The Paul Merriman Ultimate Buy and Hold Portfolio

I first met Paul Merriman back in 2017. He was kind enough to come on my podcast to talk about what he calls the Ultimate Buy and Hold Portfolio. We’ve kept in touch over the years, and in fact we were just talking about a month ago. In this article we’ll dig into the details of his investing strategy.

Who is Paul Merriman?

Paul founded an investment advisory firm back in 1983. He retired in 2012, and in 2013 he started the Merriman Financial Education Foundation where he helps educate investors. He’s also published several books, including his most recent one, We’re Talking Millions!: 12 Simple Ways To Supercharge Your Retirement.

Over the years he’s developed what he calls the Ultimate Buy and Hold Portfolio. As you’ll see, it consists of 10 stock asset classes, each implemented with a low cost index mutual fund or ETF.

The Ultimate Buy and Hold Portfolio

Stocks

There are several versions of Paul’s Ultimate Buy and Hold Portfolio. We’ll spend most of our time looking at the version that has become famous over the years. It consists of the following 10 stock asset classes:

- S&P 500

- U.S. Large Cap Value (LCV)

- U.S. Small Cap Blend (SCB)

- U.S. Small Cap Value (SCV)

- Real Estate Investment Trust (REIT)

- International Large Cap Blend (LCB)

- International LCV

- International SCB

- International SCV

- Emerging Markets

Paul allocates the equity portion of a portfolio equally across these asset classes. For example, a portfolio of 100% stocks would see 10% allocated to each asset class. An 80/20 portfolio would have 8% allocated to each class, with 20% going to one or more bond funds (we’ll look at examples in a moment, but you can check out Paul’s portfolio implemented as a 80/20 portfolio on M1 Finance.)

Bonds

Merriman recommends three types of bonds for the fixed income portion of his strategy:

- Intermediate term Treasury bonds (50% of total bonds)

- Short term Treasury bonds and bills (30%)

- Short term TIPS (20%)

I agree with much of what he suggests. He’s avoided high-risk bonds such as those issued from emerging market governments or troubled corporations. He’s also kept to a shorter yield curve and added some exposure to inflation protected securities.

If there’s any aspect I might adjust it’s to add more TIPS. If you believe inflation will be higher in the future than the market is predicting, TIPS are a way to place that bet. In contrast, if you think inflation will be lower than expected, Treasury bonds are the answer.

For those like me who have absolutely no idea, you split your bond portfolio equally between the two. That’s exactly what the David Swensen Portfolio does. The only caveat today is that TIPS start with a negative yield, and if you’re like me, that’s a hard pill to swallow. Nevertheless, that’s how I’ve implemented the Ultimate Buy and Hold strategy in M1 Finance.

How the Ultimate Buy and Hold Portfolio is Different

There are several aspects to note about Merriman’s investing strategy:

International Exposure: The portfolio allocates a full 50% of equities to international funds. This is unique among the portfolio’s I’ve evaluated. Most are less than 50%. The Warren Buffett Portfolio doesn’t allocate anything directly to international stocks. And Vanguard’s founder, Jack Bogle, saw no need to own international stocks.

I personally think international exposure is important. My portfolio allocates about 30% to global funds.

