7 Best Budgeting Apps (Free, Paid & Mint Alternatives)

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

By Rob Berger, JD | Last Updated March 5, 2026

Mint was one of the first free online budgeting apps when it launched in 2007. I used it when it was first released. Intuit purchased Mint in 2009 and in 2024 shut Mint.com down. Current users are now forced to find a replacement. Here are the best Mint alternatives worth considering.

2 of My Favorites

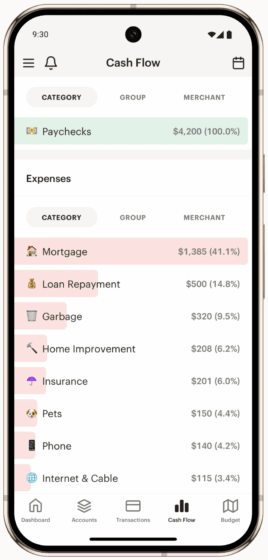

1. Monarch Money: I’ve used Monarch Money for about two years and think it’s an excellent budgeting app. It tracks budgets and spending, keeps track of recurring expenses like subscriptions, makes creating budget category rules a snap, and has an excellent user interface in both a browser and smartphone. And Monarch recently introduced Flex Budgeting, which tracks those expenses that go up and down from one month to the next.

You can also track your investments, monitor your cash flow, and get personalized advice.

- New AI Assistant: Ask AI about your budget, transactions and other data inside Monarch.

- New Receipt Scanner: Scan or upload receipts and Monarch automatically matches it to the transaction, extracts line items, and recategorizes expenses.

- New Bill Split: Snap a photo of a group bill and divvy it up quickly and easily.

PROMO CODE: Robberger.com visitors get 50% OFF the first year with code ROB50

App Store Rating: 4.9 (80k reviews)

Android Rating: 4.8 (19.7k reviews)

Platforms: Apple iOS, Android or Web

Best for: Budget, subscription management, and investment tracking

7-Day Free Trial

Get 50% OFF your first year with code ROB50

On Monarch’s Website

2. Quicken Simplifi: I’ve used and tested Quicken Simplifi since 2021. What stands out to me is the combination of low cost and excellent features. You can of course create a budget (Quicken Simplifi calls it a Spending Plan) and track your spending. Quicken Simplifi auto-categorizes your spending, which you can easily change. You can also create rules to categorize spending as you wish. It will track your investments and net worth, keep an eye on subscriptions, and connect Quicken Simplifi to monthly bills.

Now you can also use Quicken Simplifi to move money between your accounts, a feature I’ve not seen in other budgeting apps.

App Store Rating: 4.5 (11k reviews)

Android Rating: 4.3 (4.19k reviews)

Platforms: Apple iOS, Android or Web

Limited Time Offer: $2.99 /month first year billed annually, then $5.99 / month. 30-day money back guarantee

Best for: Create budgets, track spending, monitor subscriptions, track investments

7 Best Budgeting Apps & Mint Alternatives

1. Monarch Money–Best for Overall Budgeting

While we don’t track our finances with Monarch, I’ve used it for more than a year on a test basis. It’s an excellent alternative to Mint for several reasons.

First, its user interface is beautiful and informative. The dashboard gives you quick access to your most important budget details. These details include recent transactions, a comparison of income and expenses for the current month, and your net worth. If you track goals, such as saving for emergencies, the dashboard shows your progress.

Linking bank accounts and credit cards is easy. Once linked, Monarch pulls your transaction and balance data into the app. From here it’s easy to create budgets and goals. You can also track your recurring expenses, ideal for keeping an eye on subscriptions and to avoid any surprises.

Monarch also offers a tablet and smartphone app. I’ve used it on both my iPad and iPhone and found it to be very easy to use.

Key Features

- Connect all your accounts

- Track spending by category or account

- Track spending based on fixed and flexible spending

- Subscription tracking

- Track the performance and allocation of your investments

- Set financial goals

- Save for emergencies

- See your net worth

- See spending with a sankey diagram.

