Ray Dalio All Weather Portfolio

The Ray Dalio All Weather Portfolio is designed to perform well in any economic cycle. Using risk parity to match asset classes to economic risk, the portfolio promises to perform well in any market with less volatility than traditional asset allocation models. In this article, we’ll examine the portfolio to see if it should be part of our investment strategy.

Resources and Tools Mentioned in this Article:

- Ray Dalio All Weather Portfolio (implemented via M1 Finance)

- 2x Ray Dalio All Weather Portfolio (implemented via M1 Finance)

- Money Master the Game: 7 Simple Steps to Financial Freedom by Tony Robbins (2016)

- Why in the World Would You Own Bonds When . . . by Ray Dalio (2021)

- Principles: Life and Work by Ray Dalio (2017)

- The Bridgewater All Weather Fund Story

- The Definitive Guide to the All Weather Portfolio, by Nick Maggiulli

- Portfolio Visualizer

- Personal Capital

Who is Ray Dalio?

Ray Dalio is a billionaire investor and hedge fund manager. Dalio founded Bridgewater Associates in 1975 and built it into the largest hedge fund in the world with $140 billion in assets under management. He is the author of Principles: Life and Work (2017).

Dalio is a student of economic cycles. He recently produced a video describing how economic cycles work:

It’s his view on economic cycles that informs his All Weather Portfolio.

The Ray Dalio All Weather Portfolio

The Bridgewater Associates All Weather Fund

The All Weather portfolio dates back to 1996. It was the product of analysis by Bridgewater’s Bob Prince and Ray Dalio, among others. What they found is the economic cycles revolve around two things: Inflation/deflation and growth/contraction.

Source: https://www.bridgewater.com/research-and-insights/the-all-weather-story

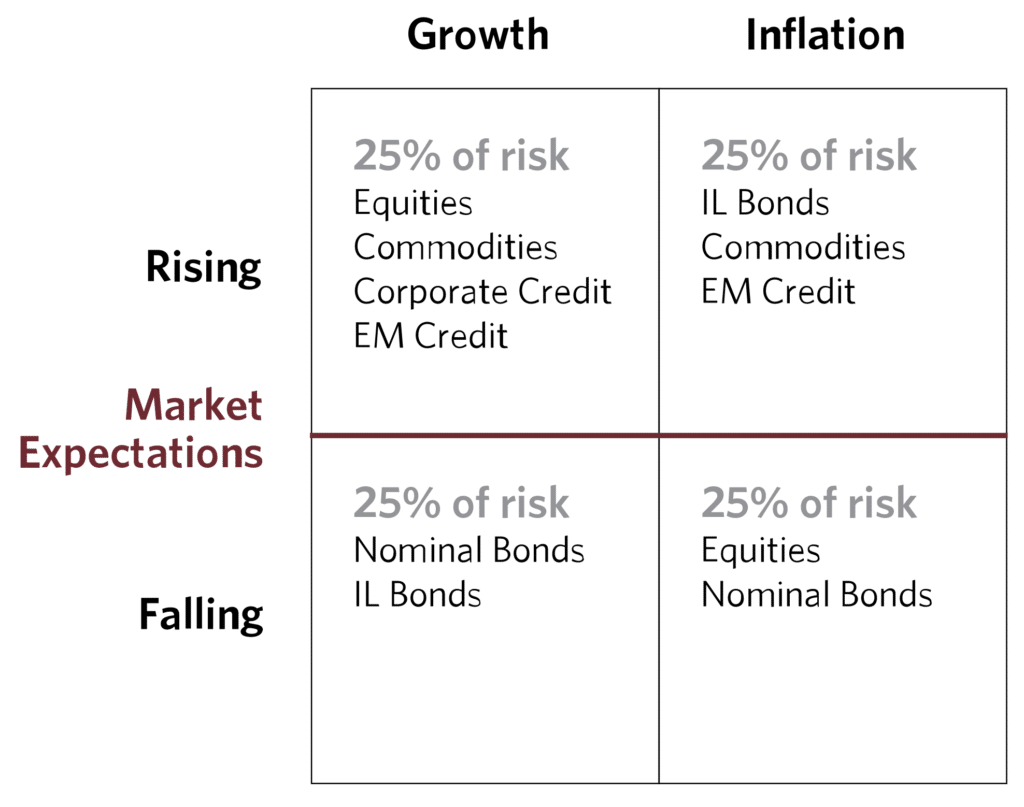

As growth and inflation rise and fall, different asset classes either rise and fall. The goal of the All Weather portfolio was to gain exposure in roughly equal percentages of the various asset classes that perform well in each quadrant. At Bridgewater, the result was the following:

