Total-Return Investing: A Smart Response To Shrinking Yields

Author(s): Jacob Bupp, Andrew S. Clarke, CFA, Ankul Daga, CFA, David Pakula, CFA

Topics:

- Investing

- |

- Retirement Spending

Year Published: 2021

My Rating: ⭐️⭐️⭐️⭐️

One Sentence Summary: Total-return investing generates more retirement spending than income-focused investing, even in a low-yield environment.

Summary

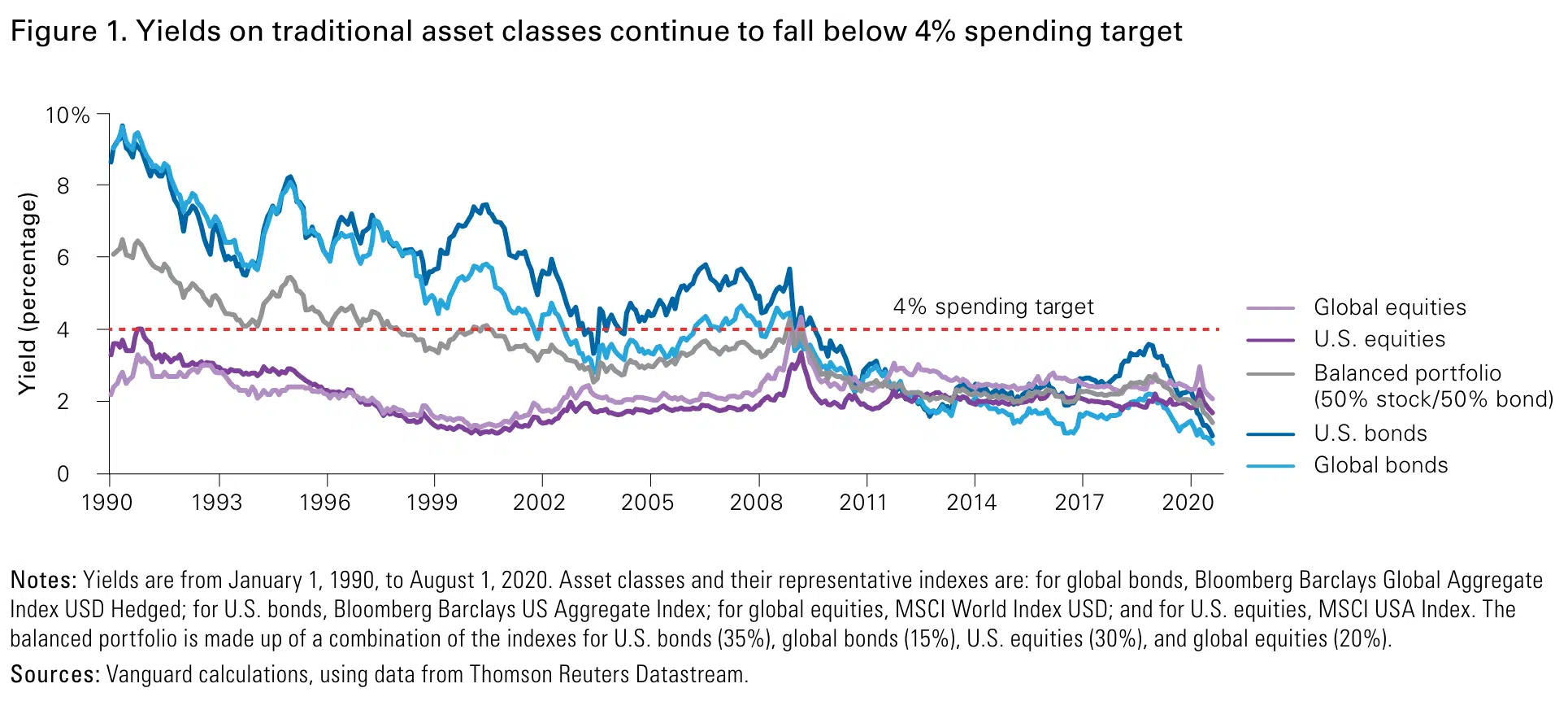

The Vanguard research paper addresses the challenges income-focused investors face in the current low-yield environment. The paper outlines the difficulties of generating sufficient income from a portfolio due to historically low yields on fixed income and equity assets, exacerbated by the financial market disruptions caused by the COVID-19 pandemic in March 2020. For instance, at its 2020 low, the 10-year U.S. Treasury note yielded only 0.52%, significantly below historical levels.

