The State of Retirement Income 2021

Author(s): Jeffrey Ptak, CFA, John Rekenthaler, Christine Benz

Topics:

- 4% Rule

- |

- Dynamic Spending Strategies

- |

- Safe Withdrawal Rates

Year Published: 2021

My Rating: ⭐️⭐️⭐️⭐️

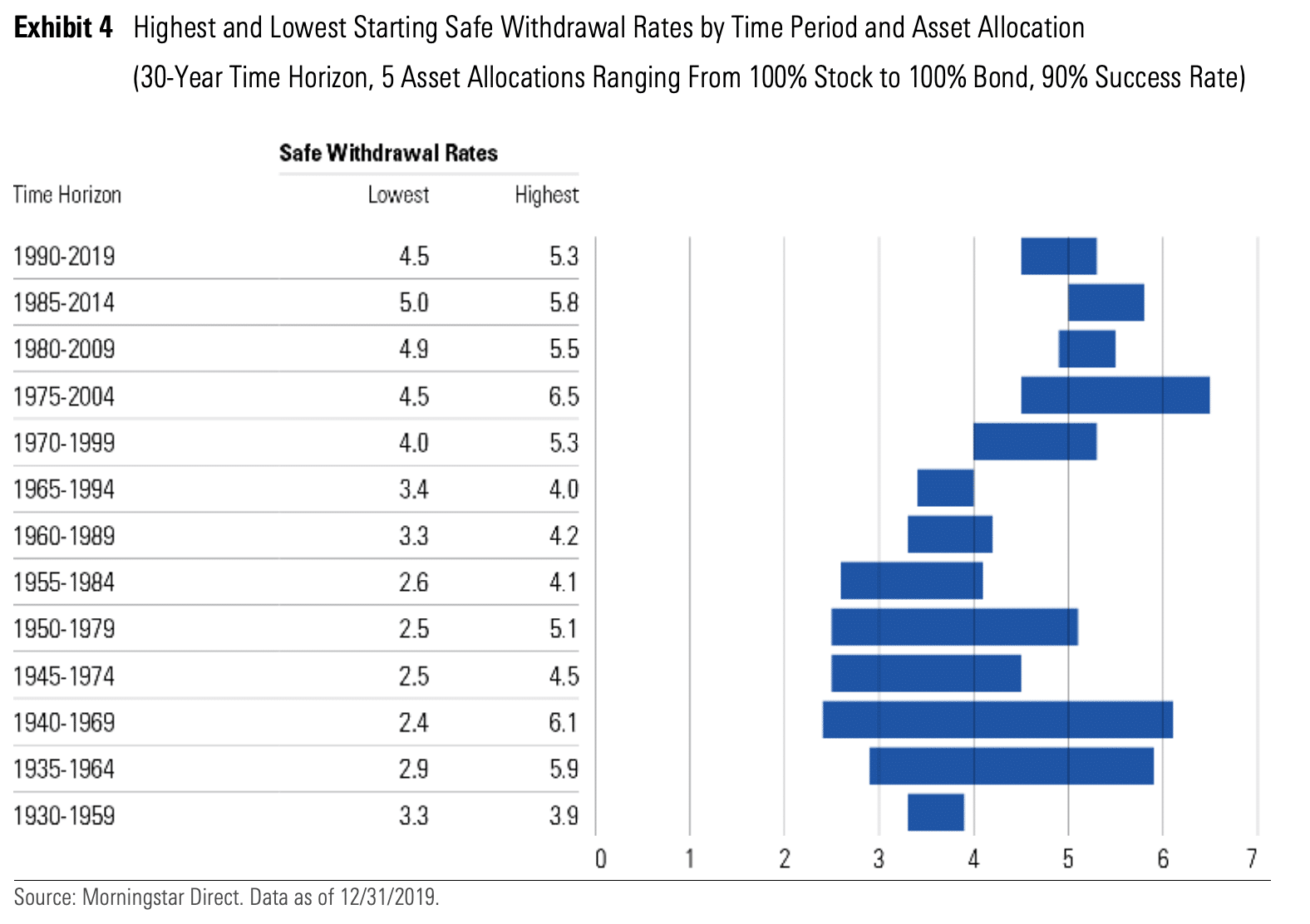

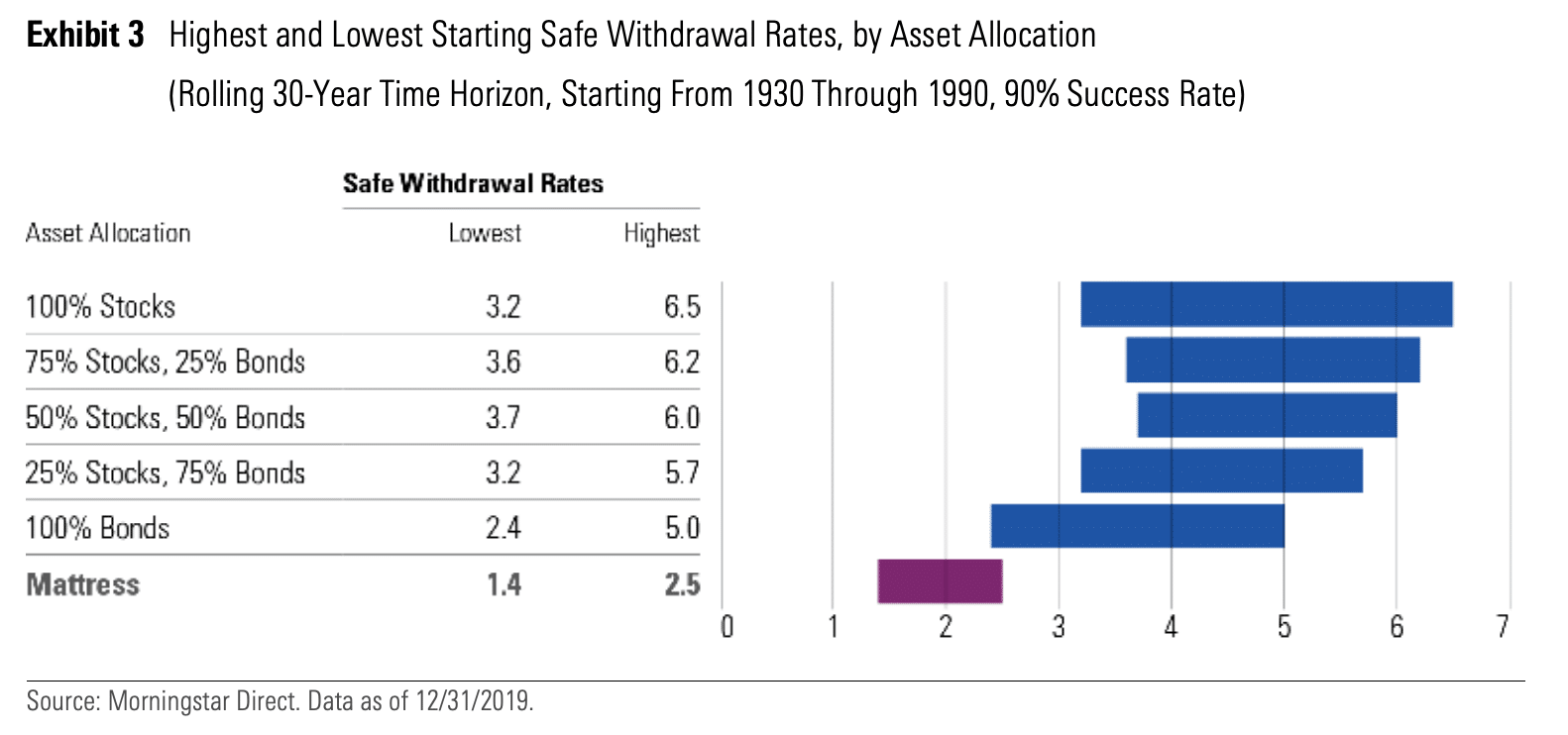

One Sentence Summary: Using forward-looking estimates of market returns and inflation, the report concludes that 3.3%, not 4%, is the new safe withdrawal rate.

