VOO vs VTI: An Easy Way to Choose Between an S&P 500 and Total Stock Market Index Fund

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

I’ve been investing for over 30 years. I’ve been writing about investing for the past 15 years. One of the questions I get the most is whether you should invest in an S&P 500 Index fund or a total stock market index fund–VOO vs VTI (ETFs) or VTSAX vs VFIAX (mutual funds).

It’s an important question that torments a lot of investors. It shouldn’t. The answer answer is really, really simple. It doesn’t matter. But the explanation takes a little bit of explanation. We’re going to walk through that today using Vanguard ETFs (VOO and VTI), although the same rationale applies to any fund family.

First we’ll compare the portfolios of the S&P 500 index with the total stock market index. We’ll look at both the differences and the similarities. Second, we’ll look at the historical returns and volatility of both indexes. Finally, I’ll offer a simple approach to deciding whether VOO or VTI is best for you.

VTI vs VOO

Both VTI and VOO are lost cost index funds. Vanguard currently charges just 3 basis points (0.03%) in fees for both funds. As ETFs, they don’t have minimum purchase requirements (Vanguard mutual funds do, typically $1,000 or $3,000). They are also both very large funds, each with more than $250 billion in total assets.

Portfolios

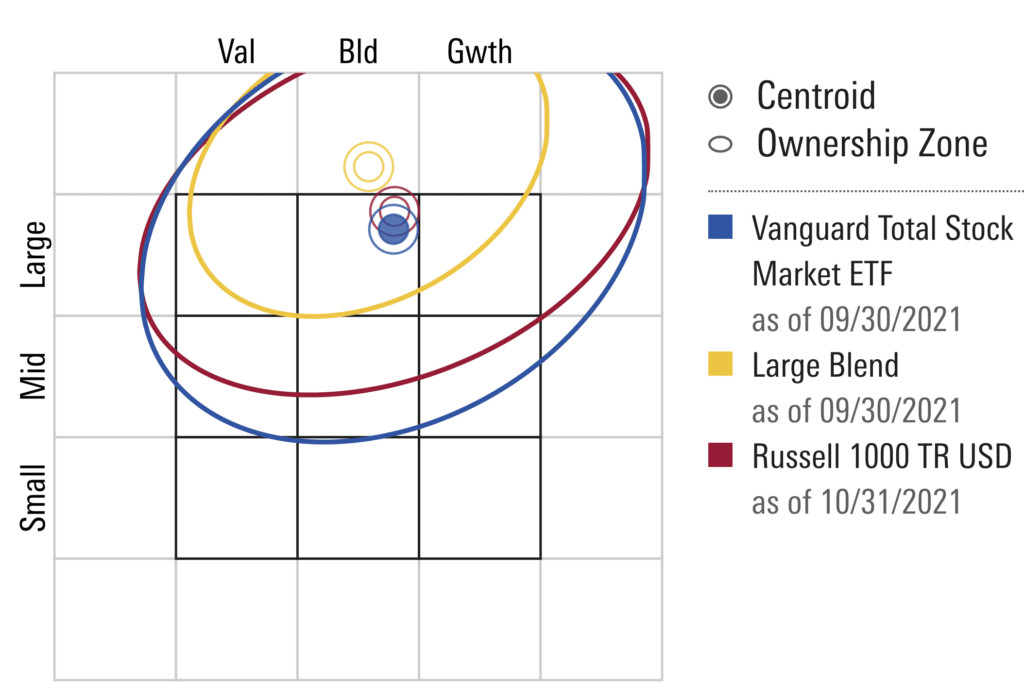

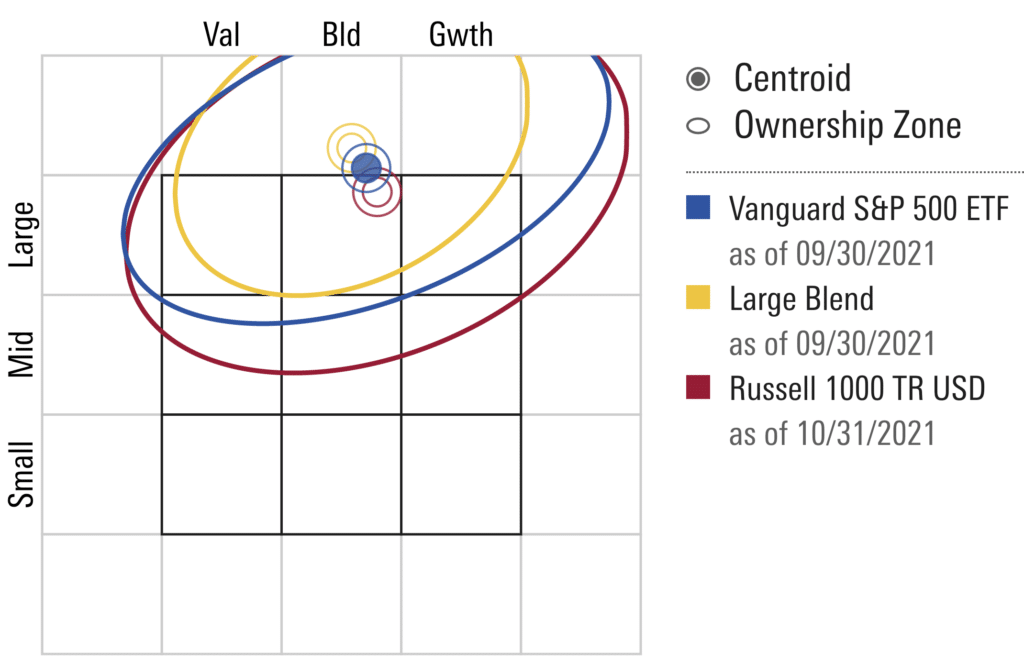

The investing style of both an S&P 500 and total stock market index fund are similar. They both portfolios heavily weighted to large U.S. companies. Using Morningstar’s style box, we can see that both funds are classified as large-cap blend (i.e., core) funds.

If you’re new to Morningstar’s tools, check out my Guide to Morningstar.

What these charts tell us is that both VOO and VTI are large cap funds (see the blue dots in the top row). They also tell us that both funds’ investment style is a blend of value and growth companies (blue dot is in the middle column).

Now they are not identical. The S&P 500’s Style Box shows that the average company’s market capitalization (market cap) is a bit larger (the blue dot is a bit higher). We can see this more clearly by looking at what Morningstar calls the “Weight” style box.

