Tiller Money Review and User’s Guide (2023)

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

Tiller Money enables you to manage your financial life in spreadsheets that are automatically updated every day. The tools make it easy to create budgets, track net worth, and even manage your Investments. We’ll take a deep dive into the tool in this 2022 Tiller Money review and user guide.

I met the Tiller Money team several years ago at Fincon, a personal finance bloggers conference. They were kind enough to give me a demo of their software. At the time, I’ll be honest, I didn’t really understand how Tiller Money worked. I found it confusing at first.

Once I understood the basic concept, however, it became clear just how powerful and easy it is to use. More recently, I’ve spent a lot of time with the tool and absolutely love it. It’s become my primary budgeting tool, which I use in conjunction with Personal Capital to track my investments.

In this review and user’s guide, I’ll walk through the main features of Tiller Money, how I use the tool, and how it can help you manage your money.

How Tiller Money Works

Many people, myself included, love working with spreadsheets. They are easy to use and give us complete control over our data. When it comes to budgeting and managing money with a spreadsheet, however, there are three key problems:

- We have to manually enter our income and expenses;

- We have to spend time designing the spreadsheet if we want it to look good; and

- We don’t have basic tools available with must budgeting apps

Tiller Money solves each of these problems.

Tiller Money enables you to link your financial accounts to a Google or Excel spreadsheet. Once linked, transaction data and balances are automatically downloaded into the spreadsheet. That solves the first problem.

Tiller also provides a robust template that can enable you to track your budget, net worth, investments, and even your business income and expenses. Problem number two solved.

Finally, Tiller gives you a robust and growing set of tools to analyze your finances. We’ll look at several in just a minute. Problem number three solved. In fact, Tiller solves these issues so well that it made my list of the best Quicken alternatives.

Connecting Financial Accounts to Tiller Money

The first step to using Tiller Money is to connect your financial accounts. Tiller enables you to connect checking accounts, savings accounts, credit cards, and even investment accounts. Tiller uses bank level security through Yodlee, which nine out of the 15 largest banks in the country also use.

Once logged in to Tiller, you simply click the Add Accounts button.

A pop-up box will prompt you to search for your financial institution. I’ve yet to encounter a bank account, credit card or investment account that Tiller can’t handle. You’ll enter your login credentials for your financial institution to connect it. Tiller money will never have access to your login credentials or to any of your financial institutions (more about security below).

Creating Spreadsheets with Tiller’s Foundation Template

The heart and soul of Tiller is the Tiller Foundation Template. While you can create your own spreadsheet from scratch, I highly recommend you start with the Tiller template. You simply launch the Google Sheet and walk through a number of easy steps to authorize the template in your Google account (see video below for a walk-thru of the process).

Here’s where one thing tripped me up. Having connected my accounts, I launched the Tiller Foundation Template. When I opened it, there were no transactions. What it took me some time to understand is that connecting my accounts to Tiller does not automatically connect them to the spreadsheet. That’s actually good news.

It allows me to connect accounts I want in up to five spreadsheets. For example, I connect our personal accounts to our personal budget spreadsheet. I connect my business checking account and credit card to a Tiller spreadsheet I use to track my business. And I connect our investment accounts to a third Tiller spreadsheet to track our net worth.

Of course, you decided how to set up Tiller. You could track everything in one spreadsheet if that’s what you want to do. For each of up to five spreadsheets, you can connect any or all of the financial accounts you’ve connected to Tiller. Once you have the spreadsheet set up and connected the financial accounts, Tiller offers various tools and templates to manage virtually every aspect of your financial life.

