10 Alternatives to Morningstar to Track Your Portfolio for Free

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

I’ve used Morningstar to track and analyze various investment portfolios for over 20 years. Recently, they launched what is called Morningstar Investor. It’s an updated and refreshed version of the company’s old portfolio tracker. Unfortunately, the new Morningstar Investor is expensive ($34.95/month or $249/year). As a result, many have reached out to me asking what other tools I’d recommend. So in this article, we’ll explore some of the best alternatives to Morningstar for managing and optimizing your investment portfolio.

Table of Contents

Why Look for Alternatives to Morningstar?

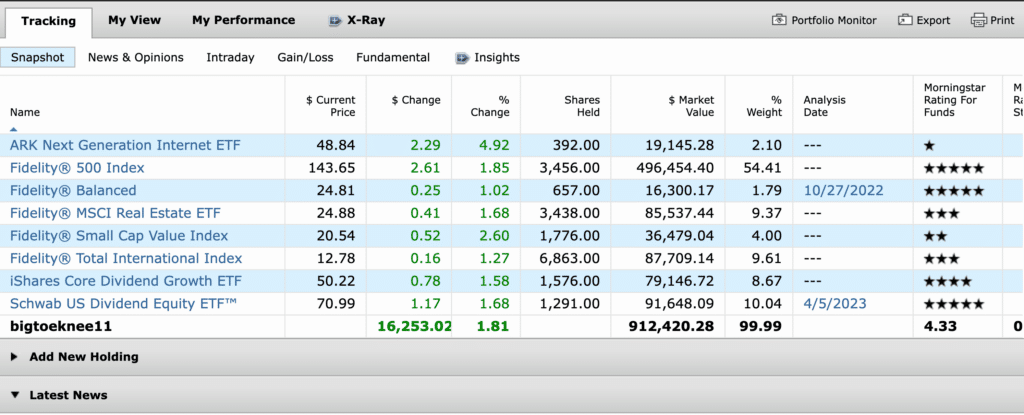

As I mentioned above, I’ve used Morningstar for 20 years or more. The company offers arguably the most information about mutual funds, ETFs and stocks that you’ll find anywhere. The downside is that its old Portfolio Tracker showed its age.

While I was comfortable with this 1990s user experience, many were not. And there were two other downsides. First, you needed to pay for a Premium Morningstar subscription to get access to all the great data, including Morningstar’s popular X-Ray tool. Second, you could not sync brokerage accounts to the tool.

Enter Morningstar Investor. It attempts to solve two of the three drawbacks of the old system. First, it updated the look and feel of the portfolio tracker.

Second, you can now sync your brokerage accounts or add investments manually. I’ve tested the sync feature with major brokerage firms, and it’s worked for me.

The one downside, however, is that it still costs a lot of money. For a lot of investors, there’s simply no need to spend the money to track their portfolio. (For those who are willing to spend the money for the enhanced features, I think Morningstar is a solid option.)

So with that, let’s check out the alternatives, many of which are free.

