My Favorite Calendar-Based Budgeting Apps

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

By Rob Berger, JD | August 28, 2025

When it comes to budgeting, there’s one word I never want to hear–Surprise! If I’ve got a bill coming due or a recurring expense around the corner, I want to know. And the best way to see this is with a calendar view of my budget.

After reviewing over a dozen options, I’ve narrowed it down to 7 calendar-based money management apps worth considering. I personally use Monarch Money, but there are a number of really good options in the list below.

My Top 2 Favorite Apps in This List

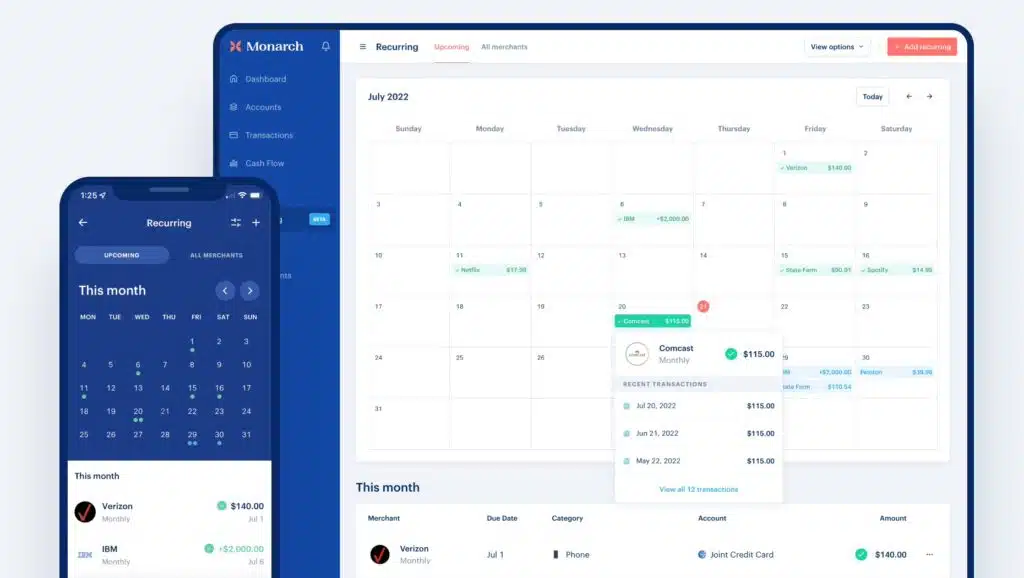

1. Monarch Money offers more robust features at a reasonable price. It includes a calendar view of your recurring expenses that shows upcoming bills. Clicking any upcoming expenses on the calendar reveals a pop-up for that expense show the amounts over the last three months. You can also invite family members (at no additional cost) to use the account which is great for couples to track finances together.

App Store Rating: 4.9 (45k reviews)

Platforms: Apple iOS, Android or Web

Cost: 7-day free trial, then $8.33 per month when paid annually ($99.99/year), and get 50% OFF your first year with code ROB50

Best for: Users looking for a more robust calendar-based personal finance app

On Monarch’s Website

2. Origin combines a calendar view for recurring expenses, including bills, and an easy way to indicate a transaction is recurring. Origin identifies transactions it belives to be recurring, and then you can click yes or no to add it to the calendar.

With the use of AI, it will create a budget for you and automatically categorize transactions. While it automates much of the work, it allows you to customize categorizes and budgets as you want. Origin also has features designed for couples. You can track your net worth and investments, and even file your taxes for free.

7 Calendar-Based Personal Finance Apps

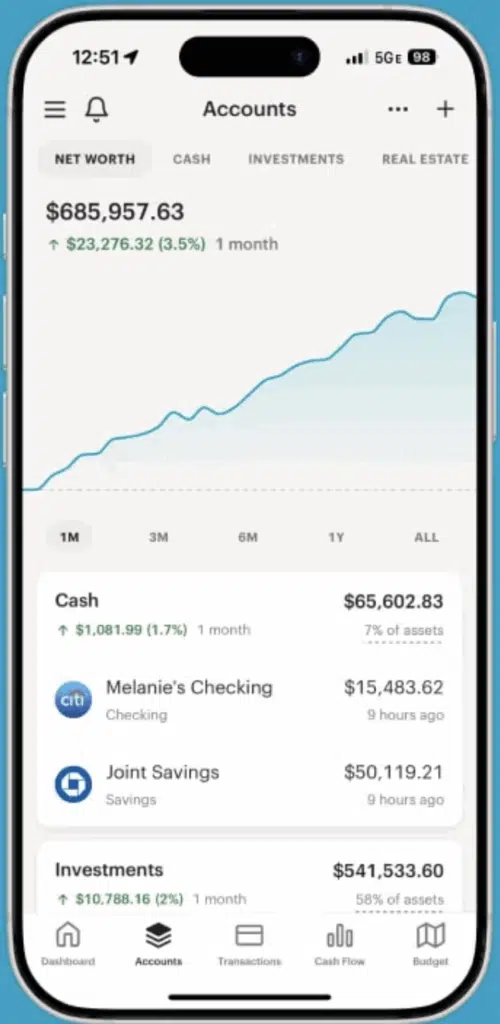

Monarch Money

Monarch Money has a recurring calendar feature for users to see upcoming bills, subscriptions, and paychecks. The calendar displays paid transactions in green with checkmarks and upcoming transactions are blue.

