How to Calculate Your Net Worth (and Why it Matters)

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

Your net worth, more than any other financial metric, gives you a window into your financial health. In one number you see the affects of every financial decision you’ve ever made. Here’s why its so important and how to track your net worth for free.

I’m going to make a bold and controversial claim about net worth. Here goes. A person’s net worth is the single most important financial metric they can track. It’s more important than their income, savings rate, or monthly budget. Our net worth reflects every single financial transaction we’ve ever had. It reflects the dollar we spent on a candy bar when we were 15 and the first car we bought when we were 18.

You may have countless financial goals. You may want to get out of debt, save for child’s education, pay off student loans, buy a house, buy a car, increase your emergency fund and save for retirement. These are all important goals and worth tracking. The ultimate measure of how we handle money, however, is our net worth. All the other goals are lack stats in a a football game–rushing yards, quarterback rating, sacks. Our net worth is the score at the end of the game.

Here’s everything you need to know about net worth and how and why to track it.

What is a Net Worth Statement

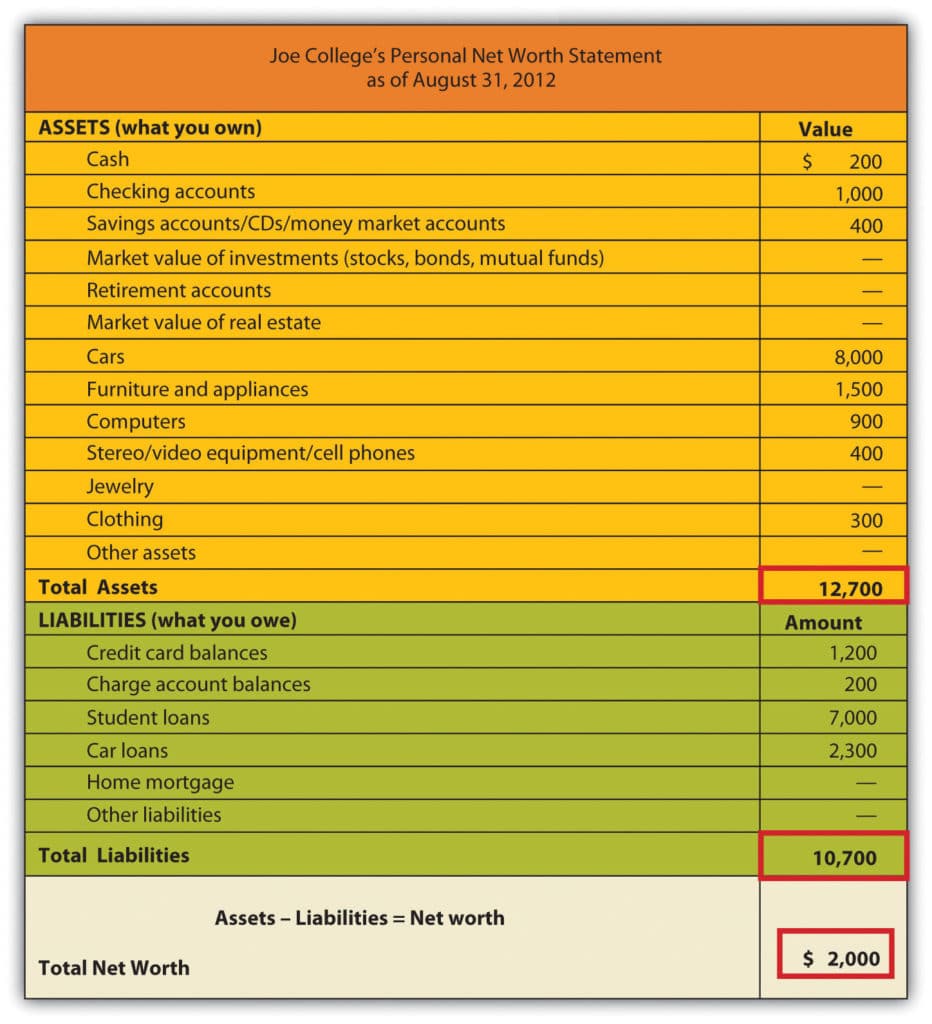

A net worth statement, also called a balance sheet, is a reflection of everything that you own (assets) and everything that you owe (debts or liabilities). Your assets minus your liabilities equals your net worth. Here’s an example of a net worth statement:

Hopefully we have more assets than liabilities, in which case we have a net worth. For some of us that might not be the case. When I graduated from law school in 1992, my wife and I had a negative net worth of about $55,000 thanks to student loans.

