7 Ways to Build an Income Producing Portfolio in Retirement (And Why It’s A Bad Idea)

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

Many in retirement seek investments with high income. Whether interest, dividends, or both, retirees value the ability to spend income from a portfolio without the need to sell shares of the investment that generates the income.

This sentiment was reflected in an email I received from a viewer of my YouTube channel: “How about a show on building an income producing portfolio for us retirees with $500,000 of capital.”

As a response, we'll cover two things in this article. First, we'll build an income-focused portfolio. By income-focused I mean a portfolio that pays more in dividends and interest than a portfolio that mimics the market, such as a 3 fund portfolio.

Second, we'll look at the significant drawbacks to the income-focused portfolio we build compared to a total-return portfolio. By total-return I mean a portfolio that seeks out the highest possible return for the risk we are willing to take, regardless of how much of that return comes from yield (i.e., dividends and interest) and how much from asset appreciation.

7 Steps to Generate More Income from a Retirement Portfolio

1. Start with the 3 Fund Portfolio

The starting point is the 3 Fund Portfolio. This simple, low-cost portfolio of three index funds covers U.S. stocks, international stocks, and U.S. bonds.

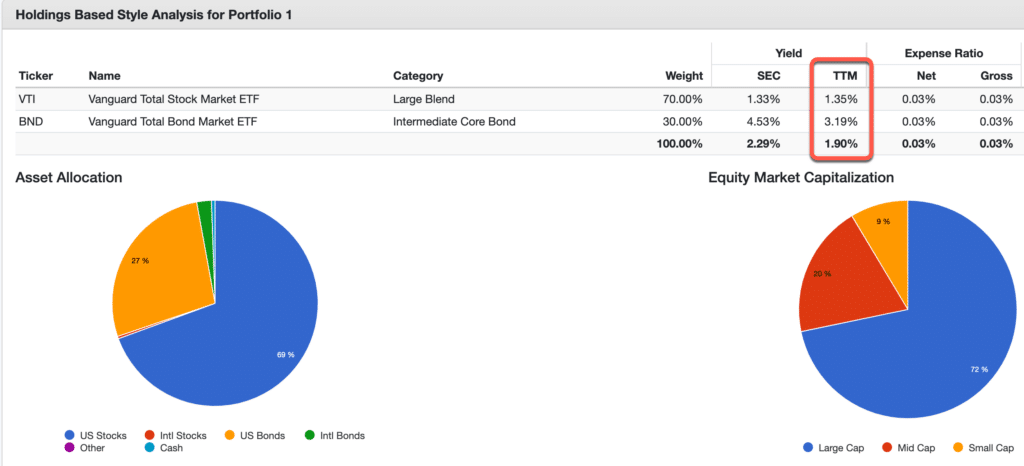

Here's an example of the portfolio using Vanguard ETFs with a 70% stocks and 30% bonds allocation (I've excluded international stocks for the moment):

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| VTI | Vanguard Total Stock Market ETF | U.S. Stocks | 70% |

| VXUS | Vanguard Total International Stock ETF | Int'l Stocks | 0% |

| BND | Vanguard Total Bond Market ETF | U.S. Bonds | 30% |

This portfolio doesn't attempt to generate dividends and interest beyond what a total market portfolio would produce. We can think of this portfolio as income-agnostic.

Even so, it does generate dividends from the stock ETF and interest from the bond ETF. Using the free tool, Portfolio Visualizer, we can see that this portfolio currently produces dividends and interest equal to 1.90% of the portfolio's total balance.

We'll use this market portfolio as our baseline as we work to increase the yield.

