9 Best Quicken Alternatives for 2026 (Free & Paid)

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

Quicken was once the go-to budgeting tool. I used it when it was first released in the 1980s. Today, it’s been eclipsed by apps that enable you to manage every aspect of your finances, often for free. I’ve tested dozens of apps, and here are the best Quicken alternatives in 2026.

My Top Picks

Of all the options out there to replace Quicken (now called Quicken Classic), two stand out among the rest:

Monarch Money

4.9

Quicken Simplifi

4.8

Empower

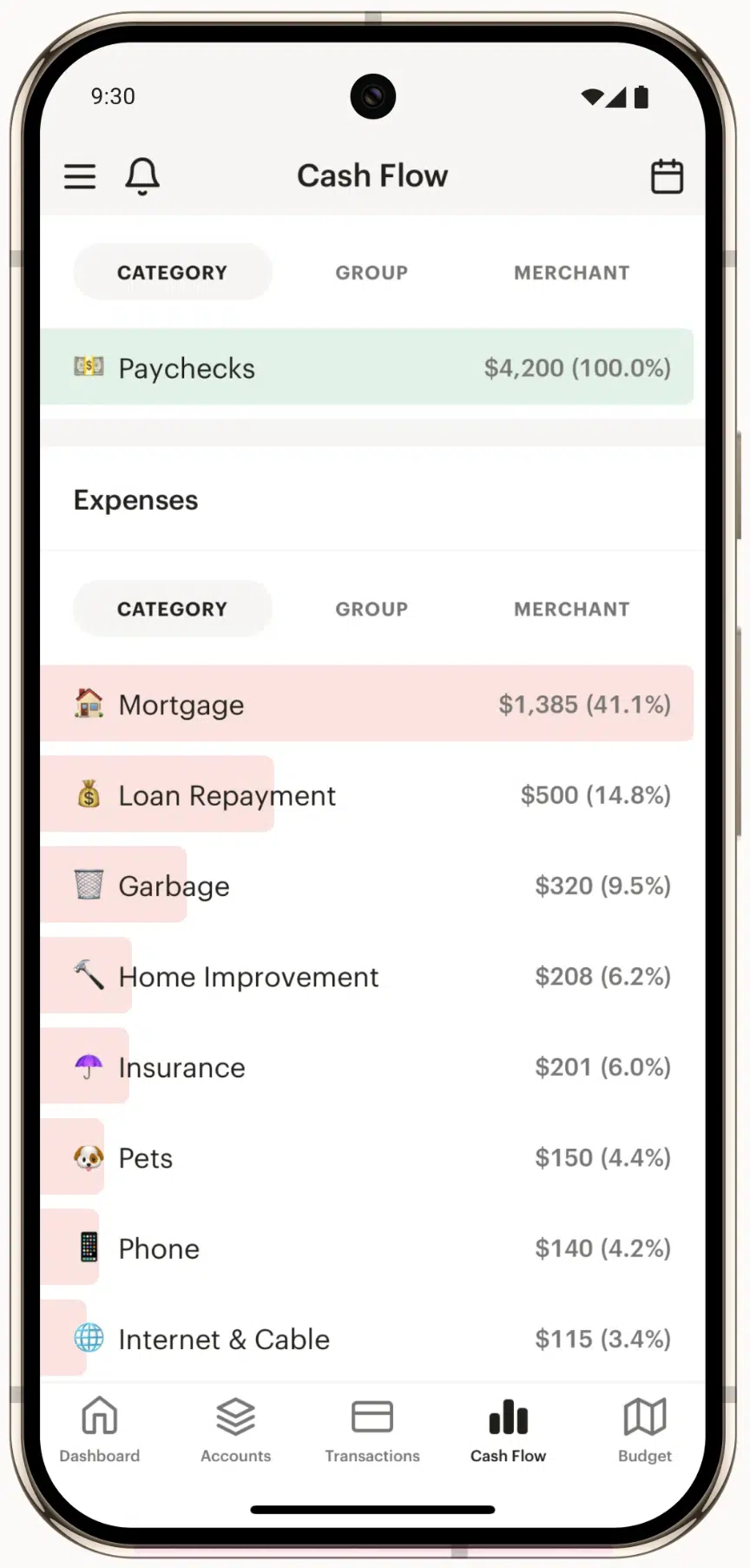

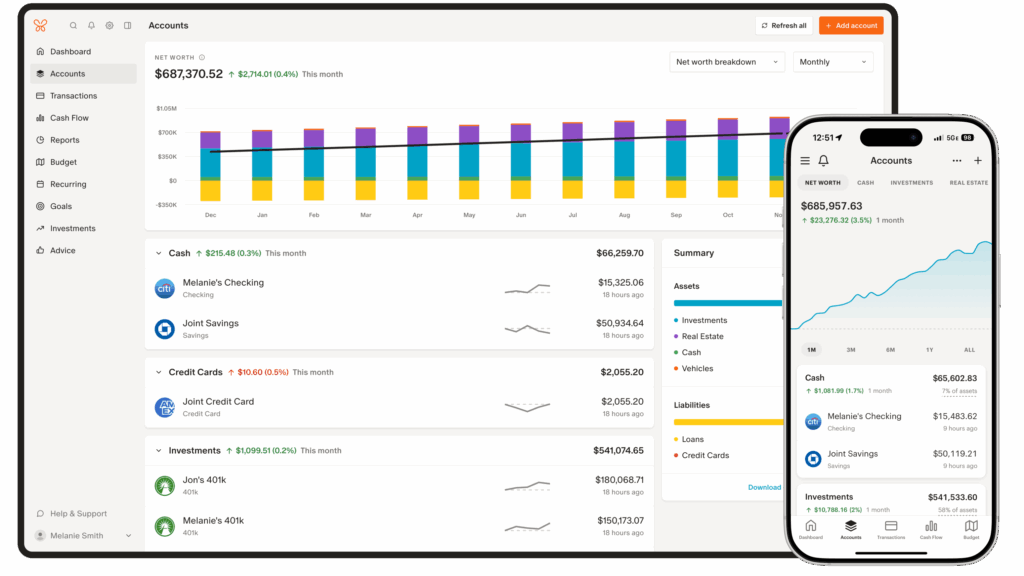

4.81. Monarch Money: I’ve used Monarch Money for about two years and think it’s an excellent budgeting app and option for Quicken users. It tracks budgets and spending, keeps track of recurring expenses like subscriptions, makes creating budget category rules a snap, and has an excellent user interface in both a browser and smartphone. And Monarch recently introduced Flex Budgeting, which tracks those expenses that go up and down from one month to the next.

You can also track your investments, monitor your cash flow, and get personalized advice.

- New AI Assistant: Ask AI about your budget, transactions and other data inside Monarch.

