Quicken Simplifi is a personal finance app developed by Quicken, designed to help users manage their finances more effectively. It was launched on January 14, 2020, marking Quicken’s effort to cater to a broader demographic, including younger users who seek a comprehensive yet straightforward tool for tracking their financial accounts, day-to-day spending, and working towards savings goals.

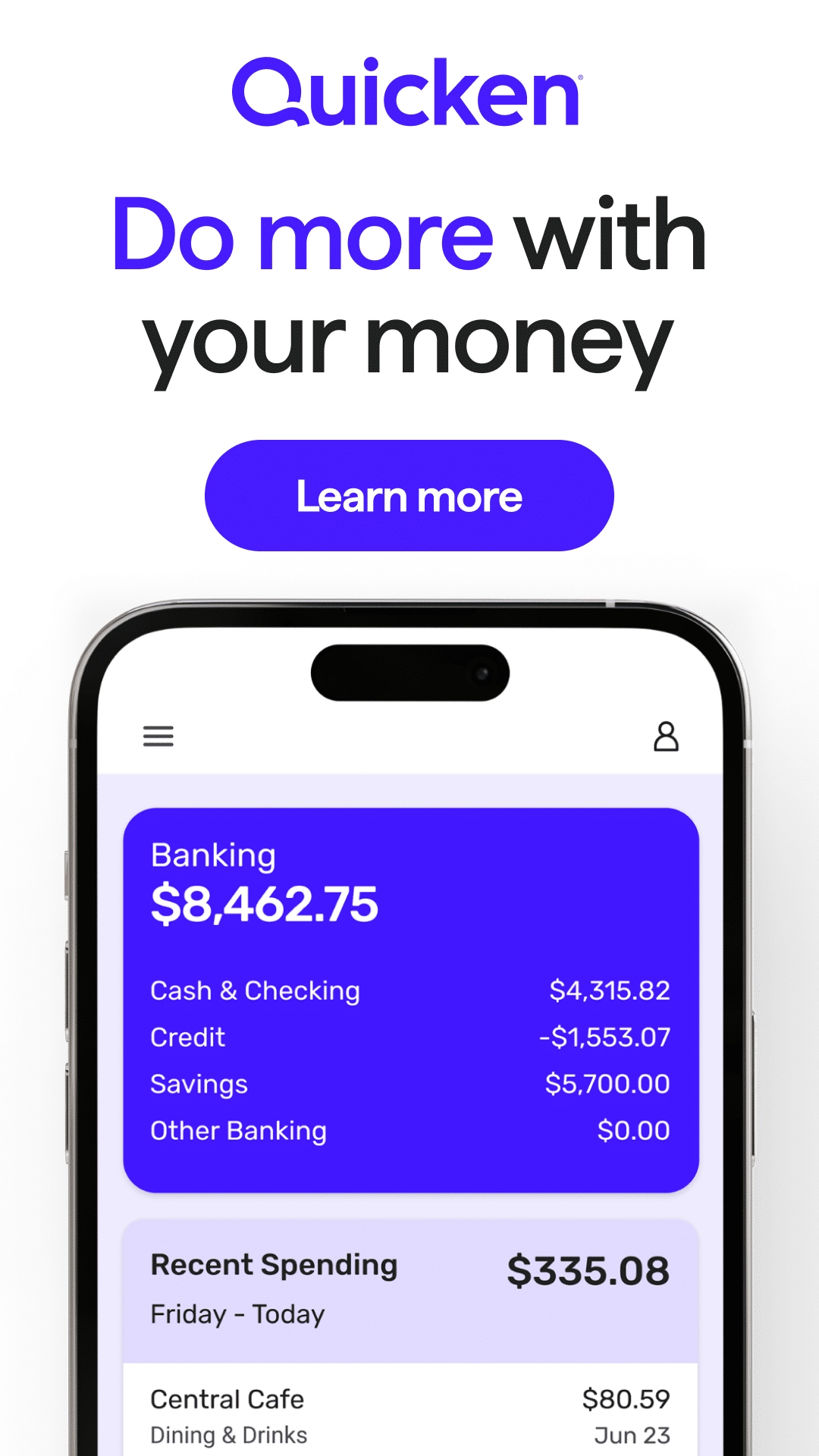

It was originally designed as a smartphone app. Today users can also access the tool via a web browser.