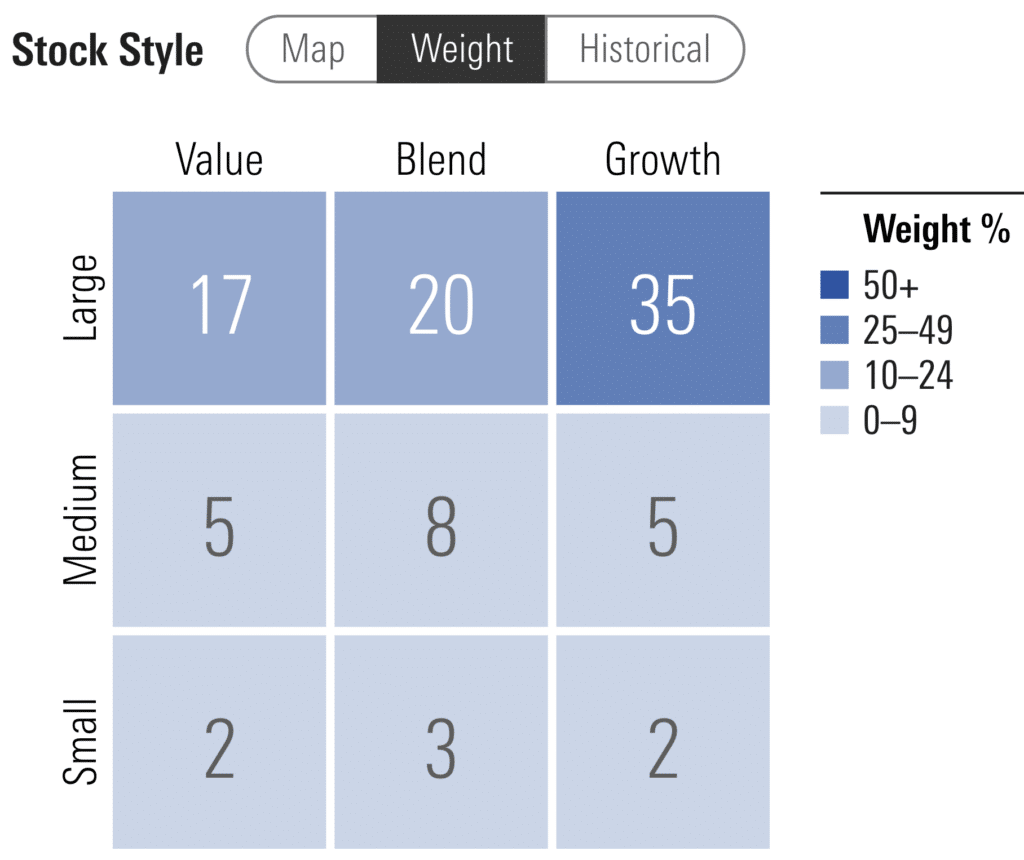

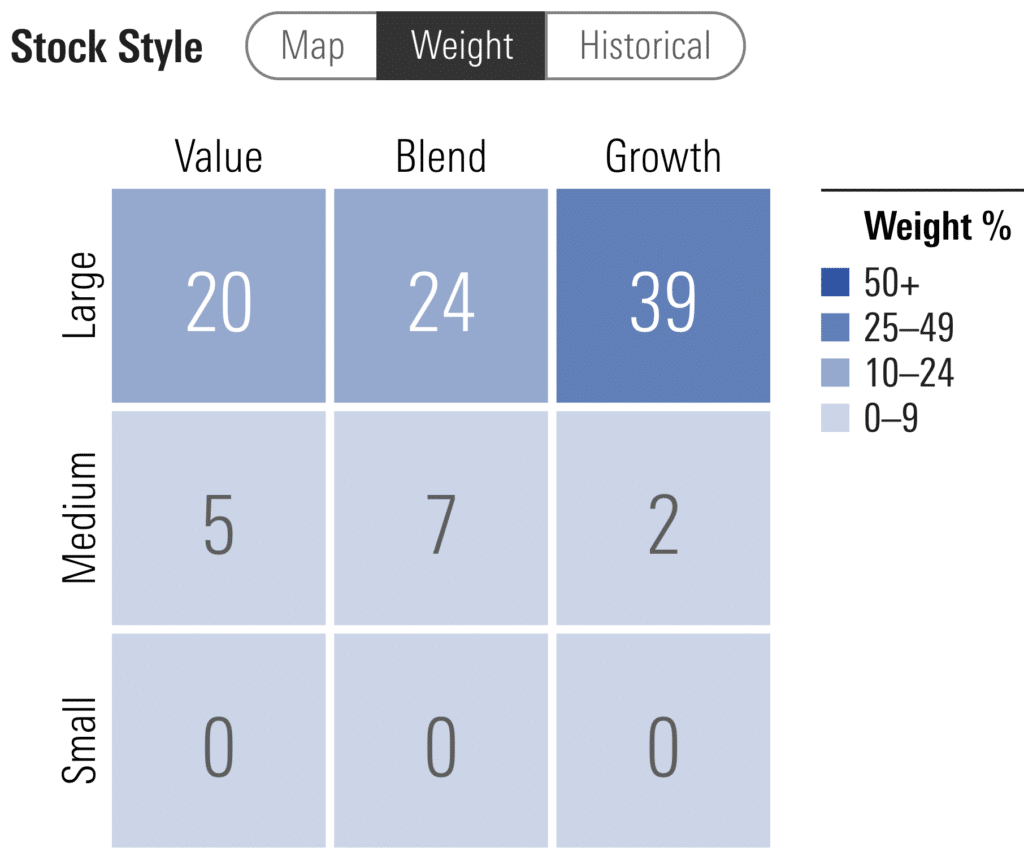

The weight style box shows us the percentage in each fund invested in small, medium and large companies, organized by value, blend or growth. As you can see, the S&P 500 is predominately large companies, with 14% in medium size companies and nothing allocated to small cap. In contrast, VTI has more allocated to medium companies and 7% allocated to small cap companies.

The big question for us is whether these differences should matter. Before we answer that question, let’s take a deeper dive into the actual companies these funds hold.

Holdings

If we go to the actual holdings, this is where things get interesting. Using Morningstar, we can see the top 10 holdings in each fund.

