Origin Review: A Financial Planning App That Goes Beyond Budgeting

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

By Rob Berger, JD | Last Updated January 3, 2026

For years, the dearly departed Mint was the go-to tool for tracking budgets and expenses. Since its shutdown, many people are still searching for a replacement. Enter Origin.

Unlike most budgeting apps, Origin isn’t just about tracking spending. It’s an all-in-one financial management platform for budgeting, investment tracking, estate planning, tax filing, and even the ability to connect with a CPA. That’s quite a list and precisely why Origin is a standout among personal finance tools.

Is Origin right for you? We signed up for a free trial to see how it works and to help you decide if it’s worth the cost. Here’s our full Origin review.

What Is Origin?

Origin connects all your financial accounts in one place. From there, it can provide insights through either AI (called Sidekick) or a real financial planner (at an additional cost). According to Origin, the goal is to make financial advice accessible and approachable for all.

While most competitors excel in one area—budgeting, investing, or retirement planning—Origin takes a broader approach. In addition to all of the functions we just listed, Origin can also file your taxes, help you write a will, set up a trust, and provide financial advice. Here’s a list of what users can do after signing up for Origin:

- Track your spending

- Track your net worth

- Connect all of your accounts

- Create a personalized budget

- Set and monitor financial goals

- Track bills and subscriptions

- Track your credit score

- Access a high-yield savings account

- Invest in curated “stock bundles” or set up auto-investing

- Plan for retirement with forecasting tools

- Write a legally valid will

- Set up a trust

- File your taxes directly in the app

- Connect with a CFP

Some of these services (like CFP sessions, estate planning upgrades, or tax pro support) cost extra, but most features are included in the membership.

Getting Started with Origin

Signup and Trial

Step 1: Sign-up, trial availability, what information is required

You can sign up for a free 7-day trial to play with all the features. Simply enter your full name and your email address and choose whether you’d like to be billed annually or monthly. You can pay with either Link or Apple Pay.

The first week is free, and Origin gives you a push notification to let you know your free trial is about to expire, but you still need to sign up with a credit card. If you don’t cancel, the plan renews automatically at $12.99/month or $99/year.

When you sign in, Origin will ask what is most important to you:

Step 2: Connecting your accounts

Origin uses MX, Finicity and Plaid to connect with banks, brokerages, and investment firms. It seamlessly connected to Discover and my bank account. For some credit cards, you’ll have to log in before they’ll connect. You can also add assets manually, like cars, jewelry, or fine art.

Once all of your accounts are linked, Origin will send you notifications about your spending (via text or email, whatever your preference), investments, and changes to your credit score.

Origin Dashboard and Features

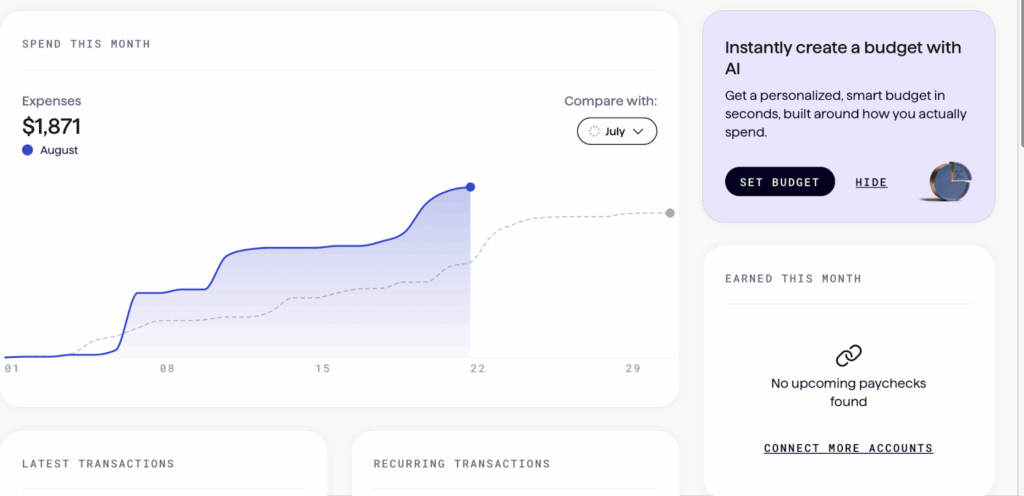

Origin’s dashboard provides a clean overview of your finances. Here’s a look at the dashboard:

Net Worth Tracker

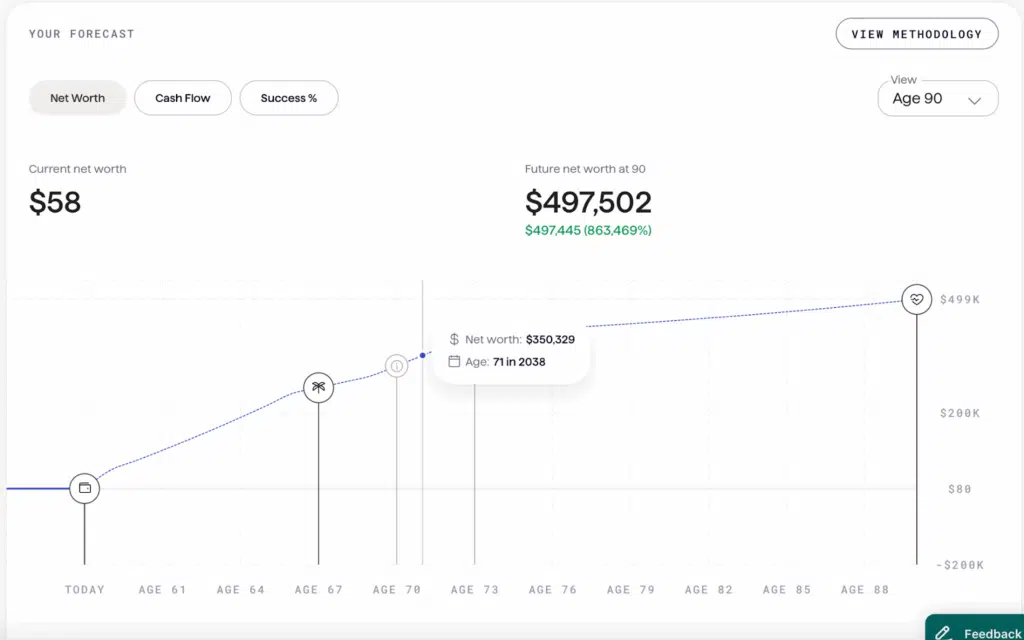

Origin considers your assets (investments, real estate, account balances, and equity) against your liabilities (credit card debt and car loans) to come up with your net worth. Origin’s forecasting tool can estimate your net worth over time, based on an average rate of return. It does make certain assumptions to do this: Inflation will be at 3% and real estate and higher education expenses will increase by 5% a year.

Origin can also add your home and cars to your net worth, but you’ll have to manually enter how much they’re worth. Or, you can link your home to Zillow to get an estimated home value.

