5 Best Net Worth Calculators in 2025 (#1 is Free)

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

By Rob Berger, JD | March 28, 2025

There are plenty of free net worth trackers on the internet. For most of them, you enter the value of your assets and liabilities, and the calculator does the simple math to show you how much you’re worth. The best net worth calculators, however, do far more than simple math.

They enable you to connect accounts to automatically pull in data. They can connect bank accounts, credit cards, investment and retirement accounts, and even the value of your home. These calculators then regularly update your net worth and keep track of changes over time.

With that in mind, what follows is a list of what I think are the top net worth apps available today.

Two of My Favorite Net Worth Apps

I’ve tested every app on this page and many others. When it comes to tracking our net worth, however, there are two apps I’ve consistently used for years.

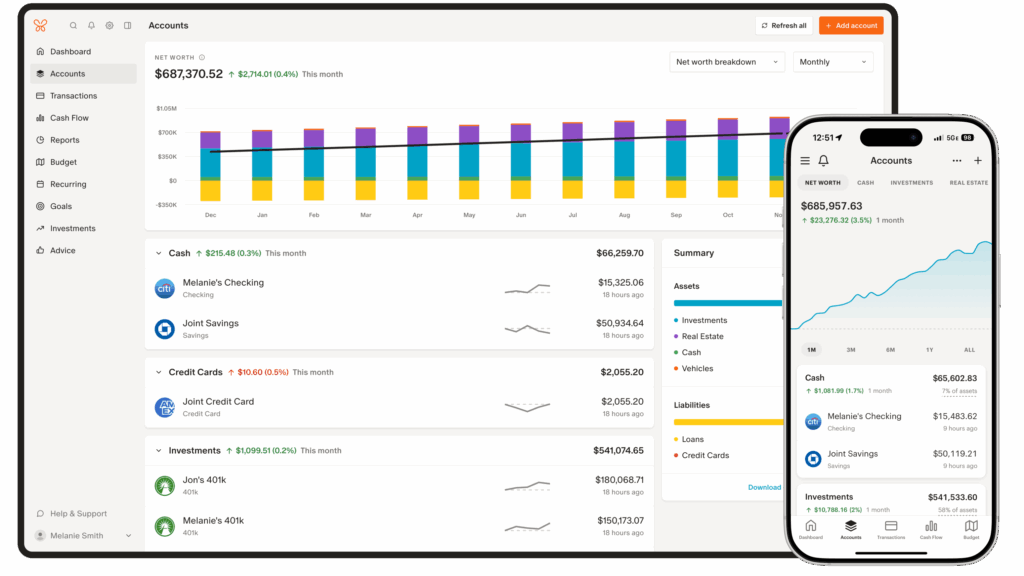

1. Monarch Money: I’ve used Monarch Money for about two years and continue to be surprised by new features. In terms of tracking net worth, you can connect all your accounts (assets and liabilities). Track your investments’ performance and asset allocation. You can connect home values through a Zillow integration. It syncs with Coinbase, and can track vehicle values with VIN. It even syncs with Apple Card.

Beyond net worth tracking, Monarch Money is an excellent budgeting app. It tracks budgets and spending, manages subscriptions, makes creating budget category rules a snap, and has an excellent user interface in both a browser and smartphone. And Monarch recently introduced Flex Budgeting, which tracks fixed versus variable expenses.