- Plan spending for the year

- Syncs w/ Coinbase, Zillow, Apple Card and vehicle values

You can try Monarch Money for free for seven days. After that, the cost is $8.33 per month if paying annually. Get 50% OFF your first year with code ROB50. You can also check out more details in our Monarch review.

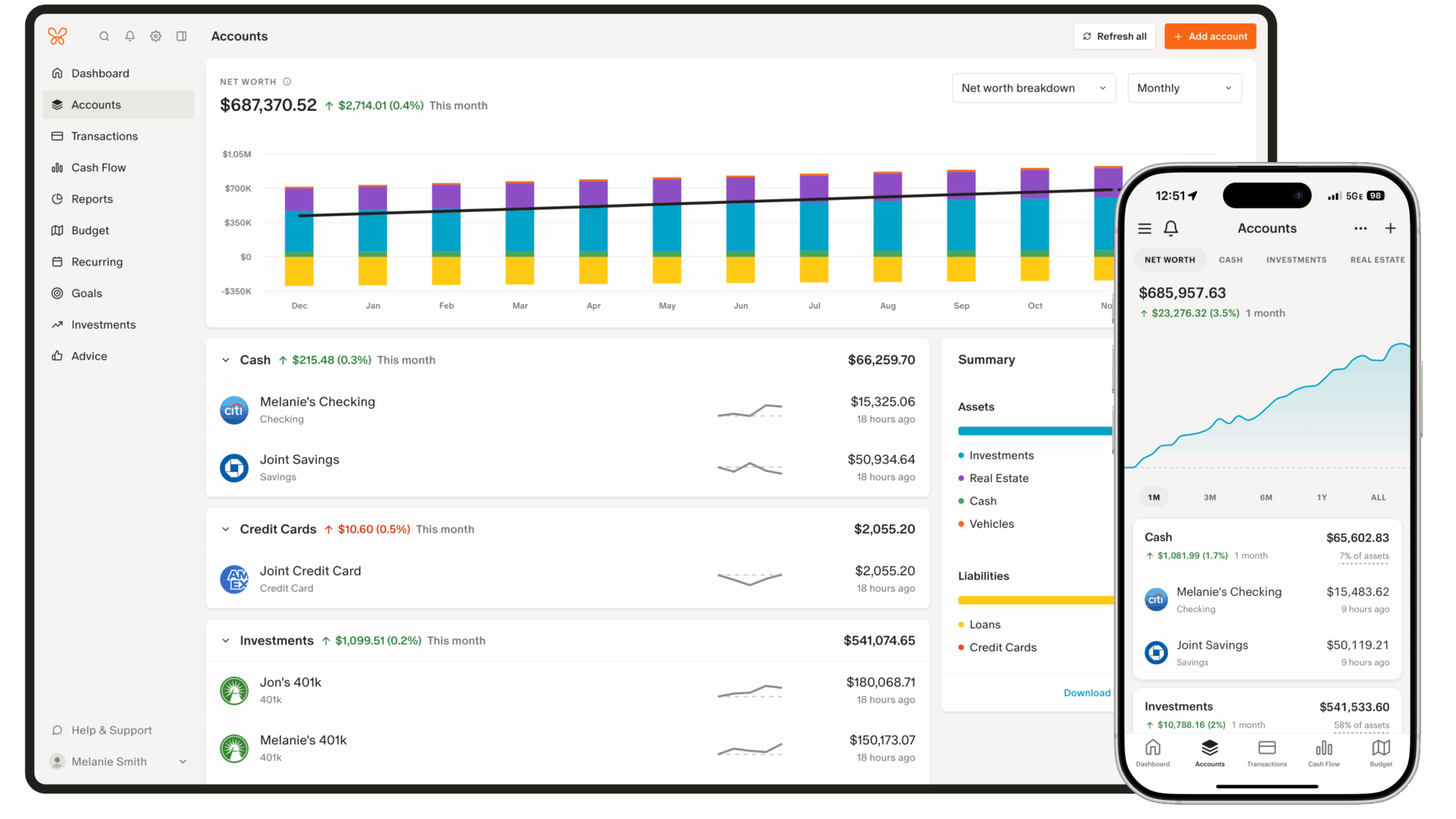

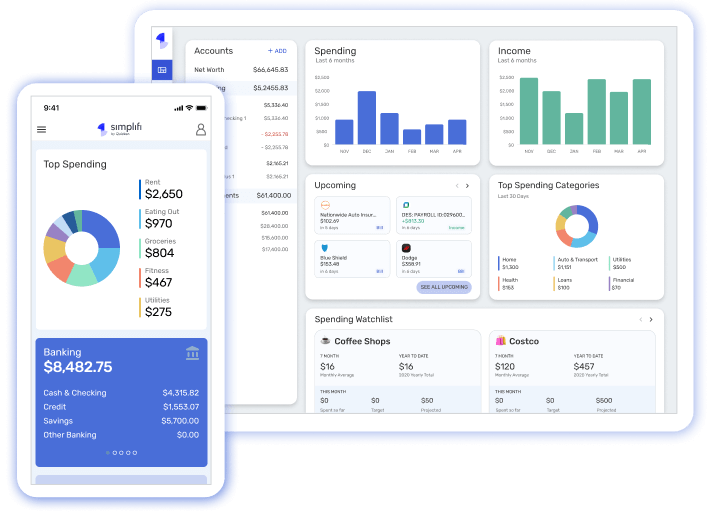

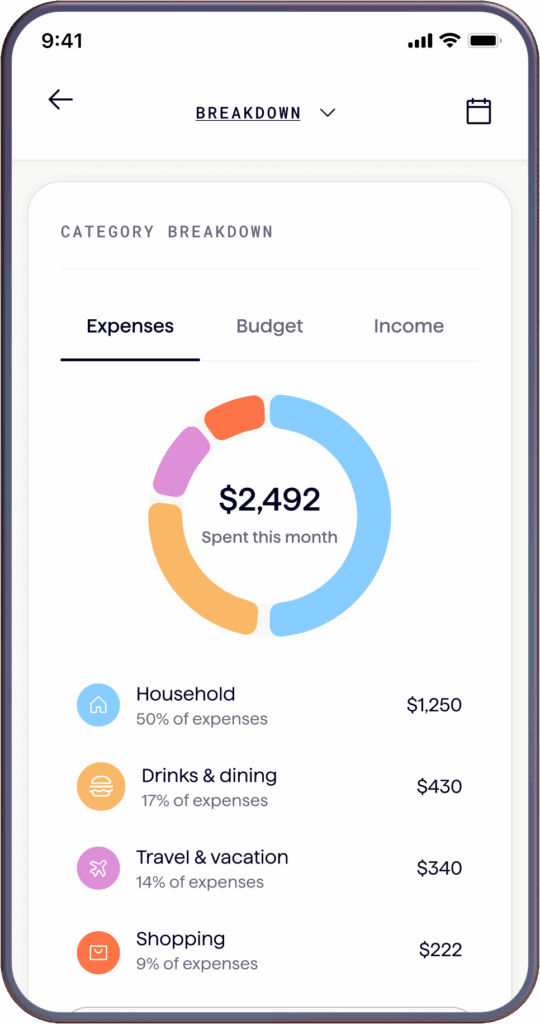

On Monarch’s Website2. Quicken Simplifi–Best budgeting app for smartphones

Quicken Simplifi is Quicken’s version of a mobile budgeting app. It’s not a mobile app for Quicken. It’s a new app built from the ground up. It uses automation to help you better manage your money.

For example, Quicken Simplifi can create a spending plan for you by analyzing your income and expenses. You can identify recurring expenses and subscriptions, which it then incorporates into the plan. It also includes a calendar view showing you upcoming expenses.