Morningstar Alternatives

1. Empower (Personal Capital)

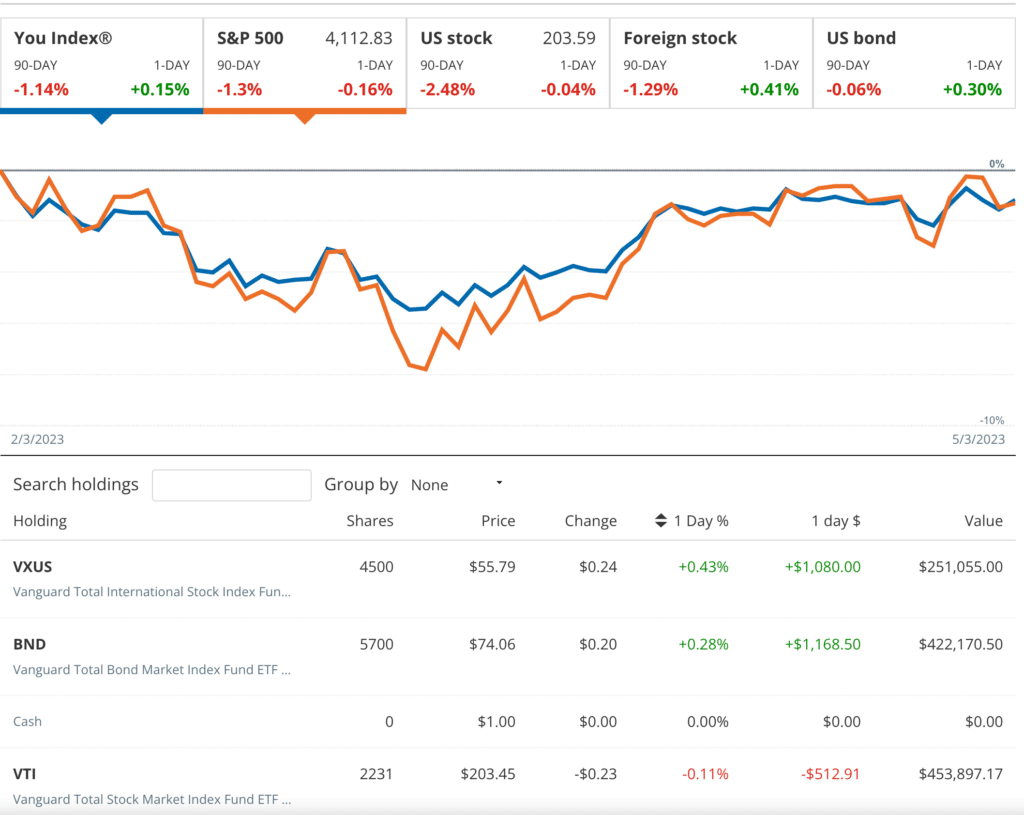

I’ve used Empower to track my portfolio since it was first launched more than a decade ago. The tool does a lot more than just track a portfolio. It is a comprehensive financial planning and investment management platform. It offers a wide range of tools and features in a user-friendly interface. The free service includes portfolio tracking, analysis, retirement planning, and budgeting tools.

Key Features

- Account aggregation: Syncs and tracks multiple financial accounts in one place, including retirement accounts, brokerage accounts, credit cards, bank accounts, and home values.

- Investment checkup: Analyzes your portfolio and provides personalized recommendations.

- Retirement planner: Assists with planning and monitoring your retirement savings and building a spending plan once you retire.

- Fee analyzer: Identifies the fees in your investment accounts and projects the costs of those fees over time.

- Cash flow analyzer: Provides a comprehensive view of your income, expenses, and net worth over time.

Pros:

- Comprehensive financial planning and investment management platform, offering a wide range of tools and features.

- User-friendly interface makes it easy for both beginner and experienced investors to navigate.

- Free service includes portfolio tracking, analysis, and budgeting tools.

Cons:

- Doesn’t offer the same amount of data and analysis you’ll find with Morningstar

- Empower will contact you to offer their free portfolio analysis, although you are not required to accept their offer to use the tool.

- Limited customization options compared to some other platforms.