2. Add International Funds

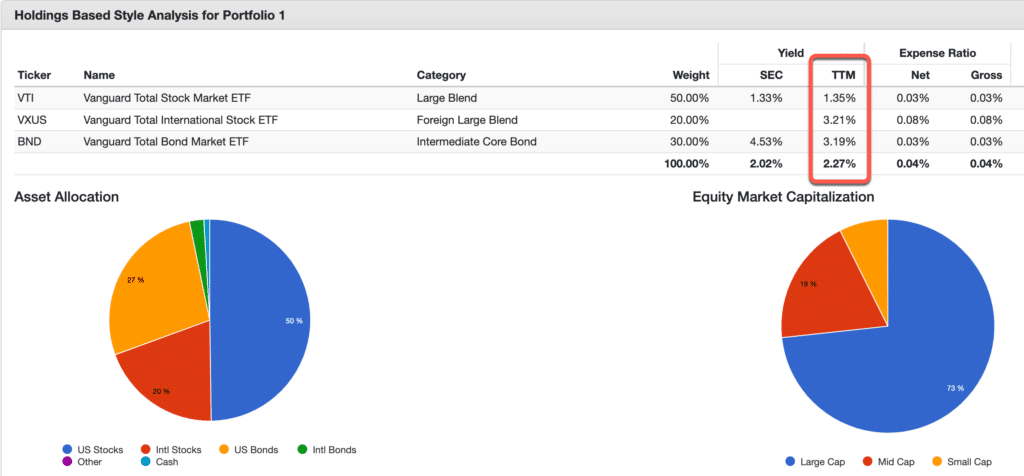

Our first step is to add international stocks. This is standard in the 3 fund portfolio, and adds significant diversification. For our purposes, it also increases the yield. International stocks, due in part to their lower valuations, are paying a higher yield than U.S. stocks.

Here's what our portfolio looks like now:

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| VTI | Vanguard Total Stock Market ETF | U.S. Stocks | 50% |

| VXUS | Vanguard Total International Stock ETF | Int'l Stocks | 20% |

| BND | Vanguard Total Bond Market ETF | U.S. Bonds | 30% |

I've decided to move 20% of our U.S. stocks to international stocks. With this simple change, we've increased the yield on our portfolio from 1.90% to 2.27%.

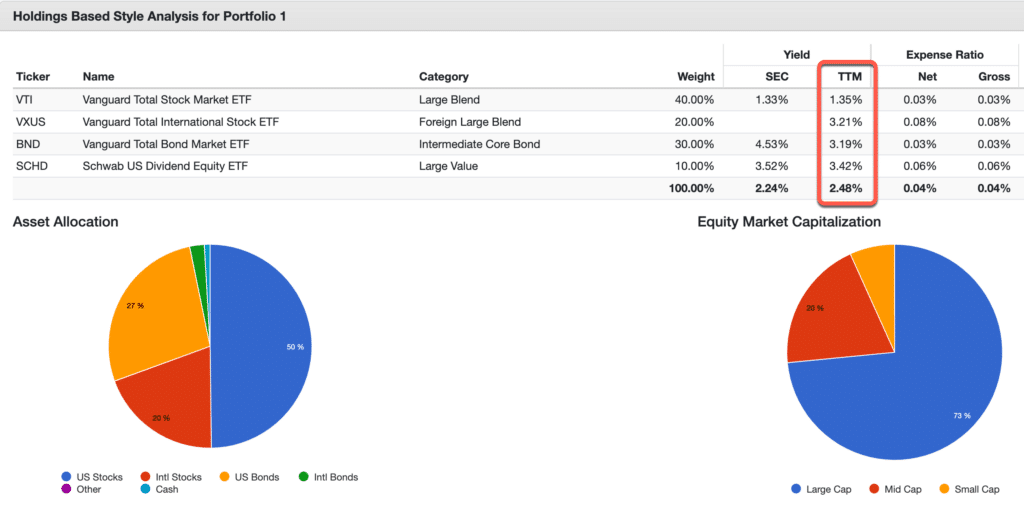

3. Add Value Funds

Value stocks tend to pay higher dividend yields than the market as a whole. As such, we can add a value fund to our portfolio. I've chosen Schwab's dividend fund (SCHD) (which I own) for this purpose. Here's are updated portfolio:

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| VTI | Vanguard Total Stock Market ETF | U.S. Stocks | 40% |

| VXUS | Vanguard Total International Stock ETF | Int'l Stocks | 20% |

| BND | Vanguard Total Bond Market ETF | U.S. Bonds | 30% |

| SCHD | Schwab U.S. Dividend Equity ETF | Large Cap Value | 10% |

I've chose to reduce VTI by 10% and add it to SCHD. This tilts the portfolio toward more large cap value stocks. The result is to increase the portfolio's yield from 2.27% to 2.48%.

