An International Perspective on Safe Withdrawal Rates: The Demise of the 4 Percent Rule?

Author(s): Wade D. Pfau, Ph.D.

Topics:

- 4% Rule

- |

- Safe Withdrawal Rates

Year Published: 2010

My Rating: ⭐️⭐️⭐️⭐️

One Sentence Summary: Based on financial market data from 17 developed countries over 109 years, the 4% rule may be overly optimistic in many cases.

Summary

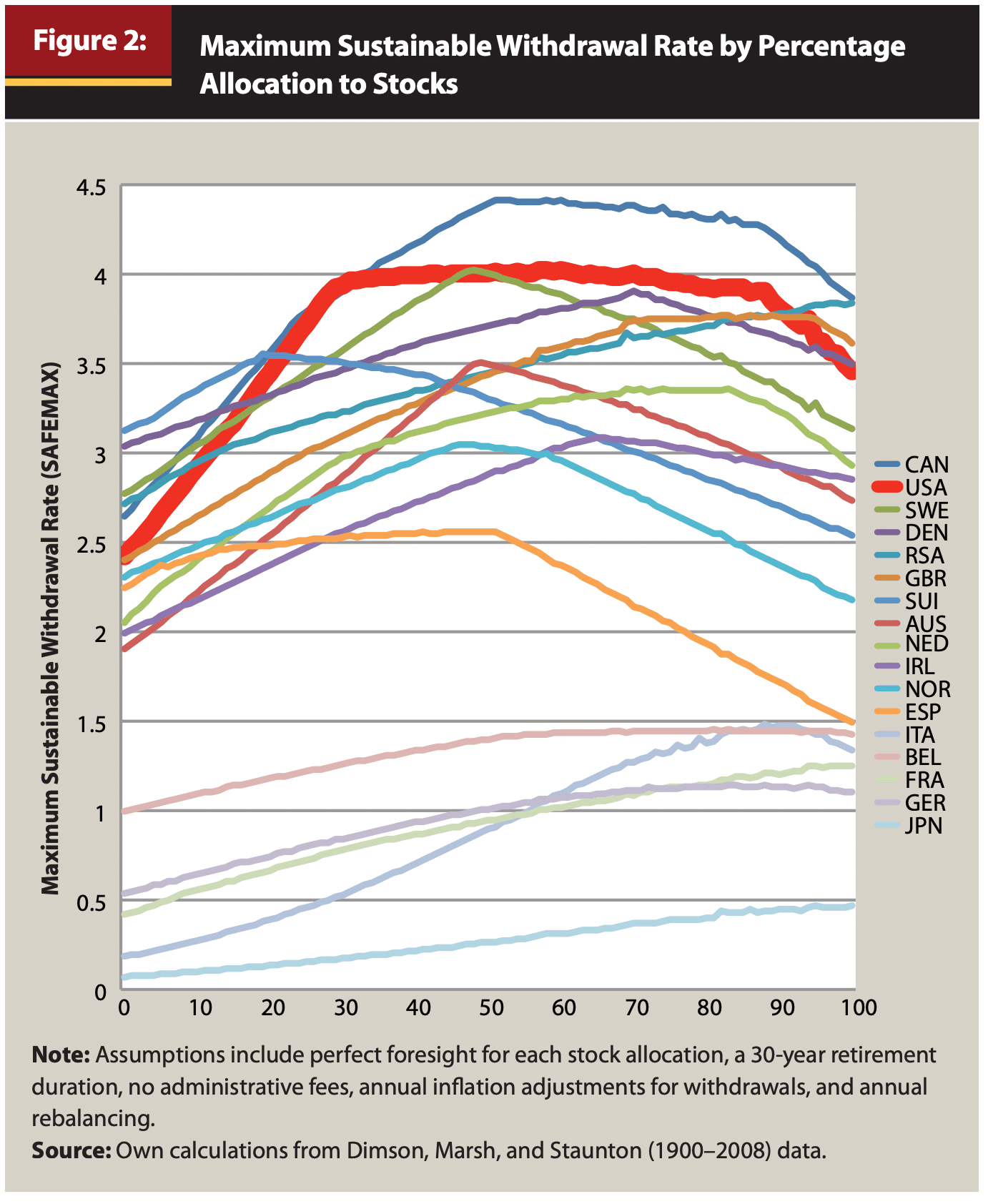

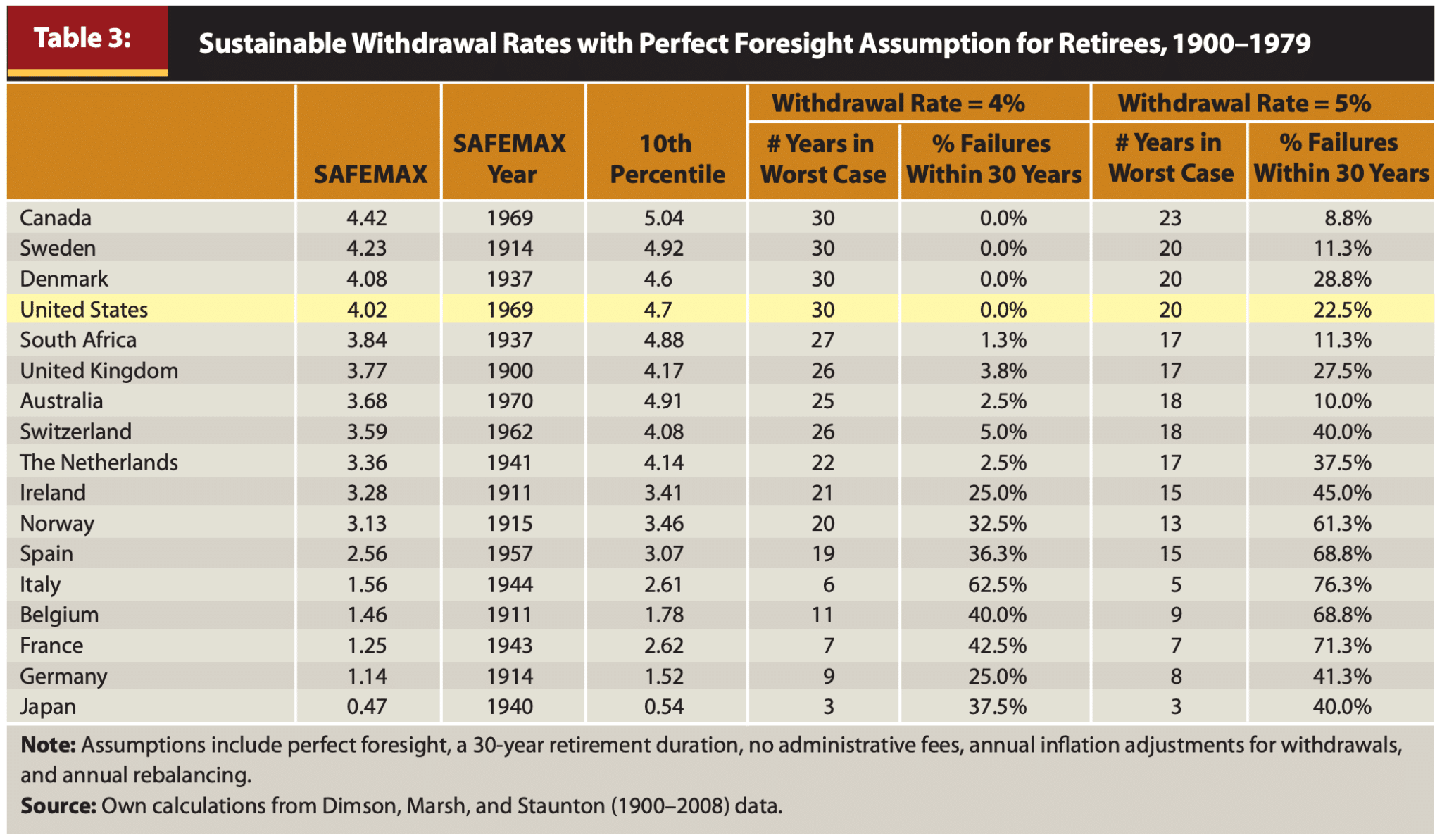

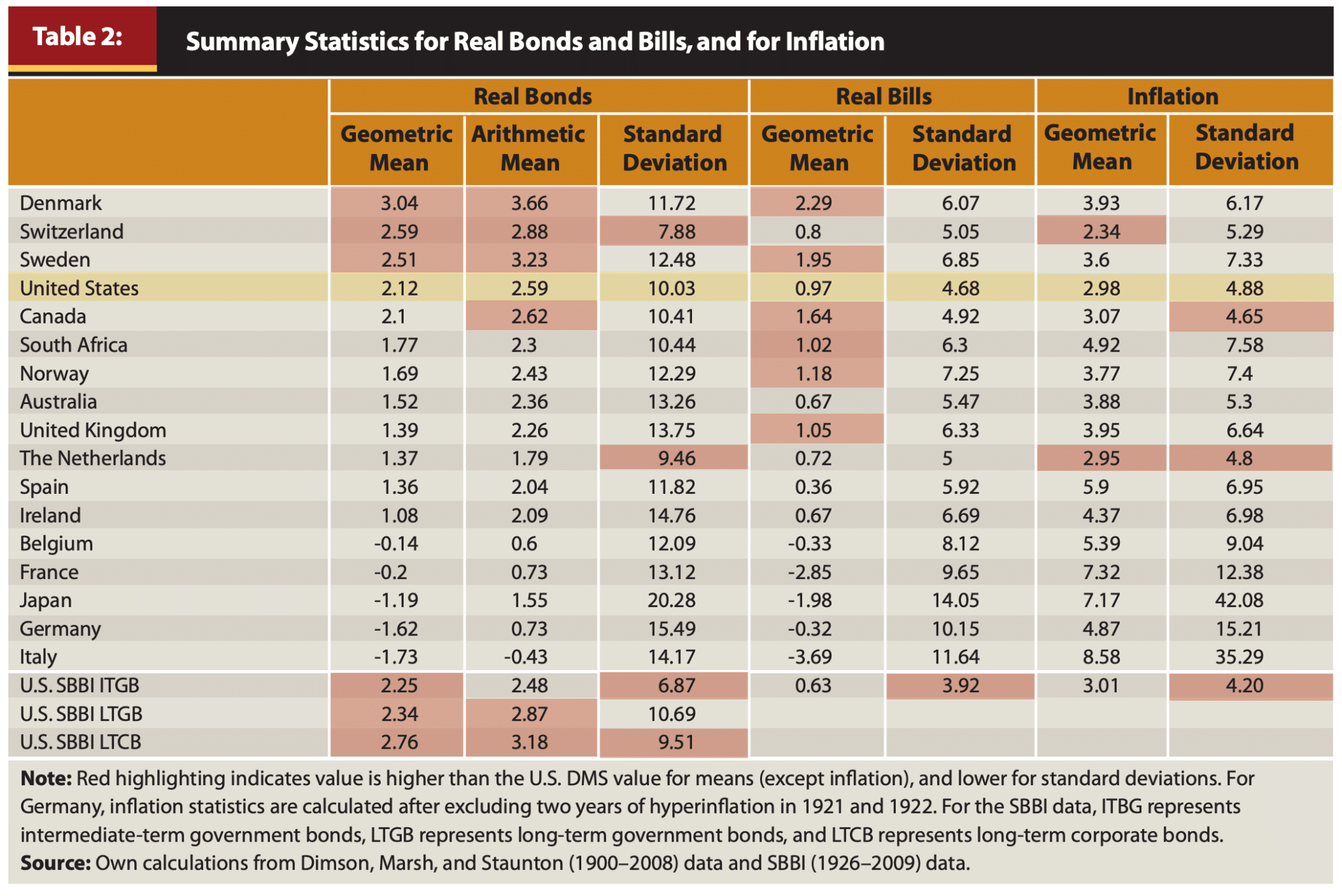

The 4% rule comes from a 1994 paper entitled, Determining Withdrawal Rates Using Historical Data, which relied on U.S. stock and bond returns data. Dr. Pfau’s paper analyzes the viability of the 4% rule by broadening the scope of analysis beyond the United States to include financial market data from 17 developed countries