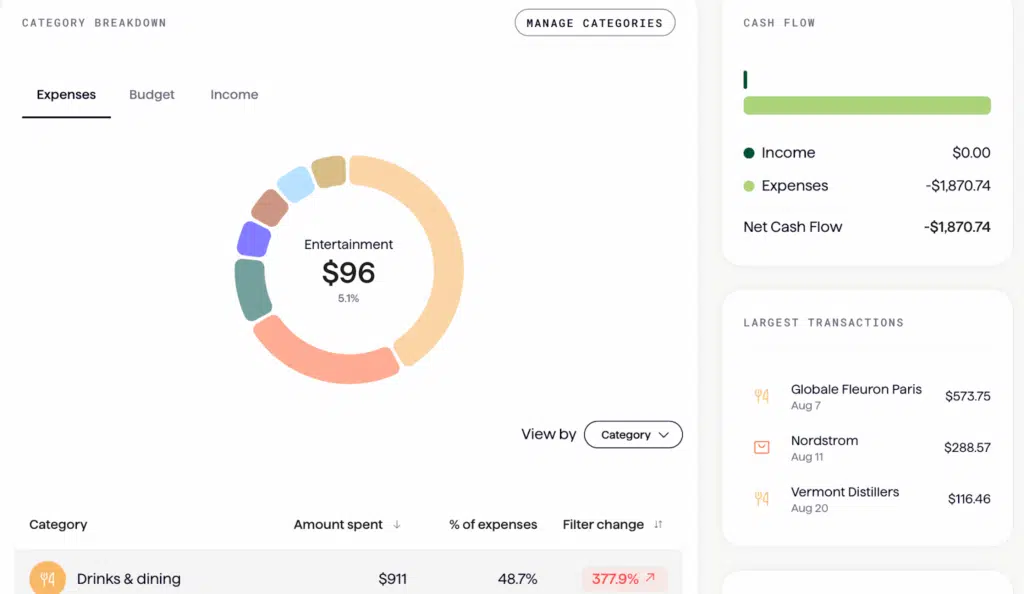

Cash Flow & Budgeting

Cash flow presents you with a chart, which you can compare with last month or any month over the last year.

I asked the AI in Origin to create a budget for me. It told me that my income was inconsistent (which is true), yet I spent a lot of money. I was surprised when it told me I have a bill coming up in May, a subscription I had forgotten about entirely.

You can add or subtract budget categories, or create new categories, as you see fit. You can also create rules. For example, you can have all of your Uber charges go to the “transportation” category, or mark all purchases at a certain gas station as work expenses.

Origin’s budgeting is straightforward, where you set a budget for each category, track your expenses and then compare the two. According to Reddit users, the budgeting feature is not Origin’s strongest feature so if you strictly want a budgeting app, you might consider Monarch Money or Rocket Money.

However, Origin stands out by offering professional advice from a CFP on budgeting or anything else. You can connect with a CFP starting at $119/session.

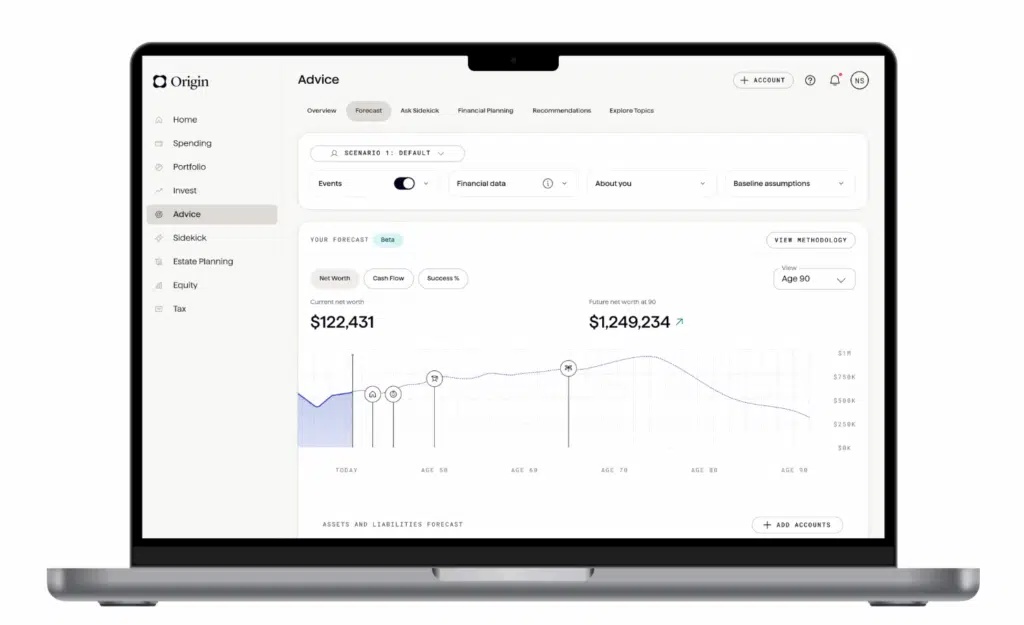

Goal Tracking and Forecasting

The forecasting feature can show you how close you are to your goals. Origin will encourage you to put aside money for an emergency fund, and to save 10% – 15% of your gross income for retirement.

