Fidelity ZERO Funds–Are They Worth the Cost?

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

Fidelity launched its ZERO index funds in 2018 to much fanfare. As their names suggest, these funds carry no expense ratios, a first in the industry.

As great as a “free” mutual fund may sound, however, many wonder whether there is a catch. Recently a subscribe to my YouTube channel asked the following questions:

Could you please share your thoughts on Fidelity ZERO funds vs their fee based funds?Fidelity ZERO International Index Fund (FZILX)Fidelity ZERO Total Market Index Fund (FZROX)Fidelity ZERO Large Cap Index Fund (FNILX)Fidelity ZERO Extended Market Index Fund (FZIPX)

Is FNILX + FZIPX = FZROX ?

ZERO funds have no fees, but other than cost, do you see any reason why one should invest in fee based instead of zero funds?

If you could please create video and share your thoughts, that would be very helpful.

Let’s dive into the details to get a better understanding of the Fidelity ZERO funds.

4 Fidelity Zero Funds

The ZERO funds consist of four index funds. These funds charge no fees in the form of an Expense Ratio, although they do pass on transaction costs to investors. There are also no minimum investment requirements.

The catch, if you want to call it that, is that the funds track proprietary indexes Fidelity created. That means, for example, that the Fidelity ZERO Large Cap index fund does NOT track the S&P 500, as one might expect.

Here are the details on each fund’s tracking index. (Note that Fidelity does not offer a ZERO fund for bonds.)

Fidelity ZERO Large Cap Index Fund (FNILX)

The Fidelity ZERO Large Cap Index Fund tracks the Fidelity U.S. Large Cap Index. The index is a float-adjusted market capitalization-weighted index. That simply means it tracks companies based on the number and value of shares outstanding in the market. Its focus is on the U.S. large capitalization equity market.

The index tracks the top 500 companies. It can, however, have fewer companies based on liquidity and investing screens that Fidelity uses. For example, the index (and the other two U.S. indexes discussed below) exclude companies with capitalizations under $75 million or with limited trading volume.

It can also have more than 500 stocks if some companies have multiple share classes. Fidelity rebalances the index annually on the third Friday in February (so mark your calendars!).

The index is similar to the S&P 500 index, but there are some differences, as we’ll see below.

Fidelity ZERO Extended Market Index Fund (FZIPX)

The Fidelity ZERO Extended Market Index Fund (FZIPX) tracks the Fidelity U.S. Extended Investable Market Index. Its designed to track U.S. mid- and small-cap stocks. It is a subset of the Fidelity U.S. Total Investable Market Index (see below), excluding the 500 largest companies.

Perhaps the closest comparison of this index is the the Dow Jones U.S. Completion Total Stock Market Index. The primary difference is that the Fidelity index is limited to 2,500 companies, whereas the Dow Jones index has just under 3,500 companies.

Fidelity ZERO Total Market Index Fund (FZROX)

The Fidelity ZERO Total Market Index Fund (FZROX) tracks the Fidelity U.S. Total Investable Market Index. This index is effectively a combination of the Large Cap and Extended Market indexes described above. As such, it is limited to 3,000 companies.

Its closest comparison is the Dow Jones U.S. Total Stock Market Index. It’s not an exact match, however, as the Down Jones index tracks nearly 4,000 companies.

Fidelity ZERO International Index Fund (FZILX)

Finally, the Fidelity ZERO International Index Fund (FZILX) tracks the Fidelity Global ex. U.S. Index. Fidelity designed this index to track mid- and large-cap companies headquartered outside the U.S. The index is created by selecting the top 90% of stocks as measured by market cap in each country.

This index is similar to the MSCI ACWI Ex USA Index. This index, however, holds about 4,700 companies, while the free version holds about 2,300 companies.

How Fidelity ZERO Funds Compare

While free funds offer an initial appeal, one wonders if investors are getting what they paid for. Are the Fidelity indexes used by the ZERO funds generating the same or better returns as the more widely used indexes? This is particularly important given that other Fidelity index funds, while they charge a fee, are still very close to $0 in cost (generally 6 basis points or less).

To get a better understanding, I compared each of Fidelity’s ZERO funds with a close counterpart offered by Fidelity.