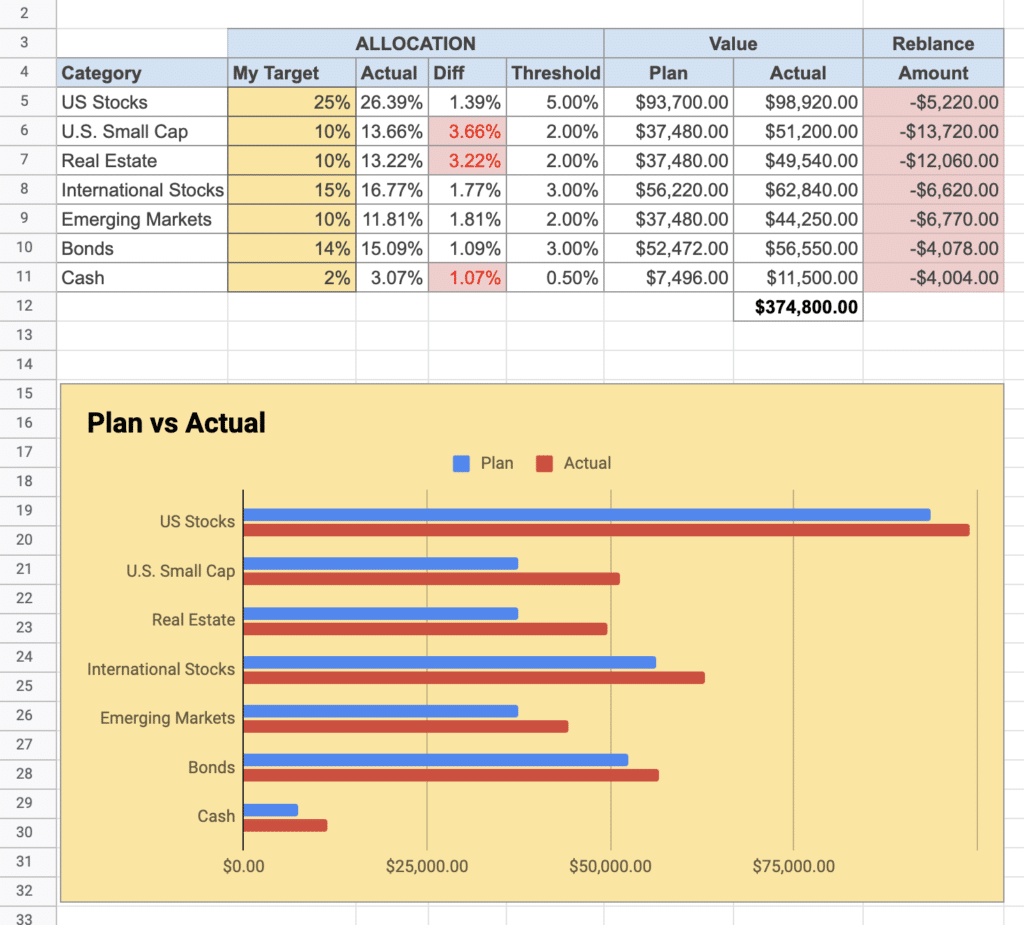

2. Google Sheets

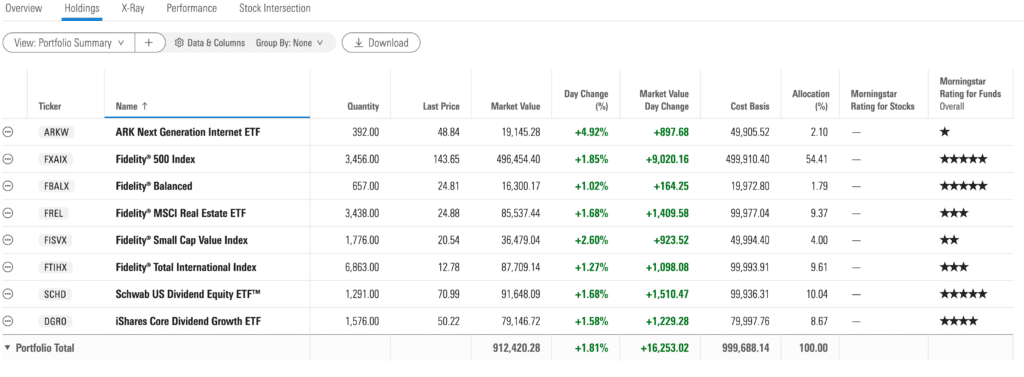

Google Sheets is highly customizable, allowing you to create a portfolio tracker tailored to your needs. It is free to use and accessible from any device with internet access. Integration with external sources, such as Yahoo Finance, is possible for importing data. To that end, and with the help of a friend, I’ve built a free Google Sheets Investment Tracker.

You can check it out here.

Key Features

- Free

- Data Control: You have complete control of your data

- Data import: Uses Google Finance functions to pull in price, expense ratio and other data on mutual funds, ETFs and stocks.

Pros:

- Highly customizable, allowing you to create a portfolio tracker tailored to your needs.

- Free to use and accessible from any device with internet access.

- Integration with external sources using Google Finance functions

Cons:

- Requires more manual input and maintenance compared to other platforms.

- Can be time-consuming to set up and optimize.

- Lacks the advanced analysis tools available on dedicated investment platforms.

3. Stock Rover

Stock Rover is a comprehensive platform focused on in-depth research and analysis. It offers stock screening, portfolio analysis, and comparison features. Stock Rover provides a wealth of information and data, but it does come at a cost. And although I’ve used Stock Rover for years, there’s still a steep learning curve. That’s in part due to the wealth of information the tool provides.

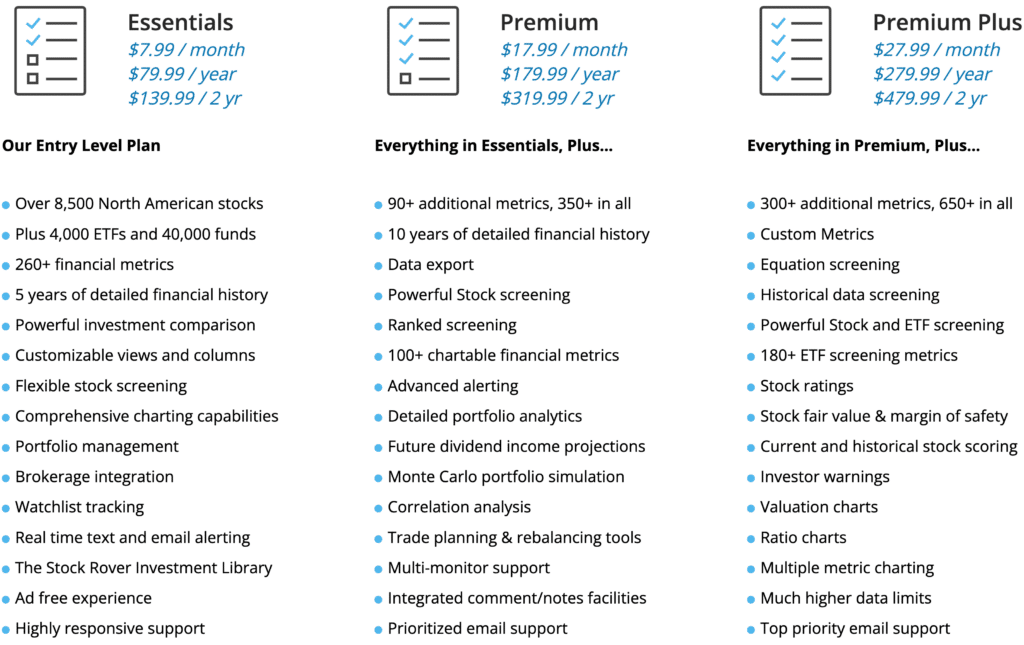

As noted above, Stock Rover is not free. You can choose from one of four plans (the free plan is not listed below):