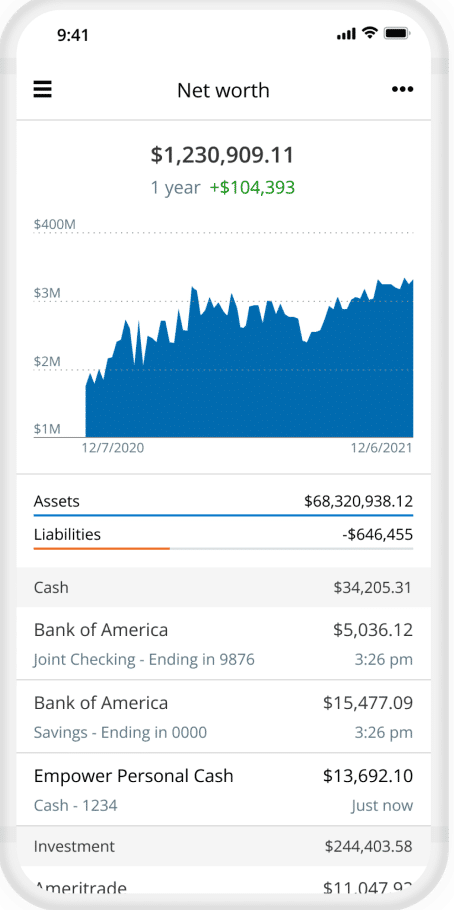

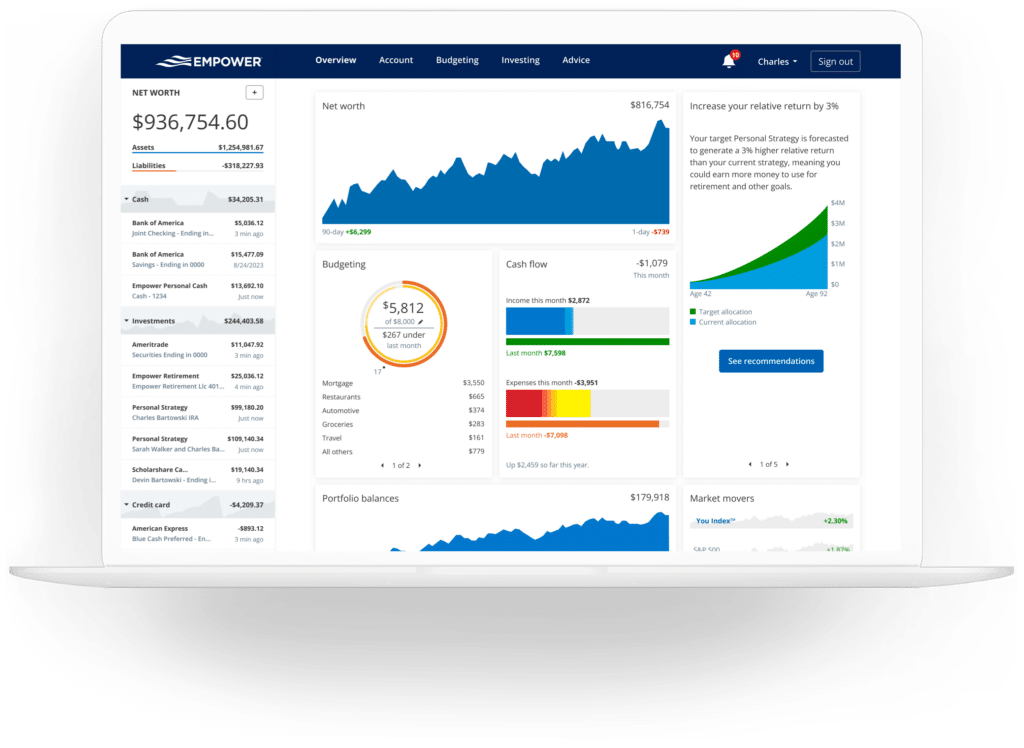

2. Empower–This free tool, previously called Personal Capital, is my top pick for tracking your net worth. You can connect bank accounts, credit cards, investment accounts, retirement accounts, crypto, mortgages and other loans, and even real estate via Zillow. You can also enter assets and liabilities manually, which comes in handy for accounts without a login.

Beyond tracking your net worth, Empower also offers a wealth of tools and charts to track spending, asset allocation, investment performance and cash flow. It also offeers a retirement planner.

Details on 8 Net Worth Calculators

1. Empower

Best for investment management

Empower is without question the best net worth tracker available today. Previously called Personal Capital, it’s still free and no other tool offers more features.

With Empower, you link all your financial accounts (it secures your data with AES-256 encryption). You can also add accounts without online logins manually (e.g., artwork or vehicles). Once linked, it automatically pulls in all transactions and balances and tracks your net worth over time.

Why Empower is my top pick, however, goes far beyond tracking your balance sheet. It enables you to track all of your income and expenses by category. It offers excellent tools to evaluate your investments, including an asset allocation inspector, fee analyzer, and retirement planner. It’s the only all-in-one financial app that covers all the bases.