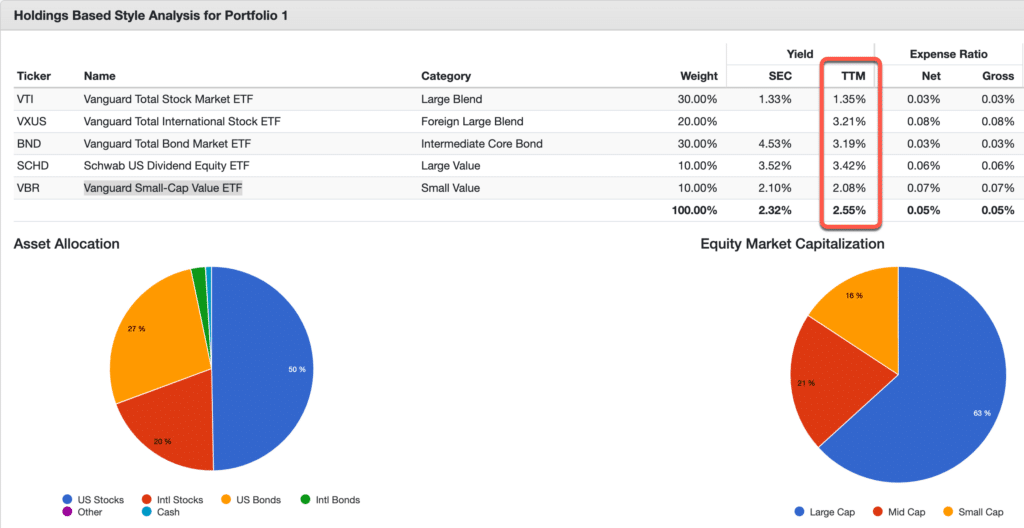

4. Add Small Cap Funds

Small cap stocks today offer higher yields than the total market. We can also combine both small cap with value by adding a small cap value ETF. I've chosen Vanguard's Small Cap Value ETF (VBR).

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| VTI | Vanguard Total Stock Market ETF | U.S. Stocks | 30% |

| VXUS | Vanguard Total International Stock ETF | Int'l Stocks | 20% |

| BND | Vanguard Total Bond Market ETF | U.S. Bonds | 30% |

| SCHD | Schwab U.S. Dividend Equity ETF | Large Cap Value | 10% |

| VBR | Vanguard Small-Cap Value ETF | Small Cap Value | 10% |

The result is an increase in our yield from 2.48% to 2.55%.

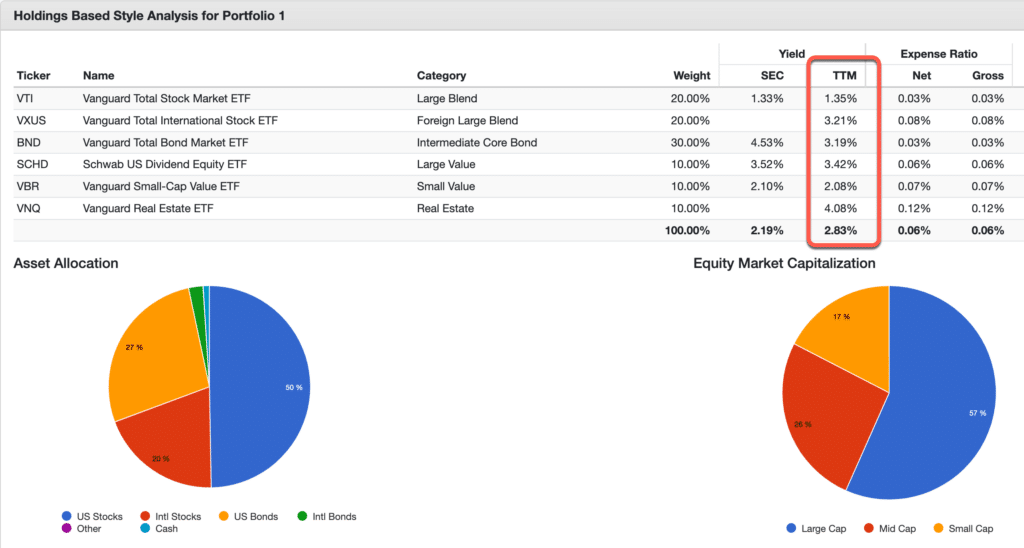

5. Add REITs

Real Estate Investment Trusts (REITs) tend to pay yields significantly higher than the overall market. Thus, we can increase our overall yield by adding even a relatively small percentage of REITs to the portfolio. I've chosen Vanguards REIT index ETF (VNQ) for this purpose.

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| VTI | Vanguard Total Stock Market ETF | U.S. Stocks | 20% |

| VXUS | Vanguard Total International Stock ETF | Int'l Stocks | 20% |

| BND | Vanguard Total Bond Market ETF | U.S. Bonds | 30% |

| SCHD | Schwab U.S. Dividend Equity ETF | Large Cap Value | 10% |

| VBR | Vanguard Small-Cap Value ETF | Small Cap Value | 10% |

| VNQ | Vanguard Real Estate ETF | REITs | 10% |

The result is to increase our yield from 2.55% to 2.83%.

