10 Best Investment Broker Bonus Offers of 2025

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

Like many other businesses, investment brokers sometimes offer bonuses to encourage investors to sign up with their services. Not all brokers offer a sign-up bonus, but a surprising number do. In this article, we’ll look at the 10 best investment broker bonus offers available in 2025.

Be aware that each of these bonus offers has an expiration date. Where available, we’ve included that date in our summaries. However, many brokers assign a cutoff date, then extend it each month. In that way, many expiration dates operate on a rolling basis.

Best Investment Broker Bonuses

We’ve ranked each of the 10 brokers based on a combination of 1) the amount of the bonus offer, and 2) the ease with which it can be obtained. And where it matters, we’ve also considered the amount of time required to tie up funds to qualify for the bonus offer.

Ultimately the merit of any bonus will depend primarily on your own personal circumstances. For example, if you have a seven-figure investment portfolio to transfer from another broker, it may simply be a matter of choosing the most generous bonus offer.

| Broker | Min. Deposit | Max Bonus | Expires | Summary |

|---|---|---|---|---|

| Public | $5,000 | $10,000 | January 31, 2025 | Tiered bonus + transfer fee coverage |

| E*TRADE | $1,000 | $6,000 | January 31, 2025 | Tiered bonus structure, use code ‘OFFER24’ |

| Merrill Edge | $20,000 | $600 | Ongoing | Self-Directed account bonus |

| J.P. Morgan | $5,000 | $700 | January 23, 2025 | Self-Directed Investing bonus |

| Citi Self-Invest | $10,000 | $500 | January 31, 2025 | New and existing Self-Invest accounts |

| Charles Schwab | $25,000 | $1,000 | Ongoing | Requires referral from existing customer |

| SoFi Invest | $25 | $1,000 | Ongoing | Bonus paid in free stock |

| Webull | Any amount | $3,000 | Ongoing | Up to 12 free stocks |

| Citi Personal Wealth Management | $50,000 | $5,000 | March 31, 2025 | New-to-Citi funds bonus |

1. M1 Finance – Get Up to $25,000–Expired

For the month of January, M1 Finance is offering a bonus of 0.50% of the amount transferred to M1, up to a maximum bonus of $25,000.

Terms: During the Promotion Period, this promotional offer is valid for new and existing M1 customers who successfully complete and settle a Brokerage Account Transfer (“BAT”) of at least $10,000 in aggregate across your account(s) (“Transfer Account Value”) (together, the “Promotion”). The appropriate M1 account must successfully receive settled funds prior to expiry of the Promotion Period (e.g., IRA to IRA). Any unsuccessful BAT will be deemed ineligible (including but not limited to, any incorrect instructions, or unsettled funds). This offer is non-transferable, and not valid with any of the following: (i) internal transfers, (ii) ACH deposits (bank transfers), (iii) wire transfers, or (iv) direct 401(k), 403(b) and/or 457(b) rollovers.

See the M1 Finance website for additional terms.

Expiration: January 31, 2025

2. Public – Get Up to $10,000

Public is offering a bonus of up to $10,000 when you transfer an investment account to Public. Funds must be transferred from another investment broker. In addition to the cash bonus, they’ll also pay any transfer fees imposed by the other broker if the incoming account value is at least $1,000.

Terms: ACAT transfers, IRA ACAT transfers and 401k rollovers made by new and existing members are eligible for this promotion. Note that deposits into your Public Investing brokerage account or your Public Investing IRA(s) are not eligible for this promotion. Contributions to your Public Investing IRA(s) are also not eligible for this promotion.

The assets transferred, and any associated bonus, must stay in your Public Investing account for the following minimum amounts of time or the bonus will be revoked:

- For ACAT transfers to your brokerage account: at least 12 months starting from the day the last transfer has settled

- For IRA transfers and 401k rollovers: at least 24 months starting from the day the last transfer has settled

See Public’s website for additional terms and conditions.

| Transfer Amount | Bonus |

|---|---|

| $5,000 – $24,999 | $150 |

| $25,000 – $99,999 | $250 |

| $100,000 – $249,999 | $600 |

| $250,000 – $499,999 | $1,000 |

| $500,000 – $999,999 | $2,000 |

| $1,000,000 – $4,999,999 | $4,000 |

| $5,000,000+ | $10,000 |

Expiration: January 31, 2025

3. E-Trade – Get Up to $6,000

E*TRADE is paying a cash bonus of up to $6,000. Offer valid for new E*TRADE clients opening one new eligible brokerage (non-retirement) account by 1/31/25 and funded within 60 days of account opening with $1,000 or more of new funds or securities. Promo code ‘OFFER24’.