This Reddit user did a good job capturing Empower’s net worth feature: “I use it completely separately just for tracking, my net worth, and all of my investments. You can compare your portfolio against the S&P, Dow, or other customize measures, it’s great for pulling up historical data very quickly. . . .It also has a pretty decent reporting feature, and I like that I can track each of my investment account separately and altogether.”

I didn’t list the user interface as a pro or con above. While I personally believe Empower’s user interface is excellent (in fact, the best of any app I’ve used), at least one Reddit user described it as drab: “As someone who just wants to see all balances across all accounts, and track total net worth, Empower certainly does the trick. The UI is a bit drab, but I don’t spend more than a few minutes at a time on the site/in the app, so it’s not really an issue.”

If you try it out, let me know what you think about the user interface.

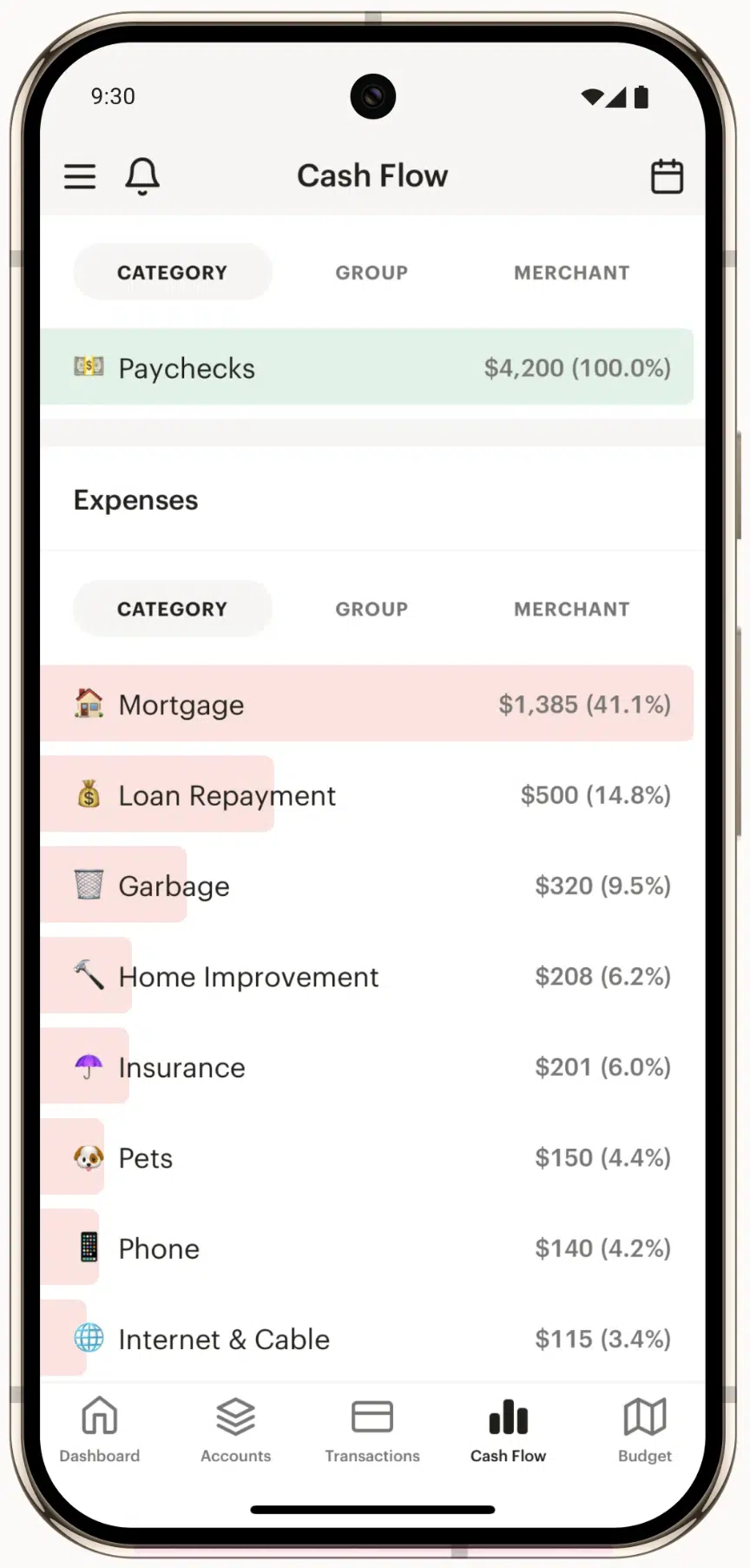

2. Monarch Money

One of the Best Overall Budgeting Apps

I’ve used and tested Monarch for about two years, but it’s only been recently that I understood its core net worth tracking features.