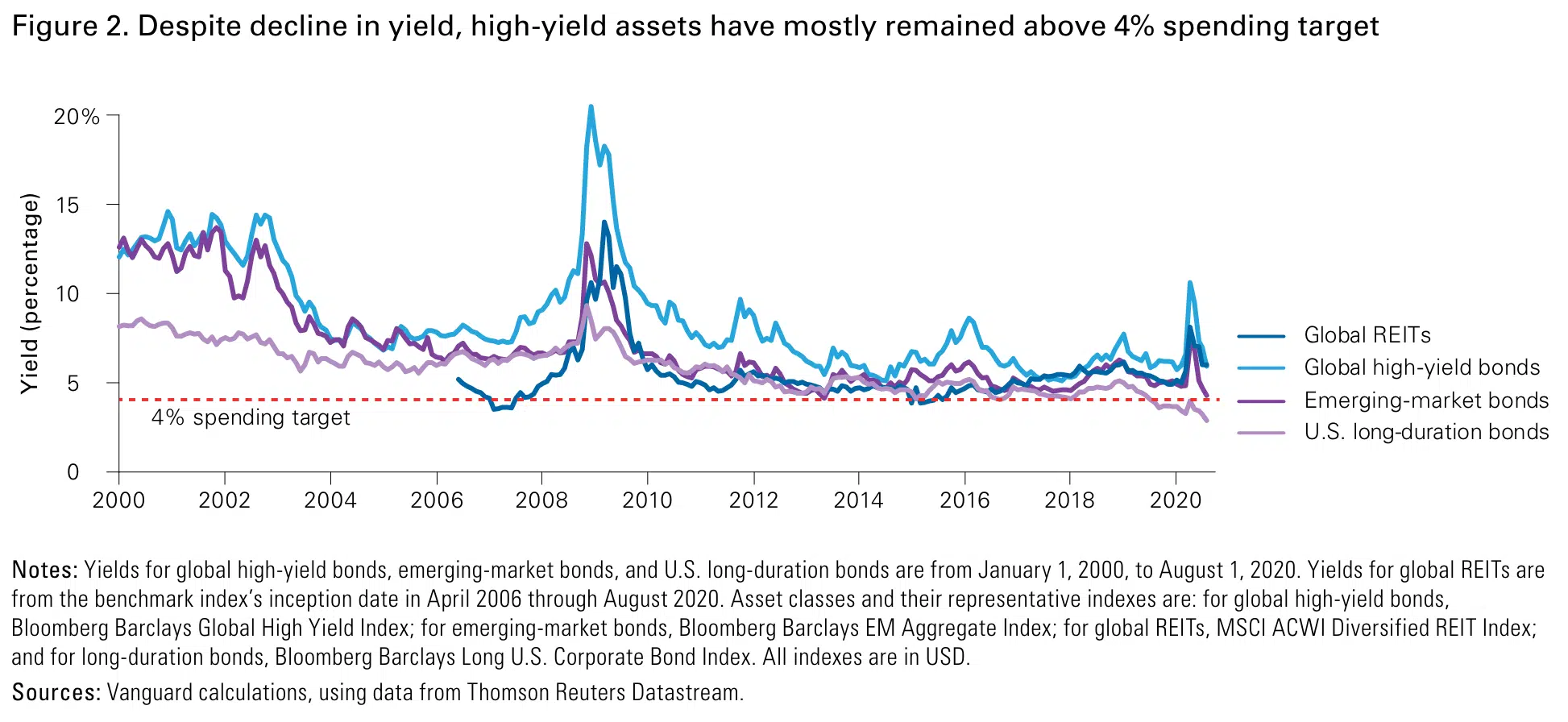

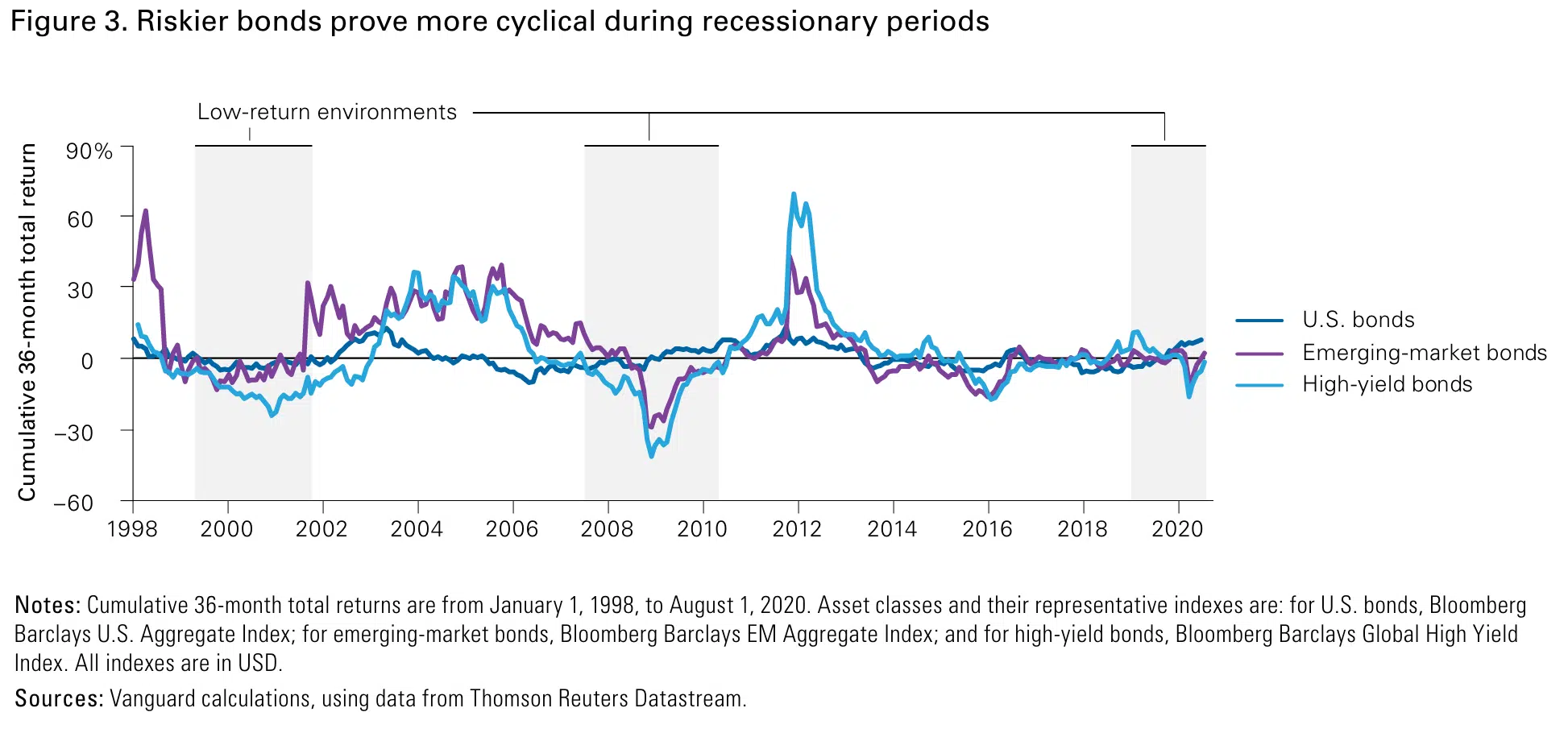

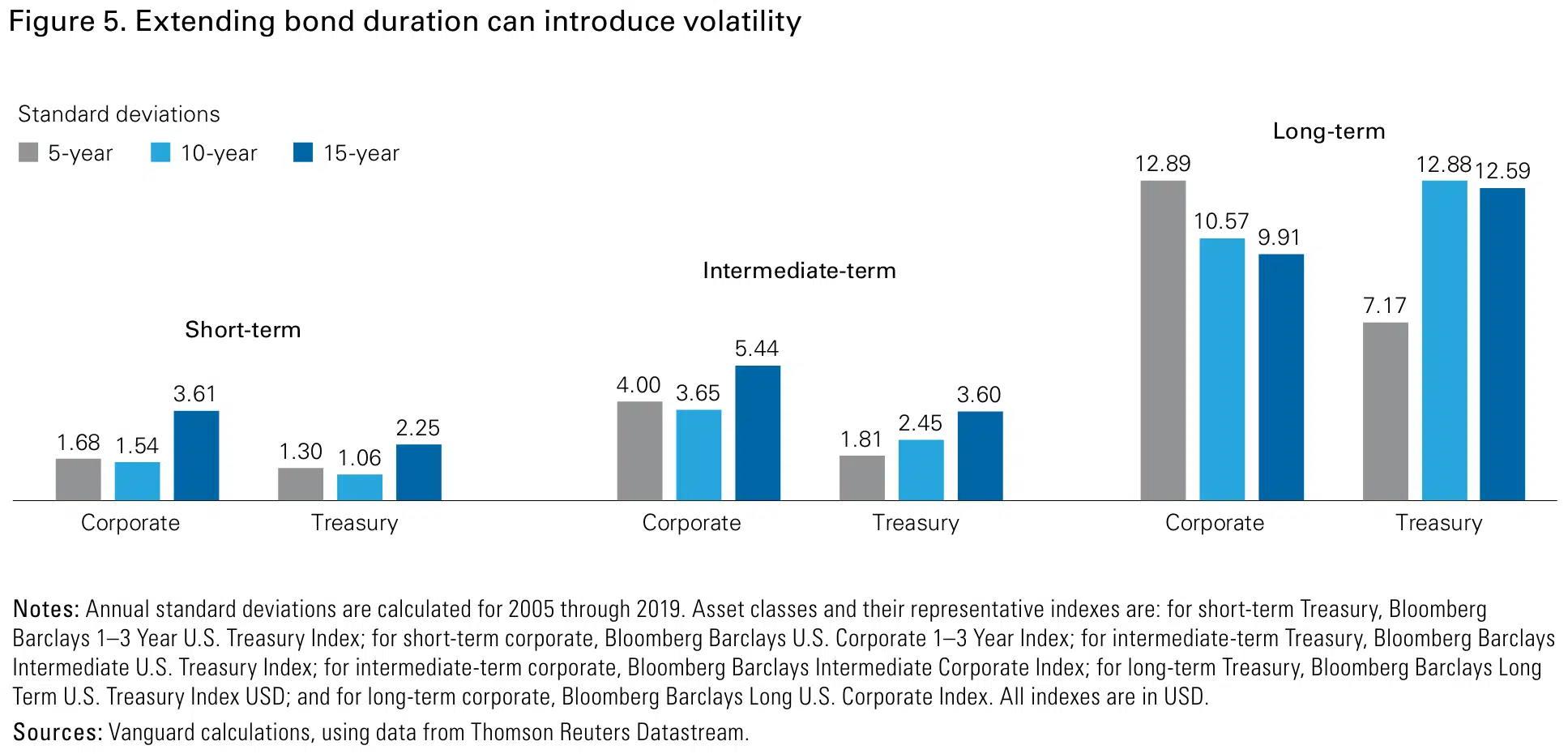

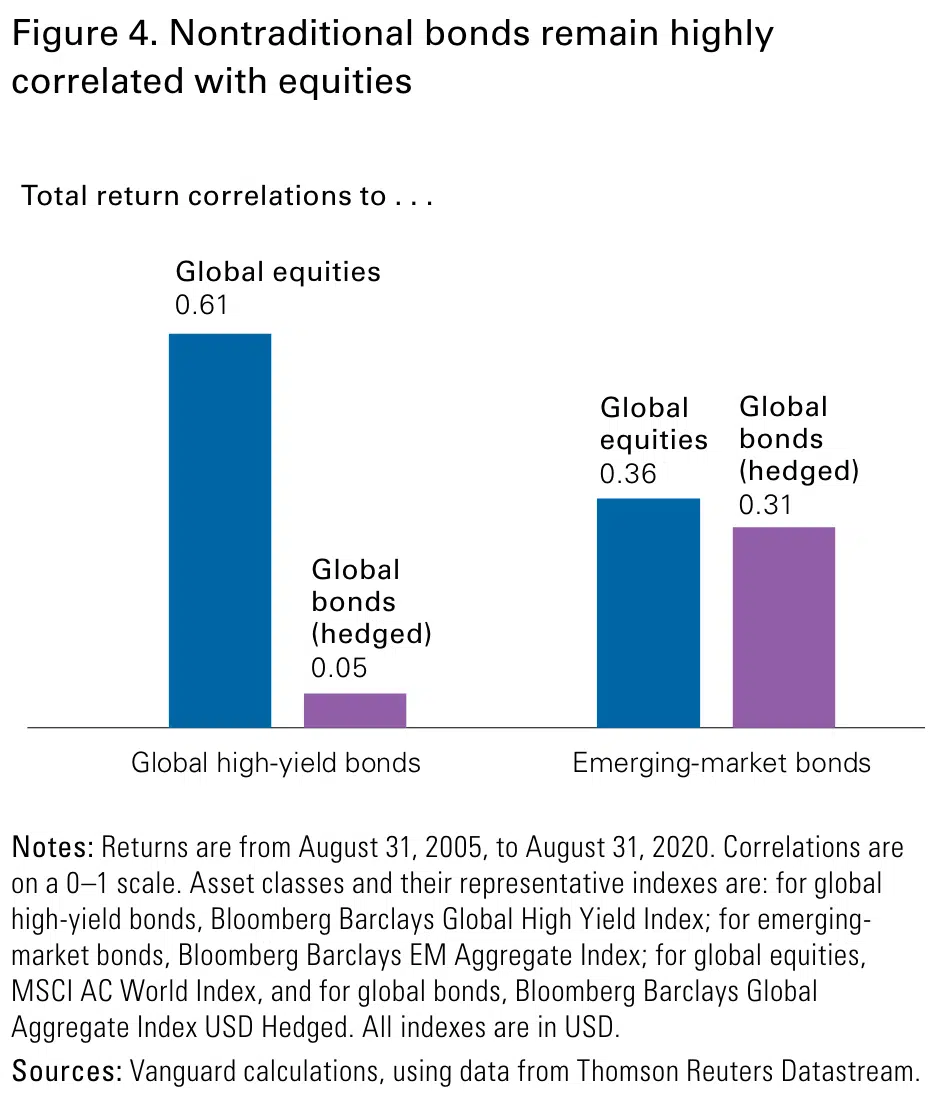

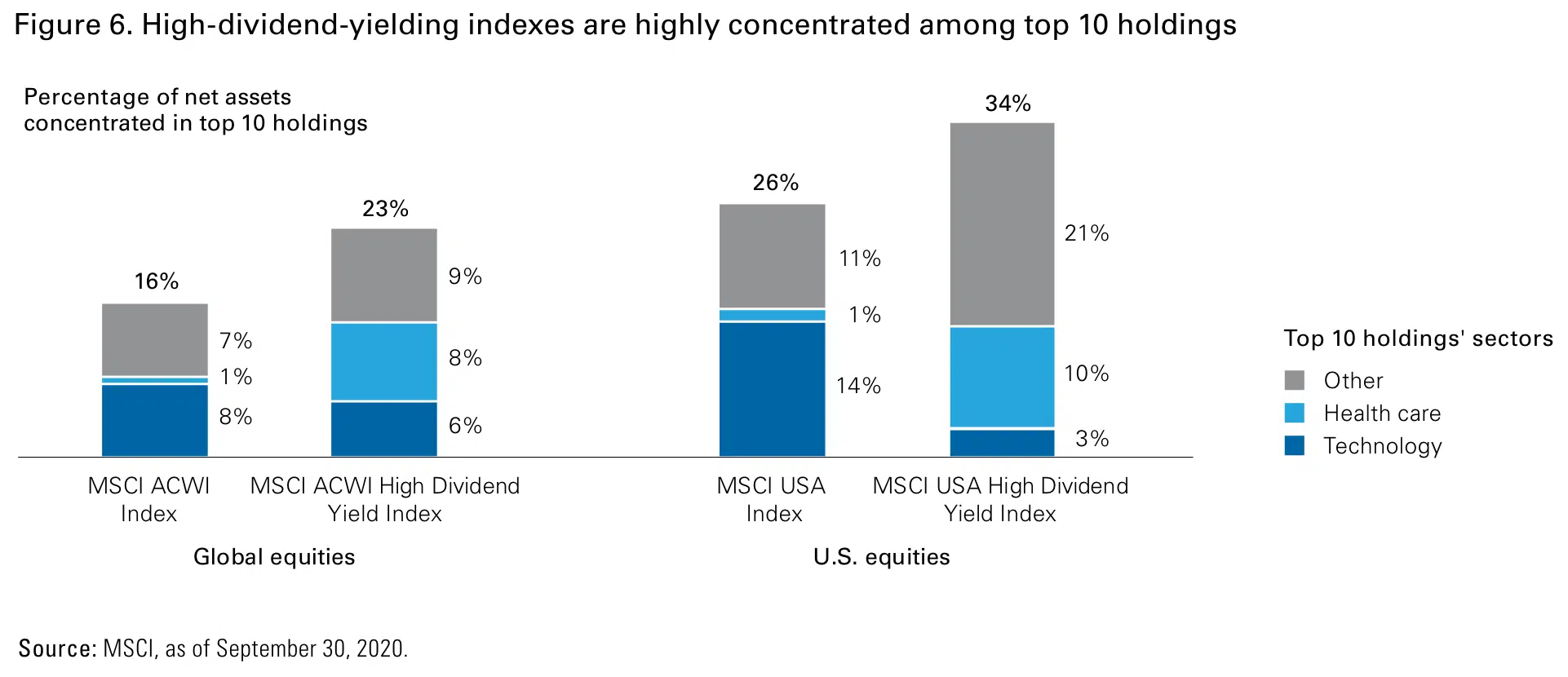

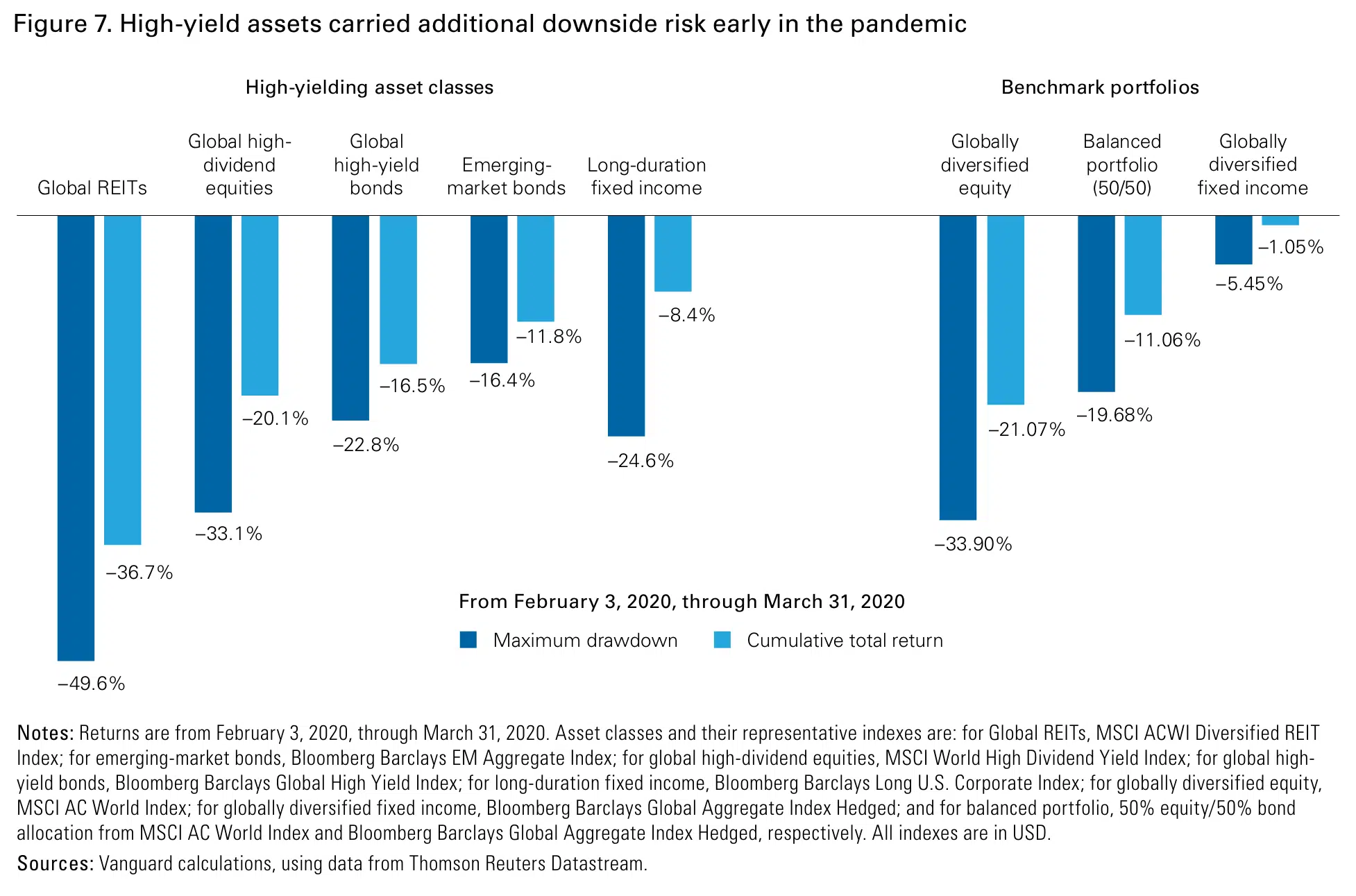

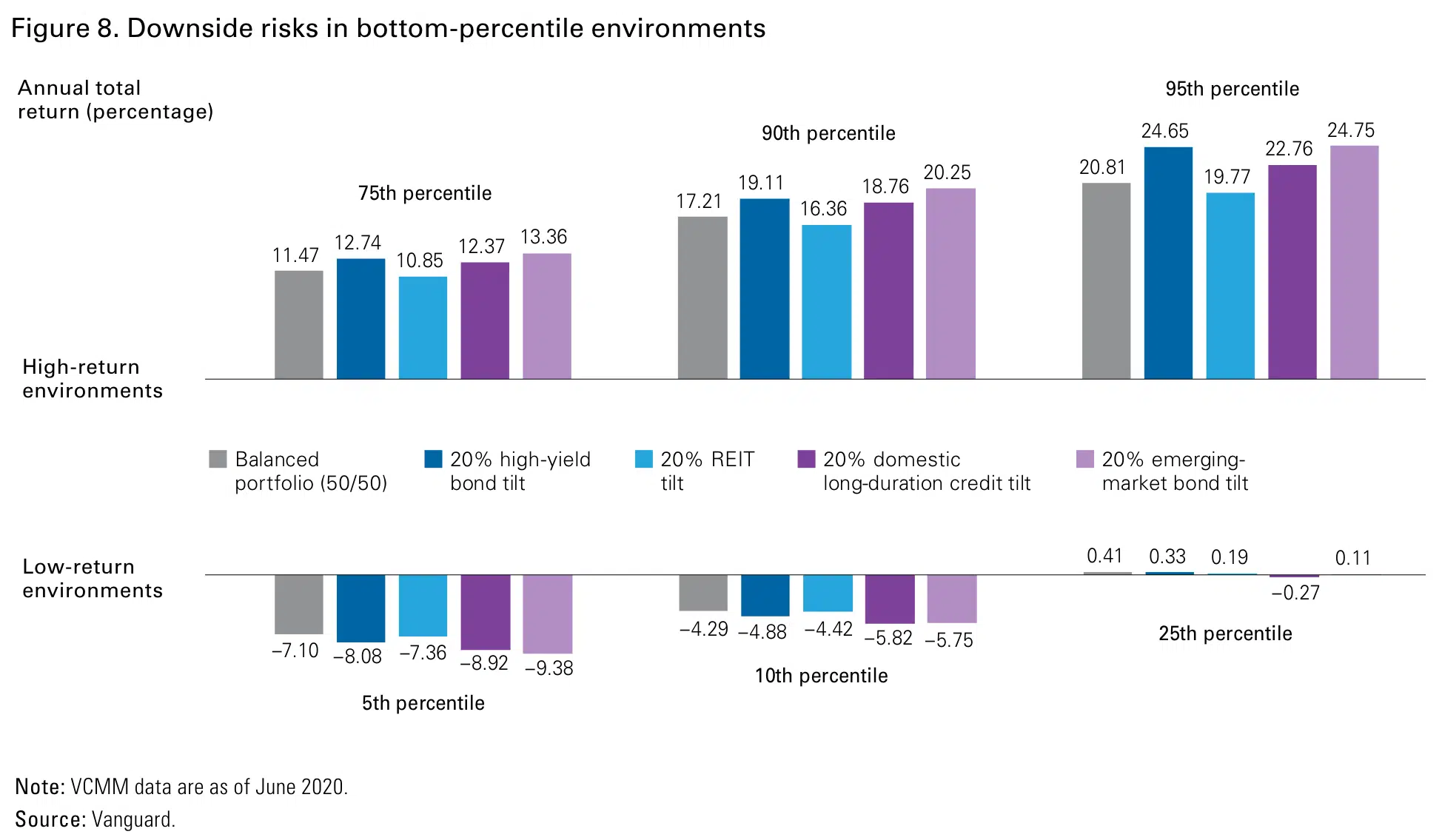

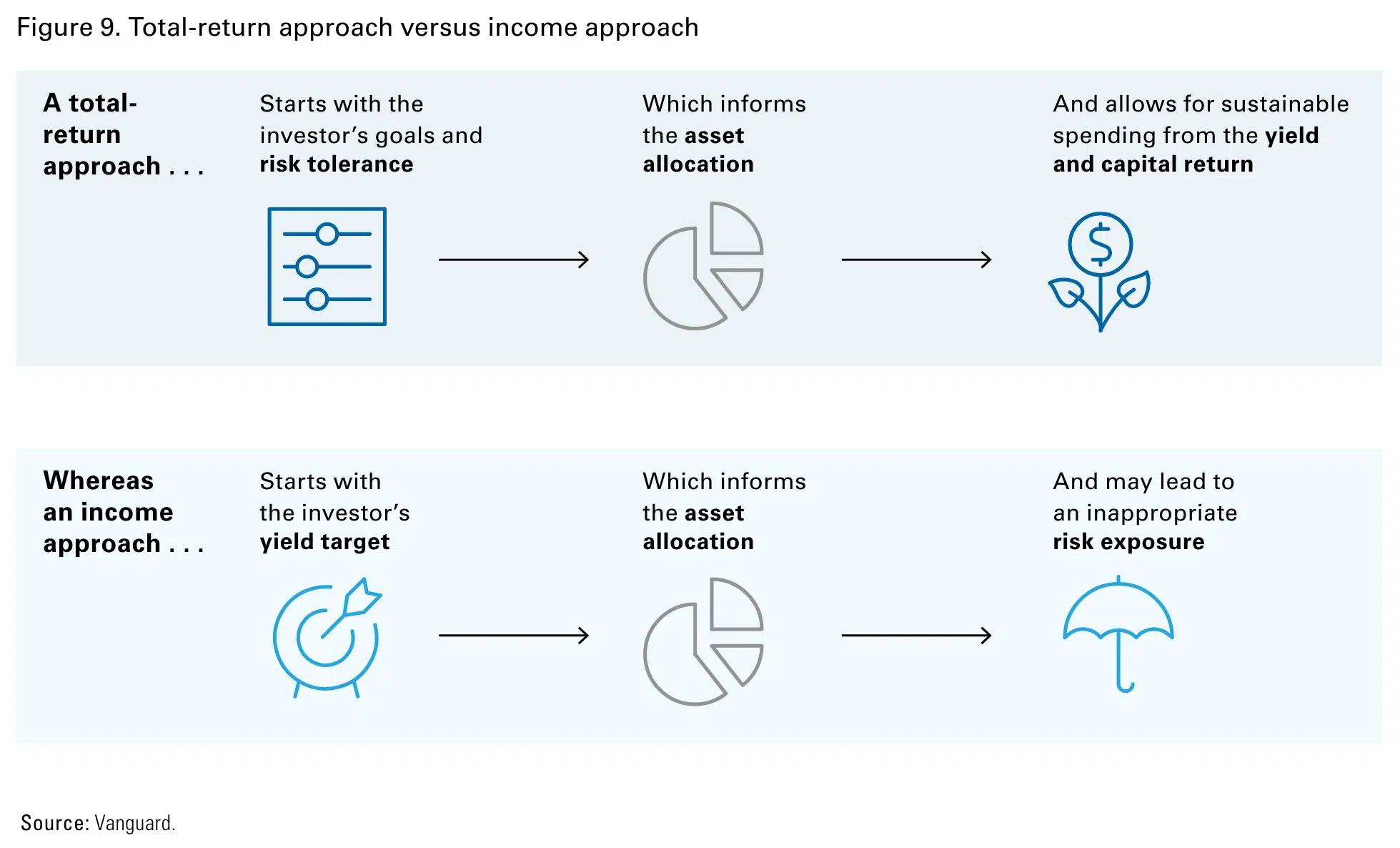

The paper presents two main strategies for investors to meet their spending needs: (1) altering