7 Best Subscription Manager Apps to Track and Cancel Recurring Charges [2026 Guide]

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

By Rob Berger, JD | February 13, 2026

Subscription services are everywhere. From streaming services and fitness apps to monthly meal kits and cloud storage, they are hard to avoid. While convenient, subscription recurring charges can quietly chip away at your bank balance if left unchecked.

Enter subscription manager apps. These powerful tools do more than just monitor your recurring charges. Subscription manager apps help you understand your spending habits and identify forgotten or unnecessary subscriptions. Below is a list of apps to help you manage your recurring charges with ease, eliminate excess subscriptions, and keep you in the driver’s seat during your financial journey.

My Top 2 Favorite Subscription Manager Apps

1. Monarch Money: I’m always surprised when Monarch Money finds another subscription that I forgot about. Its recurring expense section alerts you to when your next payment is due. This comes in handy for those annual subscriptions that are easy for me to forget. And while Monarch identifies recurring expenses automatically, you can also mark any expense as recurring or non-recurring.

Beyond subscription management, Monarch is one of the most full-featured and easiest to use apps available today. It’s mobile and tablet apps are excellent, too. It’s easy to create and track budgets, and Monarch recently introduced Flex Budgeting, which tracks those expenses that go up and down from one month to the next. You can also track your investments, monitor your cash flow, and get personalized advice.

New AI Assistant: Ask AI about your budget, transactions and other data inside Monarch.

New Receipt Scanner: Scan or upload receipts and Monarch automatically matches it to the transaction, extracts line items, and recategorizes expenses.

App Store Rating: 4.9 (74k reviews)

Google Play Rating: 4.7 (18.4k reviews)

Platforms: Apple iOS, Android or Web

Best for: Budget, subscription management, and investment tracking

Cost: 7-day free trial, then $8.33 per month when paid yearly, and get 50% OFF your first year with code ROB50

Most Popular: 7,376 people chose

Monarch in the last 30 days.

2. Rocket Money: I’ve used and tested Rocket Money for several years and its subscription tracking is one of its best features. The app automatically detects subscriptions and presents them in either a list or calendar view. You can also add transactions as recurring.

In addition, the free version of Rocket Money does all of this. The premium version adds a subscription cancelling feature, but this doesn’t work with all subscriptions.

App Store Rating: 4.5 (310k reviews)

Google Play Rating: 4.6 (123k reviews)

Platforms: Apple iOS, Android or Web

Best for: Subscription Tracking

Cost: Free; Premium for as low as $7/mo.

Summary of Top Subscription Managers

🏆 Best Overall Value (and the app I use)

Monarch Money

- Price: $8.33/month (annual plan)

- Free Trial: 7 days

- Special Offer: 50% OFF first year with code ROB50

- Key Features:

- Automatic subscription tracking

- Recurring payment alerts

- Investment monitoring

- Net worth tracking

- Couples financial management

- Why It’s the Best Value: Most comprehensive features for the price point with excellent UI/UX and reliable subscription detection. GET MONARCH MONEY →

🚀 Best for Subscription Tracking

Rocket Money

- Price: Free; Premium for as little as $7/mo.

- Free Trial: 7 days

- Key Features:

- Subscription tracking

- Bill tracking

- Calendar view

- Credit score monitoring

- Why Choose This: The free version is excellent, and it excels at subscription tracking

- GET Rocket Money→

🔄 Quick Comparison: Monarch Money vs Rocket Money

| Monarch Money | Rocket Money | |

|---|---|---|

| Price | $8.33/mo (annual) $4.17/mo (annual) the first year with Promo Code: ROB50 | Free Version; Premium for as low as $7/mo. |

| Subscription Tracking | Automatic | Automatic |

| Cancellation Service | ❌ | ✅ |

| Investment Tracking | ✅ | ✅ |

| Couples Management | ✅ | ✅ |

| Best For | Full financial management | Subscription Tracking |

| Our Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐½ |

| Try Monarch | Try Rocket Money |

EXCLUSIVE OFFER: Get 50% off Monarch Money with code ROB50 →

Additional Subscription Manager Options

🧠 Best for Financial Planning

Origin

- Price: Limited Time Offer–First year for just $1, then $99/year. Cancel any time.