- EM Credit: Emerging Market Debt

- IL Bonds: Inflation-linked bonds (Tips, I Bonds)

- Nominal Bonds: Bonds not linked to inflation (e.g., Treasury bonds)

Unlike a traditional asset allocation, the All Weather portfolio allocates just 25% or thereabouts to equities. The rest of the portfolio goes to various bonds and commodities, including gold. In this regard, in stands in sharp contrast to the 3-Fund Portfolio and the Warren Buffett Portfolio.

The above portfolio at Bridewater was available to corporate clients and pension funds. It was not available to the average investor, until recently.

The All Weather Portfolio

In 2016 Tony Robbins published Money Master the Game: 7 Simple Steps to Financial Freedom. For the book Robbins interviewed Dalio, who outlined the All Weather Portfolio in a way that average investors could mimic.

The portfolio consisted of the following asset classes:

- 30% Stocks

- 40% Long-Term Bonds

- 15% Intermediate-Term Bonds

- 7.5% Gold

- 7.5% Commodities

According to Tony Robbins, here are the performance metrics for the portfolio from 1984 to 2013:

- 9.7% annual returns

- You would have made money 86% of the time

- Average loss of just 1.9%

- Worst loss was -3.9%

- Volatility of 7.6%

The returns are remarkable given a volatility (standard deviation) of just 7.6%. By way of comparison, the S&P 500 has a standard deviation of more than 15%.

