Tax-Efficient Withdrawal Strategies (Schwab)

Author(s): Eric Tarkin, Hayden Adams, CFA, Rob Williams, CFP

Topics:

- Withdrawal Order

Year Published: 2022

My Rating: ⭐️⭐️⭐️⭐️

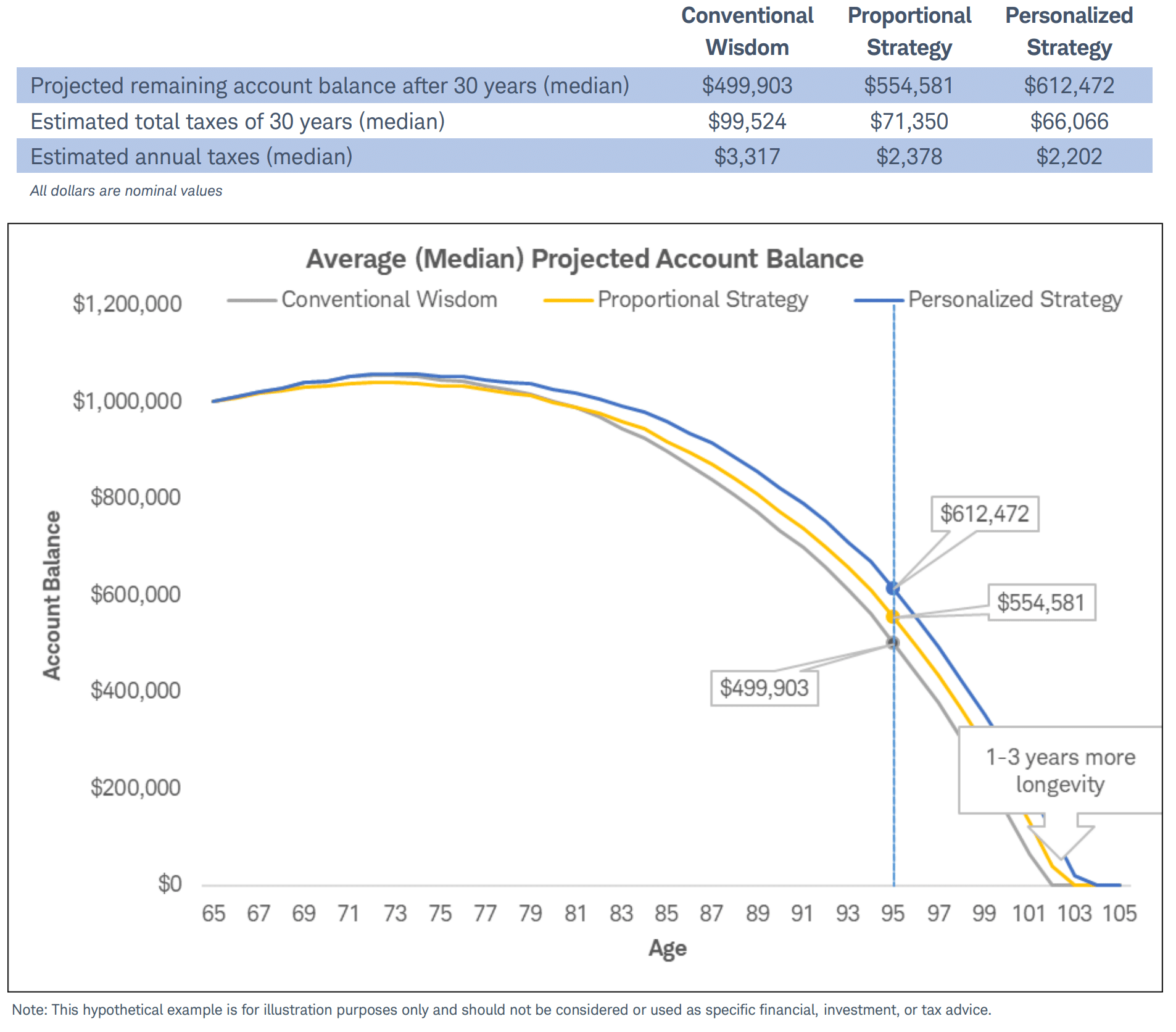

One Sentence Summary: Both a proportional withdraw strategy and a tax bracket targeted strategy reduce taxes and increase portfolio longevity over the traditional approach of spending taxable asset first, then traditional, and finally Roth in retirement.