- Key Features:

- Automatic subscription tracking

- Access to Certified Financial Planners

- High-yield cash account

- Estate planning tools

- AI financial assistant (Sidekick)

- Who It’s Best For: Users looking for comprehensive financial management and planning beyond just subscription management. TRY ORIGIN →

📱 Best for Bill Tracking

Simplifi

- Price: $5.99/month (billed annually) or $2.99/month for first year (limited-time offer)

- Guarantee: 30-day money back

- Key Features:

- Dedicated recurring transactions section

- Automated subscription identification

- Budget management

- Savings goals tracking

- Clean mobile interface

- Why Choose This: Intuitive mobile experience with a clean interface and reasonable pricing. TRY SIMPLIFI →

💻 Best Traditional Software

Quicken

- Price: From $4.99/month (Deluxe, billed annually for first year)

- Key Features:

- Subscription tracking with reminders

- Investment monitoring

- Debt reduction tools

- Long-established brand reliability

- Comprehensive budgeting

- Who It’s Best For: Users who prefer traditional, established financial software with proven reliability. TRY QUICKEN →

📊 Best for Cash Flow Management

PocketSmith

- Price: Free version available; Paid plans from $9.99/month (billed annually)

- Unique Feature: 60-year cash flow projections

- Key Features:

- Manual subscription categorization

- Long-term financial forecasting

- Multiple paid plan options

- Free version available

- Why Choose This: Unmatched cash flow projection capabilities for long-term financial planning. TRY POCKETSMITH →