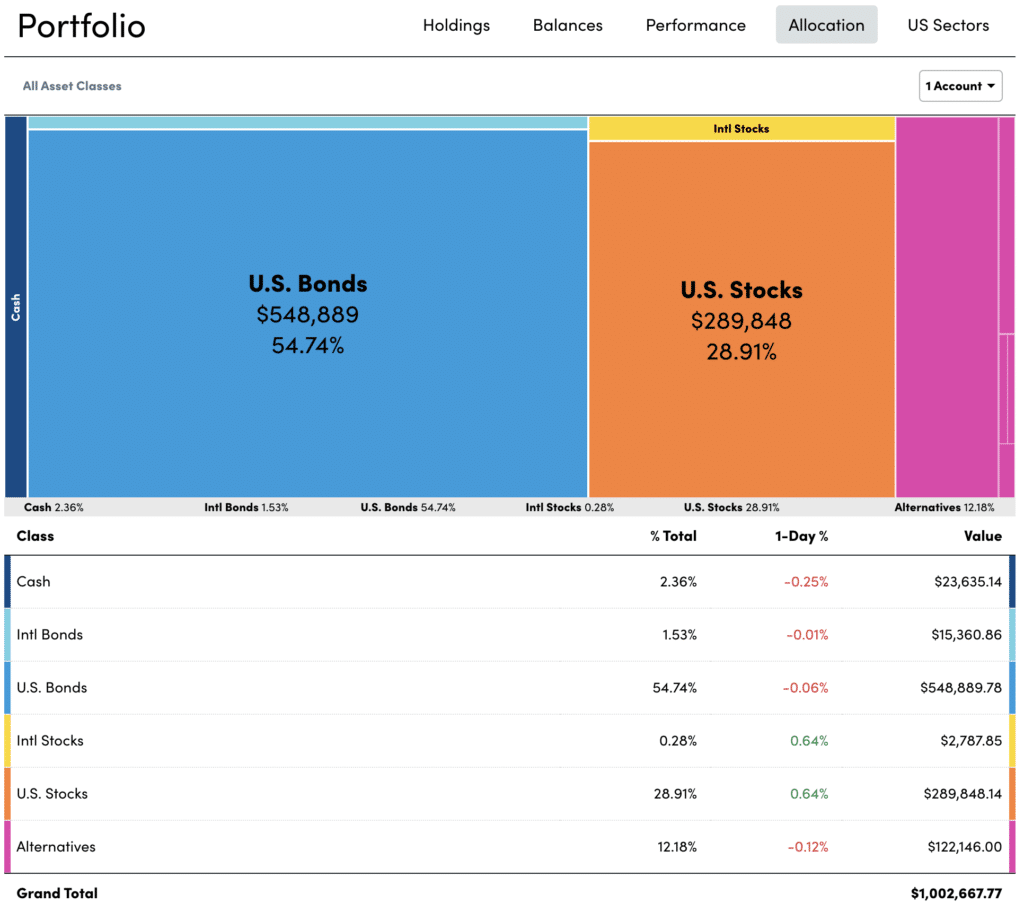

One way to implement this portfolio is to use the following ETFs:

- VTI 30%

- VGLT 40%

- USCI 7.5%

- GLD 7.5%

- BIV 15%

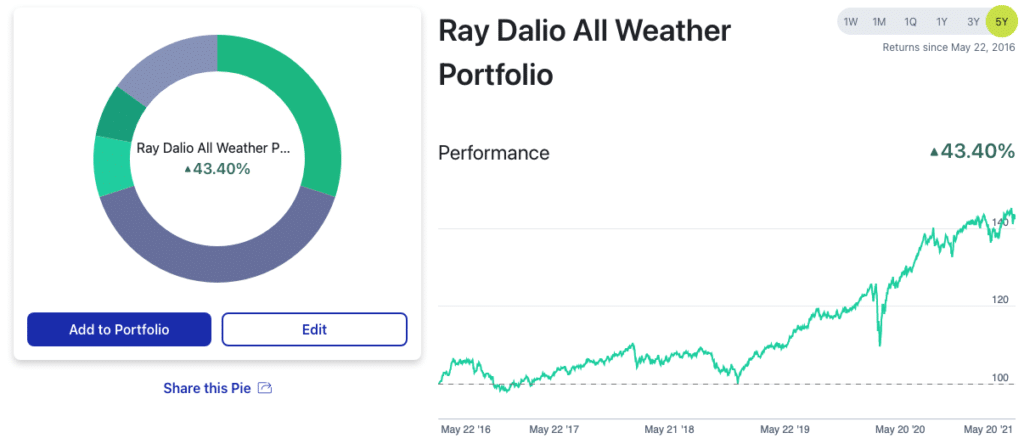

I’ve created this portfolio in M1 Finance which you can check out here.

As noted earlier, this portfolio’s asset allocation is anything but traditional. Here’s a view of the allocation using Personal Capital’s Asset Allocation Tool:

Backtesting of this portfolio is limited due to the commodities ETF. Still, we can see that it performed reasonably well since 2011 as compared to the Bogleheads 3-Fund Portfolio (80/20 allocation):

Note that it was neck-in-neck with the 3-fund portfolio until the recent post-Covid shock bull market. What’s noteworthy is that the Dalio portfolio’s standard deviation is just 6.23%, compared to 11.05% for the 3-fund portfolio. This in turn explains in part a Sharpe Ratio and Sortino Ratio much higher than the 3-fund portfolio.

In other words, the Ray Dalio portfolio performed better than the 3-fund portfolio on a risk-adjusted basis. At the same time, one can’t ignore that the 3-fund portfolio outperformed.

Long-term Bond Exposure

It’s hard to ignore the portfolio’s exposure to long bonds (and even intermediate term bonds) given current interest rates. If you believe that rates will rise, parking 40% of a portfolio in long-term bonds could be a recipe for disaster. Even Ray Dalio today questions why anybody would own bonds.

In his recent article, Why in the World Would You Own Bonds When…, Mr. Dalio described the economics of investing in bonds as stupid:

The economics of investing in bonds (and most financial assets) has become stupid.

