The 60/40 Portfolio

The 60/40 portfolio has powered retirements for decades. With 60% stocks and 40% bonds, this balanced fund offers equity-fueled growth and fixed income stability.

Today, however, many are calling into question the sustainability of the 60/40 portfolio. Some even argue that it’s dead and that retirees need take on more risk if they want to avoid outliving their retirement savings.

In this article we’ll take a deep dive into the 60/40 portfolio and whether it’s still a viable approach to investing for retirees.

A Brief History of the 60/40 Portfolio

Dating back to 1926, the 60/40 portfolio has enjoyed an annualized return of 9.1% (Source: Vanguard). Its best year, 1993, saw returns of 36.7%, while its worst year, 1931, experienced a loss of 26.6%. Over those 95 years, 22 saw the portfolio decline in value. The returns combined with relative stability have made the balanced portfolio ideal for retirees.

More recent returns show similar results. From 1972 to 2021 a 60/40 portfolio consisting of an S&P 500 index for stocks and intermediate term Treasuries for bonds has returned 9.61% with a standard deviation of 9.51% (via Portfolio Visualizer). The combination of solid returns with less volatility has been ideal for retirees.

In his 1994 paper, certified financial planner Bill Bengen gave us what is now known as the 4% Rule. In brief, the 4% Rule states the following:

- A retiree can spend 4% of their investments in the first year of retirement;

- In subsequent years, the retiree can adjust the prior year’s distribution by the rate of inflation; and

- Following this approach, the retiree should not outlive their money.

Why do we care about the 4% rule? We care because the 60/40 portfolio fits in the sweet spot of the 4% Rule. Bengen found that retirees should hold somewhere between 50% and 75% in equities. In a later book, he identified 60/40 as the ideal portfolio in retirement to avoid outliving a nest egg. Other papers evaluating safe withdrawal rates have reached similar conclusions (as we’ll see in a minute). Some have even evaluated its performance back to 1871!

Notwithstanding the 60/40 portfolio’s stellar history dating back to the post-Civil War era, many are now calling into question its future.

Arguments that 60/40 Portfolio is Dead

There have been several arguments put forth that the 60/40 portfolio is no longer ideal for retirees. All of the arguments stem from the unprecedented financial times we are currently in.

Argument #1: Bond yields are at all-time lows

The yield on the 10-year Treasury sunk to its lowest in 2020 and remains at historic lows. When viewed on a yearly basis, the yield sunk below 2% back in 1941 (1.95% to be precise). Apart from that one year, it remained above 2.00% until 2012 (Source: Shiller). It’s currently at about 1.30%.

During much of the 20th century, the yield was significantly higher. It reached over 14% in 1982. At today’s low yields, many question how a 60/40 portfolio could survive a 30-year retirement.

From Money (4/21/21):

“I think the 60/40 portfolio is antiquated,” says Keith Singer of Singer Wealth Advisors in Boca Raton, Florida. “When bonds used to pay 6-8% and interest rates were falling, the 60/40 model worked great. But as they say, past performance is no guarantee of future results, and that is especially true with the 60/40 portfolio.” (Source: Money).

Argument #2: The 40-Year Bull Market in Bonds Is Over

The second argument relates to the fall of yields over the past 40 years. They hit a high in 1982, and then steadily dropped to their historic lows today. As bond yields fall, the value of existing bonds go up. As such, retirees have benefited from falling interest rates. Unless rates go negative, however, most believe the bull market in bonds is over

If the bond bull market is over, and rates begin to rise, the value of existing bonds will fall. Rising rates can also lead to lower asset values on everything from stocks to real estate, which brings us to the third argument.

Argument #3: Equity Valuations are High (and must fall significantly)