7 Subscription Manager Apps for Recurring Transactions

1. Monarch Money

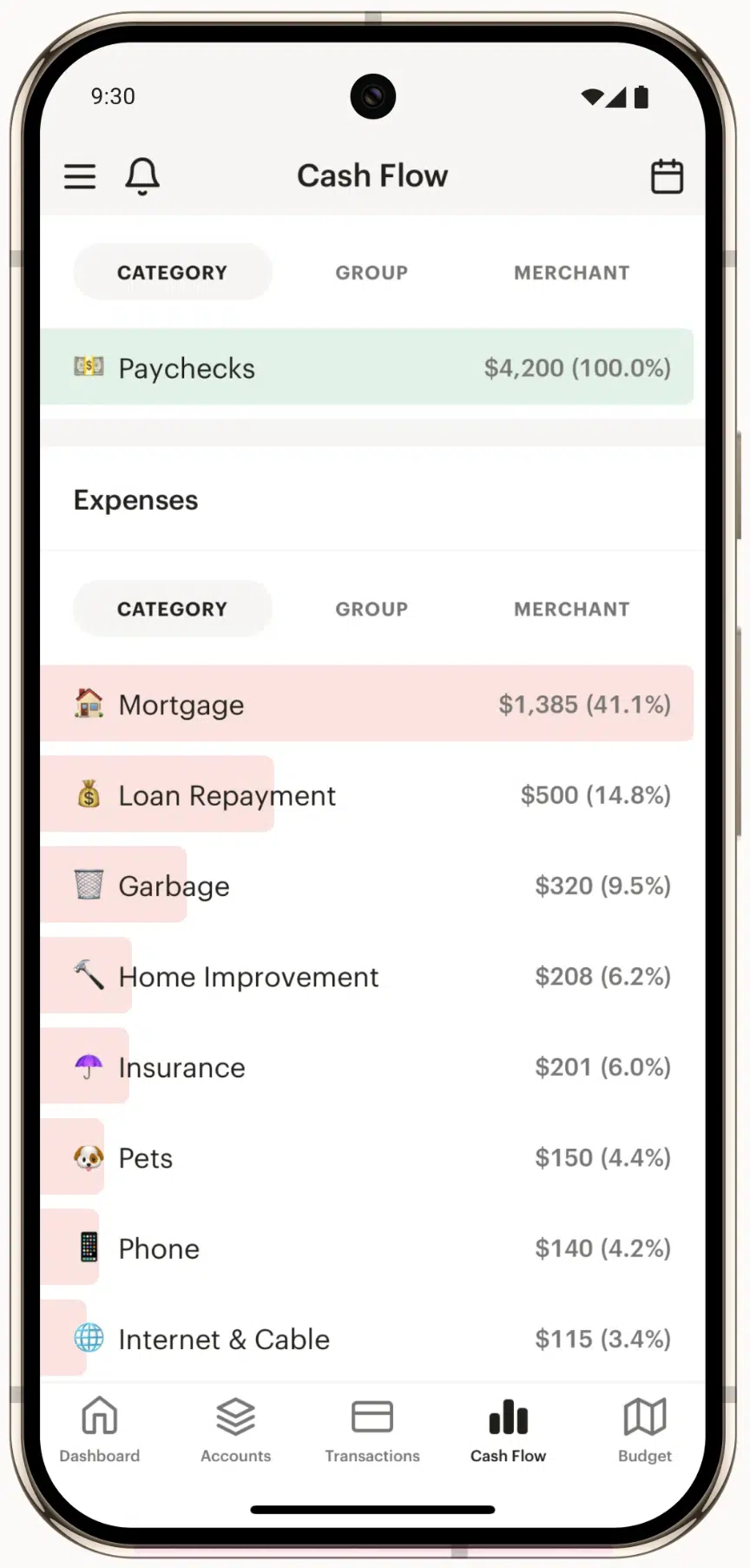

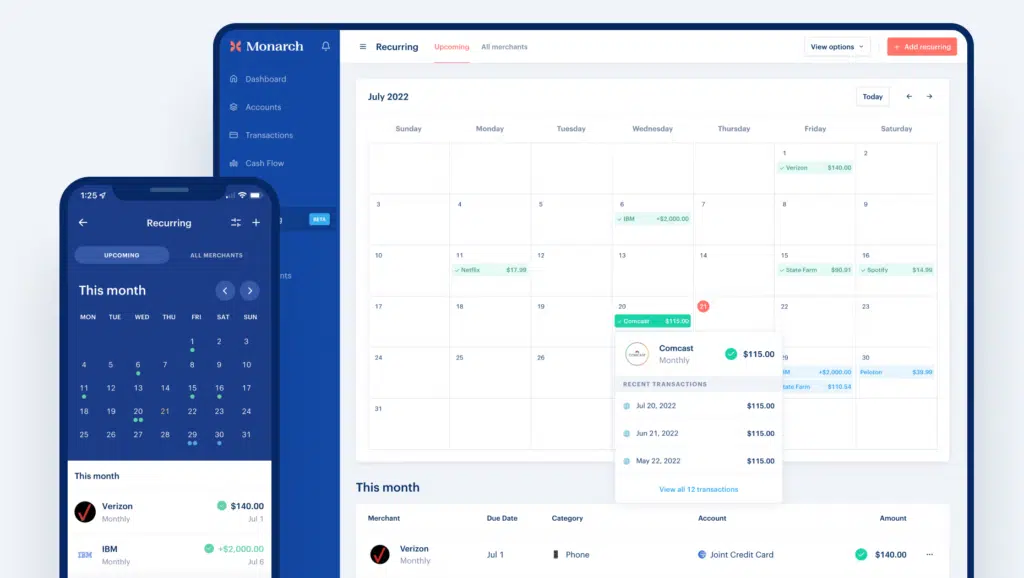

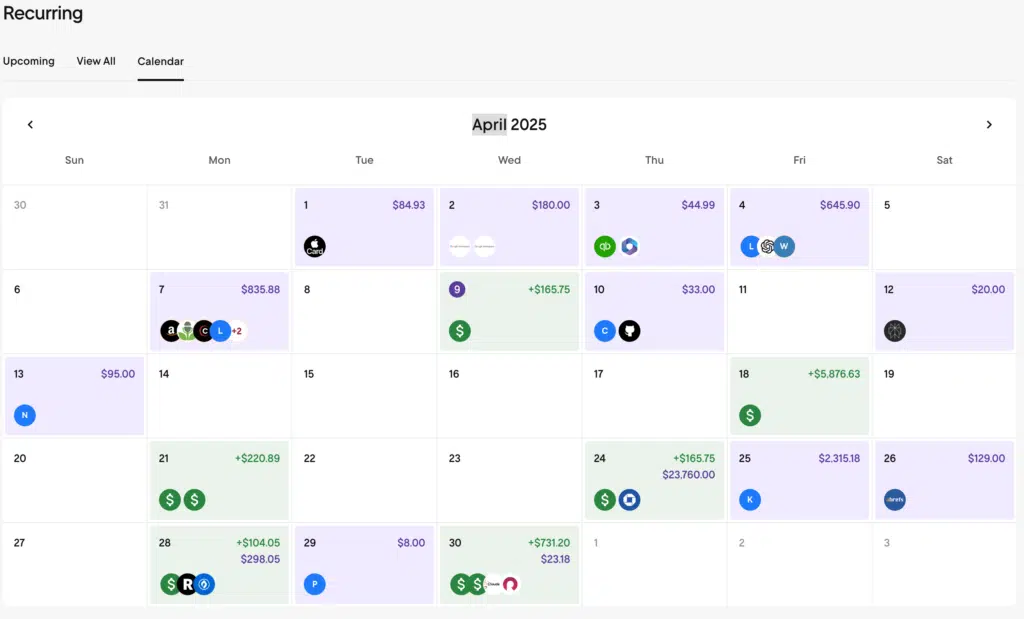

Monarch Money features a dedicated “Recurring” section that automatically identifies and organizes recurring transactions like subscriptions and bills. You can view recurring transactions in a list or a calendar, whichever you prefer, to get an overview of upcoming and completed payments.