Key Features of Quicken Simplifi

- Comprehensive Financial Overview: Simplifi connects automatically to users’ bank accounts, credit cards, and savings accounts, providing a real-time, holistic view of one’s financial health. This connectivity allows for a consolidated view across different financial institutions, making it easier for users to understand and manage their finances.

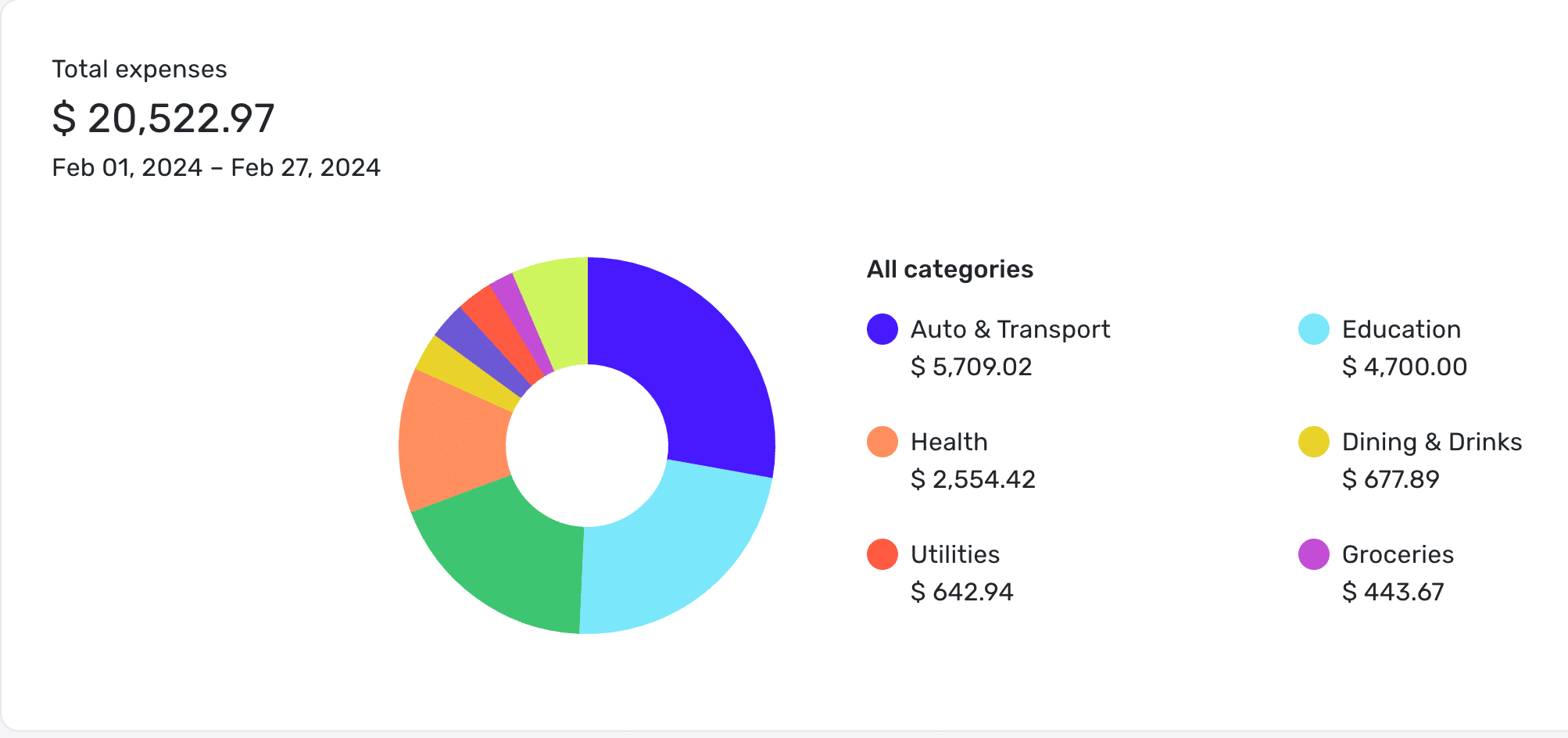

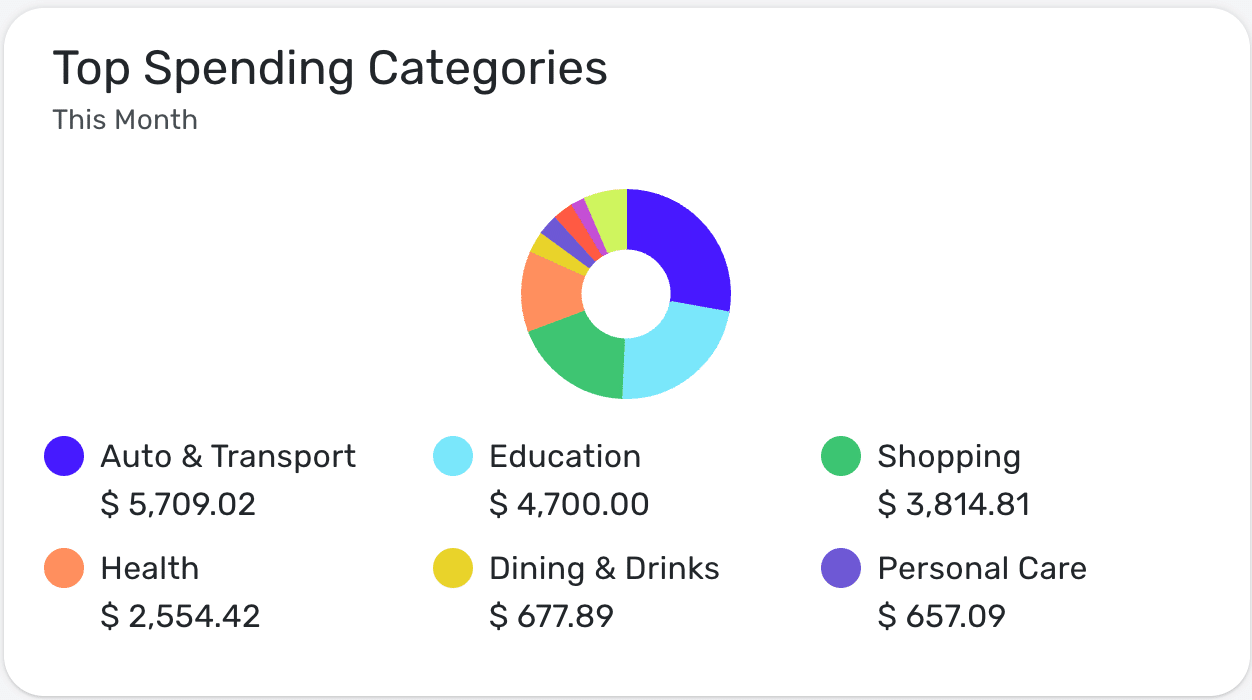

- Budgeting and Spending Tracking: The app offers tools for budgeting and tracking spending. Users can create a personalized spending plan based on their income and expenses, track spending by category, and monitor their day-to-day spending to ensure they stay within their monthly budget. Simplifi’s approach to budgeting is flexible, accommodating various methods like zero-based budgeting, envelope budgeting, and the 50-30-20 rule.