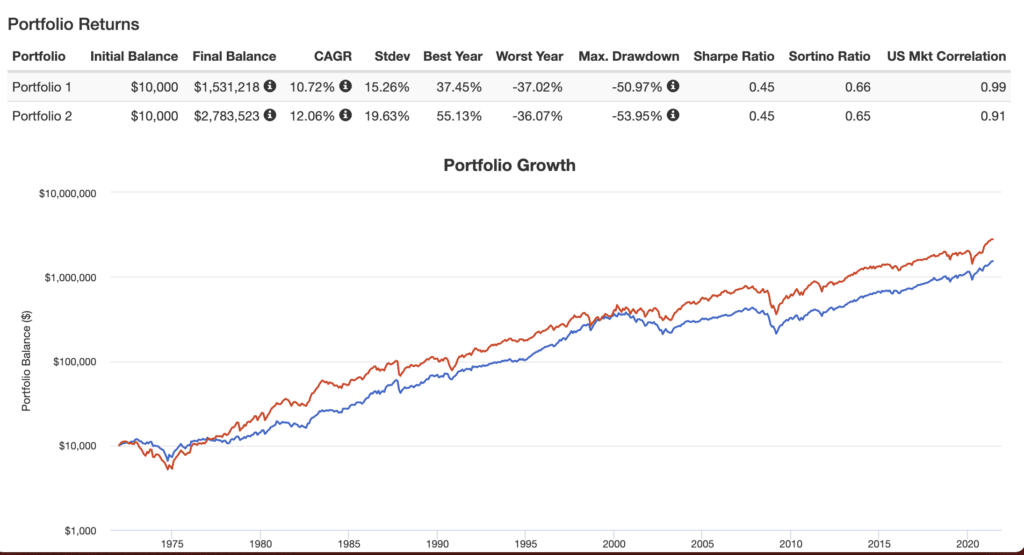

Small Cap Exposure: The Ultimate Buy & Hold portfolio allocates 20% to small cap stocks. It does so because history tells us that small cap companies out perform large cap companies over the long term. Over the past 50 years, small cap has outperformed large cap by more than 1%. A $10,000 investment beginning in 1972 would grow to more than $2.7 million if invested in small companies, compared to $1.5 million in large companies.

Value Exposure: Finally, Merriman’s strategy favors value investments over growth. Again, history tells the story. Although growth stocks have outperformed value recently, over the last 100 years, value has performed better in both large and small companies.

