3 Best Robo-Advisors in 2024 (Out of 23 Evaluated)

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

Robo-Advisors promise to make investing easy at a very low cost. Investors have taken notice. According to one estimate, automated investing platforms will manage nearly $1.5 trillion by the end of the year. With dozens of options, however, picking the best robo-advisor can be overwhelming.

To help, I examined about two dozen robos and narrowed them down to what I think are the top three choices. Note that I have used all three robo advisors that made this list. I continue to test other services and will update this list in the future.

Betterment–Best Overall Robo-Advisor

I’ve helped family members and friends set up their first investment account. After explaining the pros and cons of traditional brokers and robo-advisors, they have all chosen Betterment. There are several reasons why Betterment is such a popular choice.

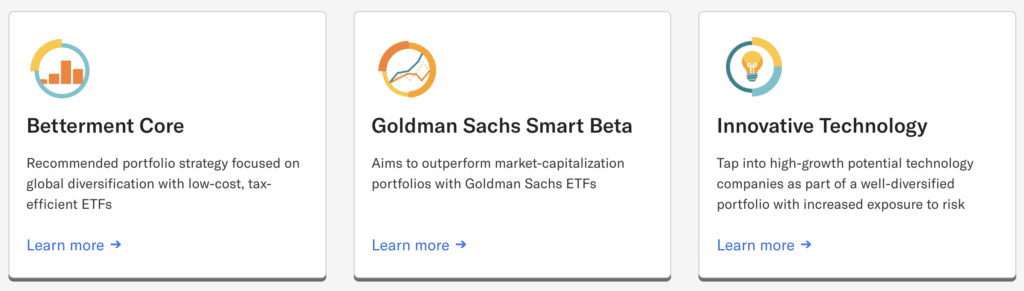

Ease of Use: With Betterment, you select your account type, answer a few questions about your goals, and fund your account (check or bank transfer). From there, Betterment does the rest. It invests your money in a several low cost ETFs that give you a diversified portfolio of stocks and bonds.

In addition to the core portfolios above, it also offers several socially responsible investing portfolios.

Account Types: Betterment offers a wide range of account types, including:

- Roth and Traditional IRA

- SEP IRA (single participant only)

- Inherited IRA

- Individual taxable accounts

- Joint taxable accounts with rights of survivorship

- Trust accounts

Beyond investment accounts, it also offers deposit accounts:

- Cash Reserve (a high-yield cash account)

- Checking account provided by nbkc bank, Member FDIC.

Features: Apart from its easy of use, Betterment’s long list of features earn it the top spot as the best robo-advisor:

- Rebalancing: Automatically rebalances your investment accounts.

- Automated Investing: Set up recurring deposits to your account and automatically reinvest dividends and interest.

- Tax Tools: Betterment offers several features to reduce your taxes, including tax loss harvesting, tax efficient rebalancing, and asset location.

- Planning: Track any number of financial goals, including retirement or saving for a child’s education.

- Financial Dashboard: See all of your finances in one place, including assets held at other financial institutions.

- Advisor Help: Unlike most robo-advisors, Betterment has Certified Financial Planners available to help you.

Low Fees: Betterment offers three fee levels:

- No Fee: You can open a no-fee checking account (comes with a free Visa debit card) or a Cash Reserve account.

- 0.25%: Digital investing with no minimum balance (comes to about $2.50 a year for every $1,000 invested).

- 0.40%: Premium investing that includes unlimited calls and emails with Betterment’s team of CFPs (requires a $100,000 minimum balance).

Finally, Betterment is ideal for every stage of an investor’s journey. It’s easy to open up your first account, with no minimum requirements. And betterment offers a wealth of tools for those entering retirement who need to start withdrawing money to live on.

M1 Finance–Best No-Fee Robo with Ultimate Flexibility

For those that want the automation of a robo-advisor, no fees, and complete control of your investment strategy, M1 Finance is without question the top choice. It blends the benefits of traditional brokers with the automation of robo-advisors.