Monarch Money also sends notifications three days before a recurring transaction is due to help users avoid missing payments. Users can also manually add recurring transactions in case the system doesn’t automatically identify one.

Other features worth noting include the ability to monitor your investment accounts, track your net worth, and create savings goals. A unique feature allows partners to also enter and track their finances so couples can have a complete view of their household finances in one dashboard.

Key Features

- Automatic subscription tracking

- Dedicated recurring transactions section

- Recurring transaction notifications

- Monitor investments

- Net worth tracking

- Create savings goals

- Great for couples to track finances

- One-week free trial

Monarch Money is $14.99/month or $99.99/year ($8.33 per month). You can get a one-week free trial, and get 50% OFF your first year with code ROB50

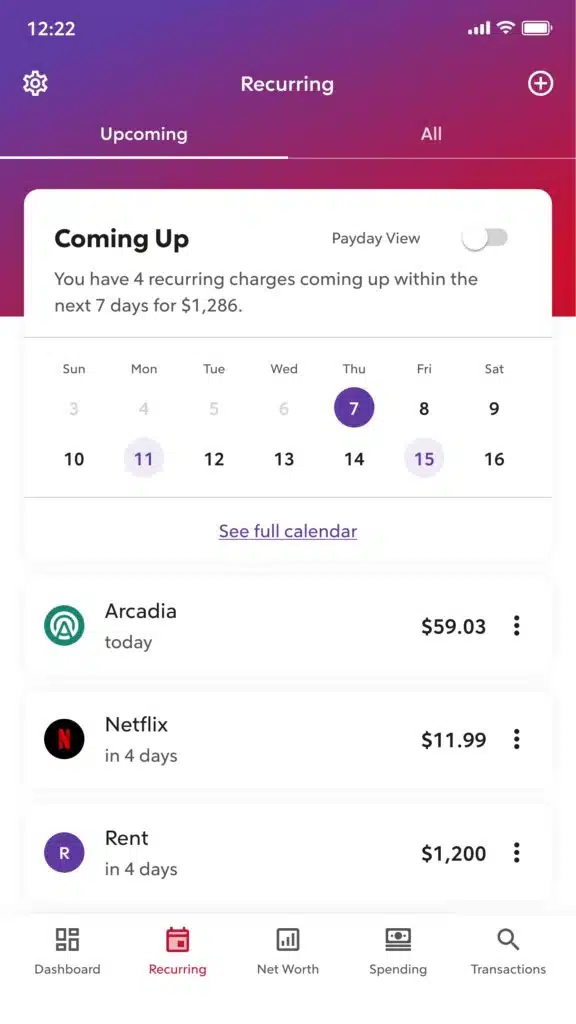

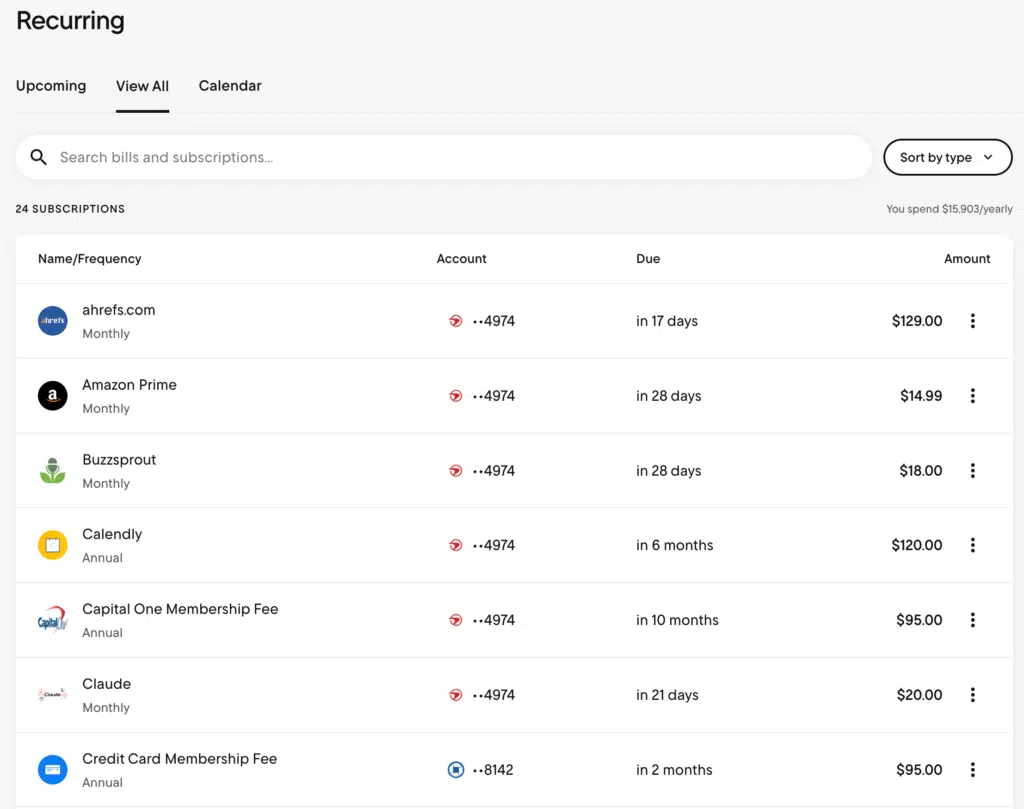

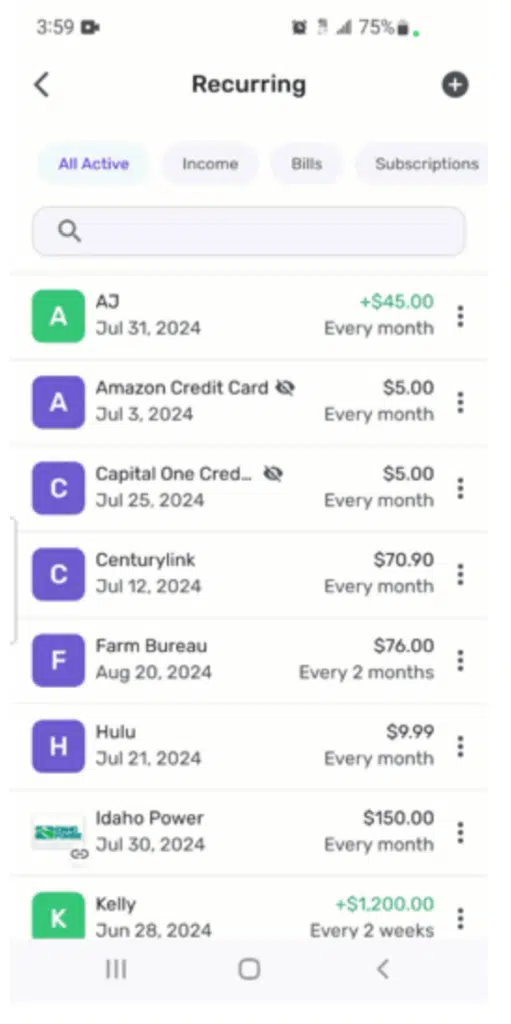

2. Rocket Money

I’ve used Rocket Money for the past year and it has become one of my go-to budgeting apps. Its subscription management feature is one of the best available. And it’s simple to use.

The Rocket Money app includes a section for recurring expenses. The section displays the service you’re subscribed to, the last four digits of the account number, the next subscription payment due date, and the amount. The due date is a nice feature because it captures annual subscriptions I’ve often forgotten about.

Here’s what the recurring expense section looks like for my business (yes, Rocket Money can track your business expenses, too):

You can also see your subscriptions in a calendar view:

Rocket Money’s subscription management comes with its free version. For as little as $7 a month for the Premium version, you can get Rocket Money’s help cancelling subscriptions. Keep in mind, however, that not all subscriptions can be cancelled with Rocket Money’s automated service. You can try the Premium service for free for 7 days, although I used the free version for years to track our recurring expenses.

