11 Easy Ways to Invest $1,000 for Free

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

My goal for this website is to help readers become better investors and prepare for retirement. To do this, some of the products featured here may be from our partners. This doesn’t influence our evaluations or reviews. Our opinions are our own.

It's easier than ever to begin investing with a small amount of money. From stocks to real estate, it takes just a few minutes to create a diversified investment portfolio. The investing options have never been better. In this article, I'll cover 11 easy ways to invest $1,000 for free.

- How to Invest $1,000

- 1. Pay Off High Interest Debt First

- 2. 401(k) with Matching Contributions if Available

- 3. High-Yield Savings Account for Short-Term Savings

- 4. Betterment for Easy Diversification

- 5. E*Trade Core Portfolios also for Easy Diversification

- 6. M1 Finance for Individual Stocks

- 7. Robinhood for Free Stock Trades

- 8. Wealthfront for Real Estate Exposure

- 9. Realty Income for Monthly Dividends

- 10. Fundrise for Direct Investing in Real Estate

- 11. Target Date Retirement Funds for Simple Retirement Investing

- How NOT to Invest $1k

- Invest $1k Video

How to Invest $1,000

1. Pay Off High Interest Debt First

First things first. If you have debit with double-digit interest rates, it needs to be your first priority. You won't find a better investment than paying off any high interest debt. If you have credit card debt at double digit interest rates, that should be your top priority.

I wouldn't worry about low interest debt, like federal student loans. I know there are financial gurus who preach you should pay off all of your debt before you start investing. They are dead wrong. if you have double digit interest rates on credit cards, however, make paying it off a top priority.

One way to deal with credit card debt is to transfer it to a 0% balance transfer credit card. That's what I did back in the day to get out of debt. If that's not available to you, the $1,000 should be “invested” in paying down that debt. You can check out this credit card payoff calculator to estimate how long it will take you to get out of debt.t

2. 401(k) with Matching Contributions if Available

If your employer matches contributions to a 401(k) or other workplace retirement account, this is where your first invested dollar should go. Your priority should be to contribute enough to take full advantage of those matching contributions. As I pointed out in an article on Forbes, the value of matching contributions over a lifetime can exceed $1 million. In other words, friends don't let friends miss the match!

3. High-Yield Savings Account for Short-Term Savings

Investing is a long-term endeavor. You can't “invest” for a day, a week, a month or even a year. They call that day-trading or swing-trading. I call it speculation. If you need money in the short term, then the best option is simply an online savings account. The rates aren't great, but the accounts are FDIC insured, and you're not going to lose any money.

One of my favorite options is CIT bank. It's an online bank that pays one of the highest yields on FDIC-insured money market accounts. It has no monthly fees, you can deposit checks remotely, there is no minimum balance required, and just $100 to open an account.

4. Betterment for Easy Diversification

Betterment is one of the easiest, least expensive ways to invest in a diversified portfolio of stocks and bonds. Unlike many mutual funds, there are no minimum investment requirements to meet. You know I love Vanguard, but most of their funds have a $3,000 minimum. That doesn't really help us when we've got $1,000 to invest. Betterment solves this problem.

I met the founder Jon Stein back in 2011. I've had accounts with betterment to try it out. It's incredbily easy to use. You deposit money into a Betterment account, and based on your investing goals, it divides your money between stock and bond ETFs (I prefer mutual funds for most investors, but automated services such as Betterment use ETFs, which is perfectly fine).

If you're new to investing and not quite sure how much to invest in stocks versus bonds, Betterment will help. It will walk you through a series of questions that will help you make that decision. And of course, you can change it anytime.

As always, we must consider investment fees and minimums. First, there are no minimums. Second, fees are relatively low. The cost is 25 basis points (0.25%) plus the cost of the underlying ETFs (which are cheap). , What you get in return is a very easy way to invest. I really like betterment, I think it's a great a great option.

