Rocket Money Review: Simplifying Subscriptions and Budgets

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

Staying on top of your money shouldn’t feel like climbing Mount Everest every month. Yet between forgotten subscriptions, rising bills, and trying to actually stick to a budget, personal finance can get messy fast.

Enter Rocket Money, an app that promises to help you take control and stay on top of your finances. But, can it actually do the heavy lifting for you? We signed up for a free trial and put it to the test. Here’s our Rocket Money review.

Quick Take

Rocket Money is a personal finance app designed to simplify budgeting and help users take control of their finances. It connects to thousands of banks, credit cards, and other financial institutions, allowing users to track spending, subscriptions, bills, and net worth in one place. Rocket Money’s unique features include identifying forgotten subscriptions, offering a subscription cancellation service, and even negotiating bills on your behalf.

What Is Rocket Money?

Rocket Money (formerly Truebill) is a personal finance app that helps you set goals, track your spending, create a budget, and monitor your net worth. Rocket Money’s biggest claim to fame, though, is finding and canceling unwanted subscriptions and negotiating with your providers to lower your bills. Rocket Money is available on desktop, for iPhones, and Android devices.

My Experience With Rocket Money

When you sign up for Rocket Money, you’ll answer questions about your financial goals.

Next, I connected my checking account and my credit cards. While Rocket Money insisted my Discover password was wrong (even though Discover accepted it), connecting other accounts, like Capital One, was seamless.

I quite like the look of the app (see the image below). It’s colorful and easy to read.

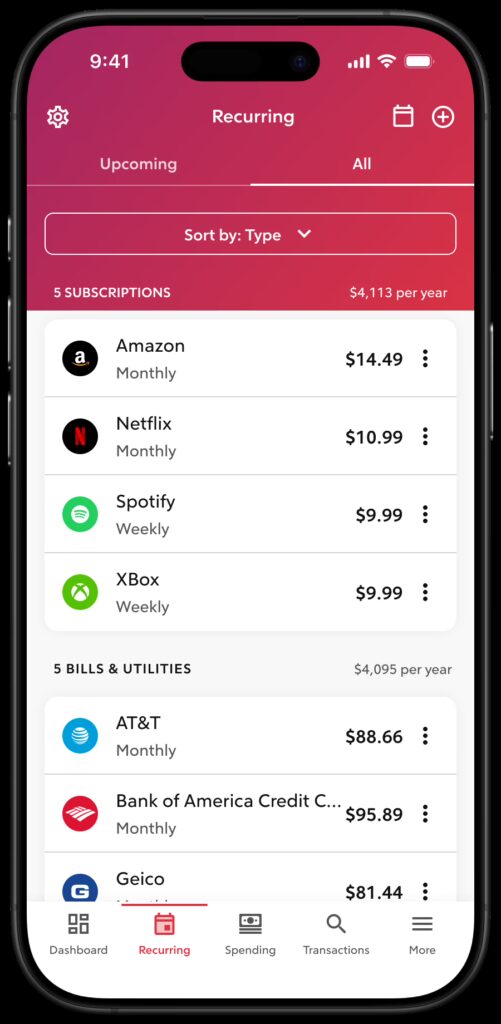

Tracking Subscriptions

Rocket Money operates under the assumption that many people have forgotten subscriptions draining their accounts. There’s even a section in the dashboard where you can see a full list of all of your subscriptions. This makes it easy to identify which subscriptions you no longer use and therefore, which ones you may want to cancel.

I have three subscriptions and I use them all, so this feature of Rocket Money isn’t life-changing for me. But, if it’s important to you, you may also want to read our article on 7 Best Subscription Manager Apps to Track and Cancel Recurring Charges. Rocket Money is one of the top contenders on the list.

Bill Negotiation

Another Rocket Money unique feature is bill negotiation. Rocket Money can negotiate bills for you, but there are a couple of caveats:

First, in order to act as your agent with bill companies, note the following:

If it’s necessary for our agents to represent to your Provider that they’re the account holder, you consent to such representation solely in order to perform the Bill Negotiation.

Also, should Rocket Money negotiate your bill successfully and save you money, they will charge you a fee, according to their Terms of Service:

The current Negotiation Fee is decided by the user, anywhere between 35-60% of the 12-month savings achieved as a result of the negotiation.

