive as the fund options we’ve looked at. Unfortunately, that isn’t the end of the fees associated with investing in the fund. ARFMX has a front load fee, meaning there’s a sales charge paid every time you buy into the fund. Purchasing through a 401(k) would bypass that fee. Otherwise, and I can’t caution against this enough, that fee would recur every time a contribution is made.

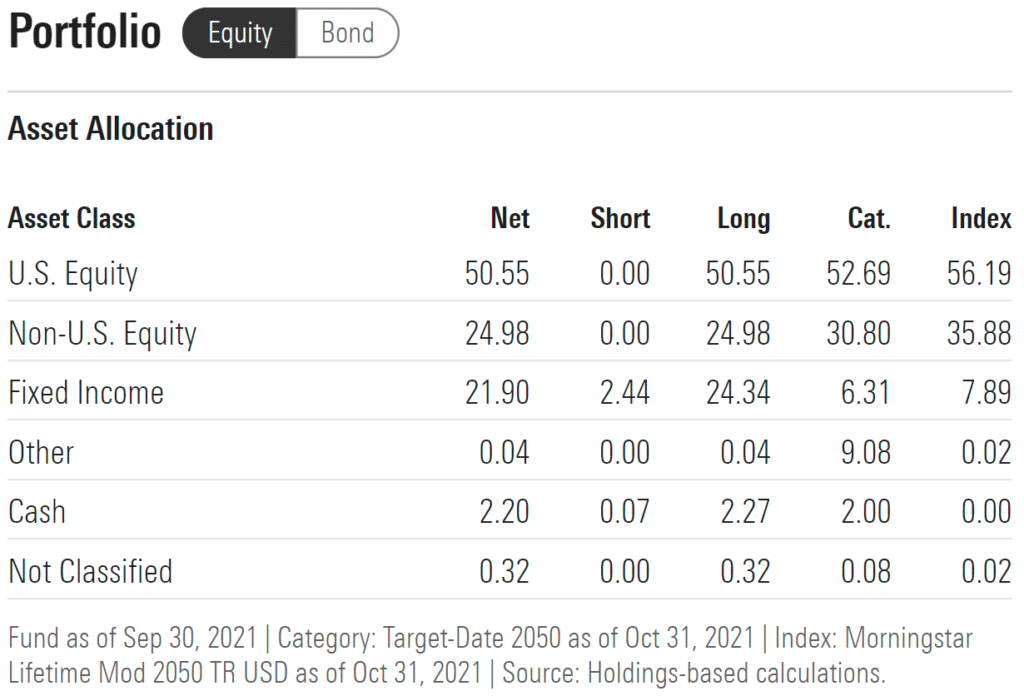

The second reason why I’m not a fan of this fund is its asset allocation.

Remember that American Century’s target date is a 2050 fund just like the 4 funds we explored. That means the typical investor in the fund is 30 years away from retirement. Nevertheless, the fund allocations 22% in bonds. For some investors, that conservative approach might be attractive. But in my estimation, that is too cautious a strategy for investors with such long time horizons.

An 80/20 split between stocks and bonds is perfectly reasonable in a vacuum, but remember the fund will increase its bond allocation over time. Overall, the fund is a suboptimal choice given its fee burden and asset allocation.