5. E*Trade Core Portfolios also for Easy Diversification

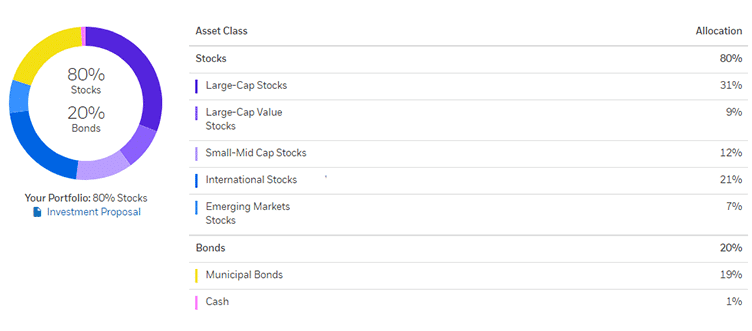

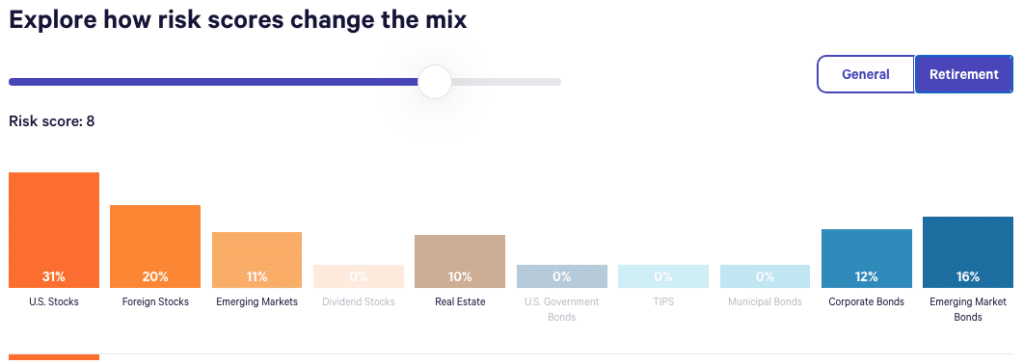

Another option along the same lines as betterment is E*Trade Core Portfolios. I've included this option because some may feel more comfortable with a traditional brokerage company. The minimum investment is $500, which works well when you have $1,000 to invest. As you can see from this screenshot, you get a well diversified portfolio of stocks and bonds (because it includes municipal bonds, or munis as they are called, this portfolio would be best suited for a taxable account).

In terms of costs, E*Trade charges 30 basis points plus the cost of the underlying ETFs. That makes it 5 basis points more expensive than Betterment. I believe in keeping expenses as low as possible, but it's not a huge difference.

6. M1 Finance for Individual Stocks

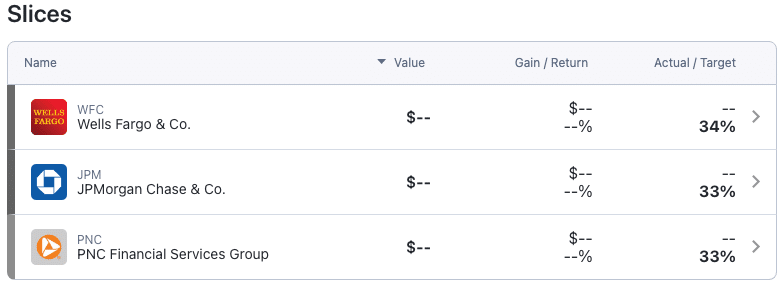

For those who want to invest in individual stocks, M1 Finance is one of my favorite options. You can buy individual stocks without paying transaction fees. What I really like about M1 Finance, however, is that you can create what they call Pies. These are baskets of stocks, much like creating your own mutual fund. I created one that contained three bank stocks:

If I wanted to invest in this pie, I could just contribute to it. M1 Finance would then divide my contribution among these three stocks in the percentages that I set: 34% would go to Wells Fargo, 33% of JPMorgan Chase, and 33% to PNC.

Transferring money into M1 Finance and getting my money out was extremely easy. So I think this is a good option for those looking to invest in individual stocks.