Except for the most expensive plan, Stock Rover costs a lot less than Morningstar. It also offers more. For example, it has built in portfolios you can use (e.g., Bogleheads’ 3-Fund Portfolio, Rick Ferri’s Portfolio). You can also sync your accounts to Stock Rover.

In the end, I think Stock Rover is a better option than Morningstar if, and this is a big if, you are willing to learn how to use the tool and have a need for the wealth of data and analysis it offers. If not, Morningstar Investor is easier to use.

Key Features

- Stock screener: Offers a powerful stock screener to help you find potential investment opportunities.

- Portfolio tracking: Provides comprehensive portfolio tracking and performance analysis tools.

- Customizable alerts: Sends notifications based on your chosen criteria, such as price targets or earnings announcements.

- Research reports: Delivers in-depth research reports on various stocks and industries.

- Comparison tools: Allows you to compare stocks, ETFs, and portfolios side by side.

Pros:

- Comprehensive platform focused on in-depth research and analysis.

- Offers stock screening, portfolio analysis, and comparison features.

- Provides a wealth of information and data for informed investment decisions

Cons:

- Can be overwhelming for beginner investors due to the extensive features and tools.

- Requires a paid subscription for full access to all features.

- Lacks some of the personal finance and budgeting tools found in other platforms.

4. Yahoo! Finance

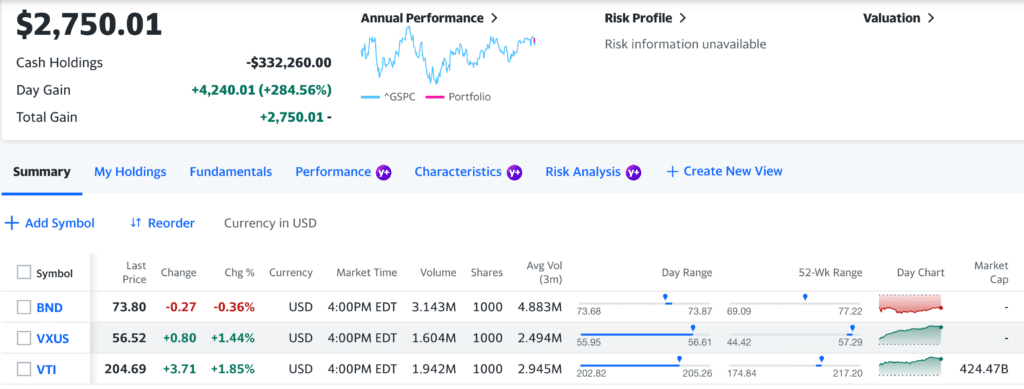

Yahoo! Finance offers a comprehensive suite of financial news, stock quotes, and market analysis. The platform includes a free portfolio tracking tool with the ability to link your investment accounts. That’s the good news. The not so good news is that the user interface is a jumbled mess. It helps if you use an ad blocker.

I’ve included it in the list because it’s free, offers excellent data, and integrates well with financial news. Note that they also offer Yahoo Finance+, but at a cost of over $350 a year.

Key Features

- Portfolio tracking: Provides a free portfolio tracking tool with the ability to link your investment accounts.

- Financial news: Offers comprehensive financial news and market analysis.

- Stock quotes: Delivers real-time stock quotes and historical data.

- Stock screener: Filters stocks based on various criteria to help identify potential investment opportunities.

- Watchlists: Enables you to create and manage watchlists for monitoring specific stocks.

Pros:

- Offers a comprehensive suite of financial news, stock quotes, and market analysis.

- Free portfolio tracking tool with the ability to link your investment accounts.

- Integrates with Yahoo Finance news

Cons:

- Investment analysis tools are more basic compared to other platforms.

- Interface can be cluttered with ads and promotions.

- Occasional syncing issues with investment accounts.

5. Quicken

When it comes to portfolio tracking, Quicken probably isn’t the first tool that comes to mind. I’ve included it, however, because it will track your portfolio and of course provide a full suite of budgeting tools.

You can enter investments manually or connect Quicken to your retirement and brokerage accounts. I’ve tested both the PC and Mac versions of Quicken and successfully connected accounts. There can be issues from time to time, but they are usually because of the particular broker, not Quicken.

