How to Build a Three Fund Portfolio

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

A three fund portfolio is a simple approach to investing that, as the name suggests, involves just three mutual funds or exchange-traded funds. In just three funds, an investor can build a diversified, low cost portfolio that’s easy to manage.

Popularized by the Bogleheads, the three fund portfolio is one of several “Lazy Portfolios.” But don’t let the simplicity fool you. A three fund portfolio has outperformed most comparable actively managed portfolios over the past several decades. In this article, we’ll look at what comprises a three fund portfolio, its diversification, its historical returns, and how to easily build and manage the investments. We’ll also look at a few ways you can supercharge the returns without a significant increase to volatility by adding a few more funds to the mix.

What is a 3-Fund Portfolio?

A three fund portfolio, as the name suggests, consists of just three mutual funds. The three funds cover U.S. stocks, international stocks and U.S. bonds.

U.S. Stocks

The U.S. stocks portion of the portfolio typically consists of a total market index fund. These funds invest in virtually all of the available public companies headquartered in the United States. An example of such a fund would be the Vanguard Total Stock Market Index Fund (VTSAX).

In some cases, an investor can choose to substitute an S&P 500 Index Fund in place of a total market stock index fund. The historical returns and volatility of a total U.S. market index fund and S&P 500 Index fund are very similar. While I prefer a total stock market fund in a three fund portfolio, this may not be an option inside of a 401k or other workplace retirement account. In those circumstances, an S&P 500 Index fund is a perfectly sound alternative.

International Stocks

For the international stocks, there are many total international stock index funds that one could use. I’ve invested in Vanguard’s Total International Stock Index Fund (VTIAX) for years. This fund invests in public companies headquartered outside of the United States, including in both developed countries (e.g., Germany and France) and emerging markets (e.g., Brazil and China).

U.S. Bonds

For the bond portion of the portfolio, an index fund focused on U.S. bonds is typically used. For example, the Vanguard Total Bond Market Fund (VBTLX) would make an ideal investment for the three fund portfolio. This fund seeks to track the investment performance of the Bloomberg Barclays US Aggregate Float-Adjusted Index. This index broadly tracks the government and investment-grade U.S. bond market.

Is a 3-Fund Portfolio Diversified?

At first glance, the three fund portfolio may not seem well-diversified. With just three funds, one can mistakenly believe that it’s too narrowly focused. Here it’s important to remember that one cannot determine the diversification of a portfolio based on the number of mutual funds or ETFs in the portfolio. I’ve seen investment advisors put clients in more than 20 funds, and yet have very little diversity.

In the case of the three fund portfolio, it is extremely diversified. For equities, it includes companies headquartered in both the United States and throughout the world. It includes both large companies and small companies. And while the bond portfolio invests just in U.S. bonds, it covers both government and corporate bonds.

In fact, each of these funds represent investments in thousands of stocks and bonds:

- Vanguard Total Bond Market Index Fund: 10,025 bonds

- Vanguard Total Stock Market Index Fund: 3,640 stocks

- Vanguard Total International Stock Index Fund: 7,361 stocks

Yeah, a three fund portfolio is diversified.

Historical Returns of a 3-Fund Portfolio

The returns of the portfolio depend in large part on how much of the portfolio is allocated to each of the three funds. We’ll look at that in a minute. Based on a standard 80/20 portfolio, however, the returns have been excellent over the last several decades. In fact, over the long-term this portfolio outperforms the majority of actively managed mutual funds.

