Reality Retirement Planning: A New Paradigm for an Old Science

Author(s): Ty Bernicke, CFP

Topics:

- Retirement Spending

- |

- Withdrawal Strategies

Year Published: 2005

My Rating: ⭐️⭐️⭐️⭐️

One Sentence Summary: Retirement withdraw plans should reflect a real (after-inflation) decline in spending, which enables an early retirement and spending more during one’s “go-go” years of retirement.

Summary

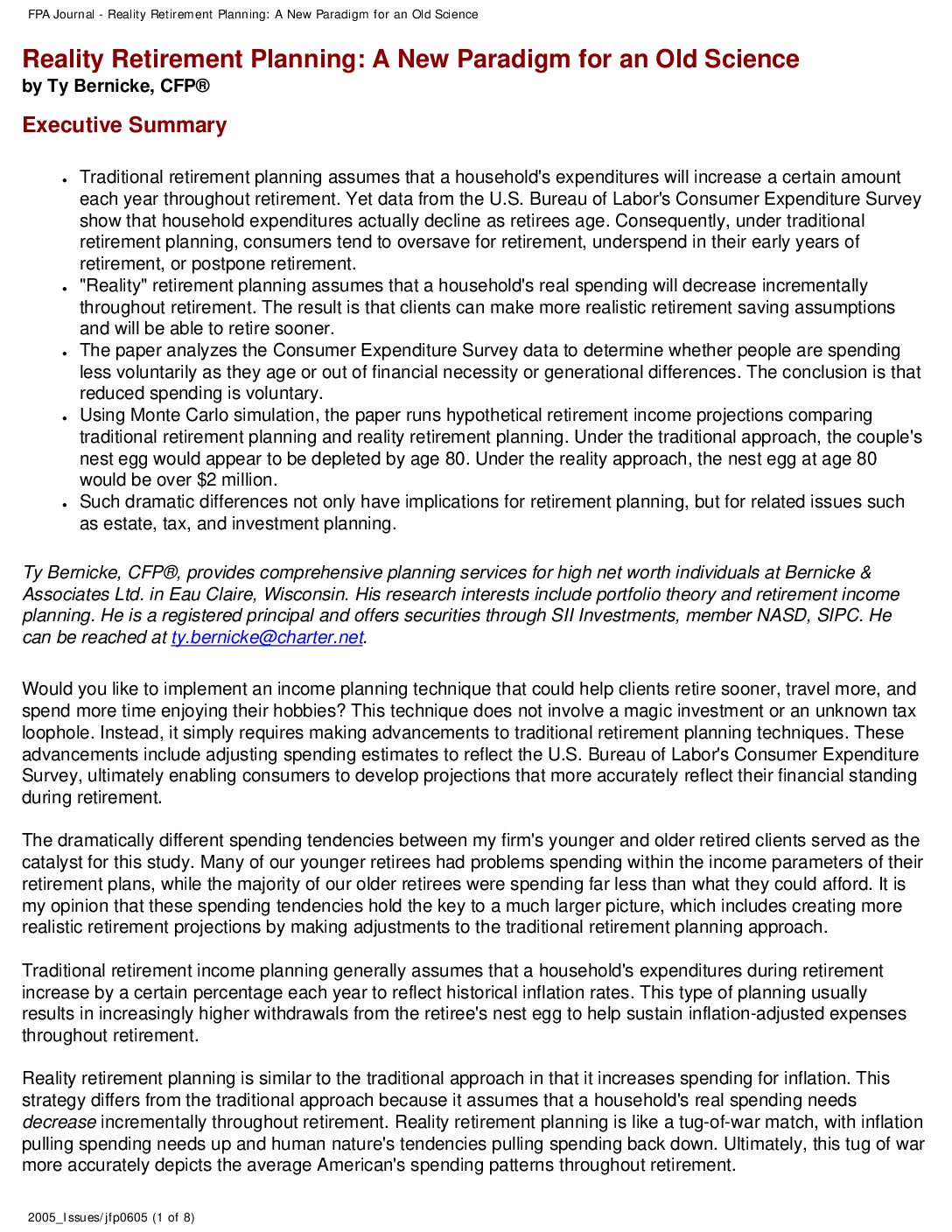

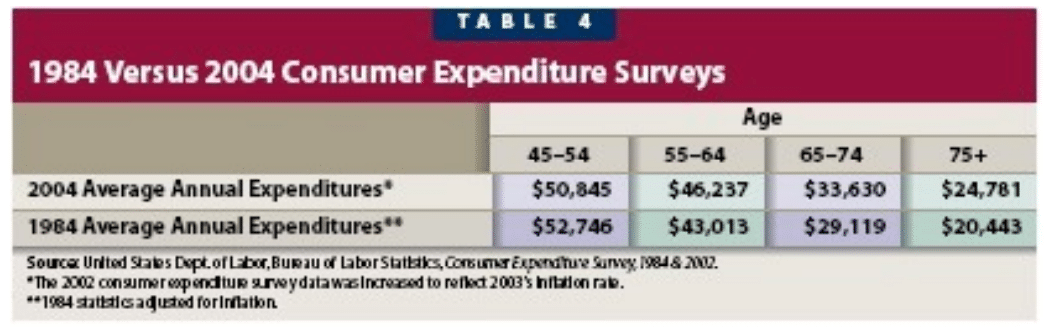

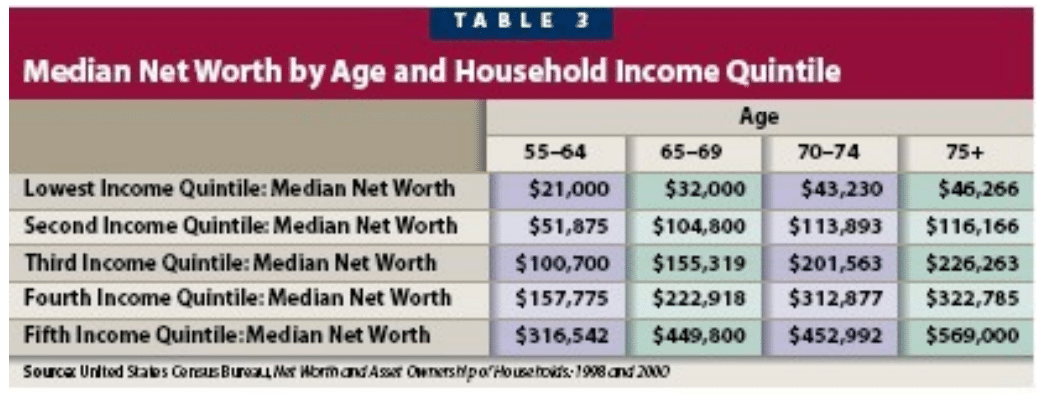

The article discusses a new approach to retirement planning that involves decreasing spending needs annually to better reflect how retirees spend money. This method is contrary to the assumptions underpinning the 4% rule and aims to enhance retirees’ quality of life during early retirement years. It proposes reducing spending by varying amounts ranging from about 3 to 4% annually from age 55 (the article assumes early retirement) to 75, and then adjusting spending by inflation from 75 to 85 to reflect the increased cost of healthcare. The article assumes an age 85 end of plan.

While the idea that retirees reduce spending through retirement is well-documented, the paper’s assumption of a 3 to 4% annual reduction may be too aggressive.

Key Quotes

“Traditional retirement planning assumes that a household’s expenditures will increase a certain amount each year throughout retirement. Yet data from the U.S. Bureau of Labor’s Consumer Expenditure Survey show that household expenditures actually decline as retirees age. Consequently, under traditional retirement planning, consumers tend to oversave for retirement, underspend in their early years of retirement, or postpone retirement.”

“Reality” retirement planning assumes that a household’s real spending will decrease incrementally throughout retirement. The result is that clients can make more realistic retirement saving assumptions and will be able to retire sooner.”