How to Invest $1 Million | A Step-by-Step Guide to Investing a Windfall

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

Investing $100 a month is simple. Many use one or more low cost index funds. So why does investing $1 million or more seem to require a more complex portfolio? In short, it doesn’t.

In this article I talk about how to invest large sums of money. I’ll share my own personal experience of investing a windfall. And I give you some specific portfolio ideas that I believe are ideal for invest even tens or hundreds of millions of dollars. Finally, I’ll share some books and other resources you may find helpful.

Who Has $1 Million to Invest?

At first it may seem like this article is for just a select few. There are several ways to find yourself with a lot of money at one time. These include inheritance, life insurance, the sale of a business or from an IPO or other liquidity even. But let’s face it, those who receive a windfall like this are few in number.

There is, however, a more common way many find themselves investing a large amount of money at one time–retirement. After a lifetime of work, workplace retirement accounts can exceed $1 million. Rolling a weighty 401k over into an IRA can be nerve-wracking. That’s why so many retirees hire expensive investment advisors to manage what they had managed on their own in a 401k for decades.

And that raises an important question–why is investing a large amount of money so psychological challenging?

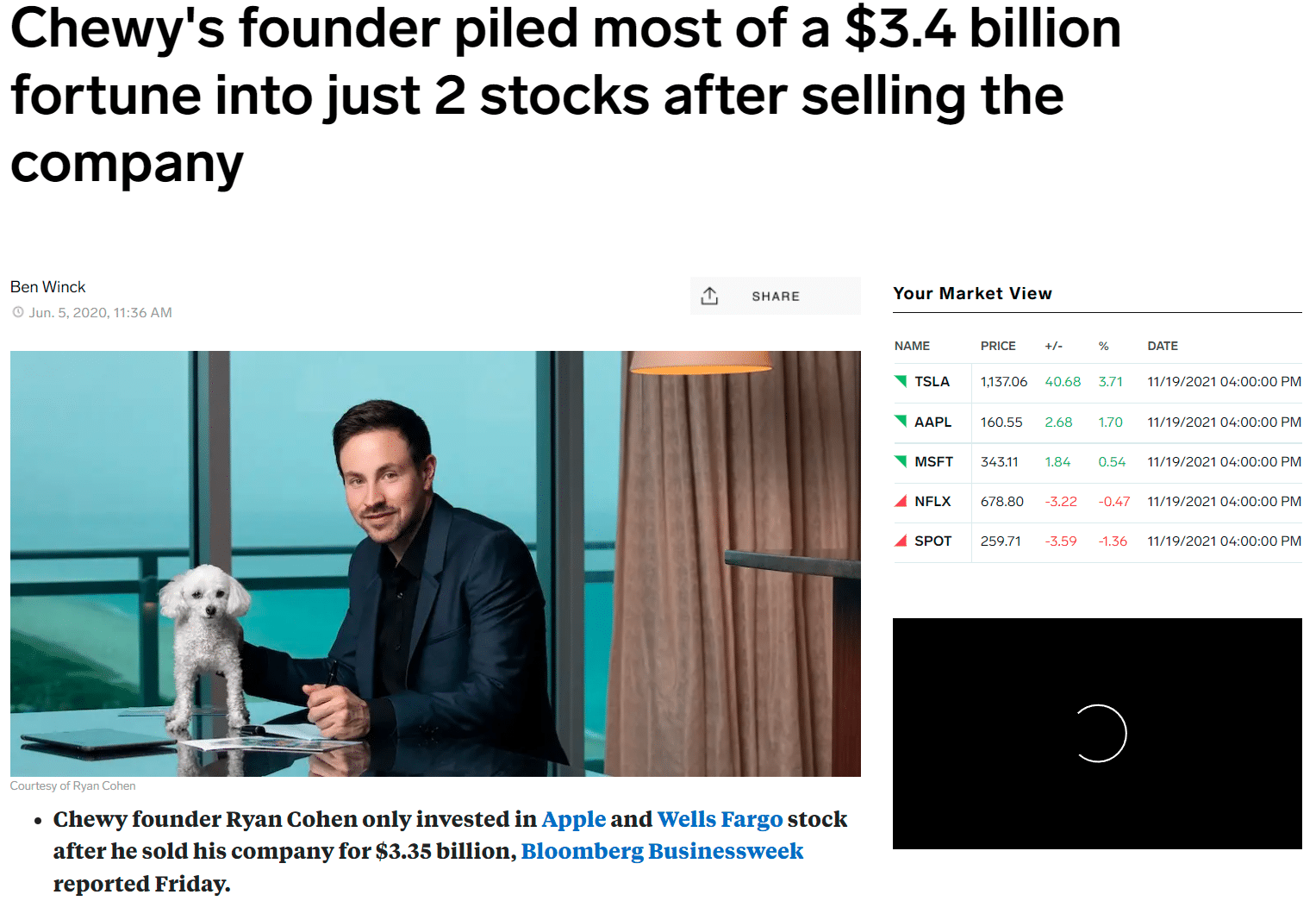

FACTOID: Ryan Cohen, of Chewy and GameStop fame, chose to stay the course with his fortune. He experienced a massive liquidity event to the tune of $3.4 billion when he sold his stake in Chewy. How did he invest his windfall? He put it all in just two stocks–Apple and Wells Fargo. Cohen accepted a lot of volatility by choosing to park his funds in only two stocks. I don’t recommend this approach, although with billions of dollars one can afford to take some risk.

Investing a Windfall is Psychology Difficult–Here’s Why

There are three main reasons why investing a windfall presents unique challenges.

Small-Big Dichotomy

The first reason is what I call the Small-Big Dichotomy. “Small” refers to the idea that most people reach a $1 million net worth after years of monthly investing. Small, steady contributions to a 401k don’t feel daunting. You invest the best way you know how and watch your net worth grow.

Reaching $1 million gradually over time may be cause for celebration. When the second comma pops up in the account, you might celebrate or tell your significant other. But you don’t have to ask yourself “how am I gonna invest $1 million?” You just keep doing what you’ve been doing.