- New Receipt Scanner: Scan or upload receipts and Monarch automatically matches it to the transaction, extracts line items, and recategorizes expenses.

- New Bill Split: Snap a photo of a group bill and divvy it up quickly and easily.

App Store Rating: 4.9 (76k reviews)

Android Rating: 4.7 (18.8k reviews)

Platforms: Apple iOS, Android or Web

Best for Budgeting and Subscription Management

Limited Time Offer: Get 50% OFF your first year with code ROB50

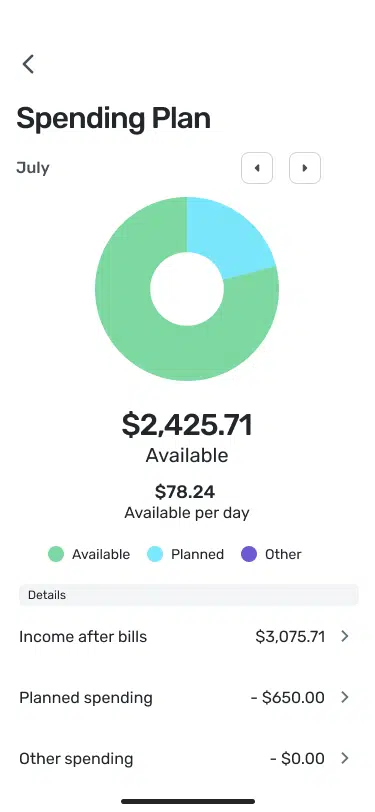

2. Quicken Simplifi: I’ve used and tested Quicken Simplifi since 2021, and what stands out most is how well it balances affordability and functionality. Quicken Simplifi makes it easy to build a spending plan (its term for a budget) and track your expenses automatically. It categorizes transactions as they come in—though you can easily adjust them or create your own rules for more control. Beyond budgeting, Quicken Simplifi helps you monitor your investments, subscriptions, and even monthly bills, all in one place.

If you want to get Quicken Classic data into Simplifi, you’ll need to download your Quicken data to a CSV file. From there you’ll format it according to Simplifi’s requirements, and then upload it into Simplifi.