Summary

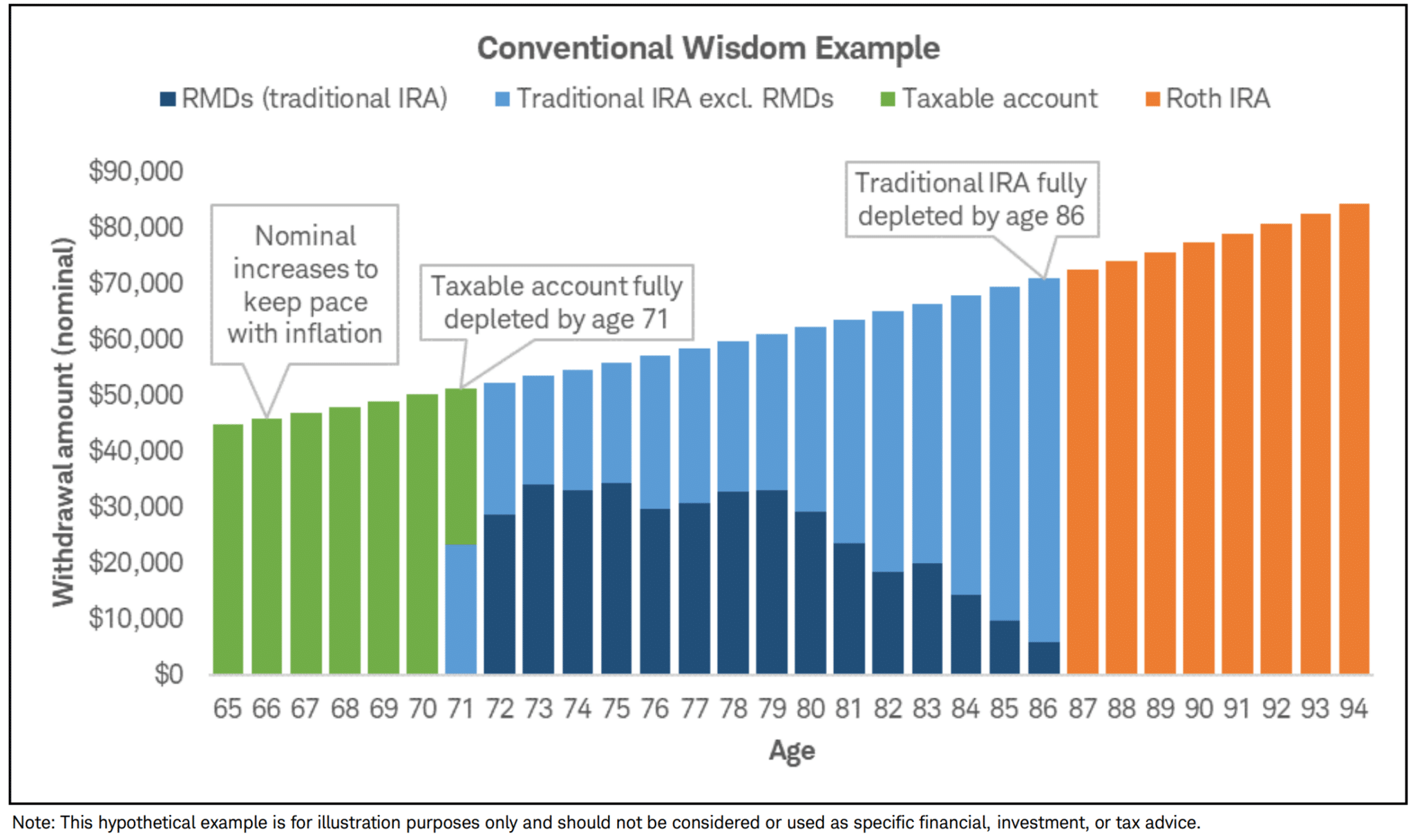

The traditional approach to spending down assets in retirement is to draw first from taxable accounts, then traditional accounts, and finally Roth accounts. For many retirees, this approach increases their tax liability and decreases the longevity of their portfolio. In this article, Schwab describes two alternative approaches, both of which lead to better results.