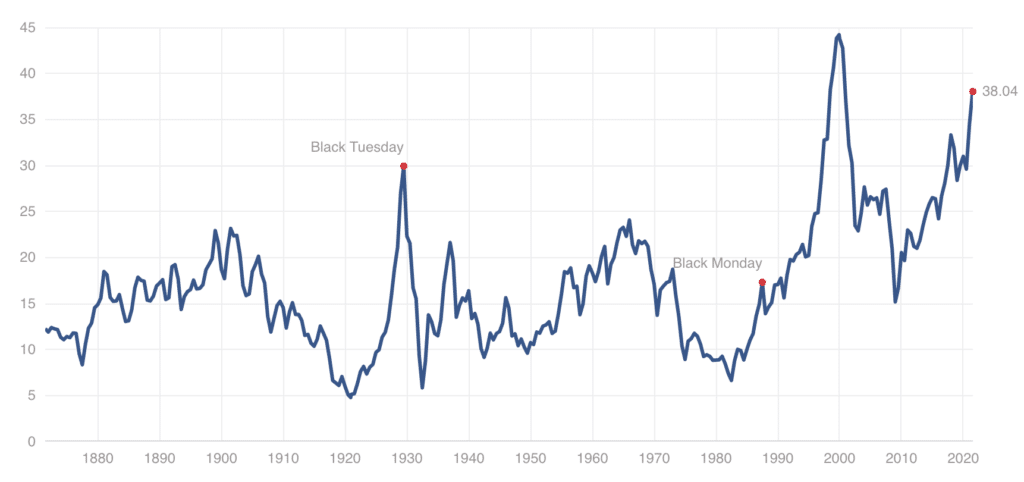

Many point to the richly valued S&P 500. The Shiller PE, which measures price-to-earnings over 10-year periods, is at one of its highest levels.

The argument here is simple. Lofty valuations suggest that stock returns over the next decade will be much lower than historical averages.

At the same time, many argue that the 60/40 portfolio should shift to a greater allocation in stocks. The reason is that while stocks are expensive, the additional long-term returns are needed to offset the paltry returns expected from bonds.

A recent report from Goldman Sachs framed the issue as follows:

The beneficial role of bonds in balanced portfolios has more recently been in doubt given that bond yields close to the zero lower bound offer a diminished returns buffer during “risk-off” periods. These doubts have only increased alongside concerns that an accelerating economic recovery from the pandemic-induced recession, amplified by historically large US fiscal stimulus, could lead to a strong rise in inflation and, in turn, the start of a prolonged bond bear market. During most historical bond bear markets, equities have outperformed bonds and have delivered positive real returns. This has been especially the case over the last 20 years, during which bond bear markets tended to be short and shallow.

Source: https://www.goldmansachs.com/insights/pages/gs-research/reflation-risk/report.pdf

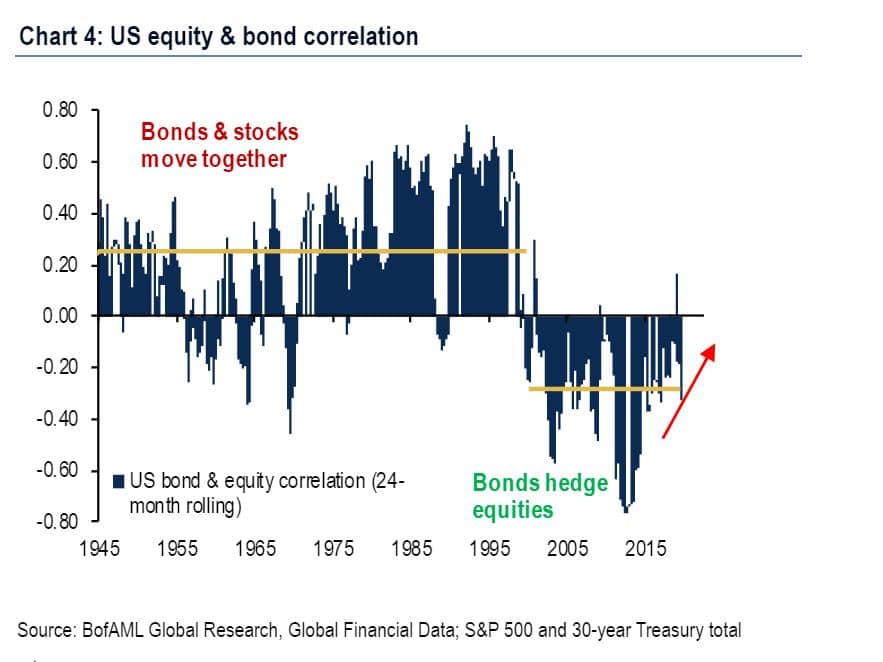

Argument #4: Negative Correlation May be Over

Finally, many believe the negative correlation that stocks and bonds have enjoyed over the past two decades may be over. In a report entitled The End of 60/40, Bank of America analysts warn that bonds may no longer provide the diversification investors have come to expect.