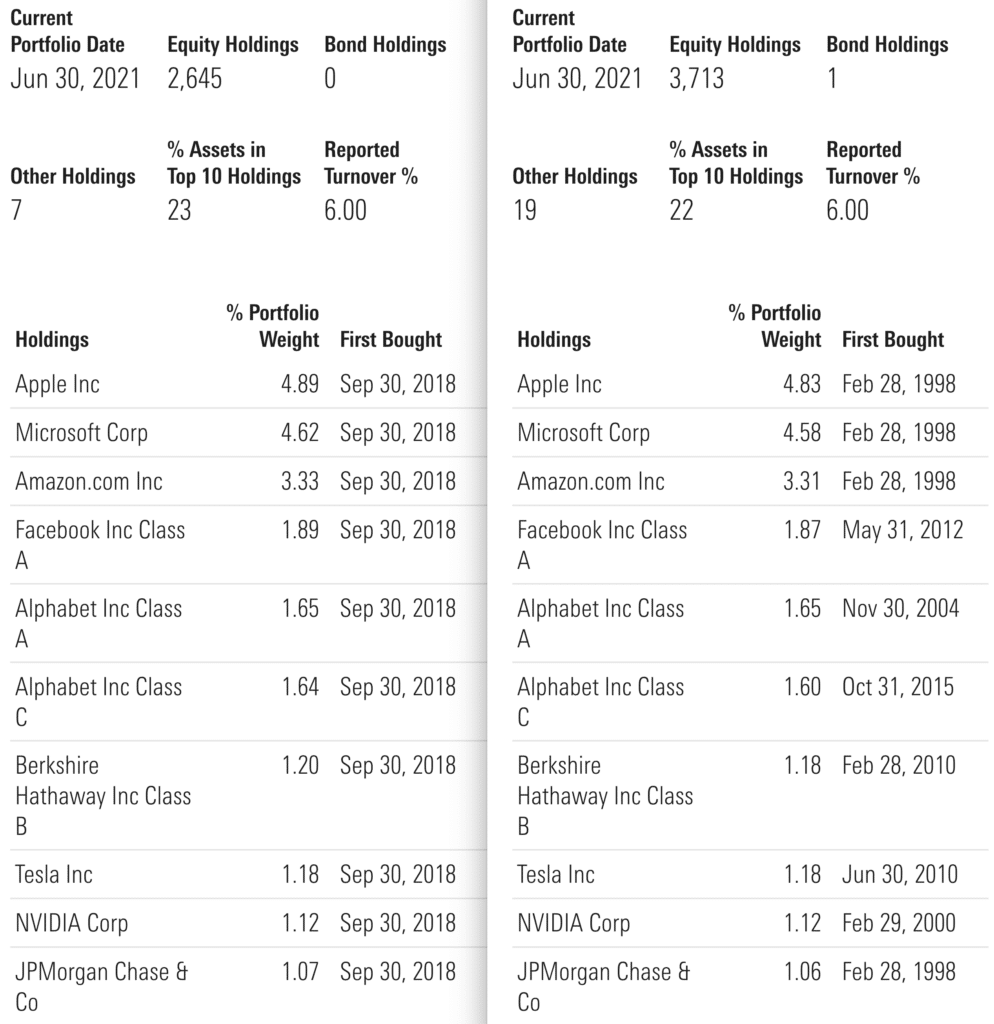

FNILX vs FXAIX

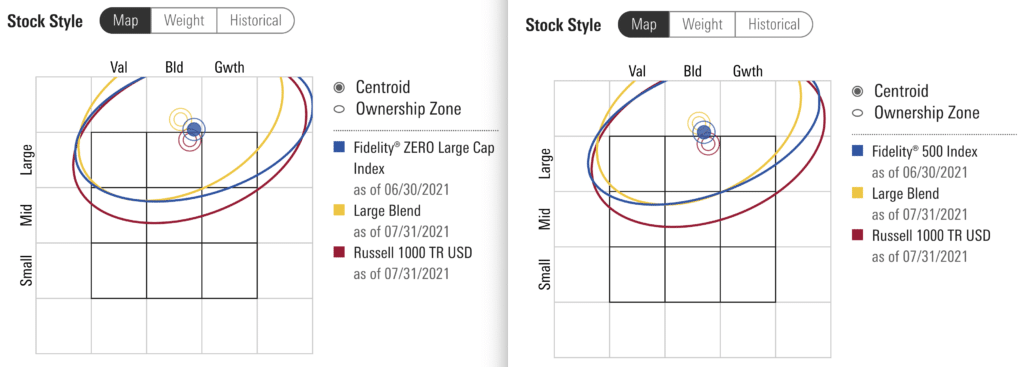

Fidelity’s Large Cap ZERO fund is arguably the closest to its most comparable index, the S&P 500. A comparison of the fund to Fidelity’s S&P 500 index fund (FXAIX) in Morningstar shows very similar style boxes and the same top 10 holdings. The notable difference is in the percentage held of each of the top 10 companies (the ZERO fund is on the left in each snapshot).