Like most apps, you can connect just about any account to Monarch. This includes bank accounts, credit cards, and investment accounts. Unlike many apps, however, it integrates with the Apple Card. You can also link a Coinbase account, real estate values via Zillow, and your vehicle values with a car’s VIN.

Beyond net worth tracking, it’s easy to create budgets and goals. You can also track your recurring expenses, ideal for keeping an eye on subscriptions and to avoid any surprises. And recently Monarch introduced Flex Budgets, which track those spending categories that vary from month to month (which are generally the most important categories to track).

You can also link your investment accounts to track your retirement savings and brokerage accounts. It tracks your balances, performance and even asset allocation.

Monarch also offers a tablet and smartphone app. I’ve used it on both my iPad and iPhone and found it to be very easy to use.

Key Features

- Connect all your accounts

- Track spending by category or account

- Track spending based on fixed and flexible spending

- Subscription tracking

- Track the performance and allocation of your investments

- Set financial goals

- Save for emergencies

- See your net worth

- See spending with a sankey diagram.

- Plan spending for the year

- Syncs w/ Coinbase, Zillow, Apple Card and vehicle values

You can try Monarch Money for free for seven days, and it’s offering 50% OFF your first year with code MONARCHVIP.

2. Rocket Money

Best for Net Worth Tracking w/ Budgeting

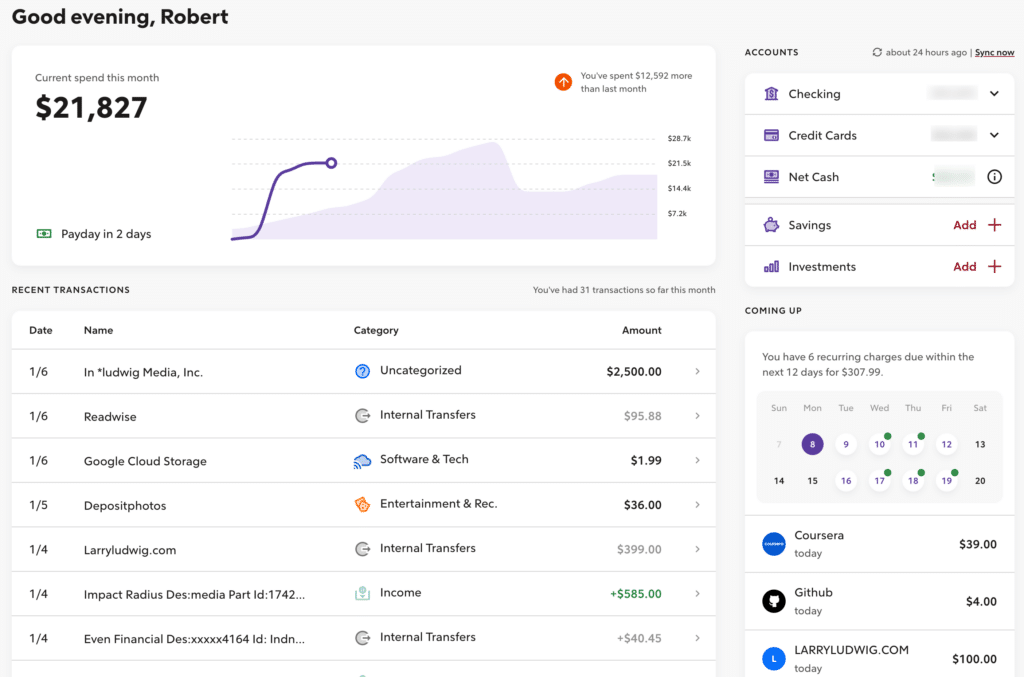

I started using Rocket Money for both our personal and business budgets over a year ago. Having used both its web and smartphone apps, I can tell you it’s one of the best-looking and easiest-to-use budgeting tools available. On top of that, you can get the premium version for as little as $4 a month, paid annually.