He went on to explain why he believes bonds are in a bubble:

…If bond prices fall significantly that will produce significant losses for holders of them, which could encourage more selling. Bonds have been in a 40-year bull market that has rewarded those who were long and penalized those who were short, so the bull market has produced a large number of comfortable longs who haven’t gotten seriously stung by a price decline. That is one of the markers of a bubble.

Beyond the end of the 40-year bull run in bonds, Dalio goes so far as to say shorting bonds is a “relatively low-risk bet.”

If Dalio is right, and I believe he is, it calls into question the sustainability of the All Weather portfolio. Keep in mind that he recommended it to Tony Robbins in 2016. A lot has changed in the last five years.

2x Leveraged Ray Dalio Portfolio

It is worth asking whether it makes sense to used leveraged ETFs with the All Weather Portfolio. While I’m generally opposed to such measures, it’s common in risk parity portfolios to see leverage deployed to offset the low risk (i.e., low volatility) that these portfolios generate. The idea is to bring the volatility of the portfolio back in line with traditional asset allocation models, while enjoying slightly higher returns.

Creating the portfolio is easy in M1 Finance using ProShares ETFs. Here’s what it looks like:

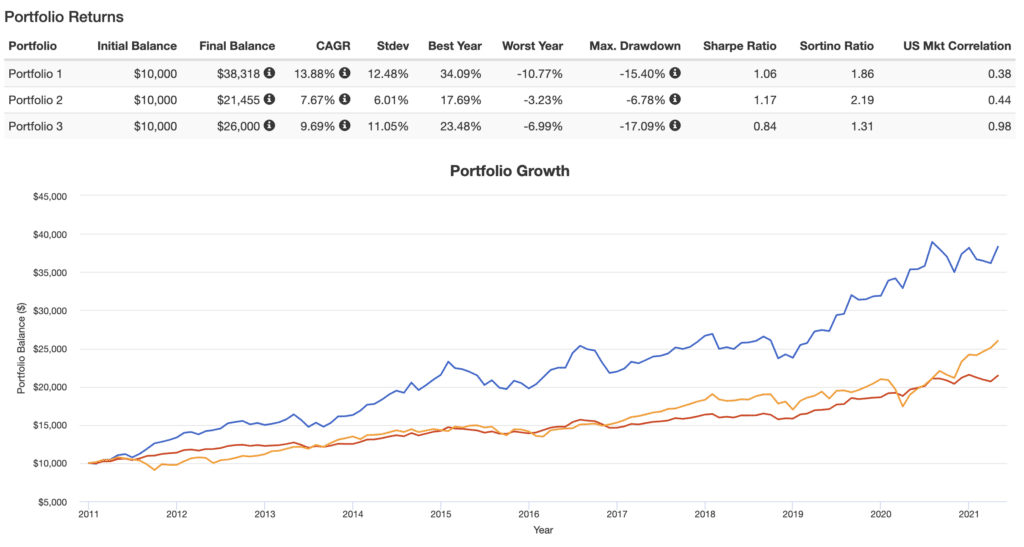

Examining this portfolio in Portfolio Visualizer led to some interesting results. What follows is a comparison of this portfolio, the standard All Weather Portfolio, and a 3-fund portfolio using an 80/20 allocation:

It’s not surprising that the leveraged portfolio (Portfolio #1) outperformed the unlevered portfolio (Portfolio #2). What is more interesting is that it trounced the 3-fund portfolio (Portfolio #3) on both a total return basis and a risk adjusted basis (see both the Sharpe and Sortino ratios).

Pros & Cons of the Ray Dalio All Weather Portfolio

In the final analysis, the Rad Dalio All Weather Portfolio has several pros and cons:

Pros

- Easy to implement with ETFs

- Volatility lower than a “traditional” portfolio

- Sharpe and Sortino ratios higher than a “traditional” portfolio

Cons

- May underperform a 3-fund portfolio unless leverage is used

- 50%+ allocation to intermediate and long-term bonds not ideal in current interest rate environment

- Exposure to commodities and gold can underperform for long periods of time.