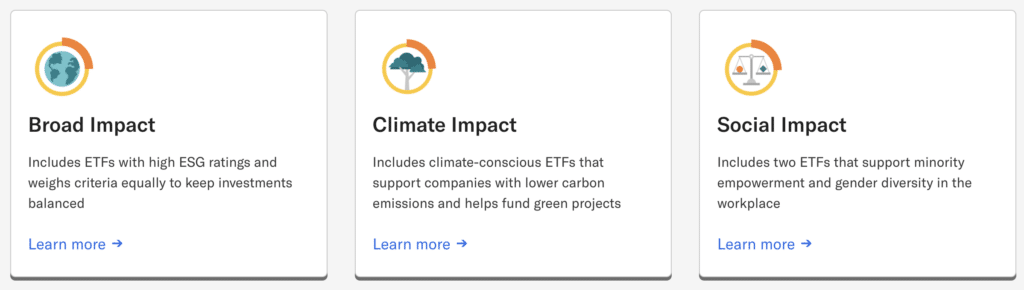

M1 enables investors to create what they call Pies. Each pie can hold individual stocks, ETFs or both. For each investment you add to a Pie, you also indicate how big each slice is. For example, you could create a Pie with the following investments:

- VTI (50%): Vanguard’s Total U.S. Stock Market ETF

- VXUS (30%): Vanguard’s Total International Stock Market ETF

- BND (20%): Vanguards Total U.S. Bond ETF

The above is what is called the three fund portfolio.

Where M1 really stands out is how easy it makes investing in the Pies of your choice. Using the three fund portfolio above as an example, M1 will automatically allocate your investments based on the percentages you set.

As markets cause your balances in each ETF to vary from your plan, M1 takes any new contributions and investments as necessary to bring your investment Pie back in line with your plan. And if your contributions aren’t sufficient, you can rebalance a pie with the click of a button.

In addition to investing, M1 offers a high-yield checking account and an excellent cash back credit card.

Wealthfront

Finally, Wealthfront rounds out my list of the best robo-advisors. Similar to Betterment, it provides a wealth of investing automation for a fee of just 25 basis points. Its list of features is similar to Betterment, with some notable differences.

Before getting those features and differences, however, it’s important to point out that Wealthfront announced in January 2022 that it had agreed to be acquired by UBS. How this will affect Wealthfront is unclear.

