Acorns is a micro-investing and robo-advisory app designed to help users invest their spare change and grow their wealth over time. Here are the key features and fees of Acorns:

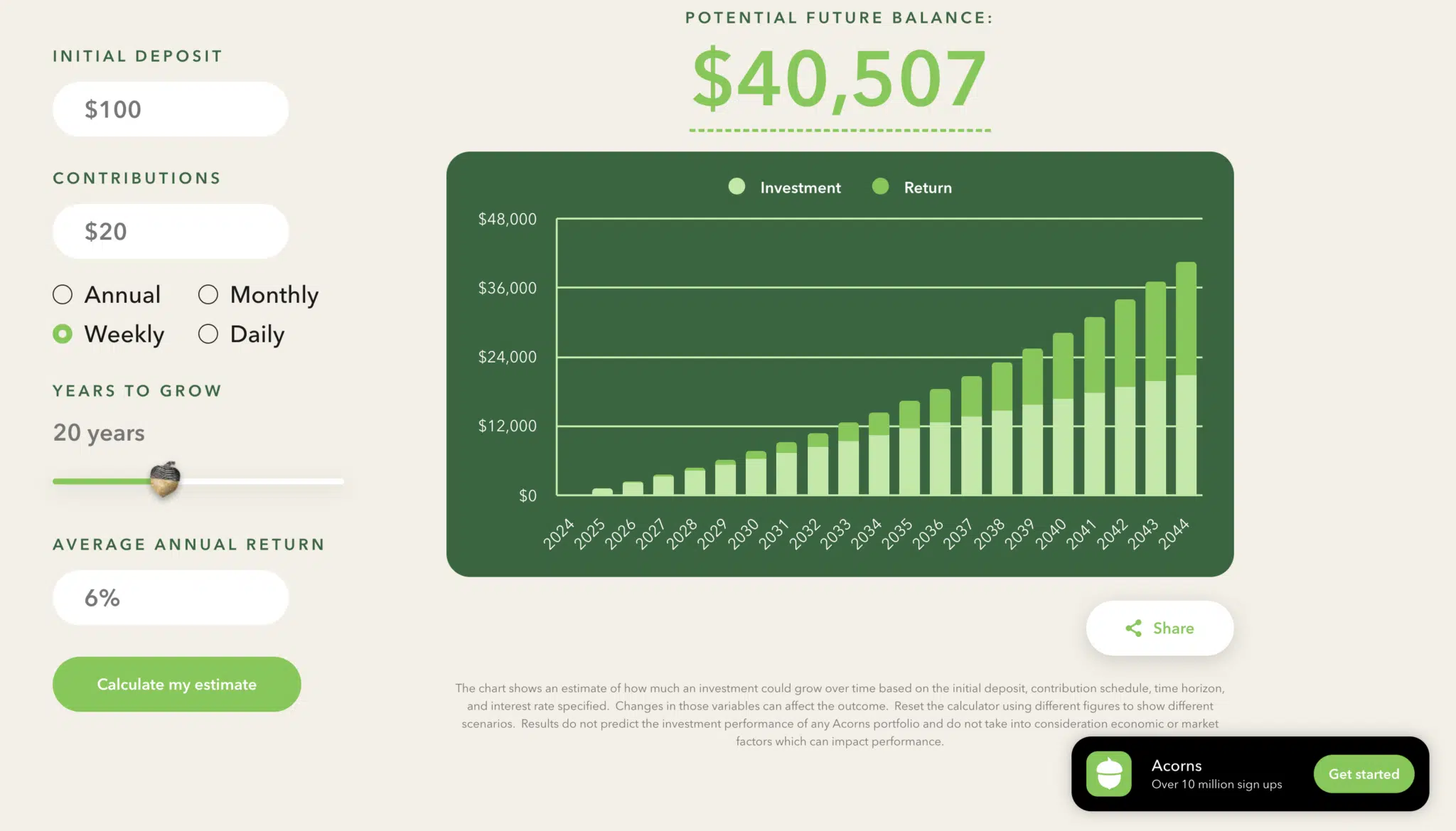

- Acorns Invest: This is a personal investment account that allows users to invest spare change through a feature called Round-Ups®, where purchases are rounded up to the nearest dollar and the difference is invested. Users can also set up Recurring Investments to automatically invest a specific amount regularly. Acorns Invest accounts are invested in diversified portfolios of ETFs, recommended based on the user’s financial goals and risk tolerance.