Quicken is a paid application. It requires an annual subscription for access to all its features. In addition, the user interface is outdated, at least on the PC version. The Mac version has a more current user experience.

Key Features

- Comprehensive financial management: Combines budgeting, investment tracking, and bill management in one platform.

- Portfolio analysis: Provides a variety of tools for analyzing your investment portfolio.

- Tax planning: Assists with tax planning and preparation, including generating tax reports.

- Synchronization: Syncs with multiple financial institutions and brokerages for seamless account management.

Pros:

- Long-standing reputation and wide range of personal finance and investment management features.

- Offers detailed investment tracking and reporting capabilities.

- One-stop solution for managing your entire financial life.

Cons:

- Requires a paid subscription for access to all features.

- Its interface is a bit outdated and not as user-friendly as other options.

- Occasional syncing issues with investment accounts.

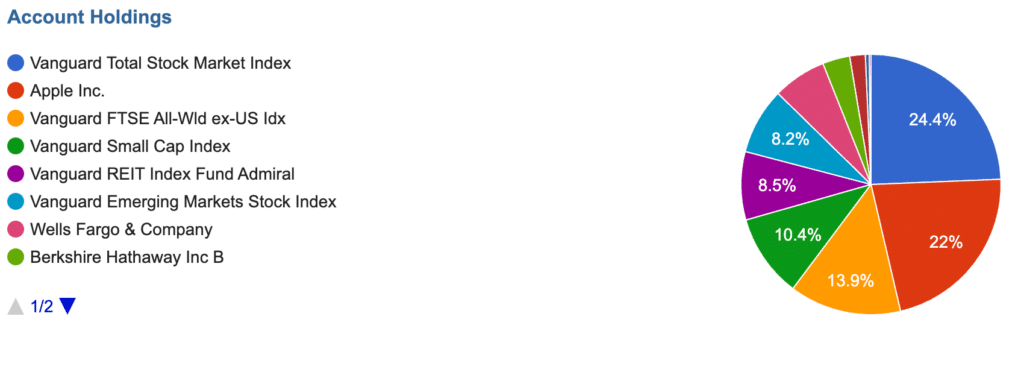

6. Fidelity Full View

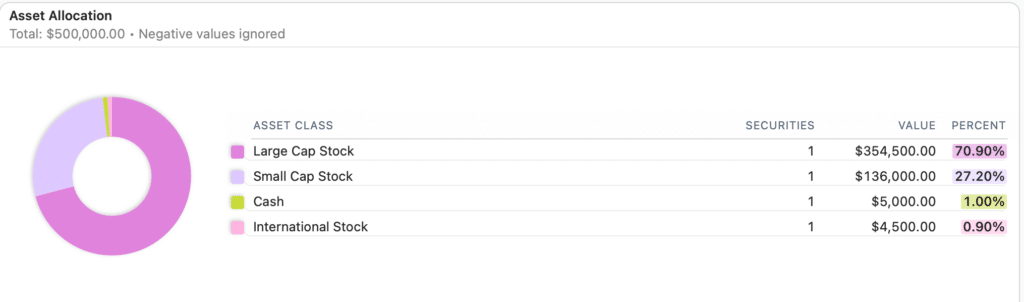

Fidelity Full View offers a unified view of your financial situation across multiple institutions. It provides detailed investment tracking and analysis features. The platform is available for free to Fidelity customers.

Full View is powered by eMoneyAdvisor, a tool used by many advisors. I’ve used both eMoneyAdvisor and Fidelity Full View. They both track your portfolio, showing you your balances and asset allocation. They also both suffer form outdated user interfaces and limited analysis tools (advisors have access to far more features in eMoneyAdvisor than do retail investors, unfortunately).

Key Features

- Account aggregation: Syncs with various financial institutions for a consolidated view of your accounts.

- Portfolio analysis: Provides tools for tracking and analyzing your investment portfolio.

- Asset allocation: Offers insights into your portfolio’s asset allocation and diversification.

- Budgeting: Helps you create and monitor budgets based on your financial goals.

Pros:

- Offers a unified view of your financial situation across multiple institutions

- Provides detailed investment tracking and analysis features

- Available for free to Fidelity customers

Cons:

- Limited to Fidelity customers, which may not suit everyone

- Lacks some of the customization options found in other platforms

- Portfolio analysis options are limited

7. Ziggma

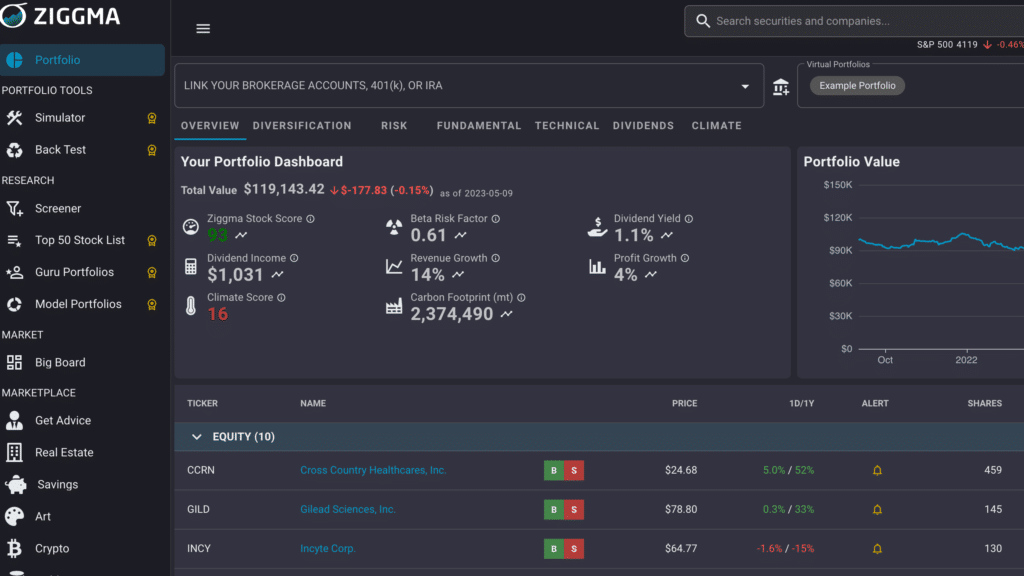

Ziggma is a portfolio tracker I just recently tested. Its interface is as busy as Times Square on New Year’s Eve (see below). You can connect your brokerage accounts to download your investments. It offers analysis options, but most of them require a paid subscription. I have found Ziggma’s customer support to be timely and responsive.

Key Features

- Intuitive interface: Offers an easy-to-use platform with robust analytics tools.

- Personalized recommendations: Provides tailored investment recommendations and alerts.

- Stock and ETF analysis: Delivers in-depth stock and ETF analysis with a proprietary scoring system.

- Portfolio monitoring: Enables tracking of your investment portfolio’s performance.

- Custom watchlists: Allows you to create custom watchlists for stocks and ETFs

Pros:

- Intuitive interface with robust analytics tools for tracking your investment portfolio

- Allows for personalized recommendations and alerts

- Offers a mix of free and premium features

Cons:

- Advanced features require a paid subscription

- Lacks some of the budgeting and personal finance tools found in other platforms