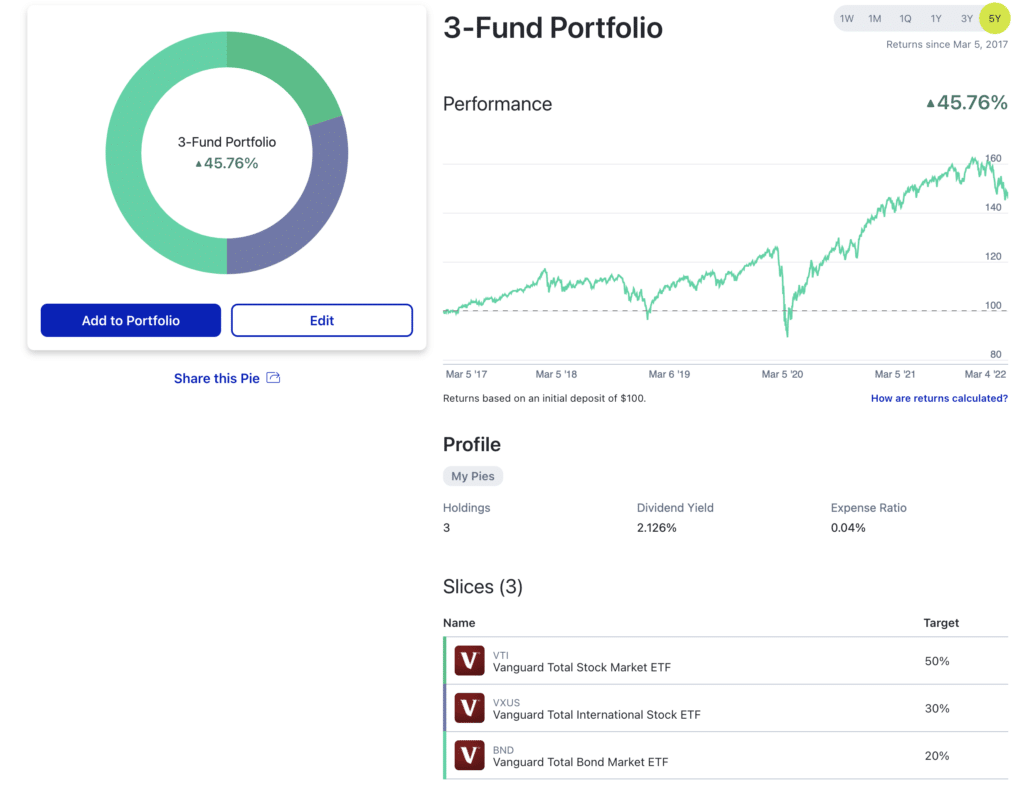

Wealthfront offers a Classic, Socially Responsible and Direct Indexing approach to investing. With a Classic portfolio, you get diversification across U.S. stocks, international stocks, and bonds. You can also chose among socially responsible ETFs.

Unlike Betterment, Wealthfront also offers what is called direct indexing for accounts with at least $100,000. With direct indexing, Wealthfront invests in 100 to 600 stocks, rather than a total U.S. stock ETF such as VTI. The idea is to get the returns of an index, but with tax loss harvesting and asset location flexibility.

On the negative side, Wealthfront does not offer the help of a CFP, as Betterment does.

Why Vanguard Digital Advisor Didn’t Make the Cut

At first glance, Vanguard Digital Advisor checks all the boxes. It offers automated investing using Vanguard ETFs. Generally Vanguard uses four ETFs to implement its investment strategy on your behalf:

- VTI: Total U.S. Stock Market

- VXUS: Total International Stock Market

- BND: Total U.S. Bond Market

- BNDX: Total International Bond Market

Vanguard automatically rebalances the portfolio periodically to keep the portfolio in line with your investment goals. In addition to investing, Digital Advisor can also help you achieve other goals, such as getting out of debt.

And if all that weren’t enough, the cost is about 0.15%, which includes the cost of the underlying ETFs.

So why doesn’t it make the cut?

Well, it wasn’t until I used the service that I experienced its many shortcomings.