Summary

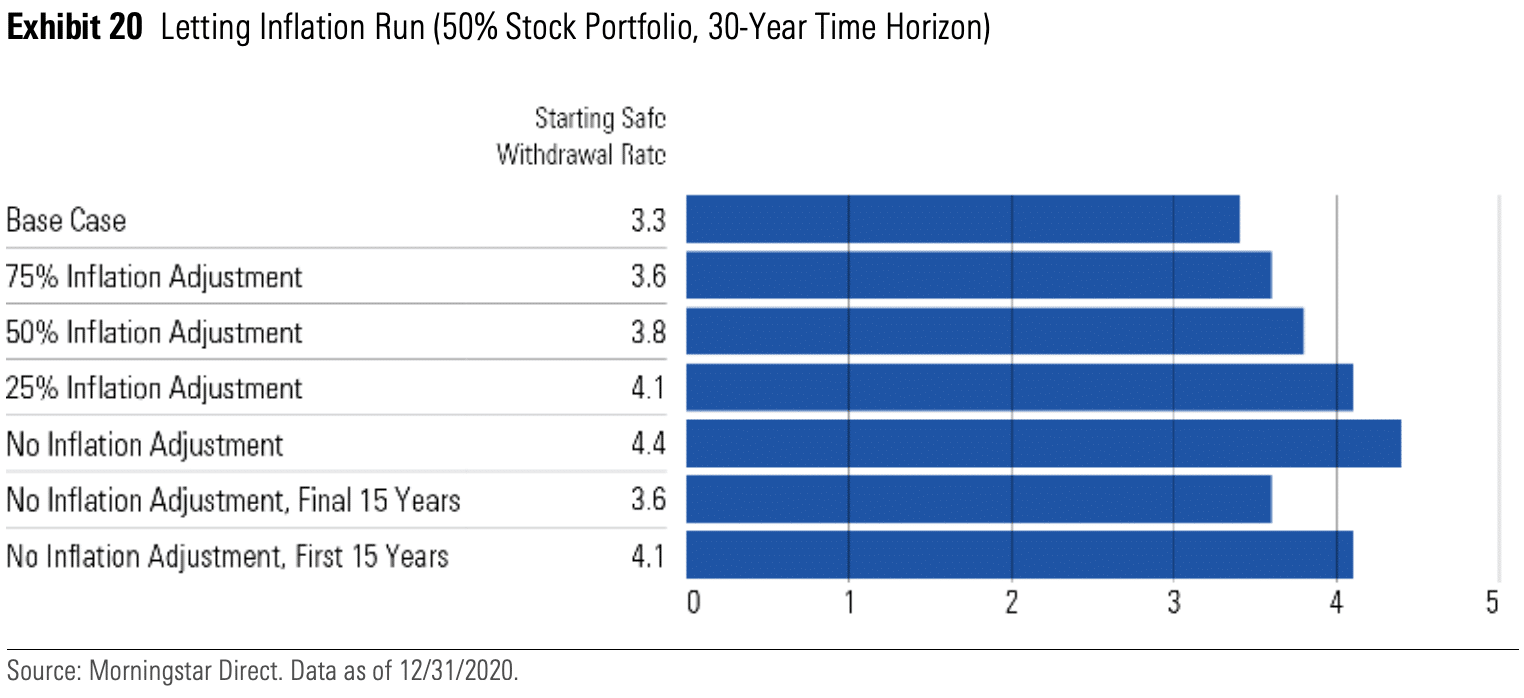

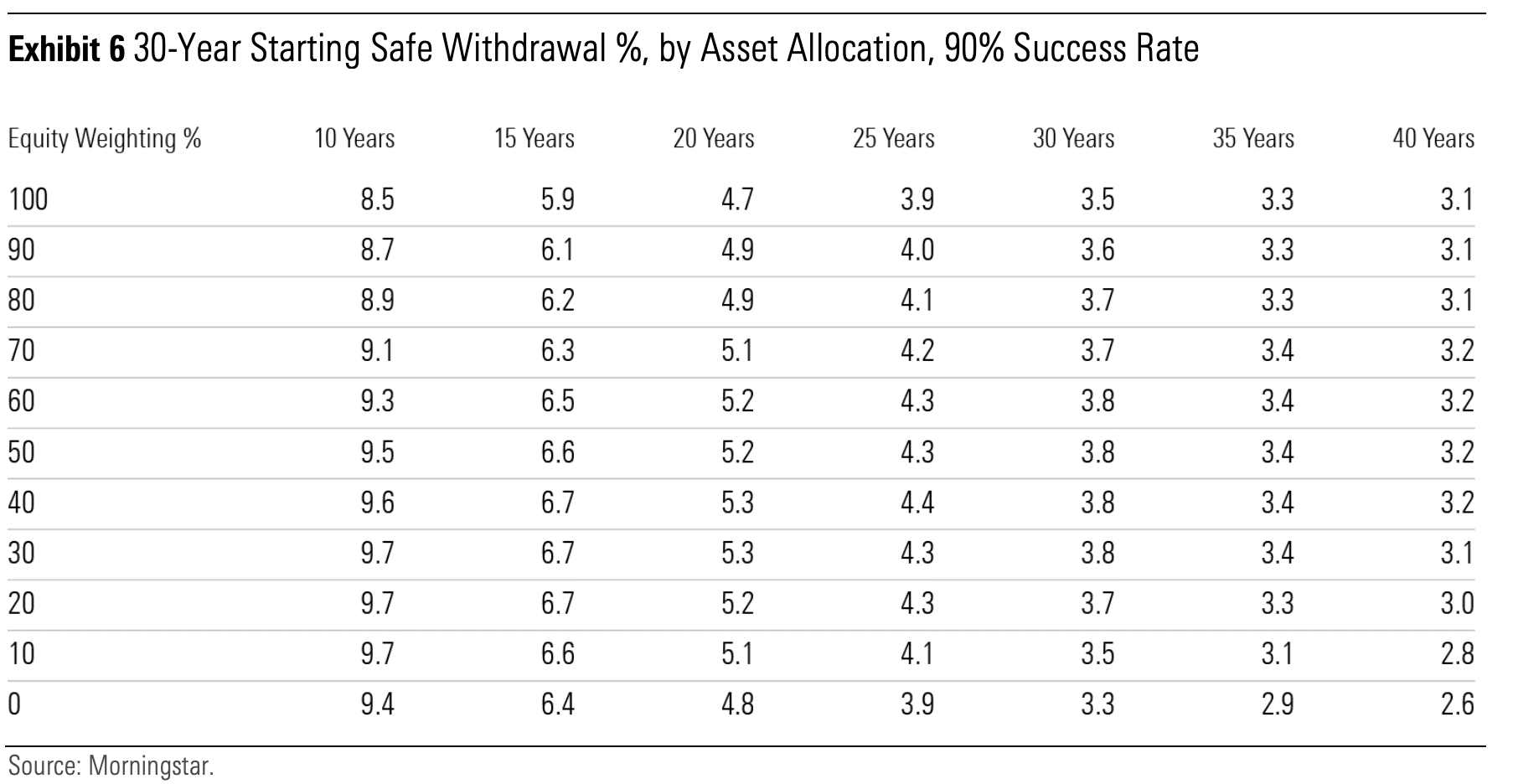

The paper concludes that 3.3% is the new safe withdrawal rate. It bases this conclusion not on historical data, as used by Bill Bengen in his 1994 paper. Rather, Morningstar uses estimates of future market returns of a 50/50 portfolio and inflation to reach its conclusion. At the same time, the paper also concludes that the initial safe withdrawal rate can rise to 4.5% if a retiree adopts a flexible spending approach with greater exposure to equities.

Specifically, Morningstar compared four flexible spending strategies to the inflation-adjusted 4% rule:

Key Quotes

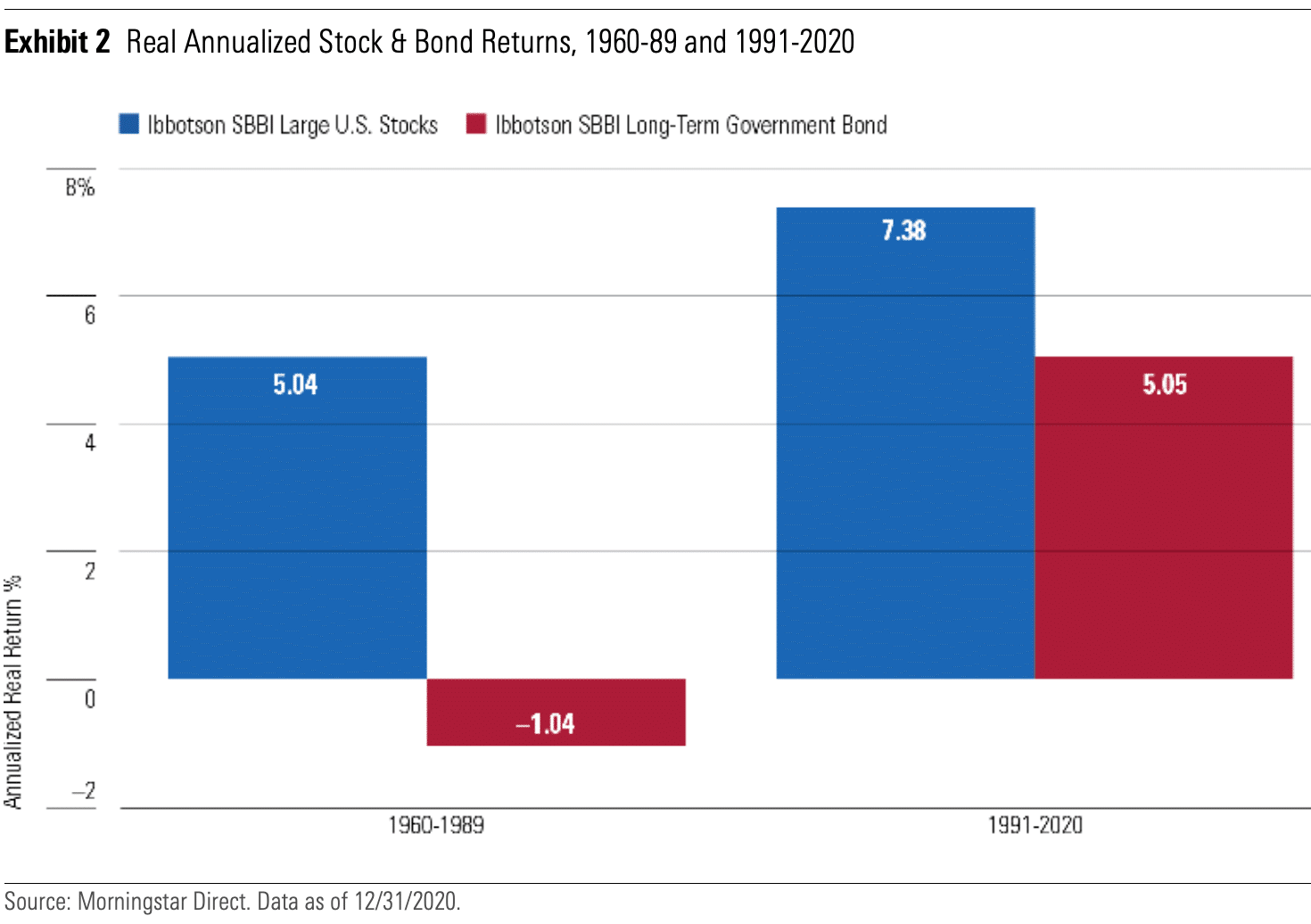

“A 4% starting withdrawal rate, with annual inflation adjustments to that initial dollar amount thereafter, is generally considered an appropriate level for retirees. Four percent has been the starting point for spending discussions since 1994, when financial planner William Bengen demonstrated that over every rolling 30-year time horizon since 1926, retirees holding a portfolio that consisted 50% of stocks and 50% of fixed-income securities could have safely withdrawn an annual amount equal to 4% of their original assets, adjusted for inflation. Under those same assumptions, a 4% withdrawal rate may no longer be feasible. Because of the confluence of low starting yields on bonds and equity valuations that are high relative to historical norms, retirees are unlikely to receive returns that match those of the past. Using forward-looking estimates for investment performance and inflation, Morningstar estimates that the standard rule of thumb should be lowered to 3.3% from 4%.”

“This should not be interpreted as recommending a withdrawal rate of 3.3%. The conventions that underlie the withdrawal-rate calculations are conservative. They presume: 1) a time horizon that exceeds most retirees’ expected life spans; 2) fully adjusting all withdrawals for the effect of inflation; 3) a fixed withdrawal schedule that does not react to changes in the investment markets; and 4) a high projected success rate for the plan (90%). As this paper will demonstrate, by adjusting one or more of those levers, current retirees can safely withdraw a significantly higher amount that the 3.3% initial projection might suggest”