Key Features

- See your banking, credit card, loans and investments all in one place

- Have your transactions automatically categorized

- Find and track recurring bills and subscriptions

- View upcoming bills, income and transfers

- Set up custom watchlists and limits by category, payee, or tags to help stay on track

- Set up savings goals

- Track refunds on returned items

Quicken Simplifi costs $5.99 per month, but you can get the first year for $2.99 per month.

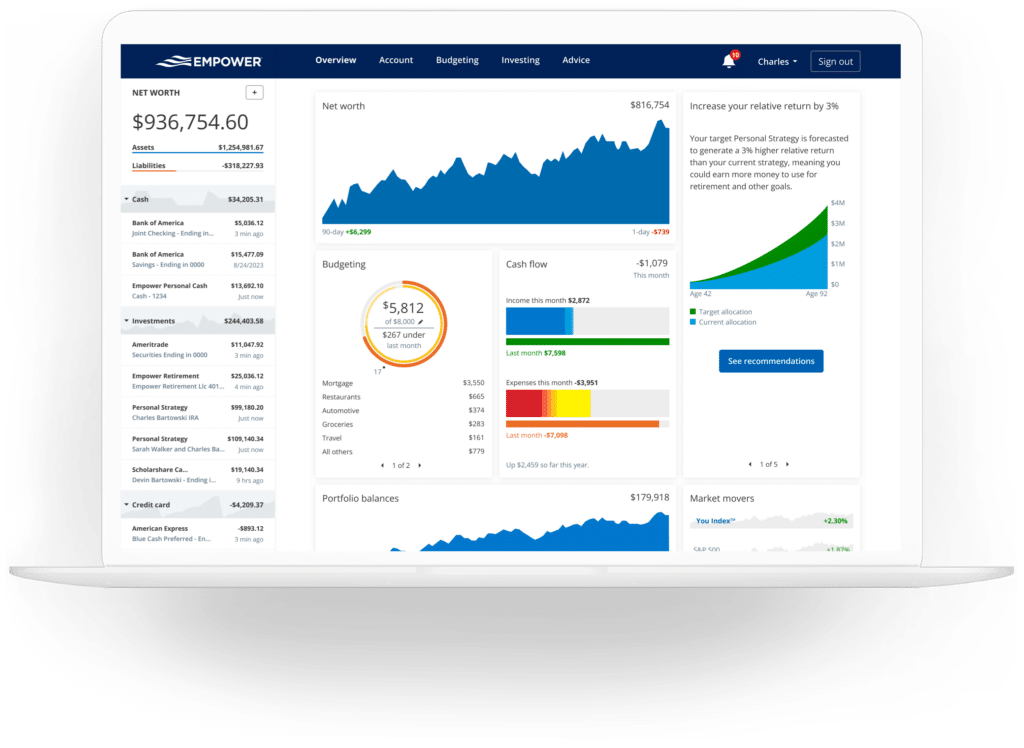

3. Empower–Best for Tracking Investments

I’ve used Empower for more than a decade, and it can easily replace Mint. Like Mint it’s free, and it offers far more tools to keep track of your finances and analyze your investments. You can link just about any financial account to Empower’s app. Once linked, the dashboard gives you a complete snapshot of your money.

Key Features

- Track spending by category or account

- Plan your retirement with monte carlo analysis

- Understand how investment fees erode your wealth

- Monitor your portfolio’s asset allocation

- Track your net worth

- Get alerts when bills are due

- Save for emergencies

- New: Track Bitcoin, Ethereum, Litecoin, and thousands of other tokens without giving access to your crypto wallet

Empower also offers an app for tablets and smartphones. I use it on both an iPad and iPhone. The user interface is exceptional and the app is easy to use. This makes Empower an excellent alternative to the Mint app.

I’ve written a detailed review and guide of Empower that you can check out.