- Acorns Later: Acorns offers retirement accounts, including IRAs (Individual Retirement Accounts), where users can start with as little as $5. These accounts benefit from potential tax advantages and are also invested in diversified portfolios.

- Acorns Checking: An all-digital checking account that integrates investing directly with everyday spending. It offers features like automatic investment of a portion of every paycheck and no overdraft or minimum balance fees.

- Acorns Early: An investment account for kids, which allows parents to invest for their children’s future. It offers potential tax advantages and the ability to invite friends and family to contribute.

- Emergency Fund: A feature that enables automatic saving of a small piece of every paycheck to prepare for unexpected expenses.

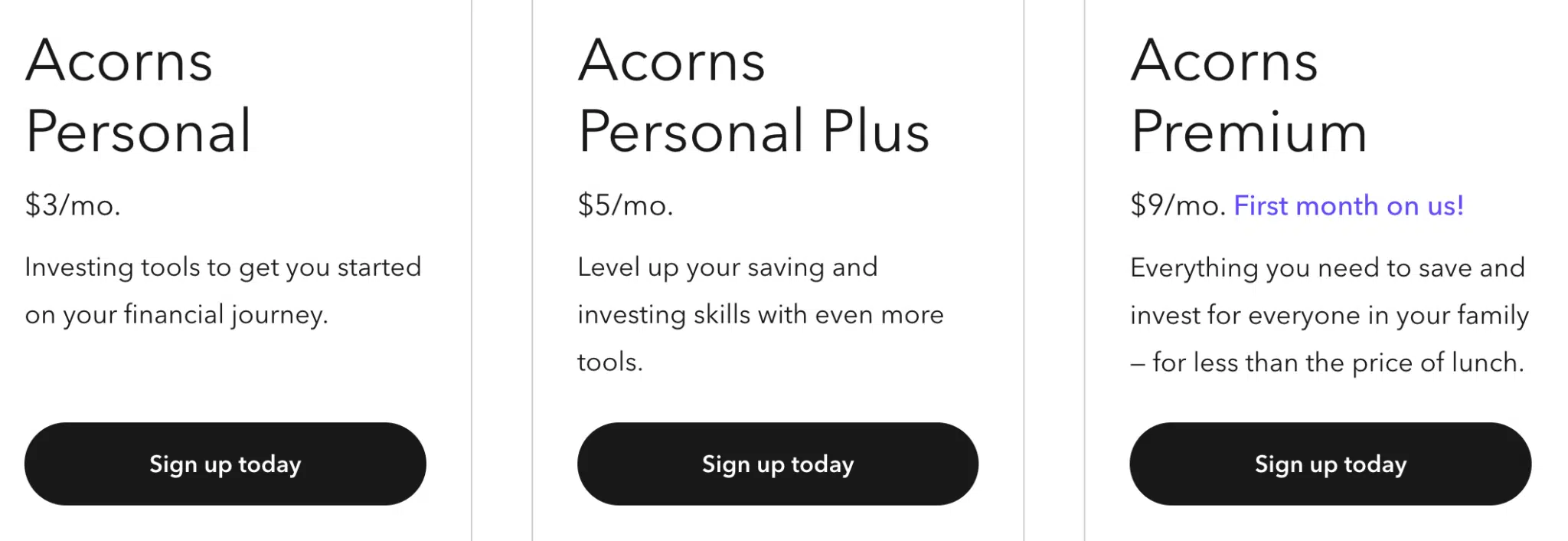

- Subscription Plans: Acorns bundles its products and services into subscription plans, offering different tiers (Acorns Personal, Acorns Personal Plus, and Acorns Premium) that cater to various needs and stages of financial growth.

- Goal Setting

- Investing

- Investment Research

- Savings

Free Trial: Yes- Premium Only

Free Version: No

Price: Personal $3/mo; Personal Plus $5/mo; Premium $9/mo

Screenshots

Similar Tools

Coming Soon!

I’ve used, tested and evaluated financial tools for more than 15 years. This directory is where I keep track of all of those tools, including software, apps, and calculators. I hope it will prove useful to you. And if you know of an app I should add to this directory, please let me know.

–Rob Berger

P.S. Join more than 20,000 really smart people who receive my free newsletter every Sunday morning.