For instance, if a 40% fee is chosen and Rocket Money is able to lower a bill by $10 per month, that would equal savings of $120 over 12 months and a Negotiation Fee of $48.

I didn’t have any bills I wanted Rocket Money to negotiate, so I did not test this feature firsthand.

Getting Started With Rocket Money

This part is interesting because Rocket Money offers two versions: a free version and a Premium version. But, you can’t choose the free version right off the bat. Instead, you need to sign up for a free trial of the Premium version. You can cancel the Premium trial within seven days, but Rocket Money takes your credit card information just in case you decide to keep the Premium version. I find this a bit annoying, although the app does offer excellent features in its free version.

Once I had an account, Rocket Money connected to my bank right away (less than a minute). As I mentioned before, Rocket Money insisted my password for my Discover credit card was incorrect, but it had no trouble linking to Capital One.

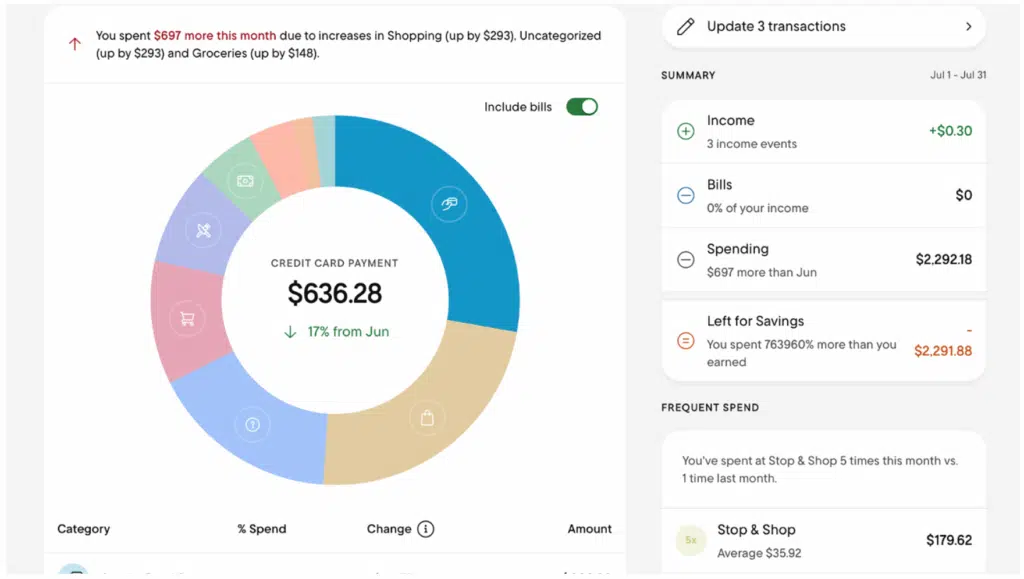

This is what the dashboard looks like:

Rocket Money Features

There are two versions of Rocket Money: the free version and the Premium version. For the Premium version, members can choose a payment anywhere between $7 and $14, depending on how much you feel the service is worth. There is also a 7-day free trial of Premium so you can try it out before you decide.

The Free version includes:

- Account linking: View checking, savings, credit cards, and investment accounts in one dashboard.

- Balance alerts: Get notifications for low balances or high credit card usage.

- Subscription management: Identify all recurring charges; cancellation is manual. It’s up to you to cancel any unwanted subscriptions.

- Spend tracking: Categorizes your expenses and highlights overspending.

- Budgeting: Tracks income vs. spending with preset categories (custom categories require Premium).

The Premium subscription includes everything in the free version, plus:

- Subscription cancellation assistant: Rocket Money will cancel unwanted subscriptions for you. You tell Rocket Money what subscriptions you don’t want and then it contacts those services and cancels them for you.

- Automated savings plan: Rocket Money will set aside a portion of every paycheck to reach financial goals.

- Credit score updates: You can check your credit score daily through Rocket Money.

- Net worth tracking: Rocket Money can track your assets vs. your debts to calculate your net worth. You can also include your home in this calculation if you switch the toggle on.

