Capitalize Review–A Free 401k Rollover Service

We earn a commission from the offers on this page, which influences which offers are displayed and how and where the offers appear. Learn more here.

Rolling over a 401k to an IRA is a hassle. I know from personal experience. Capitalize, a venture capital backed technology company, looks to take the hassle out of 401k rollovers.

The company offers a free service that handles all of the paperwork to safely transfer a 401k to an IRA. It never has access to your money and can help you choose an IRA if you want. In this review of Capitalize, I’ll look at the details of how the service works and how they manage to offer it for free.

Capitalize QuickTake

- Free 401k rollover service

- 4.9/5.0 Trustpilot Rating

- Works with most IRA providers

- Capitalize never has custody of your money

About Capitalize

Co-founders Gaurav Sharma and Chris Phillips launched Capitalize in 2020. The mission of the company is simple–to make the 401k rollover process easy. It raised $12.5 million in capital earlier this year. It has 17 employees and a TrustPilot customer rating of 4.9 out of 5.0.

Capitalize Review

How Capitalize Works

Capitalize follows a simple 3-step process.

Step 1: Locating your 401k

While this may seem odd to some, many people have long forgotten about an old 401k account. Or perhaps they don’t know how to access it. In step 1, Capitalize will help you locate your 401k if you need the help.

I searched for an old company that no longer exists (they went bankrupt). Capitalize found the company’s 401k plan, to my surprise.

Step 2: Choose an IRA

Here you can use an existing IRA if you have one. Otherwise, Capitalize can help you choose a new IRA. To help you pick an IRA, the tool walks through a number of questions:

- Whether you want to manage your investments or have them managed for you

- What factors are most important to you, including low fees, long standing brand, easy to use, and access to a human advisor.

- How much money you have in your 401k (some IRA accounts have minimum deposit requirements).

Based on answer these questions, Capitalize suggests a number of IRA providers. For me, the top choices were Betterment, Wealthfront, Fidelity and Vanguard, among others.

At this step in the process, you create a Capitalize account with an email and password. Once created, you can click a link to open an IRA account at your chosen firm

Step 3: Submit 401k Info

Finally, you submit information about your existing 401k. This allows Capitalize to initiate the 401k rollover process. I found this process to be extremely quick and easy as I walked through it as part of this review.

What 401k Accounts Does Capitalize Worth With?

Capitalize works with all major 401k providers, as one would expect. This includes Fidelity, Empower, Vanguard and T.Rowe Price. For those with smaller providers, Capitalize allows you to search for your retirement account by your former employer’s name.

How does it do this? Workplace retirement accounts like a 401k must be registered with the federal government. In fact, you can search what are called Form 5500 returns yourself here at the Department of Labor’s website. The search feature is a bit hard to navigate. Fortunately, Capitalize makes it much easier.

If your 401k provider is not listed, just search for your company. Capitalize will then track down the 401k plan for you.