App Store Rating: 4.5 (9.5k reviews)

Android Rating: 4.5 (3.85k reviews)

Platforms: Apple iOS, Android or Web

Limited Time Offer: $2.99 /month first year billed annually, then $5.99 / month. 30-day money back guarantee

Best for: Create budgets, track spending, monitor subscriptions, track investments

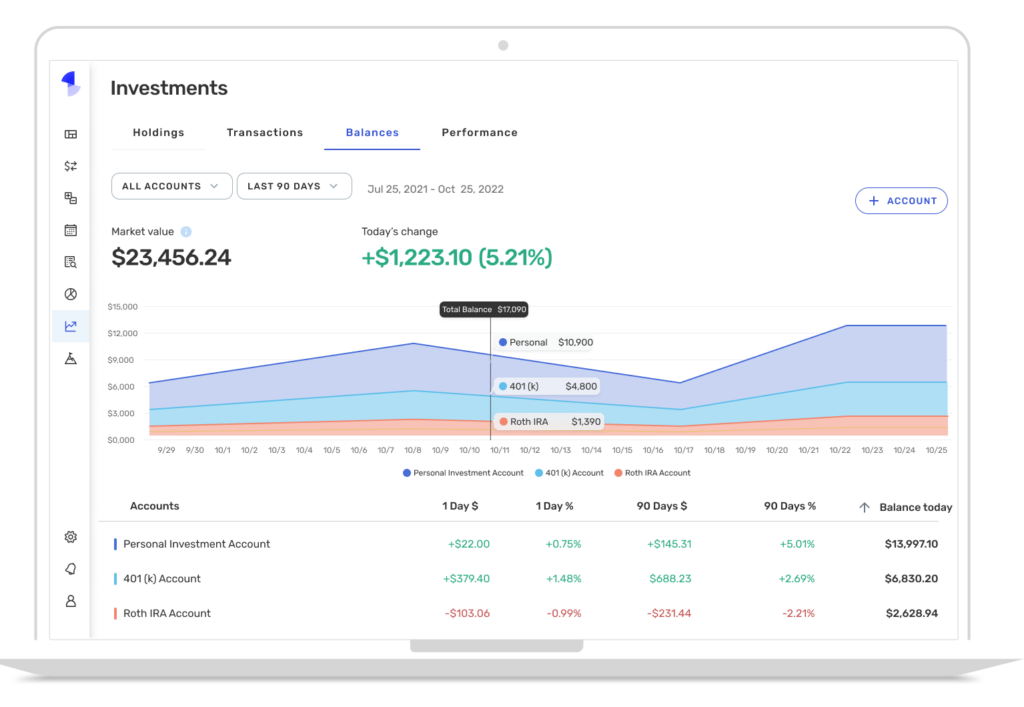

3. Empower: I’ve used the Empower Personal Dashboard for more than a decade. Formerly called Personal Capital, it offers the most robust budgeting, cash flow, investment tracking, and financial tools of any app out there. It also includes excellent iOS and Android apps. In fact, I use it more on my iPad than I do on the website. It has over 3.3 million users, and it’s free.

9 Quicken Alternatives

1. Monarch Money

Monarch Money is the highest rated budgeting app on this page with an Apple App Store rating of 4.9 with more than 44,000 ratings. It’s earned this rating for good reason. It’s easy to use, has an excellent mobile app, and offers a wide range of features.

You can connect all your accounts, including bank, credit card, investment and loan accounts. Once connected, Monarch syncs your accounts to download transactions and balances. It automatically categorizes your spending, which you can easily change if needed. You can also create spending rules to categorize future transactions. The app lets you see all your transactions in one place, set financial goals, and customize your dashboard.

Monarch is ideal for couples because of its collaboration features. Invite someone to your Monarch account with a separate login. They can view your data and connect their own accounts. This feature is particularly useful for couples who keep separate accounts but want to understand their combined financial picture.

Like Quicken Classic, you can also track all of your retirement and other investment accounts:

Try Monarch Money for free for 7 days, then get 50% OFF your first year with code ROB50.