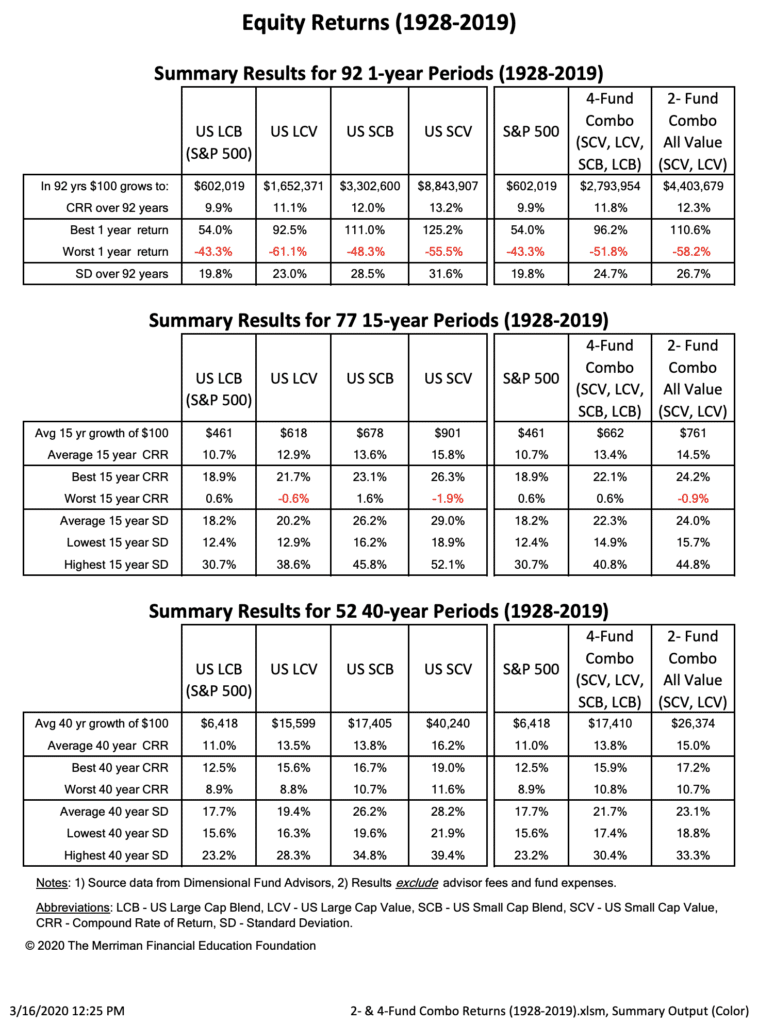

Historical Performance of the Ultimate Buy and Hold Strategy

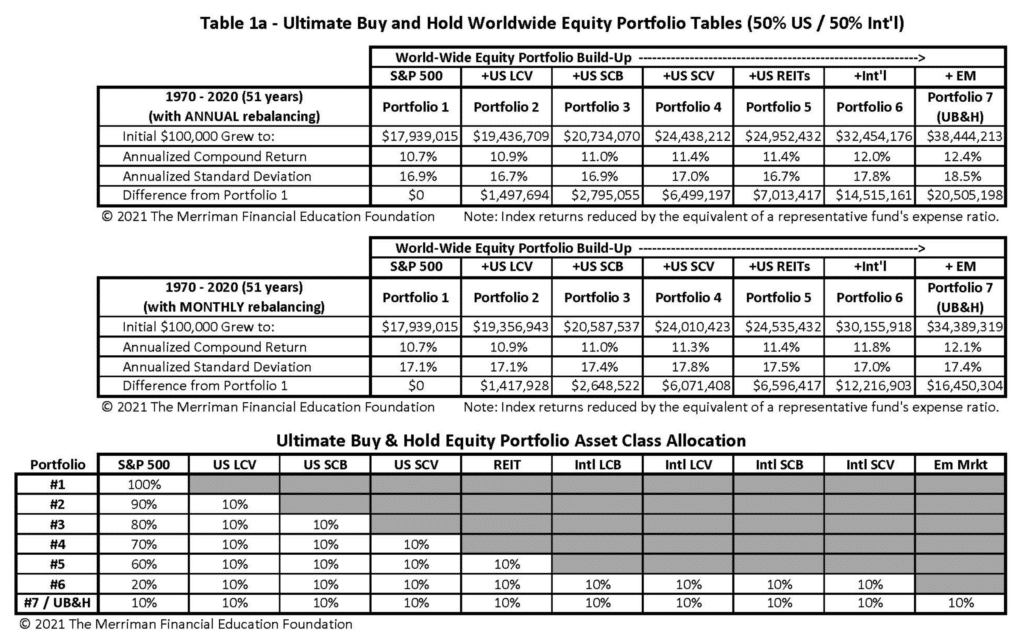

The big question is how Merriman’s Ultimate Buy and Hold portfolio has performed. As you can see in the chart below (click the image to enlarge it), the portfolio has trounced the S&P 500 over the last 50 years.

The portfolio has returned 12.4% annually compared to 10.7% for the S&P 500. Note, however, that it comes with more risk. The standard deviation of Merriman’s portfolio, when rebalanced annually, weighs in at 18.5%, compared to 16.9% for the S&P 500. In other words, if you can handle the volatility, Merriman’s portfolio may be a sound option. Note too that by rebalancing monthly, you decrease both the returns and volatility.

