MyBudgetCoach Review: Budgeting With Built-In Coaching

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

By Rob Berger, JD | Last Updated January 3, 2026

Most budgeting apps hand you the playbook and expect you to run the game alone. MyBudgetCoach offers a different strategy by pairing zero-based budgeting with real human coaches you can message or talk to directly. Below, I break down the features, pros and cons, and who it’s best for.

Quick Take

MyBudgetCoach is a personal finance app built around zero-based budgeting, but with a unique twist: it pairs every user with a real human coach. You can message your coach anytime or schedule one-on-one sessions for extra guidance (for an additional cost). The coaching feature turns budgeting into an interactive and supportive process. MyBudgetCoach offers the essentials like bank syncing, transaction tracking, goal setting, and basic reports. It’s ideal for beginners or anyone who’s struggled to stick with a budget in the past.

What Is MyBudgetCoach?

Zach Welchel founded MyBudgetCoach in 2023 after finding difficulty navigating other zero-based budgeting apps, like YNAB. MyBudgetCoach helps users build a zero-based budget (meaning every dollar has a job) while also pairing them with a real, human coach. Coaches guide users through the app as they build a budget and are available via app messaging or by scheduling a video call. The idea is to provide you with valuable coaching and insight into using the app until you learn the skills to budget by yourself.

MyBudgetCoach is available via browser (desktop), iPhone, iPad, and Android via Google Play.

MyBudgetCoach Key Features

Zero‑Based Budgeting

MyBudgetCoach is based on zero-based budgeting, meaning every dollar has a job, and your income minus your expenses will equal zero. This prevents you from getting to the end of the month, seeing $50 in your account and then thinking, “Great! I can go shopping!” Instead, you allocate all of your money into categories, so there isn’t any leftover. Some goes to bills, some to savings, some to pay down debt, and so on until you’re left with zero.

Zero-based budgeting is time consuming, but it does give you a high level of control over your money. There is also a lot of flexibility because every month starts with a clean slate. You can adapt to changing priorities or income.

Bank Sync & Transaction Import

When you start using MyBudgetCoach, you’ll create an account, then choose a plan. You won’t have to enter any credit card information, and you won’t be charged until the trial is over, which is nice.

MyBudgetCoach took a while (over ten minutes) to grab my account information. You can also add all of your transactions manually, if you prefer, instead of linking your bank accounts. Some people may find manual entry helpful because it forces you to be hands-on with your budget. On the other hand, if you’re going to enter all of your transactions manually, you could also use an Excel spreadsheet, which is free.

Keep in mind, linking your bank accounts cuts down on a lot of time and extra work on your end. It also automates the process and makes it easier for you to use. If it’s easy to use, you’re more likely to use it.