Read our Monarch Money Review

2. Simplifi

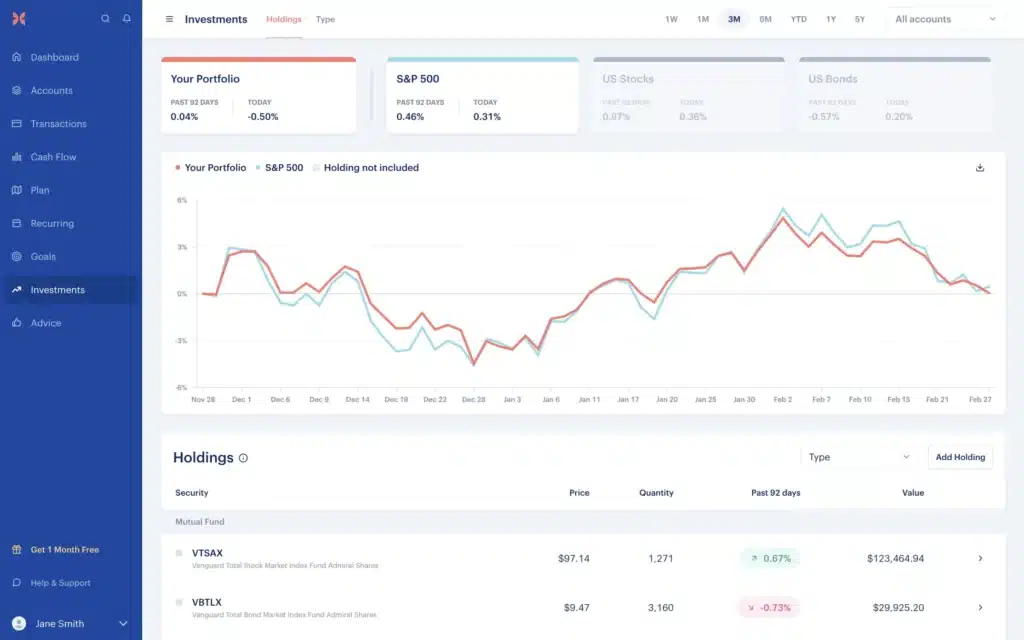

Simplifi is the budgeting app solution offered by Quicken. It was built from the ground up to be a mobile-first budgeting app. In fact, originally it was only available on mobile, although now it is available as a web app. I’ve used Simplifi extensively and found its features and user interface to be excellent.

It offers a rich feature set. Users connect their accounts for automatic download and categorization of transactions. You can easily track spending, set goals, and monitor your upcoming bills. Its reports look great and give you the budgeting details you need to make spending decisions.

NEW: Simplifi recently added investment tracking, making it a more complete Quicken replacement. That being said, I much prefer Empower for tracking investments.

Simplifi costs $5.99 a month, but for a limited time they are running a 50% discount, bringing the price down to $2.99.

Read our Quicken Simplifi review

3. Origin

Origin is a app designed to cover every aspect of your finances. In this regard, it’s similar to Quicken Classic Premier, except its a web-based and offers both Apple and Android apps. In addition, it integrates AI throughout.

Limited Time Offer: Get Origin for one year for just $1. Click here for details.

For example, you can create a budget manually like most apps, or you can let AI create a budget for you. AI will also create plans to save for an emergency, get out of debt, or plan your retirement. Origin can track your budget, spending, goals and your investment portfolio. In addition, Origin offers tax preparation and a basic will for no extra fees. They offer more complicated wills and even trusts for a small fee.

Origin will invest your money for you with its robo-advisor offer and it comes with a high-yield savings account paying 4.52% APY as of Augusut 26, 2025.

Try Origin for free for 7 days, then $12.99/month or $99/year.

