YNAB Alternatives: 5 Better Options for Budgeting and Wealth Building

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

By Rob Berger, JD | February 5, 2026

YNAB (You Need a Budget) is one of the most well-known budgeting tools around. It has a loyal following for its approach to zero-based budgeting and emphasis on “giving every dollar a job.” I used YNAB myself, and it absolutely does what it promises if you’re looking for envelope-style budgeting. But, that’s where the wealth of features ends.

If you want to track investments, monitor your credit score, or manage subscriptions and recurring expenses, you’ll need a different tool. Add to that a $109 annual price tag, making YNAB expensive for a tool that only tackles one part of the personal finance equation.

If you’re looking for a tool that does more than just budget your money, we gathered a list of the best options. Below are YNAB alternatives that offer more features often at the same or lower cost.

Quick Take

My Top 5 YNAB Alternatives

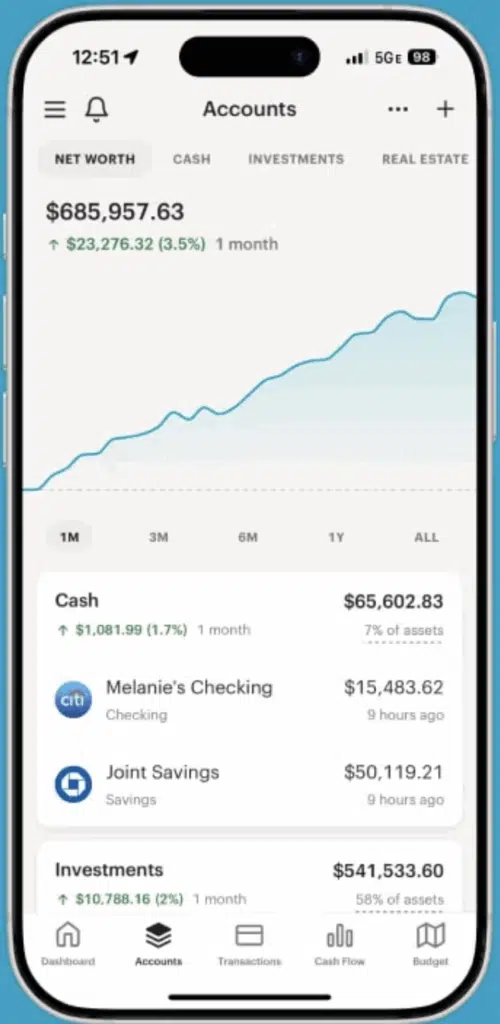

Monarch Money: The Best All-in-One Alternative

To go beyond budgeting, Monarch Money is at the top of our list. Founded by former Mint developers, Monarch is just as easy to use, but it’s a massive improvement with a ton more features.

One of the best features of Monarch is the ability to share financial information with your spouse or partner. You can have separate logins but with access to the same information. You can also change permissions on shared financial info to give your partner full access or read-only access. The only way to share information on YNAB is to use one login, which isn’t ideal.

Monarch Money also tracks your investment accounts, something YNAB doesn’t offer at all. For many people, one dashboard to track all your finances is priceless. Fortunately, in the case of Money Monarch, it comes at a reasonable cost.

Cost: $14.99/month or $99.99/year—right in line with YNAB, but far more powerful. Right now, get 50% OFF your first year with code: ROB50

Verdict: Monarch is like YNAB with superpowers. If you want full-spectrum money management, this is it.

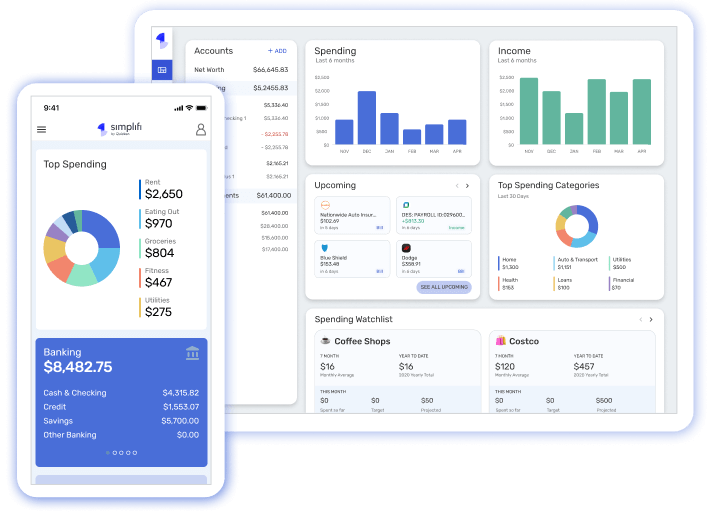

Simplifi

Simplifi from the makers of Quicken is an excellent YNAB alternative. It allows for the easy creation of zero-based budgets. It does this through what it calls “Planned Spend.” It’s part of its Spending Plan feature, and allows you to give every dollar a job, a concept that YNAB popularized.