While you won’t find a “Goals” section as one of the main tabs on your dashboard, you can find this under the Advice tab. From there, you can navigate to the Forecast menu option.

Forecasting also allows you to play with different scenarios like changing jobs, having a child, and other milestones to see how it affects your financial goals.

To begin your forecast, Origin will ask you about your income, age you’re planning to retire, current expenses and projected expenses to come up with your net worth at whatever life expectancy you enter.

There’s a list of “events” you can choose when using with the forecast tool:

- Retirement

- Buy a home

- Sell a home

- Have a kid

- College savings

- Windfall event

- Additional income

- Equity

- Custom event

You can add whatever you want under “custom event” but you’ll have to figure out how much this event will cost you and if it’s taxable. You’ll also need to enter the start year and end years. So, if you’re hoping to move to Costa Rica in your retirement, there’s a lot of estimating you’ll have to do yourself and manually input.

Origin for Couples

A new-ish feature of Origin is the ability for both you and your partner to link all of your accounts. You can connect checking, savings, credit cards, loans, mortgages, investment accounts, retirement accounts, and of course, set up a budget.

Unlike some apps, you can choose to combine all of your accounts or keep some separate so your birthday surprises can stay surprises. What I particularly like is that you and your spouse can choose a different color, so that you can easily see at a glance who spent what.

Another handy feature is the toggle switch. This makes it easy to view your accounts and your and your partner’s combined accounts by just toggling a switch. Your partner can join Origin for no additional cost. Even better, each partner can have their own login to access the shared account.

High-Yield Savings Account

Origin offers a FDIC-insured high-yield savings account earning well over 4.00% APY as of this writing, which is a solid rate.

Alerts & Insights

On the home page, you can go to settings and choose how you want your notifications sent (email or text). On the investing side, you’ll get notifications if there are significant portfolio changes as well as market updates.

Investing Features

Not only can Origin track the investments you already have, but you can also invest through the platform. Besides the high-yield savings account mentioned above, you can engage in auto-investing or invest in curated stock bundles. There is no minimum amount you need to invest.

If you’re interested in auto-investing, go to the invest tab on the dashboard and click “Open Auto Index Account.” It will then ask you about your investing experience, goals, time horizon, and risk tolerance. Based on your answers, Origin will recommend individual taxable investment accounts. You link a bank account, transfer money and that’s that.

Stock bundles are curated bundles of 8-20 stocks. You can choose from bundles called Buffet’s Picks, Chip Champions, Ocean and Orbit, or any of the other 15 bundles Origin offers. They all have a specific focus, such as Clean Energy or Mid-cap Movers.

Origin doesn’t charge any AUM (assets under management) fees for investing, but DriveWealth, Origin’s custodian, may charge a fee, which will be disclosed to you when you open an account.

Financial Guidance

You can get advice from the financial AI, called Sidekick, or you can use a real human (for an extra fee). If you choose Sidekick, you can ask questions pertaining to your finances, such as how can I create an emergency fund or how much did I spend on groceries this year.

If your question is complex, (how much should I save for my kid’s college education) Sidekick will give all the usual steps (estimate future college costs, plan for inflation, set a savings goal) and then it will recommend that you meet with a CFP for more personalized advice.

Filing Taxes

Origin can file your Federal and State taxes for you. You can upload all your documents like you would on TurboTax or any other tax program and Origin will file your taxes for you. If you need the assistance of a Tax Pro, you can also get expert-assistance for $189. Even if you start your free trial during tax season, Origin will still file your taxes for free.

Estate Planning

Origin can help you write a basic will stating where you want your assets to go and what to do with the body. If you want more, such as guardianship of surviving children and pets, power of attorney, health care proxy, etc., you can go with the full will for $149. Should you need to set up a trust or other more complex issues, the Trust is $449.

