Mutual Funds vs ETFs–Here’s Why Mutual Funds Win

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

In this article, we’re going to look at the differences between exchange traded funds (ETFs) and mutual funds. In past videos (check out my YouTube channel) I’ve mentioned that for long-term buy and hold investors, I don’t see any reason that we need to bother with ETFs. That’s sparked some emails and comments from folks wanting to understand why I believe that for most investors, all you need are mutual funds.

We’re going to start by looking at mutual funds. And then we’ll turn to ETFs. And then we’ll get into the differences and why I don’t think ETFs are necessary for most of us.

Mutual Funds

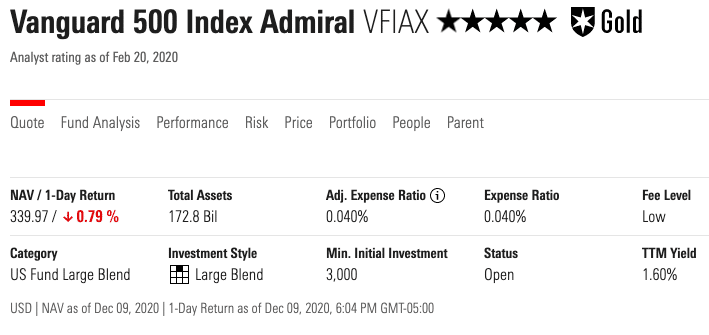

So I want to begin by looking at the Vanguard 500 index fund (VFIAX). Here’s a snapshot of the fund from Morningstar (it’s one of my favorite investing tools).

This is an example of a mutual fund. To better understand mutual funds let’s look at the problem they were designed to solve. Before mutual funds, if you wanted a diversified portfolio you had to research companies and governments and then buy enough stocks and bonds to create a diversified portfolio. It was very time consuming and expensive. You could hire a broker, which many people did, which just added to the cost.

Mutual funds made it easier and less expensive for investors to create a diversified portfolio. Rather than having to go out and research all these companies, you can just invest in a few mutual funds and get instant diversification. Your money is divided up among hundreds, if not thousands of stocks and bonds at a relatively low cost.

Actively Managed vs Passively Managed (Index) Funds

There are two types of mutual funds–actively managed and passively managed.

An actively managed fund is one where the management of the fund picks specific stocks or bonds based on fundamental or technical analysis. A passively managed fund, also called an index fund, simply tracks an index such as the S&P 500.

How Mutual Funds are Bought and Sold

There are two important thing to understand about mutual funds. First, shares of a mutual fund are bought and sold directly with the mutual fund company. If you want to invest in a mutual fund, like our Vanguard 500 fund above, you buy directly from Vanguard. Vanguard issues you shares of the fund and invests your money in the underlying assets of the mutual fund.

In contrast, when you buy a share of stock, the transaction is with another investor. This distinction is going to become important when we get to ETFs.

Second, with a mutual fund, you always pay what’s called the Net Asset Value (NAV). The NAV represents the value of the stocks and bonds the fund owns. NAV is reported on a per share basis. You can see in the above screenshot that the NAV for the Vanguard fund was $342.68.

Unlike a stock price that fluctuates throughout the trading day, a mutual fund’s NAV is adjusted just once after the market closes. When you buy or sell shares of a mutual fund, the price you pay or receive is determined after the market closes. That means, as a practical matter, that when we submit an order to buy or sell shares of a mutual fund, we won’t know the price until after the market closes. The price, however, will always be the NAV–no more, no less.

Exchange-traded Funds

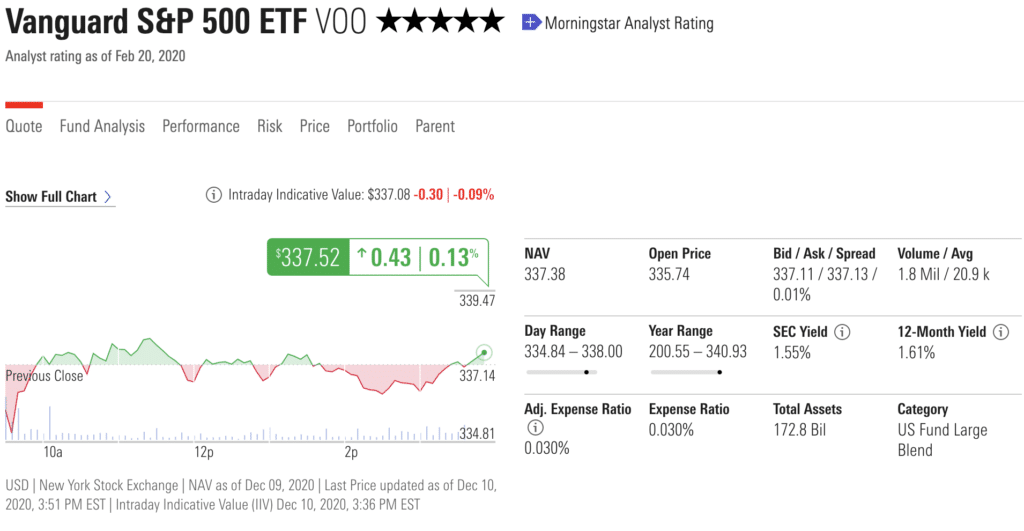

Let’s turn to exchange traded funds or ETFs. This screen shot is of the Vanguard S&P 500 ETF (ticker: VOO) taken from Morningstar.

