When Nest Eggs Need a Safety Net

Author(s):

Topics:

- Annuities

- |

- Longevity

Year Published: 2023

My Rating: TBD

One Sentence Summary: Retirees of all income levels can increase their retirement spending and protect against longevity risk by buying an income annuity with 30% of their retirement savings

Summary

Blackrock’s study noted two seemingly contradictory findings. First, according to a 2023 Blackrock study (BlackRock, Read on Retirement™, 2023.), only 21% of workers believe they will have enough money to last through retirement. Second, a 2018 Blockrock study (BlackRock, EBRI, “To Spend or Not to Spend,” 2023 (updated from 2018)) found that most retirees had 80% of their pre-retirement savings after two decades of retirement. These results were found across all income levels, leading Blockrock to conclude that it’s a behavioral issue, namely, that retirees don’t like watching a “leaky bank account.”

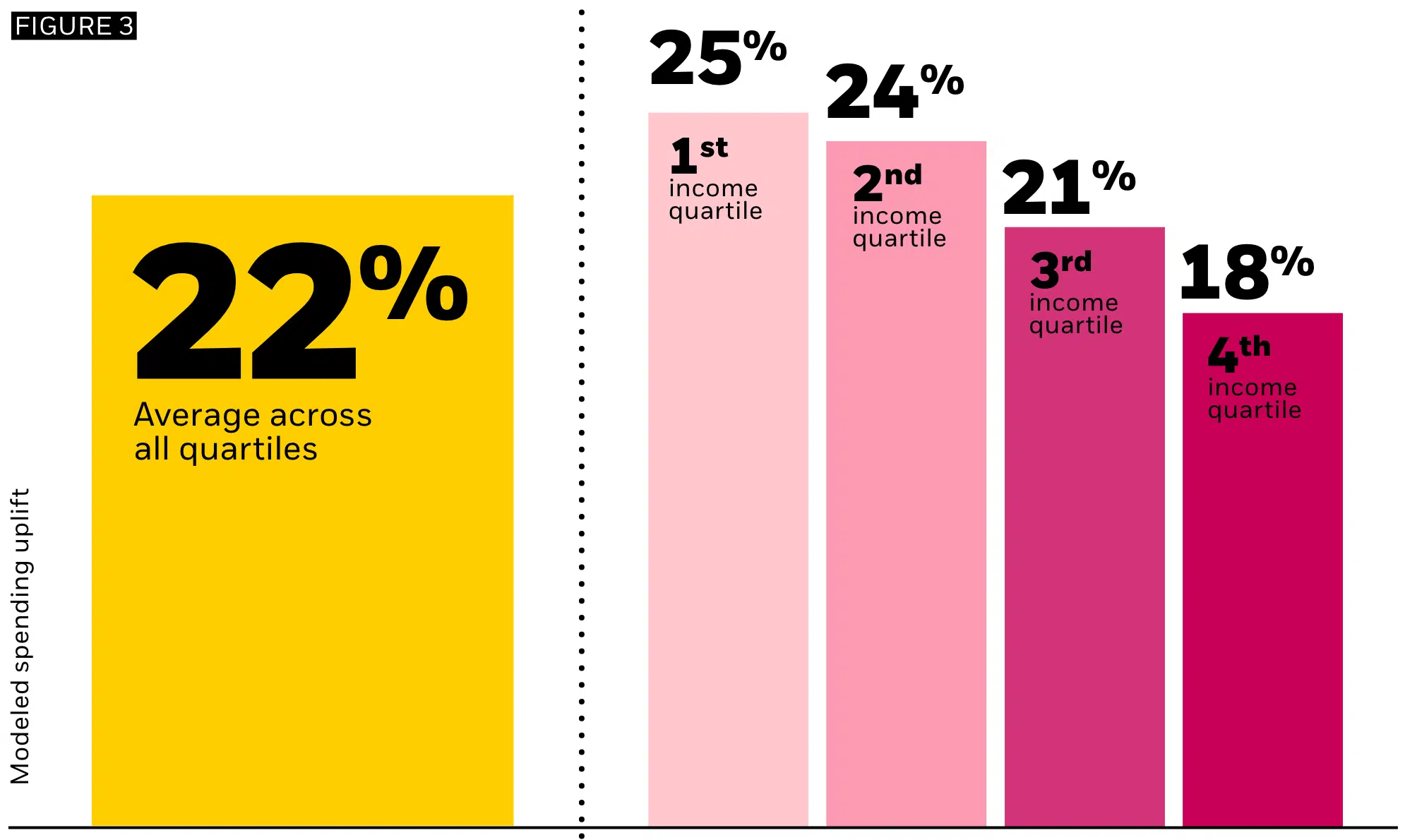

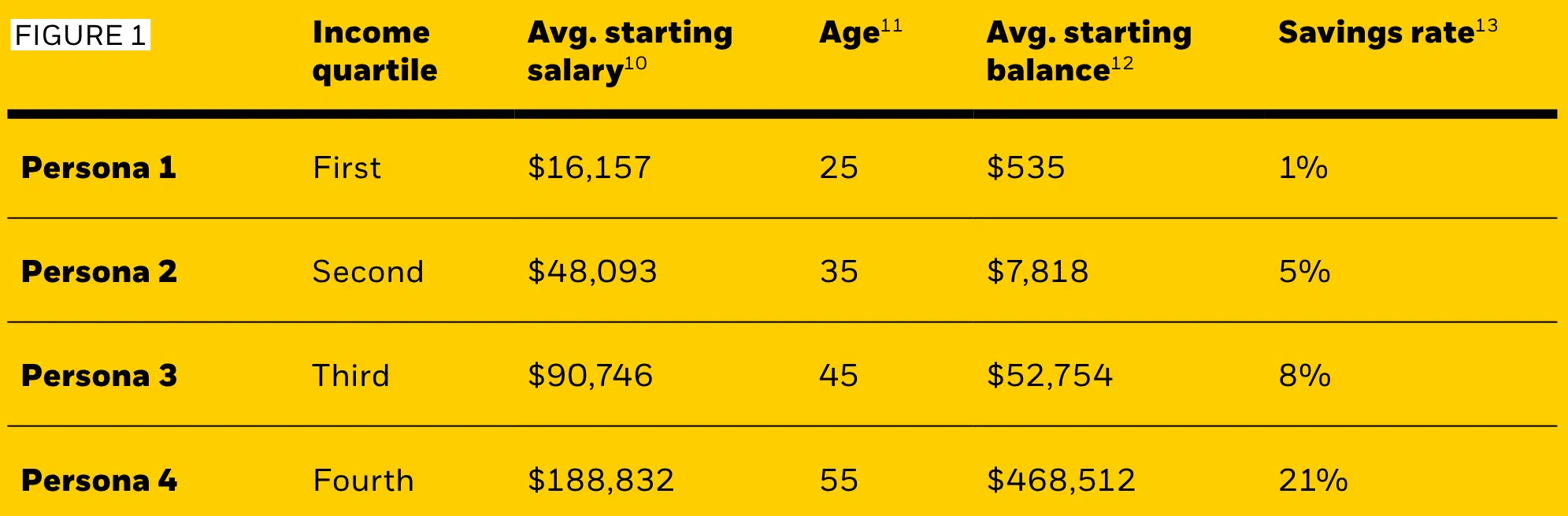