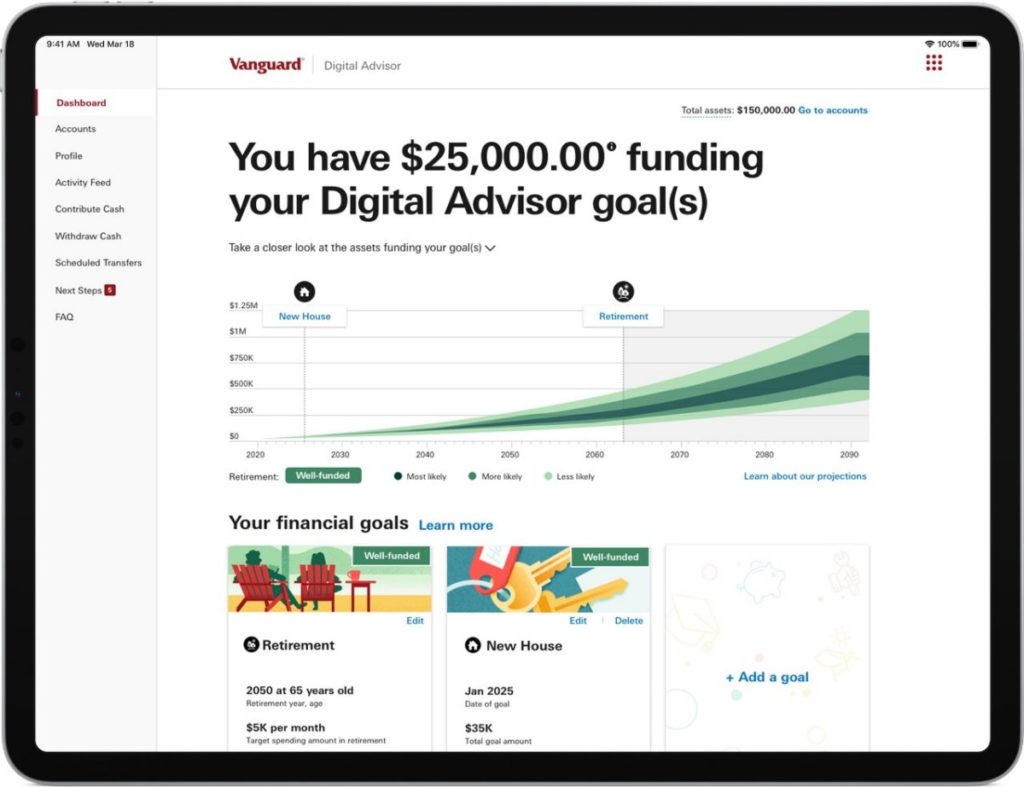

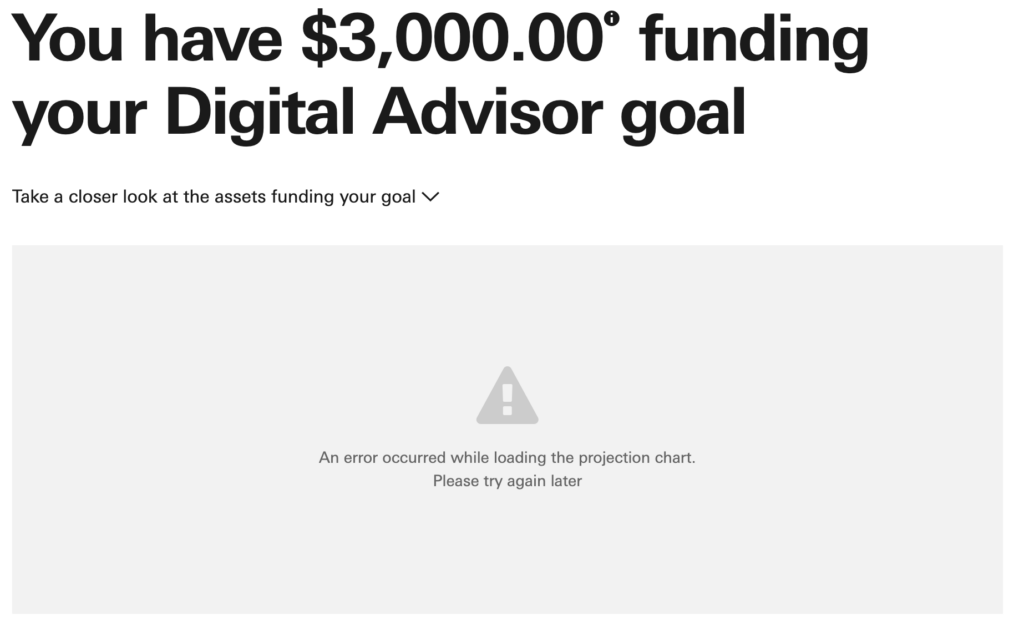

First, there have been a number of technology issues. Do you see the pretty graph in the image above showing the investor’s progress? Here’s what mine looks like:

Vanguard tells me they are working on it.

For a week I couldn’t even enroll in the service. I kept getting this message:

These issues may be temporary, but it gets worse.

Unlike other robo-advisors, you are limited to just five initial asset allocations. Once selected, you are limited in the changes you can make to the asset allocation. And, similar to a target date retirement fund, Vanguard will change your asset allocation as you near your retirement goal.

What’s more, you can’t tell Vanguard to leave your asset allocation alone. It changes whether you like it or not. The result is that Digital Advisor is not well suited for taxable accounts.

And even if you want to use the service in an IRA, you’d be better off with a Vanguard Target Date Fund. These funds use the same funds and cost just 8 basis points. Why pay 15 basis points for effectively the same thing. (A Vanguard rep told me that one can customize the glidepath with Digital Advisor a bit more than with a TDR fund, but the differences seem minimal at best).

In short, Vanguard’s Digital Advisor fails to make the grade.

The True Cost of “Free” Robo Advisors

There are two “free” robo-advisors that did not make my list of the top four–SoFi and Schwab Intelligent Portfolios. In both cases it’s because they have “hidden” fees. Let me explain.

SoFi

SoFi is best known for its student loan business. Several years ago it began to broaden its financial services offerings, including SoFi Automated Investing. While it doesn’t charge a management fee, they get their money another way. Let me explain.