Security & Privacy

All account connections are read-only, meaning Origin can see balances but can’t move money. The platform uses 256-bit encryption and supports multi-factor authentication. If you want to enable multi-factor authentication, go to the “Accounts” section and scroll down to find security. There’s a toggle switch to turn on multi-factor authentication.

Origin doesn’t have ads or sell your data, although you may get the occasional notification about referring friends.

Pricing

Origin offers a free 7-day trial, which you can sign up for via Apple Pay or Link. Origin will send you a push notification to let you know your free trial is about to expire so you can cancel it before you’re billed. The cost is $12.99 a month, or $99 a year (billed as $8.25 a month).

Again, there is no extra charge to add your partner–all your combined and separate accounts are still $99 a year.

Comparing Origin to Alternatives

Origin vs. Empower

Empower is free, although there is a 0.89% investing fee for the first $1 million you invest. But the tools for net worth, investing, and retirement planning are all free, and there’s no requirement that you invest with Empower to use these tools. Origin is $12.99 a month (or $99/year) and this includes all of the features, although there are a few fees for human guidance and estate planning should you need it.

Empower does have budgeting, but it’s better at wealth and investment tracking. Origin has a more robust budgeting feature and the AI can provide assistance to help you set goals and gain insights into your spending.

Origin vs. Rocket Money

Origin wants to be your one-stop-shop financial app, whereas Rocket Money is focused more on budgeting, canceling subscriptions and bill negotiation. Origin can also find your subscriptions, but it won’t cancel them for you, nor will it negotiate your bills. On the other hand, Origin is more expensive at $12.99 a month compared to Rocket Money’s $6 to $12 (the user chooses the fee between those amounts). Rocket Money also offers a free version that offers features sufficient for most users.

One thing to keep in mind is that Origin connects to financial institutions through Plaid, MX and Finicity whereas Rocket Money only uses Plaid. Some institutions are more finicky than others and might connect more easily via MX or Finicity.

Origin vs. Monarch Money

Origin is ideal for individuals who want streamlined goal tracking and financial planning with a clean, minimalist interface, while Monarch Money offers more advanced budgeting tools and visual customization for users who prefer greater control and flexibility.

Both are great options for couples and are similarly priced. Monarch Money is $14.99 a month, or $99 a year. Monarch Money also offers a free 7-day trial, and readers of Robberger.com can get 50% off their first year with code ROB50.

What’s Great (Pros) & What Could Be Better (Cons)

Customer service at Origin is stellar. Origin is always hopping onto Reddit to listen to feedback and keep people up to date on upcoming features.

FAQs

Is Origin better than Monarch Money?

That depends. Origin has more features, but Monarch Money is arguably better for budgeting. Some people prefer Monarch’s colorful graphs and some prefer Origin’s more minimalistic look. Both are roughly the same cost, and both offer a free trial, so sign up for both and choose the one that you prefer.

Is there a free version or trial?

There is a free trial! You get 7-days for free, and after that, it’s $12.99 a month or $99/year. During your free week trial you can play with all the features–even filing your taxes for free if your free trial is during tax season.

How secure is Origin?

Origin has bank level 256-bit encryption and you can turn on multi-factor authentication. Origin does not sell your data, and they have access to a “read-only” version of your accounts (Origin can not make changes).

Does it provide investment planning or advice?

Sidekick can evaluate your portfolio and make recommendations that align with your long-term goals and risk tolerance. If you want more human-centered advice, you can employ the services of a CFP for a fee of $119 per session.

Origin does not give you advice on what stocks to buy or where to invest your money.

Final Thoughts & Ideal Users

Origin is great for couples who manage multiple accounts and want to work together better. It’s also great for a busy professionals who want budgeting, investing, estate planning, and taxes in one platform. Or, for anyone who values advice with the AI insights or wants access to a CFP.

Origin easily connected to my accounts and gave me excellent spending insights which I appreciated. I also really like the high-yield savings account, which is a great rate. I also love how responsive customer service is, on Reddit and elsewhere.

If your main goal is deep-dive budgeting, you might prefer Monarch Money. But if you want a single hub for managing your financial life, Origin is one of the strongest tools available today.