7. Robinhood for Free Stock Trades

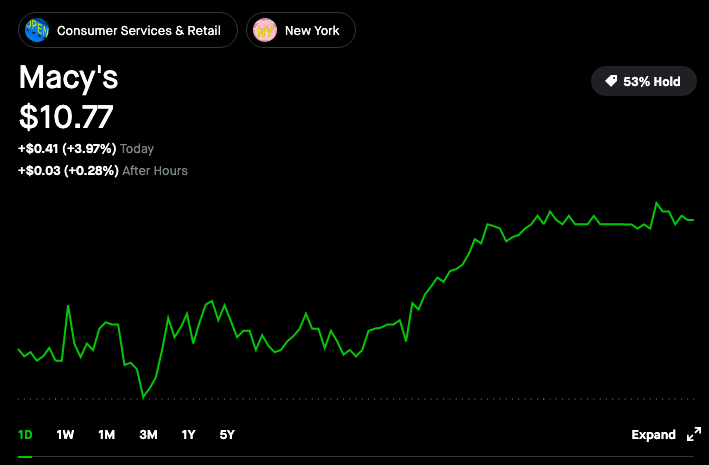

I include Robinhood in this list with some reservation. It is a free way to trade stocks, and the website and app are fun to use.

I should warn you, however, that Robinhood does a lot in my view to encourage certain types of very risky investing. That includes buying and selling options, buying and selling cryptocurrencies, buying and selling commodities and buying on margin. I think those strategies are a good way to lose a lot of money. If you avoid those and just invest in individual stocks, Robinhood is a reasonable option.

8. Wealthfront for Real Estate Exposure

You can invest in real estate even just $1,000. Perhaps the simplest way is to invest in a REIT mutual fund. REIT stands for real estate investment trust. One potential problem is you've got to deal with minimum investments. So one approach is to use a service like Wealthfront.

Wealthfront is very similar to betterment and E*Trade Core Portfolios. I've used Wealthfront in the past for a SEP IRA and found it very easy to use and inexpensive. Unlike Betterment, Wealthfront includes exposure to real estate in its retirement portfolios.

9. Realty Income for Monthly Dividends

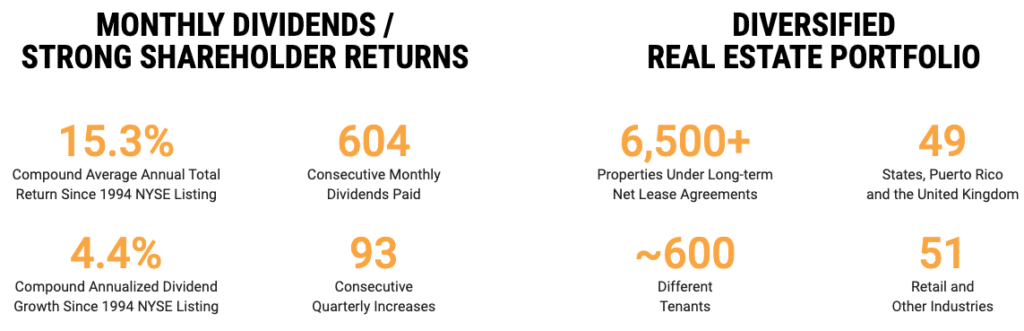

If you want even more exposure to real estate, you could invest directly in a REIT. One that I like is called Realty Income (ticker: O).

Realty Income is best known for paying a monthly dividend for over 600 consecutive months and counting. You can also see from its portfolio that it is very diversified. One thing I'll caution is that REITs like Realty Income should be held in a retirement account. They are not tax efficient.