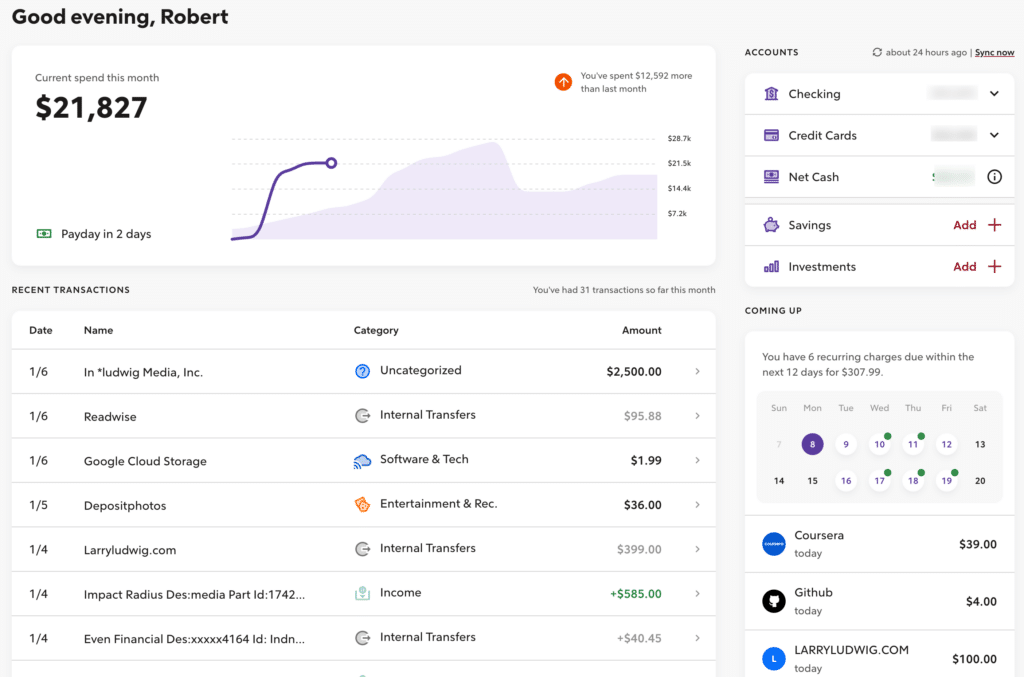

4. Rocket Money–Best for Budgeting

I started using Rocket Money for both our personal and business budgets last year. Having used both its web and smartphone apps, I can tell you it’s one of the best-looking and easiest-to-use budgeting tools available. On top of that, you can get the premium version for as little as $7 a month, paid annually.

Rocket Money does the basics well. It’s easy to track your spending and set up budgets. It’s easy to create rules for automatically categorizing transactions. And it’s easy to connect your investment accounts if you want to.

Here’s what the dashboard looks like for my business:

It gives me a snapshot of everything I need to manage my money. Rocket Money keeps track of subscriptions and makes it easy to cancel them. It’s an excellent Mint replacement, particularly if you focus on budgeting.

Key Features

- Subscription management

- Calendar budget

- Bill negotiation

- Net worth tracking

- Credit score monitoring

- Investment tracking

- Spending goals

- Budgeting

Rocket Money offers a free and paid version. The paid version costs $7 to $14/mo based on what you choose to pay them. Seriously.

5. Origin

The Origin app is unique among all of the budgeting apps I’ve ever tried (including all of the apps on this page). For starters, it does a lot more than just budgeting. For example, with Origin you can:

- Track your investments

- Invest with index funds

- Save cash with a competitive APY

- Do your taxes

- Create a will

- Create a trust

- Talk to a Certified Financial Planner

- Track shares, RSUs, ISOs, and NSOs

- Understand potential tax implications

- Simulate exercising stock options

Most of these features come with the monthly or yearly subscription fee. For example, Origin includes tax software that comes with your subscription. Those features that require additional fees, such as creating a trust or talking with a CFP, are reasonably priced in my view.

