Tax-Efficient Spending Strategies From Retirement Portfolios

Author(s): Michael Kitces

Topics:

- Capital Gains

- |

- Roth Conversions

- |

- Withdrawal Order

Year Published: 2016

My Rating: ⭐️⭐️⭐️⭐️

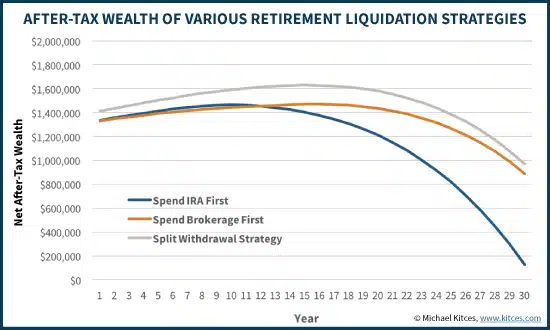

One Sentence Summary: A tax-efficient liquidation strategy is to tap IRA accounts earlier rather than later, but not so much that the tax bracket is driven up too much now, but enough to reduce exposure to higher tax brackets in the future.

Summary

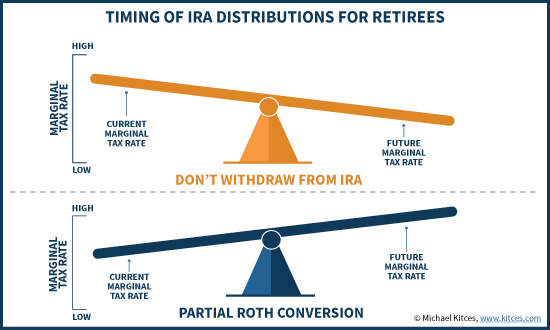

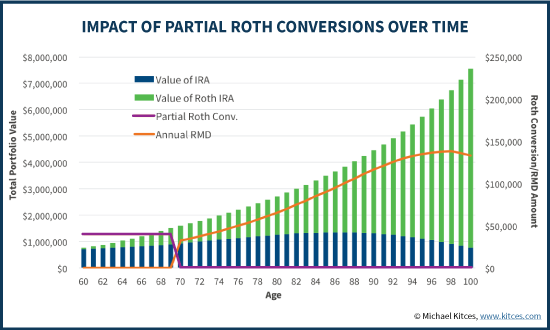

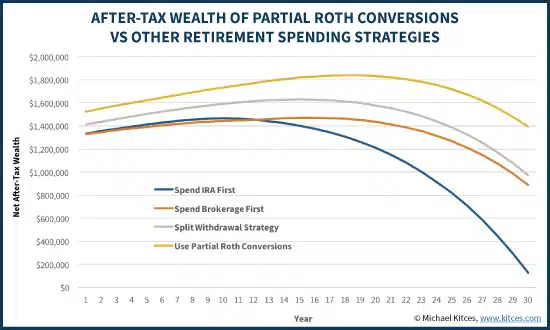

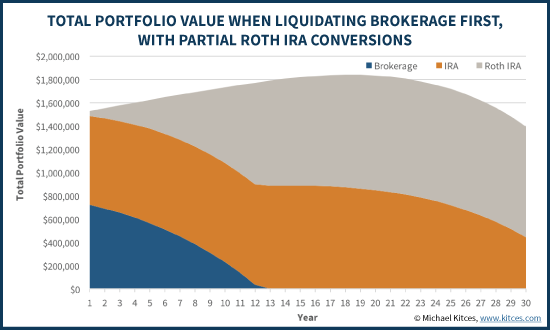

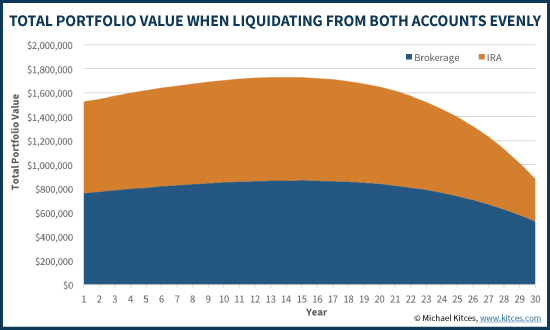

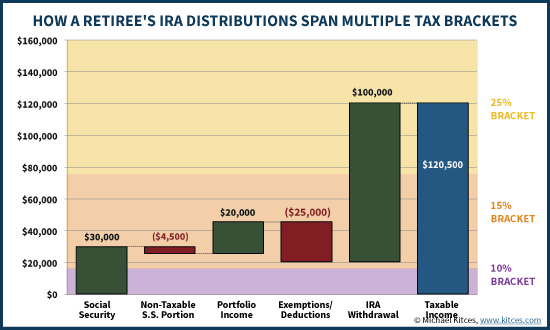

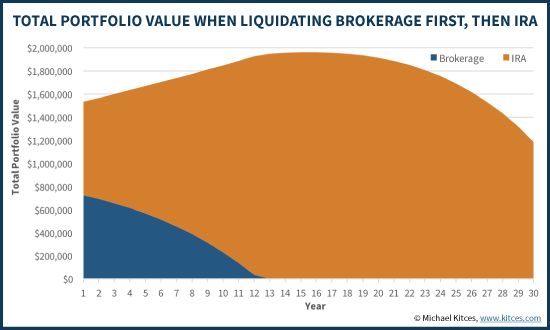

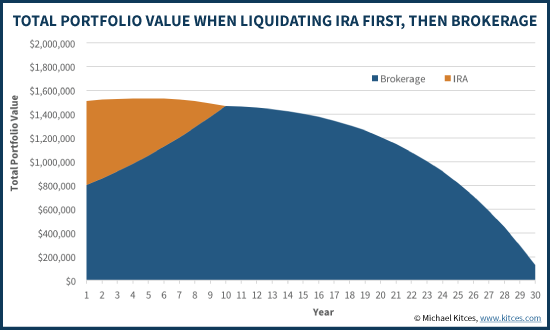

The rule of thumb for tax-efficient withdrawals in retirement is to spend down accounts in the following order: 1. taxable accounts, 2. traditional retirement accounts, and finally, 3. Roth retirement accounts. The problem with this approach is that it may push retirees into higher tax brackets when either they need to start spending traditional retirement accounts or, thanks to RMDs, they are forced to draw down those accounts. As a result, the most tax-efficient withdrawal strategy may involve depleting taxable investments first while at the same time undertaking annual Roth IRA conversions in amounts designed to avoid entering higher tax brackets at any time during retirement. This strategy still spends the less tax efficient investments first (taxable accounts thanks to taxable interest and dividends), allowing tax-advantaged accounts to grow for longer periods of time.