Terms:

New customers:

| Deposit Amount | Cash Credit |

|---|---|

| $1,000–$4,999 | $50 |

| $5,000–$19,999 | $150 |

| $20,000–$49,999 | $200 |

| $50,000–$99,999 | $300 |

| $100,000–$199,999 | $600 |

| $200,000–$499,999 | $800 |

| $500,000–$999,999 | $1,000 |

| $1,000,000–$1,499,999 | $3,000 |

| $1,500,000–$1,999,999 | $5,000 |

| $2,000,000+ | $6,000 |

Expiration: January 31, 2025

4. Merrill Edge – Get Up to $600

Merrill Edge is offering a bonus of up to $600 when you open and fund a new account. You need to open an account with at least $20,000 to qualify for the minimum bonus of $100. Funds must be deposited within 45 days of account opening, and the balance maintained for at least 90 days. The offer applies strictly to a Merrill Edge Self-Directed account.

Terms:

- Deposit $20,000 to $49,999: $100

- $50,000 to $99,999: $150

- $100,000 to $199,999: $250

- $200,000 or more: $600

If you have significantly more to transfer than $200,000, you may be able to negotiate a much higher bonus. Contact a Merrill Edge advisor to get their best offer. I did this last year and received an offer of nearly $5,000, although I ended up going with a different broker.

Use Promo Code 600ME

5. J.P. Morgan Self-Directed Investing – Get Up to $700

J.P. Morgan is offering a bonus of up to $700 when you open a new account by January 23, 2025. You must open a new Self-Directed Investing account by that date, and then transfer the qualifying funds into the account within 45 days of opening. The bonus amount will be determined on Day 45.

Deposited funds must remain in your account for at least 90 days to qualify for the bonus. The bonus will be paid into your account within 15 days thereafter. The bonus applies on either taxable brokerage accounts or traditional and Roth IRA accounts.

Terms:

- Deposit $5,000 to $24,999: $50

- $25,000 to $99 999: $150

- $100,000 to $249,999 or more: $325

- $250,000 or more: $700

6. Citi Self-Invest – Get Up to $500

Citi is offering a bonus of up to $500 when you open a Self-Invest account. To qualify for the minimum bonus of $100, you must deposit at least $10,000 into your account. The bonus applies to deposits made in either new or existing Self-Invest accounts.

See Citi’s website for terms and conditions.

Terms:

- Deposit $10,000 to $49,999: $100

- $50,000 to $199,999: $200

- $200,000 or more: $500

7. Charles Schwab – Get Up to $1,000

The biggest retail investment broker in America is paying a bonus of up to $1,000 when you open and fund a new account after you’re referred by an existing Schwab customer.

Like most investment broker promotions, the bonus is tiered based on the amount of funds you deposit into your account. To qualify, you’ll need to get a referral code from your Schwab friend. Funds must be deposited into an investment account within 45 days. Funds deposited into the Schwab Bank High Yield Investor Checking account do not qualify.

Terms:

- Deposit $25,000 to $49,999: $100

- $50,000 to $99,999: $300

- $100,000 to $499,999: $500

- $500,000 or more: $1,000

For higher balances, you may be able to negotiate a larger bonus. Contact Schwab directly to inquire.

8. SoFi Invest – Get Up to $1,000 in Free Stock

SoFi is offering a bonus of much as $1,000 in free stock when you move your portfolio from another broker into a SoFi Invest account. They’ll also cover up to $75 in transfer fees charged by the other broker. The bonus applies to new accounts only and must be funded with a minimum of $25 within 30 days of account opening.