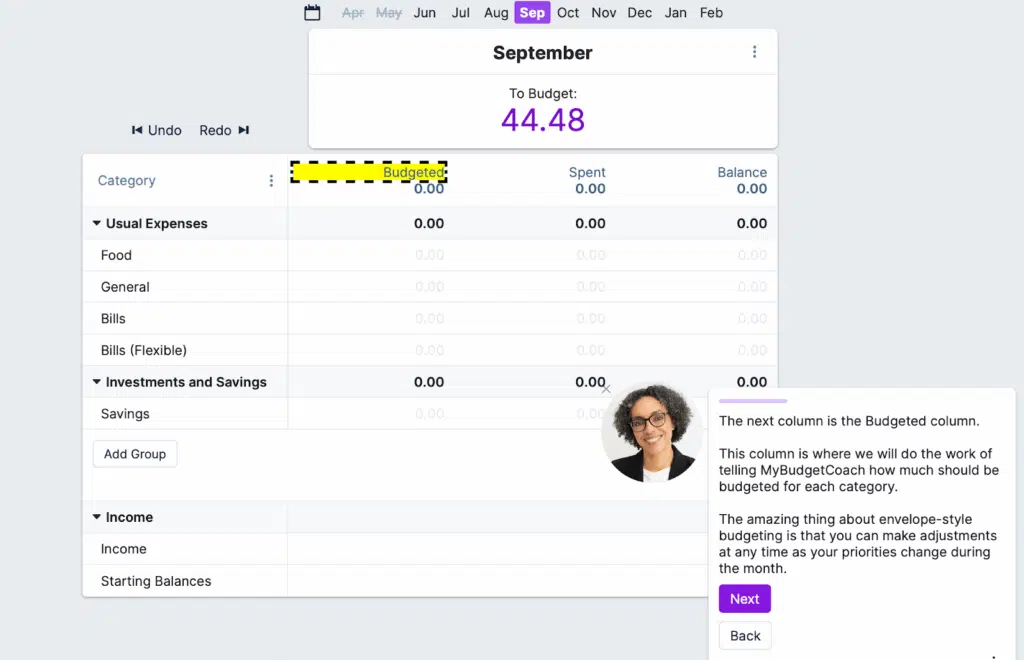

The tutorial starts by walking me through the checking account part of my budget and offers plenty of encouragement.

At the end of the tutorial for the checking section, you’ll get a prompt to begin adding credit cards. The prompt also mentions I can message my coach with questions or schedule a zoom call, which I did.

Also, if you leave and come back the next day, the whole tutorial resets. This is handy if you feel you missed something the first time through. To close the tutorial, you can click the “X” in the corner of the box.