Read our Origin review

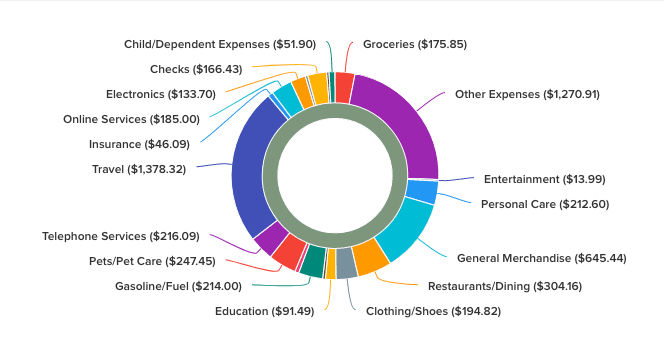

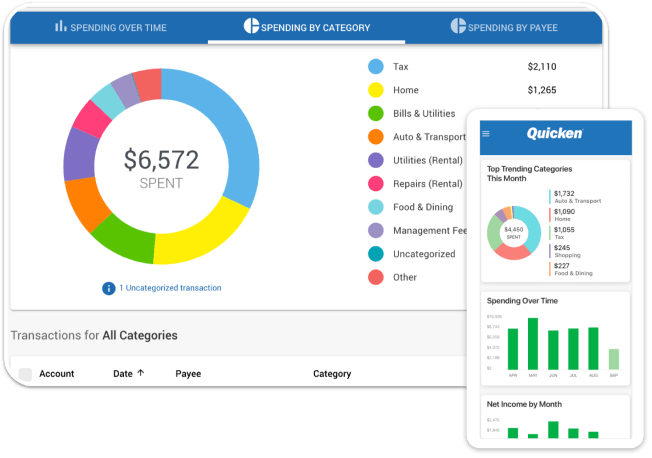

4. Rocket Money

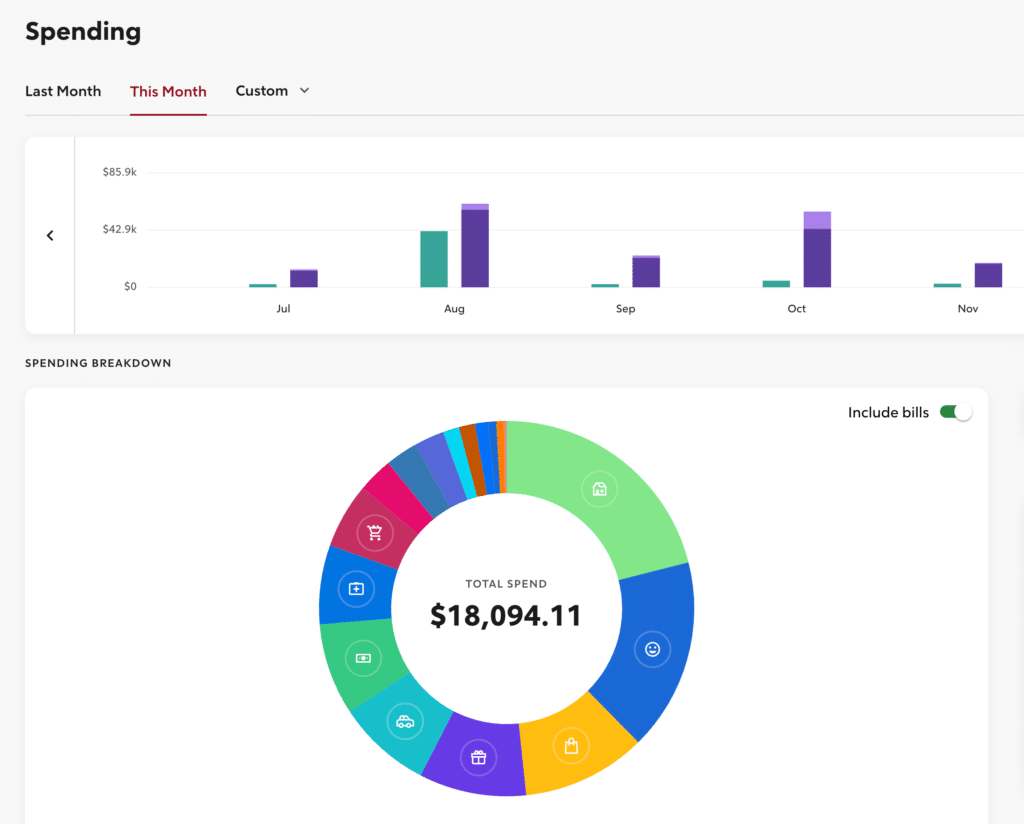

I’ve just started using Rocket Money to track both personal and business spending. Having used countless budgeting apps, including Quicken, Rocket Money has become one of my favorites. Both its desktop and smartphone app are easy to use. I had no trouble connecting my bank accounts and credit cards. It presents my spending data with easy-to-read graphs:

You can easily drill down into any spending category with the click of your mouse or tap of your phone. In addition, I’ve found the following features to be very helpful:

- Create rules to categorize future expenses

- Track subscriptions and enlist Rocket Money to help cancel those you no longer need

- Alerts let me know if unusually large transactions have occurred

Rocket Money offers a free version. The paid version is as little as $7 a month.