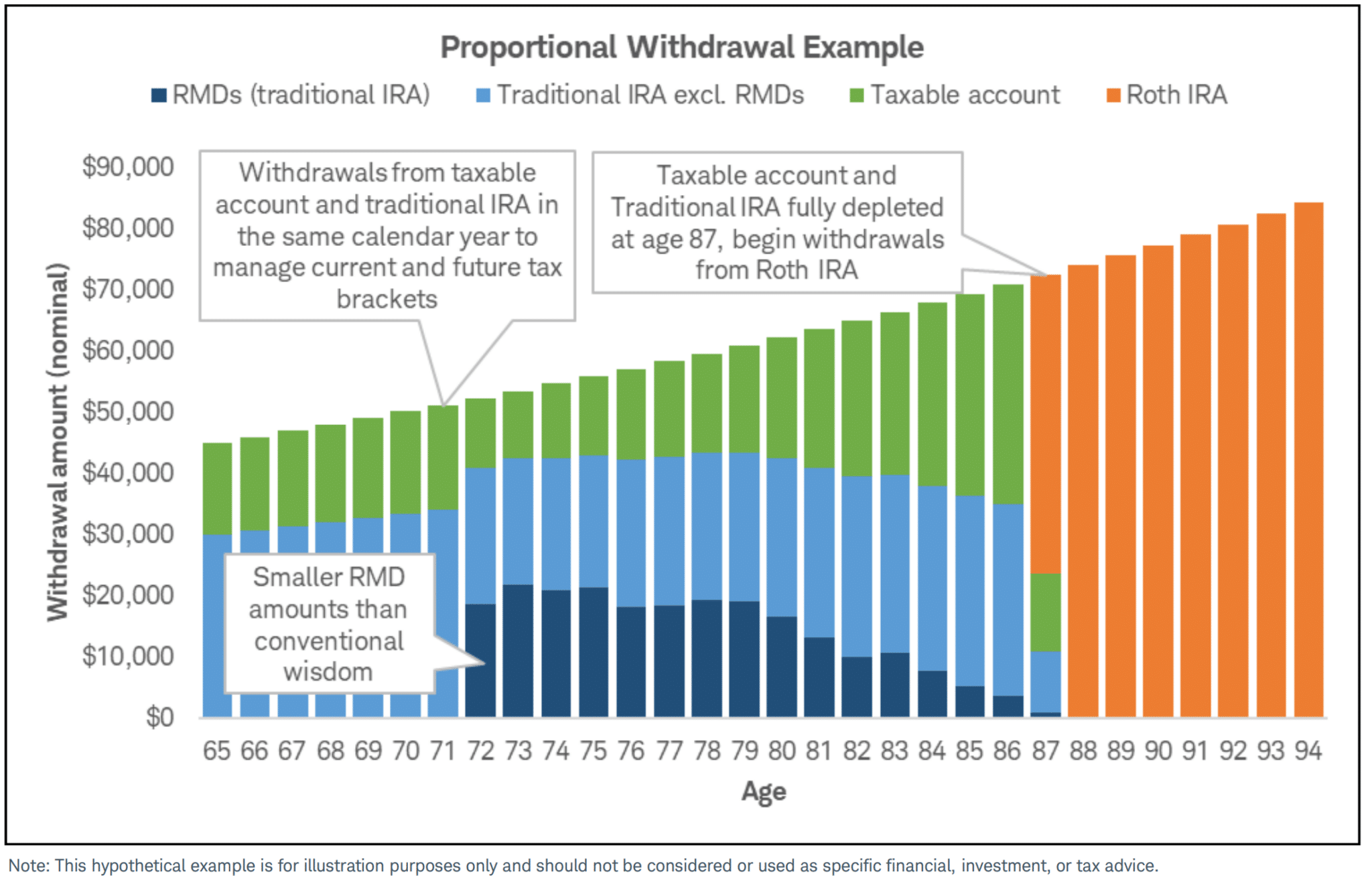

The first is what Schwab calls the Proportional Withdrawal Strategy. This strategy has retirees spend down taxable and traditional retirement accounts in amounts proportional to their balances. Once depleted, the retiree spends down Roth accounts.