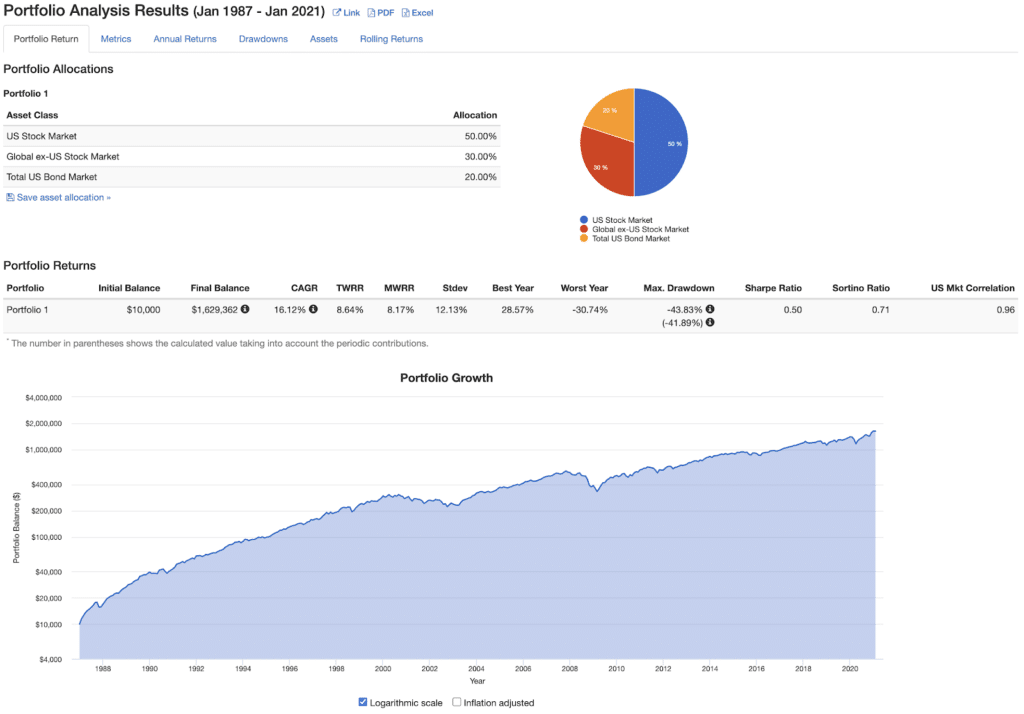

Since 1987, the three fund portfolio has returned compound annual growth rate of over 16% using the following allocation and assuming a $10,000 starting balance and $500 monthly contributions adjusted for inflation:

- US stock market 50%

- Global stock market excluding the U.S. 30%

- Total U.S. bond market 20%

Here, it’s important to understand how contributions to a portfolio can affect its returns. In the above screenshot, I assumed a starting balance of $10,000 in January 1987. I also assumed monthly contributions of $500, adjusted for inflation. If instead we assumed a $10,000 initial contribution with no additional monthly investments, the compound annual growth rate of the portfolio would be just over 8.5%.

Why would this be? It’s because the monthly contributions were made at different price points. With dollar-cost averaging, we invest in both good times and bad. This stream of investments affect the compound annual growth rate of a portfolio, just as systematic withdrawals in retirement do.

Regardless, the three fund portfolio has performed very well over the last three to four decades.

How to Create a 3-Fund Portfolio

We need to answer three questions when building a three fund portfolio:

- What percentage do we allocate to each fund?

- What mutual fund family do we use?

- Where do we hold our investments?

What percentage do we allocate to each fund?