It’s easy to categorize transactions, create rules and split transactions. It also makes tracking bills and subscriptions very easy.

Simplifi can also connect to your bank accounts, create and track savings goals, and show you a breakdown of your spending so know where you money is going. You can also track your investment accounts and your net worth.

Simplifi is also one of the more affordable apps in this list. It’s regularly $5.99/month (billed annually at $71.88) but you can get it now for $2.99/month for the first year (billed annually at $47.88).

- App Store Rating: 4.4 out of 5 stars among 5.6k iOS users.

- Google Play Rating: 4.1 out of 5 stars among 3k+ Android users.

- Price: Regularly $5.99/month (billed annually at $71.88) but available now for $2.99/month for the first year (billed annually at $47.88).

Key Features

- Connect your bank accounts

- Create savings goals

- Manage your budget

- Track investments

- Track net worth

- 30-day money back guarantee

- Billed annually

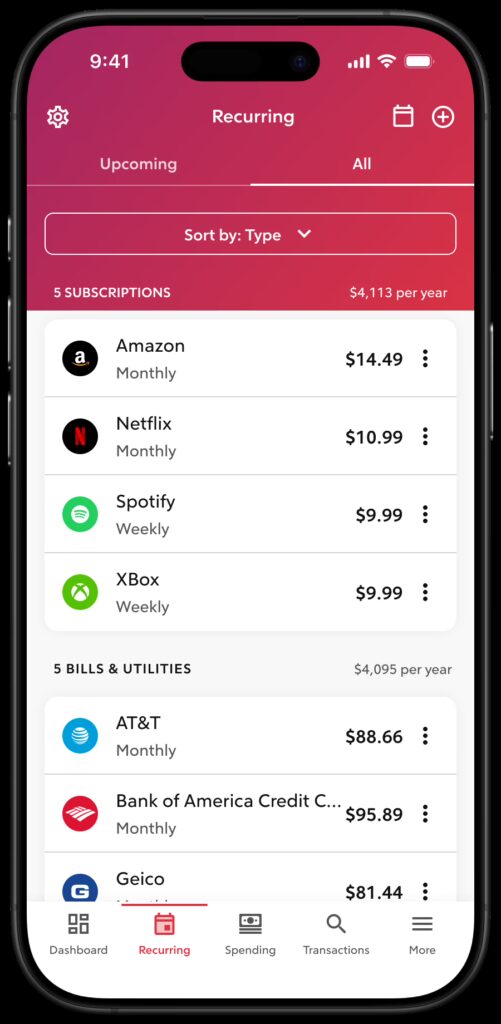

Rocket Money: The Smart Choice for Subscription Tracking

Rocket Money is tailor-made for people who love a good subscription but need help managing the costs. Rocket Money makes it easy to track your recurring charges. Even better? You can easily spot, then cancel a subscription you might have forgotten about. Or, if you have a premium Rocket Money subscription, with a few taps of a button, you can tell Rocket Money to cancel it for you.

Rocket Money also alerts you when it spots large transactions, low balances, and bill increases. This is particularly handy for keeping an eye on subscription costs, which often increase.

Another bonus for using Rocket Money is tracking your credit score. You can check your credit score as often as you want. With the Premium subscription, you can also get access to monthly credit reports.

For investors, neither Rocket Money nor YNAB are the proper tools to track your investments. But you might consider using Monarch Money to monitor your household budget, your investments, and your net worth. Then you can use Rocket Money’s free version to track your subscriptions and keep an eye on rising bills to help you figure out what to cut, if you need to.

Cost: Free version available. Premium plans range from $7 to $14/month.

Verdict: Great for trimming the fat. If you’re paying for things you forgot you signed up for, Rocket Money will find them.