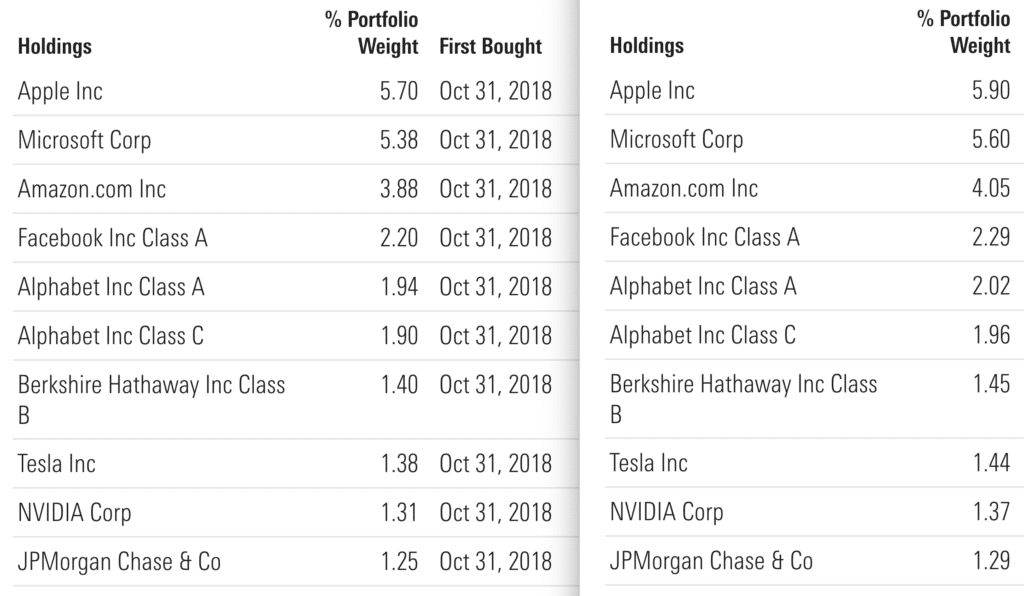

Performance data on the ZERO funds is limited as the funds were launched in 2018. Nevertheless, since then the ZERO Large Cap fund has outperformed Fidelity’s S&P 500 index fund by substantially more than its 1.5 basis point fee:

Whether the ZERO fund will continue to outperform the S&P 500 index only time can tell. As you’ll see below, however, the other ZERO funds haven’t performed as well.

https://fundresearch.fidelity.com/mutual-funds/summary/315911750 (FXAIX)