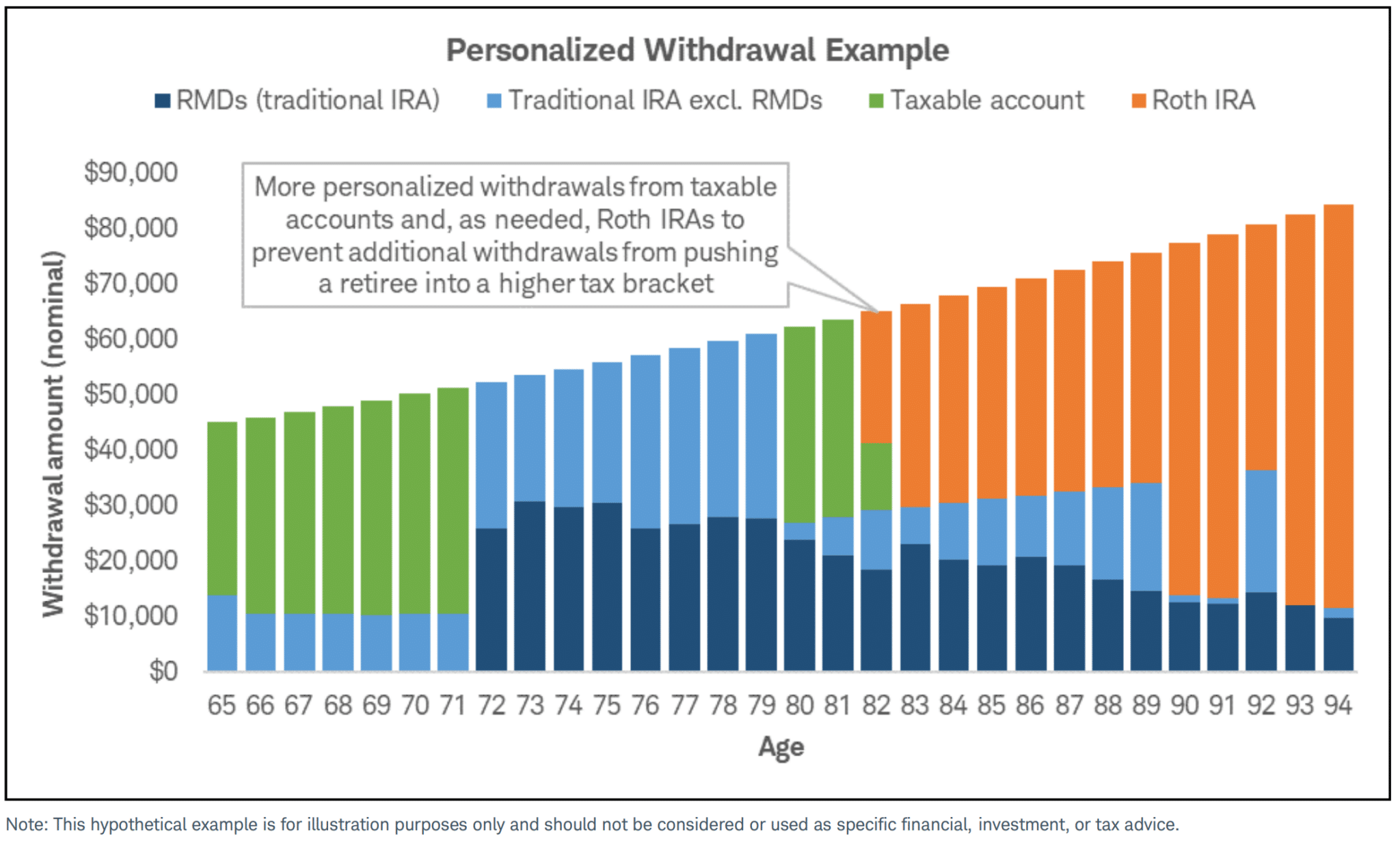

The second is what Schwab calls the Personalized Withdrawal Strategy. This strategy draws down accounts in a way that places them in a tax bracket that will smooth their taxes over their retirement.

Schwab concludes that both of these strategies yield lower taxes and longer portfolio longevity as compared to the traditional approach.

Key Quotes

“A consequence of a large or growing balance in a tax-deferred account, such as a traditional IRA, is the possibility that future RMDs will trigger a higher tax bill than the investor would have experienced had they taken distributions from that IRA earlier than RMD age (currently age 72) and smoothed out taxes over time.”

“Schwab and the Schwab Center for Financial Research (SCFR) recommend that retirees younger than age 72 consider tapping traditional IRAs and 401(k)s early in retirement to manage their current and future tax bracket using a multi-year strategy.”