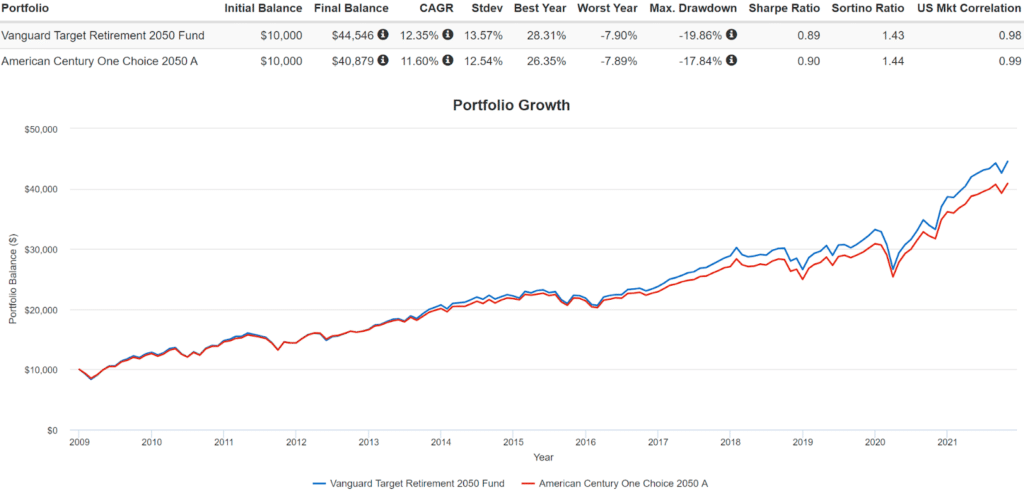

The American Century fund performance in comparison to Vanguard’s offering should bear out my concerns.

That data for this backtest in Portfolio Visualizer goes back to 2009. The fund’s fees and asset allocation drag on the ugly duckling fund to the tune of almost a full percent less in returns.

The key point is to recognize that not all target date funds are created equal.

How Target Date Retirement Funds Work

Target date retirement funds feature a date in their name. For example, the funds we’ve discussed are 2050 funds. The date corresponds to the investor’s planned retirement date. Somebody seeking to retire in about 30 years would be especially interested in 2050 funds.

Target date retirement fund offerings are typically spaced out in 5-year increments, meaning there are 2045 and 2055 versions of the funds we’ve explored. Picking a retirement date is not an exact science and things do change. Still, having a target date in the fund name provides some useful information about the fund’s asset allocation today and in the future.

Target date retirement funds hold a combination of U.S. stocks, international stocks, and bonds. The specific weighting of those asset classes adjusts over time and can vary between mutual fund companies. The expense ratio associated with target date funds goes, in part, toward paying for these adjustments. Allocation adjustments are made based on “glide paths”, which are predetermined rebalancing plans that each target date retirement fund follows.

As investors get closer to their chosen retirement date, target date funds shift more heavily toward bonds and away from stocks. This shift is meant to reduce portfolio volatility during investors’ retirements. An attractive approach in theory but one that can create some pitfalls, which we’ll address next.

The Downside of Target Date Funds for Retirees

Target date funds are a reasonable approach to investing for retirement. Once you reach retirement, however, these funds have a downside. They become far too conservative.

These funds follow a declining glide path. That simply means that as we get closer to retirement, the funds move stock investments over to bond investments. That in itself is reasonable. The problem is that they become far too conservative.

For example, the Vanguard Target Retirement 2015 fund is only 30% invested in stocks. A retiree six years in might want the security of a healthy bond allocation, but I would argue there’s such thing as being too safe. Granted, I’ve shifted my own investments into safer investments in retirement. Still, I wouldn’t recommend divesting a portfolio of stocks past the 50% mark.

In fact, Bill Bengen, the father of the 4% rule, found that a retiree’s portfolio should have 50% to 75% in stocks. Anything less and their odds of running out of money early go up.

With the exception of M1 Finance, each of the target date funds mentioned above fall well below the 50% equity floor.

Are Target Date Retirement Funds Diversified?

Diversification is important to any investor. Investing in a single mutual fund seems counter to that idea, but not in the case of target date retirement funds. Target date retirement funds provide ready-made diversified portfolios that hold thousands of domestic and international stocks and tens of thousands of bonds of various credit qualities. So yes, these funds are well diversified.

Final Thoughts

While I don’t personally invest in target date retirement funds, they are still reasonable and effective options. I advocate that investors start their wealth-building plans with a 3-fund portfolio. That said, the solid target date fund options we’ve discussed are all reasonable approaches to retirement investing.

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.