8. Portfolio Visualizer

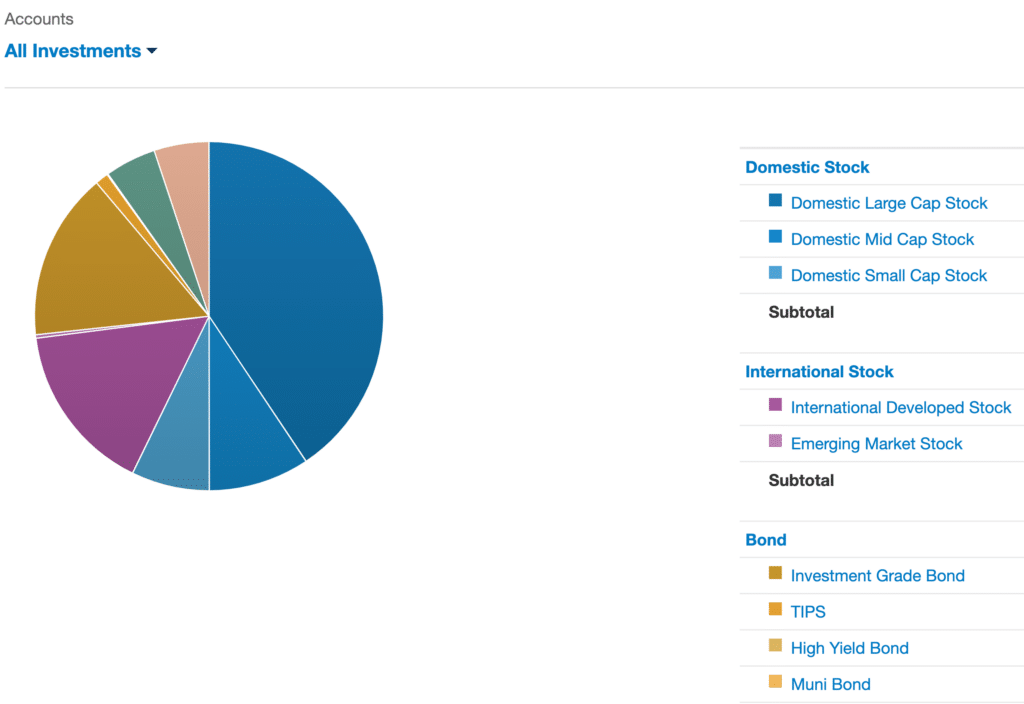

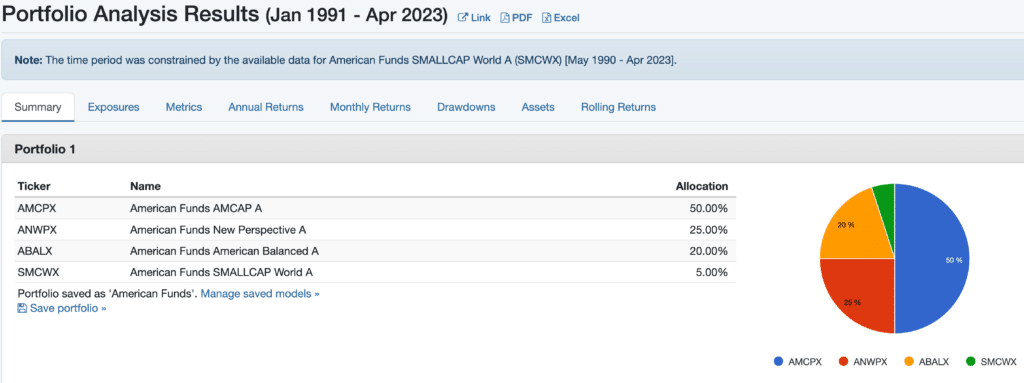

Portfolio Visualizer is an online tool that offers a wide range of portfolio analysis and optimization features. It is particularly useful for investors who want to dig deep into their portfolios’ performance and asset allocation. While not as user-friendly as some of the other alternatives, Portfolio Visualizer offers a robust set of features for those looking to perform more in-depth analysis.

The downside is that you must use the paid version to save your portfolio. The cost starts at $19/month. I’ve had the Basic paid version for a couple of years now. While I don’t use it to track my portfolio, I do use it to save and analyze Lazy Portfolios, such as the 3-Fund Portfolio.

Key Features

- Backtesting: Allows users to analyze the historical performance of a portfolio based on specified asset allocations and rebalancing strategies.

- Asset Class Analysis: Provides data and analytics on various asset classes, including stocks, bonds and commodities.

- Portfolio Optimization: Provides tools for optimizing a portfolio based on modern portfolio theory, which seeks to maximize expected return for a given level of risk.

- Monte Carlo Simulation: Provides tools for simulating the future performance of a portfolio under different market conditions.

- Retirement Planning: Includes features specifically designed to help plan for retirement, such as withdrawal analysis.

- Asset Correlation: Analyzes the correlation between different assets or asset classes in a portfolio, which can help to inform decisions about diversification.

- Savings & Withdrawal Rates: Allows users to see how different savings and withdrawal rates could affect the growth and longevity of their portfolio.

- Periodic Table of Investment Returns: Visualizes the annual returns of different asset classes in a format similar to the periodic table of elements.

Pros:

- Comprehensive Tools: It offers a wide range of tools for portfolio backtesting, asset allocation, and investment analysis

- Data: The platform provides a wealth of data on different asset classes and investment factors

- Easy-to-use Interface: The website’s interface is user-friendly and makes complex analysis accessible to non-professional investors.

- Portfolio Optimization: This is a useful feature that helps in constructing a portfolio that maximizes return for a given level of risk.

Cons:

- Limited Assets: While Portfolio Visualizer includes data for a wide range of asset classes, it might not include every single investment that an individual might hold in their portfolio.

- Historical Focus: The platform focuses heavily on historical data and past performance, which, while useful, is not always indicative of future results.

- Learning Curve: Despite its user-friendly interface, some of the more complex features might have a steep learning curve for those without a background in finance or investing.