The authors explain,

The core premise of every 60/40 portfolio is that bonds can hedge against risks to growth and equities can hedge against inflation; their returns are negatively correlated,” Woodard and Harris added. “But this assumption was only true over the past two decades and was mostly false over the prior 65 years. The big risk is that the correlation could flip, and now the longest period of negative correlation in history is coming to an end as policy makers jolt markets with attempts to boost growth.

In short, there’s no place to hide.

Arguments that 60/40 Portfolio is Still Solid

All of the above arguments identify real and significant challenges to the capital markets. Interest rates are at historic yields. The 40-year bull market in bonds does appear to be over. And stock valuations are extremely high.

Nevertheless, I believe the 60/40 portfolio is still ideal for retirees. It’s not the only reasonably allocation in retirement, but it will continue to support a retiree for 30 years or more who relies on the 4% Rule. Here’s why I believe this.

Argument #1: Retirees are long-term investors

Those who retire at a traditional age are long-term investors. For a 65-year-old couple, there is a 1-in-4 chance of at least one spouse living past 97 and a 1-in-10 chance of at least one spouse living to 100 (Source: BofA). Retirees could be in the market 35 years or longer. To put that number in perspective, 35 years ago Ronald Reagan was President and Boy George and Mr. T were filing an episode of The A-Team.

The point is that while both equities and bonds may underperform over the next several years, or decade, retirees must consider a much longer time horizon.

Of course, the first ten to 15 years of retirement are critical. Due to the sequence of returns and inflation risk, a devastating market in the first decade of retirement could spell disaster. And that brings us to the second point.

Argument #2: The 60/40 Portfolio has Worked Since 1871

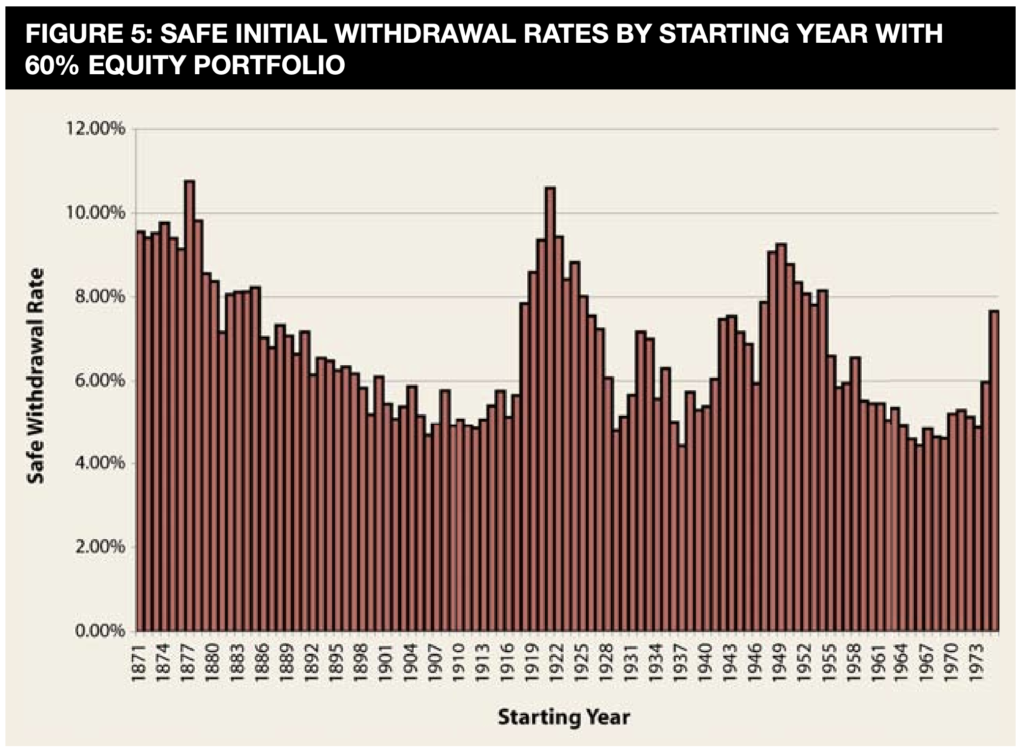

No, that’s not a typo. Researchers have tested the 60/40 portfolio against the 4% Rule with markets dating back to just after the Civil War. It’s never failed.

