The 3 Finance Apps I Use Every Day

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

I use three apps to manage our financial lives.

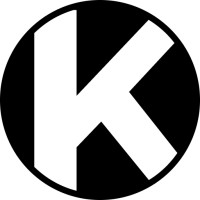

1. Monarch Money — Budgeting

I’ve tested dozens of budgeting apps, and Monarch Money is hands down the most feature-rich option available today. And the developers have managed to make it very easy to use.

The app’s dashboard offers a comprehensive snapshot of your finances, including spending, net worth, and even credit score tracking. One standout feature is its credit card utilization tracker, which shows how much of each credit line you’re using—an important metric for maintaining a healthy credit score.

Monarch excels at budgeting flexibility. It allows users to categorize transactions, build custom rules, and review spending at a high level—splitting expenses into fixed, flexible, and non-monthly categories. This approach gives a clearer view of spending patterns than simply tracking line-by-line expenses. For those who do set forward-looking budgets, Monarch displays historical spending data, making it easy to set realistic targets.

Recurring expenses and subscriptions are another strength. Monarch automatically identifies repeat charges, helping users spot forgotten subscriptions. Its calendar view makes upcoming bills easier to manage. For goal-setting, Monarch allows savings or debt-paydown goals tied to specific accounts, tracking progress automatically as money moves.

A newer feature allows users to sync their Amazon and Target purchases through a Chrome extension. Instead of lumping all Amazon transactions under “shopping,” the app uses AI to categorize purchases individually, even splitting them across categories if needed.

The main downside is Monarch’s investment-tracking feature, which provides balance and performance data but lacks meaningful allocation details (e.g., stock vs. bond breakdowns). For robust investment analysis, you’ll need another tool, which brings me to the second app I use.

Get 50% off your first year subscription with promo code ROB50.

Alternatives:

- Empower (free) for basic expense tracking.

- Rocket Money (free tier available, premium $6–$12/month) for subscription management.

- Tiller ($79/year) for spreadsheet enthusiasts who want full control.

- Origin (newer, AI-powered) for advanced financial insights.

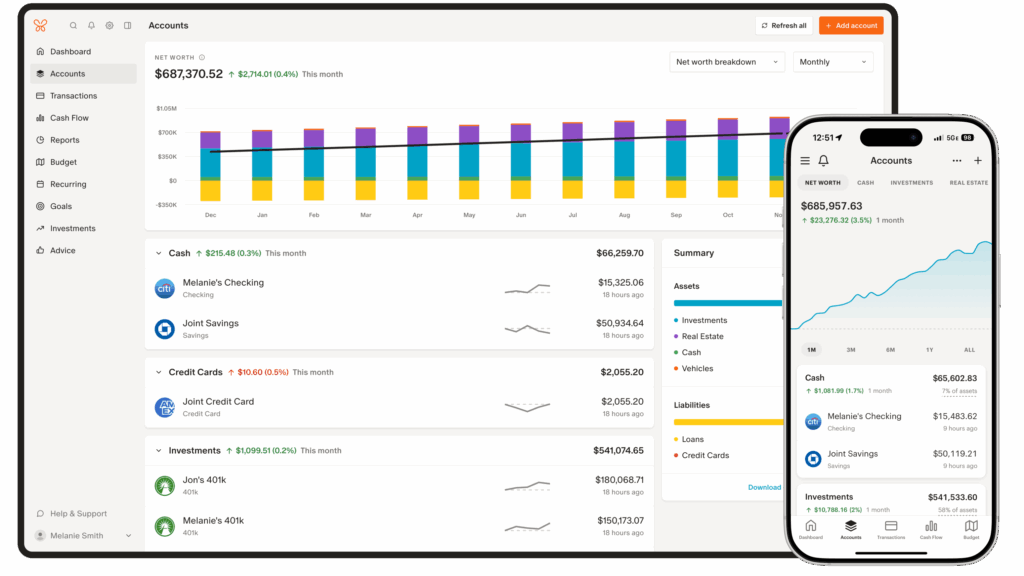

2. Kubera — Investment Tracking

While Monarch Money tracks investments at a basic level, Kubera specializes in net worth and portfolio tracking. At $249 per year, it isn’t cheap, but its features make it one of the most comprehensive tools for serious investors.

Kubera’s dashboard provides net worth, daily portfolio returns, asset allocation, and even unrealized capital gains with tax estimates. Unlike many competitors that rely on a single account-linking service like Plaid, Kubera uses multiple services for better connection reliability. It also displays uptime statistics so users know when sync issues stem from their broker, not Kubera.

Asset tracking is highly customizable. Users can create custom tabs for categories like “Retirement Accounts”, “Taxable Accounts” or “Real Estate.” Beyond traditional assets, Kubera tracks crypto wallets, domains, cars, precious metals, and real estate—pulling home values from multiple sources like Zillow and Redfin. For private investments, users can upload statements or spreadsheets, and Kubera’s AI will parse the data automatically.

One particularly helpful feature is the ability to mark assets as non-investable (e.g., cash set aside for a home project), preventing distortions in asset allocation reporting. Assets can also be designated as taxable, tax-deferred, or tax-free, giving investors a clearer picture of future tax liabilities.

Document storage and beneficiary features add estate-planning utility: users can attach insurance policies, deeds, or other files and assign a “beneficiary access” to ensure loved ones can access everything if needed.

For forward-looking analysis, Kubera includes tools to forecast asset values under optimistic, realistic, or conservative assumptions. Investors can also export data to ChatGPT for financial analysis.

Alternatives:

- Empower (free), which combines net worth and investment tracking with a lighter retirement planner.

- Spreadsheets, for those who prefer DIY tracking.

3. Boldin — Retirement Planning

When it comes to retirement planning, Boldin strikes the right balance between sophistication and usability. While apps like Empower or Monarch include basic retirement tools, Boldin goes deeper—helping users plan around accounts, expenses, taxes, and future scenarios.

Setup is straightforward: users enter accounts, balances, expected returns, and expenses. Unlike investment trackers, Boldin isn’t about daily market moves—it’s about long-term projections. You can set different return assumptions (optimistic, pessimistic, or custom), adjust them over time to reflect portfolio changes, and instantly see how the changes affect your retirement outlook.

The app allows users to model real-world scenarios: downsizing homes, relocating to different states with varying tax structures, or taking on part-time income in retirement. It also supports Roth conversion analysis, Social Security timing strategies, and healthcare cost planning. These scenarios are visualized through intuitive graphs, making it easy to see how small adjustments can affect long-term outcomes.

Try Boldin for free.

For many, Boldin is the sweet spot between too-simple and too-complex planning tools. However, power users may find more advanced options in:

- Prolana: Highly detailed, with professional-grade depth, but difficult to learn.

- ProjectionLab: Great for modeling life events beyond retirement (college savings, home purchases).

If you only want one app to handle budgeting, investment tracking, and retirement planning, Empower is probably the best all-in-one solution. While it isn’t the best in any single category, it’s good in all three—something no other app currently matches.