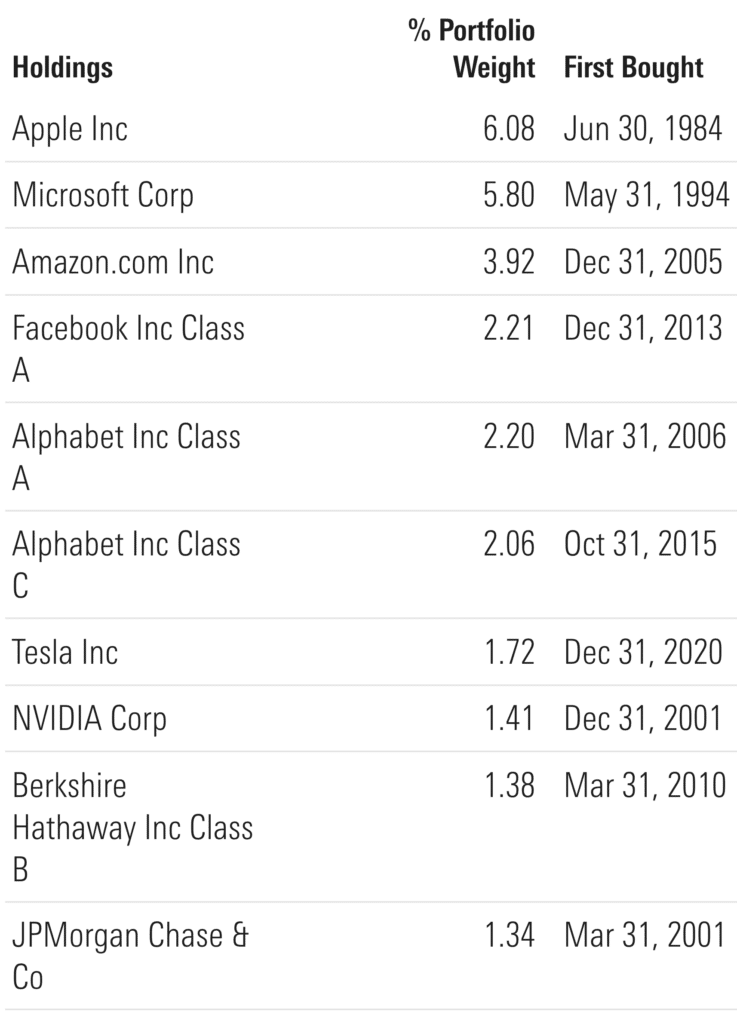

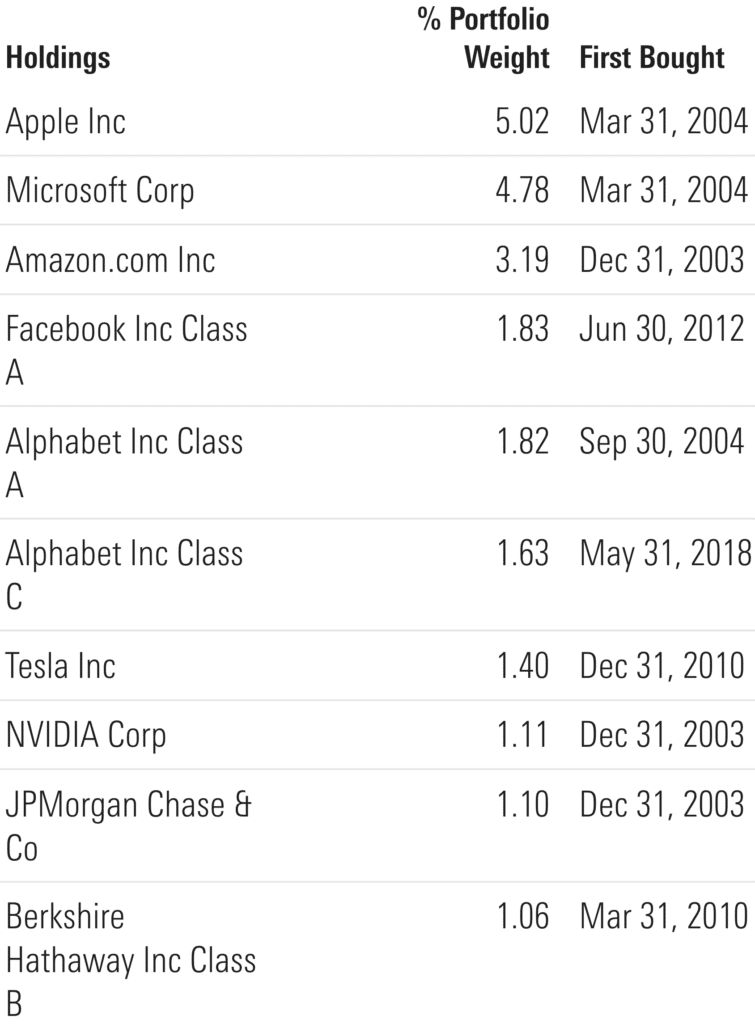

Here are the top 10 holdings for VOO, followed by the top 10 for VTI:

As you’ll see, the top 10 holdings are identical for both funds. Apple is the current #1 holding (this may change to Microsoft soon) with Berkshire Hathaway holding the #10 spot. What is different is the percentage that each fund holds of each of these stocks.

