3-Step Guide to Mastering Bank Accounts and Cash Flow in Retirement

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

Congratulations on your retirement! Now, have you considered how you’ll handle your finances? The shift from a steady paycheck to drawing income from investments, social security, and perhaps other sources requires a different approach to cash management.

This article was inspired by an email from a reader named Irving who asked the following question: “I’m a 65-year-old retiree, could you recommend a good bank account setup?”

That’s an excellent question, so let’s dig in.

Cash Management Challenges in Retirement

During your working years, cash management is simple. You get paid, deposit the check, and spend the money.

In retirement, things aren’t so simple. Retirees generate income from multiple sources. There are guaranteed sources of income, such as Social Security, pensions, and annuities. Retirees also draw from retirement accounts, such as 401(k) and IRA accounts. Then there are taxable investment accounts and bank accounts to consider. For couples, the number of retirement accounts can double, and that’s not counting the Health Savings Accounts (HSA) that many have.

If you are 70 1/2 72 73 or older, there’s also the matter of managing required minimum distributions (RMDs) from retirement accounts.

To help you navigate these complexities, we’ll cover three topics. First, we’ll look at the bank account setup I recommend. Then we’ll discuss how to automate cash flow from investment accounts. Finally, I’ll suggest some tools you can use to help manage all of these accounts.

My Bank Account Setup

The bank account setup is similar to what many have during their working years. But there are some important considerations that may affect where you open these accounts. We’ll look at checking accounts, savings accounts and credit cards.

1. Checking Account

Traditional Checking Account

The checking account is the heart and soul of our banking setup. It’s where we’ll receive direct deposit of Social Security, any part-time income, and possibly pension or annuity payments. It’s also where we’ll receive transfers from our investment and retirement accounts, including any RMDs.

There are several important features I’ve found that are critical for a checking account. The account needs to provide check-writing capabilities, online bill pay, mobile check deposit, an excellent mobile and online experience, and a debit card. (The debit card may be needed to withdraw cash from an ATM, but for regular purchases, it’s not as secure as a credit card.)

Many retirees keep the same checking account they’ve used for years. If that works for you, then stick with it. It’s an excellent option, particularly if your bank has branches near you.

Cash Management Account

Another option is keeping most of your money with a brokerage firm that offers a cash management account. It will give you the ability to keep your cash reserves where you invest, which can simplify transfers between accounts. Just as important, some cash management accounts also come with debit cards, mobile check deposit, online bill pay, and other features commonly associated with traditional checking accounts.

My favorite cash management account is the one offered by Fidelity. I personally think it’s the best of its kind in the industry. The account checks several boxes, including check writing, no fees or balance minimums, online bill pay, ATM debit card, ATM fees reimbursed globally, digital wallet compatibility, and FDIC insurance protection.

The account also pays a decent rate of interest on your savings. However, there are higher interest rate options available elsewhere. And since Fidelity is a broker, you can always park excess funds in Treasury bills that are currently paying a higher rate of return (see below).

Fidelity isn’t the only broker offering a good cash management account. Charles Schwab offers many of the same features as Fidelity. Merrill Edge is another option, with its own CMA account, complete with a Visa debit card, Bill Pay, and other features.

One exception is Vanguard. Though they offer some of the best funds in the industry, their CMA option is limited. That doesn’t mean abandoning your Vanguard account, but only that it isn’t suitable for cash management purposes.

2. Cash Reserve Account

We also need a secure account to hold our emergency fund and perhaps some of the money we plan to spend over the next year. A good cash reserve account has three important qualities:

- The account earns a decent amount of interest.

- Funds held in the account are safe.

- The account provides ready access to our funds.

There are several reasonable options, and we’ll look at each:

- Savings account

- Money market account

- Money market fund

- Short-term certificates of deposit

- T-Bills

- Cash Management Accounts

Savings and Money Market Accounts

Bank savings products have the advantage of FDIC insurance, which makes them completely safe up to the amount of the insurance. To get the best rates, however, we need to look beyond large banks with branches. Most offer miserly rates.