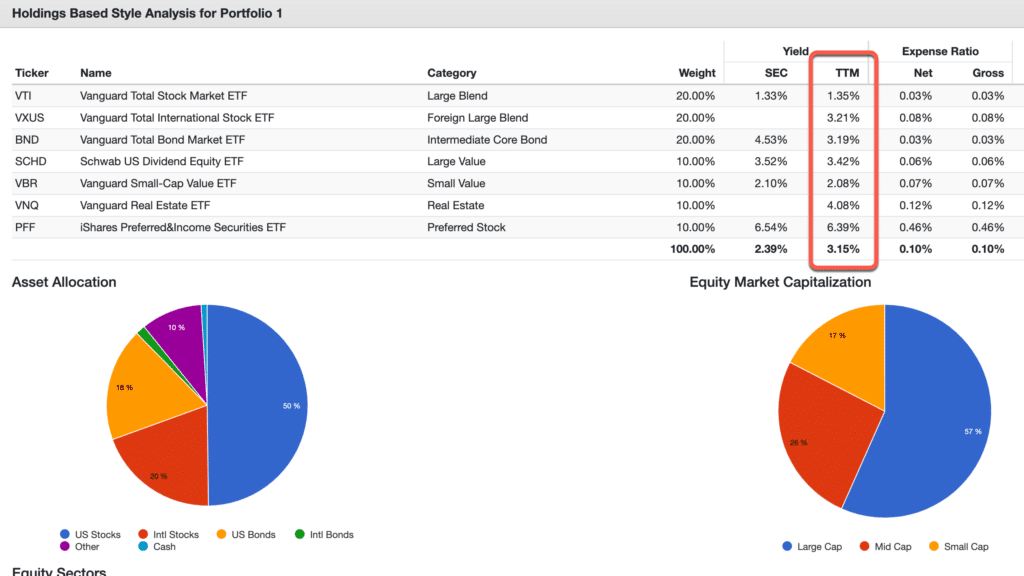

6. Add Preferred Stock Funds

Now we turn to bond and bond-like investments. Preferred stock has characteristics of both stocks and bonds. They pay a fixed dividend, and in some cases can be converted to common stock. I've included them in the bond portion of the portfolio due to their bond-like dividend payments.

For preferreds we'll use the fund recommended in Rick Ferri's Income Seeker Core 4 Portfolio, iShares Preferred and Income Securities ETF (PFF).

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| VTI | Vanguard Total Stock Market ETF | U.S. Stocks | 20% |

| VXUS | Vanguard Total International Stock ETF | Int'l Stocks | 20% |

| BND | Vanguard Total Bond Market ETF | U.S. Bonds | 20% |

| SCHD | Schwab U.S. Dividend Equity ETF | Large Cap Value | 10% |

| VBR | Vanguard Small-Cap Value ETF | Small Cap Value | 10% |

| VNQ | Vanguard Real Estate ETF | REITs | 10% |

| PFF | iShares Preferred and Income Securities ETF | Preferred Stock | 10% |

The addition of preferred stock pushed our yield above 3% to 3.15%.

7. Add More Bond Funds

Finally, we can increase our bond exposure to produce higher yields. To do this we'll increase by 10% our allocation to Vanguards total U.S. bond fund (BND). This change requires us to lower our investment in VTI.

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| VTI | Vanguard Total Stock Market ETF | U.S. Stocks | 10% |

| VXUS | Vanguard Total International Stock ETF | Int'l Stocks | 20% |

| BND | Vanguard Total Bond Market ETF | U.S. Bonds | 30% |

| SCHD | Schwab U.S. Dividend Equity ETF | Large Cap Value | 10% |

| VBR | Vanguard Small-Cap Value ETF | Small Cap Value | 10% |

| VNQ | Vanguard Real Estate ETF | REITs | 10% |

| PFF | iShares Preferred and Income Securities ETF | Preferred Stock | 10% |

This is a significant change. We've gone from a 70/30 portfolio to a 60/40 portfolio. Doing so increases our yield from 3.15% to 3.33%.

All of these changes have allowed us to more than double our yield from 1.90% to 3.33%.

The question still remains, however, whether such a change is a good idea.