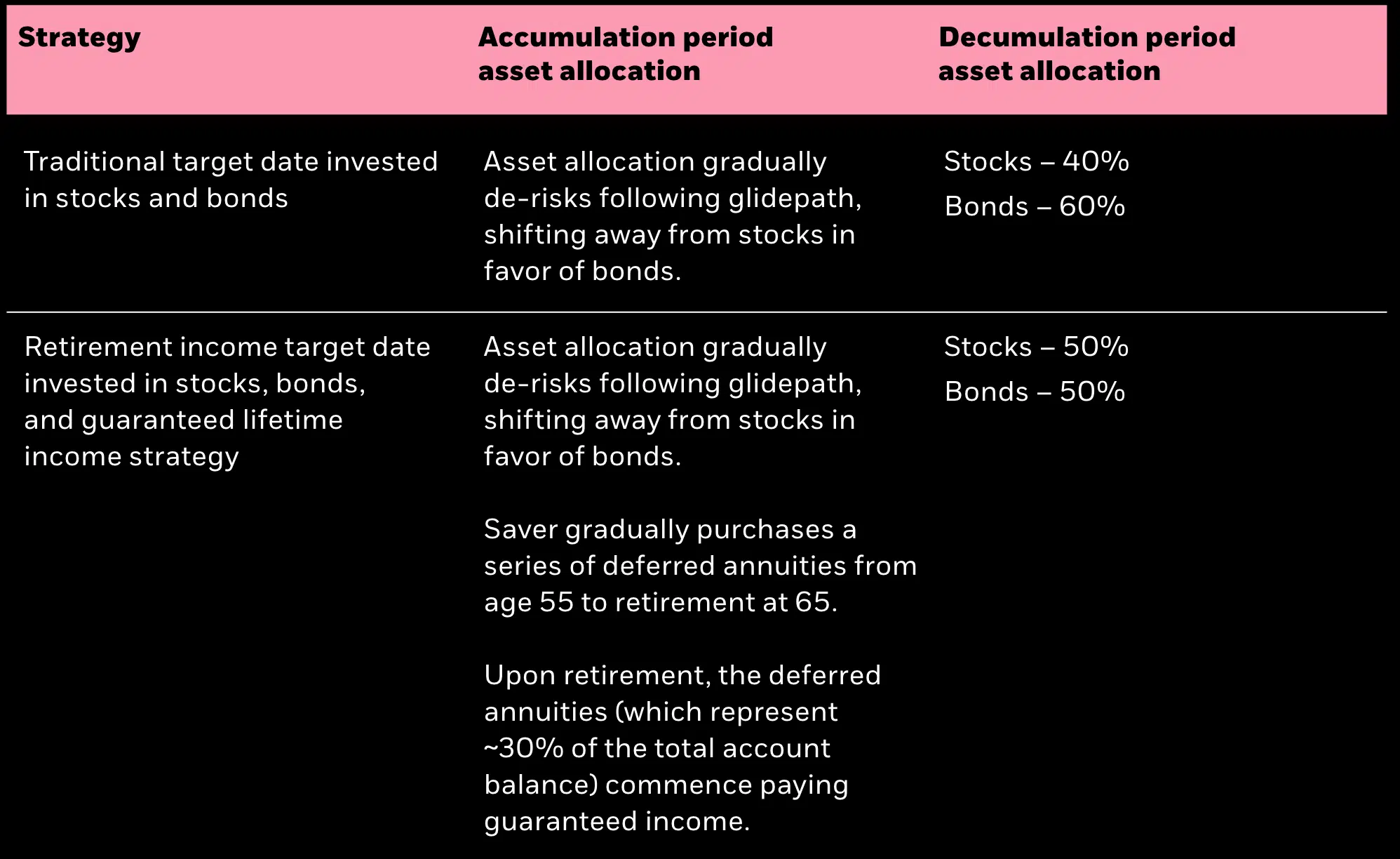

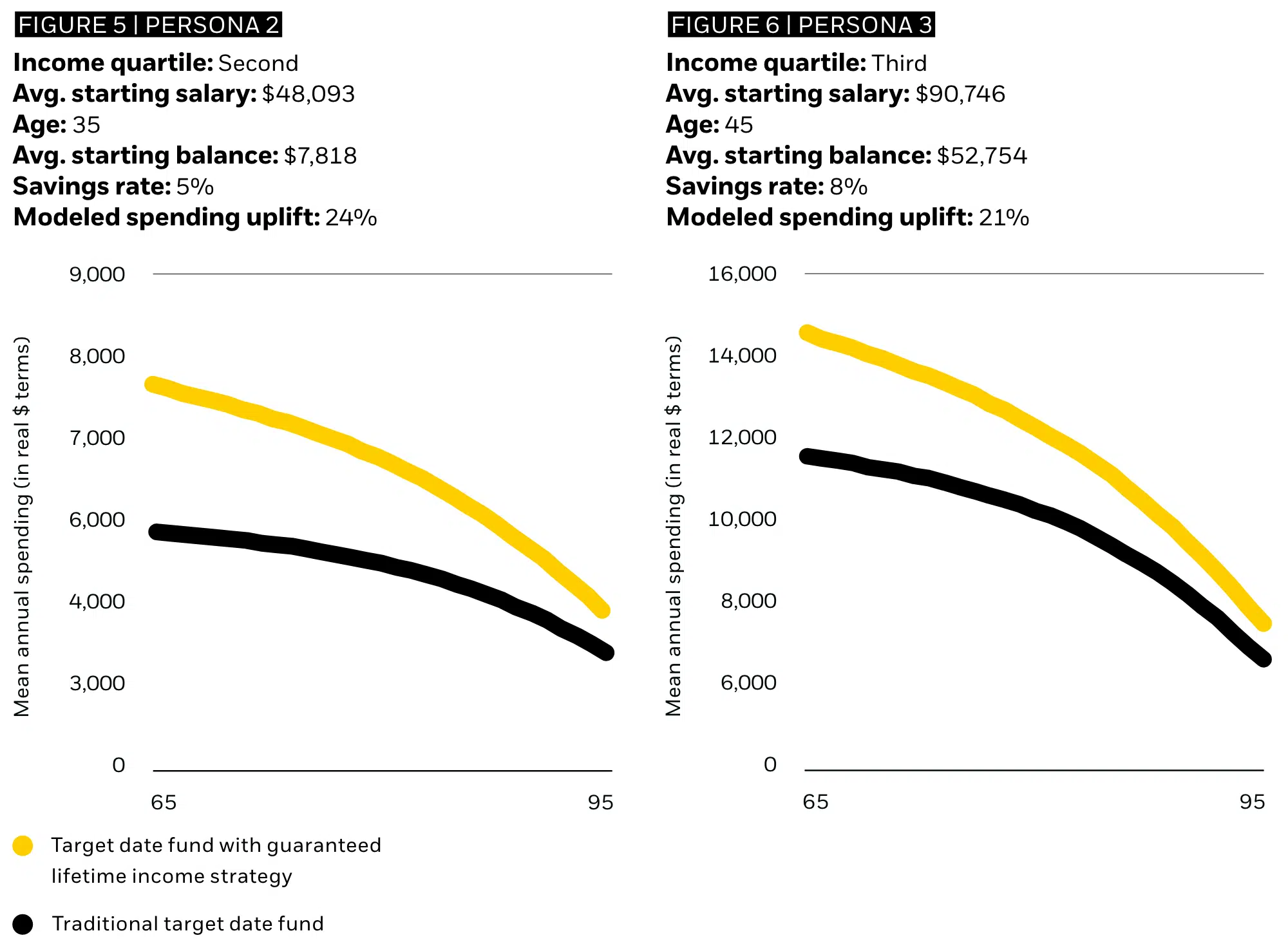

To address this issue, Blackrock ran simulations in which the retiree used 30% of their savings to buy an income annuity, investing the rest in stocks and bonds in a 50/50 portfolio. The results, according to Blackrock, is that the addition of the annuity increased spending across all income levels by an average of 22%.

My Take

The strategy of annuitizing some portion of retirement savings is one that deserves more attention than it receives. As the study notes, retirees (myself included!) do not like watching their savings dwindle. The result is that many underspend during retirement. Annuitizing part of savings can address this fear while providing some protection against the risk of outliving one’s savings.

It is important, however, to understand the assumptions underlying the paper’s findings. For example, the paper assumes a flat 2% inflation rate. As annuities are no longer indexed for inflation, an assumed low inflation rate favors the purchase of an annuity as its spending power erodes more slowly.