Monarch Money can automatically identify recurring transactions and users can also manually add or edit recurring items. The Bill Sync feature shows credit card and loan statements with balances and minimum payments due within the calendar.

Amazon Sync: One of my favorite Monarch features is its Amazon Chrome Extension. It syncs Amazon transactions with your Amazon account giving you visibility in Monarch of what you bought. This makes categorizing Amazon transactions much easier.

Other Monarch Money features include customizable reports, investment tracking, and goal setting. Users can also invite partners to manage finances together at no extra cost.

- App Store Rating: 4.9 out of 5 stars among 45k+ iOS users.

- Google Play Rating: 4.8 out of 5 stars among 11k+ Android users.

- Price: Try Monarch for free for seven (7) days. After that it’s $14.99/month or $99.99/year ($8.33 per month). For a limited time, get 50% off the first year subscription with promo code ROB50.

Key Features

- Calendar view

- Dedicated recurring transactions section

- Monitor investments

- Net worth tracking

- Create savings goals

- Add partner or family members

- One-week free trial

Don’t forget the Promo Code ROB50 to get 50% off the first year of Monarch.

Rocket Money

Rocket Money offers users a calendar feature that allows you to view upcoming bills and subscriptions. You can access the Calendar View in the “Recurring” tab of the Rocket Money app.

In the image below, you can see what it looks like when you add the Rocket Money calendar view widget to your iphone.

Rocket Money is also on my list of favorite subscription management apps. It can identify recurring charges, like subscriptions, organize them in one place, and alert you when any are due.

- App Store Rating: 4.4 out of 5 stars among 214k iOS users.

- Google Play Rating: 4.6 out of 5 stars among 93k Android users.

- Price: Free, but there is a Premium Membership. Pricing for the Premium membership ranges between $6 – $12 per month. You choose what you want to pay within this range.

Key Features

- Calendar view

- Organizes subscription transactions

- Track your spending

- Free version available

- Link your bank accounts

- Credit score tracking

- Automatic savings feature

- Balance alerts

Simplifi

Simplifi’s calendar view shows scheduled and past transactions including income like regular paychecks, as well as bills and recurring transactions. You can access the calendar in the Bills & Income section of the app.

Simplifi can also connect to your bank accounts, create and track savings goals, and show you a breakdown of your spending so know where you money is going. You can also track your investment accounts and your net worth.

Simplifi is also one of the more affordable apps in this list. It’s regularly $5.99/month (billed annually at $71.88) but you can get it now for $2.99/month the first year (billed annually at $47.88).

- App Store Rating: 4.4 out of 5 stars among 5.6k iOS users.

- Google Play Rating: 4.1 out of 5 stars among 3k+ Android users.

- Price: Regularly $5.99/month (billed annually at $71.88) but available now for $3.99/month (billed annually at $47.88).

Key Features

- Connect your bank accounts

- Create savings goals

- Manage your budget

- Track investments

- Track net worth

- 30-day money back guarantee

- Billed annually

Quicken

Quicken Classic also has a calendar feature showing users their daily cash balance and projected future balance. You can also see when bills are due and when you can expect to get paid. The calendar view allows users to manually enter and edit transactions and set reminders to pay bills.

This calendar also has a unique feature allowing users to create calendar notes on specific dates. For example, this can help you remember why are you choosing to pay a bill on a certain date.

Users can access Quicken Classic’s calendar feature through the Bills & Income tab or through the Tools menu.

- App Store Rating: 4.7 out of 5 stars among 14k+ iOS users.

- Google Play Rating: 2.7 out of 5 stars among 4.4k Android users.

- Price: The Deluxe version is $5.99 per month but it’s billed annually at $71.88. The Premier version is $7.99 per month, billed annually at $95.88.