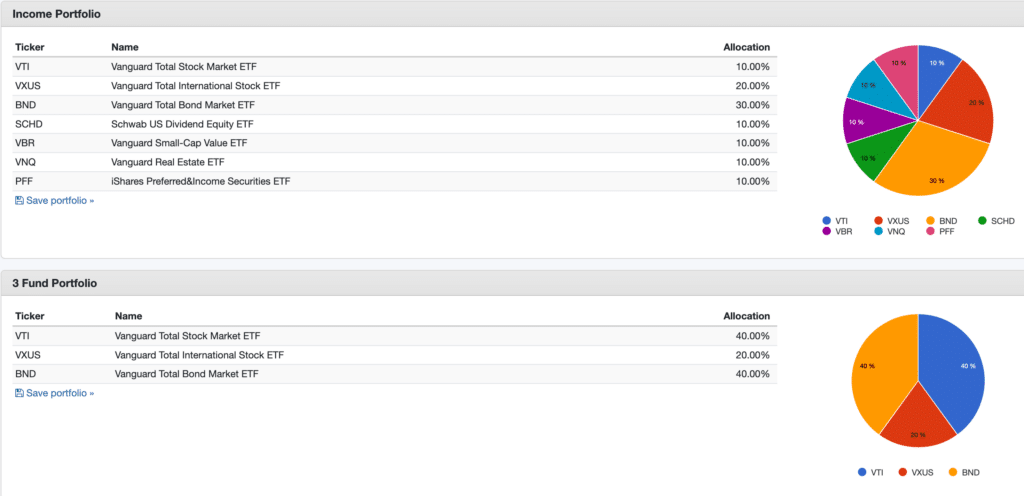

Why Total Return Is More Important Than Income

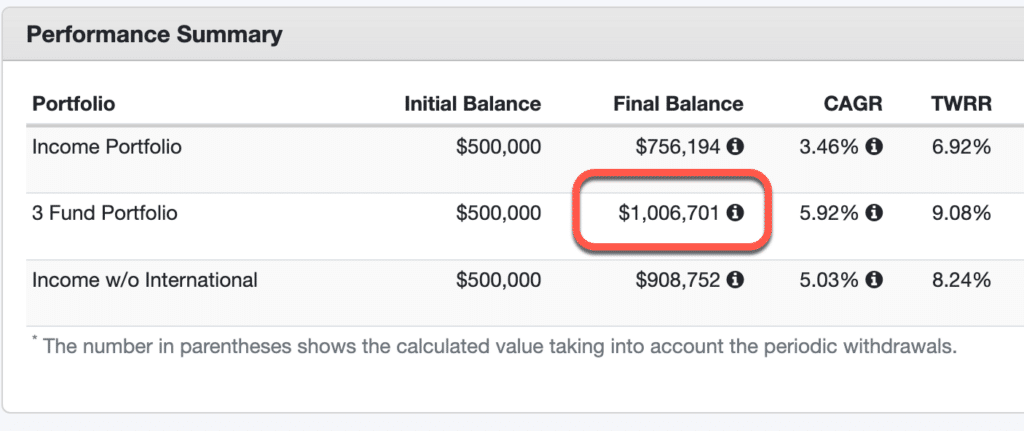

To compare the above income-focused portfolio, we'll compare it to the standard 3 fund portfolio. To make the comparison fair, we'll have a 60/40 portfolio for both.

