Morningstar Investor Review And 2024 User’s Guide

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

Morningstar is best known for its stock, bond, etf and mutual fund research. Recently it launched Morningstar Investor, a paid service for retail investors. It replaces Morningstar Premium, a service I used for years. In this Morningstar review, I’ll take a deep dive into the Investor product and provide some tips on how best to use it.

Morningstar Investor

Summary

Morningstar Investor is the new version of the company’s portfolio tracking and research subscription service for retail investors. Overall it’s a workable product that needs more development.

Morningstar Investor Overview

Morningstar Investor is Morningstar’s paid portfolio tracker and research tool kit designed for retail investors. Launched in June 2022, Morningstar Investor replaces the Morningstar Premium and Basic subscriptions. And frankly, this has caused some confusion.

Before the change, users had a choice between Morningstar Basic and Morningstar Premium. Morningstar Basic was free and gave users access to a portfolio tracking tool, research and a stock screener. It was one of the best free portfolio trackers available anywhere. The paid service, called Premium, added Morningstar analysts reports, ratings, and certain X-ray tools. Although I subscribed to the Premium service for years, it wasn’t worth the price.

Today, new Morningstar users have just one option–Morningstar Investor.

Some Morningstar Investor reviews I’ve read claim that Morningstar Basic is still available for free. For those who already have an account, the legacy portfolio tracker is still available. While Morningstar plans to retire the legacy tracker, it has stated it will continue to be available through at least 2023. For new users, however, the Morningstar Basic free membership is not an available option, as far as I can tell.

The cost of Morningstar Investor is $34.95 a month or $249 a year. Morningstar offers a 7-day free trial and a $50 discount off the first year’s price.

Morningstar Premium vs Morningstar Investor

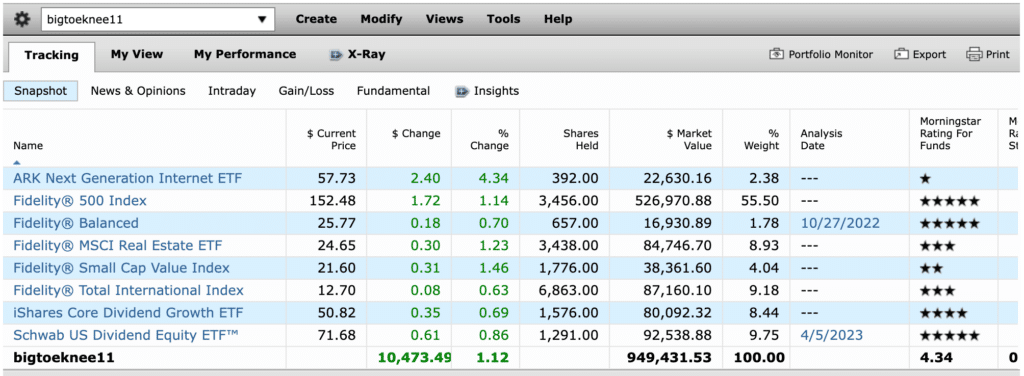

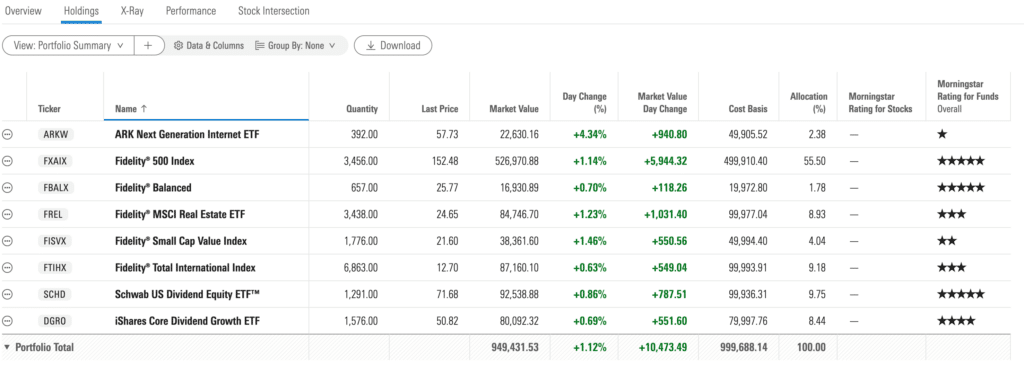

So what’s the difference between the old Morningstar Premium and the new Investor? The primary difference is the user interface. Here’s what the portfolio trackers looks like for each service.