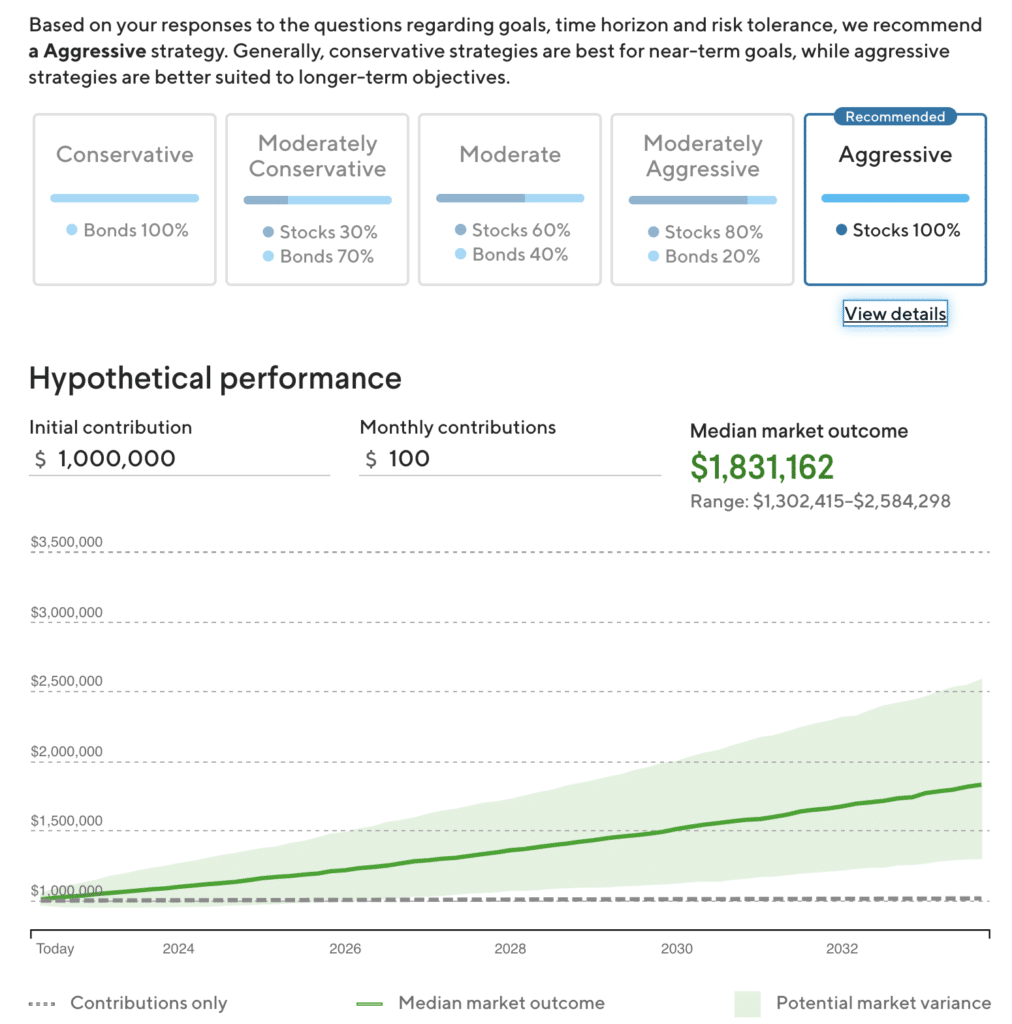

Here’s the portfolio that SoFi suggests for me (I assumed a $1 million contribution, but the amount isn’t important):