Rocket Money does the basics well. It’s easy to track your spending and set up budgets. It’s easy to create rules for automatically categorizing transactions. And it’s easy to connect your investment accounts if you want to.

Here’s what the dashboard looks like for my business:

It gives me a snapshot of everything I need to manage my money. Rocket Money keeps track of subscriptions and makes it easy to cancel them. It’s an excellent Mint replacement, particularly if you focus on budgeting.

Rocket Money offers a free and paid version. The paid version costs $6 to $12/mo based on what you choose to pay them. Seriously.

3. Kubera

Best for just net worth tracking

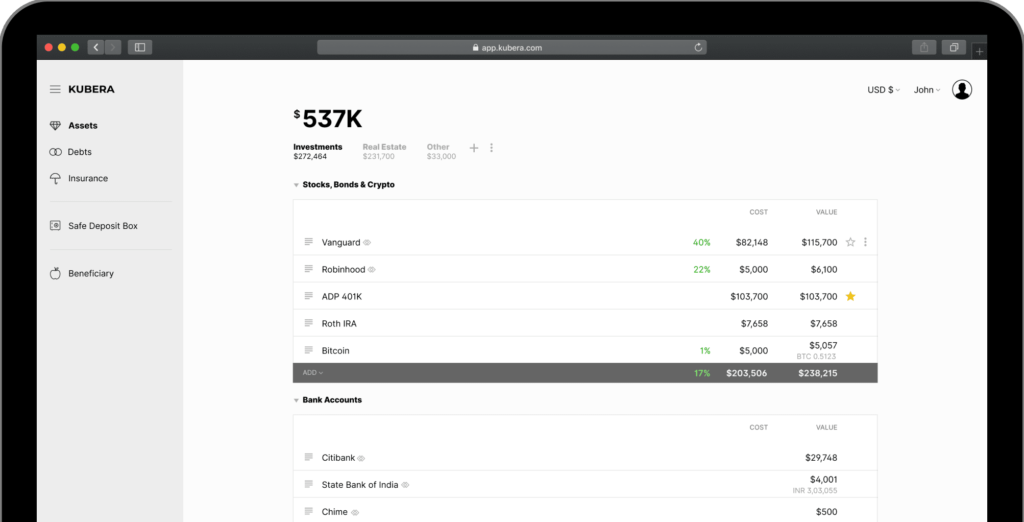

Kubera is a relatively new app designed specifically to track net worth. You can link just about any type of account to Kubera. In addition to bank, credit card, and investment accounts, you can link cars using the VIN, the value of real estate via Zillow, and even the value of domain names.

The user interface is clean, and the tool allows you to organize your assets and liabilities as you wish. I’ve linked numerous brokerage and retirement accounts to Kubera without any issues.

In addition to keeping tabs on your net worth, Kubera can keep track of your insurance policies and securely store important documents. It also now offers some insight into your asset allocation. While this aspect of the app is not as robust as Empower, it’s a step in the right direction.

Kubera costs $249 a year, which is one reason Empower earns the top spot. That said, they are offering a 14-day trial for $1.