It is virtually identical to the mutual fund above in several respects.

Just like a mutual fund, it provides a low cost way to achieve easy diversification. This Vanguard ETF, just like the mutual fund, invests in 500 of the largest US companies. ETFs are also inexpensive, just like index funds.

There are, however, some significant differences. The best way to understand these differences is to understand why ETS exist in the first place. If they’re so similar to index mutual funds, why in the world do we have them? The answer is that some investors want the ability to trade a mutual fund in ways similar to trading a stock. An ETF enables them to do that. An ETF is like taking a mutual fund, but giving it the ability to trade like a stock.

So what does that actually mean? Well, the first thing is that just like buying or selling a stock, the price of the Vanguard S&P 500 ETF, or any ETF for that matter, fluctuates throughout the day when the market is open. That’s why, in the above screenshot of VOO, you see the Day Range, Opening Price and so on. You also see a bid/ask spread, just like you would for an individual stock.

As a result, an investor can short an ETF just like shorting a stock. You can also buy and sell options on an ETF. That’s not possible with a mutual fund. It also allows you to sell or buy the ETF at the price that exists during the trading day. So if I want to buy VOO right now, you can see the bid/ask I could buy it at. I know what price I’m going to get at least within a couple of pennies. If I buy the mutual fund, I’ll pay the NAV as calculated after the close of the market.

ETFs vs Mutual Funds

| ETFs | Mutual Funds | |

|---|---|---|

| Low Cost | Yes | Yes, for index funds |

| Diversification | Yes | Yes |

| Trades at NAV | No | Yes |

| Trades like a stock | Yes | No |

| Options trading | Yes | No |

| Required minimum investment | No | Sometimes |

| Automated monthly investments | No | Yes |

Why Mutual Funds are Better than ETFs for Long-term Investors

At first glance ETFs may seem like the better deal. You get all the benefits of a mutual fund, along with some extra trading features of a stock. Not so fast.

First, long-term buy and hold investors don’t need the features ETFs offer. We have no need to short a stock or an ETF. We have no reason to buy or sell call or put options on an ETf.

Second, buying ETFs adds complexity because of the bid/ask spread. In the case of VOO, the bid/ask spread is not significant–Just a few pennies. For other ETFs, it can be much wider . The result is that we would pay more than NAV when we buy and receive less than NAV when we sell. There’s simply no good reason for long-term investors to take this haircut.

Finally, if you want to set up monthly contributions, mutual funds are the answer. You can automate contributions or withdrawals to or from an ETF.

VFIAX vs VOO

To underscore why EFTs are not necessary, let’s compare VFIAX and VOO. Their portfolios are identical. Since they both track the S&P 500, it makes sense that they would hold the same investments. For example, they both have 99.04% in U.S. equities. The both have a P/E ratio of 19.59. The price to book is 33.17 and the price to sales 2.31% for both.

Now, if we look at the expense ratios we see a small difference. The mutual fund is four basis points (0.04%), while the ETF is three basis points (0.03%). So I suppose one could say why not go with the least expensive option, even if it is just one basis point.

There are two reasons. First, you still have to deal with the bid/ask spread, it’s not significant, but it will add costs as you buy and sell above and below the NAV.

Second, we need to look at each fund’s performance on an after-fee basis. A comparison of performance from Morningstar shows that the mutual fund more often than not actually outperforms the ETF. It’s not by much, just a few basis points most years. But it’s enough to erase the one basis point difference in expenses.

When an ETF may be a Better than a Mutual Fund

I will concede that there are a few times when it may make sense for long-term, buy and hold investor to consider an ETF. The first reason deals with the required minimum initial investment of mutual funds. VFIAX above has a minimum investment of $3,000. In the case of the ETF, there is no minimum investment. This could be a hurdle for some. In my view, one should save up the $3,000 and then invest. Alternatively, there are other S&P 500 index funds that have no minimum investment, such as those offered by Fidelity.

Second, you could want exposure to certain very unique asset classes where ETFs are the better option. A friend of mine likes to invest in country-specific ETFs rather than developed and emerging market funds. For the vast majority of investors, however, this is not necessary.

If you have already built a portfolio of ETFs, I’m not suggesting you should exchange them for mutual funds or that you’ve made a mistake. As we’ve seen from the Vanguard funds, they are virtually identical in terms of fees and portfolio. Certainly, there’s no reason to make any changes if it’s going to trigger tax liability in a taxable account. But for those that are just beginning or thinking about this question, I think for most buy and hold long-term investors, mutual funds are our ideal.