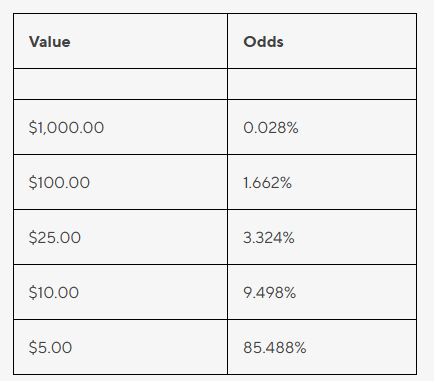

The bonus is payable in stock, and the website discloses the likelihood of receiving a stock worth $1,000 is 0.028%. You must open a SoFi Active Invest brokerage account to qualify.

Terms:

SoFi discloses the odds of receiving stock at various values as follows:

9. Webull – Get Up to 12 Free Stocks Worth up to $3,000

Webull is offering a bonus paid in fractional shares. When you open a Webull brokerage account, each fractional share will be valued between $3 and $3,000.

To receive a Tier 1 Offer Reward – make a single initial deposit to their Webull Account during the Offer Period of any amount between $500 and $1,999.99, and maintain a balance in cash and securities in their Webull Account equal to or greater than the amount of their Initial Deposit (excluding trading losses) for a period of 30 days following the date of the Initial Deposit.

To receive a Tier 2 Offer Reward – make a single initial deposit to their Webull Account during the Offer Period of any amount equal to or greater than $2,000, and maintain a balance in cash and securities in their Webull Account equal to or greater than the amount of their Initial Deposit (excluding trading losses) for a period of 30 days following the date of the Initial Deposit.

Terms:

| Initial Deposit Amount | Rewards |

|---|---|

| $2,000+ | 40 Free Fractional Shares |

| $500 – $1,999.99 | 20 Free Fractional Shares |

Probability of the value of account opening stock rewards is as follows:

- $3 to $10: 1/1.02

- $11 to $50: 1/52.63

- $51 to $150: 1/1,111.11

- $150 to $300: 1/10,000

Probability of the value of initial deposit rewards stock is as follows:

- $7 to $30: 1/1.02

- $31 to $100: 1/52.63

- $101 to $999: 1/1,111.11

- $1,000 to $3,000: 1/10,000

10. Citi Personal Wealth Management – Get Up to $5000 –

Fund a new or existing Citi Personal Wealth Management account with required activities. A minimum funding of $50,000 is required during the promotional period to receive your cash bonus.

Terms:

| New-to-Citi Funds | Cash Bonus |

|---|---|

| $2,000,000 or more | $5,000 |

| $1,000,000–$1,999,999 | $3,000 |

| $500,000–$999,999 | $2,000 |

| $200,000–$499,999 | $1,000 |

| $50,000–$199,999 | $500 |

Contact a Financial Advisor to enroll a new or existing eligible Citi Personal Wealth Management account by 3/31/2025.

FAQ

Are investment broker bonuses taxable?

Income from just about any source is taxable at both the federal and state level. That includes investment broker bonuses. However, a broker will generally not issue a Form 1099 for the amount of the bonus unless it is at least $600, per IRS guidelines.

What are the typical requirements to qualify for an investment broker bonus?

Specific requirements vary by broker, but you can expect to see any mix of the following:

1. Opening an account by a specific date.

2. With most brokers, qualification applies only to new accounts.

3. Meeting minimum funds deposit requirements, usually by a secondary date.

4. Some brokers require funds to be transferred from an investment account held with another broker.

5. Maintaining the minimum fund balance for a specified period of time, which is often 90 days.

What happens if I don’t meet all the requirements of a broker bonus?

If you fail to meet even one requirement the broker probably won’t pay the bonus. Investment broker bonus requirements are something of a matrix. You need to familiarize yourself with all conditions of any bonus offer and be fully prepared to meet them. If not, opening a new account may not be worth doing, unless the bonus was never the main reason for doing so.

Is a bonus a good reason to open an account with a specific broker?

Generally, no. It’s important to remember that a bonus is a one-time event. What’s more important are the ongoing features and benefits a broker offers. That includes commissions and fees, customer service, investment resources and education, and the number of investments offered, among others factors.

Final Thoughts

None of the bonus offers listed in this article are set in stone. Investment brokers, like other businesses, add and withdraw offers on a regular basis. It’s also possible a broker may either reduce or even enhance a bonus offer, so always pay careful attention to the details of any program.

And once again, never open an account just because it offers an attractive bonus. Investing is serious business and has too many moving parts to justify transferring accounts in an open-ended search for the bonus du jour.