Coaching / Accountability

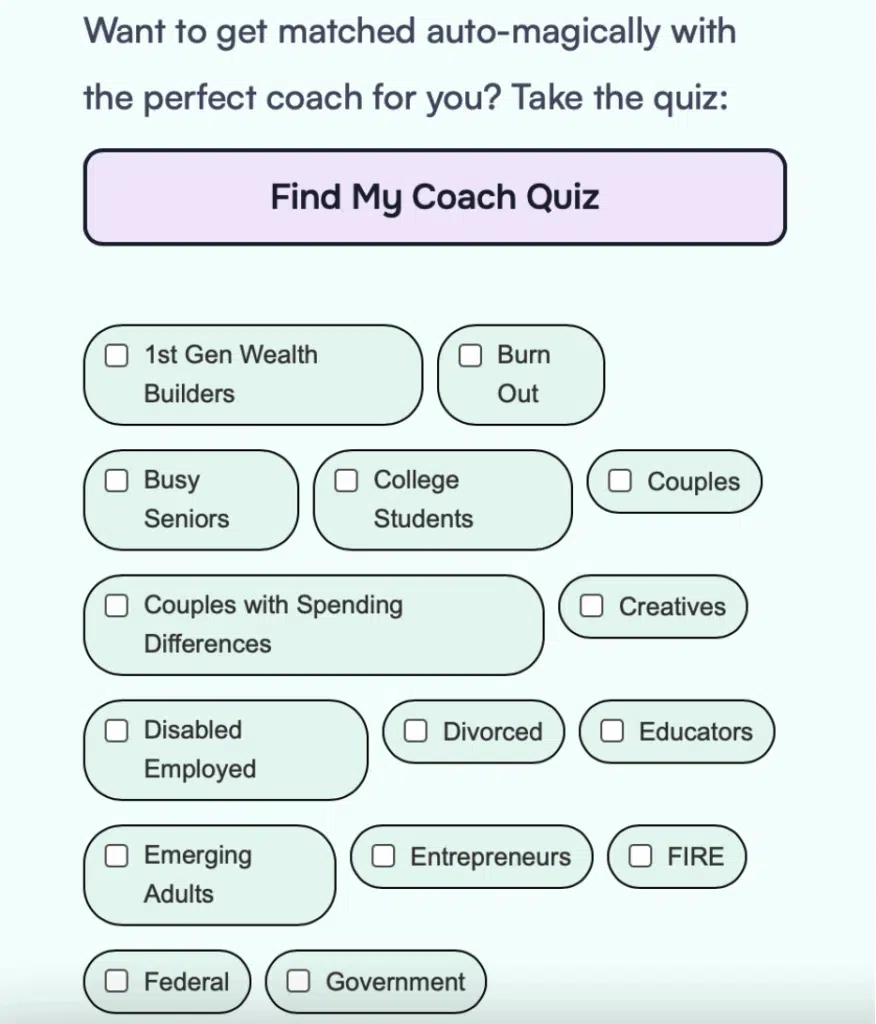

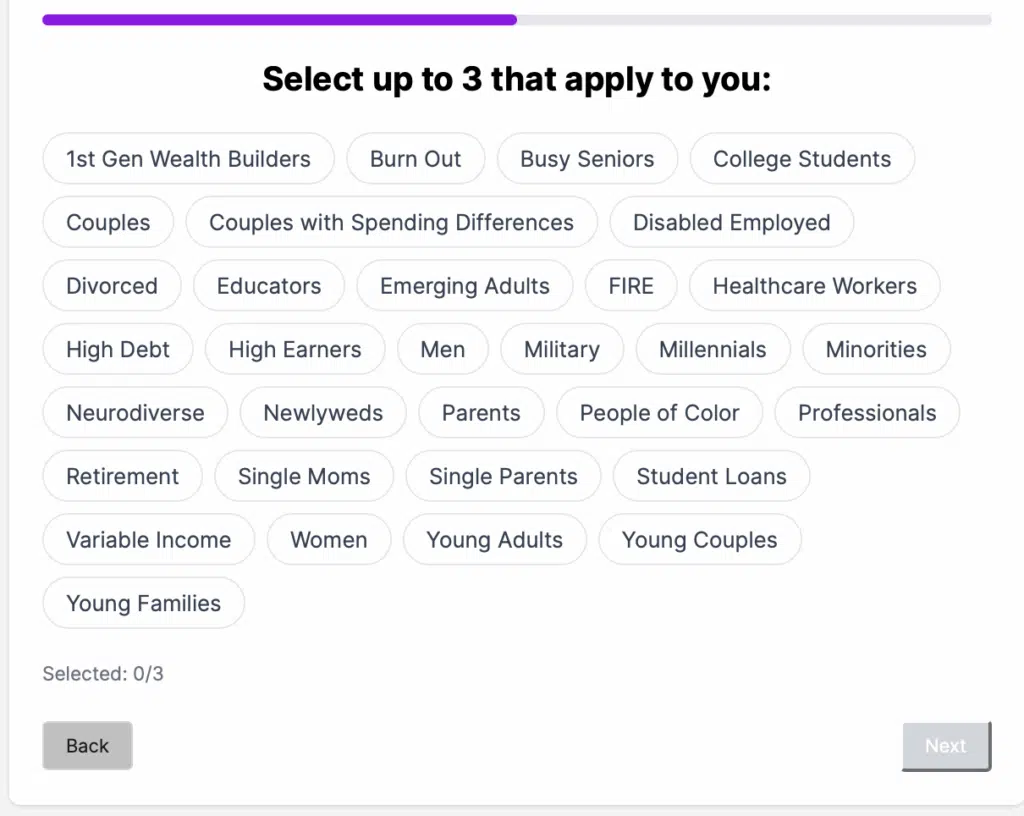

One of the first things you do after signup is choose a coach. There are at least 30 coaches, with more on the way. Each coach has a profile so you can read about them and choose who resonates with you and your financial goals. You can either choose your coach yourself, or you can take a quiz (which I did) and MyBudgetCoach will match you with someone.

You may find the pricing for one-on-one coaching confusing. As you can see in the last screenshot, in the section above, it says a one-on-one zoom call is an additional charge. But, at signup, it says I get a zoom call free per month with the Premium version. Before my zoom call, I did ask my coach about this and she confirmed this first call was free.

I also hopped onto the chatbot with Zach Welchel, the founder of MyBudgetCoach, to test the chat feature and clarify the payment structure. He says MyBudgetCoach is in the process of migrating to a new system, where all coaches will charge the same $55 an hour if you choose Premium, and everyone will offer a free trial session. As of this review, you’ll find coaches charge different rates and may or may not offer a free session.