Key Features

- Subscription tracking

- Calendar view

- Track your spending

- Free version available

- Subscription cancellation assistant

- Credit score tracking

- Automatic savings feature

- Balance alerts

- Link your bank accounts

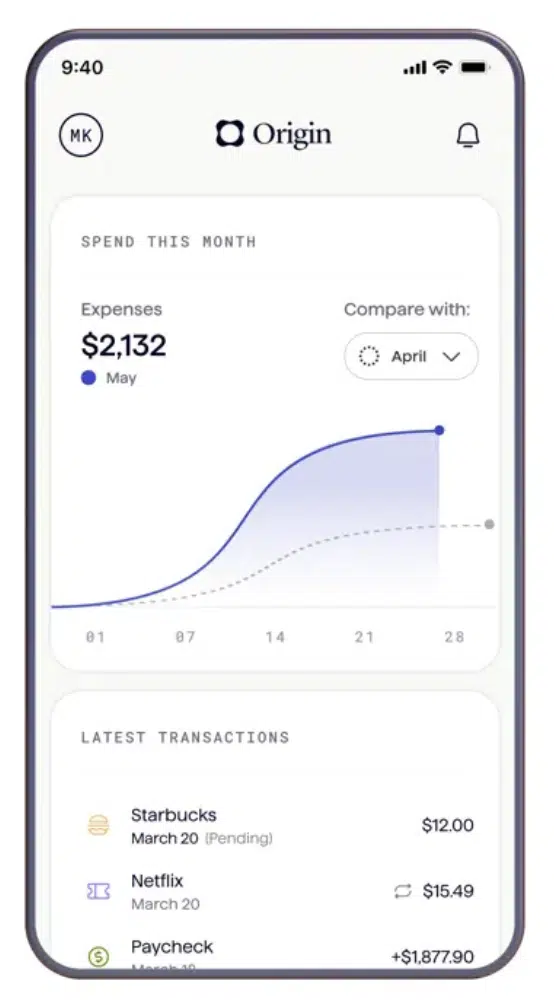

3. Origin

Origin is an app that automatically identifies recurring expenses, including subscriptions, bills, and regular payments, and puts them in one list. This allows you to see exactly how much you’re spending on subscriptions each month. You can also spot subscriptions you no longer need or want so you can cancel going forward.

Beyond subscription management, Origin provides several unique features including a high-yield cash account, access to automated investing, estate planning tools, and access to Certified Financial Planners and more. Some users might also find Origin’s AI tool called Sidekick useful. Users can ask Sidekick money-related questions and get instant answers.

Origin is running a limited time offer–get the first year for just $1, then $99/year.