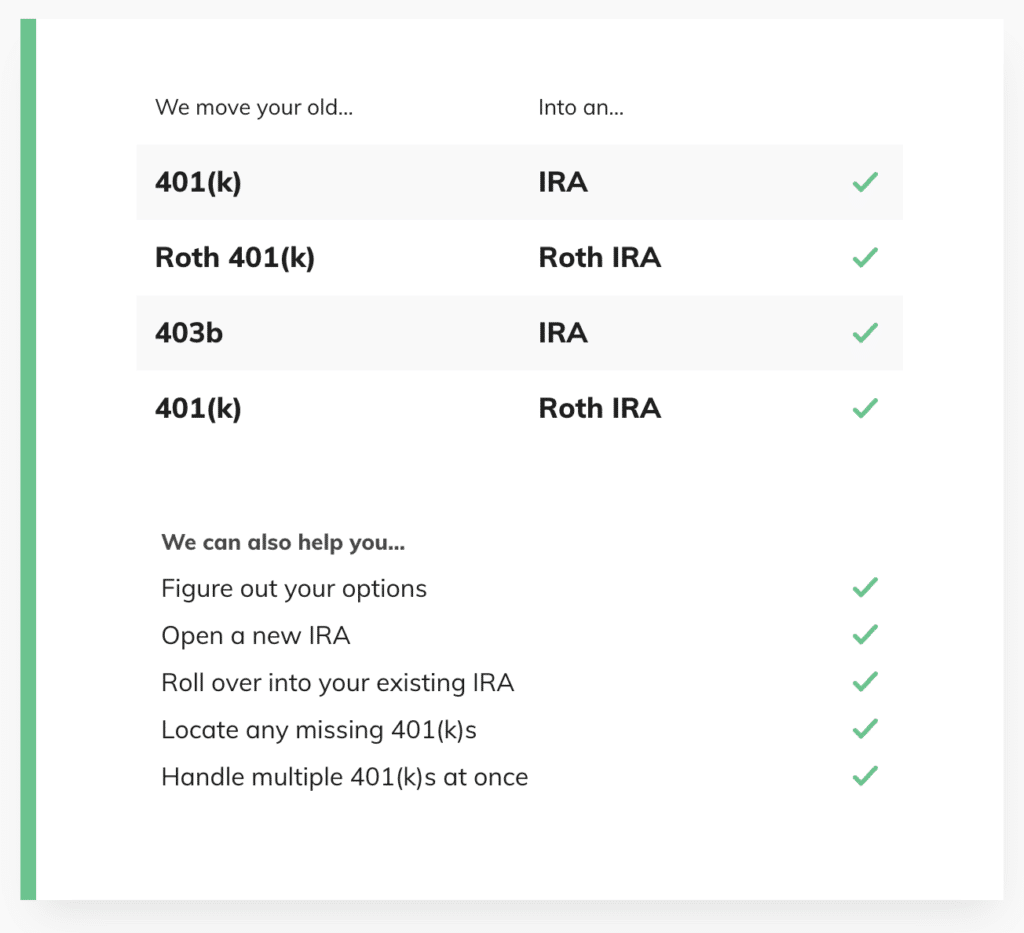

In addition, Capitalize works with both traditional and Roth 401k accounts, as well as 403b accounts.

What IRA Accounts Does Capitalize Work With?

If you need to open an IRA, Capitalize offers a variety of options. These include traditional brokers (Fidelity, Vanguard, Merrill, ETrade, TD Ameritrade), robo-advisors (SoFi, Betterment, Wealthfront), and some newer brokers (Ally, TradeStation).

You can also use your existing rollover IRA account if you have one.

How Long does a 401k Rollover Take with Capitalize?

It depends. It can take from a few days to a few weeks. The time varies because the processes that must be followed vary from one 401k provider to another.

How is Capitalize Free?

Capitalize makes money if a customer opens a new IRA account through its platform. This raises an important question. Does Capitalize’s revenue model influence the IRA accounts that it recommends? According to Capitalize, the answer is no:

If you choose to open up an IRA with one of the providers on our platform then we may be compensated. This helps us keep the service free for users, but none of those providers is ever allowed to impact the content on our site. It also never affects the fees you pay as a customer. If you’ve ever used a site like Nerdwallet, Credit Karma or Lending Tree then you’ll be familiar with this model. Our reputation depends on you feeling like we provide an honest, independent product.

I can add to their list of sites that earn money through partners RobBerger.com. My site makes money from some of the tools and services discussed on this site, including Capitalize.

My approach to this is simple. I’ll only recommend a product or service that (1) I use or (2) would feel comfortable recommending to my mom or my children. However, you should always be aware of a company’s financial incentives and undertake your own due diligence to make the best decision for you and your situation.

Capitalize Alternatives

At the moment, the only alternative to Capitalize that I’m aware of is to do it yourself. If you take that route, one tip is to contact your IRA provider first. They can often help you through the process, although you’ll have to do all of the legwork.

Final Thoughts

I’ve rolled over 401k accounts a number of times. Fortunately, I’ve never encountered significant issues, but it is a hassle. The last rollover a few months ago required a lot of paperwork, faxing and scanning. It would have been much easier if I had help.

I’ll be rolling over another 401k in December. I’ll definitely be using Capitalize. Why not take the free help?