Read our Rocket Money review

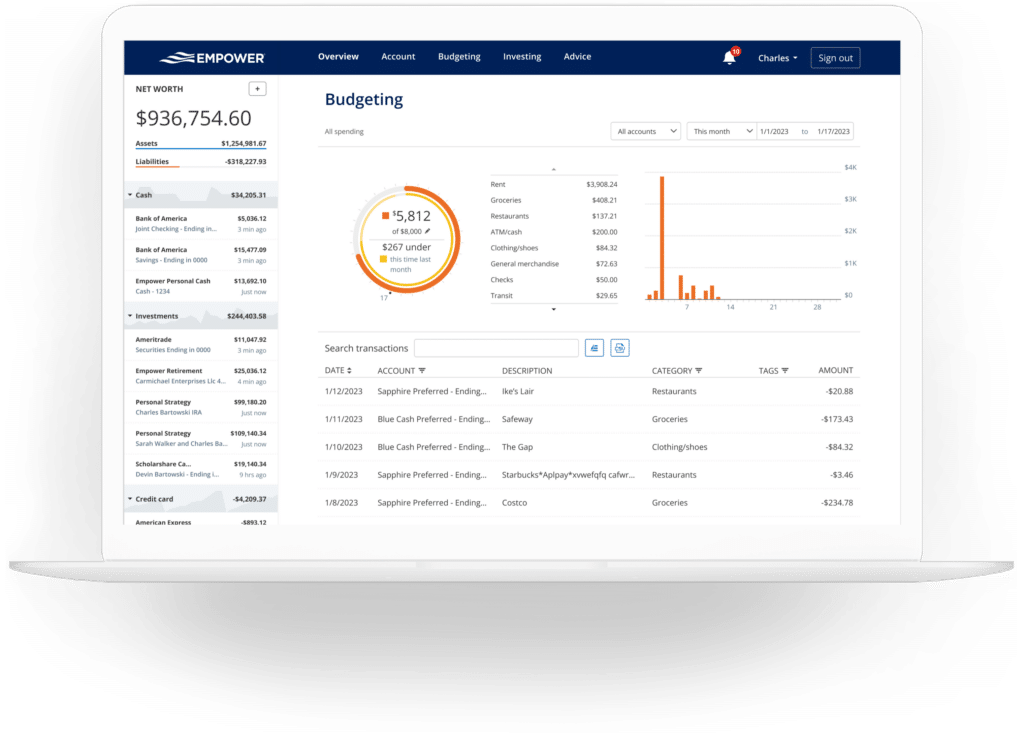

5. Empower

Empower is an ideal alternative, particularly if you have investments you want to track. It’s free, and it offers tools to manage every aspect of your finances. With Empower, you can link just about every financial account you have–checking, savings, credit cards, retirement accounts, investments accounts, HSAs, and even your home (via Zillow).

Once linked, Empower’s financial dashboard offers valuable insights into your finances. As an example, the tool enables you to–

- Track your spending by category

- Estimate when you can retire

- Calculate the cost of your investments

- View the asset allocation of your portfolio

- Generate a net worth statement

- Get alerts when bills are due

- Evaluate your investment portfolio

- Save for emergencies

- Track Bitcoin, Ethereum, Litecoin, and thousands of other tokens without giving access to your crypto wallet.

I’ve used Empower for years. It’s the only option that in my opinion can handle every aspect of my finances, from budgeting to investing to retirement planning.

I’ve written a detailed review and guide of Empower that you can check out.

6. Tiller Money

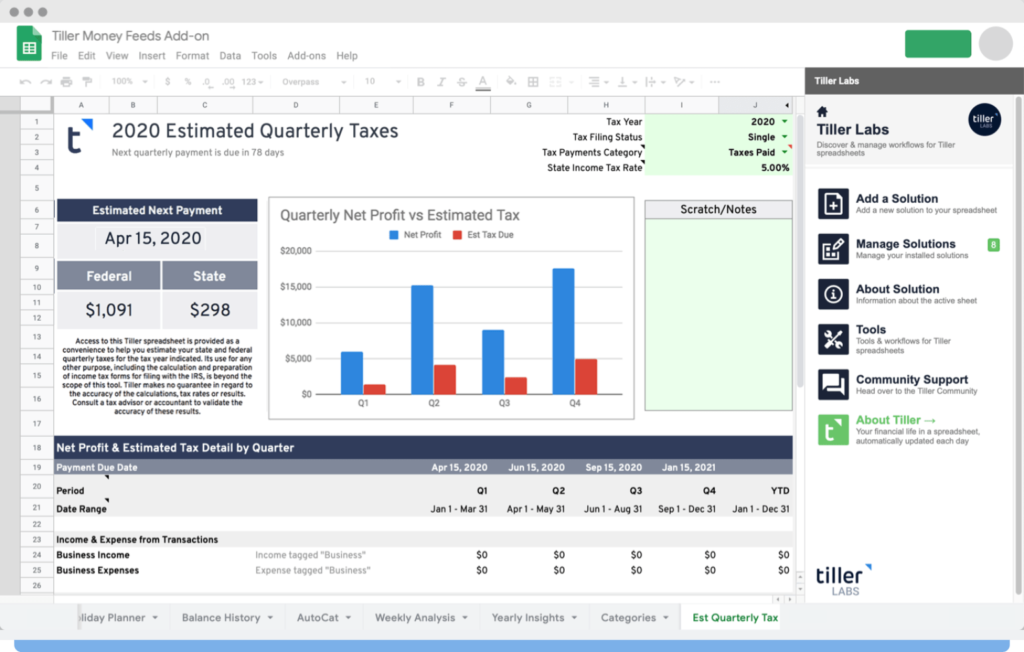

I don’t know how they do it, but Tiller Money has figured out how to turn a Google Sheet into a dynamic budgeting tool. You link your bank accounts and credit cards to Tiller’s Google Sheet tool, which automatically downloads all your transactions. From there, you can create budgets, categorize spending, and generate reports.