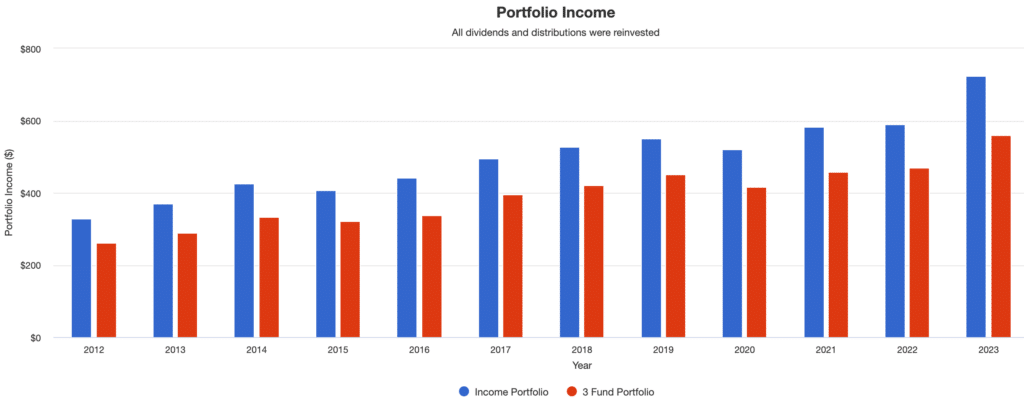

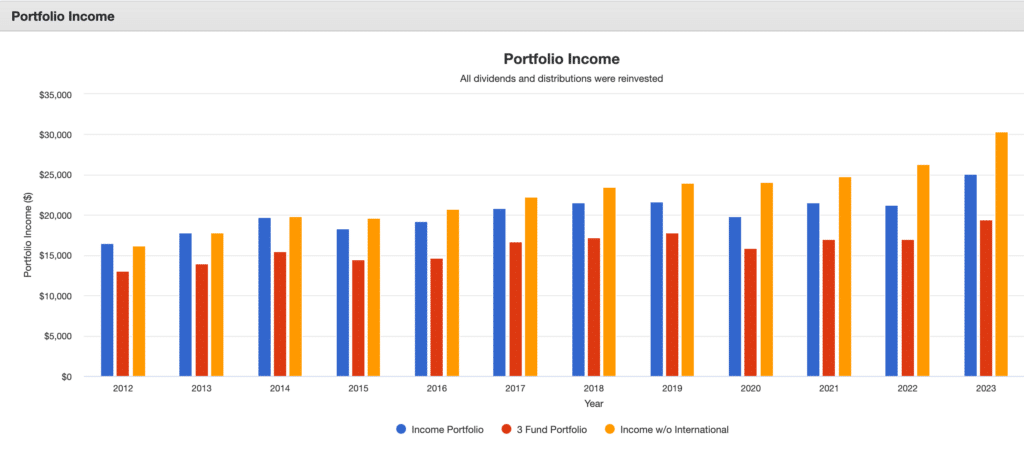

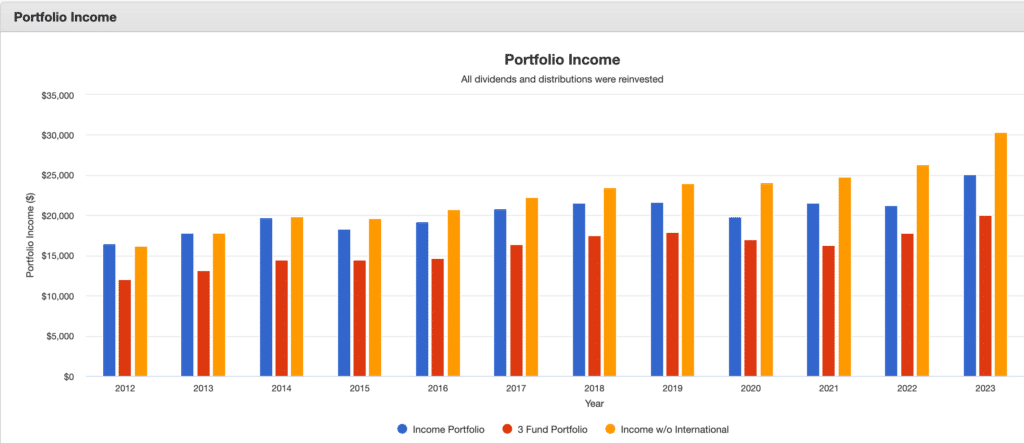

We know that our income portfolio has a 3.33% yield. The 60/40 3 fund portfolio sports a yield of 2.46%. As such, the income portfolio will produce significantly more dividends and interest than a total market portfolio. We can see the difference in the follow chart:

We can see that our income portfolio, the blue bars, consistently produces more income than the 3 fund portfolio. But at what cost?

