7 Best IRA Accounts to Open in 2023

Some of the links in this article may be affiliate links, meaning at no cost to you I earn a commission if you click through and make a purchase or open an account. I only recommend products or services that I (1) believe in and (2) would recommend to my mom. Advertisers have had no control, influence, or input on this article, and they never will.

My goal for this website is to help readers become better investors and prepare for retirement. To do this, some of the products featured here may be from our partners. This doesn’t influence our evaluations or reviews. Our opinions are our own.

Opening an IRA account is an important step towards saving for retirement. The best IRA accounts have low fees, a wide array of investment options and tools that make investing easy.

Summary of Best IRA Accounts

Betterment

Best Robo for hands-off investors

I met the founder of Betterment, Jon Stein, about 10 years ago. Since then, I've followed Betterment closely. It is one of a few robo advisors I recommend for IRA accounts.

With Betterment, the only decision you have to make is how much you want invested in stocks and how much in bonds. Betterment even helps you make that decision through a series of questions. Once you set your stock and bond allocation, Betterment does the rest. It automatically allocates your portfolio across about a dozen stock and bond ETFs.

One downside of Betterment is that, like all robo advisors, there is a fee. Betterment's fee is 25 basis points (0.25%) for what it calls Digital Investing. The cost goes up to 40 basis points (0.40%) with Premium Investing, which gives you unlimited calls and emails to Betterment's team of Certified Financial Planners. You can also purchase flat-fee advice from one of Betterment's CFPs. These fees are in addition to the costs of the underlying ETFs.

Pros:

- Well established robo advisor

- Reasonable costs

- Excellent portfolio construction

- Flexible Portfolios

- Retirement planning tools

- Very easy to use

- Human advisors for an extra fee, including flat-fee advice

Cons:

- Fees over and above the cost of ETS

Account Types: Traditional IRA, Roth IRA, SEP IRA, Inherited IRA

Account Fees: 0.25% to 0.40%

Transaction Costs: None

Required Minimum: None

Investing Tools: Automatic portfolio construction, diversification, rebalancing, and dividend reinvestment

Promotions: Up to 1 year of waived account fees

Fidelity

Best Overall IRA Account

Fidelity is a full service broker that powers many of the 401k plans and other retirement accounts. As an IRA provider, it gives investors access to virtually every mutual fund and ETF or stock available in the market. It does so without account fees, and its minimum investment requirements, if any, are low.

It spends $2.5 billion a year on technology, enabling it to offer excellent tools. One example is an account aggregation feature called Full View. Powered by eMoneyAdvisor software, you can aggregate all of your financial accounts, including those held outside Fidelity, into the tool. It gives you a dashboard of all of you finances. While I do take advantage of this feature, Personal Capital is a better option in my view.

Fidelity also offers its own version of a robo advisor, called Fidelity Go. Unlike Vanguard's Digital Advisory Service, it requires no account minimum and is free for accounts up to $10,000. For accounts between $10,000 and $49,999, it costs $3 a month. For accounts $50,000 and up it costs 0.35% per year.

Finally, I've found Fidelity's customer service to be very good. It also has physical locations, which I find helpful. It's not often that I need to speak with a Fidelity representative in person, but it's nice to know that I can if needed.

Pros:

- Excellent customer service

- Fidelity invests heavily in technology

- Wide range of account types

- Wide range of investment options, including low cost index funds

- Robust investing tools

- Low costs

- Cash management (debit card, credit card, online bill pay)

Cons:

- Website can be difficult to use

- No Roth Solo 401(k) for business owners

- Robo Advisor services (Fidelity Go and Go + are more expensive than alternatives)

Account Types: Traditional IRA, Roth IRA, SEP IRA, IRA Rollover, Inherited IRA

Account Fees: None

Transaction Costs: None

Required Minimum: None

Investing Tools: Stock ETF or mutual fund research and market analysis tools, Full View

Promotions: None

Vanguard

Best for Low Cost Advisory Services

I've been a Vanguard client for decades. I'm a huge fan of their mutual funds and ETFs. Of course, you don't need to open a Vanguard account to invest in their funds. In fact, you can invest in Vanguard funds through any of the IRA brokers listed here.

For those who know they want to invest in only Vanguard funds, however, it is a good option for opening an IRA. It's also a good option if you want to use its advisory services. It offers both a digital advisory service for 25 basis points ($3,000 minimum) and a human based advisory service for 30 basis points (minimum $50,000). Otherwise you can invest on your own for just the cost of the Vanguard mutual funds and ETFs.

