Tax-savvy withdrawals in retirement

Author(s): Fidelity

Topics:

- Withdrawal Order

Year Published: 2018

My Rating: ⭐️⭐️

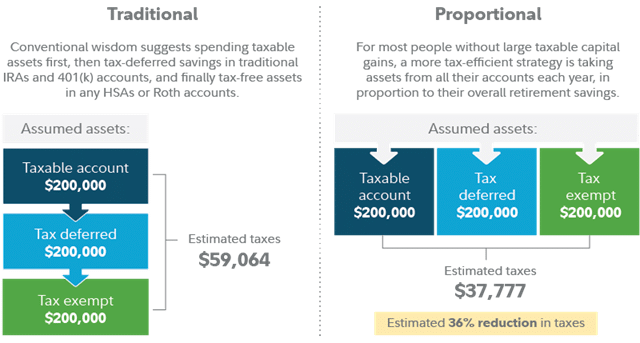

One Sentence Summary: Rather than withdrawing first from taxable, then traditional, and then Roth accounts, taking an annual withdrawal from every account type (traditional, Roth, and taxable) based on that account’s percentage of overall savings can reduce taxes in retirement.

Summary

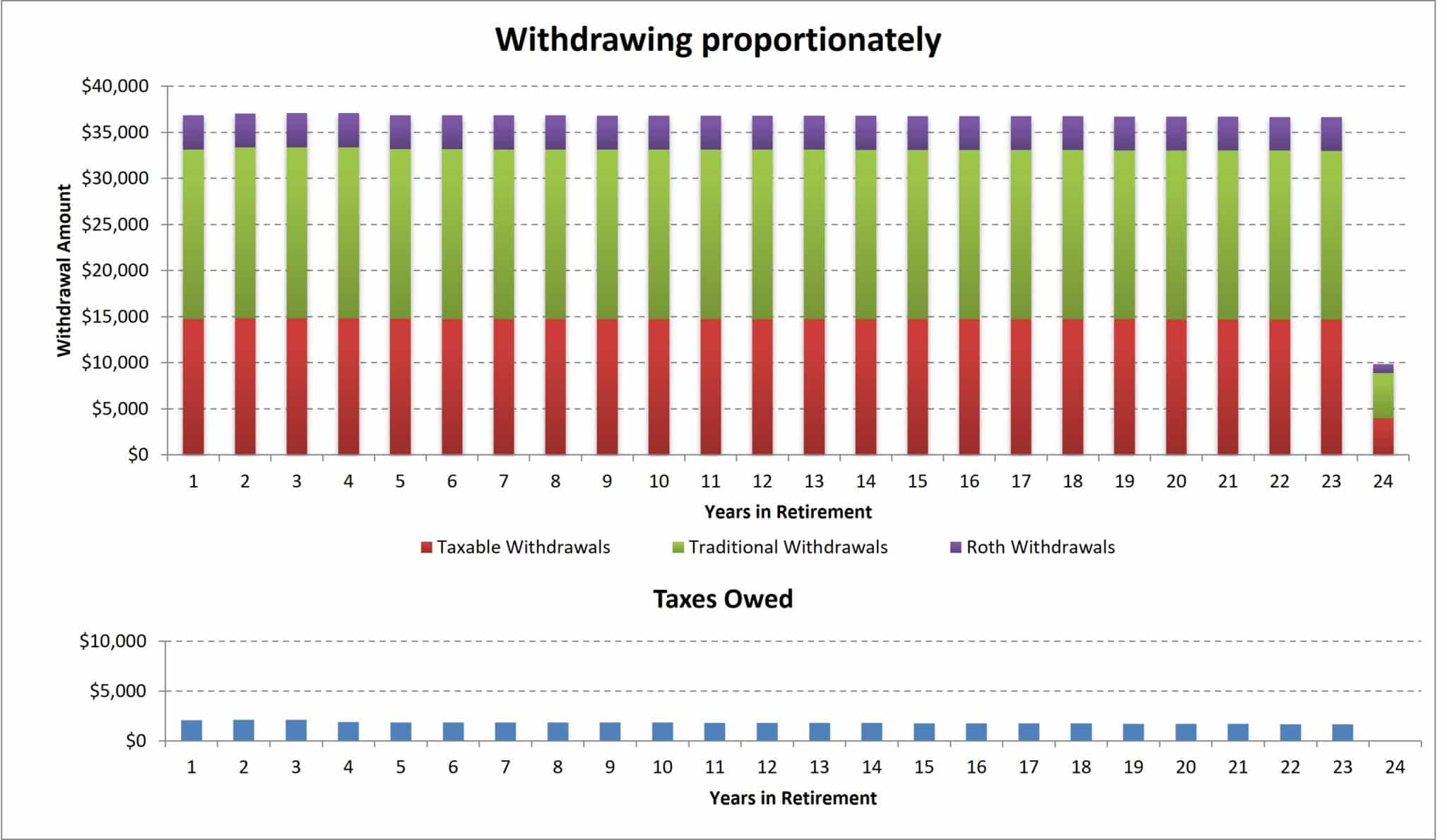

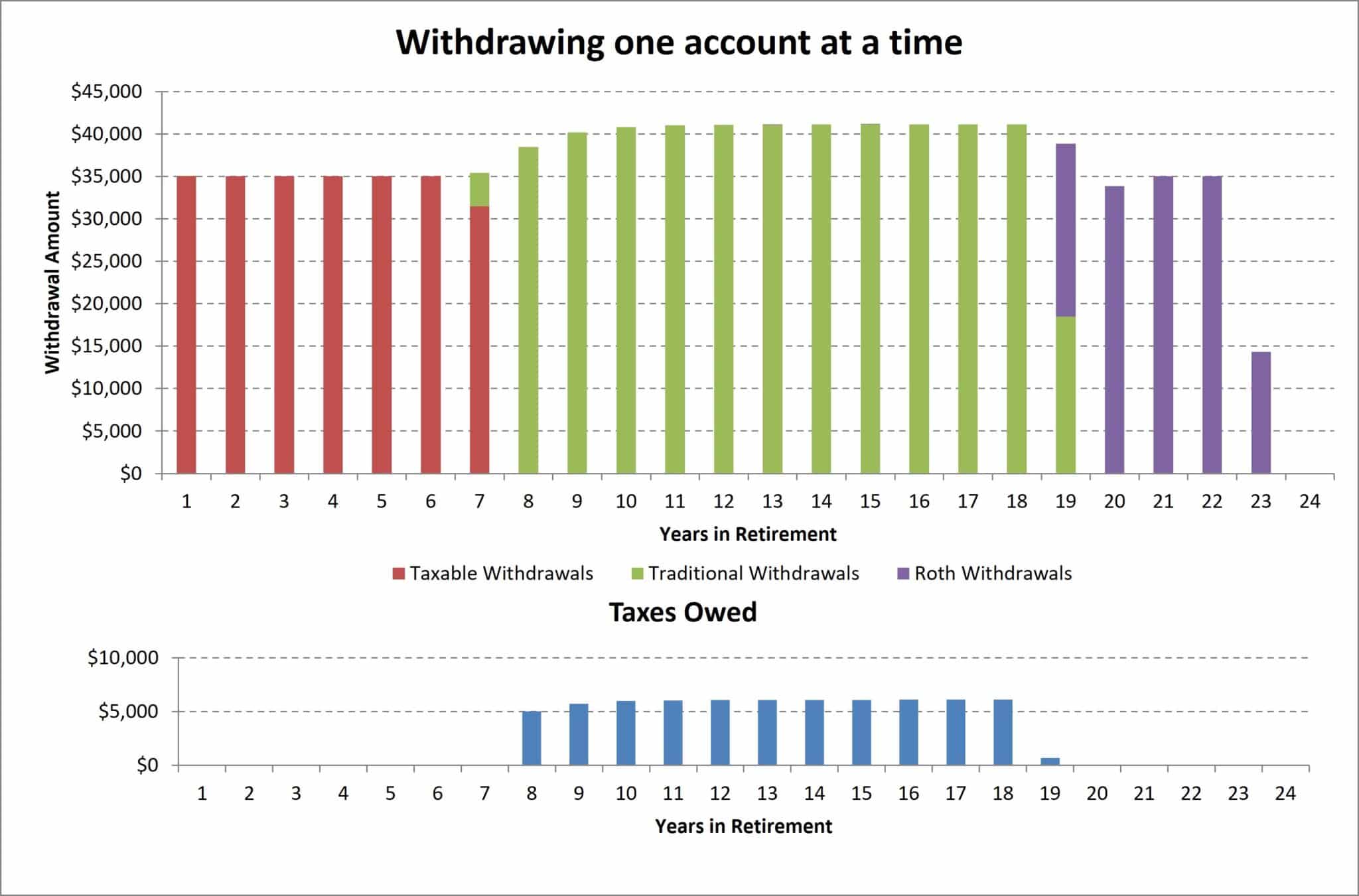

Drawing down retirement and taxable accounts in proportion to their balances reduces taxes over a retiree’s lifetime and extends the time their money will last.

My Take

The article provides an easy-to-follow approach to spending down your retirement accounts. Spending from each account type in proportion to its total balance is a simple strategy. The approach, however, has two significant downsides.

First, it includes in its proportional spending approach Roth retirement accounts. I see no reason to spend Roth accounts earlier than necessary, unless you have a specific tax-related reason for doing so.

Second, the approach may lead to suboptimal results. The goal should be to target a specific tax bracket (your tax equilibrium) throughout retirement to avoid excessive taxes, often due to deferring income until RMDs begin. Drawing down accounts proportionally may or may not achieve this goal, depending on specific circumstances.

Key Quotes

“If Joe takes a traditional approach, withdrawing from one account at a time, starting with taxable, then traditional and finally Roth, his savings will last slightly more than 22 years and he will pay an estimated $59,000 in taxes throughout his retirement.”

“Now let’s consider the proportional approach. This strategy spreads out and dramatically reduces the tax impact, thereby extending the life of the portfolio from slightly more than 22 years to slightly more than 23 years. ‘This approach provides Joe an extra year of retirement income and costs him approximately $41,000 in taxes over the course of his retirement. That’s a reduction of almost 40% in total taxes paid on his income in retirement,’ explains Koval.”