Expenses, Goal Setting & Metrics

You can categorize your expenses under fixed, variable, or non-monthly. You can even change those category names if that doesn’t work for you. The app is flexible.

Goal setting is straightforward. You simply list your goals under the goal category. If you hover over the right-side of the column, an arrow appears. From here, you can rename your goal, hide it, or delete it entirely. You can also add notes by clicking on the notebook paper icon on the right.

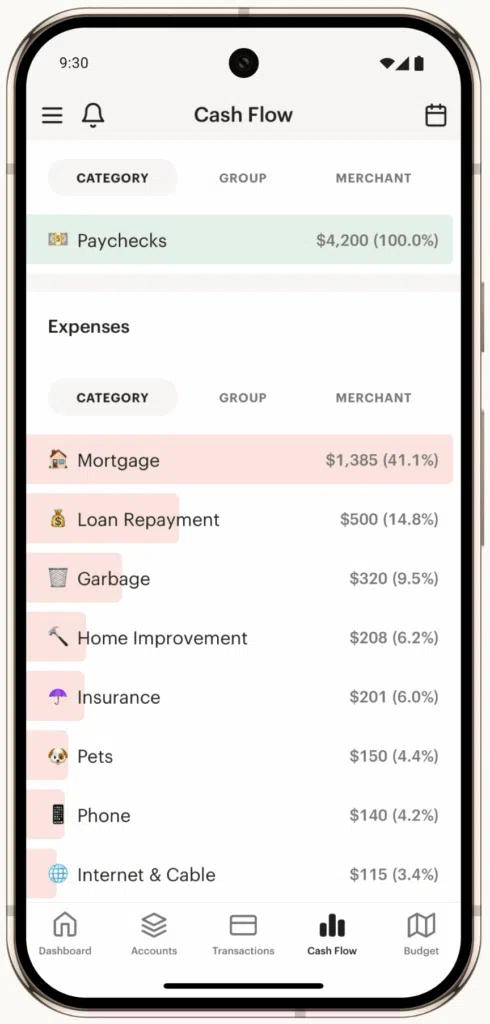

There is basic reporting available on things like net worth, cash flow and monthly spending. MyBudgetCoach has net worth as a report, but the app doesn’t consider assets like your car or your house–strictly liquid cash. You will not find any information on retirement or investments, either. It’s a basic budgeting app.

Web + Mobile Access

MyBudgetCoach is available for desktop, iPhone and Android. It has 5 out 5 stars and 24 ratings on the Apple App Store. No ratings appear yet for this app on Google Play.

My Experience Getting Started with MyBudgetCoach

Clicking on “Start my Free Trial” takes me to a page where I can read through profiles and choose a coach on my own, or I can take the “Find My Coach” quiz. I click the “Find My Coach” quiz and get the screen below:

After choosing a plan, I go on to complete the quiz:

I match with a coach, Amanda, and confirm with her before our session that our first call is free. The call is a great experience and Amanda is helpful and encouraging. She also helps me set up my budget.

First, I link my bank account and three credit cards (through Plaid). Then MyBudgetCoach gets stuck, and I see the screen below for ten minutes. I’ve tried six or seven budgeting apps now, and MyBudgetCoach is the only one that struggled this much. The others connected within seconds.

Eventually, MyBudgetCoach loads my information, and then my coach, Amanda (or Amanda’s avatar), walks me through setting up my budget. I was curious about this, because I did try YNAB once and it’s both labor intensive and overwhelming. This experience is the complete opposite. Having someone help me through the initial set up of MyBudgetCoach is extremely helpful.

I have lots of questions for my coach, and she is pleasant, supportive and answers them all. For example, after subtracting all my bills from my income, there is $0.48 left. “What do I do with the $0.48?” (since my total is supposed to equal zero, for zero-based budgeting). She says I can add it to savings or assign it to next month’s budget; “Every little bit helps.”

I also ask where I should put assets such as my car and my house, and she says MyBudgetCoach isn’t really set up to track net worth: liquid cash only. Fair enough.