Using Tiller’s Tools to Manage Your Finances

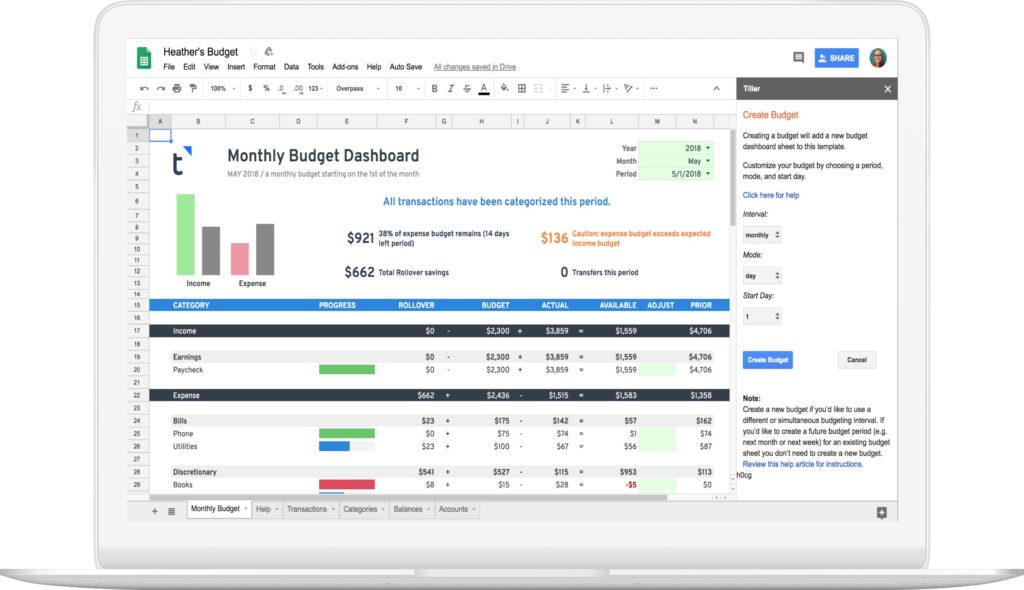

Once you’ve launched the Tiller Foundation Template and connected your accounts to the spreadsheet, you’ll notice a number of tabs in the Google Sheet. These include the Insights tab, which is a financial dashboard that gives you a high level summary of your financial data. There’s a Transactions tab that lists all of the transactions from all of the accounts you’ve connected to the spreadsheet. A Categories tab enables you to define your income and expense categories and set a monthly budget for each expense.

There’s a monthly budget tab that summarizes your income and expense data by month. There’s also a yearly budget tab, that shows you all of your income and expenses for an entire year.

Tiller Google Sheet Add-ons

There are two really important add-ons to Google Sheets that you’ll want to use with Tiller. One is called Tiller Money Feeds, and the other is called Tiller Money Labs.

Tiller Money Feeds

Tiller Money Feeds provides the tools you need to connect your financial accounts to each spreadsheet. We’ve already covered it above, and it gets added to your spreadsheet as part of the process of using the template.

It includes a feature called AutoCat, which allows you to automatically categorize income and expenses based on the transaction description. More about this feature in a moment.

Tiller Money Labs

The Tiller Money Labs add-on provides additional tools that are incredibly useful. You can add it to Google Sheets by going to the Add-ons menu, select Get Add-ons, and then searching for Tiller Money Labs. This Add-on gives you access to a number of extremely useful tools that are far too numerous to cover in one review. But I’ll highlight a few of the more important ones.

Split transactions: As the name suggests, it makes it very easy to split a transaction across multiple categories.

Net worth dashboard: A template focusing on balances and how they change over time. It includes a net worth chart and trends table for up to 12 months of net worth data. A similar tool, called the Net Worth Snapshot, enables you to compare your net worth over two different years.

Debt planner: A streamlined debt-planning tool to build and manage your debt payoff plan and achieve debt freedom.

Bill payment tracker: The Bill Payment Tracker is designed to keep you informed about your upcoming bill payments.

Tiller also offers a number of dashboards for small businesses. I use a separate Google Sheet to track the income and expenses of my business. While I have a bookkeeper and use QuickBooks, I like Tiller as the better way to actually budget my expenses and to track them, day to day. It’s just much easier than QuickBooks.

There are even tools for those pursuing FIRE (financial independence / retire early). Specifically, it offers a Retirement Planner that estimates the total value of your investments into the future. You can experiment with different growth rate scenarios and project outcomes in real time.