Key Quotes

“Given that taking full distributions from the IRA up front can drive the couple into higher tax brackets, and taking full distributions from the IRA in the later years will also drive the couple into higher tax brackets, the solution is actually remarkably simple: to take distributions from each account along the way.”

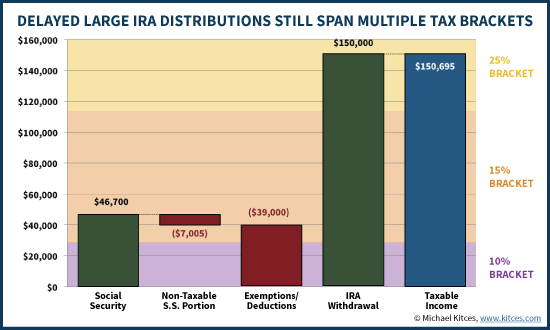

“While the strategy of taking partial distributions from an IRA earlier rather than later can be an effective means to enhance the longevity of the portfolio by reducing the average tax rate paid on the IRA, the one caveat to the strategy is that it still depletes a tax-preferenced account earlier than may have been necessary. In other words, the strategy faces a fundamental tension between the desire to take withdrawals earlier (to avoid “wasting” unused low tax brackets in the early years) versus the desire to benefit from tax-deferred compounding growth (by leaving the money in the IRA to compound tax-efficiently over time).

The resolution to this dilemma is to recognize that it’s possible to “fill up” the lower tax brackets in the early years from the IRA, without actually liquidating the tax-preferenced account. The solution is to engage in systematic partial Roth conversions in the early years, moving the dollars from the IRA to a Roth IRA, and generating the taxable income that fills the 15% tax bracket in the early years.”