Key Features

- Automatically identifies recurring expenses

- Dedicated recurring expenses list

- Access to high-yield cash account

- Access to automated investing

- Access to estate planning tools

- Access to Certified Financial Planners

- Instant answers to questions from Sidekick

- 7-day free trial

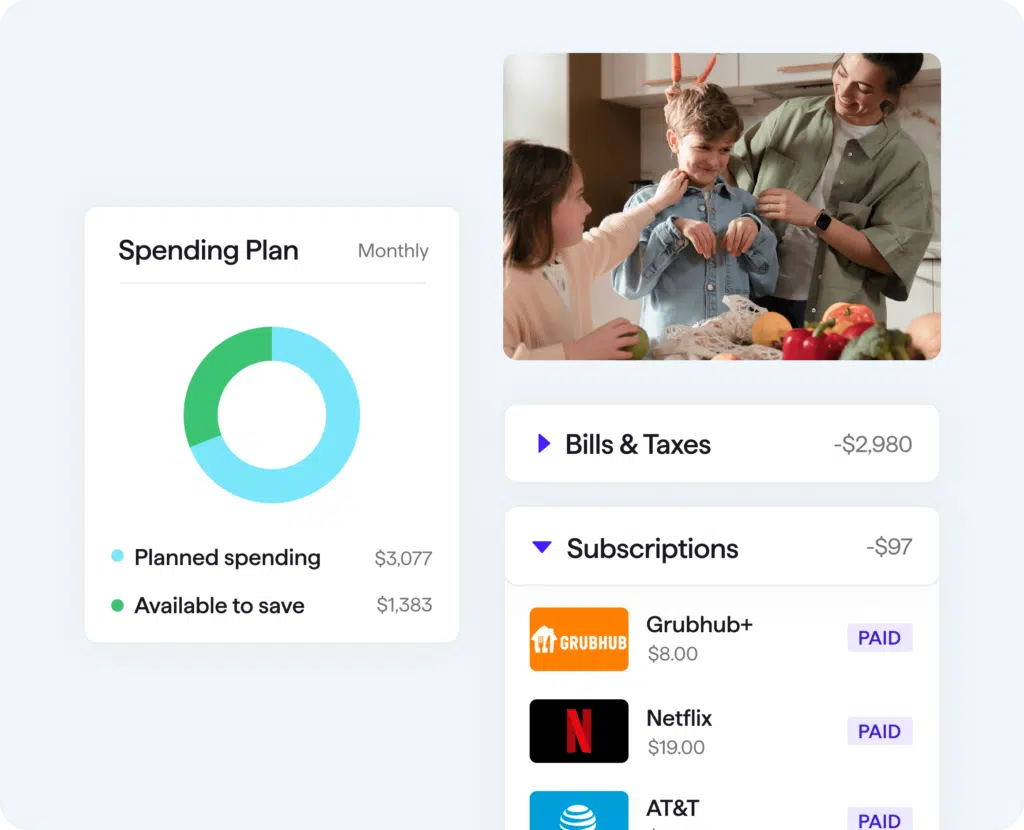

4. Simplifi

Simplifi allows users to create and manage recurring transactions in the Recurring Series section of the app. Simplifi can also find and mark transactions as recurring items. If it misses a recurring transaction, there are a few ways you can manually mark it as recurring. You can go to the Recurring Series section and add the transaction there, or you can find the transaction and mark it as recurring. Then, you’ll see it listed in the Recurring Series list. Manually marking transactions as recurring also helps Simplifi automatically identify them later.

Other Simplifi features include connecting your bank accounts, credit cards, and investment accounts for a comprehensive view of your finances. You can also set savings goals and manage your budget.

Simplifi is $5.99/month, but it’s billed annually which totals $71.88 per year. They do run sales, however, and for a limited time you can get Simplifi for $2.99/month. While there isn’t a free trial, their website does say they offer a 30-day money back guarantee.

Key Features

- Dedicated section for recurring transactions

- Automatically identifies recurring transactions

- Connect your bank accounts

- Set savings goals

- Manage your budget

- 30-day money back guarantee

- Billed annually

5. Quicken

Quicken is a robust version of Simplifi and allows users to manage your recurring charges like subscriptions. Users can also set up reminders for these transactions. This can help you keep track of subscriptions, which ones are coming up, and which ones you might want to cancel before they’re paid.

Quicken is a well-known budgeting tool and it’s been around for quite awhile. Which means you can trust that it will likely be around for years to come. Quicken can also monitor investment accounts and set and track savings goals. A standout feature is the debt reduction tool to help users pay off debt.

Quicken is available in Deluxe at $5.99/month and Premier at $7.99/month. Each plan is billed annually, and they are currently running sales to reduce these prices for the first year.

Key Features

- Subscription tracking

- Subscription reminders in case you want to cancel before paying

- Well-known budgeting tool

- Investment monitoring

- Set and track savings goals

- Debt reduction tool

- Plan billed annually

6. PocketSmith

PocketSmith doesn’t have a dedicated feature to manage subscriptions but you can still manage recurring transactions, including subscriptions. PocketSmith allows users to categorize and label transactions. For example, you can create a category for Subscriptions. Then you can further label each Subscription how you would like. Let’s say you have a TV streaming subscription, a podcast Patreon subscription, and a music streaming subscription. You can use the labels to name them: TV, Podcast, and Music. If you want to see the full list of subscriptions you’re paying for, you can search for your subscriptions in PockeSmith.

PocketSmith also has a cash flow projection feature. According to PocketSmith, this feature allows you to see your daily bank balance up to 60 years in the future. That’s mind-blowing.

PocketSmith offers a few different plans including a free version. However, the free version does not automatically import your bank transactions so you’ll have to import transactions manually. Pricing for the paid plans start at $9.99/month if billed annually or $14.99 on a month to month basis.

Key Features

- Manually categorize and label transactions as Subscriptions

- Cash flow projection up to 60 years in the future

- Free version available

- Paid version allows you to automatically import bank transactions

- 3 paid plans to choose from

7. Empower

Empower does not have a dedicated subscription management tool, but it’s still one of the most powerful personal finance apps I’ve used. That’s why it deserves a spot on this list. This is the only totally free option available today.

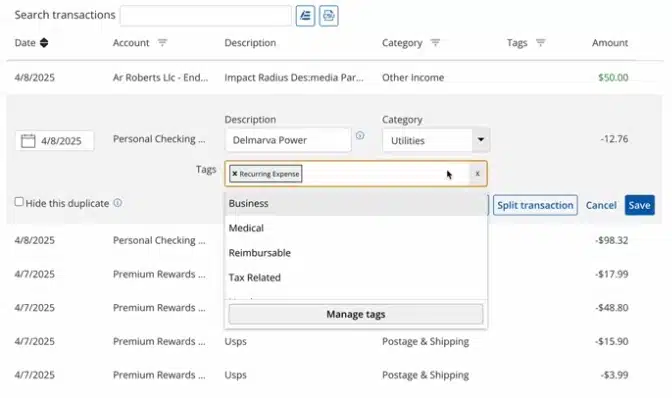

While Empower doesn’t automatically identify or track recurring expenses, you can choose to do it manually. Empower allows users to create custom tags for transactions. I’ve created a tag called “Recurring Expenses” that I can apply to all my subscription charges—streaming services, software, cloud storage, etc. Again, it is a DIY process, but once you get into the habit, it’s easy to maintain.