I’ve used Tiller for three years for my personal and small business budgets. Tiller is ideal for those who love working with spreadsheets. I will caution you that setting up Tiller can be a bit daunting. The good news is that they have videos to walk you through each step. If I can do it, you can do it.

One thing to keep in mind is that you must manually categorize each transaction. For some, this is a show-stopper. They want the convenience of tools like Empower that automate this process. For others, they would prefer to categorize transactions themselves. It forces them to look at each entry, understand how they spent money, and properly categorize the expenses. Tiller does offer an auto-category tool that you can use to categorize transactions based on the description automatically.

With Tiller, you can also have your transactions downloaded to an Excel spreadsheet. This is an ideal approach for those who don’t want to keep their financial data in the cloud.

There is no right or wrong here. It comes down to preference. You get a 30-day free trial. After that Tiller costs $79 a year.

Read our Tiller Review

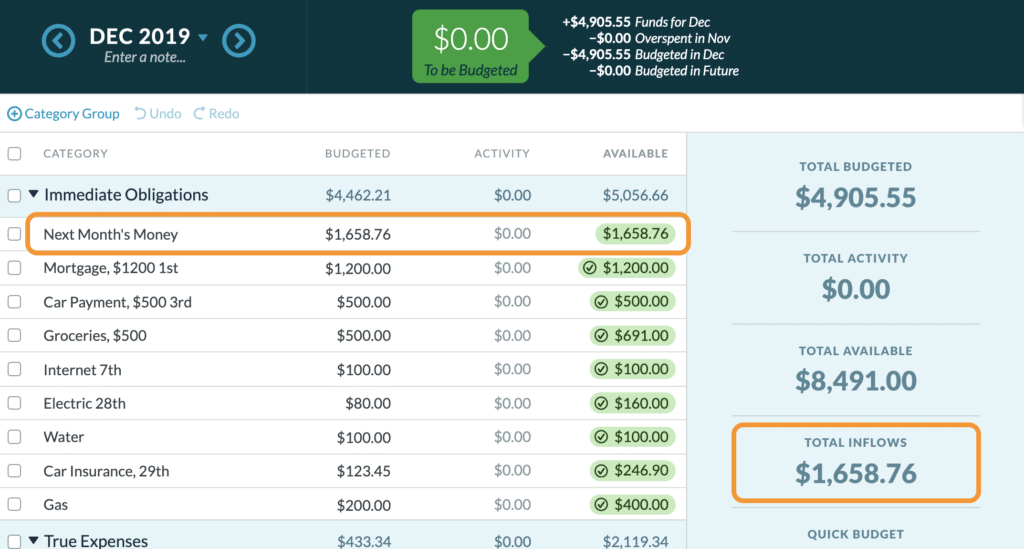

7. You Need a Budget (YNAB)

YNAB is ideal for those looking just for a budgeting tool. In my view, there is no better app for creating a zero-based budget. YNAB’s interface is similar to a spreadsheet. The tool makes it easy to budget by category based on the money you have in the bank.

One of YNAB’s core principles is to give every dollar a job. You do that by deciding how you’ll spend every dollar in your checking account. As with other tools, you can connect your bank accounts and credit cards to YNAB. This allows for real-time updates so that you can track your spending throughout the month.

YNAB doesn’t have the rich feature set offered by Simplifi or Monarch Money. That’s particularly clear when it comes to investing. For those who don’t want to track investments, however, YNAB is a good option.

So what’s the downside to YNAB? Well, there are two actually. First, it’s one of the most expensive budget apps on the market. It costs $14.99 a month or $109 a year. Second, while many love its budgeting features, that’s about all you get. YNAB hasn’t kept up with the other apps that offer investment tracking, automated net worth tracking, AI integration and a host of other features.

8. PocketSmith

PocketSmith started as a calendar to plan upcoming income and expenses. Today, it’s a full-fledged budgeting app. You can sync your accounts with PocketSmith. Once synced, you can track your budget and net worth. You can also see your income and spending in a handy calendar view.

One stand-out feature is PocketSmith’s auto-budget tool. It can create a budget for you based on past spending. It also has a cash flow feature that maps income and spending by date range.

While there is a free version of PocketSmith, it requires manual data entry. To get automatic bank fees, you’ll need to pay at least $9.95 a month or $7.50 a month when paid annually.