- Savings Goals: Simplifi allows users to set and track custom savings goals, such as for vacations, vehicles, emergency funds, and retirement. This feature helps users plan for the future and make informed decisions about their spending to reach their financial objectives.

- Security: The app uses multi-factor authentication and 256-bit encryption to securely transmit data from bank servers, ensuring that users’ financial information remains confidential and protected.

- User Experience: Simplifi is praised for its fresh user experience, featuring a concise and helpful dashboard, innovative views of financial data, and a design that makes it a pleasure to use. The app’s interface is intuitive, making financial management accessible even to those who may not be tech-savvy.

- Mobile Accessibility: With its mobile app, Simplifi ensures that users have access to their financial data anytime, anywhere. This flexibility allows users to make informed financial decisions on the go and stay on track with their financial goals.

- Account Linking

- Budgeting

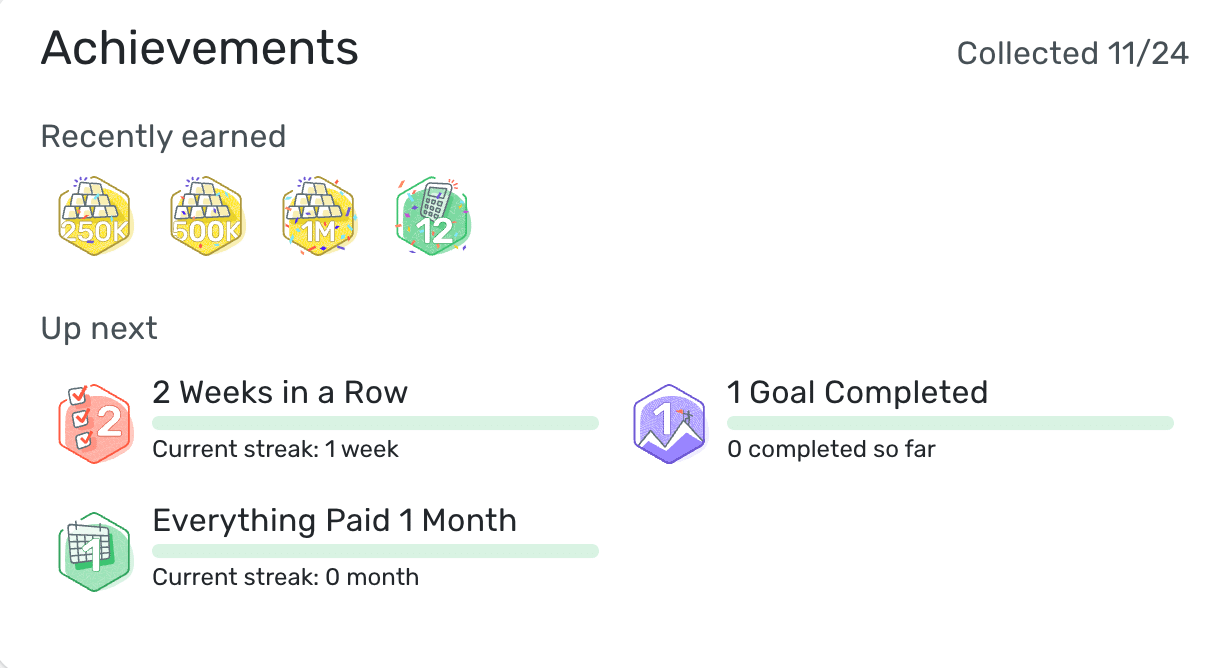

- Goal Setting

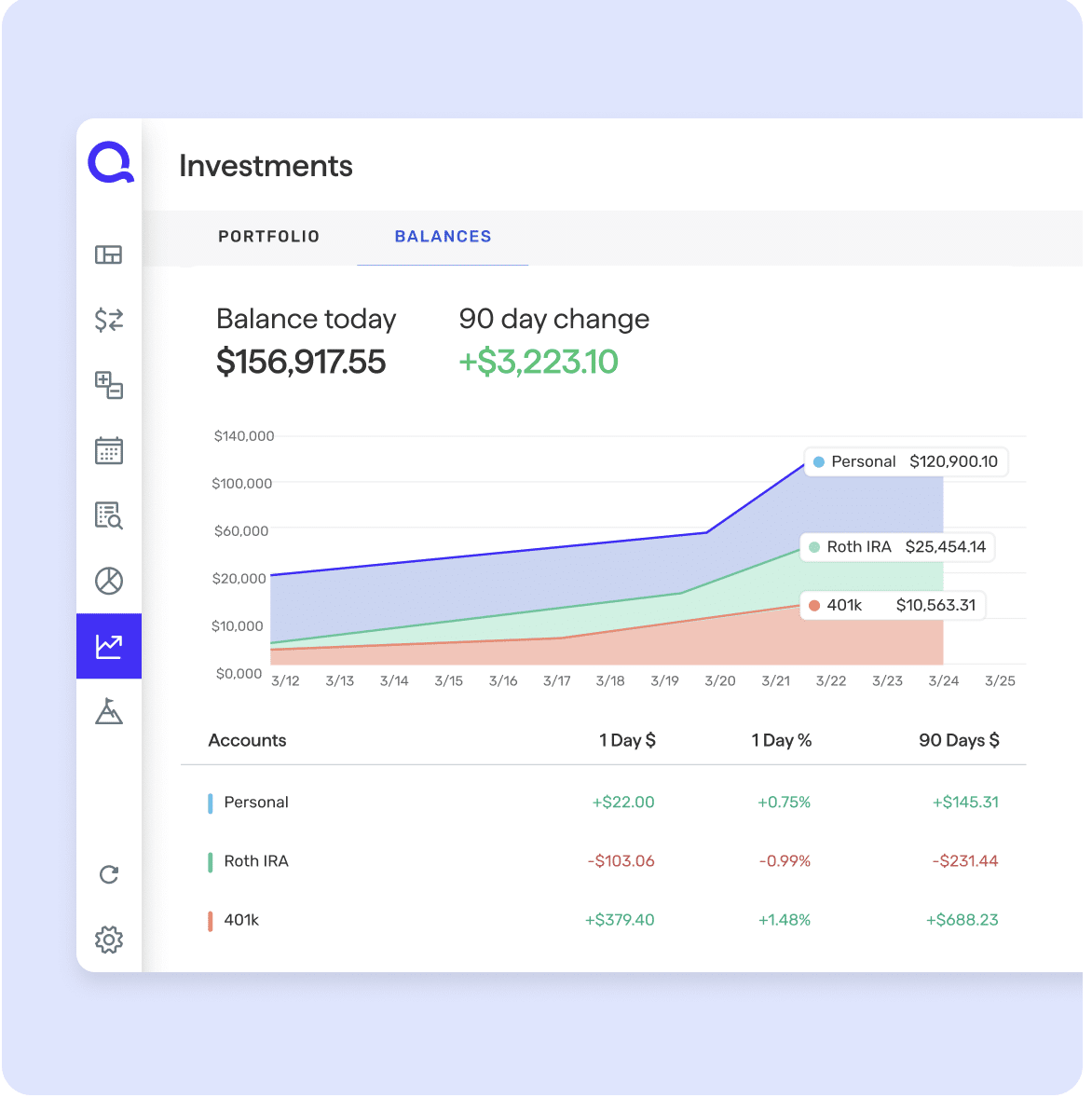

- Investment Tracking