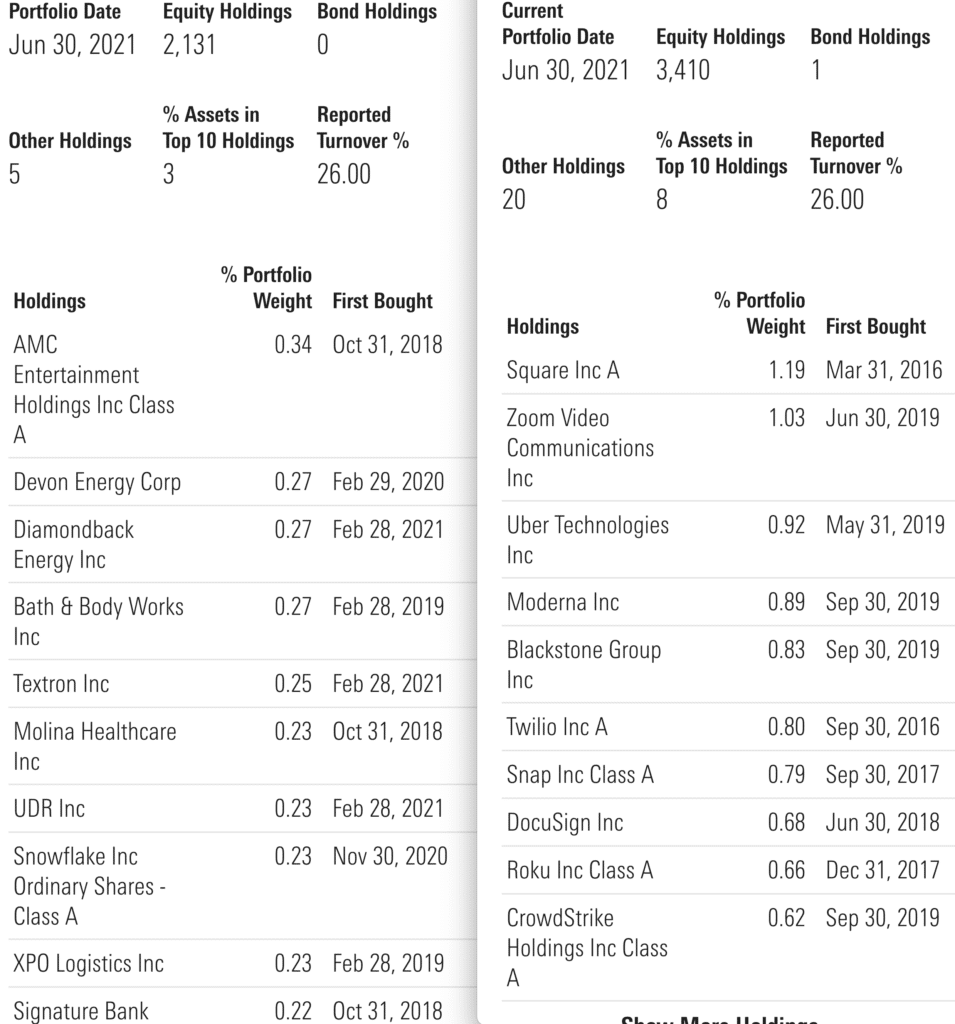

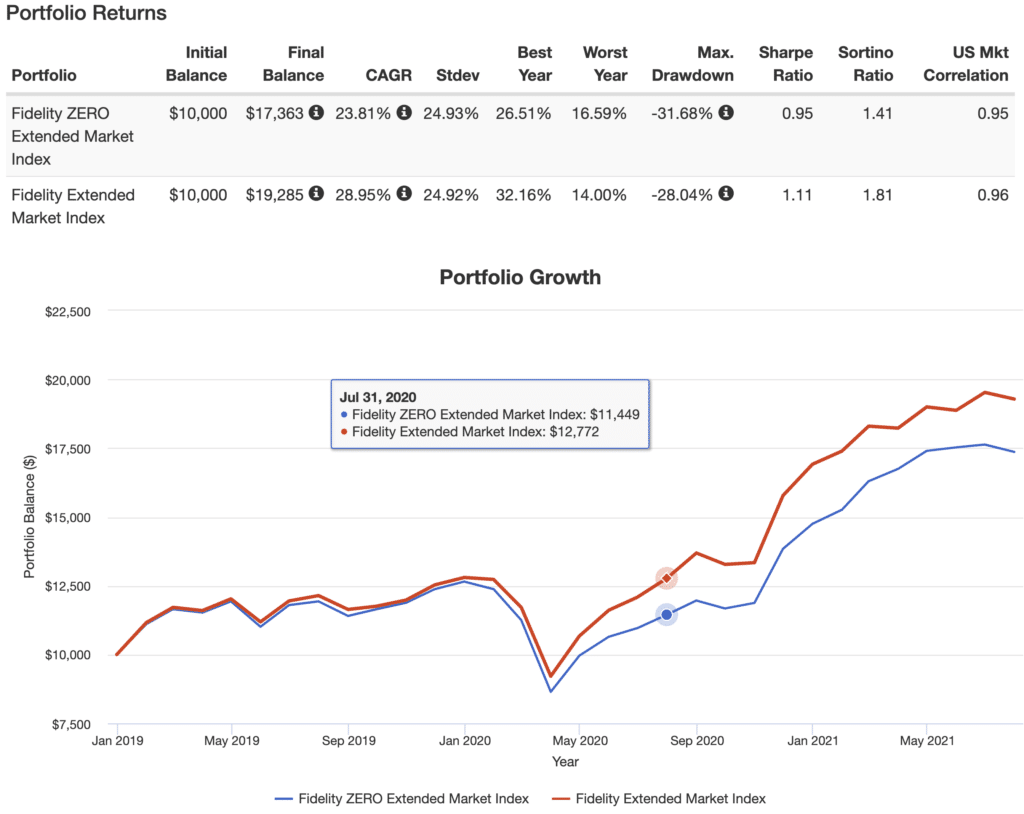

FZIPX vs FSMAX

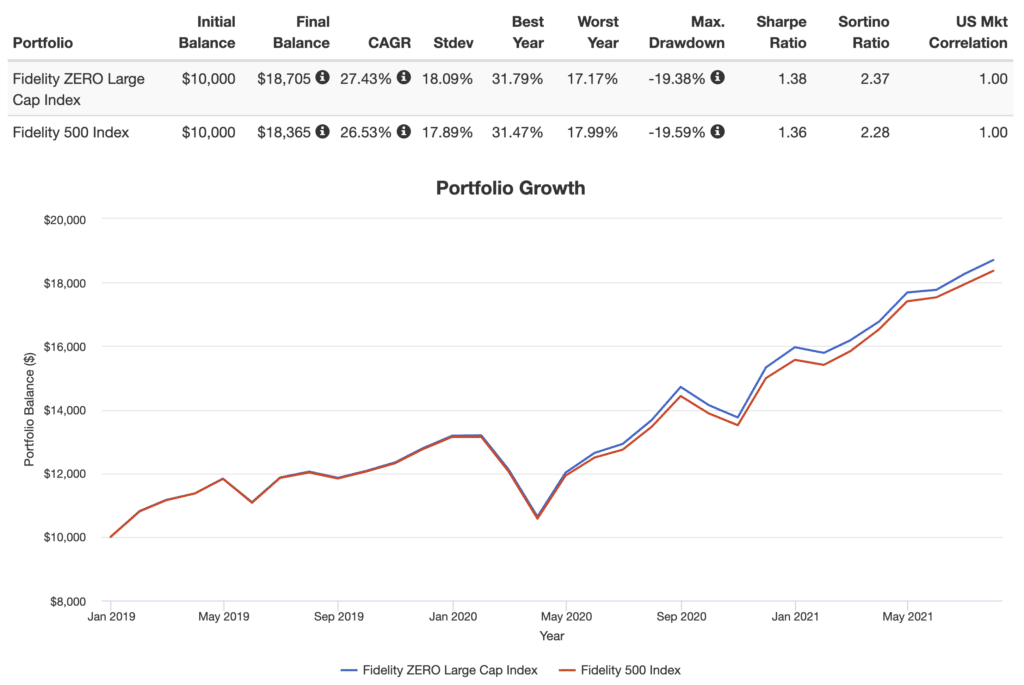

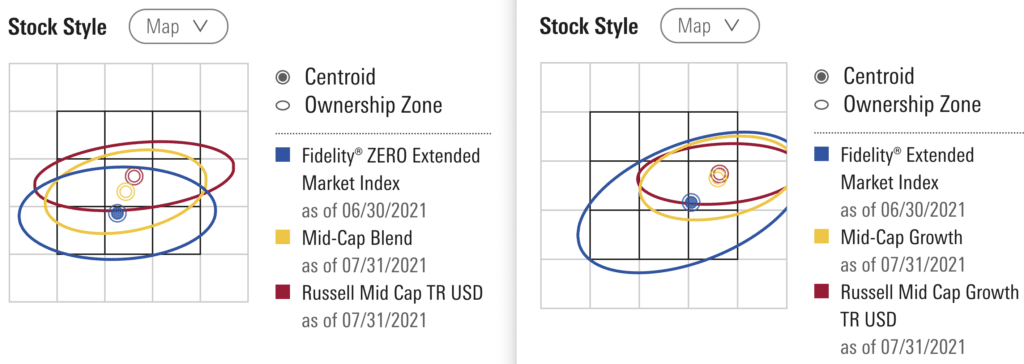

Fidelity’s Extended Market Index fund (FSMAX) tracks the Dow Jones U.S. Completion Total Stock Market index. Think of it as everything except the companies in the S&P 500. As such, it covers about 1,000 more companies than Fidelity’s proprietary completion index used for the ZERO extended fund. Its cost is just 3.5 basis points.