Did you know? Savings accounts and money market accounts are functionally equivalent. They both are FDIC-insured and pay interest. In contrast, a money market fund is not FDIC-insured, and is typically offered through a broker.

For example, according to the FDIC, the current average interest returns on bank savings products are as follows (as of 9/21/2023):

- Savings accounts, 0.45%

- Money market accounts, 0.65%

- One-year certificate of deposit, 1.75%

Those rates are common with local banks, and well below what you can get elsewhere. For that reason, you’ll want to hold your cash reserve accounts someplace other than your regular bank. The solution is likely to be an online bank. Because they lack branch networks and the multitude of employees to staff them, online banks typically offer higher interest than traditional banks.

I maintain a list of the best rates on savings accounts, money market accounts, no-penalty CDs, and one-year CDs.

Money Market Funds

Money market funds and money market accounts are a lot like lightning and lightning bugs. They may sound similar, but they ain’t. Money market funds are offered by brokers and are NOT FDIC insured. They are still reasonable options, in my opinion, because they invest in very safe short-term government and corporate debt.

An example of a money market fund, and one I hold myself, is the Vanguard Federal Money Market Fund (VMFXX).

Another is the Fidelity Money Market Fund (SPRXX). Just be aware that, like some other liquid investments, money market funds can take several days to liquidate your position and have the funds transferred into your spending account. You’ll need to plan accordingly.

Certificates of Deposit

A no-penalty CD can also be a reasonable option for an emergency fund. As the name suggests, you can pull your money out at any time (after seven or in some cases 30 days) without penalty. The rates on no-penalty CDs are competitive, and bank CDs are FDIC-insured.

U.S. Treasury Bills

Another option for cash reserves is U.S. Treasury bills. Those are short-term government bonds (under one year) that pay interest and are guaranteed by the US government. One benefit of T-bills is that they are free from state and local income tax.

You’ll want to hold treasury bills in a brokerage account. But be aware that if you sell the securities, there will be a delay of several days as the transaction settles before the cash is available in your brokerage account.

3. Credit Cards

Though it’s important to avoid debt in retirement, especially the credit card variety, credit cards do occupy an important place in retirement cash management. They are, after all, the method most commonly used for spending by many people. But the caveat is that you should pay off your balance in full each and every month to avoid the steep interest rates they charge.

It can also be a real advantage with rewards credit cards. I get a little bit fancy when it comes to credit cards, letting the rewards we earn on the cards accumulate. I save and invest those rewards, which have grown to about $30,000. You can check out my favorite cash back credit cards here.

Generating a Retirement Paycheck

Once you have your cash accounts set up, the next step is to automate your flow of cash as much as possible. Here are the three steps I use:

- For taxable investment accounts, I have the dividends and interest automatically transferred to my spending account. Dividends and interest are taxable income anyway, so I use them as a first source of spending money.

- For those who have reached the age of RMDs, you can have your broker automatically deposit the RMD into your spending account. Most brokers I’m familiar with will do this monthly, quarterly, or annually, based on your preferences. Again, since RMDs are taxable income, it makes sense to tap them to cover expenses.

- Finally, if additional spending money is needed, you can sell investments from your retirement and/or taxable accounts. This part of the process is manual, and you’ll need to consider taxes when deciding which accounts to draw from.

Tools to Help You Better Manage Your Cash

There are a lot of accounts and income sources to juggle. Fortunately, there are tools you can use to help you manage the whole process. Here are three of my favorites that I use.

