Optimal Withdrawal Strategies for Retirees with Multiple Savings Accounts

Author(s): Stephen M. Horan, Ph.D., CFA

Topics:

- Withdrawal Order

Year Published: 2006

My Rating: ⭐️⭐️⭐️

One Sentence Summary: A withdrawal strategy that distributes funds from tax-deferred retirement accounts up to the 15% tax bracket, and then from Roth IRA accounts, results in the highest residual balances for retirees with little or no taxable portfolios.

Summary

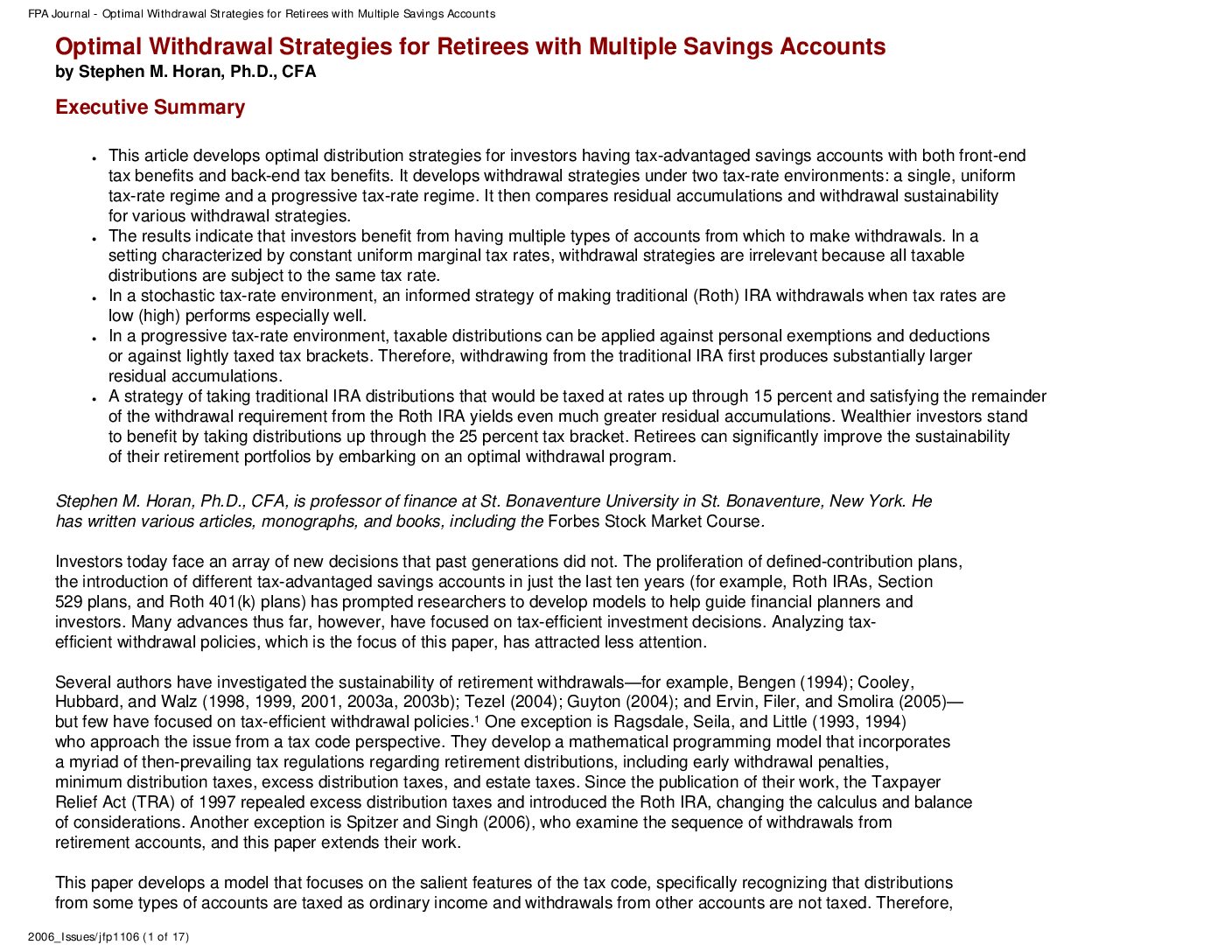

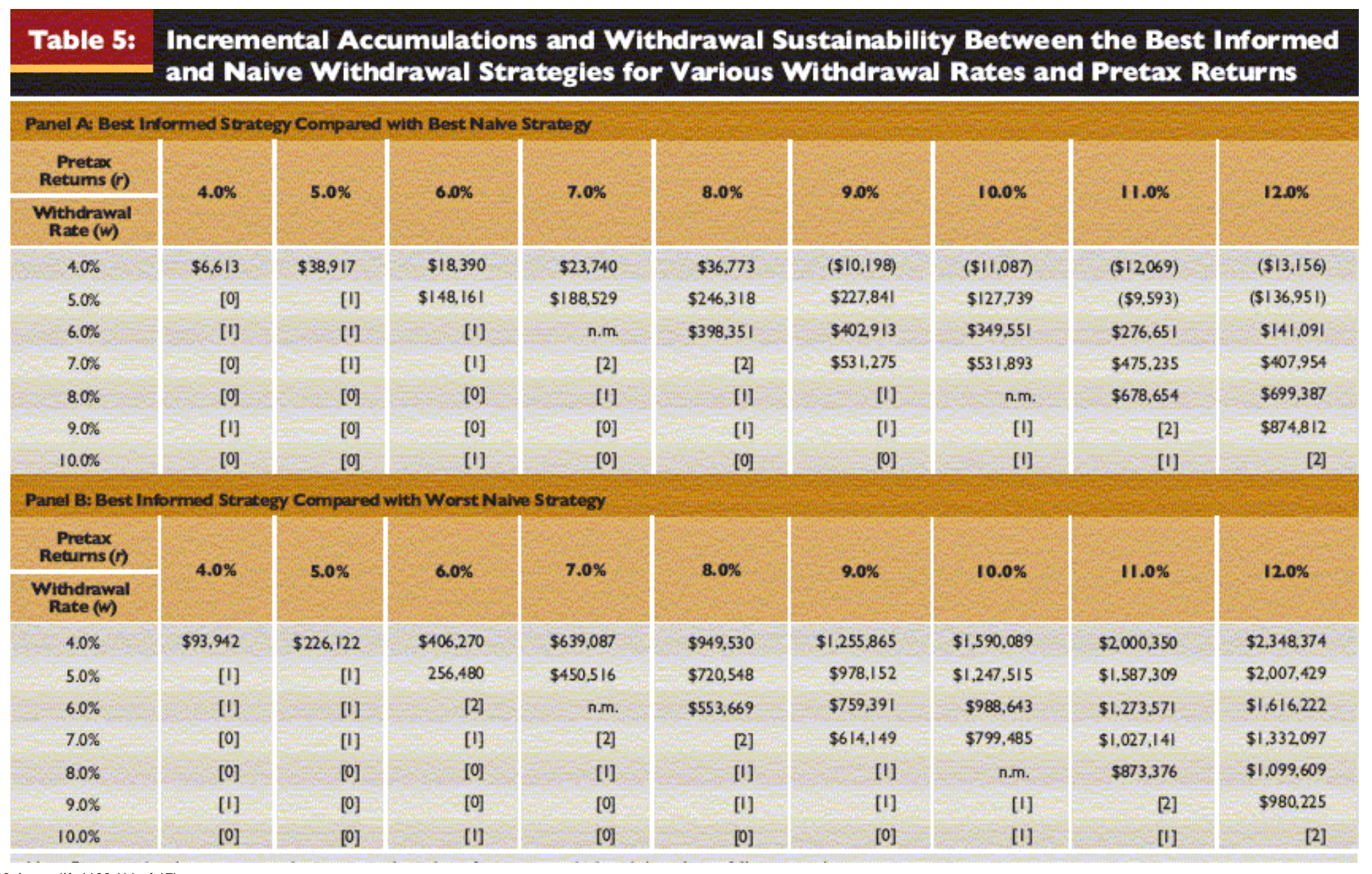

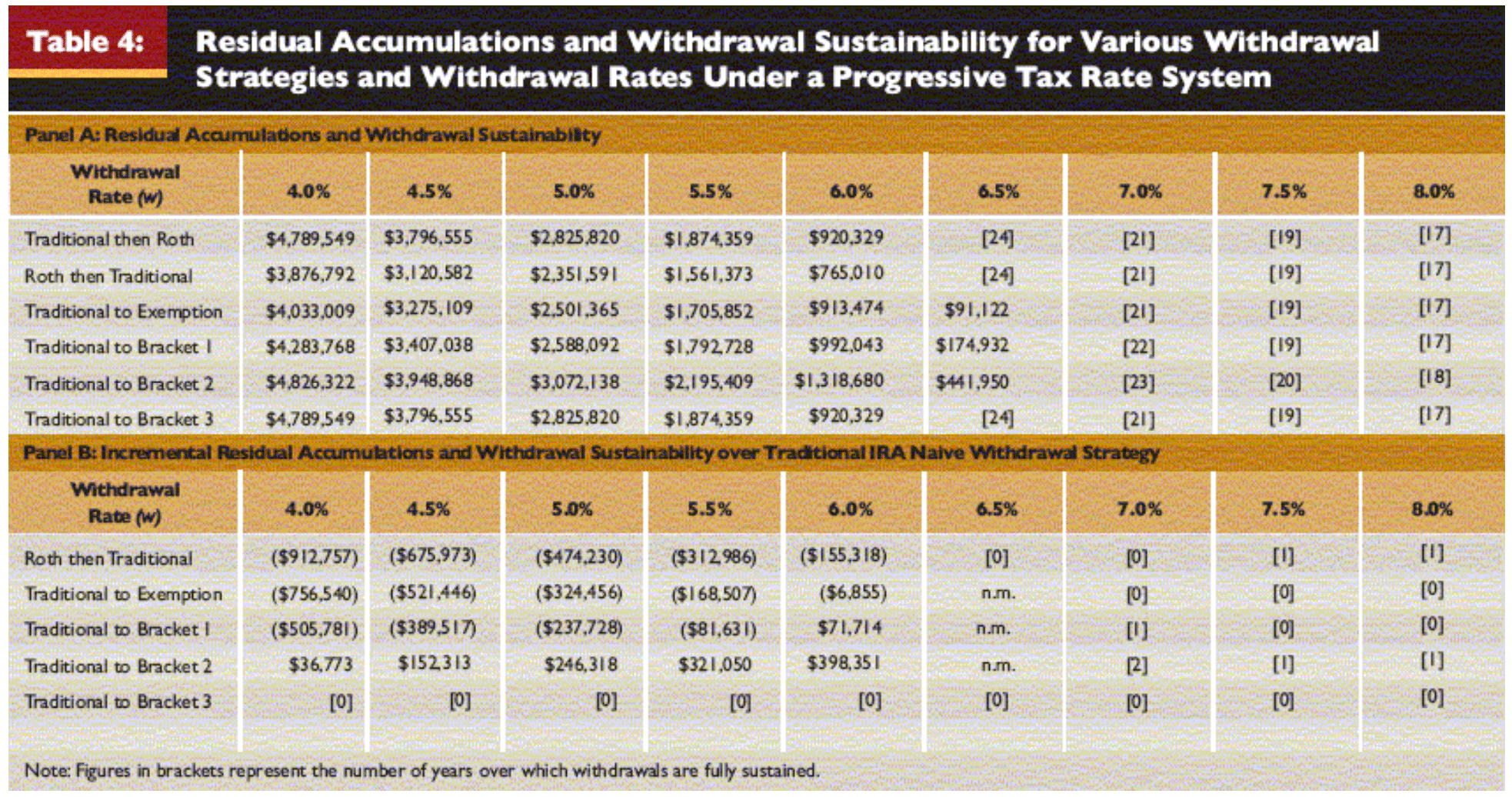

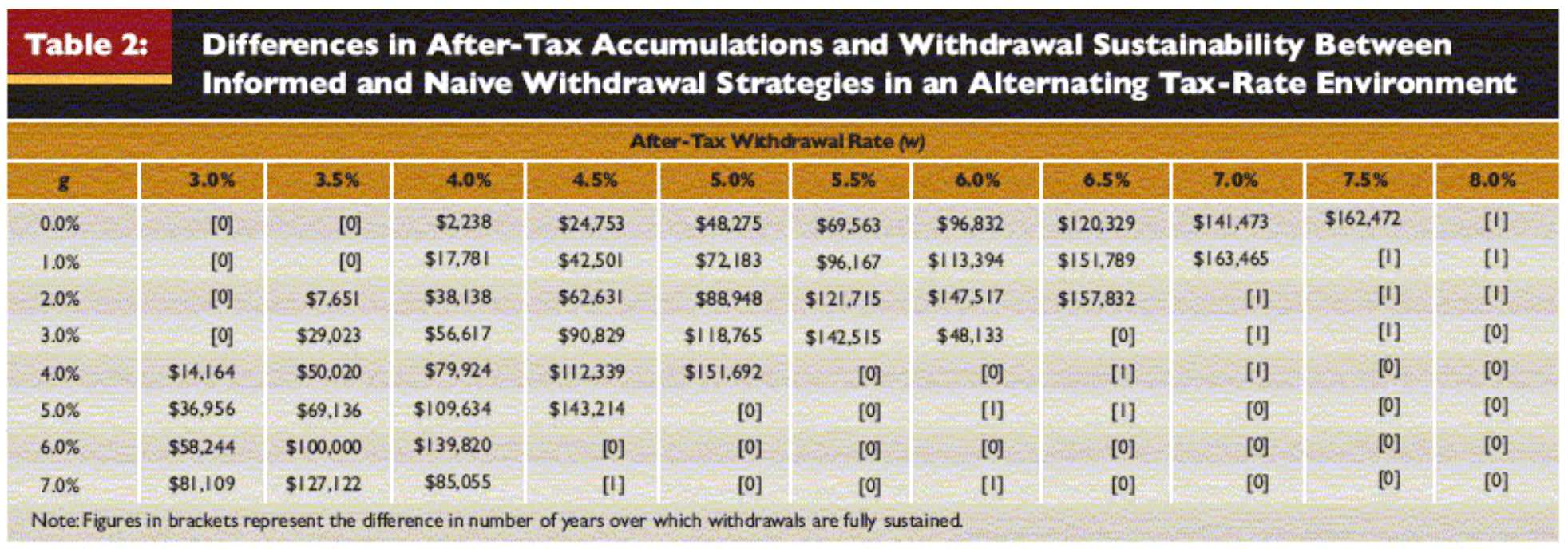

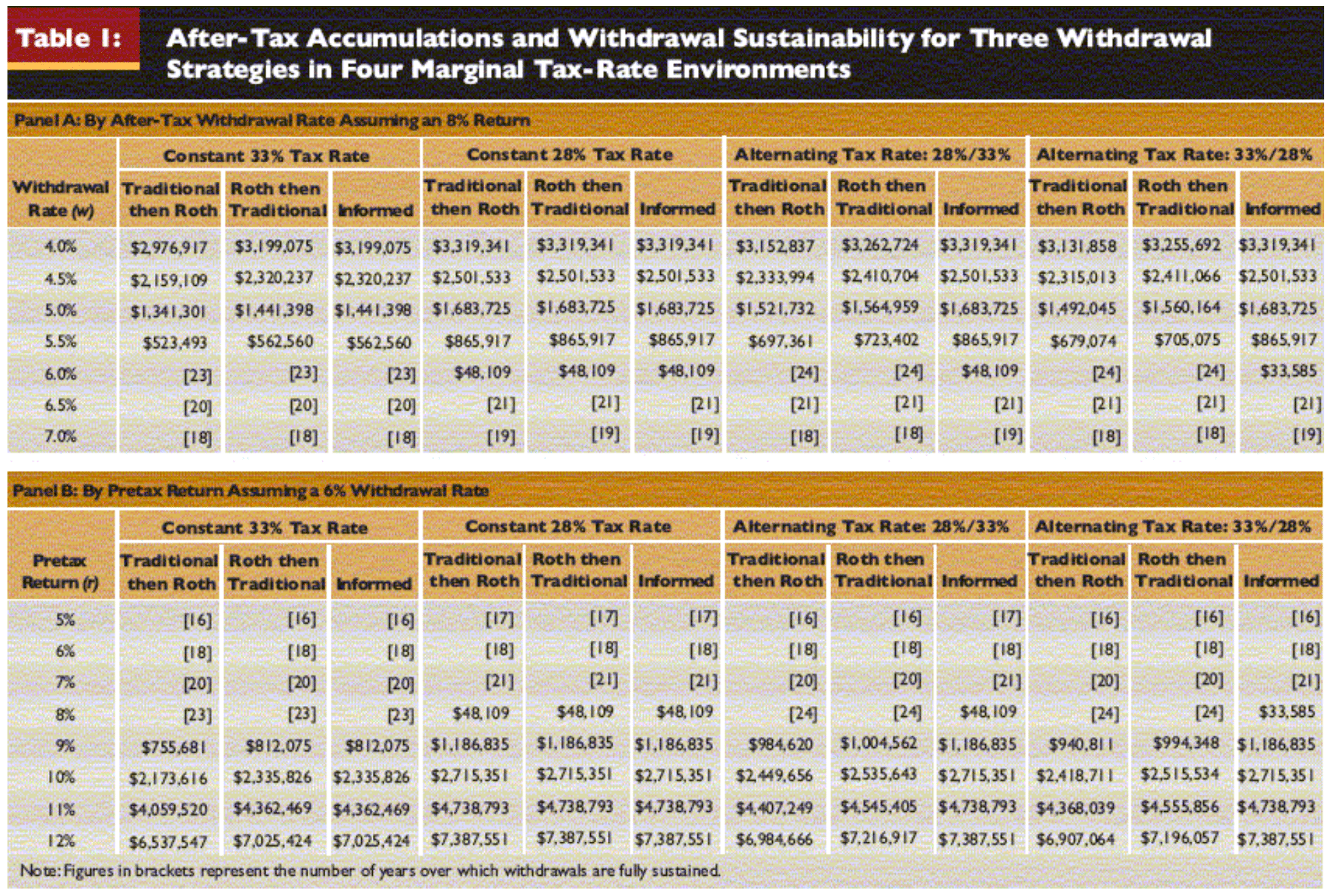

The paper concludes that in a progressive tax-rate environment, an optimal withdrawal strategy draws from pre-tax retirement accounts when tax rates are relatively low, and tax-exempt retirement accounts when tax rates are relatively high. In practical terms, this often means filing up the 15% tax bracket with distributions from pre-tax retirement accounts and using tax-exempt accounts thereafter. For wealthier individuals, filling up the 25% tax bracket may yield optimal results.

Key Quotes

“A strategy of taking traditional IRA distributions that would be taxed at rates up through 15 percent and satisfying the remainder of the withdrawal requirement from the Roth IRA yields even much greater residual accumulations. Wealthier investors stand to benefit by taking distributions up through the 25 percent tax bracket. Retirees can significantly improve the sustainability of their retirement portfolios by embarking on an optimal withdrawal program.”