In the short time FZIPX has been available, it has significantly underperformed FSMAX even with the same volatility. Here are the comparisons:

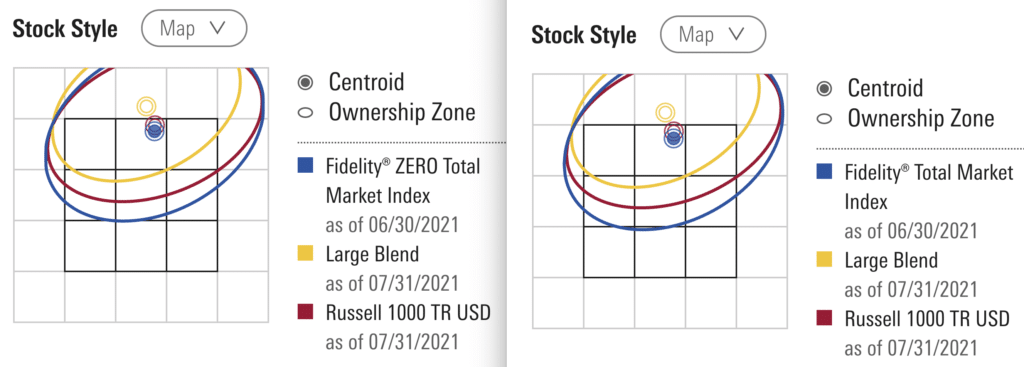

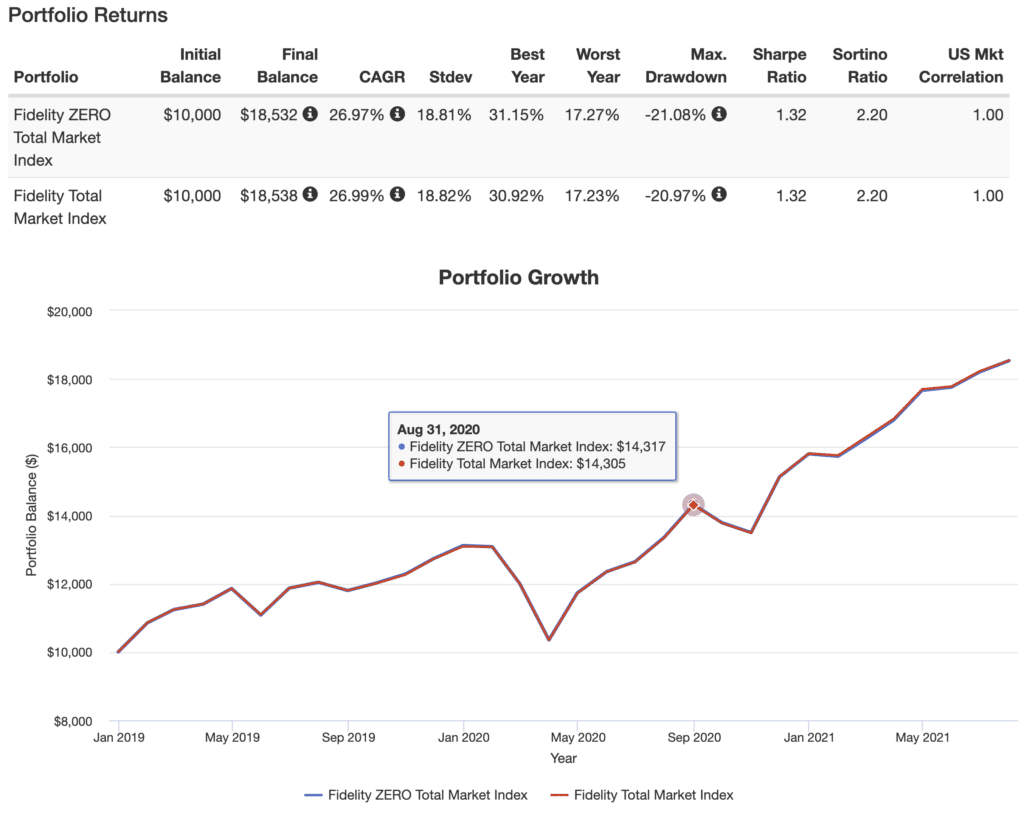

FZROX vs FSKAX

Fidelity’s Total Market Index fund (FSKAX) is the closest comparable to its ZERO Total Market fund. FSKAX charges just 1.5 basis points and gives investors exposure to over 3,700 stocks. The ZERO fund, in contrast, holds about 2,600 equity holdings.