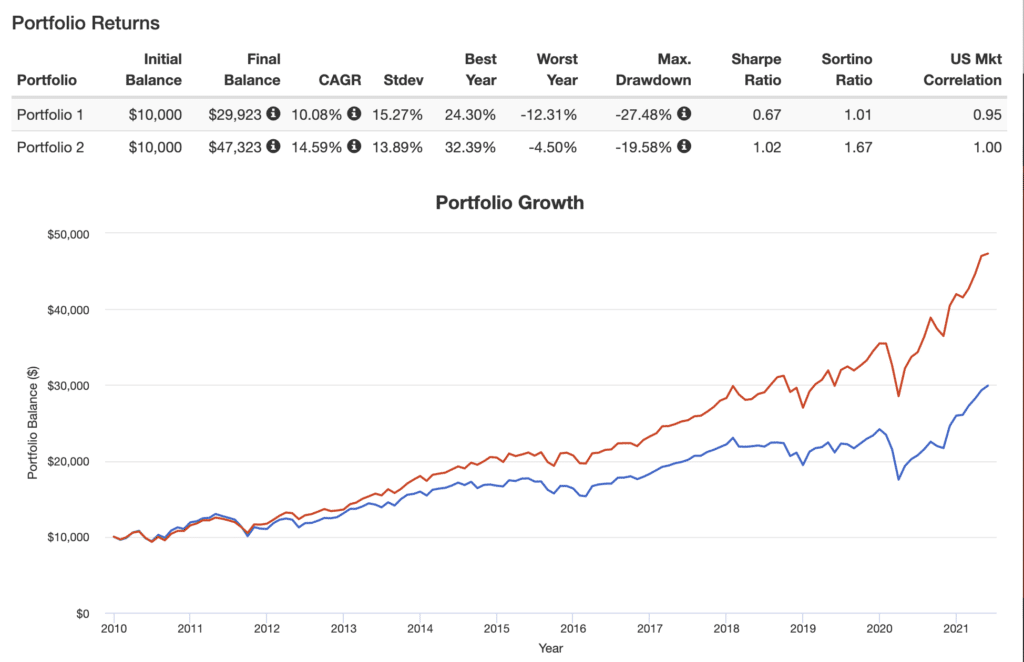

Before we leave the performance of this investing strategy, it’s worth looking at how well it’s done over the last decade. As you can see, the portfolio has lagged the S&P 500 since 2010:

Why? Over the last decade large companies have outperformed small companies, growth companies have outperformed value companies, and U.S. companies have outperformed international companies. In other words, in just about every way that the Buy and Hold portfolio overweights has seen underperformance.

Much of this is the result of a low inflation, and easy money policy of the Fed and federal government. Massive borrowing and spending has sent asset prices soaring, which favors larger growth companies.

I don’t believe this undermines Merriman’s portfolio. The U.S. can’t borrow to infinity. But it does underscore that any investment strategy can lag the market for extended periods of time.