Key Features

- Manually enter or edit transactions

- Add notes to calendar events

- See projected balance in calendar

- Add bill reminders

- Choose from two plans

- Plan billed annually

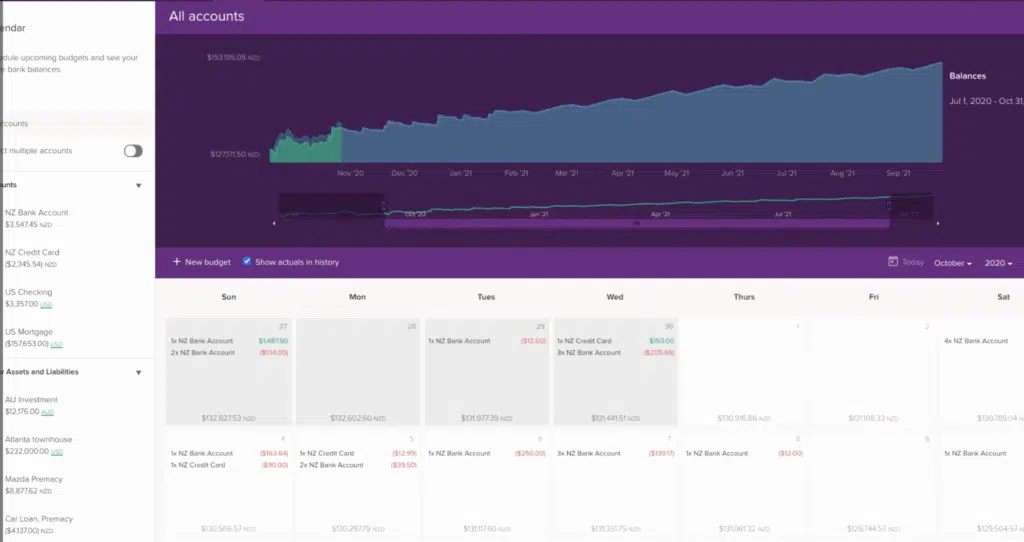

PocketSmith

PocketSmith is a good choice if you are looking for a variety of plans since they offer four, including a free version. The Free plan provides manual imports, two dashboards, up to 12 budgets, two accounts, and six-month projections. The next level up is Foundation, which adds automatic bank feeds, email support, six connected bank accounts, six dashboards, 10-year projections, and unlimited accounts and budgets.

These three levels we mentioned above should be enough for the average household. But, there are two other plans with more robust and expensive features. The Flourish plan has 18 connected banks from all countries, 18 dashboards, 30 years of projections, and unlimited accounts and budgets. Finally, the Fortune plan provides priority email support, unlimited connected banks from all countries, unlimited dashboards, 60-year projections, and unlimited accounts and budgets.

- App Store Rating: 3.3 out of 5 stars among 49 iOS users.

- Google Play Rating: 3.5 out of 5 stars among 169 Android users.

- Price: Free version; Foundation, $14.95 monthly/$120 annually; Flourish, $24.95 monthly/$200 annually; Fortune, $39.95 monthly/$320 annually. (33% discount on all plans if you pay annually)

Key Features

- See your daily balance in calendar

- Project future balance

- Schedule bills

- Connect multiple bank accounts

- Color-code expense categories in calendar

- Free version available

- Choose from 4 plans

Lunch Money

I’ve included Lunch Money on the list even though its calendar view is a list by date, not an actual calendar. Why? Because it’s an excellent budgeting app, and it gives you all the data you would want from a calendar-based budgeting app. Here’s what its list looks like:

This screenshot comes from the Recurring expenses section of the app. You can view these expenses by date (Lunch Money calls it Cadence), category, account or type.

Beyond the calendar view, the app makes it extremely easy to set a budget and track your spending throughout the month. It categorizes expenses automatically and makes it easy to customize categories. It’s one of my favorites.

Lunch Money costs $10 a month or as little as $50 a year. In addition, the price is guaranteed for life. They will not raise the price on existing customers. They also offer a 30-day free trial.

What Is a Calendar-Based Personal Finance App?

A calendar-based finance app is a budgeting app that allows you to track and plan your finances using a visual calendar format. Since most of us are familiar with calendars, it’s often easier to track and plan financial activities grouped by days, weeks, or months.

Calendar-based personal finance apps assemble similar information from budgeting apps into a calendar format, making it easy to track finances with a quick glance of the day or even a week ahead.

Why Use a Calendar Based Personal Finance App?

The strength of calendar-based personal finance apps is in the visual presentation. It’s one thing to follow a to-do list of upcoming financial transactions or even to get reminders by email or text. But for many people, the ability to glance at a calendar to see upcoming financial events is much more impactful than looking at a list or getting an alert.

The calendar method gives you the ability to know what’s coming up well in advance. It’s also helpful for planning many months into the future. For many consumers, a calendar-based personal finance app can provide just the type of discipline needed to stay on top of all things financial.

How We Chose the Best Calendar-Based Budgeting Apps

We created this list of what we think are the best calendar-based personal finance apps by considering the many that are available and whittling it down to a handful we believe offer great features at a resaonable price.

The criteria used to make this determination include:

- Ratings from iOS users on The App Store

- Ratings from Android users on Google Play

- Pricing

- Features

- Ability to customize the app

- Potential integration with other apps and services

- What each app does better than the competition

Final Thoughts

As you can see, there are plenty of calendar-based personal finance apps available. While this list represents what we believe to be the best apps available, you’ll need to determine for yourself which will work best for you. Carefully evaluate the features and benefits of each, as well as the cost (if any), before choosing the right app for you. In the table below, you’ll find a quick look at what each app does best.

| Calendar Budget App | Best For |

|---|---|

| Monarch Money | Robust budgeting features |

| Rocket Money | Excellent free features |

| Simplifi | Affordable option |

| Quicken | Ability to add custom notes to transactions |

| PocketSmith | 4 plan options |

| Lunch Money | Customization and clean interface |

| Google Calendar | Simply keeping track of due dates |