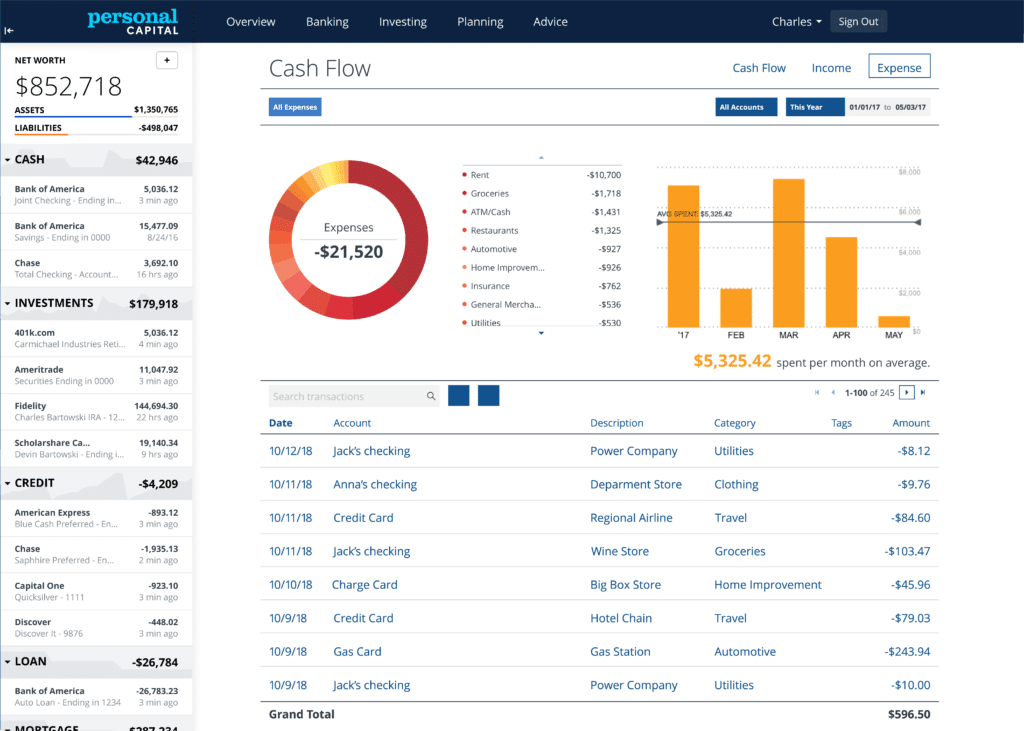

Empower Personal Dashboard

Empower Personal Dashboard is my favorite financial management tool. It’s an online financial aggregator, where you can link and track your investment accounts, retirement accounts, bank accounts, real estate values, and even loans and credit cards, all in one place.

The Dashboard is free to use and provides various tools to help you better manage your finances. They even offer a fee analyzer to show you what you are paying in fees on various funds you hold in your retirement and investment accounts.

Now as I said, Empower is free to use, but they will reach out to you with a free evaluation of your portfolio. That’s because Empower has a premium wealth management service they will market to you with a free portfolio evaluation. You certainly can talk to them if you like, but you’re not required to do so in order to use the Financial Dashboard.

New Retirement

New Retirement is a robust retirement planning tool. You can think of it as a tool to create a roadmap for your finances in retirement. It doesn’t track your investments, analyze your fees, and evaluate your asset allocation like Empower does (which is why I use both tools). However, it does analyze your spending and income in retirement to determine if your plan is sound.

With New Retirement, you can factor in everything from Social Security to Medicare to Roth conversions. It offers tools to help you determine when to start taking Social Security and whether a Roth Conversion makes sense. You can run “what-if” scenarios on everything from working an extra two years to moving to a lower income tax state.

Tiller Money

Tiller Money is a budgeting tool that also aggregates your financial accounts in one place. It differs from other budgeting apps in that it downloads your data into Microsoft Excel or Google Sheets. The information contained on the spreadsheet will automatically be updated each day.

Though I use Empower to track our investments and New Retirement to plan our retirement, I use Tiller Money to track our budget. It’s a good choice if you’re a spreadsheet person. I like the fact that I control our data.

Conclusion

Cash management will get more complicated in retirement. The right combination of bank accounts, automation, and tools can make the job a lot easier.