Pros:

- Excellent mutual funds and ETFs

- Digital and human powered advisory services

Cons:

- Website and tools could be better

- Advisory services have minimum investments

- Vanguard mutual funds have minimum investments (typically $1,000 or $3,000)

Account Types: Traditional IRA, Roth IRA, SEP IRA, IRA Rollover, Inherited IRA

Account Fees: None unless an advisory service is used

Transaction Costs: $0

Required Minimum: $1,000 to $3,000 for many of Vanguard's mutual funds, no minimum for ETFs, $3,000 for its Digital Advisory Services, $50,000 for its Personal Advisory Services.

Investing Tools: Asset allocation tool, investment comparison, screen & analyze investments, retirement planning tools, education savings tools.

Promotions: None

Wealthfront

Best for hands-off investors

Wealthfront is one of three robo advisors to make our list of the top IRA account options. It's very similar to Betterment. You simply select your stock and bond allocation and Wealthfront takes care of the rest.

It has a similar cost structure at 25 basis points plus the cost of the underlying ETFs. It does have a few differences in terms of portfolio construction. Most notably it includes a REIT index fund in retirement accounts, whereas Betterment does not. Wealthfront automates investing. It helps you create a personalized portfolio, and then rebalances it automatically as markets fluctuate.

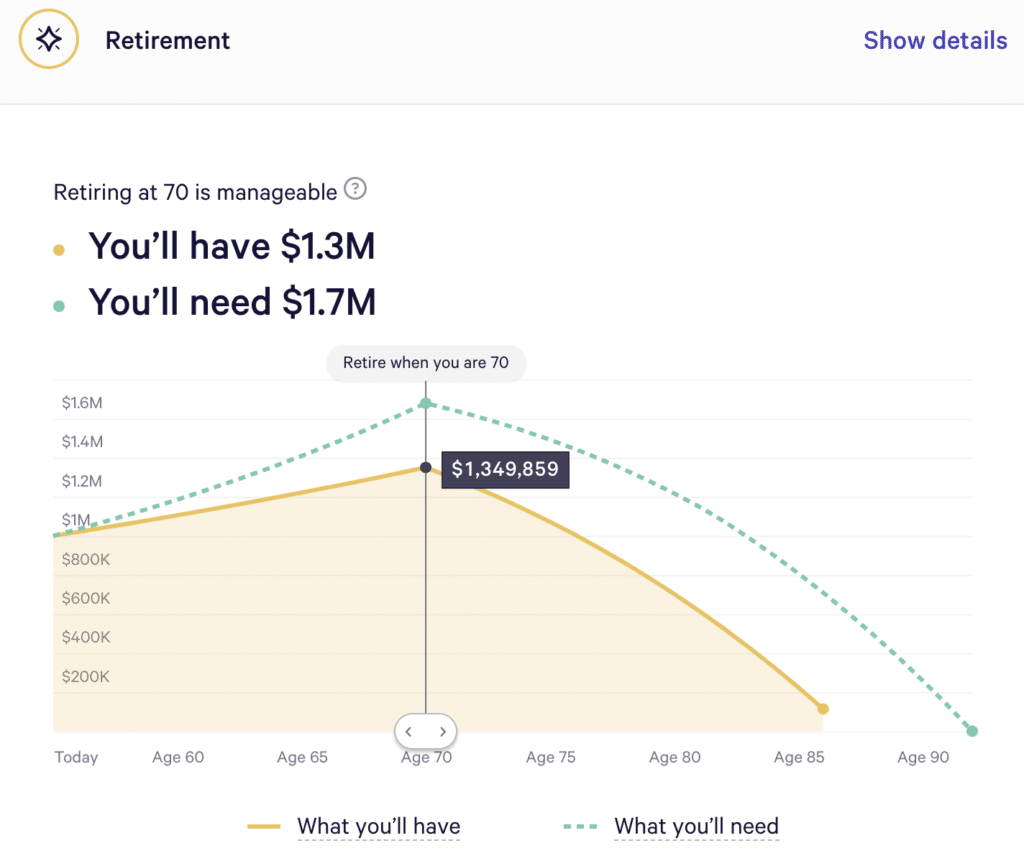

Wealthfront also offers a retirement planning tool it calls the Path. The tool enables users to connect outside accounts, and then it evaluates your retirement readiness.

For those in retirement, Wealthfront offers a number of cash management features. These include accounts with up to $1 million in FDIC insurance, online bill pay, mobile check deposit and no account fees. It also offers a Visa debit card with over 19,000 free ATMs. Note, however, that its interest rate is well below the best online bank options.

If you have taxable accounts at Wealthfront, it also offers automated tax-loss harvesting and direct indexing.