You can see that for the total stock market index, Apple comprises about five percent of the fund, whereas for the S&P 500 index, it’s just over six percent (these percentages can change daily as the price of each stock changes).

To understand why there’s a difference, we need to understand cap weighted versus equal weighted indexes.

Cap Weighted vs Equal Weighted

Most index funds are market cap weighted. That means that the more valuable a company is the more it represents in the particular index. Since Apple is the most valuable company in the world at the moment (actually, Microsoft took the lead, but the change hasn’t been reflected yet in the Morningstar data), an index fund allocates more of each investment in Apple than it does smaller companies.

There are equal weighted index funds, too. These funds divide investors’ money equally among all of the companies in the index. This type of index fund is much less common. Both VOO and VTI are cap weighted index funds.

Thus, if we add up the top 10 companies that you see for each fund, we’ll see similar but not identical results. With VOO, the top 10 companies represent about 26% of the fund. For VTI, the top 10 comprise about 21%. Again, these percentages do change as company market caps change.

VTI’s percentage allocated to the top 10 is less than VOO because it must allocate its assets among all publicly traded companies headquartered in the U.S. (about 3,700). VOO only allocates its capital among 500 companies.

Dividend Yield

It’s worth noting that the dividend yield is different for these funds as well. VOO has a trailing twelve month (TTM) yield of about 1.25%. In contrast, VTI’s yield is 1.20%. The difference isn’t significant in my view, but for some it’s a critical factor.

VOO vs VTI Performance

Now we move to what really matters, performance. Using Portfolio Visualizer, we can see how the S&P 500 has compared to a total stock market index over several decades.

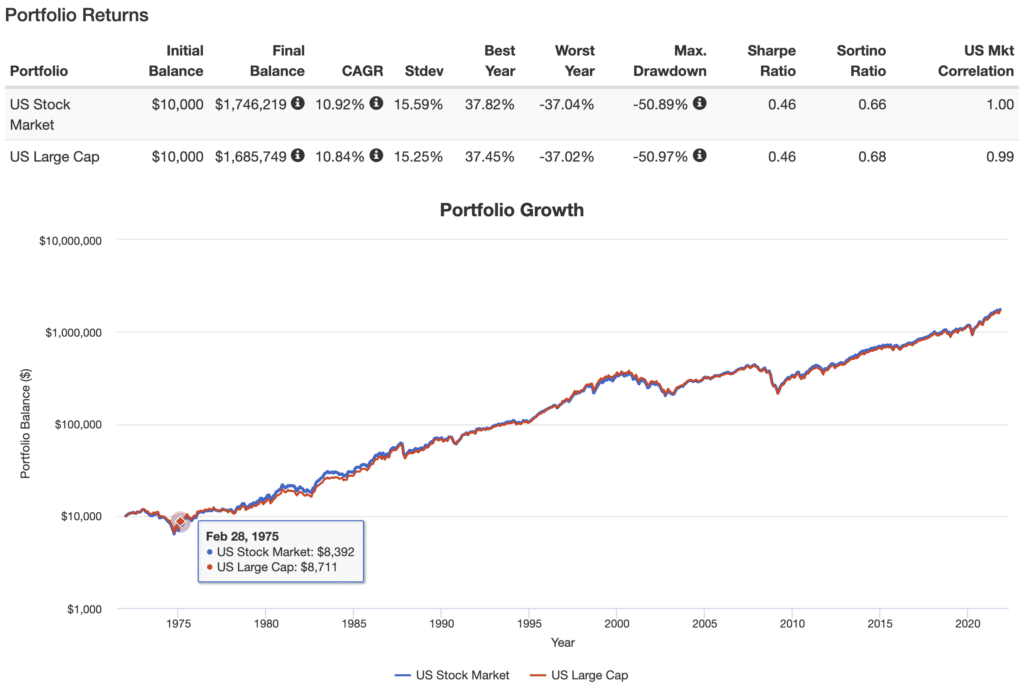

First, let’s see how a $10,000 investment in each of these asset classes beginning in 1972 (that’s as far back as Portfolio Visualizer goes) would have performed:

Note that I’m comparing asset classes, not VOO and VTI. I’m doing that because we get more data. As you can tell, the performance has been almost identical. The Compound Annual Growth Rate (CAGR) was just 8 basis points higher for total stock market. The S&P 500 had slightly less volatility as measured by standard deviation. For all practical purposes, the investments were identical.