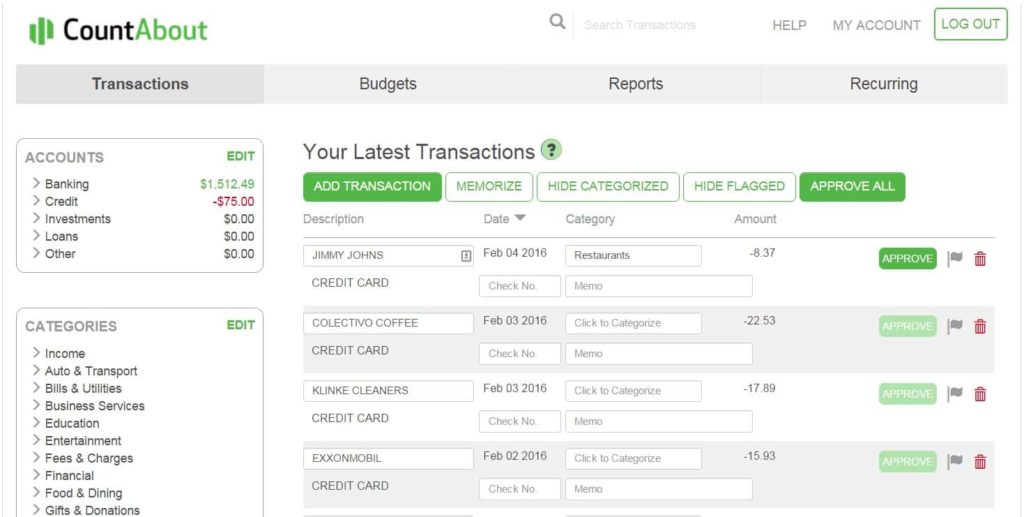

9. CountAbout

If you have a lot of data in Quicken (or Mint), CountAbout may be the budgeting tool for you. It has a feature enabling you to import data from Quicken or Mint.

CountAbout enables you to download transactions from your bank and customize both income and expense categories. You can even attach receipt images to expense transactions. You can set up recurring transactions and generate financial reports.

For the features you get, the cost is very reasonable. The basic plan costs just $9.99 a year (not a month). If you want automatic downloading of bank transactions, the cost is $39.99 a year.

Top Quicken Alternatives

| Quicken Alternative | Best For | Free Trial (Cost) | Learn More |

|---|---|---|---|

| Simplifi | Mobile Budgeting & Bill Tracking | $2.99/mo. first year billed annually, then $5.99/mo. 30-day money back guarantee | Visit Simplifi |

| Monarch money | Budgeting | 7-day free trial, Get 50% OFF your first year with code ROB50 | Visit Monarch |

| Rocket Money | Budgeting | Free version; Premium offers 7-day free trial ($7-$14/mo) | Visit Rocket Money |

| Tiller | Spreadsheet Budgeting | 30-day free trial ($79/yr) | Visit Tiller |

| YNAB | Envelope Budgeting | 34-day free trial ($9.08 to $14.99/mo) | Visit YNAB |

| PocketSmith | Calendar Budgeting | Free version ($9.99 – $26.66/mo) | Visit PocketSmith |

| CountAbout | Importing Quicken Data | 45-day free trial ($9.99 – $39.99/yr) | Visit CountAbout |

Quicken Alternatives FAQs

What is the best free alternative to Quicken?

If your focus is budgeting, Quicken Simplifi and Monarch Money are two of the best options. While they are not free, they are very low cost. If investment tracking is your key objection, Empower is the best free Quicken replacement.

Is Quicken Classic available without a subscription?

Sadly, no. Like so many other software packages and apps, Quicken is now only available as a subscription. As a result, you must pay for Quicken every year.

What is the best option to migrate Quicken data to a new app?

If you want to migrate Quicken data to a new budgeting app, CountAbout is a solid option. It has features enabling users to migrate data from Quicken or Mint.

What is the best Quicken replacement for calendar budgeting?

Once again, Quicken Simplifi fills this need well. It offers a calendar view of expenses and upcoming bills.

Which Quicken alternatives allow you to schedule bill payments?

With both Tiller Money and YNAB, you can plan future bill payments. Tiller offers a Bill Payment Tracker template and YNAB enables you to allocate funds to bills you plan to pay in the future.

What is the best free alternative to Quicken?

There are only a few free alternatives to Quicken. The best in my view is Empower, although it’s more of an investment tracking tool than budgeting tool. It does offer expense tracking, but not forward budgeting. But its combination of features, ease of use, and user interface make it an excellent option.

Whatever tool you choose, the key is to pick one that works for you. For me, that’s Monarch Money. One or more of the above Quicken alternatives, however, should suit the needs of most looking to better manage their money.