Here’s how to add a custom tag to a transaction in Empower:

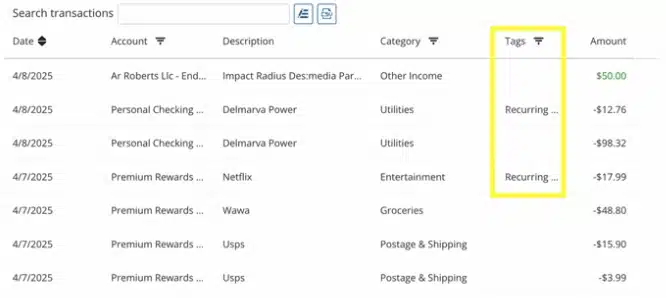

And here’s what a custom-tagged transaction looks like in Empower:

Empower is most known for giving users a broad picture of their finances and net worth. You can link all your accounts including checking, savings, credit cards, loans, investments. The dashboard allows you to see everything in one place and it’s easy to use.

If you’re looking for a free, customizable financial dashboard and don’t mind manually tagging recurring transactions, Empower is a solid option.

Key Features

- It’s free

- Excellent financial dashboard

- Net worth tracking

- Tag transactions to find subscriptions

- DIY option for tracking subscriptions

- Broad overview of your finances

- Link your bank accounts

- Track investments

- Easy to customize

Subscription Management App Comparison

📋 Complete Comparison: All 7 Subscription Manager Apps

| Monarch Money | Rocket Money | Origin | Simplifi | Quicken | Pocket Smith | |

|---|---|---|---|---|---|---|

| Starting Price | $8.33/mo | Free | $8.25 /mo | $2.99/mo | $5.99 /mo | Free |

| Premium Price | $8.33/mo | $7-$14 /mo | $12.99 /mo | $5.99/mo | $7.99 /mo | $9.99 /mo |

| Subscription Tracking | Automatic | Automatic | Automatic | Automatic | Manual | Manual |

| Mobile App | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Free Version | ❌ | ✅ | ❌ | ❌ | ❌ | ✅ |

| Investment Tracking | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ |

| Subscription Cancellation | ❌ | ✅ | ❌ | ❌ | ❌ | ❌ |

| Unique Strength | Couples Finance | Cancel Services | Financial Advising | Mobile UI | Debt Reduction | Cash Flow Projection |

| Best For | Complete Financial Management | Subscription Elimination | Financial Planning | Mobile Users | Traditional Software | Future Planning |

| App Store Rating | 4.9/5 | 4.4/5 | 4.6/5.0 | 4.4/5.0 | 4.7/5.0 | 3.1/5.0 |

| My Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐½ | ⭐⭐⭐⭐½ | ⭐⭐⭐⭐ | ⭐⭐⭐½ | ⭐⭐⭐ |

| Try Monarch | Try Rocket Money | Try Origin | Try Simplifi | Try Quicken | Try PocketSmith |

How to Choose the Right Subscription Manager App

- Budget Considerations

- If cost is your primary concern, start with free options like Empower or Rocket Money’s free version

- For the best value with comprehensive features, Monarch Money offers the most complete package

- Feature Priorities

- For automatic cancellation: Choose Rocket Money Premium

- For couples finance: Choose Monarch Money

- For financial advice: Choose Origin

- Ease of Use

- For beginners: Simplifi offers a very intuitive interface

- For detailed tracking: Monarch Money and Rocket Money provide the best automatic tracking

- For traditional software users: Quicken offers familiar interfaces

- Special Circumstances

- Business expenses: Rocket Money works well for business subscription tracking

- Investment focused: Empower offers the best investment tracking

- Debt reduction: Monarch Money has specialized debt payoff tools

EXCLUSIVE OFFER: Get 50% off Monarch Money with code ROB50 →

Summary

If you’re not careful, subscriptions can silently siphon money from your bank account. Every tool in this list can help you keep track of those sneaky recurring transactions. The best part is that some of these tools can do that for free!

The goal here is to cut waste and make more intentional decisions with your money. Smart subscription tracking isn’t just about saving a few bucks, it’s much more. It’s about taking control and building habits that support financial wellness and eventually, financial freedom.