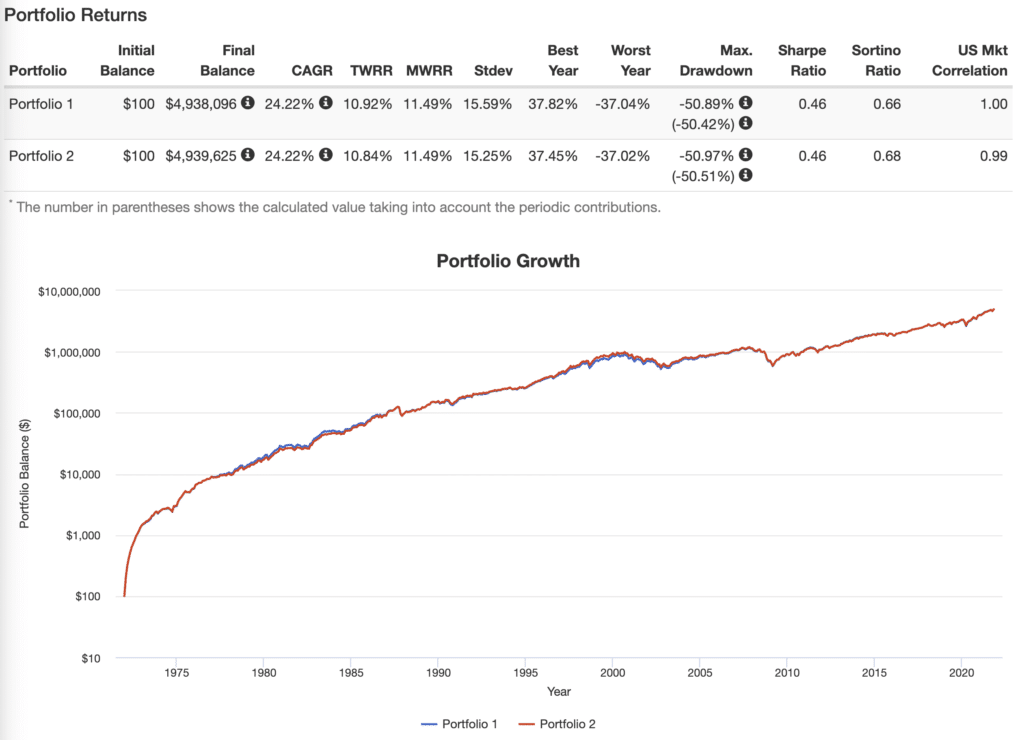

If instead of investing one lump sum, we start with $100 and add $100 every month, the results continue to be nearly identical:

During shorter periods of time, VOO or VTI might outperform the other by small margins. Over the long term, however, they’ve performed very similarly.

VOO vs VTI–How to Choose

Given the nearly identical performance and volatility, how do we decide between VOO and VTI? I’m going to suggest three factors to consider.

First, in a 401(k) or 403(b), you may not have a choice. The 401(k) I currently have offers an S&P 500 index fund, but doesn’t offer a total stock market index fund. In this situation, take whichever one your workplace retirement account offers. It doesn’t really matter and you shouldn’t view that as a problem or something to worry about.

Now, if you do have a choice or you’re investing in an IRA or a taxable account where you absolutely do have a choice, then I’d suggest one of two approaches.

If simplicity is your goal and you want all of your U.S. stocks in a single fund, go with VTI or another total stock market index fund. For example, if you invest in a three fund portfolio, I prefer a total stock market index fund. It’s not because I think it’ll outperform the S&P 500. We just saw that the performance numbers are pretty much identical. What VTI does give you, however, is added diversity. If the volatility or risk is effectively the same, and the performance is effectively the same, why not get greater exposure to the equities market.

On the other hand, if you want to slice and dice your portfolio into several U.S. asset classes, as I tend to do, I prefer the S&P 500. Why? It gives me more control over the specific asset allocation I’m trying to achieve.

Final Thoughts

So there you go. There are some of the key differences between an S&P 500 index fund and a total stock market index fund. We specifically looked at VOO versus VTI, but these considerations apply to similar funds from Fidelity, Schwab or other investment companies. The good news is that while there are differences between the two types of investments, both are excellent options for U.S. equity exposure.

I use Empower to track all of my investments. The free tool shows me my asset allocation, total costs, and retirement projections. Check out my Empower Review and User’s Guide to learn how it can help you, too.