The flip side of the dilemma is a “big” event–$1 million materializing overnight. Those who receive a windfall from a business sale or inheritance naturally fear making an investment mistake. Even moving money saved over a lifetime from a 401k to an IRA can feel overwhelming and fraught with danger. That worry is perfectly reasonable. Bad portfolio management has consequences. But the dilemma is more the same than different. Taking the same approach in both “big” and “small” situations makes more sense than it seems.

The Road Less Travelled Dilemma

The second challenge is the Road Less Travelled Dilemma. Windfalls often occur in tandem with big life changes. That might mean no longer owning a business, a loved one passing away, or retirement. There’s often a lot of essential change swirling. “What am I going to do with this money?” often runs parallel to “what am I gonna do with my life?” The anxiety behind both decisions can compound.

Living Off Your Nestegg

The last dilemma is the fear of living off a portfolio. You can read all the retirement books out there and understand the 4% rule. It’s going to still feel strange. I can tell you from personal experience that living off a nest egg is a new experience. As with the other two dilemmas, working away the emotional weight of the change is the best approach, but it takes time.

The starting point is to ask three questions.

3 Questions to Ask Before Investing a Windfall

- How much cash do I need over the next 5 years?

First, think about how much cash you’ll need over the next five years. Factor in both month-to-month expenses and large one-time purchases like home renovations, traveling, or paying for a child’s wedding. As a general rule, one should not invest money needed over the next five years in the stock market (although one can argue in favor of investing for short-term goals).

Setting aside five years of expenses serves another purpose, too. It helps create mental preparation for the market potentially going sideways or down for that period of time. Historically, there have been a number of periods where returns stayed flat or gone down over a five year period. For that reason, cash is king over short time periods.

- Do you invest in one lump sum or dollar cost averaging

My approach has always been to invest a windfall in a lump sum rather than dollar cost averaging over an extended period. It’s the approach I followed when I received bonuses at work. It’s also the approach I took when I sold my business a few years ago. Further, studies show that lump sum investing beats dollar cost averaging most of the time.

Notice I said most of the time. There will be periods of time when it would have been better to dollar cost average into the market. The key here is to accept that we cannot know the future, and therefore, we cannot know which approach would be the best at any given point in time.

If it makes you feel more comfortable to dollar cost average of say a 12 month period, that’s perfectly reasonable. Just put your plan in writing and follow it.