Beyond these features, Origin has also integrated AI into its app. You can use AI to ask questions about your budget. For example, I asked Origin’s built-in AI for help with creating an emergency fund. Here’s what it did in response:

- Asked me which connected accounts to analyze

- Calculated my average monthly spending based on those connected accounts

- Calculated a 6-month emergency fund, along with a slider that I could use to change the amount

- Asked me how much I already have saved for emergencies

- Asked me how much I can contribute monthly toward the emergency fund

- Then produced a chart showing how long it would take to fully fund the emergency account and my balance over time.

- Provided a link for me to open up an Origin cash account, although this was of course not required.

It’s one of the most advanced and feature-rich money apps I’ve ever used.

Origin offers a 7-day free trial, after which the cost is either $12.99 a month or $99 a year ($8.25 a month).

Limited Time Offer: Get Origin for one year for just $1. Click here for details.

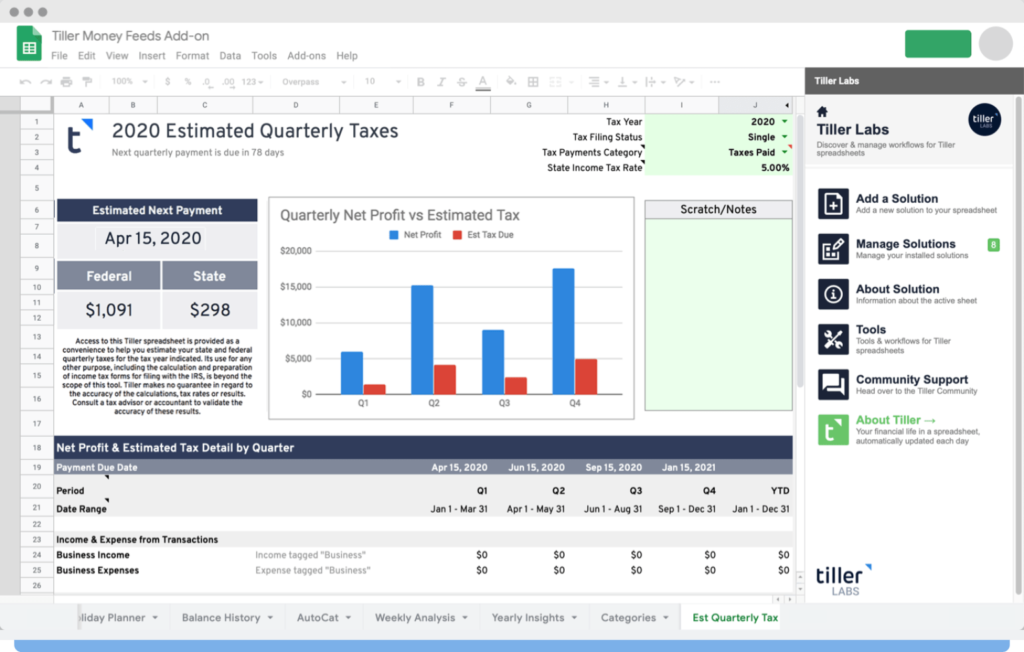

6. Tiller Money–Best for those who love spreadsheets

For those focused primarily on budgeting, Tiller Money is the best option for those who enjoy working with spreadsheets. Along with Empower, I use Tiller every single day. There is, however, a bit of a learning curve. But once you understand how it works, it’s a breeze to use.

In short, Tiller enables you to connect your bank accounts, credit cards, and even investment accounts to a Google Sheet or Excel. I use the Google Sheet version. It then gives you templates and tools to do everything from creating a budget to tracking your spending to save for retirement.

The more I use Tiller the more I appreciate the simplicity and ease of use. If you like spreadsheets, you’ll like Tiller. To get an idea of how it works, check out this video I created.

Key Features

- Download transactions to Google Sheets or Excel

- Track all accounts in one place

- Create monthly and annual budgets

- Track spending by category

- Track your net worth with automated dashboards

- Create spending category rules

- Get daily email showing charges, transactions and balances

The one potential drawback of Tiller is using it on a smartphone. Google Sheets does have an app for both tablets and smartphones. I’ve used Tiller and Google Sheets on my iPad, and it works well. On a smartphone, however, it’s very difficult to navigate.