The call lasts about 25 minutes, and before we end, she says I can reach out to her at any time. I still get messages from Amanda, asking if I have any questions. It’s nice to know the coaches are eager to help.

You can also click on “Start a new conversation.” Once you do that, your options are:

- Add credit card

- Options to import transactions

- Make budget equal to zero

- Calculate credit card payment

- Reconciliation step by step

If you click on one of these options, your coach’s avatar is there to walk you through the tutorial, or you can message them if you have more questions.

Keep in mind, budget coaches are there to help you budget your money so you reach your financial goals. Coaches are not there to provide financial advice, investment advice, or advice on tax loopholes.

MyBudgetCoach for Couples

This app works well for couples, too. You and your partner can both use the same budget for the same price. You can either add all of your accounts together under one screen, or you can share specific accounts with your spouse. You can also choose to have fully separate accounts.

Check out our list of Best Budgeting Apps for Couples

Pricing

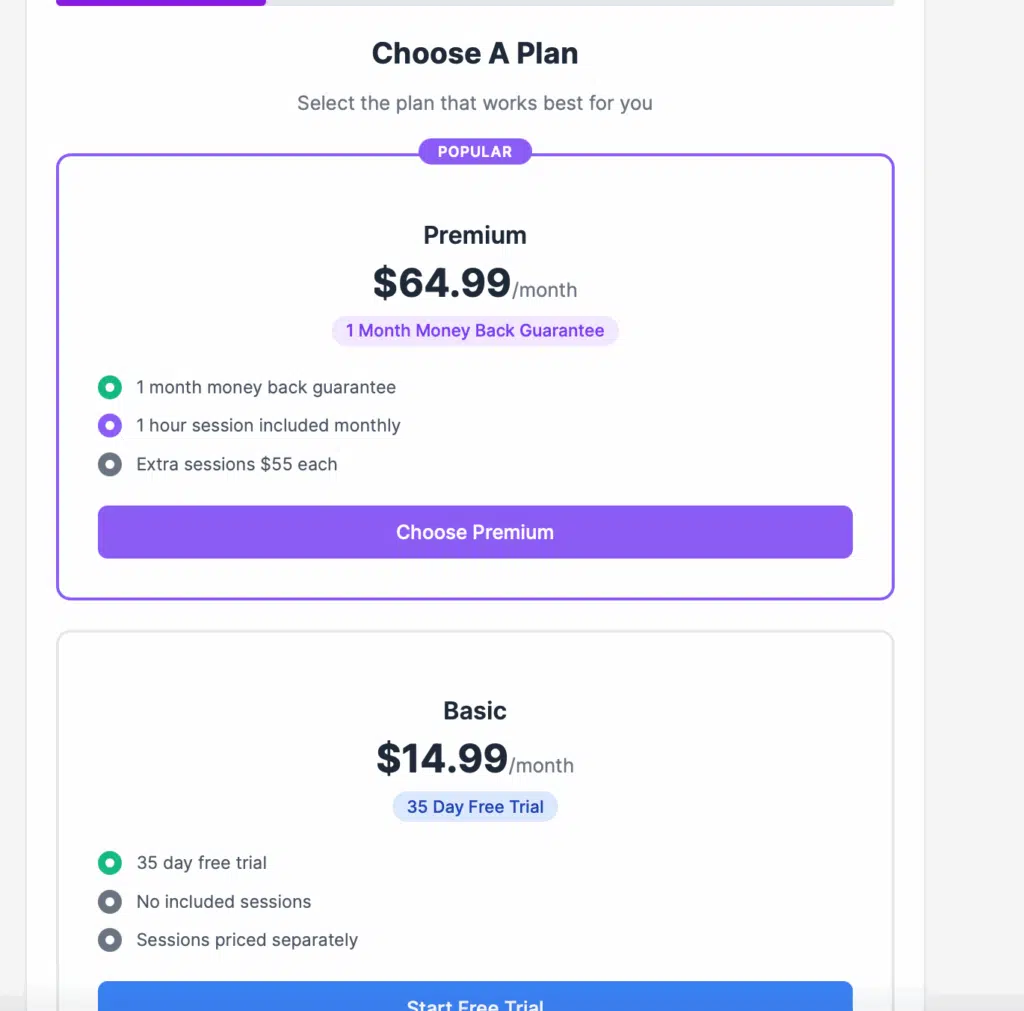

The Basic tier is $14.99 a month and includes:

- 35 day free trial at the time of writing (regularly it is a 7 day trial)

- Virtual coaching

- Browser and mobile website

- Bank import

- Simple goal tracking

- Net worth tracking

- Basic reports

There is also the choice to have more one-to-one coaching, at a cost of $35 and up.

Premium is $64.99 per month and includes:

- 35 day money back guarantee at the time of writing (regularly it is a 7 day trial)

- 60-minute call per month

- Extra sessions available for an added cost

- Unlimited chat

Plus, everything that the basic plan includes. If you go to the app and it says something different, remember that Zach said MyBudgetCoach is currently migrating to the new payment system I mentioned above ($55 an hour for Premium with a free trial session).

Who Should Use MyBudgetCoach?

If you thought about using YNAB, or even tried YNAB and came away (as I did) with a sinking feeling of failure, MyBudgetCoach is perfect for you. The tutorial explains most of what you need to know step by step. If you have further questions, you can get some guidance from your coach. Most people should be able to make progress using the Basic plan.

MyBudgetCoach is a fit for anyone with straightforward finances (income, expenses, debt, maybe basic savings) rather than complex investments or asset tracking. Also, consider the price. It can be pricey for a first-time budgeter. If you’re on a tight budget, you’ll want to consider a more affordable, or even, a free budgeting app.

MyBudgetCoach vs. the Alternatives

MyBudgetCoach vs. Monarch Money

Monarch Money is sleeker, more customizable, and ideal for users who want to track everything—budgets, investments, goals, and net worth—in one place. But it’s self-guided.

MyBudgetCoach, on the other hand, includes personal coaching, making it a better fit for people who want accountability. If you want beauty and control, and have more complex finances, Monarch Money wins. If you want structure and support, and need a simple budget, go with MyBudgetCoach.

MyBudgetCoach vs. YNAB

YNAB is laser-focused on zero-based budgeting with powerful rule-based planning—but it assumes you’re doing the work yourself. MyBudgetCoach follows a similar budgeting philosophy but pairs it with human coaching. If you’re confident with DIY tools and don’t need help, YNAB is great.

If you want someone to keep you on track, MyBudgetCoach offers more hands-on support. Price-wise, both are $14.99 for a basic subscription, but keep in mind if you want more than one session of coaching with MyBudgetCoach, that’s extra.

MyBudgetCoach vs. Rocket Money

Rocket Money is great at finding subscriptions, tracking bills, and spotting sneaky expenses. But its budgeting tools are limited. MyBudgetCoach doesn’t cancel subscriptions for you—but it does help you build a budget and stick to it, with a coach in your corner. Rocket Money is reactive, while MyBudgetCoach is proactive.

Read more about Best Subscription Manager Apps to Track and Cancel Recurring Charges

MyBudgetCoach vs. Simplifi

Simplifi is easy to use and highly automated, with great spending insights and custom watchlists. But it’s entirely self-serve. MyBudgetCoach is more structured, less automated, and offers real human support. If you want a guided budgeting journey, MyBudgetCoach is the better choice. If you want automation and a sleek dashboard, Simplifi wins.

MyBudgetCoach Pros & Cons

Final Thoughts & Verdict

MyBudgetCoach fills a niche that many budgeting apps don’t with built-in coaching. Most people will probably be well-served with the basic subscription, which makes MyBudgetCoach a good value. And if you find you need more assistance, it’s there for you (at an additional cost).

Consider trying out the free-trial period and see how much you use the coach. If you find messaging and asking questions helps, great. If not, then consider one of the alternatives listed above. Overall, MyBudgetCoach is a great app if you want to learn to budget with a zero-based budgeting system but need a bit of assistance to make that happen.