- What are your specific investing goals?

The last thing to consider is how hands-on you want to be with your portfolio. Many investors prefer to be hands-off and automate the management of their investments. Others enjoy investing and what to handle everything from fund selection to rebalancing on their own.

There is no right or wrong choice here. What you chose to do, however, may affect how you invest and where you keep your money. A DIY investor may open a standard brokerage account. Someone who wants an automated service, by contrast, might select a robo-advisor such as Betterment.

How to Invest $1 Million

Now let’s turn to the actual investing of a large sum of money. What follows are three simple, easy to manage portfolios that I believe are reasonable choices whether you want to invest $500 or $500 million.

Warren Buffett Portfolio

A few years ago Warren Buffett described how he thinks most people should invest their money. It’s become known as the Warren Buffett Portfolio. He advocates a portfolio that consists of 90% in an S&P 500 index fund and 10% in short-term U.S. treasuries. Buffett even instructed that his wife’s trust be allocated as such when he passes away.

The portfolio is attractive given its low-cost, broad market diversification, and mix of stocks and bonds. Here’s a snapshot of the portfolio implemented at M1 Finance.

Factoid: The Warren Buffett Portfolio is very similar to the 2-fund portfolio William Bengen followed in his landmark study that brought us the 4% Rule. The two key differences are that Bengen used intermediate term Treasuries and advocated no more than 75% in stocks.

3-Fund Portfolio

Buffet and Bengen’s 2-fund portfolios are perfectly reasonable, but there are more diversified strategies. The 3-fund portfolio adds international exposure and features a total bond market fund. There’s no guarantee it will outperform the 2-fund option, but the added asset classes should smooth out volatility over the long term.

The Total Stock Market Index ETF (ticker: VTI) adds some welcome mid and small-cap exposure compared to the S&P 500. You can see my VTI vs VOO comparison here. The Total Bond Market fund diversifies bond risk across a number of types of bonds. The portfolio’s expense ratio remains low at just 5 basis points (.05%).

6 Fund Portfolio

The 3-fund portfolio works well for $1 million, $10 million, even $400 million. It’s a solid starting point for any investor. Investors looking for more granularity should consider the 6-fund portfolio, which is what I use. The 6-fund portfolio adds exposure to REITs, small-cap value stocks, and emerging markets.

The additional asset classes in the portfolio are historically volatile. The theory is that the excess risk brings greater returns. Adding non-correlated assets to the portfolio can help ensure that if several sectors are going down, one is at least going up.

Avoid Expensive Investment Advisors

An itch best left unscratched is the urge to seek out a high-cost investment advisor. Commissioned brokers sell pricey financial products disguised as unique opportunities. They’re never going to recommend keeping fund expenses low because that’s not in their best interests.

After I sold my business, I talked with some investment advisors. They were recommending exotic investments like non-traded REITs, expensive insurance products, and private equity that enriches the brokers who sell them but rarely justify their expense to the investor.

Getting Help

There are reasonably priced methods of getting professional investment advice. As a rule of thumb, avoid advisory fees that exceed 50 basis points (.50%). For example, Vanguard offers advisory services for 30 basis points (.30%). To the best option is an advisor who charges by the hour or a flat fee. There’s simply no reason to give away part of your wealth each and every year for financial advice.

Resources

I recommend a number of books that further detail the investing strategies outlined above. A few of the books either reference or were written by Jack Bogle. Bogle founded Vanguard and gave rise to the “Boglehead” approach to investing.

The Bogleheads’ Guide to Investing by Taylor Larimore is a great resource on investing and retirement. An older title, but one that is still relevant, is The Four Pillars of Investing by William Bernstein. The book is a great learning tool when it comes to portfolio construction and investing.

Another book by Jack Bogle worth your time and money is The Little Book of Common Sense Investing. It’s worth exploring the Boglehead forum as a supplement to picking up a book. The discussion on the site is quite interesting and evidence-based.

Final Thoughts

Investing a large sum of money at one time can feel daunting. It causes many to hire expensive financial advisors who put them in complex, expensive and unnecessary investments. I firmly believe that the best approach is a simple, low-cost portfolio constructed of index funds.

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.