- Cost: Only paid subscribers can save and track portfolios

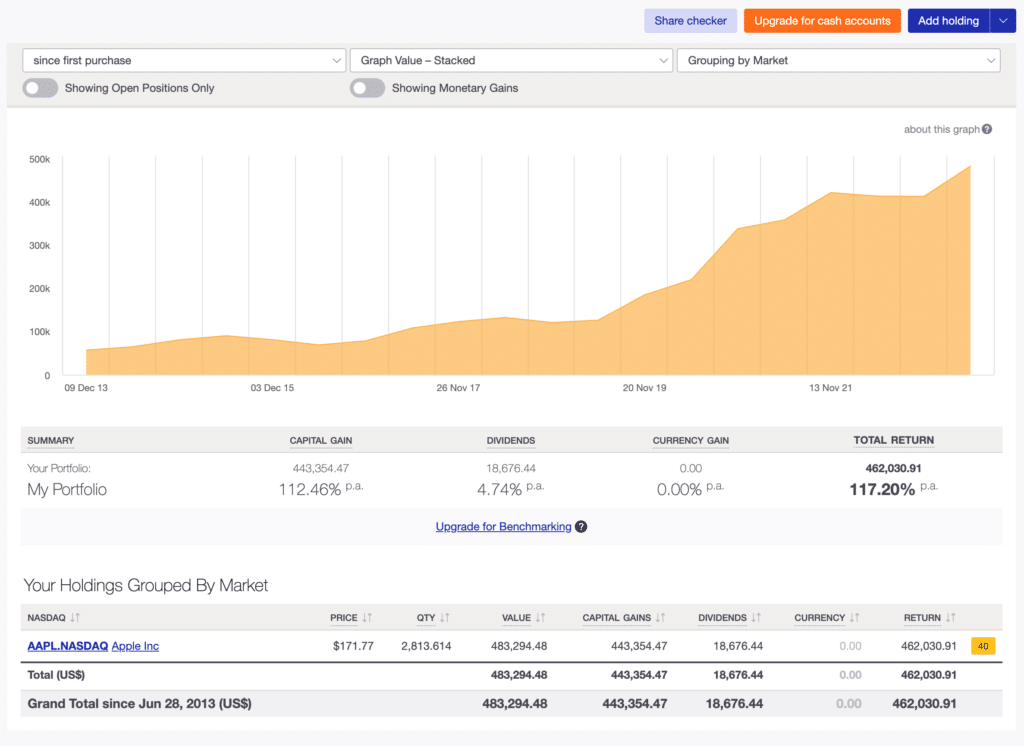

9. Sharesight

Sharesight features comprehensive reporting tools, including automatic dividend tracking and capital gains tax reporting. It supports multiple currencies and exchanges, making it suitable for international investors. The platform offers benchmarking features to compare your portfolio performance against market indices. However, the free version has limited features; advanced features require a paid subscription.

Key Features

- Portfolio performance tracking: Monitors your investment portfolio’s performance, including capital gains and dividends.

- Tax reporting: Generates tax reports to simplify tax planning and filing.

- Dividend tracking: Tracks dividend income and automatically adjusts for reinvested dividends.

- Benchmarking: Compares your portfolio’s performance against chosen benchmarks.

- Integration: Syncs with various brokerages and financial institutions.

Pros:

- Comprehensive reporting tools, including automatic dividend tracking and capital gains tax reporting.

- Supports multiple currencies and exchanges, making it suitable for international investors.

- Offers benchmarking features to compare your portfolio performance against market indices.

Cons:

- Free version has limited features, and advanced features require a paid subscription.

- Lacks some of the personal finance and budgeting tools found in other platforms.

- Interface may not be as user-friendly as some other options.

10. EquityStat

EquityStat is a web-based tool designed to help investors track and manage their investment portfolios. The tool offers a range of features that enable users to monitor their investments and analyze performance.

Key Features:

- Portfolio Tracking: EquityStat allows users to track their investment portfolios in real-time. Users can import data from various brokerage firms and banks, and the tool will automatically update the portfolio with the latest market data.

- Performance Analysis: The tool provides users with various performance metrics to analyze the performance of their investments. Users can view their portfolio’s return, risk, and volatility, and compare it to benchmark indices.

- Asset Allocation: EquityStat offers users a visual representation of their portfolio’s asset allocation. Users can see the distribution of their investments across various asset classes, such as stocks, bonds, and cash.

Pros:

- Easy to Use: EquityStat is easy to use and offers a simple, intuitive interface.

- Customizable: The tool offers a range of customization options to suit individual investment needs.

- Comprehensive: EquityStat offers a range of features to help users monitor and manage their investment portfolios.

- Free: EquityStat is currently free.

Cons:

- Limited Brokerage Integrations: The tool currently only supports a limited number of brokerage integrations.

- Limited Historical Data: The free version only provides users with limited historical data, which may not be sufficient for some investors.

- Limited Portfolio Analysis: The tool does a great job tracking performance, but offers little in the way of in-depth analysis.

Overall, EquityStat is a comprehensive tool that offers a range of features to help investors track and manage their investment portfolios. While it has some limitations, the tool’s easy-to-use interface, customization options, and investment ideas make it a valuable resource for investors of all levels.

Finding the Right Alternative for Your Needs

As you consider the various alternatives to Morningstar, carefully weigh several key questions:

- Data: Do you want to sync brokerage accounts to a tool or enter the data manually?

- Privacy: How does the tool protect and use your data?

- Features: Are you looking just for a portfolio tracker, or do you also want a tool that can handle your budget and financial planning?

- Cost: Will you consider a paid tool, and if so, how much are you willing to spend?

Conclusion

While Morningstar is a popular choice for tracking investment portfolios, it may not be the perfect fit for everyone. With a variety of alternatives available, you’re sure to find a platform that meets your needs and preferences. Whether you’re looking for a simple, user-friendly option or a more advanced tool with in-depth analysis features, there’s an alternative to Morningstar that can help you manage and optimize your investment portfolio.

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.