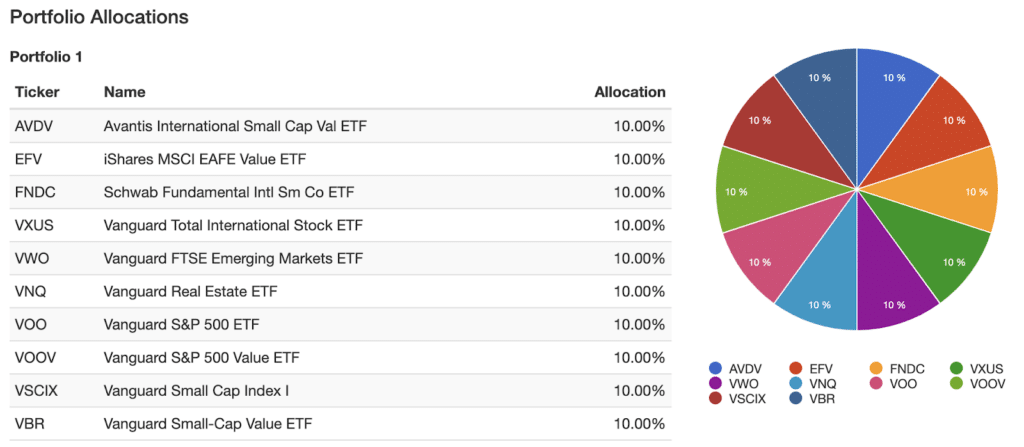

Building the UB&H Strategy

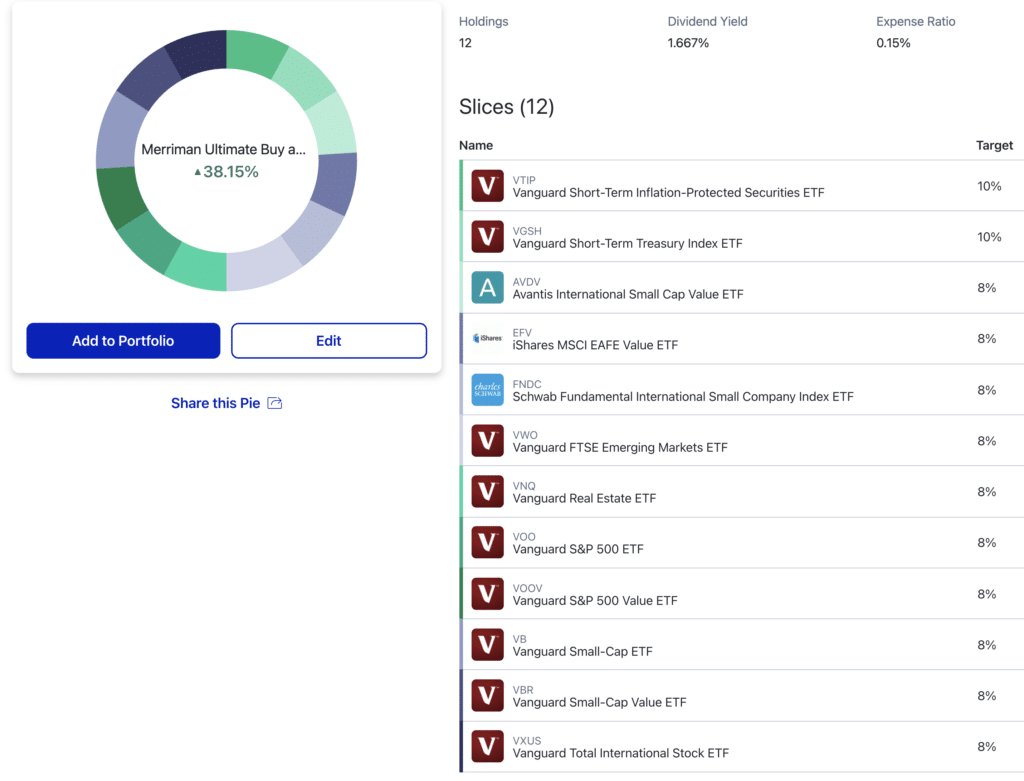

There are a number of ways to construct the Ultimate Buy & Hold Strategy. I’ve built one approach in M1 Finance using low cost index ETFs:

Keep a few things in mind. First, the above portfolio is 80% stocks and 20% bonds. One can easily change this to whatever stock/bond allocation is best to meet their investment goals.

Second, some of the chosen ETFs cover more than one asset class. For example, Vanguard’s small-cap ETF (ticker: VB) includes mid-cap companies. I think this is a perfectly reasonable approach to the UB&H strategy, but one could easily substitute a micro-cap ETF (e.g, iShares Micro-Cap ETF IWC).