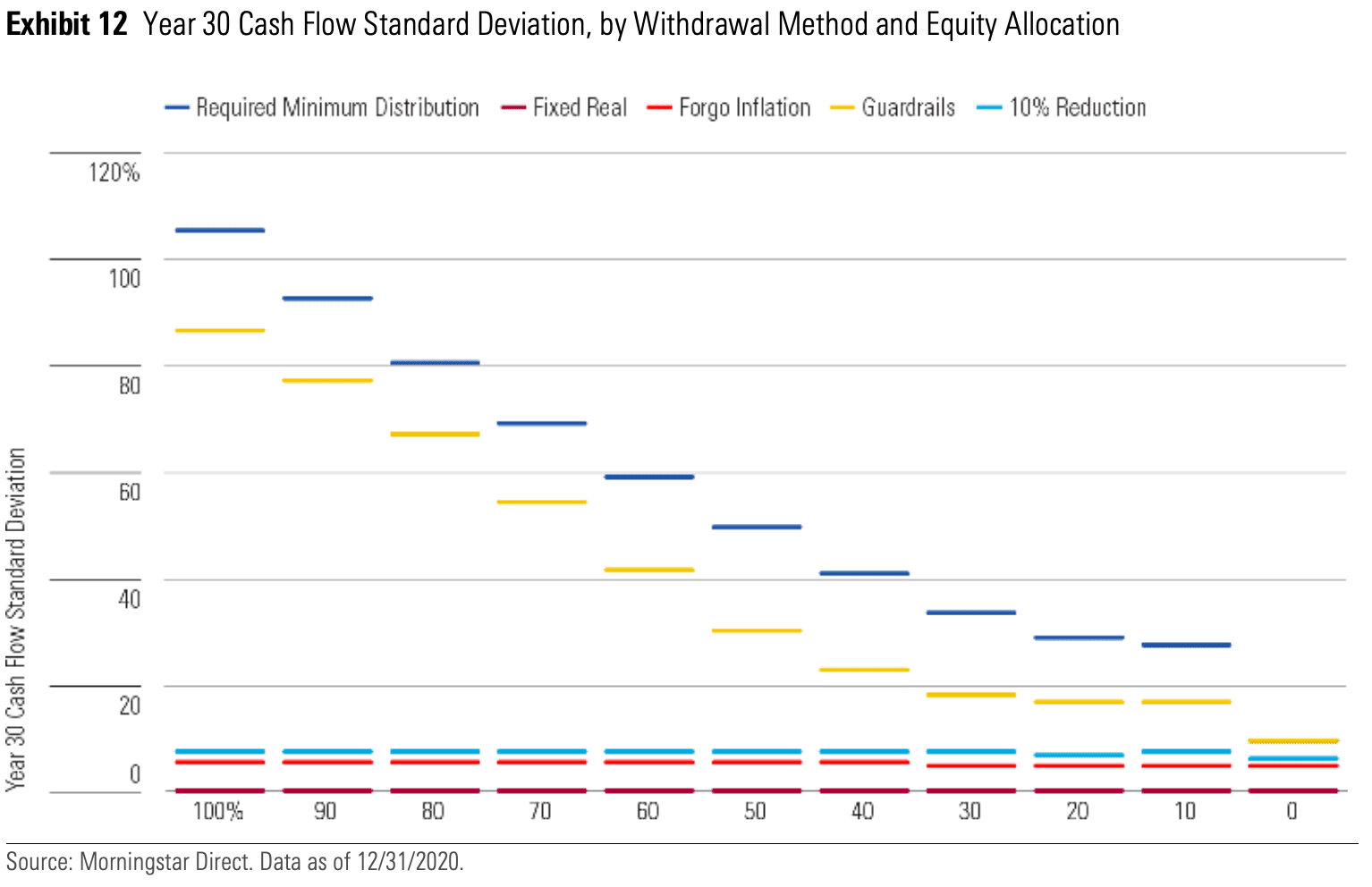

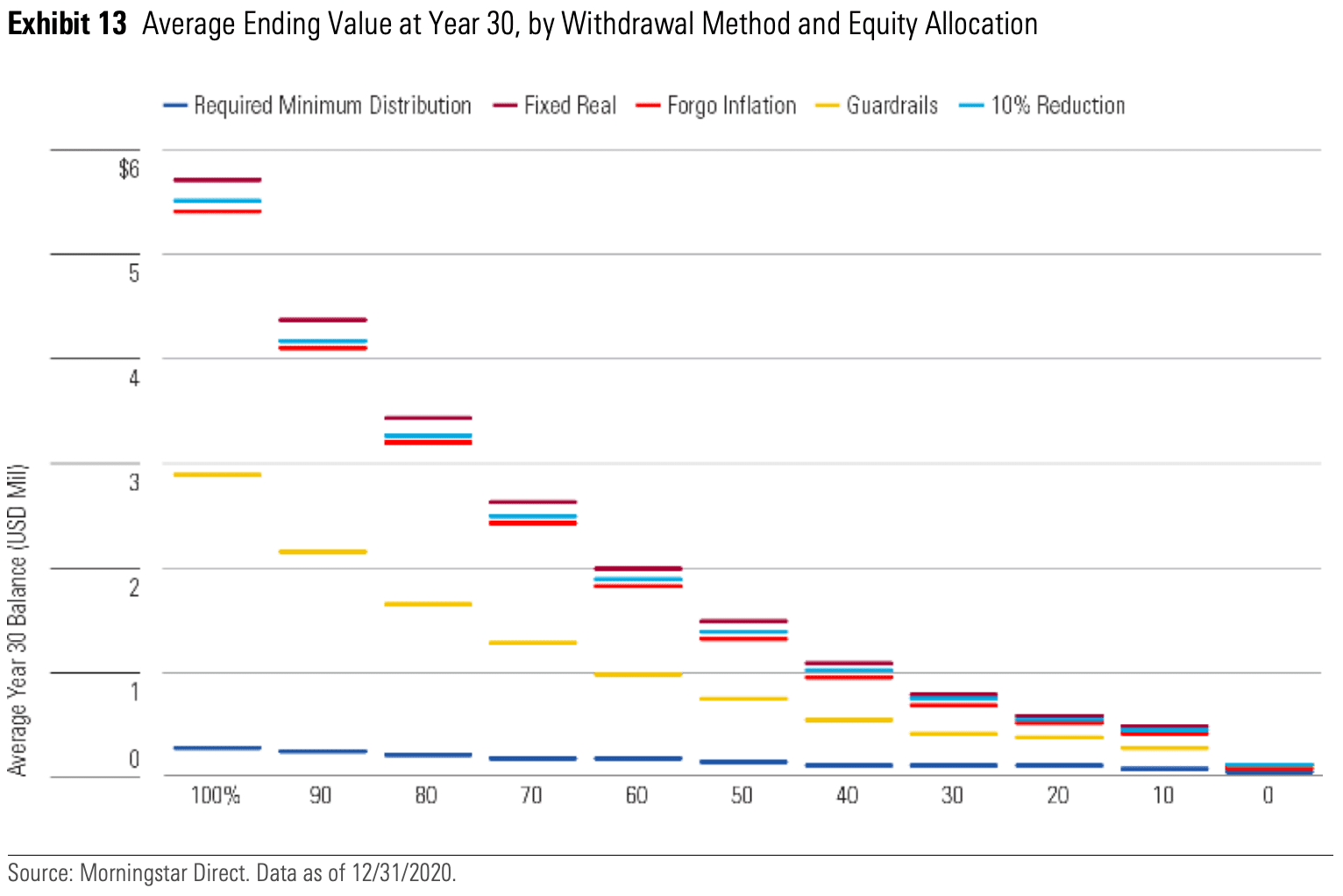

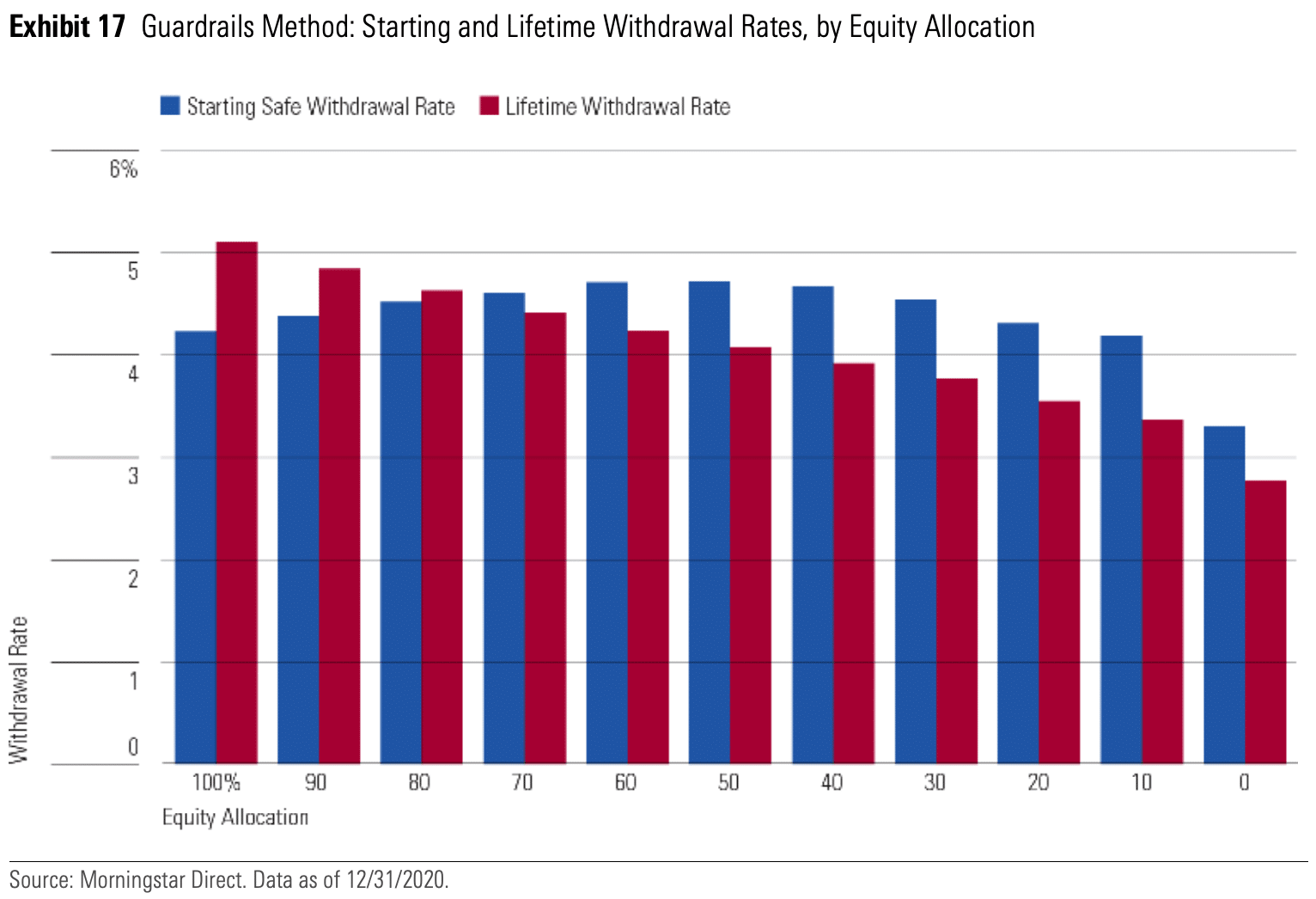

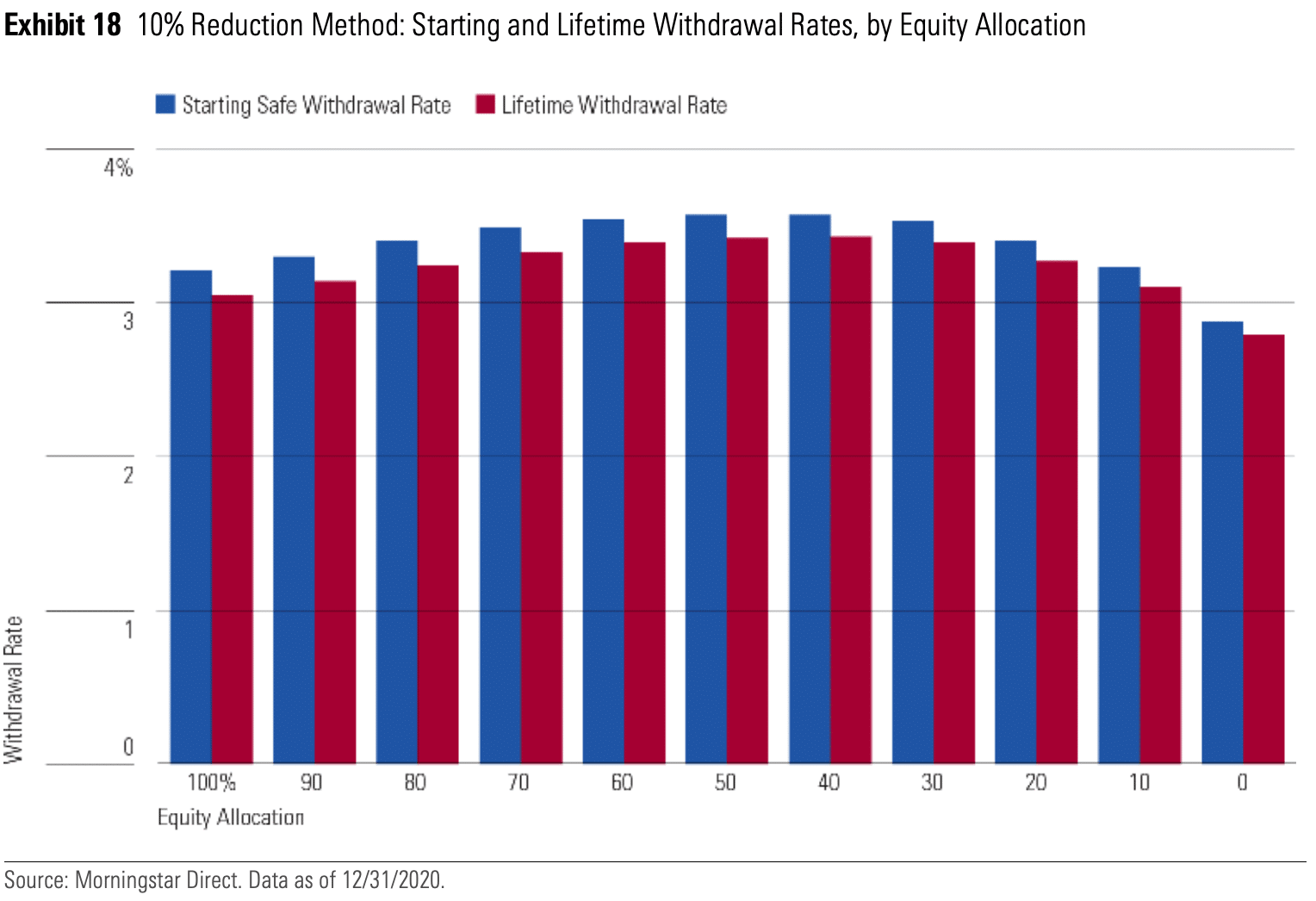

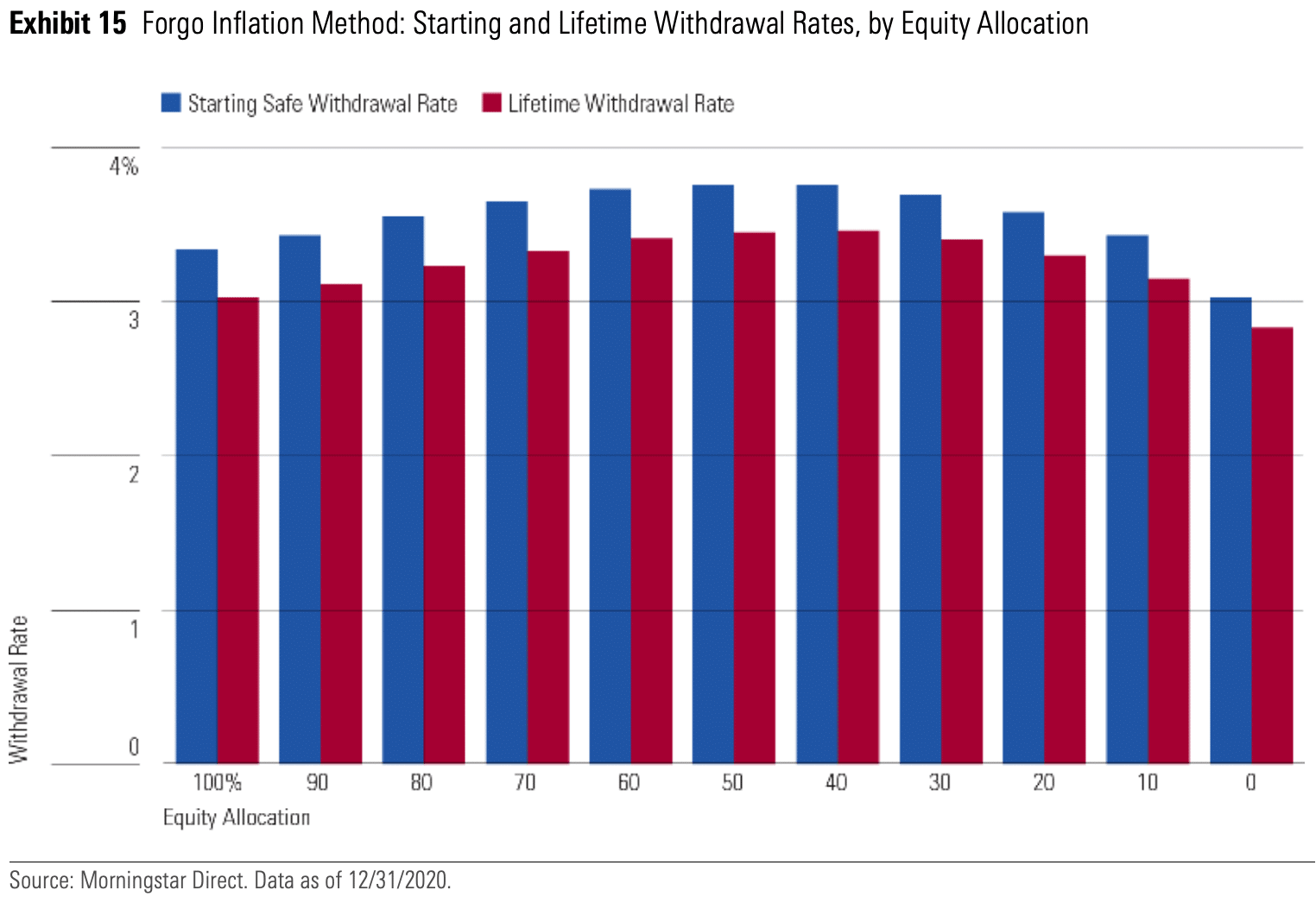