As you can see, Morningstar gave its new Investor portfolio tracker a facelift. Overall, I like the new user interface, even though I had grown accustomed to the 1990’s style interface from many years of using it.

Beyond that, Morningstar Investor offers very few new features. It does allow users to connect their brokerage accounts to download transactions and balances. This feature was notably absent from the legacy tracker. Beyond that, however, it offers generally the same features as Morningstar Premium.

I’ve tested the brokerage connection feature and found that it works most of the time. When I have experienced issues, it has been because of the specific broker (Hello, Vanguard), not Morningstar.

Morningstar Investor Key Features

Portfolio Tracking

Tracking your portfolio is the key feature of Morningstar’s paid service. As noted above, you can connect your brokerage accounts to download your transactions automatically. Alternatively, you can enter your portfolio manually. Here there are two significant things to keep in mind.

First, Morningstar Investor cannot track the portfolio’s performance if you link your brokerage accounts. You must enter your portfolio manually to see performance. This is a major issue with the service, which will look at further in the next section.

Second, if you want detailed transaction level tracking, you must enter your portfolio manually. Here it’s not just a matter of entering current balances, but also entering each transaction (including dividend reinvestments) manually. And for the most accurate tracking, you’ll want to track cash flow, which is an option when you set up a new portfolio.

Tip: if you select Cash Flow Tracking, you’ll need to manually add cash to the portfolio before you’ll be able to see any of the investments you’ve added to the portfolio.

Once you have a portfolio entered, Morningstar provides a wealth of data about your investments.

Holdings

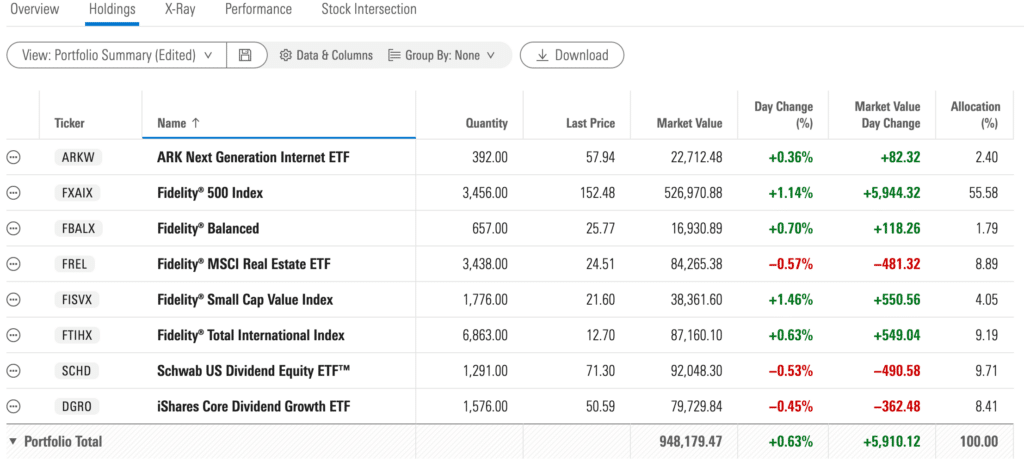

The list of investment holdings is arguably the standout feature of Morningstar Investor. At first glance, it appears as a standard list of holdings with basic information for each investment:

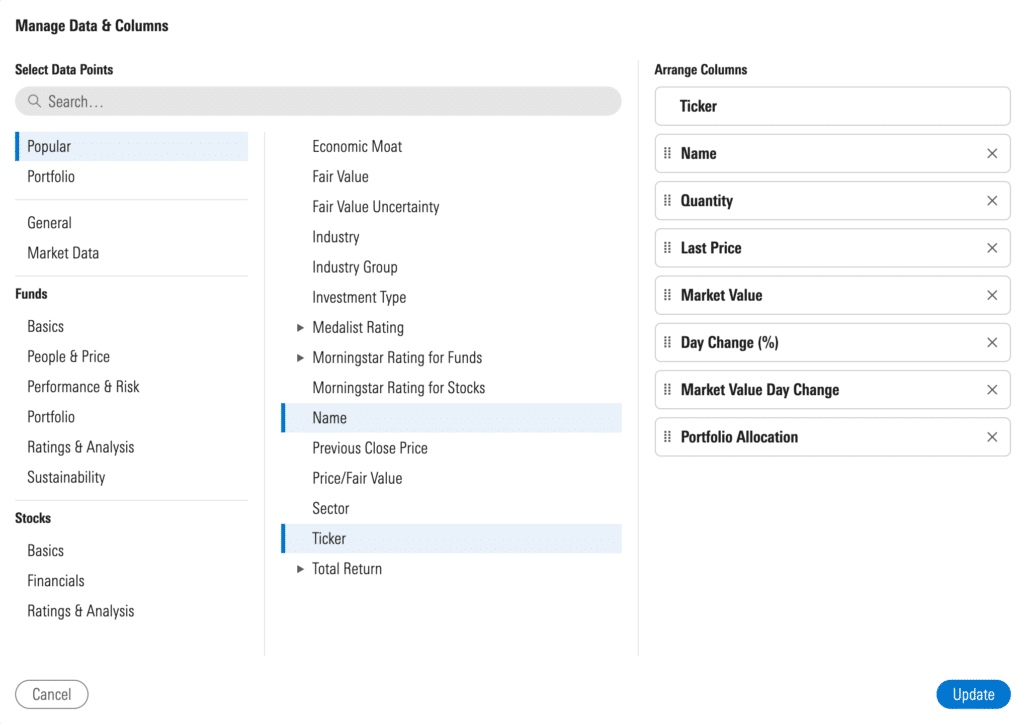

What sets it apart is the long list of data points Morningstar offers depending on the type of investment (e.g., etf, mutual fund, stock, bond). You access the list from the “Data & Columns” link. From there you can select what data to display and even create multiple views.

If you create multiple views, you can easily switch from one view to another with the dropdown box.