Michael Kitces, CFP, published a paper showing the maximum initial withdrawal rate one could have taken in the first year of retirement without running out of money over a 30-year retirement. His research tested retirements beginning in 1871.

The lowest initial withdrawal rate was 4.4% in 1966. Some years could have seen an initial withdrawal rate of over 10%. The point is that a 60/40 portfolio has sustained a 30-year retirement through the aftermath of the Civil War, the Panic of 1893, WWI, the Great Depression, WWII, the stagflation of the 1970s, the tech bubble, 9/11, the Great Recession, and the ongoing Covid pandemic.

Argument #3: The 60/40 portfolio offers growth and stability

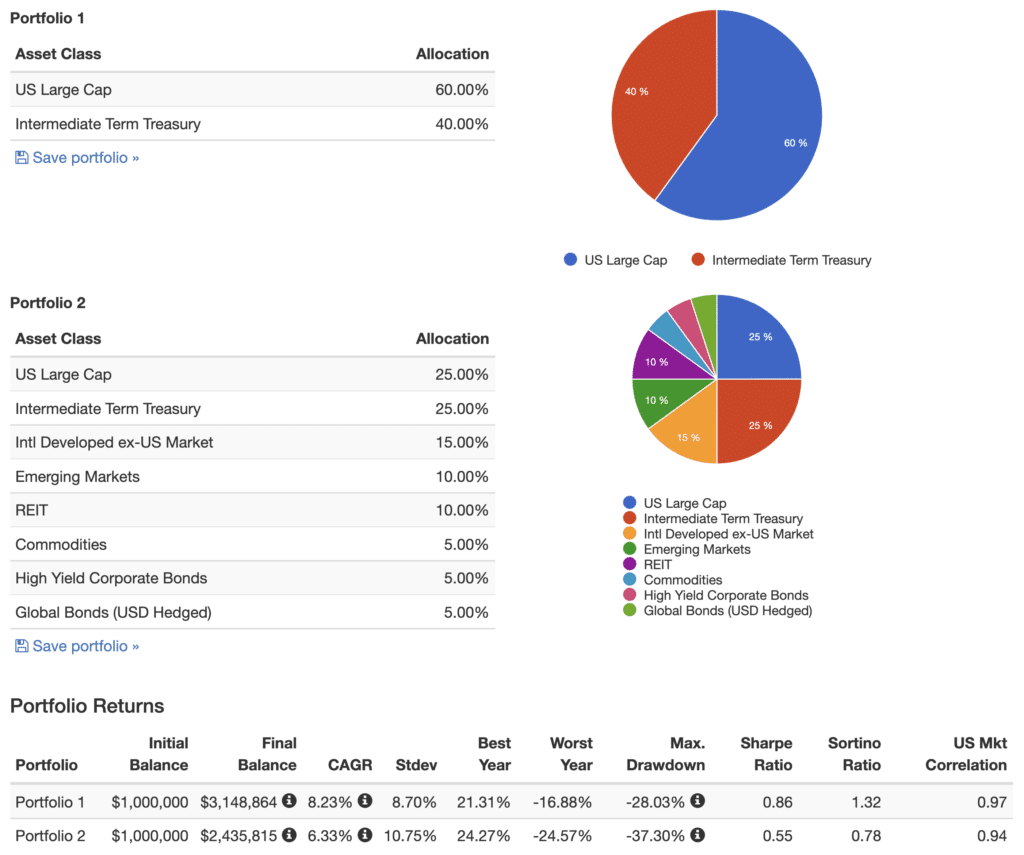

When compared to a portfolio heavily weighted in stocks, the 60/40 portfolio stands out for its excellent growth and muted volatility. That’s not to say it’s not volatile, but its up and downs are significantly less than a 100% stock portfolio. And that’s precisely what many retirees need.

Since 1972, a 60/40 portfolio has returned an annual compound rate of 9.61%. These returns are lower than a 100% stock portfolio, which returned 10.75% over the same period. What’s notable, however, is the volatility. The standard deviation of a 60/40 portfolio was just 9.51%, while the stock portfolio came in at 15.25%.