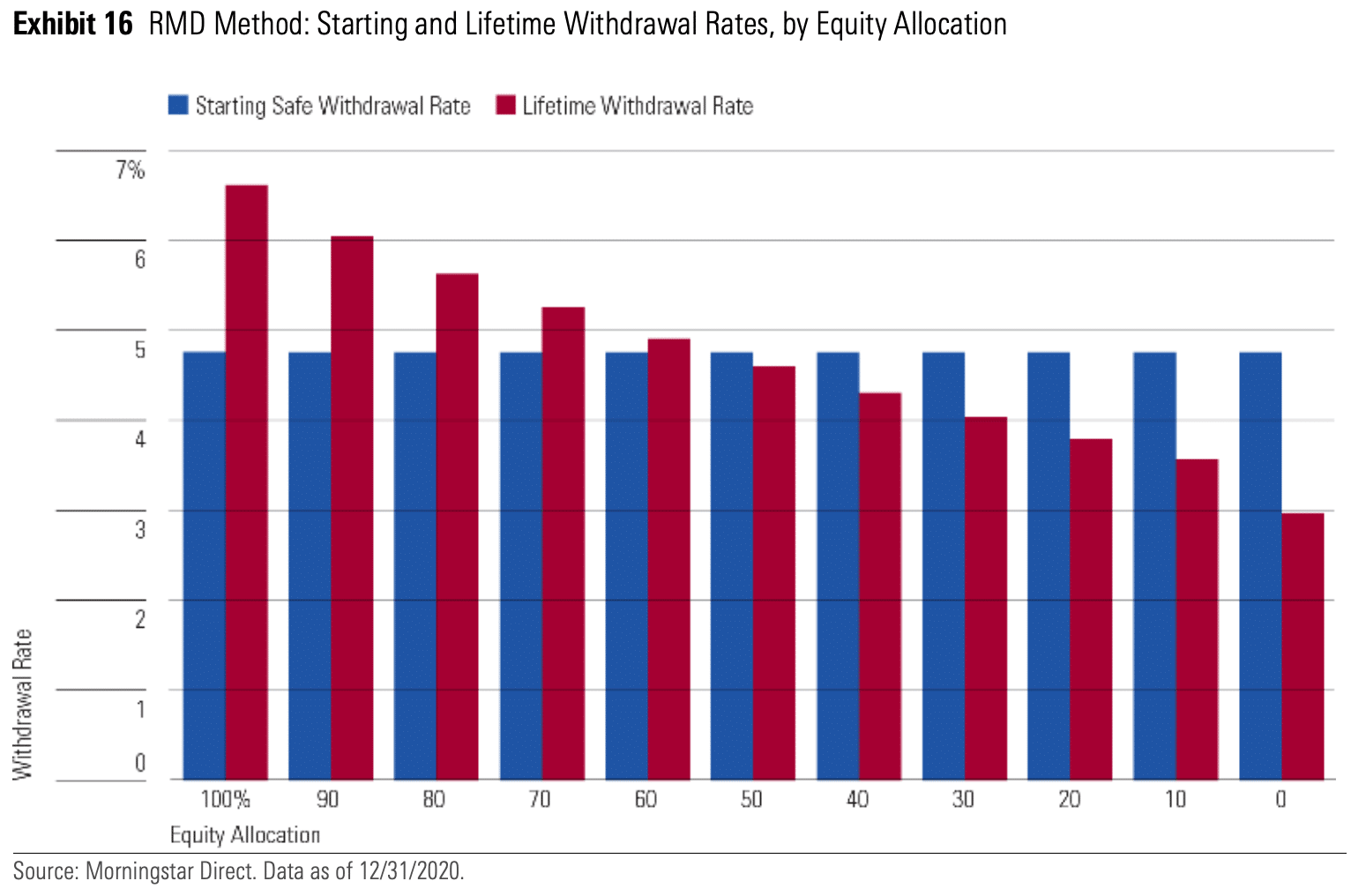

“Each flexible spending method supported a higher initial safe withdrawal rate than the fixed real withdrawal method. But the RMD and guardrails methods supported the highest starting safe withdrawal rates. This reflects the nature of these approaches, which can support higher initial withdrawals by making potentially significant year-to-year adjustments to dollar withdrawals, including throttling spending at inopportune times. With the exception of RMD, starting safe withdrawal rates are highest in balanced allocations like 50% stocks/50% bonds and tended to be lowest in less-diversified allocations like 100% stocks.”