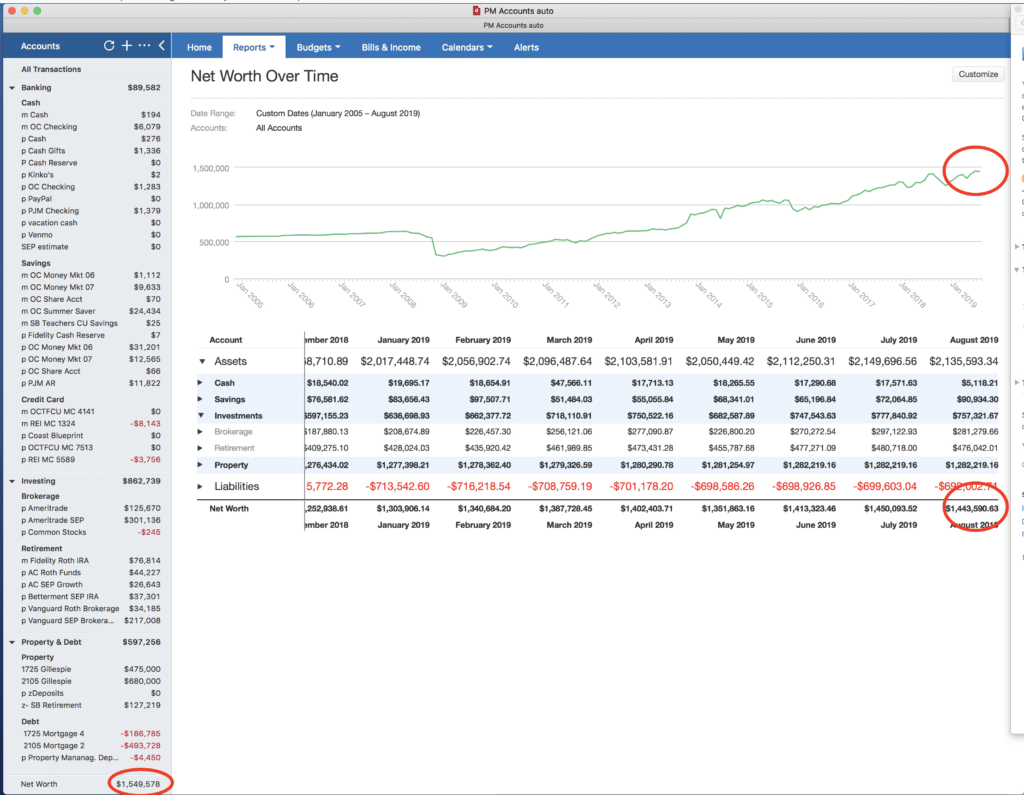

4. Quicken

One of the first budgeting tools, and one that I remember using when it first came out, is Quicken. It is responsible for bringing personal finance into the digital age. Today, it seems to be a lot less popular, possibly because it moved to a subscription pricing model. Nevertheless, it is a solid budgeting tool that will track your net worth.

Quicken can provide a wealth of data about everything from spending to investments. On the downside, the user interface is not the best. As a result, Quicken is best for those who care more about data than how that data is presented.

Quicken costs $7.99/month.

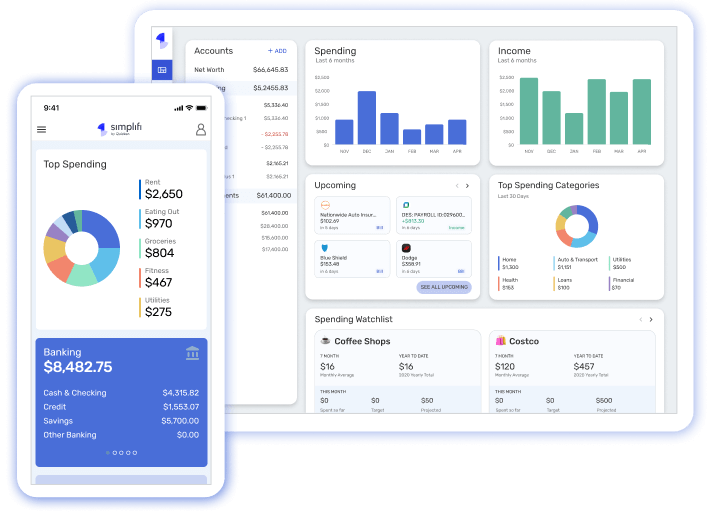

5. Simplifi

The makers of Quicken launched a smartphone budgeting app called Simplifi several years ago. Today it’s also available as a desktop app. It’s my personal top pick for those who want to track their net worth with a budgeting app that looks great on a smartphone.

I’ve used Simplifi for two years now. It’s not my primary budgeting app (see Rocket Money above for what I now use). But it is a great app. It’s user interface is excellent. You can set budgeting goals and track your spending. Recently, they also added the ability to track your investments. And with that, I added it to this list of the best net worth calculators.

Simplifi costs $5.99/month.

Final Thoughts

Tracking your Net worth is simple. It’s just a matter of adding up your assets (everything you own) and your liabilities (everything you owe). The difference is your net worth.

You could use a simple spreadsheet to keep tabs on your assets and liabilities. I’ve done that for years. The tools listed above, however, make it much easier and offer additional tools to help you manage, track, and evaluate your finances and investments.