You get a 30-day free trial. After that, Tiller costs $79 a year.

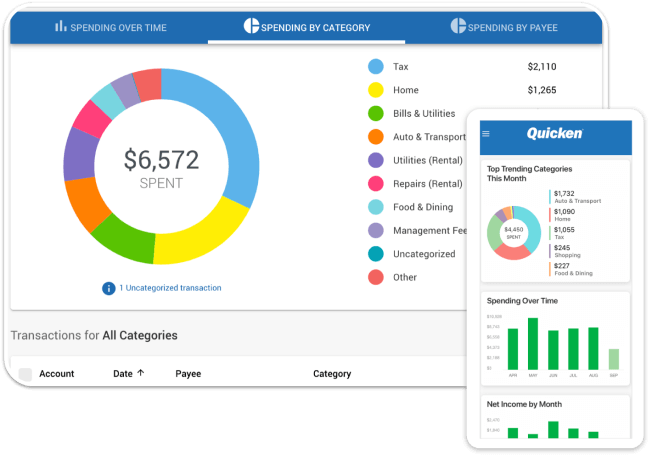

7. Quicken–Best for those wanting comprehensive budgeting software

I began using Quicken back in the 1990s. It’s changed a lot over the years. Today, it is a subscription-based financial planning software package. It can run on both PCs and Macs, although there are some differences between the two versions. Quicken Online is no longer available.

Quicken is best known as a budgeting app. It comes with just about every budgeting feature imaginable, including categorizing expenses, setting goals, paying bills, and running reports. I will say that the look and feel of the PC version is a bit dated.

Key Features

- Create savings goals

- Manage and reduce debt

- Create and track your budget

- Track your investments

- Track your net worth

- Built-in tax reports

- Track & pay bills

- Reconcile accounts

With Quicken you can also track your investments. The software enables you to link all your banking and investment accounts. It provides some insight into your investments, including asset allocation.

Quicken Deluxe costs $5.99/month and Premier $7.99/month, billed annually. The Premier version offers additional investment features. Note that Quicken is software, not an app, and they offer versions for both Windows and Mac.

Budget App Comparison

| Budget App | Best For | Learn More |

|---|---|---|

| Monarch Money | Overall Budgeting | Visit Monarch |

| Empower | Investment Tracking | Visit Empower |

| Rocket Money | Overall Budgeting | Visit Rocket Money |

| Simplifi | Mobile Budgeting | Visit Simplifi |

| Tiller | Excel Budgeting | Visit Tiller |

| Quicken | Traditional Budgeting | Visit Quicken |

| Origin | Complete Financial Management | Try Origin |

Methodology

My first step in evaluating Mint alternatives was to use dozens of budgeting and investment tracking apps. I’ve used each of the tools in our list extensively, with the exception of Pocketsmith and CountAbout (I’m working on those two now). I’ve also undertaken in-depth research into these and more than 25 other options.

In evaluating these apps, I focused on the following key criteria:

- Cost

- Ease of use

- Mobile app availability

- Ability to consolidate all accounts in one place

- Budgeting tools

- Investment tracking tools

Mint Alternatives FAQs

What is the best free alternative to Mint?

Empower is the best free Mint replacement. It comes with nearly every feature Mint offers and many additional tools. It’s particularly well suited for those who want to manage all of their money in one place, including investments.

What is the best Mint replacement for calendar budgeting?

Monarch Money is the best in my opinion. Excellent features to see upcoming bills and recurring expenses.

Which Mint alternatives allow you to schedule bill payments?

With both Tiller Money and YNAB, you can plan future bill payments. Tiller offers a Bill Payment Tracker template and YNAB enables you to allocate funds to bills you plan to pay in the future.

Whatever tool you choose, the key is to pick one that works for you. For me, that’s Monarch Money. And its 50% discount (Promo Code: ROB50) is an added bonus. One or more of the above Mint alternatives, however, should suit the needs of most looking to better manage their money.