To put these differences in perspective, the worst year for a 100% stock portfolio during this period was -37.45%, compared to just -16.88% of the 60/40 portfolio. At the same time, the worst maximum drawdown for the stock portfolio was nearly -51%, compared to -28% for the balanced portfolio.

The increased volatility that comes with 100% stocks brings us to the next argument.

Argument #4: Retirees can stick with a 60/40 portfolio

Studies have shown that investors are not adept at timing the market. Called the investor gap, studies have documented the gap between an investment’s return and an investor’s return. Because investors tend to buy high when stocks are rising and to sell low in a panic when investments fall, they consistently underperform the very investments where they place their money.

One Morningstar study found that investors lost on average 45 basis points due to market timing. There was, however, one bright spot. The study found that investors in less volatile investments performed better. From the study,

When we broke down funds within asset classes based on their standard deviation, we found that funds in the least-volatile quintiles consistently had higher investor returns than those in more-volatile quintiles. This suggests that “boring” funds work well because they aren’t as likely to inspire fear or greed.

A portfolio with more stocks may perform better over the long-term. Investors in retirement, however, need to ask whether they can handle the ride.

Argument #5: The 60/40 portfolio survived rising rates and inflation

No two time periods are identical. Today we face challenges the U.S. and world have never faced. We can, however, look back at similar times to gain an understanding of how the 60/40 portfolio might perform when interest rates and inflation rise. Here I’m thinking of the period from 1941 to 1982.

The yield on the 10-year Treasury stood at 1.95% at the start of 1941. In 1982 it began the year north of 14%. Over the decade leading up to 1982, the U.S. experienced double-digit inflation, with low growth, giving way to the term stagflation.

During this time how did the 60/40 portfolio perform for retirees? Just fine. To be sure, this period is why we have the 4% rule. It represents the low water mark on a safe initial withdrawal rate. But that rate still stands at 4 to 4.5%.

The 60/40 portfolio also performed well more recently when rates began to rise earlier this year. The first quarter of 2021 was the worst for U.S. investment-grade bonds in the last two decades. The 60/40 portfolio did just fine:

“The first quarter of 2021 showed that even the worst quarter for U.S. investment-grade bonds in the last 20 years wasn’t enough to derail the classic 60/40 portfolio”, says Jason Kephart.

So what’s the take for investors. As long as the correlation between traditional asset classes doesn’t shift dramatically and the portfolio continues to rise over time, then holding a 60/40 portfolio still makes sense.

That doesn’t mean investors shouldn’t consider some alternative mixes but perhaps hold those on the margins and keep your core in stocks and bonds. Although, instead of holding broad indexes, they might want to consider diversifying by adding buckets of individual stocks and bonds.

At the end of the day, the most important risk any investor should always think about is the permanent loss of capital and the loss of purchasing power. The 60/40 portfolio still offers the best defence. And even it if did seem to veer off course at one point, it could have been by design.

Source: https://www.morningstar.ca/ca/news/213154/does-the-60%2F40-portfolio-still-make-sense.aspx