10. Fundrise for Direct Investing in Real Estate

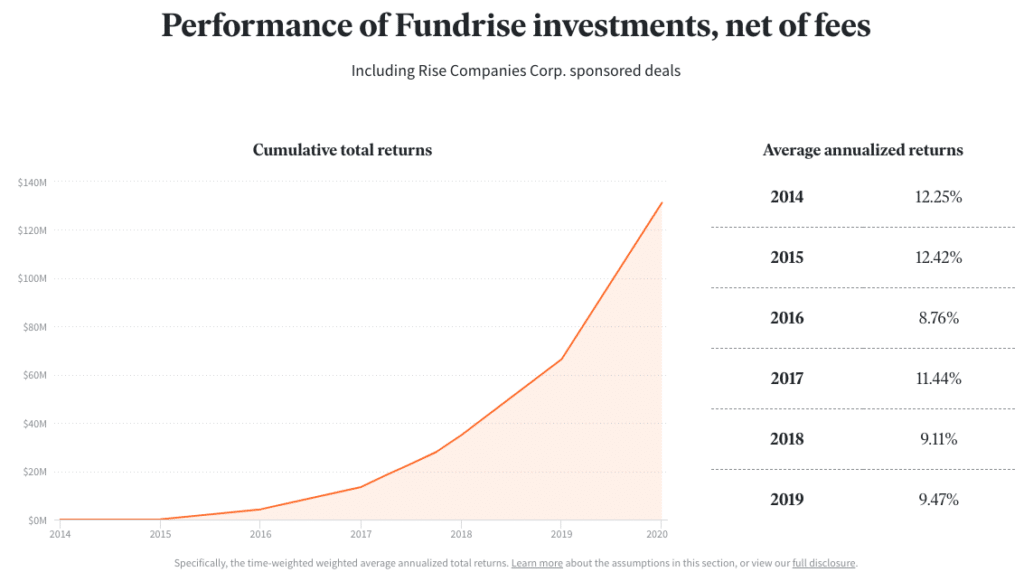

One final option for those looking to invest in real estate is Fundrise. It allows you to get as clsoe to being a landlord without actually being a landlord. The minimum investment is $1,000. The fees are on the higher side (about 1%), so keep that in mind. If we look at its historical performance, though, it's been reasonably good over the last six years:

11. Target Date Retirement Funds for Simple Retirement Investing

One last option I want to give you is what are called target date retirement funds. Most of the major mutual fund companies offer a target date retirement fund, and you'll find these investing options in your 401(k). They're similar to something like Betterment or Wealthfront in that you invest your money into a single mutual fund. The mutual fund then takes your money and invests it in U.S. stocks, international stocks and bonds.

They are different than robo advisors in one important respect. As you near retirement, the allocation between stocks and bonds will change. It will gradually move away from stocks and toward bonds.

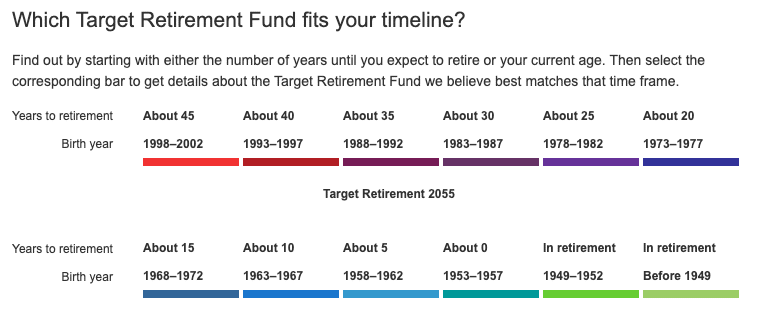

Choosing a target date retirement fund is easy. Simply select the one that most closely corresponds with the year you plan to retire. Here are several options from Vanguard.

The one thing I'll caution about target date retirement funds is that they can be on the expensive side. Vanguard's funds cost just 15 basis points, which is very low. Others tend to be higher, so you want to keep an eye on the fees.

How NOT to Invest $1k

When it comes to investing $1,000, there are several strategies you should avoid.

The first one is what's called day trading. Day traders seek to make money buy buying a stock, holding it for a few minutes or hours, and then selling it before the market closes. The reality is in study after study after study shows this day traders do not make money. One such study found that “it is virtually impossible for individuals to day trade for a living, contrary to what course providers claim.”

The second strategy you should avoid is buying and selling options. There are a lot of websites that try to sell options trading strategies. But again, study after study after study shows that most people lose money trading options. One study found that the “results show that most investors incur substantial losses on their option investments, which are much larger than the losses from equity trading.”

The next one, and I know this is going to be controversial, is Bitcoin and other cryptocurrencies. I know that they're all the rage right now because prices are up. The problem is that they have no intrinsic value and are subject to wild swings. Can you find people that have made a fortune with crypto? Sure, but you can also find people that have made a fortune in the lottery. I don't think it's a good way to build long term wealth.

And the last way not to invest $1,000 are commodities, such as gold and silver. The historical returns have been terrible, and they are not a productive asset.

Invest $1k Video

New to investing and managing your money? Check out my book,

Retire Before Mom and Dad.

“This book is a must-have for anyone, regardless of age, to understand how to grow and protect our money over the course of our lives.” — Adrienne

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.