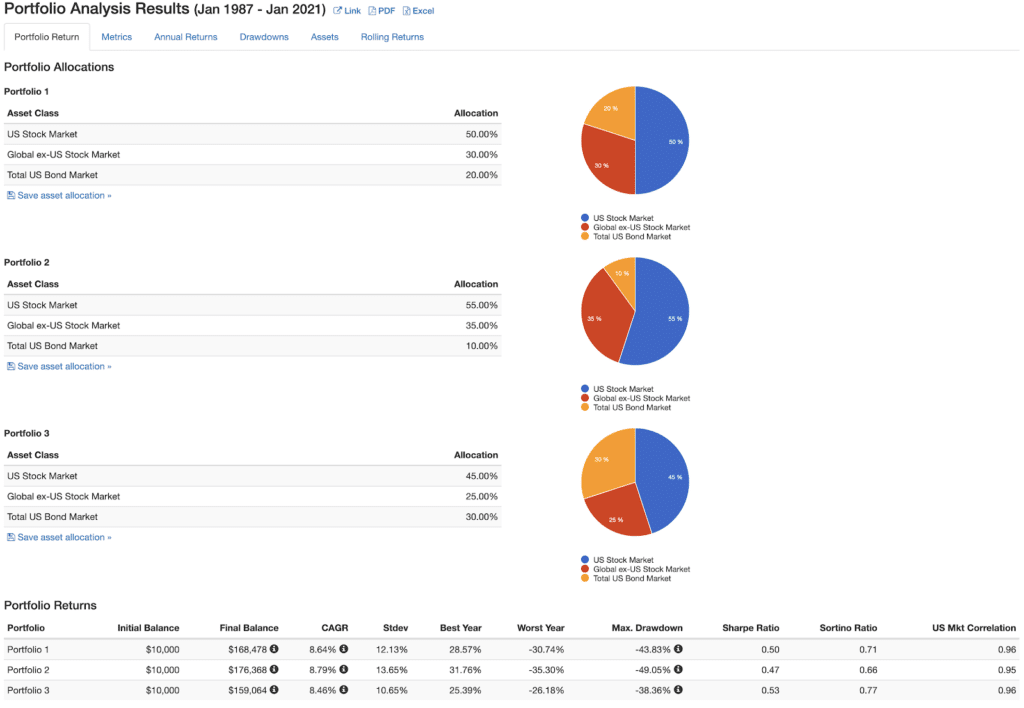

For long-term investors saving for retirement, I believe that a 90/10 portfolio is ideal. Such a portfolio, however, will from time to time suffer significant losses in the short-term. For those that are unwilling to handle that volatility, an 80/20 or even 70/30 portfolio is certainly reasonable.

As you make the decision, keep in mind that the expected returns and volatility can vary significantly based on the stock to bond allocation. Indeed, it’s the most important decision one makes with regard to asset allocation. The following chart shows the compound annual growth rate and standard deviation of these three portfolios based on an initial contribution of $10,000 and no additional monthly Investments.

The above allocations are merely suggestions. One of the features of the three fund portfolio is that you can customize the allocation to your specific requirements. Even within say a 90/10 portfolio, there’s no set rule on how much should be allocated to U.S. stocks vs international stocks, for example.

That being said, I tend to put about 60% of the stock allocation in U.S. stocks and 40% in international stocks. This is consistent with the Bogleheads’ approach.

What mutual fund family do we use?

You can build a three fund portfolio using any low-cost index funds. While Vanguard is the most popular choice, it’s certainly not the only option. Below I’ve listed mutual fund options from major mutual fund companies, and I’ve also included the ETF options from Vanguard. I’ve also included the funds one could use from the Thrift Savings Plan to build a three fund portfolio.

Vanguard

- Vanguard Total Stock Market Index Fund (VTSAX)

- Vanguard Total International Stock Index Fund (VTIAX)

- Vanguard Total Bond Market Fund (VBTLX)

- Vanguard Total Stock ETF (VTI)

- Vanguard Total International Stock ETF (VXUS)

- Vanguard Total Bond Market ETF (BND)

Fidelity

- Fidelity ZERO Total Market Index Fund (FZROX) or Fidelity Total Market Index Fund (FSKAX)

- Fidelity ZERO International Index Fund (FZILX) or Fidelity Total International Index Fund (FTIHX)

- Fidelity U.S. Bond Index Fund (FXNAX)

Charles Schwab

- Schwab Total Stock Market Index (SWTSX)

- Schwab International Index (SWISX)

- Schwab U.S. Aggregate Bond Index Fund (SWAGX)

Thrift Savings Plan

- C fund

- I Fund

- F Fund, or alternately, the G Fund

T. Rowe Price

- Total Equity Market Index Fund (POMIX)

- International Equity Index Fund (PIEQX)

- U.S. Bond Enhanced Index Fund (PBDIX)