Building a 60/40 Portfolio

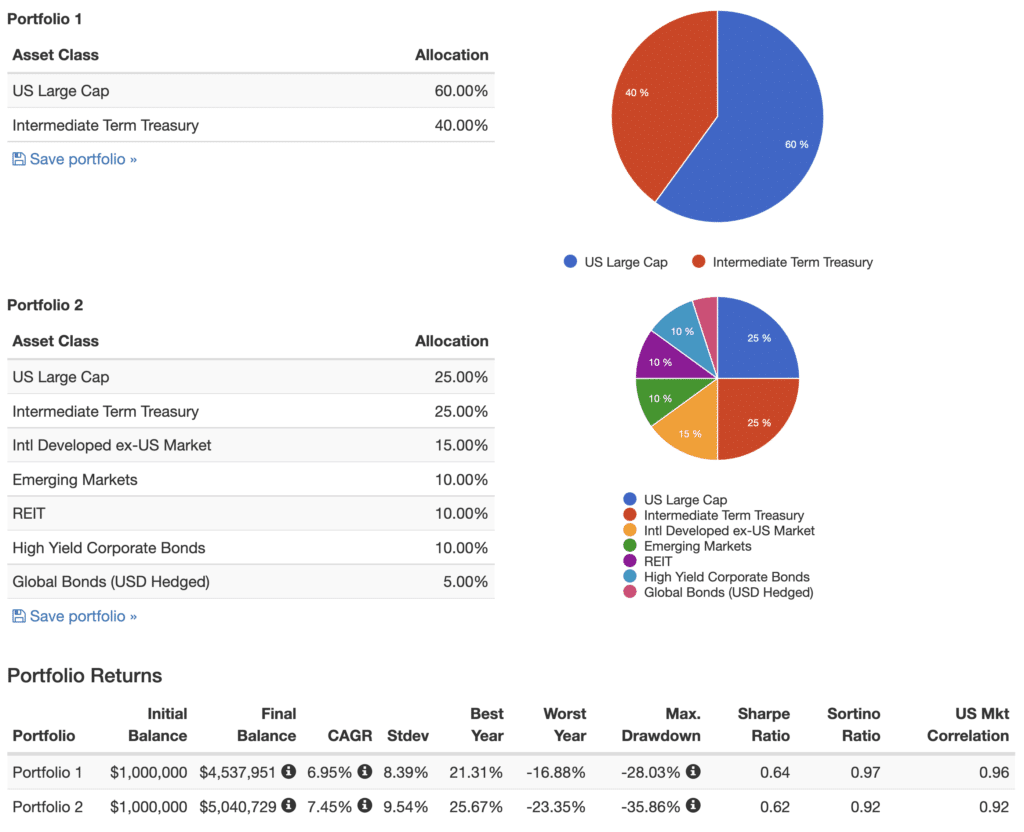

So far we haven’t discussed the stock and bond investments that make up a 60/40 portfolio. Most of the studies on a balanced portfolio use an S&P 500 index for stocks and intermediate term U.S. bond fund for fixed income. Given current economic challenges faced by retirees, should we further diversify our asset classes?

Warren Buffett would likely say no. The Warren Buffett portfolio he recommends consists of just two asset classes: S&P 500 index and short term U.S. government bonds. He’s bullish on the future of the United States.

At the same time, the U.S. faces significant hurdles. Its population is aging, reducing the workforce while increasing the cost of social programs for senior citizens. The country’s debt to GDP ratio skyrocketed as a result of the pandemic and now stands at more than 125% (Source: The Fed). And our politicians in Washington seem willing to continue borrowing at unprecedented levels indefinitely. Eventually we’ll have to pay for all of this spending.

As a result, some financial advisors recommend moving beyond U.S. stocks and Treasuries. Bob Rice, the Chief Investment Strategist for Tangent Capital made such an argument when he spoke at the fifth annual Investment News conference for alternative investments.

“You cannot invest in one future anymore; you have to invest in multiple futures,” Rice said. “The things that drove 60/40 portfolios to work are broken. The old 60/40 portfolio did the things that clients wanted, but those two asset classes alone cannot provide that anymore. It was convenient, it was easy, and it’s over. We don’t trust stocks and bonds completely to do the job of providing income, growth, inflation protection, and downside protection anymore.”

Source: https://www.investopedia.com/articles/financial-advisors/011916/why-6040-portfolio-no-longer-good-enough.asp

While I don’t share his pessimistic views of the 60/40 portfolio, diversifying to international equities seems reasonable. This could include both developed countries and emerging markets. Other diversification opportunities could include real estate (REITs) and commodities. For bonds, some argue that retirees should take on more credit risk through high-yield bonds and emerging market debt.

Having said that, there’s no guarantee that diversifying the portfolio will lead to better results. A well diversified portfolio has significantly underperformed a basic 60/40 portfolio over the last 15 years (commodities data wasn’t available before 2007 in Portfolio Visualizer).

At the same time, if we remove commodities and add the 5% allocation back into the S&P 500, we extended the data to 1999 AND see that the greater diversification paid off.

Of course, this time period saw the tech bubble burst, 9/11 and the Great Recession, all of which had significant affects on the S&P 500. And that really is the point. While diversification is generally a sound approach to investing, it’s not a guarantee of higher returns.

Final Thoughts

The 60/40 portfolio is certainly not the only reasonable approach to investing in retirement. Yet for many retirees, it has stood the test of time. It offers both growth and stability, which retirees need for their money to last 30 years or more.

Nobody knows the future. Is it possible that we could see unprecedented economic conditions that could wreck havoc on retirees? Of course we could. Although if that happens, one wonders if any asset allocation would save us.