over 109 years. This comprehensive study challenges the universal applicability of the 4% rule, concluding that its success is contingent on the economic and market conditions of specific countries and time periods.

Pfau’s findings indicate that the 4% withdrawal rate, while historically viable in the U.S., does not hold up when applied to a global context, with many countries experiencing periods where such a rate would have led to the exhaustion of retirement savings well within 30 years. The paper suggests that the variability in market returns, inflation rates, and other economic factors across different countries and historical periods makes the 4% rule overly optimistic for a significant portion of retirees, especially in environments of low-interest rates and high market valuations.

Key Quotes

“With the SAFEMAX criterion, and from an international perspective, the 4 percent real withdrawal rule has simply not been safe. With the perfect foresight assumption, only 4 of 17 countries had a SAFEMAX above 4 percent, while a 50/50 allocation for stocks and bonds led to zero successes for the 17 countries in the DMS data.”

“It may be tempting to hope that asset returns in the 21st century United States will continue to be as spectacular as in the last century, but Bogle (2009) cautions his readers, ‘Please, please, please: Don’t count on it.’”

“Granted, researchers have demonstrated that including more financial assets, using dynamic rules to adjust withdrawals to market conditions, and changing rebalancing strategies can all serve to increase safe withdrawal rates, and these modifications have not been incorporated here.”