Pros:

- Easy to use

- Low cost

- Excellent portfolio construction

- Automatically rebalances portfolio

- Automatically harvests tax losses in taxable account

Cons:

- It does charge a fee over and above the ETFs

- Limited portfolio construction options

Account Types: Traditional IRA, Roth IRA, SEP IRA and IRA Rollover

Account Fees: 0.25%

Transaction Costs: None

Required Minimum: $500

Investing Tools: Personalized portfolio construction, automatic rebalancing, automatic tax loss harvesting

Promotions: Get the first $5,000 managed for free

M1 Finance

Best Free Robo-Advisor

M1 Finance earns our top award for the best free robo-advisor IRA account. It earns this honor for several reasons.

First, it charges no account fees or transaction fees. While I like other automated services such as Wealthfront and Betterment, M1 Finance is the only one that doesn't charge a fee for its services. Second, it enables you to build what it calls pies. You can think of a pie as a portfolio that you can include just about any ETF or stock that you want.

You can use pre-constructed pies that are excellent for retirement investing. In fact, I've created a 3-fund retirement portfolio in M1 Finance that anyone can use. I've also created several more complex portfolios to consider.

With M1 Finance, managing an IRA is easy. You can rebalance a portfolio with the click of a button. And for those that want to invest in individual stocks, you can easily create a pie that contains the stocks of your choice or add individual stocks to a pie that is invested also in index ETFs like the portfolios above.

Creating the pies, while easy, does take some effort. As such, M1 Finance is not as hands-off as other robos, such as Betterment and Wealthfront (see below).

Account Types: Traditional IRA, Roth IRA and SEP IRA

Account Fees: $0

Transaction Costs: $0

Minimum Deposit: $100

Investing Tools: Easily create customized portfolios or use portfolios created by M1 Finance, auto-invest settings, auto-rebalance portfolio

Promotions: $30 bonus when you fund your account with $1,000+

Want help with a 401k Rollover? Capitalize will walk you through the process for free. They do all the leg work to move your 401k to your existing IRA or a new one of your choosing. Not sure where to open an IRA? Capitalize can help you with that, too.

Merrill Edge

Best for hands-on investors and Bank of America clients

I recently opened a rollover IRA at Merrill Edge. It's part of Bank of America, making it ideal if you bank at BofA. Merrill Edge can be a great way to have all of your accounts under one umbrella. Similar to a Fidelity or Vanguard, you can invest in just about anything through Merrill Edge.

It also offers a robust set of tools for research and analyzing investments, including tracking your progress towards retirement. It does offer its version of a robo advisor, called Merrill Guided Investing. The downside is that it's more expensive than Betterment or Wealthfront.

Pros:

- Low Cost

- Excellent investment tools

- Integrated with Bank of America accounts

Cons:

- No automated rebalancing

- Merrill Guided Investing more expensive that other robo advisors

Account Types: Traditional IRA, Roth IRA, SEP IRA, IRA Rollover, Inherited IRA

Account Fees: None for self-directed IRA accounts. Merrill Guided Investing costs 0.45% for online only and 0.85% for online with an advisor

Transaction Costs: None

Required Minimum: None for self-directed IRA; $1,000 for Merrill Guided Investing; $20,000 for Merrill Guided Investing with an advisor

Investing Tools: Research and retirement planning tools

Promotions: Up to $2,500 for new accounts depending on value. This promotion occurs annually for a limited time.

Ally Invest

Best for hands-off investors

Ally, the financial institution best known for online banking, brings the same excellent website and mobile app to an investment platform. It offers both self-directed IRAs and its own version of a robo advisor called Managed Portfolios. It also comes with a host of tools to analyze your investments and your portfolio.

For self-directed IRAs, there are no commissions or account fees. The Managed Portfolios option requires just a $100 minimum. Unlike other robo advisors, Ally doesn't charge a fee. However, it does require you to keep 30% of your portfolio in cash, which is a non-starter for retirement investing. As such, I don't recommend Ally Invest's Managed Portfolios unless you have a specific reason for keeping so much in cash.

Pros:

- Virtually free

- Easy website to navigate

- Excellent tools

- Excellent mobile app

Cons:

- Managed Portfolios keep 30% in cash

Account Types: Traditional, Roth IRA and Rollover IRA

Account Fees: None

Transaction Costs: None

Required Minimum: None to open a self-directed account, $2,000 for margin accounts, and $100 for a Managed Portfolio account.

Investing Tools: Streaming charts, profit/loss calculator, market and company snapshots, probability calculator, watchlists, market data and option chains.

Promotions: $50 to $3,500, requiring a deposit of transfer of $10,000 to $2 million or more. Ally Invest also credits transfer fees, up to $150, when moving accounts from another broker.

How to Choose the Best IRA Account

Don't focus on what you will invest in

One of the big misconceptions about opening an IRA account is that you should focus on what you want to invest in. When I started investing 30 years ago, this was an important consideration. I couldn't go to Fidelity and buy Vanguard funds. Over time, you could but there were fees.