The paper also compares the annuity + 50/50 portfolio with one that invests 40% in stocks and 60% in bonds. The rationale is that with an annuity, a retiree may be willing to take on more risk in their investment portfolio. While I believe this is a reasonable assumption, one wonders how the findings would change if compared against a 75/25 portfolio.

Key Quotes

“Our modeling shows that embedding a guaranteed retirement income solution in a target date fund can drive a 22% average increase in potential spending ability across all income levels.” (Blackrock, 2024, p. 3)

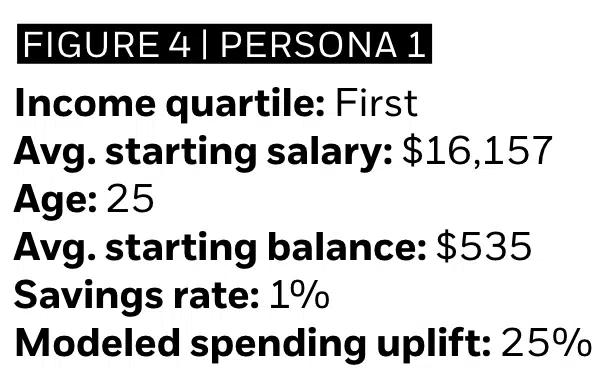

“The increase in potential spending ability from savings is particularly strong among lower-income workers. Our modeling shows that guaranteed retirement income solutions can drive a 25% increase for this group.” (Blackrock, 2024, p. 3)

“Workers in the 25th to 75th income percentiles represent a significant portion of 401(k) savers.8 Looking across this analysis and our annual survey of retirement savers, we find that this group derives outsized value from increased potential spending certainty and reduced longevity risk.” (Blackrock, 2024, p. 3)

“While higher-income earners are typically able to self-insure, we still find that guaranteed retirement income solutions can increase their potential spending ability by 18% – which, we believe, can strengthen their overall income optimization strategy.” (Blackrock, 2024, p. 3)

“We believe a target allocation of 30% to a guaranteed income option provides income certainty, while the remaining 70% invested in stocks (50%) and bonds (50%) delivers participants flexibility, opportunity for growth, and inflation protection. In our view, the presence of annuity income gives investors capacity to take on additional equity risk (hence the comparison to the 40/60 scenario).” (Blackrock, 2024, p. 6)