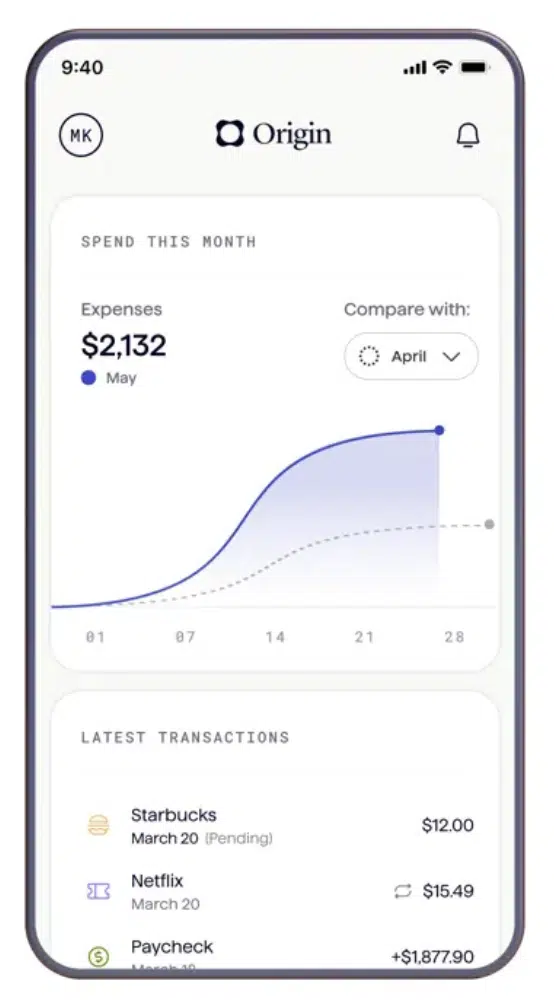

Origin: Budgeting Meets Life Planning

Imagine an app that allows you to budget, track subscriptions, track your credit score, invest, access a high-yield savings account, file your taxes, create a will, and meet with a Certified Financial Planner. Imagine no more, it exists, and it’s called Origin.

With Origin, you’ll find a high yield cash account offering a highly competitive APY with no minimum deposit or minimum balance required. Origin also offers several interesting ways to invest your money called stock bundles. For example, you can invest in a group called the Gentile Giants, which is a collection of big-name and low-volatility companies from the S&P 500. You can also choose to use their automated investing platform.

There’s a forecasting tool that allows you to see how your net worth can grow decades into the future. You can also see how major life events like buying a home, or growing your family, impacts your cash flow, net worth, and retirement goals.

Origin includes a feature called Sidekick, an AI financial assistant to answer your money-related questions. If you prefer guidance from a real person, you can book a session with a Certified Financial Planner through Origin. Sessions do cost, but they are fairly reasonable at $119 per session.

More unique Origin features you won’t find with any other app on this list include estate planning documents from a basic will to a full will, and trust. The basic will is free, and while the full will and trust are not, they are both relatively affordable.

Cost: $12.99/month or $99/year. Includes a 7-day free trial. The annual plan also includes a 30% discount on Financial Planning and full Estate Plan services.

Verdict: Origin is perfect if you want long-term structure and planning, not just category-level budgeting. If YNAB is about budgeting for this paycheck, Origin is about planning for the next 10 years.

Limited Time Offer: Get Origin for one year for just $1. Click here for details.

Empower: Best for Investment Tracking and Net Worth

Empower is in a category of its own. While it offers basic budgeting tools, its real strength lies in investment tracking and wealth management. This is truly one of the best dashboards for an overall view of your finances. You can connect your investment accounts, 401(k) or other retirement accounts, HSA, credit card accounts, and bank accounts to see them all in one place.

Empower is the tool for long-term financial planning including tracking your net worth. If you enjoy analyzing your finances, Empower does that for you with visually appealing charts and graphs. Empower also has a debt paydown tracker and savings planner.

One of my favorite Empower features is it’s free to use! There is a wealth management feature that does come at a cost but the dashboard, retirement planner, net worth tracker and the rest of the features we mentioned here are free.

Cost: Free

Verdict: If you’re investing or planning for retirement, Empower is a no-brainer to keep tabs on your portfolio and net worth.

Final Thoughts

YNAB is a great tool for budgeting. But at $99/year, it’s hard to justify when you can get more robust tools for the same price or less. Whether you’re looking to track your investments, manage your net worth, or just cancel that gym membership you forgot about, there’s a better option out there for you.

My Picks:

- Want everything in one place? Go with Monarch Money.

- Just need free investment and net worth tracking? Try Empower.

- Drowning in subscriptions? Rocket Money is your lifeboat.

- Looking for a full-life financial planner? Origin has it covered.