Today, you can invest in virtually anything at just about any broker with few if any transaction costs. As a result, when opening an IRA account, the focus shouldn't be on what you want to invest in. Instead, focus on how you want to invest.

Focus on how you will invest

There are basically three types of investors. There's the hands off investors, who simply wants to set it and forget it. There's the hands-on investor who wants to control every detail of the portfolio. And then there are those who want to be able to control their investments to some degree, but at the same time automate things like rebalancing the portfolio.

Understanding the type of investor you are will help you pick the best IRA account.

3 Types of Investors

1. Hands-Off Investors

The best IRA account options for hands-off investors are M1 Finance, Betterment and Wealthfront. Strictly speaking, Betterment and Wealthfront are the most hands off types of IRA accounts in our list. As noted above, you simply set the stock and bond allocation and they do the rest. The downside is that they both charge fees for the service of 25 to 40 basis points. While that may not seem like much, over a lifetime of investing it can easily add up to hundreds of thousands of dollars.

With M1 Finance, you do have to decide on the pie you want to use. They're easy to create and there are pre-built pies that are ideal for long term retirement investors. Once you select one, it functions very similar to a robo advisor.

Each contribution you make is divided among the individual investments in your pie according to the allocation you set. In addition, you can rebalance the portfolio with the click of a button. At the same time, however, you get great control over your investments. For example, if you wanted to add the stock of a single company to a three fund portfolio, you could do so in a matter of seconds. You could then allocate whatever percentage of that portfolio you want.

Either way, M1 Finance, Betterment and Wealthfront are all good options for hands-off investing.

2. Hands-On Investors

A traditional broker is certainly a strong option in our list that includes, Vanguard, Fidelity, Merrill Edge and Ally Invest. While they each have their own pros and cons, for most IRA investors it frankly doesn't matter. You can buy any investment you want at any of these brokers and they all function in a relatively similar ways.

Alternatively, hands-on investors could use M1 Finance. As noted above, you can construct the pie or multiple pies as you see fit. You control the rebalancing and at the same time M1 Finance tools make rebalancing very easy.

3. Control with Automation

As you've probably guessed by now, there's only one that fits into this category, and that's M1 Finance. If I were starting as an investor today, I'd probably use M1 Finance. I use it today to invest all of the cashback credit card rewards that we receive.

Understanding the Impact of IRA Account Fees

Investment fees are critical to the long term performance of any portfolio. Most IRA account brokers charge no account fees or transaction fees. The one exception are robo advisors, including automated investing platforms at traditional brokers. Fees for these services range from about 0.25% to 0.45%.

It would be a mistake to dismiss these fees. While robo advisors are a good choice for those wanting totally hands-off investing, it's important to understand how these fees can effect your wealth over time.

Let's assume you invest $500 a month over a 45 year period (we'll ignore inflation). The account would grow to approximately $2.6 million with an 8% return (thank you, compounding!). If we reduce that return assumption by 25 basis points to account for the robo advisor fees, the account balance drops by more than $200,000 after 45 years.

While it's certainly true that $200,000 45 years from now will be worth a lot less than it is today, it's still a lot of money. This doesn't rule out Betterment, Wealthfront or other managed portfolios. But it should be a consideration as you make your choice.

Mythodology

My analysis stems from holding accounts at each of the brokers on the list, with the exception of Ally Invest. I've had a Rollover IRA, Roth IRA, Traditional IRA, SEP IRA or an Inherited IRA at Wealthfront, Vanguard, Fidelity and Merrill Edge. I've held taxable accounts at Betterment and M1 Finance.

Beyond my own experience, I focus on fees and functionality. Fees are always critical, and how each broker works is important. You want to match your own personal approach to investing with the right IRA account. I also considered each broker's website and mobile app, as well as their investing tools.

FAQs

Where is the best place to open an IRA?

For the vast majority of investors M1 Finance is an ideal option. It's virtually free and gives access to just about every mutual fund, ETF or stock out there. In addition it has excellent tools to manage your portfolio, including automated rebalancing.

Are there any free IRA accounts?

Yes. Most brokerage accounts today offer IRA accounts with no account fees and no transaction costs. One exception would be robo advisor type services, such as Betterment, Wealthfront or Vanguard’s Digital Advisory Services. These tools, while making investing easier, typically cost 25 to 45 basis points, in addition to the costs of the ETFs.

Can I open an IRA account if I have a 401k?

Yes. Having a workplace retirement account does not disqualify you from opening an IRA.

Your income, marital status, and other factors, however, could determine whether you can deduct traditional IRA contributions from your income, or whether you can contribute to a Roth IRA.

Rob Berger is a former securities lawyer and founding editor of Forbes Money Advisor. He is the author of Retire Before Mom and Dad and the host of the Financial Freedom Show.