What If You Invested at the Peak Right Before the 2008 Crisis

Author(s): Ben Carlson, CFA

Topics:

- Investing

- |

- Market History

Year Published: 2024

My Rating: ⭐️⭐️⭐️⭐️

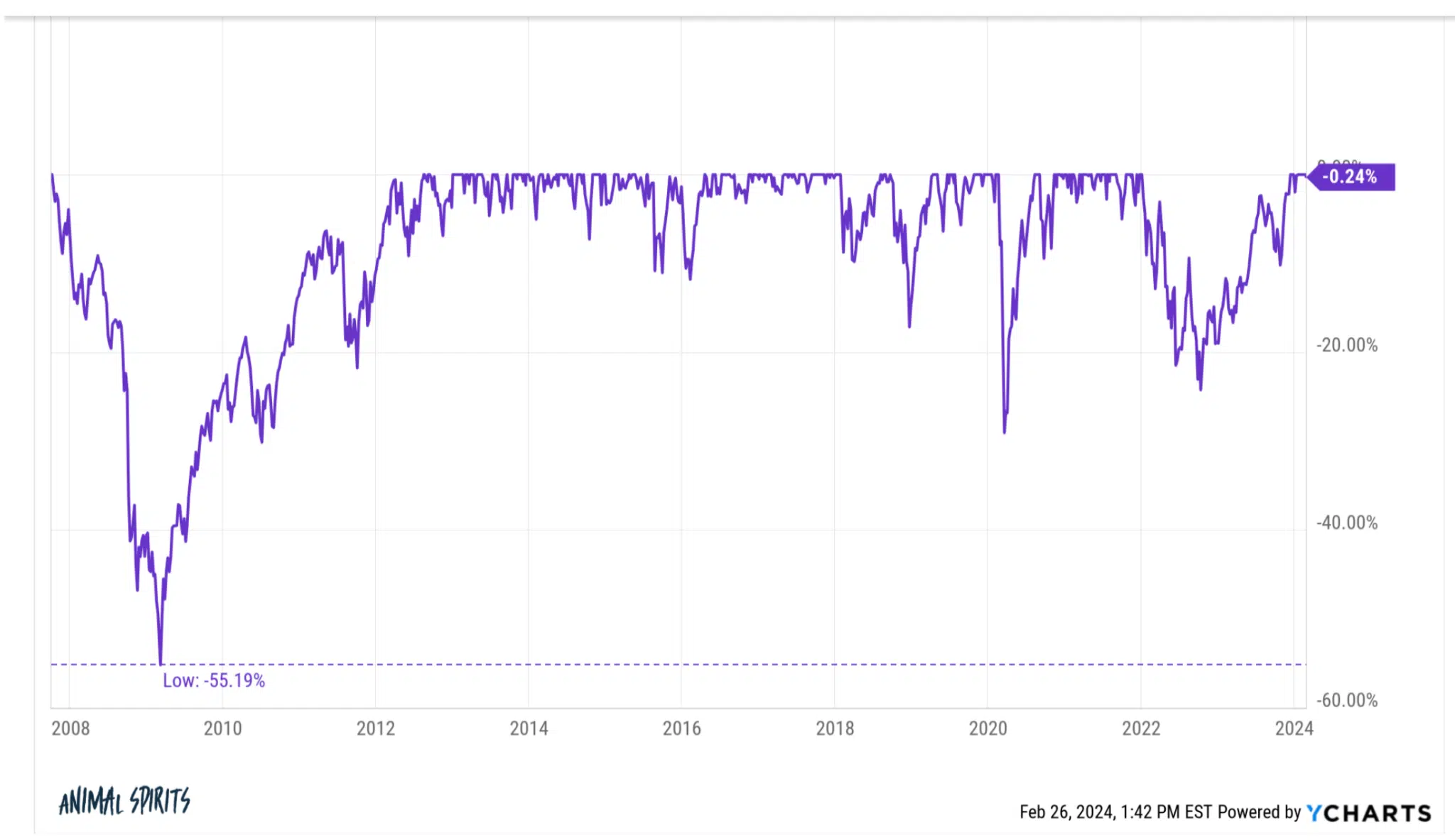

One Sentence Summary: If you had invested at the market peak just before the 2008 financial crash, you still would have earned a 9.5% annual return through March 2024, suggesting that we shouldn’t obsess over valuations as long-term, buy-and-hold investors.

Summary

Even if an investor is “unlucky” enough to invest at a market peak, they still get reasonable returns over the long run. Specifically, the author found that an investment at the market peak before the 2008 financial crisis still delivered a 345% return through March 2024 (9.5% annual return). This idea is relevant to Lump Sum vs Dollar Cost Averaging and whether one should set Asset Allocation Based on Valuations.

The article also notes that sometimes we hit a dozen or more market highs in one year. At other times, like from 2009 to 2013, it took 5 years or more before we hit a market high.

Key Quotes

“Your money got cut in half and then some from 2007-2009. You also would have lost more than 19% in the 2018 correction, 34% during the Covid crash and 25% in the 2022 inflation bear market. If you had the unfortunate timing of top-ticking the stock market right before it got cut in half and then some, your returns would still look pretty good over the long-haul.”

“From the market peak just before the financial crisis ripped your face off, the S&P 500 is up just shy of 350% in total. That’s good enough for annual returns of 9.5% per year, which is essentially the long-term average over the past 100 years.”