Net Worth Statement vs a Budget

Now one question we want to consider is the difference between our net worth and our monthly budget. At one one level, the difference is obvious.

A budget shows how much we make and how much we spend. You can imagine that at the top of our budget is our monthly income, and below that are our monthly expenses organized by category. And that’s, of course, very different than our net worth statement, which shows what we own and what we owe. But when we dig a little deeper, we can see two more fundamental differences.

Time Period

The first is that a budget covers a period of time. We think of our monthly budget or perhaps a yearly budget. Either way, our budget covers a period of time. In contrast, a balance sheet is a snapshot in time. For example, we update our net worth statement at the end of every year. As a result, our net worth statement is as of 12/31 of each year.

You can think of a budget as a video over a period of time, while your net worth is a snapshot.

Publicly traded companies are no different. Their annual income statement (called a Statement of Operations) shows income and expenses over the past fiscal year. In contrast, their balance sheet is as of the last day of their fiscal year.

Transactions that Affect our Net Worth and Budget

The second difference, and this is I think even more important, is that the way we earn and spend money affects our net worth and budget in different ways. Here’s the key thing to remember– every single thing we do with money, every transaction, we engage in, whether we’re buying tickets to go to the movies or we’re paying down our credit card, affects our net worth. On the other hand, not every single thing we do actually affects our budget.

Getting paid

For example, let’s imagine we get paid $2,500 after taxes on payday. How would that payment affect our financial statements? Well, the $2,500 would be added to our budget as income. It would also be added to our net worth as an asset. In that example, the transaction affected both our net worth and our budget. It also increased our net worth by $2,500.

Paying off a credit card

Recall that earlier I noted that every transaction affects your net worth, but not every transaction affects your budget (income and expenses). Let’s look at an example of that now. Let’s imagine that a week ago, we charged an Xbox series X console (if we could find one) to a credit card. After getting paid, we decide we’re going to pay it off to avoid any interest charges. How would paying our credit card off affect our financial statements?

Well, we would decrease our cash by $500. At the same time, however, we are going to decrease a liability (our credit card debt) by the same $500. This is a perfect example of a transaction that had absolutely no impact on our budget. We simply transferred $500 from one account (our checking account) to another (our credit card account).

This may seem counterintuitive. After all, we did spend $500 to buy an Xbox. These expense occurred when we charged the Xbox to our credit card. At that point the purchase would have shown up on our budget, perhaps under the entertainment category. But when we paid the credit card bill off, that transaction had no affect on our budget.

This is exactly how budgeting software such as Empower works. The charge to the credit charge results in a categorized expense. Paying the card off is simply a transfer.

What to Include in Your Net Worth

What should we include in our net worth? Here I use two rules that apply to just about every situation.

Rule #1: Include all liabilities

Rule number one is that you include every single debt that you have. This would include credit cards, student loans, a mortgage, or even a personal loan that you owe to a friend or family member. Every liability gets included in your net worth statement.

Rule # 2: Include Cash and Assets that Go Up in Value Over Time

With assets, you include cash and every asset that over time you expect to go up in value. Some examples of asset to include on your net worth calculation:

- Primary residence

- Other real estate

- Retirement accounts (e.g., 401(k), IRA)

- Taxable investment accounts

- Collectibles

- Ownership in a business

At the same time, Rule #2 means you’re going to exclude some things that may be surprising to some. For example, I do not include our cars in our net worth statement. Yes, they have value. Yes, if we were doing a complete net worth statement for a bank loan, we would include the cars. But I don’t include them because over time they depreciate, and eventually, we go out and spend more money to buy another car.

If you do include your cars on your net worth statement, but sure to reduce the value each year based on the amount of depreciation.

We also don’t include personal property, such as clothes or furniture.

How to Track Your Net Worth for Free

We track our net worth in two ways–using a Google Sheet and using Personal Capital.