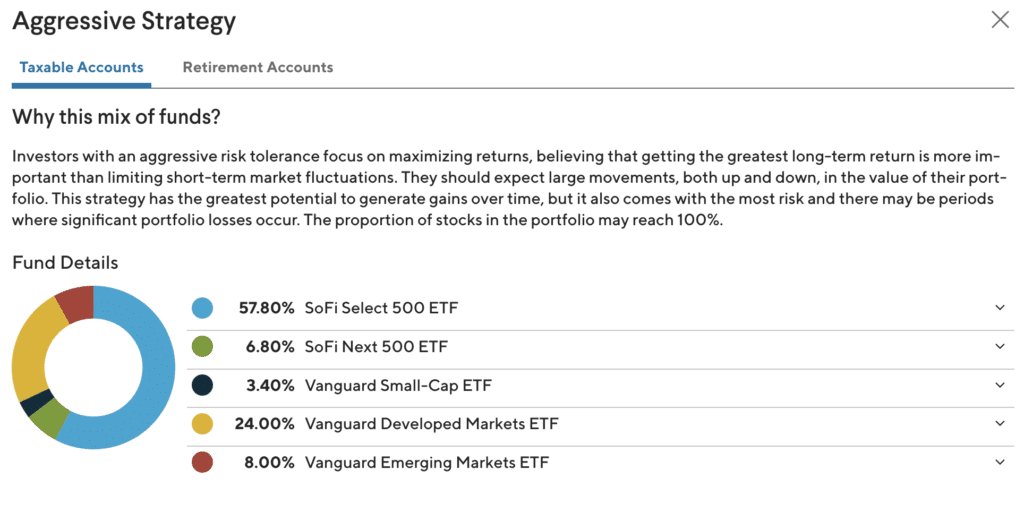

When you click in the View details link, here are the specific funds SoFi uses:

Notice that the selected funds include two SoFi ETFs. That’s how SoFi makes its money. And those funds are expensive and not what you might think they are.

For example, the SoFI Select 500 ETF is NOT an S&P 500 index fund. It doesn’t track that index, instead tracking something called the Solactive SoFi US 500 Growth Index. And it costs 19 basis points each year. While not outrageous, solid S&P 500 index funds typically cost less than 5 basis points.

Does this make SoFi a “bad” robo-advisor. I wouldn’t go that far. But its pricing isn’t as transparent as it should be in my opinion, and I have no interest in tracking a SoFi index with my investments. For these reasons, it didn’t make the list of the best robos.

Schwab Intelligent Portfolios

Schwab entered the robo-advisor market with its Intelligent Portfolios. Like SoFi, there are no management fees charged by Schwab. Investors just pay the fees of the underlying ETFs. Unlike SoFi, Schwab doesn’t force you to invest in ETFs that track a proprietary index.

So what’s the problem?

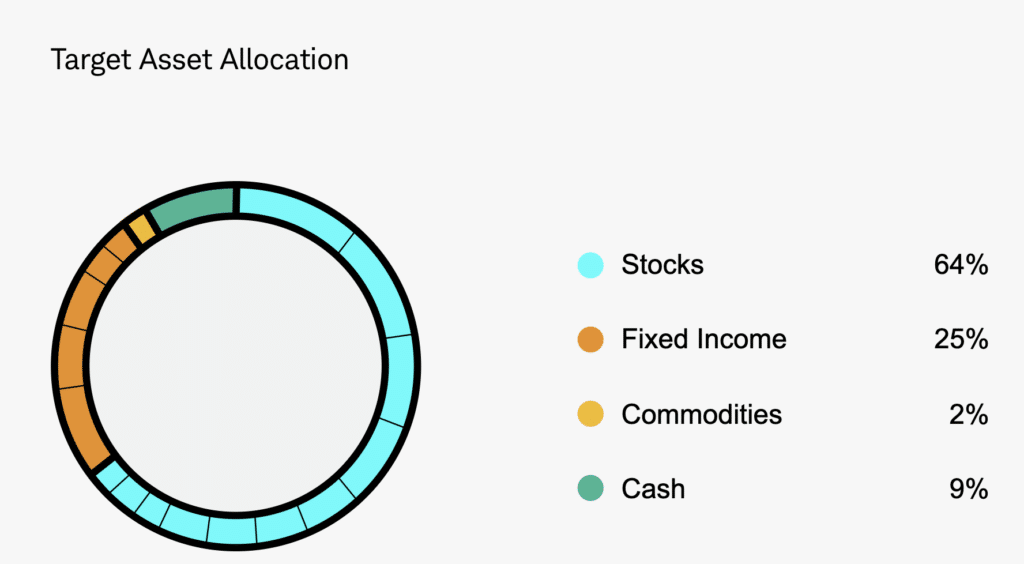

Schwab forces you to keep at least 6% of your portfolio in cash. And that’s how Schwab makes its money. The amount of cash you must keep goes up as your portfolio becomes more conservative.