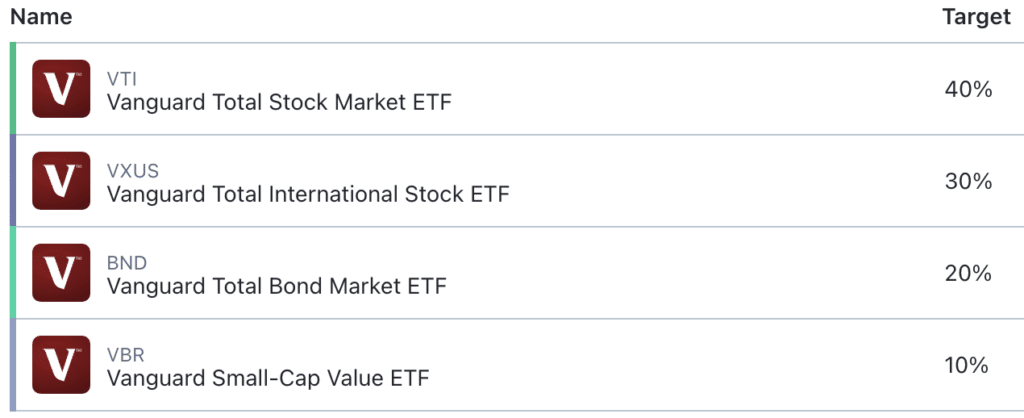

How to Build a 3-Fund Portfolio in M1 Finance

One of the easiest ways to build and manage the three fund portfolio is through M1 Finance. M1 Finance is an online broker that charges virtually no fees and makes building and rebalancing a portfolio very easy.

One key aspect that makes it ideal is that the portfolio can be rebalanced with the click of a button. M1 Finance does not charge any trading fees, and you can set the allocation of each fund as you wish. As you make new contributions, M1 Finance allocates them to the funds in your portfolio in a way to rebalance them to your original asset allocation.

I created the portfolio in M1 Finance, which you add to your portfolio in M1 Finance if you use the broker.

Supercharge the 3-Fund Portfolio

There are several ways one can increase the expected returns of a three fund portfolio without significantly increasing its volatility. While these require investing in additional funds in the portfolio, the portfolio is still very manageable. In addition, if you use M1 Finance, the addition of one, two or three more funds does not increase the work required to manage the portfolio.

4-Fund Portfolio–U.S. Small Cap Value

A 4-fund portfolio adds a small cap fund to your portfolio. It’s common to use a fund focused on value stocks given their long-term performance. If you choose to add a small cap fund, you can replace the Vanguard Total Stock Market ETF with a Vanguard S&P 500 ETF, although this certainly isn’t necessary.

5-Fund Portfolio–Emerging Markets

A 5-fund portfolio adds emerging markets to the international portion of the portfolio. Emerging markets have a higher expected return than developed countries, but they also have significantly more volatility. In the context of an overall portfolio, however, the added volatility should be minimal.

6-Fund Portfolio–REIT

A 6-fund portfolio adds real estate. Here it’s important to make sure that any REIT funds are held in a tax-deferred retirement account. REITs distribute a significant percentage of their income each year that is taxed as ordinary income. As a result, I would not recommend this 6-fund portfolio for a taxable account.

FAQs

What is a three fund portfolio?

Three fund portfolio is one designed using just three mutual funds or ETFs. Typically, the funds used are a total stock market index fund, a total international stock index fund and a total U.S. Bond Fund.

How much should be allocated to each bond in a three fund portfolio?

There is no hard and set rule. The Bogleheads version of the three fund portfolio is typically an 80/20 portfolio, with 50% allocated to US stocks, 30% allocated international stocks and 20% allocated to U.S. bonds.

Do I have to open up a Vanguard account to invest in Vanguard funds?

No. You can invest in Vanguard mutual funds and ETFs from just about every broker.

How do you create a three fund portfolio?

You create a three fund portfolio by investing in a U.S. stock index fund, and international stock index fund and a U.S. bond index fund.

Final Thoughts

The 3-fund portfolio is an easy, diversified and low-cost way to invest. In my view, it should constitute the core of any portfolio, if not the entire portfolio. M1 Finance is an ideal broker to build the 3-fund portfolio, given its zero trading costs, ability to invest small amounts of money, and easy rebalancing tools.