Google Sheets

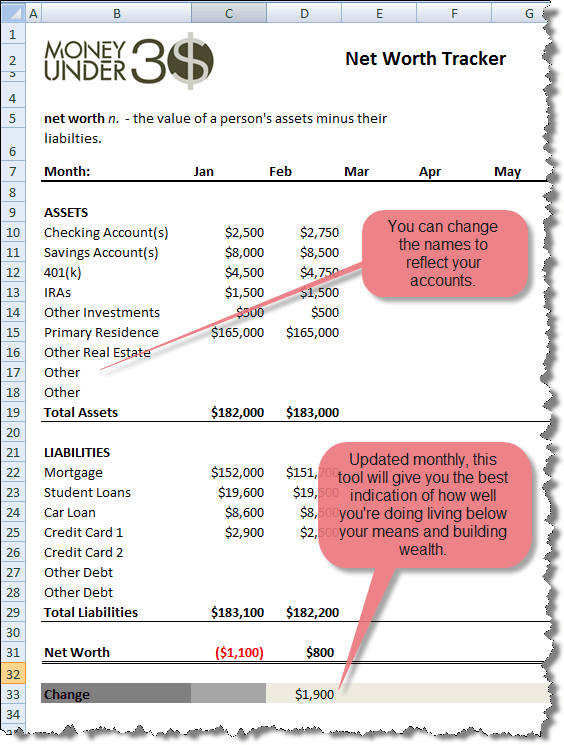

Google Sheets is an easy way to track your net worth for free. It does require manual entry of asset and liability values. We update our net worth at the end of every year, and the process takes just a few minutes. By tracking our net worth in this fashion, I’m able to see the progress we’ve made going back to 2007.

If you’d like a template, check out this Excel template from Money Under 30. You can easily export it to Google Sheets if you prefer.

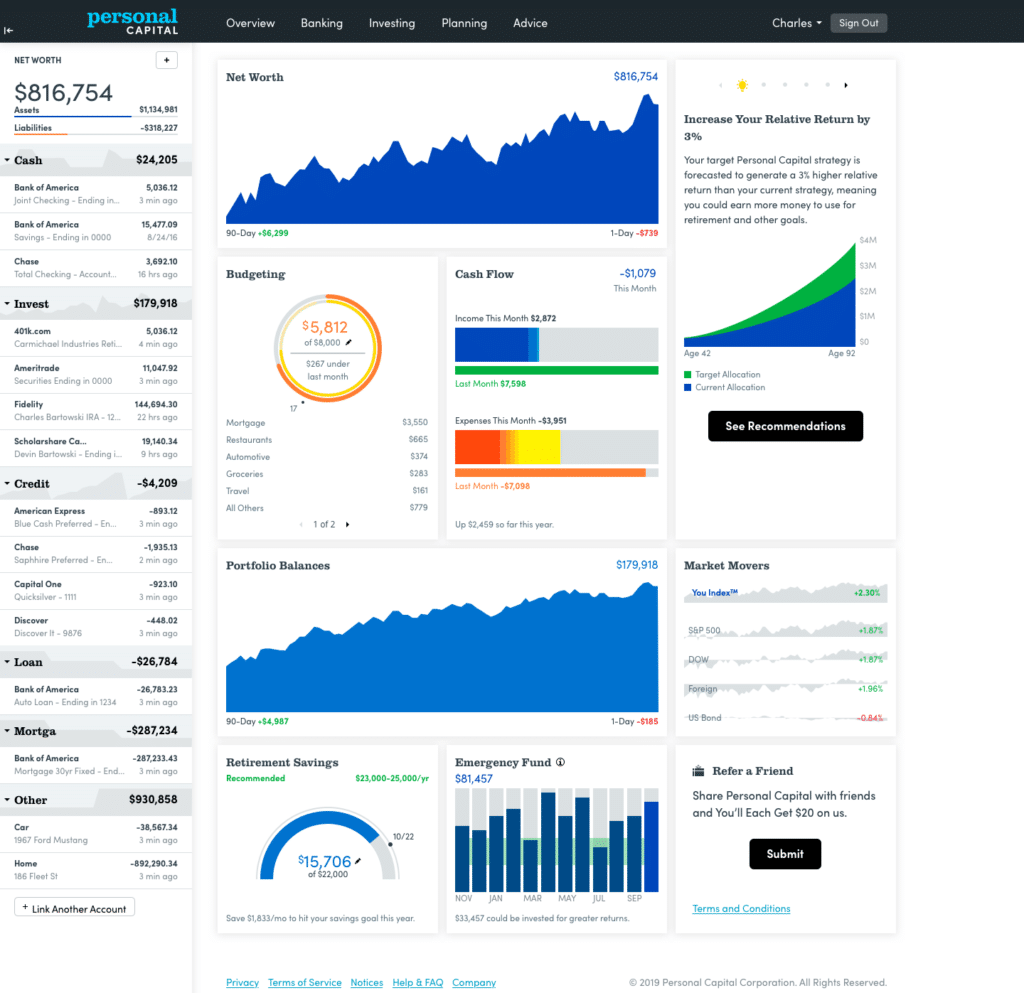

Personal Capital

The other thing I do is use Personal Capital (now called Empower). Once you connect all of your financial accounts, Personal Capital automatically tracks and updates your net worth on a daily basis. It couldn’t be any easier. And it’s free.