For example, a Moderate Growth portfolio requires 9% in cash:

I would much prefer for Schwab just to charge a management fee rather than requiring a significant cash position. At least then the costs would be transparent.

Methodology

My first step in creating this list was to identify a complete list of automated investing platforms. In addition to those listed above, I considered the following:

- Etrade Core Portfolios: https://us.etrade.com/what-we-offer/our-accounts/core-portfolios

- Axos Managed Portfolios: https://www.axos.com/invest

- Acorns

- Fidelity Go: https://www.fidelity.com/managed-accounts/fidelity-go/overview

- Morgan Stanley Access Investing: https://www.morganstanley.com/what-we-do/wealth-management/access-investing/my-goals

- Merrill Edge Guided Investing: ttps://www.merrilledge.com/guided-investing

- Wells Fargo Intuitive Investor: https://www.wellsfargoadvisors.com/services/intuitive-investor/how-it-works.htm

- Zacks Advantage: https://www.zacksadvantage.com/

- UBS Advice Advantage: https://adviceadvantage.ubs.com/

- FutureAdvisor (Blackrock): https://www.blackrock.com/futureadvisor

- Stash: https://www.stash.com/smart-portfolio-investing

- Ally Invest Robo Portfolios

- SigFig

- Ellevest

- Interactive Advisors

I then considered the following factors:

- Cost

- Ease of Use

- Account Types

- Underlying ETFs used in portfolios

- Additional features (particularly as it relates to planning and retirement)

Note that just because a robo-advisor didn’t make the list of the best doesn’t mean the service isn’t worth considering. For example, Acorns is a solid option for those looking for a round-up app.

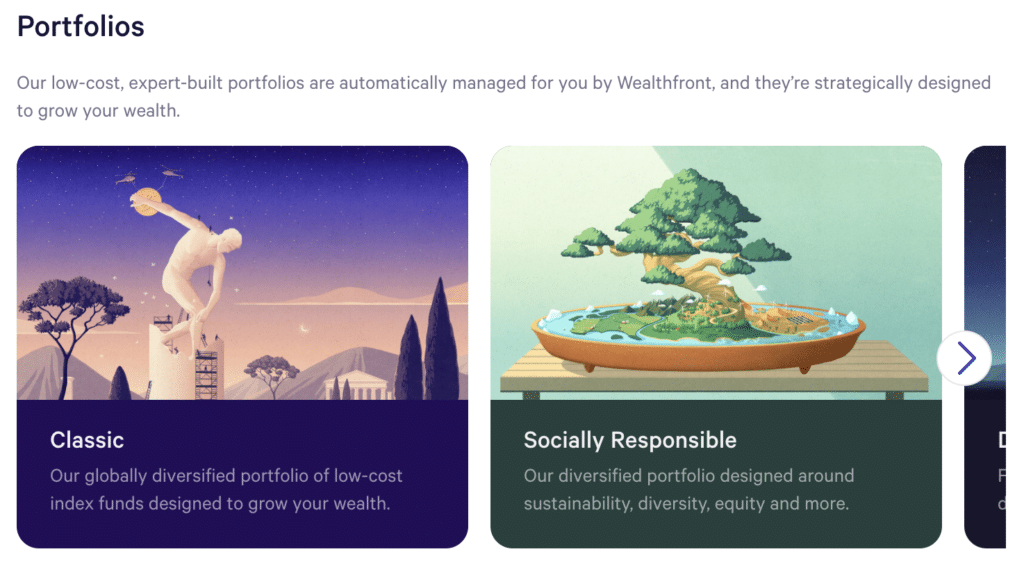

How to Choose the Best Robo-Advisor for Your Needs

| Robo-Advisor | Best for |

|---|---|

| Betterment | Best overall robo-advisor |

| M1 Finance | Best free robo-advisor |

| Vanguard Digital Advisors | Best for Vanguard fans |

| Wealthfront | Best for large taxable accounts |

Final Thoughts

Robo-advisors can simplify the process of investing for your future. Not all automated investing services are the same, however. It’s important to understand how a service works, its fees, and its portfolio construction before investing.

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.