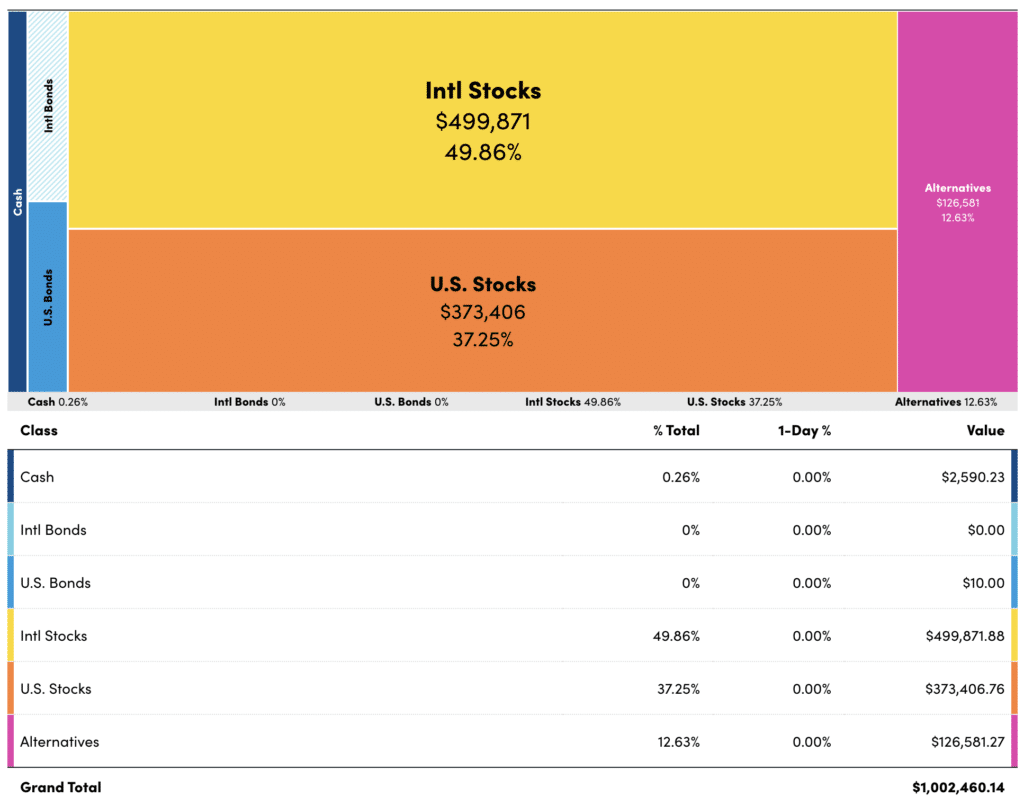

Here’s what the asset allocation looks like in Personal Capital:

Finally, M1 Finance is ideal for this portfolio as it makes rebalancing easy. With M1, you can rebalance a portfolio with the click of a button.

The Simplified Ultimate Buy and Hold Portfolio Alternative

Paul Merriman and his team have released simplified versions of the UB&H portfolio. These are ideal for those who don’t want to juggle 10 stock asset classes! He has both a 4-fund and a 2-fund solution.

4-Fund Ultimate Buy and Hold Portfolio

The Merriman 4-Fund Portfolio (see it here at M1 Finance) consists of the following four asset classes:

- LCB (S&P 500)

- LCV

- SCB

- SCV

This portfolio’s performance is similar to the 10-fund portfolio. It has averaged 13.8% over rolling 15-year periods since 1928. The S&P 500 has averaged just 11.0%.

2-Fund Ultimate Buy and Hold Portfolio

The 2-fund solution has performed even better. Its average performance over rolling 15-year periods is an amazing 14.5%. Here, however, some cautionary words.

The 2-fund portfolio bets everything on value investing. The two asset classes are SCV and LCV. In the short to medium term, this portfolio could significantly underperform the market, such as what the 3-fund portfolio seeks to replicate.

Final Thoughts

The 10-fund Ultimate Buy & Hold portfolio is an excellent way to potentially outperform the market without sacrificing diversification. It does, however, represent a more volatile approach to investing. Therefore, it’s not for everyone. At the same time, one can modify the portfolio to better suit individual approaches to investing.

My Research for this Article

- Ultimate Buy and Hold Portfolio (via M1 Finance)

- 4-Fund Buy and Hold Portfolio (via M1 Finance)

- About Paul Merriman

- Jack Bogle on International Investing

- The Ultimate Buy and Hold Strategy: 2021 Update

- Worldwide Equity Portfolio Tables 50% US/50% Int’l

- Simplified Ultimate Buy and Hold Portfolio

- 4-Fund Combo Latest Recommendations