Budgeting with Tiller Money

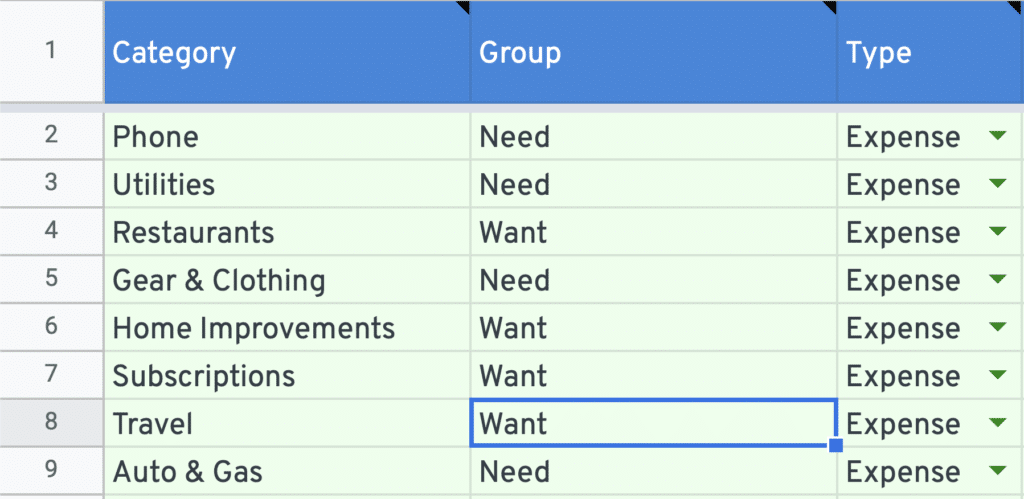

Budgeting is the core Tiller feature. Once you’ve connected your financial accounts to the spreadsheet, the first thing you should do, in my opinion, is set up your categories in the Tiller Foundation Template. Here’s what the categories tab looks like in the template:

You can and should customize the categories and groups. The groups organize the categories when viewed on a monthly or yearly basis. If you love the 50/30/20 budget, you could use just three groups that map to Needs (50%), Wants (30%) and Freedom (20%–savings, investing and debt paydown). You can also set your budget for the year. Any budget amounts you enter in the Jan 2022 column will automatically populate for the rest of the year.

Once you’ve created your categories, you can go to the transaction tab and begin giving each income and expense transaction a category. Here it’s important to know that Tiller offers what it calls an automatic category tool (AutoCat). What this allows you to do is to automatically set the category of a transaction based on the contents of the transaction description.

For example, you could set all transactions with a description that includes “Starbucks” to a coffee category or perhaps a restaurant category. Once these AutoCat categories are set up, the vast majority of your transactions will be automatically and correctly categorized. It’s a very cool feature.

Is Tiller Safe?

One important question is whether Tiller Money is safe. The short answer is yes. Tiller supports two factor authentication. When you connect a financial account with two factor authentication enabled the pop-up box will ask you for the code that either gets texted to you or that is generated from an authentication app if that’s what you use. The data is protected with bank grade 256 bit AES encryption.

Furthermore, Tiller connects to your financial institutions using Yodlee. It’s an industry standard tool used by nine of the 15 largest U.S. banks. As noted earlier, Tiller does not see or store your login credentials to your financial accounts. In addition, no one at Tiller will see your data unless you specifically choose to share it with a Tiller analyst or support team member. Tiller’s access to your accounts is strictly read only, and it has no ability to move any of your money.

How Much Does Tiller Cost?

You can use Tiller for free for 30 days without any obligation. If you like it and want to continue using it, it’s $79 a year.

Tiller Rating

Tiller Money Rating

Summary

Tiller Money is one of the best budgeting tools available today. It gives you the power, flexibility and simplicity of a spreadsheet, with the tools and templates that compete with the best budgeting apps available today.

Tiller Money Video

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.