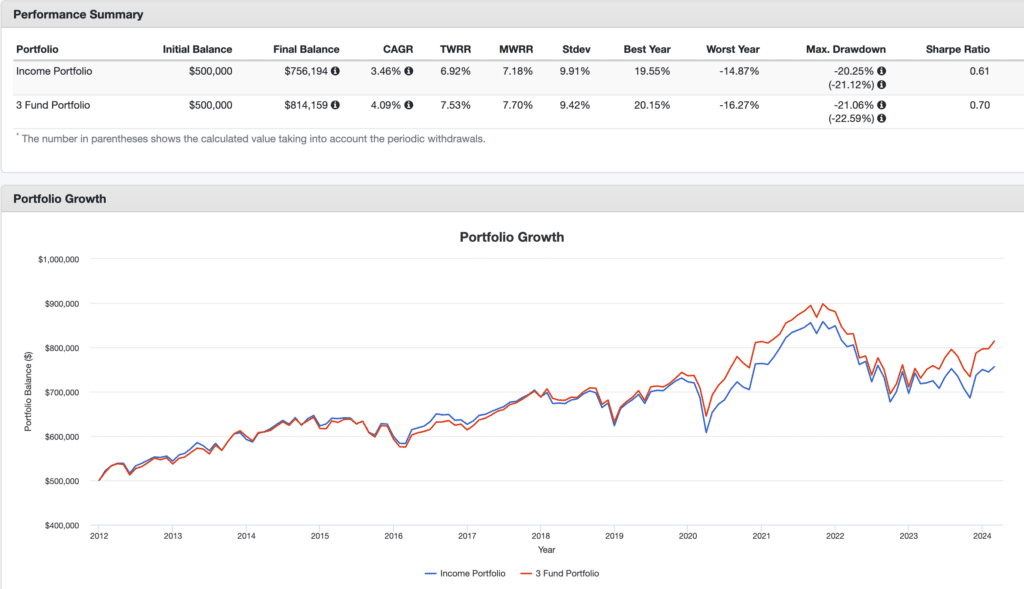

To model an actual retirement, we start with a $500,000 portfolio. Using the 4% rule, we'll assume that a retiree withdrawals $20,000 the first year. Thereafter, they adjust this withdrawal by the rate of inflation.

Our data goes back to 2012, so we'll assume that's the year we retired. How did each portfolio grow after about 12 years?

Both have performed well, in large part because of the solid stock market returns over the past decade. Yet we can see that the 3 fund portfolio outperformed, leaving our retiree with nearly $60,000 more.

The key point is this–a higher dividend yield doesn't produce better outcomes.

Or Does It?

Can we make a change to the above income portfolio to improve its outcome? With the benefit of hindsight, we can. How?

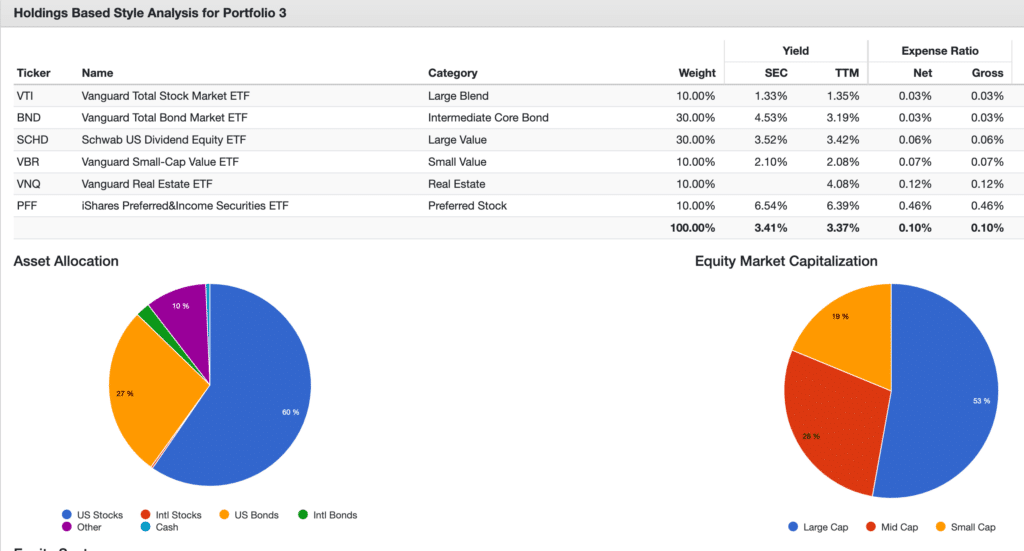

We can eliminate the international ETF and move that money into the Schwab dividend fund. Here's what that portfolio would look like:

| Ticker | Fund Name | Asset Class | Allocation |

|---|---|---|---|

| VTI | Vanguard Total Stock Market ETF | U.S. Stocks | 10% |

| VXUS | Vanguard Total International Stock ETF | Int'l Stocks | 0% |

| BND | Vanguard Total Bond Market ETF | U.S. Bonds | 30% |

| SCHD | Schwab U.S. Dividend Equity ETF | Large Cap Value | 30% |

| VBR | Vanguard Small-Cap Value ETF | Small Cap Value | 10% |

| VNQ | Vanguard Real Estate ETF | REITs | 10% |

| PFF | iShares Preferred and Income Securities ETF | Preferred Stock | 10% |

Why would this change help? It would improve the portfolio's performance over the past 12 years because U.S. stocks have outperformed international stocks. In addition, the Schwab fund pays a solid dividend yield. The result is an income portfolio with a yield of 3.37% over the past 12 months.