the portfolio asset allocation to include higher-yielding, potentially riskier assets, or (2) adopting a total-return approach that combines portfolio yield with capital appreciation. The authors caution against the former strategy, noting that shifting towards higher-yielding assets can compromise the original risk profile of the portfolio and reduce diversification. Instead, they advocate for a total-return strategy, which they argue can help minimize portfolio risks, increase portfolio longevity, and allow investors to meet their spending goals more effectively.

The total-return approach is described as a holistic strategy that considers the investor’s goals and risk tolerance to develop an appropriate asset allocation. This approach aims to support spending through both portfolio yield and capital appreciation, offering several advantages over an income-focused strategy. These include maintaining portfolio diversification, creating more tax efficiency, and allowing more control over the size and timing of portfolio withdrawals.

The paper also discusses the tax implications of income-focused versus total-return investing, highlighting that income can be taxed more heavily than long-term capital gains, which can result in a higher tax liability and lower after-tax return for income-focused investors.

In conclusion, the Vanguard research paper argues that a total-return approach is a smarter response to the challenges posed by shrinking yields, providing a more sustainable and flexible strategy for meeting spending needs in retirement. The paper emphasizes the importance of a diversified portfolio tailored to the investor’s unique risk and return preferences, suggesting that this approach can offer better protection against market shocks and more stable portfolio withdrawals.

Key Quotes

“We recommend a total-return approach to investing that can help minimize portfolio risks and increase portfolio longevity, while allowing investors to meet spending goals with a combination of portfolio income and capital.”

“The total-return strategy proves beneficial to investors in the decumulation phase of retirement, with increased spending flexibility coming from the combination of two sources: capital gains and income. The total-return strategy, when accompanied with a prudent spending rule, provides value compared with the income approach by: Maintaining portfolio diversification (no unintentional factor, credit, or concentration risks), Creating more tax efficiency, Allowing more control over the size and timing of portfolio withdrawals.”