The Importance Of Finding Your Tax Equilibrium Rate For Retirement Liquidations

Author(s): Michael Kitces

Topics:

- Capital Gains

- |

- Roth Conversions

- |

- Withdrawal Order

Year Published: 2019

My Rating: ⭐️⭐️⭐️⭐️

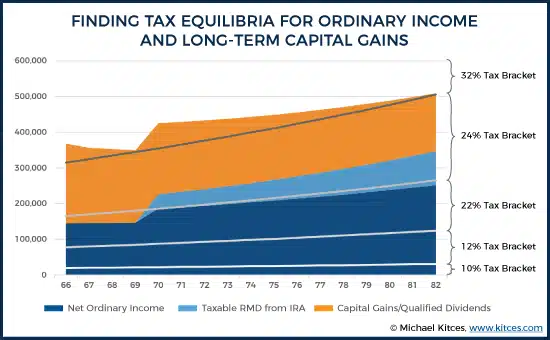

One Sentence Summary: Retirees should withdraw from investment accounts (taxable, traditional and Roth) in a way that keeps their tax brackets (both on ordinary income and capital gains) consistent throughout retirement.

Summary

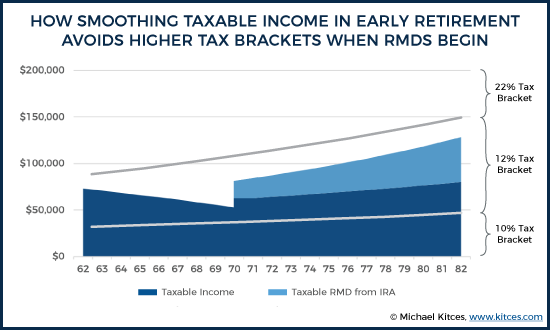

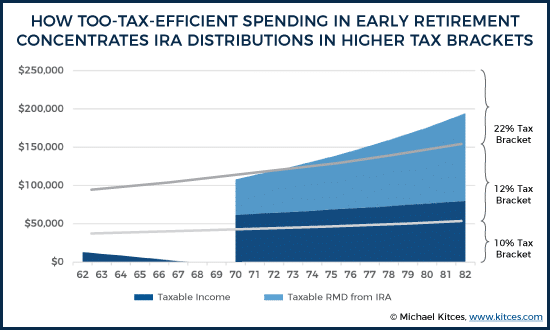

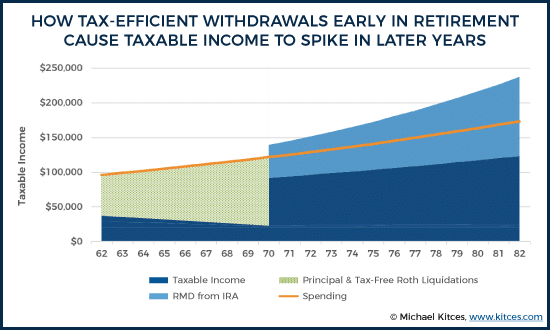

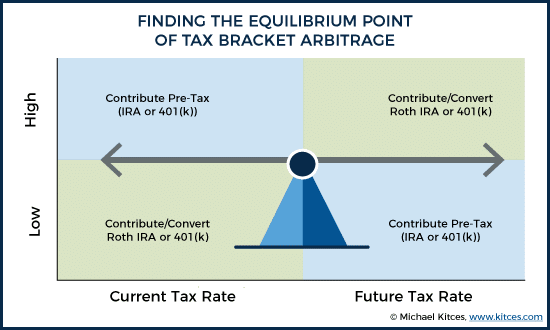

Tax-deferred retirement accounts can lead to higher tax rates in retirement when Required Minimum Distributions (RMDs) begin and retirees enter higher tax brackets. To avoid this, retirees should find a “tax equilibrium rate” that balances current and future tax rates by engaging in strategies such as Roth conversions and capital gains harvesting to fill lower tax brackets now and avoid higher brackets in the future.

Key Quotes

“Ultimately, the optimal tax rate equilibrium – or really, two equilibria for both ordinary income and long-term capital gains – will vary by the retiree, depending on his/her income sources and when they begin (e.g., Social Security and pensions), overall wealth, and projected spending (that determines whether wealth in the aggregate will continue to grow and compound towards even higher brackets in the future).”

“As a result, the optimal strategy for managing tax-deferred growth, and the potentially substantial build-up of pre-tax assets (from unrealized capital gains to traditional IRAs and 401(k) plans), is to defer enough to avoid high tax rates now, but not so much as to cause much higher tax rates in the future. In essence, it’s about finding the equilibrium point – like the balancing point on a seesaw – where enough income is created or recognized now to avoid “too much” in the future, but not so much is drawn into the present that it would have been better to just defer the income and wait until later when tax rates might have been lower!”