- Bill negotiation: As mentioned above, the bill negotiation feature is either the best thing since podcasts or almost a scam, depending on your perspective. It is true that Rocket Money will negotiate your bills for you, but then they claim a fee between 35% and 60% of the first year’s savings. Not only is there a fee, but the fee is somewhat hidden. We had to dig through the Terms of Service to find it.

On the positive side, it’s great that someone else will call your internet company and negotiate a lower payment; on the other hand, you could do that yourself.

Rocket Money Settings and Security

Rocket Money uses Plaid to connect to over 12,000 banks and financial institutions globally. They also use bank-level encryption to keep your account information secure. You can elect to use multi-factor authorization as well.

Rocket Money does not sell your data to any third parties.

Rocket Money Alternatives

Rocket Money vs. Monarch Money

Monarch Money doesn’t negotiate bills, but it offers a complete picture of all household accounts and highly customizable budgeting. Monarch Money also allows you to connect your accounts with your partner’s accounts and gives each of you separate login access.

Monarch Money costs $8.33/month (paid yearly) versus Rocket Money’s $7–$14 Premium plan. Monarch Money does so much more than basic budgeting, though, and they offer a 50% discount off the first year with promo code ROB50. It may well be one of the best (if not the best) personal finance apps available right now. You can read our Monarch Money Review here.

While there is a free version of Rocket Money, you’ll need Premium to unlock the subscription cancellation and bill negotiation features. Monarch Money is better for advanced financial tracking, but if you’re looking for a free app, Rocket Money is a good choice.

Rocket Money vs. YNAB

YNAB is excellent at budgeting, teaching you to assign every dollar a job. If all you need is a budgeting app, YNAB is a good option. On the other hand, if you’re new to budgeting, YNAB is overwhelming at first and there is a steep learning curve. Rocket Money makes it much easier to get started.

YNAB is more expensive ($14.99/month or $109/year), and it lacks many of the features Rocket Money and other budgeting apps offer. Rocket Money is simpler, more beginner-friendly, and cheaper, but only offers a 7-day Premium trial.

Rocket Money vs. Simplifi

Simplifi is Quicken’s web-based and mobile personal finance app. Simplifi offers a simpler version of Quicken Classic, for people who want to track expenses and everyday spending. You can also create a savings plan, analyze investments, and plan for retirement. Simplifi has better investment analysis and tracking than Rocket Money, but Simplifi won’t negotiate bills for you.

There is no free version of Simplifi, nor is there a free trial, although there is a 30-day money back guarantee. However, Simplifi’s pricing is a reasonable $5.99 per month. Even better, at the time of this writing, Simplifi is down to a special offer of $2.99/month. If investment tracking matters, Simplifi is the stronger choice over Rocket Money.

Rocket Money Pros and Cons

FAQs

Is Rocket Money safe to use?

Yes, Rocket Money is safe to use. It uses 256-bit encryption to store your data, and uses Plaid to connect to your bank accounts. You can also turn on multi-factor authentication to access your account.

Does it actually cancel subscriptions?

Yes. The Premium version features a concierge service that will cancel your unwanted subscriptions for you. To do that, you have to agree that Rocket Money can act on your behalf. The free version identifies your subscriptions, but it’s up to you to cancel them (or keep them).

How does Bill Negotiation work?

You identify a bill you want Rocket Money to negotiate: say, your internet bill. Rocket Money’s team then contacts the internet service provider and tries to negotiate a lower price for you. If successful, Rocket Money will charge you between 35% and 60% of the savings. The user decides what percentage of the savings is appropriate for the fee. Also, beware, some users report the bill negotiation service doesn’t work as intended.

Can I use Rocket Money without Premium?

Yes. Anyone is welcome to use the free version if all you want is simple budgeting and expense tracking. To unlock all the features, you’ll need the Premium version.

Final Thoughts

Rocket Money is beginner-friendly, visually appealing, and simplifies budgeting. It’s not ideal for advanced investment tracking, but if your goal is to consolidate accounts, manage subscriptions, and possibly save on bills, it’s worth considering. Its combination of ease of use, flexible pricing (including a free version), and its unique features make it a solid option for first-time personal finance app users.