X-Ray

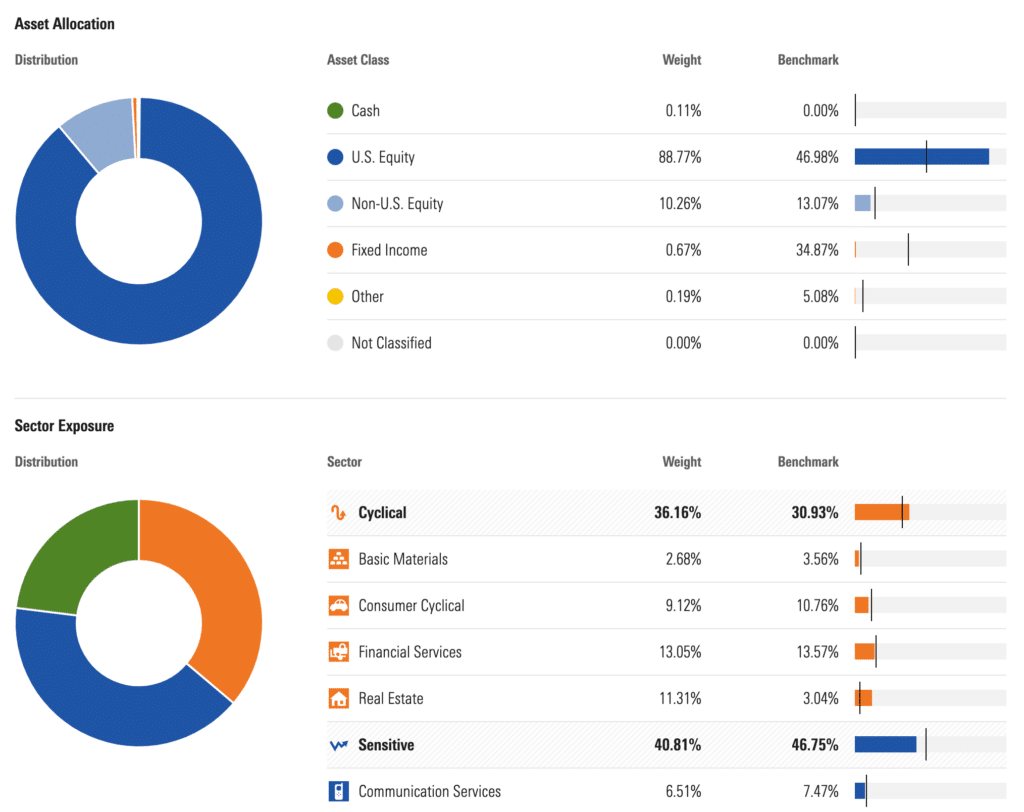

The X-Ray tool is Morningstar’s version of an asset allocation tool. It will show you the allocation of your portfolio, including stocks vs bonds, sectors and geographic coverage.

The X-Ray tool provides a good overview of a portfolio’s asset allocation, although I prefer Empower’s approach to asset allocation (see below)

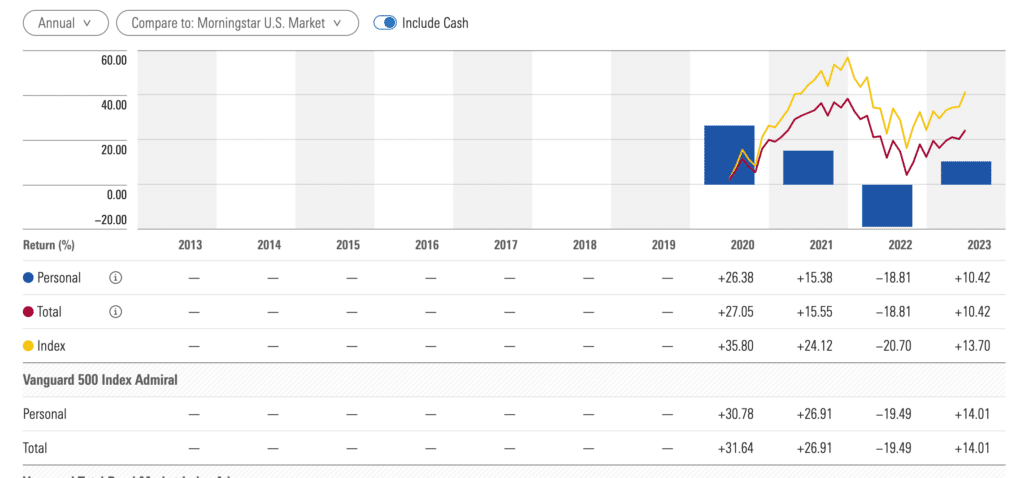

Performance Tracking

Performance tracking of a portfolio is a key feature of any portfolio tracker. Unfortunately, there is a big issue with Morningstar Investor in this regard. It only works if you manually enter your portfolio. If you connect your brokerage and retirement accounts, you’ll see this message when you go to the performance tab:

Performance charting requires exact transactional information on when holdings are bought and sold, and at what price, in order to track return. Because manually added holdings include transactional information, they will always be represented here. Linked accounts do not include transactional information, so they won’t be included.

Frankly, it’s beyond me why Morningstar has this limitation. While transaction level details result in more accurate performance data, just about every other tool I’ve examined can track performance when accounts are connected. This is a big issue limiting Morningstar Investor.

Now, if you do enter your transactions manually, the performance tracking is excellent:

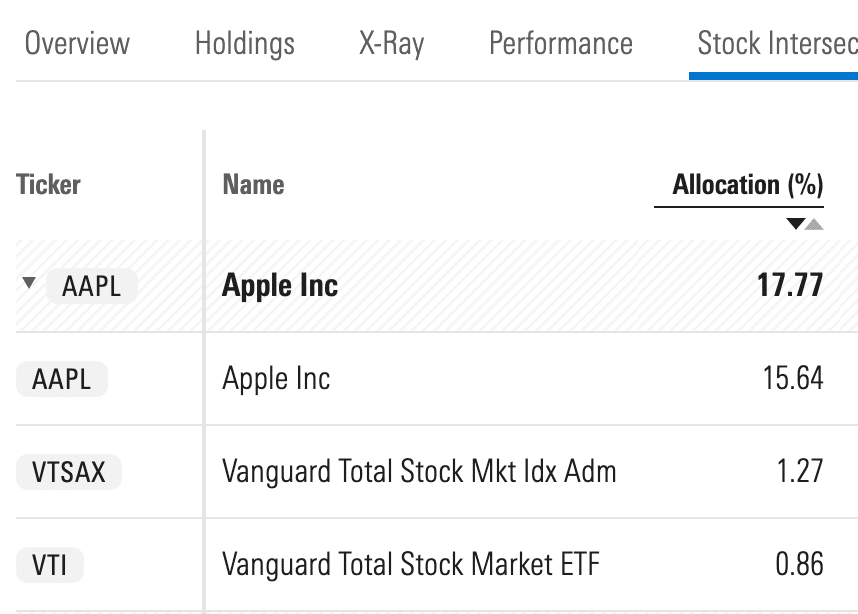

Stock Intersection

With Morningstar’s Stock Intersection tool, you can see how much of each company you own. This can be useful for those who invest primarily in ETFs and mutual funds. In my case, for example, Apple makes up more than 17% of my portfolio via mutual funds and direct ownership (Yes, I know this is too much!).

Stock Intersection also shows you which funds own each company and the percentage of your portfolio represented.

Morningstar Research

Morningstar is a leading provider of investment research and analysis. Its investment research capabilities include detailed analysis of stocks, mutual funds, ETFs, and other types of investments. Morningstar’s research covers various aspects of investment, including financial performance, valuation, risk assessment, and qualitative factors.

That’s all fine and well. For our purposes, the key factor is that most of this research is available for free. In fact, it’s primarily Morningstar’s analysts reports and some ratings that are only available for paid subscribers. Generally, I don’t find this content to be very useful, but it may be for you.

Watchlists And Screener

Morningstar’s Watchlist and Stock Screener features offer tools to find investments and track them. The one advantage Morningstar has here is that you can view a wealth of data for any investment in your watchlist or screener. The same data available for holdings is available here. These tools could be very useful for active traders.

Morningstar Smartphone and Tablet Apps

Morningstar’s apps are another letdown. The smartphone app appears to just wrap the web version into a smaller screen. Expect to do a lot of side-to-side scrolling to see all of the information about your portfolio. This may explain the 4.2 rating for the iPhone app. It’s not the worst rating I’ve seen, but well below Empower’s 4.7 rating (see below).

Morningstar doesn’t have a tablet app. You can download the smartphone app onto an iPad, which I’ve done. But the result is a viewable screen the size of an iPhone. In short, Morningstar doesn’t appear to have invested anything into a mobile app of its Investor product.

Morningstar Investor Alternatives

Empower

For most people, I suspect Empower’s free financial dashboard will be a better fit. It doesn’t offer all of the data Morningstar does. But most investors don’t need all that data, or can get it for free from Morningstar.

What empower offers a better user interface, budget tracking, a better asset allocation tool, and analysis tools for investment fees and retirement planning. You can check out my detailed review of Empower here.

Stock Rover

For those that do need a lot of data, I prefer Stock Rover. It incorporates data from Morningstar, as well as data from Zacks, Intrinio, Quandl and IEX Cloud. It provides more tools, such as a library of model portfolios, and endless ways to view your own portfolio. The cost is about the same as Morningstar or cheaper, depending on the plan you choose. It also offers a free version.

Morningstar Investor FAQs

Is there a free version of Morningstar Investor?

No. Morningstar use to offer its Basic membership for free. Morningstar Basic and Premium have now been replaced by Morningstar Investor, a paid tool.

Is Morningstar Investor worth the cost?

In my opinion, no. For those wanting a free tool, there are much better options. Empower is the one I use. For those wanting the research, watchlists and stock screener tools, Stock Rover is a better option at roughly the same cost or less.

How much does Morningstar Investor cost?

It costs $249/year, although you can save $50 off the first year with this link.

Can I customize my portfolio and track its performance with the premium subscription?

Yes, but keep one thing in mind. If you link your investment accounts to Morningstar, rather than entering them manually, you can’t track your performance.

Does Morningstar offer a mobile app?

Yes, but frankly, it’s not very good. The iPad app is just the iPhone app on a tablet. And the iPhone app appears to be the web-based version, with lots of horizontal scrolling required.

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.