While returns thus far have been nearly identical, FSKAX has managed to edge out the ZERO fund by 2 basis points. The comparable performance is likely driven by the similar returns amongst the larges U.S. companies in these cap-weighted funds.

https://fundresearch.fidelity.com/mutual-funds/summary/315911693 (FSKAX)

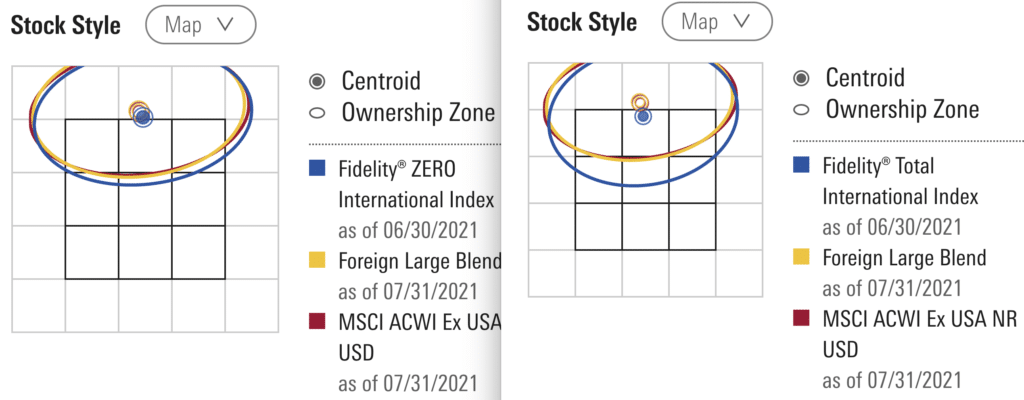

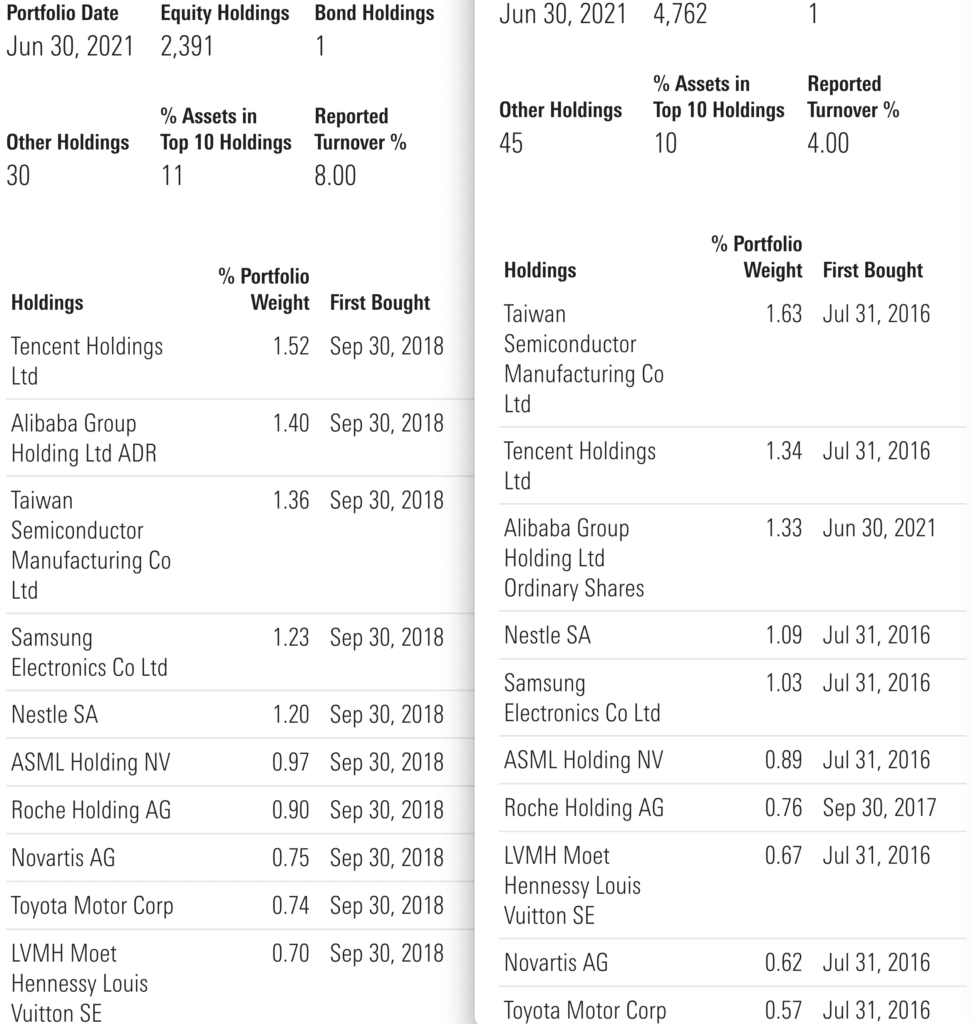

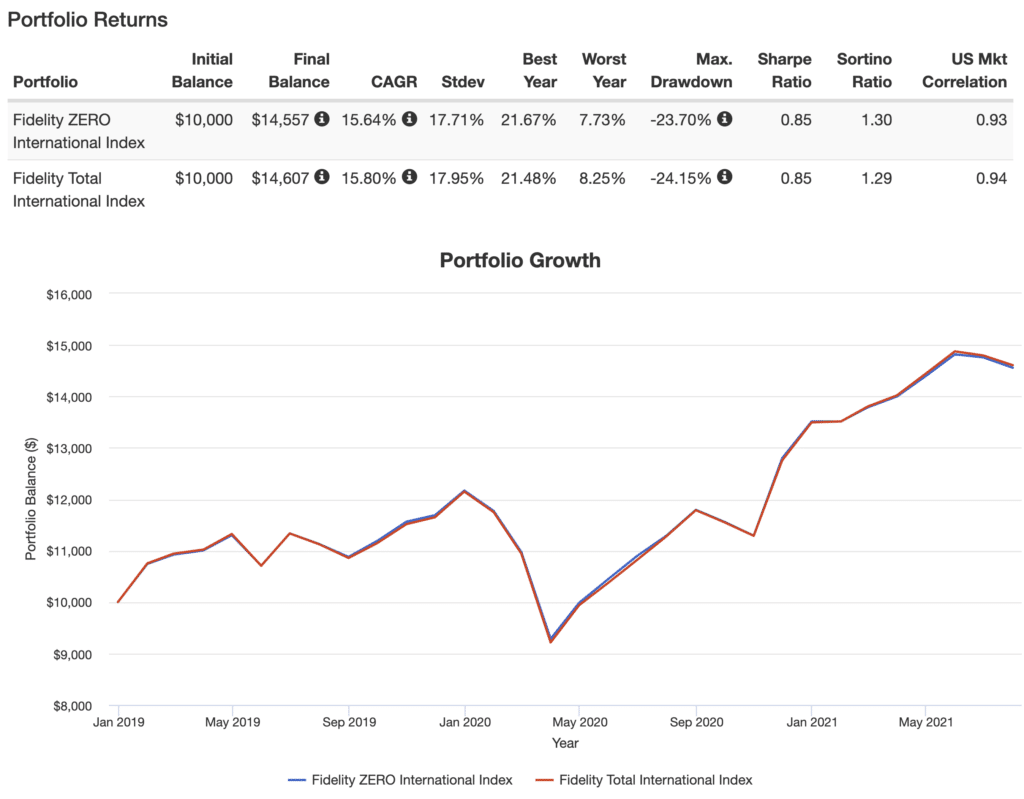

FZILX vs FTIHX

Fidelity’s Total International Index (FTIHX) charges 6 basis points and tracks the MSCI ACWI ex USA Investable Market index. The style box for this and the ZERO International Index are nearly identical. The free fund, however, holds just under 2,400 stocks while FTIHX holds over 4,700 stocks. And FTIHX has edged out the ZERO fund in performance thus far.

Final Thoughts

The cost of most index funds have fallen dramatically over the last few decades. Today one can invest in an index fund for 10 basis points or less. In many cases, a fund costs less than 5 basis points. For that reason, Fidelity ZERO funds seem more like a marketing strategy than a product that meets investors’ needs.

Certainly free beats even a very small cost. The problem is that fidelity achieves a 0% Expense Ratio by tracking its own proprietary indexes. I’m not sure that’s worth saving a few basis points each year. And thus far, with perhaps the exception of the Large Cap ZERO fund, these funds have trailed their Fidelity counterparts by more that the cost savings.

That said, I would have no reservations investing in one of these funds in a 401k if it were my best option.

I use Personal Capital to track all of my investments. The free tool shows me my asset allocation, total costs, and even retirement projections. Check out my Personal Capital Review and User’s Guide to learn how it can help you, too.