3 Fund Portfolio

The 3 fund portfolio is an investment strategy that builds a diversified portfolio with just three index funds: a U.S. stock index fund, an international stock index fund, and a bond index fund. This approach was popularized by the Bogleheads, followers of the late Vanguard founder John Bogle’s investing philosophy. Investors can customize the allocation among the three funds based on factors like age, risk tolerance, and investment goals.

Pros of a 3-Fund Portfolio:

- Simplified Diversification: Offers diversification across various asset classes with minimal effort.

- Low Fees: Index funds typically have lower expense ratios compared to actively managed funds.

- Long-Term Growth Potential: Provides exposure to U.S. and international stocks for growth and stability through bonds.

- Customizable Asset Allocation: Allows investors to tailor their portfolio to match their risk tolerance and investment objectives. This makes the 3 fund portfolio a reasonable choice for both long-term investors and those well into retirement.

- Ease of Maintenance: Requires minimal effort to build and maintain, making it suitable for hands-off investors.

Cons of a 3-Fund Portfolio:

- Limited Control: While investors have control over the allocation to each fund, the 3 fund portfolio doesn’t allow for more concentrated positions in a specific asset class, such as small cap value, emerging markets, or REITs. Some would view this as a positive aspect of the investment strategy.

- Rebalancing Required: While not overly time-consuming, regular monitoring and rebalancing are necessary if an investor wants to maintain the desired asset allocation.

- No TIPS Exposure: The 3 fund portfolio typically uses an index fund that tracks the Bloomberg U.S. Aggregate Bond Index for fixed income. This index, however, does not include Treasury Inflation Protected Bonds (TIPS). As such, an investor would need to add a fourth fund to include TIPS in their portfolio.

Building the 3 Fund Portfolio

You can build the 3 Fund Portfolio with index funds from one or more fund companies. Below you’ll find model portfolios from four of the largest ETF providers. Keep in mind, however, that you can construct this portfolio with mutual funds, as I’ve done in the case of Fidelity below. You can also build the portfolio with funds from multiple companies.

In addition, the percentage allocations listed below are just one example of how one could create this portfolio. To increase the expected return and risk, one could reduce the bond exposure and increase the stock exposure. To reduce the expected return and risk, one could increase the bond exposure and decrease the stock exposure.

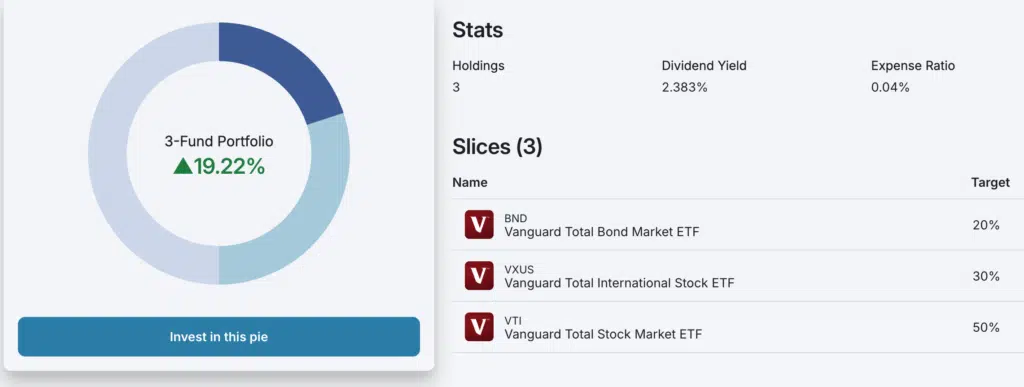

Vanguard

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| VTI | Vanguard Total Stock Market ETF | U.S. Stocks | 50% |

| VXUS | Vanguard Total International Stock ETF | Int’l Stocks | 30% |

| BND | Vanguard Total Bond Market ETF | U.S. Bonds | 20% |

Fidelity

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| FSKAX | Fidelity Total Market Index Fund | U.S. Stocks | 50% |

| FTIHX | Fidelity Total International Index Fund | Int’l Stocks | 30% |

| FXNAX | Fidelity U.S. Bond Index Fund | U.S. Bonds | 20% |

Schwab

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| SCHB | US Broad Market ETF | U.S. Stocks | 50% |

| SCHF | International Equity Index ETF | Int’l Stocks | 30% |

| SCHZ | U.S. Aggregate Bond Index ETF | U.S. Bonds | 20% |

iShares

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| ITOT | iShares Core S&P Total Market ETF | U.S. Stocks | 50% |

| IXUS | iShares Core MSCI Total International Stock ETF | Int’l Stocks | 30% |

| AGG | iShares Core Total U.S. Bond Market ETF | U.S. Bonds | 20% |

You can see the 3 fund portfolio using Vanguard ETFs at M1 Finance.

Alternatives

An investor can achieve similar objectives using two or even just one fund. For example, instead of using a U.S. stock fund and an international stock fund, an investor could gain exposure to the entire global stock market in a single fund. An example of such a fund is Vanguard’s Total World Stock ETF (VT).

Going ever further, an investor could use a single fund, such as a target date retirement fund or an asset allocation fund.