- Net Worth Tracking

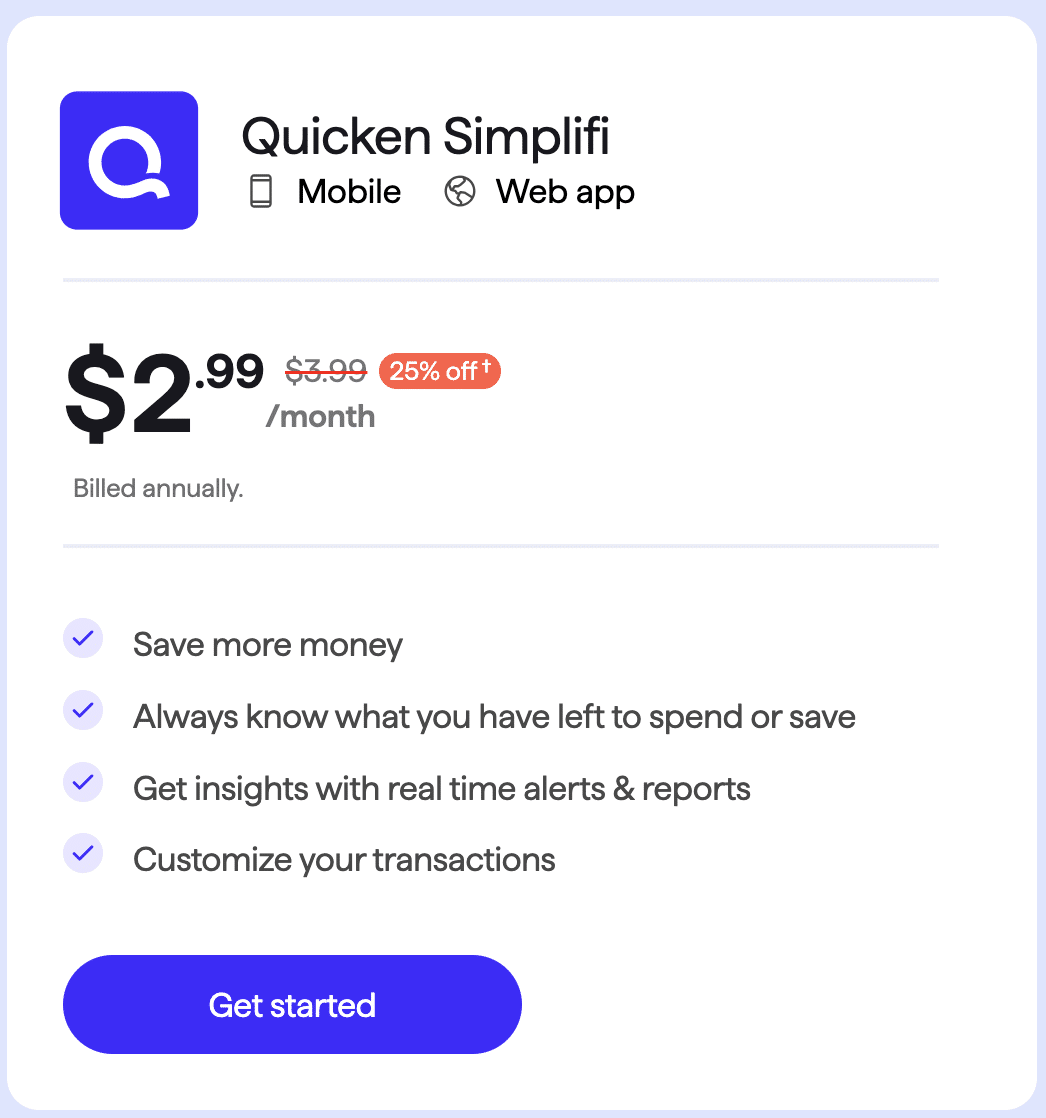

Free Trial: No

Free Version: No

Price: Currently 25% off for $2.99/mo billed annually

Screenshots

Similar Tools

Coming Soon!

I’ve used, tested and evaluated financial tools for more than 15 years. This directory is where I keep track of all of those tools, including software, apps, and calculators. I hope it will prove useful to you. And if you know of an app I should add to this directory, please let me know.

–Rob Berger

P.S. Join more than 20,000 really smart people who receive my free newsletter every Sunday morning.