The Awesome Value of a Money-Making Net Worth Statement

I like to look at all of our assets that are generating income or profit for me. It could be in the form of a dividend, interest, or increased market value. When viewed this way, we see a clear difference between owning shares of an S&P 500 index fund and owning a car. The car generates nothing but more expenses. The index fund generates dividends and capital gains.

Here’s where the real power of a money-making net worth statement comes into play. When you start out, all of your income comes from work. That’s all you have, if you’re like we were at of law school. We didn’t have two dimes to rub together.

As you spend less than you make and invest the rest, however, this begins to change. Over time, the income-producing assets on your balance sheet begin to compound. Fast forward a few decades (yes, this takes time), and your assets will generate more income than your day job. They call that financial freedom.

What is a Good Net Worth

People want to know where their net worth stands compared to others. While we shouldn’t focus too much on how other people are doing, it can be a motivated to do smarter things with your money.

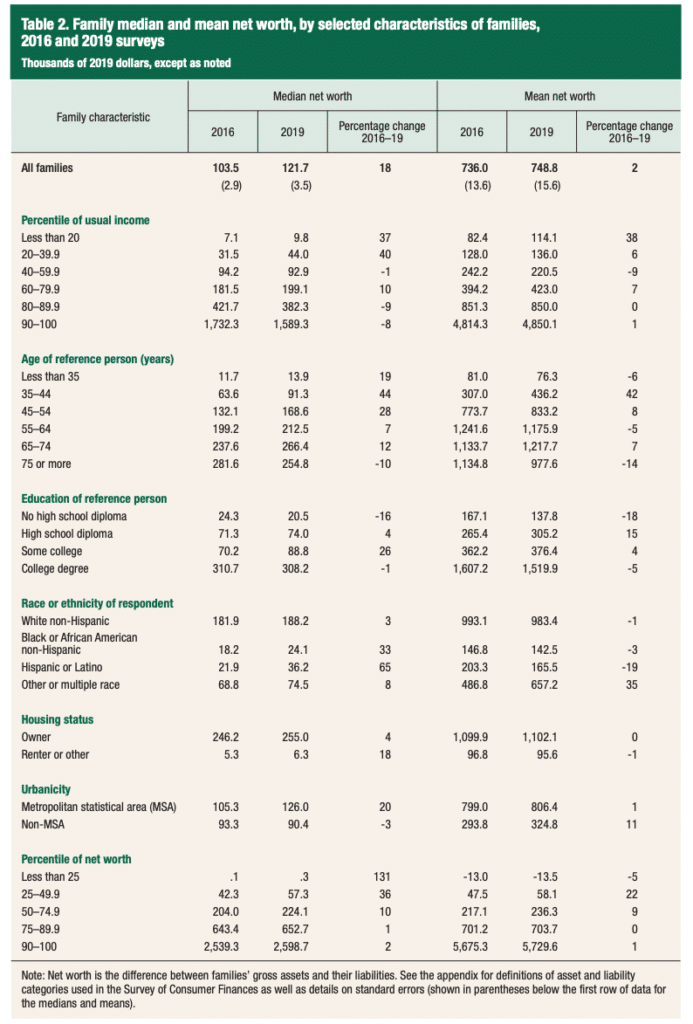

According to the Federal Reserve, the median net worth in 2019 was $121,700. By itself, this number is not very helpful. We can, however, look at net worth by age and income.

By Age and Income

Here are the median and mean net worth by age and income according to the Fed (in thousands):

Net Worth Ratios

While the Fed’s data are interesting, there’s an even more useful way to think about net worth–as a ratio based on age and income. In 2010, a lawyer by the name of Charles Farrell published, Your Money Ratios: 8 Simple Tools for Financial Security at Every Stage of Life. The book walks through a ratio of how much you should have saved given your age, income and retirement goals.

As an example, if you want to retire at age 65 and live on 70% of your pre-retirement income, at age 30 you should be saving 8% of your income and have already accumulated 0.45 times your annual income. Of course, the book goes into a lot more details.

Net Worth Video

Next Up–>Check out my favorite money tools.