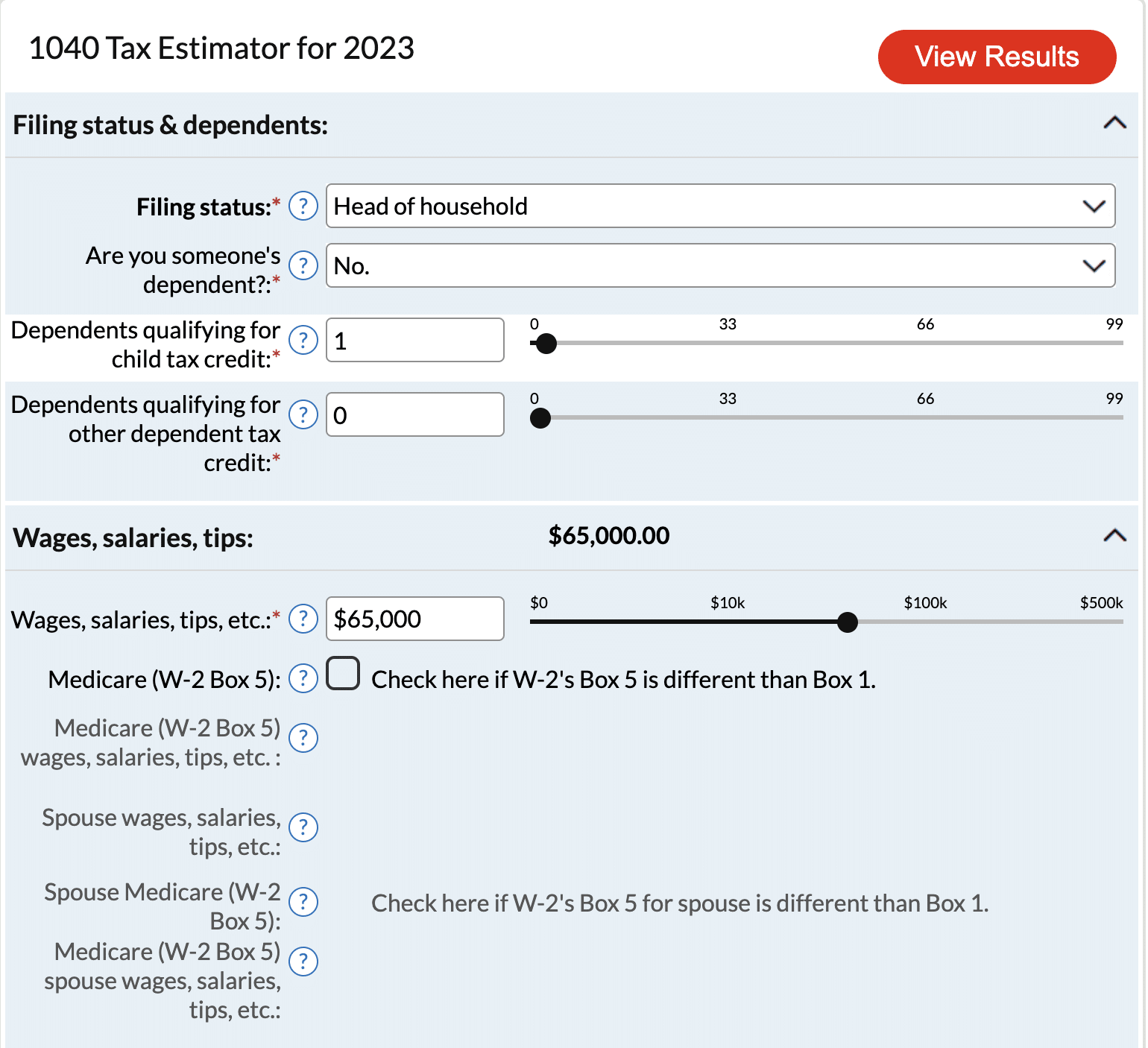

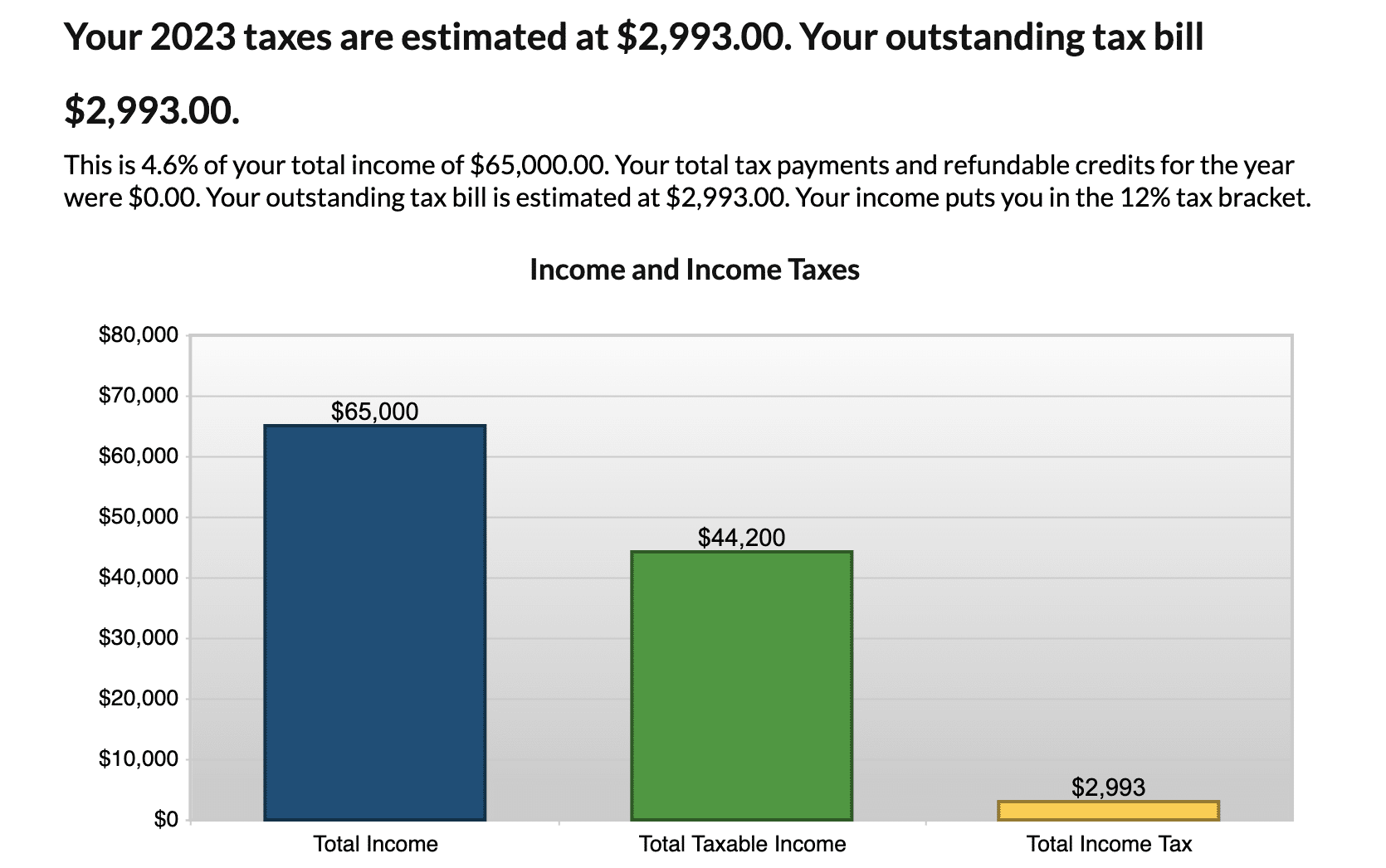

The AARP’s 1040 Tax Calculator is an online tool that helps individuals estimate their federal tax liability for a given tax year. Users can enter their filing status, income, deductions, and credits to calculate their total taxes, as well as their tax refund or the amount they may owe the IRS.

The calculator takes into account various factors such as the standard deduction, itemized deductions, and the graduated nature of the federal tax brackets. The tool is designed to provide an estimate for the tax year 2023, with the next federal income tax filing deadline being April 15, 2024. It also includes information on the standard deduction amounts for single taxpayers and couples filing jointly for the year 2023.

- Tax Analysis

Free Trial: N/A

Free Version: Yes

Price: Free

Screenshots

Similar Tools

Coming Soon!

I’ve used, tested and evaluated financial tools for more than 15 years. This directory is where I keep track of all of those tools, including software, apps, and calculators. I hope it will prove useful to you. And if you know of an app I should add to this directory, please let me know.

–Rob Berger

P.S. Join more than 26,000 really smart people who receive my free newsletter every Sunday morning.