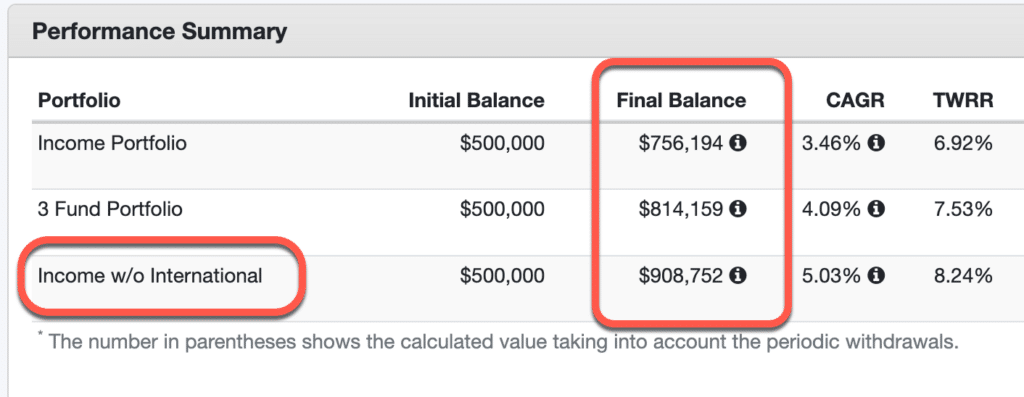

This new portfolio results in a higher balance compared to the other two after 12 years of retirement distributions:

It also pays out the highest income:

It would appear that we have found the perfect income portfolio for retirees. Not so fast.

If we remove the international ETF from the 3 fund portfolio as well, and transfer those assets to a total U.S. market fund, we see that the high yields of the income portfolio fall short. And that's true even though the removal of the international fund from the 3 fund portfolio reduces its yield down to just 2.09%!

The balance of the 3 fund portfolio without international stocks is higher than our income portfolio without international funds:

And that's true even though the income portfolio produces more dividends and interest than the 3 fund portfolio:

What If Yields From a Total Return Portfolio Are Low?

Some argue that the historically low yields we've experienced warrant a focus on income-producing investments. Today yields on fixed income assets have risen from near 0% just a few years ago. Still, dividend yields remain low for U.S. stocks as valuations are at an all time high. And even though bond yields have risen, they are still not as rich as they once were and they may be coming down even more.

In such a low-rate environment, certainly a focus on income is important in retirement, right?

A recent study by the folks at Vanguard addressed this very issue. The authors compared total-return investing to income-focused investing in a low yield environment. They found that moving a portfolio to higher yielding assets was counterproductive.

Specifically, the paper concluded that there are several downsides to seeking out above-market yields:

- Increased risk: High-yield assets such as junk bonds, emerging market bonds, and high dividend paying stocks carry higher risks, including credit risk, interest rate risk, and volatility risk.

- Reduced diversification: Focusing on income-generating assets can result in less diversification, making the portfolio more susceptible to losses in a particular market segment or asset class.

- Tax inefficiency: Income-focused investments can generate higher levels of taxable income, potentially leading to higher tax liabilities and lower after-tax returns.

The finding of reduced diversification was curious to me. I own shares of both VTI (total U.S. stock market) and SCHD (a Schwab dividend/value ETF). I understood that SCHD and limited exposure to growth stocks, which does reduce the diversification. But there was something else.

VTI's top ten holdings account for account for 28% of the fund. It's a common criticism of index funds. As it turns out, however, SCHD's top ten holdings account for 39% of the fund's assets.

From this I don't conclude that some exposure to SCHD or other value funds is “wrong.” But going too far with a value/dividend tilt will significantly reduce a portfolio's diversification.

Yes, But . . .

Some may correctly point out that growth stocks have outperformed value stocks over the past decade. As a result, they would argue, it's no surprise that the income portfolio, which has more exposure to value stocks, underperformed. When value stocks outperform growth, the income portfolio should shine.

I agree wholeheartedly. But here's the key. The reason the income portfolio may outperform a 3 fund portfolio over some periods of time is because value outperforms growth. It's NOT because it pays a higher dividend.

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.