Tax-Efficient Withdrawal Strategies

Author(s): William Reichenstein, CFA, William Meyer, Kirsten A. Cook

Topics:

- Taxes

- |

- Withdrawal Order

Year Published: 2015

My Rating: ⭐️⭐️⭐️

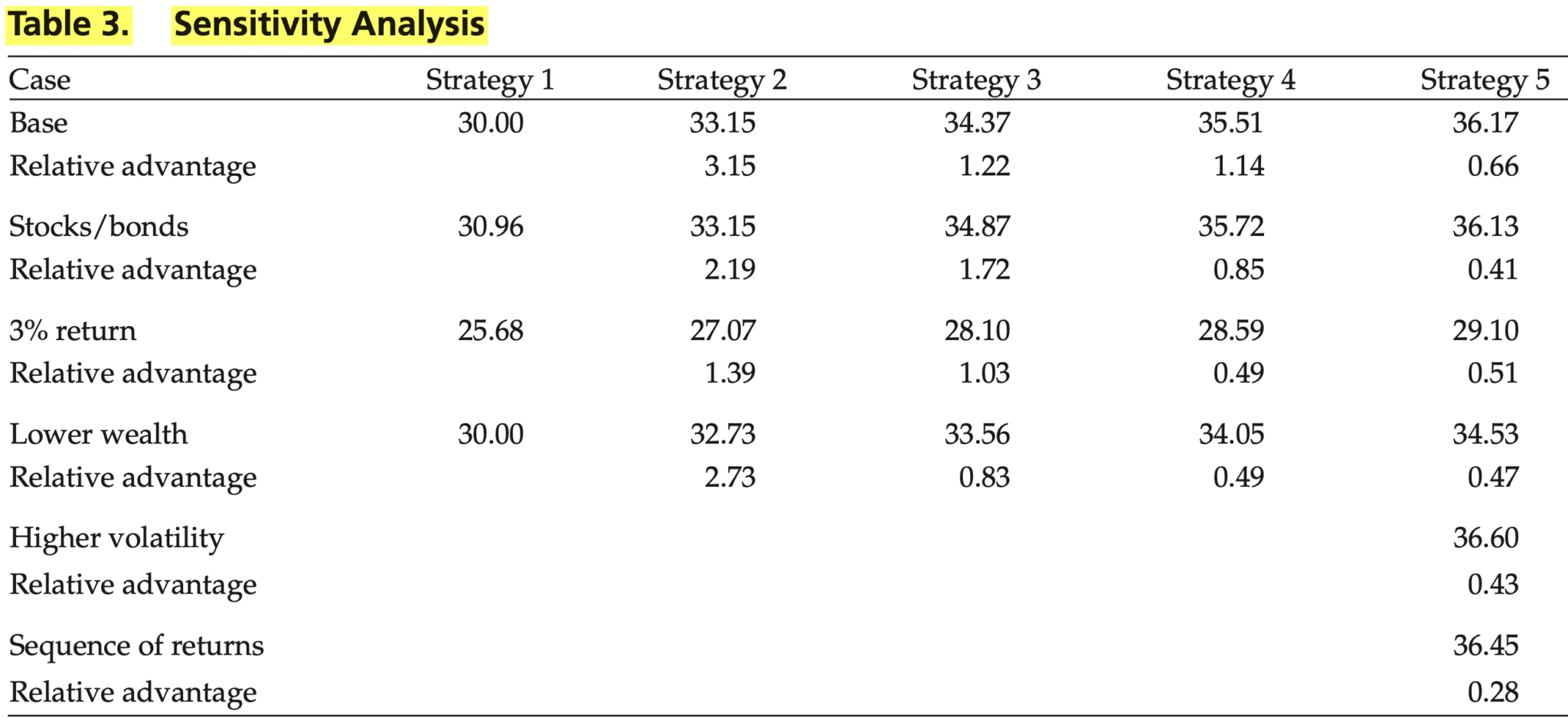

One Sentence Summary: Using traditional retirement account funds, either through distributions or conversions, can take advantage of relatively low marginal tax rates, thereby expended the life of a retirement portfolio by more than three years.

Summary

Tax-efficient withdrawals from financial portfolios aim to minimize the government’s share of taxable deferred accounts (TDAs). Strategies involve withdrawing funds from TDAs when taxed at low marginal rates and then withdrawing from taxable accounts until exhausted. This allows the investor to extend the longevity of their financial portfolio. A second strategy utilizes Roth conversions to further extend portfolio longevity.

Note that the paper discusses a strategy that uses Roth IRA conversion recharacterizations, which are no longer permitted.